It (pan card)

•Descargar como PPTX, PDF•

2 recomendaciones•2,146 vistas

pan card, MAKING OF PAN CARD

Denunciar

Compartir

Denunciar

Compartir

Recomendados

Más contenido relacionado

La actualidad más candente

La actualidad más candente (20)

Startup - Selecting appropriate entity related compliances

Startup - Selecting appropriate entity related compliances

Woman director under the Indian companies act, 2013

Woman director under the Indian companies act, 2013

Similar a It (pan card)

Similar a It (pan card) (20)

How to master income tax return in 6 simple steps paysquare

How to master income tax return in 6 simple steps paysquare

Más de GAURAV PRAKASH

Más de GAURAV PRAKASH (6)

Último

https://app.box.com/s/x7vf0j7xaxl2hlczxm3ny497y4yto33i80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...

80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...Nguyen Thanh Tu Collection

Último (20)

Micro-Scholarship, What it is, How can it help me.pdf

Micro-Scholarship, What it is, How can it help me.pdf

Python Notes for mca i year students osmania university.docx

Python Notes for mca i year students osmania university.docx

UGC NET Paper 1 Mathematical Reasoning & Aptitude.pdf

UGC NET Paper 1 Mathematical Reasoning & Aptitude.pdf

Sensory_Experience_and_Emotional_Resonance_in_Gabriel_Okaras_The_Piano_and_Th...

Sensory_Experience_and_Emotional_Resonance_in_Gabriel_Okaras_The_Piano_and_Th...

ICT role in 21st century education and it's challenges.

ICT role in 21st century education and it's challenges.

Unit 3 Emotional Intelligence and Spiritual Intelligence.pdf

Unit 3 Emotional Intelligence and Spiritual Intelligence.pdf

HMCS Max Bernays Pre-Deployment Brief (May 2024).pptx

HMCS Max Bernays Pre-Deployment Brief (May 2024).pptx

80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...

80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...

Beyond_Borders_Understanding_Anime_and_Manga_Fandom_A_Comprehensive_Audience_...

Beyond_Borders_Understanding_Anime_and_Manga_Fandom_A_Comprehensive_Audience_...

On National Teacher Day, meet the 2024-25 Kenan Fellows

On National Teacher Day, meet the 2024-25 Kenan Fellows

Exploring_the_Narrative_Style_of_Amitav_Ghoshs_Gun_Island.pptx

Exploring_the_Narrative_Style_of_Amitav_Ghoshs_Gun_Island.pptx

Jual Obat Aborsi Hongkong ( Asli No.1 ) 085657271886 Obat Penggugur Kandungan...

Jual Obat Aborsi Hongkong ( Asli No.1 ) 085657271886 Obat Penggugur Kandungan...

It (pan card)

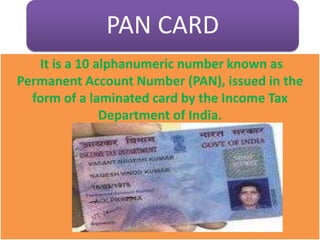

- 1. PAN CARD It is a 10 alphanumeric number known as Permanent Account Number (PAN), issued in the form of a laminated card by the Income Tax Department of India.

- 2. INDEX • INTRODUCTION TO PAN CARD • WHY NECESSARY • HOW TO APPLY FOR PAN • VALID POI & POA

- 3. Why is it necessary to have PAN? It is necessary to have PAN because as per the rules of I-T Department, it is mandatory to quote PAN on all correspondence with any income tax authority. It is good to mention here that since 1 January 2005, it has become mandatory to quote PAN on challans for any payment due to the I-T Department. Also, as stated above, it is now compulsory to quote PAN in all documents pertaining to financial transactions notified from time to time by the Central Board of Direct Taxes (CBDT). Some of these financial transactions include sale and purchase of immovable property or motor vehicle, or paying the hotels and restaurants in cash whose amount exceeds a certain limit, or in connection with travel to any foreign country. In fact PAN has to be mentioned for obtaining a telephone or cellular telephone connection! Likewise, PAN has to be quoted for making a time deposit exceeding Rs.50, 000/- with a Bank or Post Office or for depositing cash of Rs.50, 000/- or more in a Bank.

- 4. How to apply for a PAN? It has to be made ONLY on Form 49A. A PAN application (Form 49A) can be downloaded from the website of Income Tax department . The form is also available at IT PAN Service centers and TIN Facilitation centres. The following documents are to be submitted with Form 49A: •Individual applicants will have to affix one recent stamp size (3.5 cm x 2.5 cm) photograph on the form •Any one document listed in Rule 114 must be submitted as proof of identity and address •Designation and Code of the concerned Assessing Officer of the Income Tax Department will have to be mentioned in the form . * One needs to pay Rs.5/- in cash to the I-T office when you submit the downloaded form.

- 5. POI & POA Proof of identity (copy of any one) Proof of address ( copy of any one) 1. School Leaving Certificate Electricity bill 2. Matriculation Certification Telephone bill 3. Degree of recognized educational institution Employer Certificate 4. Depository Account Statement Depository Account Statement 5.Bank Account Statement/Passbook Bank Account Statement/Passbook 6. Voter's Identity Card Voter's Identity Card

- 6. Proof of identity (copy of any one) Proof of address ( copy of any one) 7. Ration Card Ration Card 8. Water Bill Rent receipt 9. Property Tax Assessment Order Property Tax Assessment Order 10. Passport Passport 11. Credit Card Credit Card Statement 12. Driving License Driving License 13. Certificate of Identity signed by a member of Parliament or a member of Legislative Assembly or Municipal councilor or a Gazetted Officer Certificate of Address signed by a member of Parliament or a member of Legislative Assembly or Municipal councilor or a Gazetted Officer

- 7. Who can apply on behalf of non-resident, minor, lunatic, idiot, and court of wards? Section 160 of IT Act, 1961 provides for a Representative Assessee who will make an application for PAN on behalf of a non- resident, a minor, lunatic, idiot, and court of wards and such other persons.

- 8. How to find ‘Assessing Officer code? • You may find the Assessing Officer code from the I-T Office where you submit your return of income. Applicants who have never filed return of income may find out Assessing Officer code with the help of either IT PAN Service Center or TIN Facilitation Center or jurisdictional Income Tax Office.

- 9. DURATION TO GET PAN • It generally takes about 15 days to get a new PAN allotted. • You can also get a TATKAL PAN if the application for the same is made through the Internet and the payment for the same is made through a ‘nominated’ credit card. • However, PAN can be obtained quicker (TATKAL PAN) in around 5 days.

- 10. DO I PAY TAXES IF I HAVE A PAN? Having an PAN doesn't mean that you have to pay taxes. You only pay tax if you generate income from/in India. But, it is always recommended to file 'ZERO' taxes even if you don't have any tax liability.