My report_donald.docx

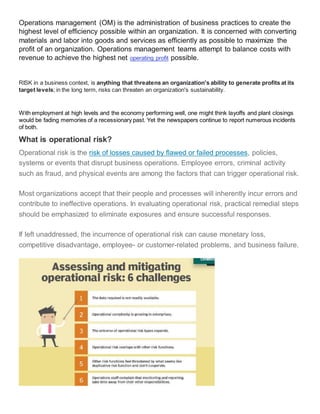

- 1. Operations management (OM) is the administration of business practices to create the highest level of efficiency possible within an organization. It is concerned with converting materials and labor into goods and services as efficiently as possible to maximize the profit of an organization. Operations management teams attempt to balance costs with revenue to achieve the highest net operating profit possible. RISK in a business context, is anything that threatens an organization's ability to generate profits at its target levels; in the long term, risks can threaten an organization's sustainability. With employment at high levels and the economy performing well, one might think layoffs and plant closings would be fading memories of a recessionary past. Yet the newspapers continue to report numerous incidents of both. What is operational risk? Operational risk is the risk of losses caused by flawed or failed processes, policies, systems or events that disrupt business operations. Employee errors, criminal activity such as fraud, and physical events are among the factors that can trigger operational risk. Most organizations accept that their people and processes will inherently incur errors and contribute to ineffective operations. In evaluating operational risk, practical remedial steps should be emphasized to eliminate exposures and ensure successful responses. If left unaddressed, the incurrence of operational risk can cause monetary loss, competitive disadvantage, employee- or customer-related problems, and business failure.

- 2. What are the causes of operational risk? The causes of operational risk can stem from people inside or outside the organization, technology, processes or even external events, including the following:

- 7. A business imperative is an initiative or objective that the city must accomplish to make meaningful progress toward achieving its strategic vision. What is a business imperative? A business imperative is a primary goal that companies make to positively change the outlook of their businesses. These objectives are usually long-term goals that take a collaborative effort to achieve. This means that each employee actively works on meeting the business imperative. When management declares a business imperative, they plan on obtaining it. These goals are serious and usually necessary, which is why they're called imperatives. The company's goal is to achieve the objective to look impressive towards stakeholders and customers. Management typically creates strategies for the entire company to help meet the business imperative.

- 9. Risk Management Process The risk management process is a framework for the actions that need to be taken. There are five basic steps that are taken to manage risk; these steps are referred to as the risk management process. It begins with identifying risks, goes on to analyze risks, then the risk is prioritized, a solution is implemented, and finally, the risk is monitored. In manual systems, each step involves a lot of documentation and administration. Here Are The Five Essential Steps of A Risk Management Process 1. Identify the Risk 2. Analyze the Risk 3. Evaluate or Rank the Risk 4. Treat the Risk 5. Monitor and Review the Risk

- 10. Step 1: Identify the Risk The initial step in the risk management process is to identify the risks that the business is exposed to in its operating environment. There are many different types of risks: Legal risks Environmental risks Market risks Regulatory risks etc. It is important to identify as many of these risk factors as possible. In a manual environment, these risks are noted down manually. If the organization has a risk management solution employed all this information is inserted directly into the system. The advantage of this approach is that these risks are now visible to every stakeholder in the organization with access to the system. Instead of this vital information being locked away in a report which has to be requested via email, anyone who wants to see which risks have been identified can access the information in the risk management system.

- 14. What are Best Practices in Managing Risk? 1. Involve Stakeholders In order to effectively manage risk, you should involve the stakeholders every step of the way, beginning with the initial Risk Assessment. Stakeholders can include people such as managers, clients, employees, shareholders, unions, etc. Many of these individuals may be key personnel and are key to your Risk Management processes. Each of these individuals represent different roles and responsibilities within your organization, thus giving you a holistic representation of all of the aspects of your business and each risk that comes along with it. Encourage stakeholders to help improve the continuous risk process by getting them involved in answering the question, “What keeps you up at night?” 2. Tone from the Top Our second risk management best practice – and an important step in any successful Risk Management program – is creating a strong risk culture. Risk culture is defined as the values, beliefs, and attitudes about risks by a common group of people. It is the responsibility of management and the board of directors to clearly communicate the company’s culture and set the tone for compliance from the top. Management buy-in is critical to ensure that the importance of risk awareness is emanated throughout the entire organization. What is your company’s risk culture? 3. Communication Good practice in risk assessment and risk management starts with communication. Communicating risks throughout your organization is another important aspect of Risk Management. Key risks, or risks that would have a high organizational impact,are identified and monitored byall departments.Any new risks are identified,assessed,and mitigated properly. You mustcreate awareness ofrisks through communication to your entire organization. 4. Clear Risk Management Policies Is your Risk Assessmentpolicyclearly documented? Are the roles and responsibilities clearlydefined? Are there clear policies and procedures defining mitigation ofany and all identified risks? Do you have a Business ContinuityPlan and an Incident Respon se Plan in place that map out how your organization will handle and overcome any unforeseen risks? Are these policies communicated effectively to all employees? Having these clear policies developed will help you identify all potential risks thatcould affect your business,the likelihood and impactofthose risks,how you plan to mitigate and prevent those risks,and how you will monitor for and manage and new risks. 5. Continuous Risk Monitoring In order to manage your risks,you mustfirst know what your risks are.Assuming you’ve already performed your initial risk assessment and have put the proper controls in place to mitigate and address these risks,the next crucial step is monitoring.Clear mon itoring processes mustbe established to ensure thatany and all risk mitigation efforts are working and effective. This is a crucial aspectof any Risk Managementprocess. Risk Management,the process ofdetermining whatthe risks are to your organization and creating steps to mitigate those risk s,is critical to your organization.It’s a continuous and constantlyevolving process.We hope these good practices in risk assessment and risk management have helped outline a plan for your organization. To learn more aboutRisk Managementor how KirkpatrickPrice’s Risk Assessment services could benefityour organization, contact us today. Understanding critical success factors is the first step towards developing an effective marketing plan,and investing in these processes is the key to any company that wants to succeed. But what exactly are the critical success factors? Critical success factors: A brief conceptualization Critical success factors are key points that, when well executed,define and ensure the development and growth of a company and its business, as well as achieving its goals. In contrast, when these same factors are overlooked or ignored, they can contribute to the failure of an organization.

- 15. Critical success factors should and need to be found through a thorough study of the company’s goals, deriving them from its mission, vision, and values, making them mandatory and essential references for the company to survive, to be competitive and succeed whatever the industry. Moreover, critical success factors also help managers define the main guidelines for the implementation of process control and IT governance in daily life and in the business management model. Examples of generic critical success factors Financial strengthreputation. Management qualifications. Knowledge of the market. Image with stakeholders. Available equipment. Relationshipwith suppliers. Expertise in controlling costs. Location. Lines of products and services. Expertise indistributionand logisticschannels. Expertise inpromotional campaigns. Specific examples of critical success factors The automotive industry: Vehicle style, fuel economy, compliance with environmental legislation, efficient distribution network, control over production costs. The computer industry: innovation,quality in sales and user literature, ease of use of the products. The food industry: effectiveness in advertising, efficiency in product distribution, product innovation capacity. Training companies: Recognized instructorcompetencies, quality, and size of customer base and prospects,identifying current and relevant topics, image recognized in the market. High-tech companies: managerial training in working in competitive environments, innovation, technology marketing, integration with the scientific and technological community.

- 19. Business Imperative: Definition & Examples

- 20. What Is Financial Management? At its core, financial managementis the practice of making a business plan and then ensuring all departments stayon track. Solid financial managementenables the CFO or VP of finance to provide data that supports creation ofa long-range vision,informs decisions on where to invest, and yields insights on how to fund those investments,liquidity,profitability, cash runway and more. ERP software can help finance teams achieve these goals:A financial managementsystem combines several financial functions,such as accounting,fixed-assetmanagement,revenue recognition and paymentprocessing.By integrating these key components,a financial managementsystem ensures real-time visibilityinto the financial state of a companywhile facilitating day-to-day operations, like period-end close processes. Objectives of Financial Management Building on those pillars,financial managers help their companies in a variety of ways, including butnot limited to: Maximizing profits Provide insights on,for example, rising costs ofraw materials thatmighttrigger an increase in the cost of goods sold. Tracking liquidity and cash flow Ensure the companyhas enough moneyon hand to meetits obligations. Ensuring compliance Keep up with state,federal and industry-specific regulations. Developing financial scenarios These are based on the business’ current state and forecasts that assume a wide range of outcomes based on possible market conditions. Manage relationships Dealing effectively with investors and the boards of directors.

- 21. Scope of Financial Management Financial managementencompasses four major areas: 1. Planning The financial manager projects how much moneythe companywill need in order to maintain positive cash flow,allocate funds to grow or add new products or services and cope with unexpected events, and shares thatinformation with business colleagues. Planning maybe broken down into categories including capital expenses,T&E and workforce and indirectand operational expenses. 2. Budgeting The financial manager allocates the company’s available funds to meetcosts,such as mortgages or rents,salaries,raw materials,employee T&E and other obligations.Ideallythere will be some leftto put aside for emergencies and to fund new business opportunities. Companies generallyhave a master budgetand mayhave separate sub documents covering,for example,cash flow a nd operations; budgets maybe static or flexible. Static vs. Flexible Budgeting Static Flexible Remains the same even if there are significant changes from theassumptions made during planning. Adjusts based on changes in the assumptions used in t planning process. 3. Managing and assessing risk Line-of-business executives look to their financial managers to assess and provide compensating controls for a variety of risks, including: Market risk Affects the business’ investments as well as,for public companies,reporting and stock performance.May also reflect financial risk particular to the industry, such as a pandemic affecting restaurants or the shift of retail to a direct-to- consumer model. Credit risk The effects of, for example,customers notpaying their invoices on time and thus the business nothaving funds to meetobligations,which mayadversely affect creditworthiness and valuation,which dictates abilityto borrow at favorable rates.

- 22. Liquidity risk Finance teams musttrack currentcash flow, estimate future cash needs and be prepared to free up working capital as needed. Operational risk This is a catch-all category, and one new to some finance teams.Itmay include,for example,the risk of a cyber- attack and whether to purchase cybersecurityinsurance,whatdisaster recovery and business continuityplans are in place and what crisis management practices are triggered ifa senior executive is accused of fraud or misconduct. 4. Procedures The financial manager sets procedures regarding how the finance team will process and distribute financial data,like invoices, payments and reports,with security and accuracy. These written procedures also outline who is responsible for making financial decisions atthe company— and who signs offon those decisions. Companies don’tneed to start from scratch;there are policy and procedure templates available for a variety of organization types, such as this one for nonprofits. Functions of Financial Management More practically, a financial manager’s activities in the above areas revolve around planning and forecasting and controlling expenditures. The FP&A function includes issuing P&L statements,analyzing which productlines or services have the highestprofitmarg in or contribute the mostto net profitability, maintaining the budget and forecasting the company’s future financial performance and s cenario planning. Managing cash flow is also key. The financial manager mustmake sure there’s enough cash on hand for day-to-day operations,like paying workers and purchasing raw materials for production.This involves overseeing cash as itflows both in and out of the business, a practice called cash management. Along with cash management,financial managementincludes revenue recognition,or reporting the company’s revenue according to standard accounting principles.Balancing accounts receivable turnover ratios is a key part of strategic cash conservation and management.This maysound simple,butit isn’talways:At some companies,customers mightpay months after receiving your se rvice. At whatpoint do you consider thatmoney “yours” — and report the good news to investors? 5 Tips to Improve Your Accounts Receivable Turnover Ratio 1. Invoice regularly and accurately. If invoices don’t go out on time, money will not come in on time.

- 23. 5 Tips to Improve Your Accounts Receivable Turnover Ratio 2. Always state payment terms. You can’t enforce policies that you haven’t communicated to clients. If you make changes, call them out. 3. Offermultiple ways to pay. New B2B options are coming online. Have you considered a payment gateway? 4. Set follow-upreminders. Don’t wait until customers are in arrears to start collection procedures. Be proactive, but not annoying, with reminders. 5. Consideroffering discounts for cash and prepayments. Cash(less) is king in retail, and you can reduce AR costs by encouraging customers to p rather than on your normal customer credit terms. Learn moreabout maximizing your AR turnover ratios. Finally, managing financial controls involves analyzing how the companyis performing financiallycompared with its plans and budgets. Methods for doing this include financial ratio analysis,in which the financial manager compares line items on the company’s financial statements. Strategic vs. Tactical Financial Management On a tactical level, financial managementprocedures govern how you process dailytransactions,perform the monthlyfinancial close, compare actual spending to what’s budgeted and ensure you meetauditor and tax requirements. On a more strategic level, financial managementfeeds into vital FP&A (financial planning and analysis) and visioning activities,where finance leaders use data to help line-of-business colleagues plan future investments,spotopportunities and build resilientcompanies. Importance of Financial Management Solid financial managementprovides the foundation for three pillars ofsound fiscal governance: 1. Strategizing Identifying what needs to happen financiallyfor the companyto achieve its short- and long-term goals.Leaders need insights into currentperformance for scenario planning,for example.

- 24. 2. Decision-making Helping business leaders decide the bestway to execute on plans by providing up-to-date financial reports and data on relevant KPIs. 3. Controlling Ensuring each departmentis contributing to the vision and operating within budgetand in alignmentwith strategy. With effective financial management,all employees know where the companyis headed,and they have visibility into progress. What Are the Three Types of Financial Management? The functions above can be grouped into three broader types of financial management: 1. Capital budgeting Relates to identifying whatneeds to happen financiallyfor the companyto achieve its short- and long-term goals.Where should capital funds be expended to supportgrowth? 1. Capital structure Determine how to pay for operations and/or growth.If interestrates are low, taking on debt mightbe the bestanswer.A companymightalso seek funding from a private equity firm,consider selling assets like real estate or, where applicable, selling equity. 2. Working capital management As discussed above,is making sure there’s enough cash on hand for day-to-day operations,like paying workers and purchasing raw materials for production. What Is an Example of Financial Management? We’ve covered some examples offinancial managementin the “functions” section above.Now, let’s cover how they all work toge ther: Say the CEO of a toothpaste companywants to introduce a new product: toothbrushes.She’ll call on her team to estimate the costof producing the toothbrushes and the financial manager to determine where those funds should come from — for example,a bank loan. The financial manager will acquire those funds and ensure they’re allocated to manufacture toothbrushes in the mostco st-effective way possible.Assuming the toothbrushes sell well,the financial manager will gather data to help the managementteam decide whether to put the profits toward producing more toothbrushes,starta line of mouthwashes,pay a dividend to sharehol ders or take some other action. Throughoutthe process,the financial manager will ensure the companyhas enough cash on hand to pay the new workers producin g the toothbrushes.She’ll also analyze whether the companyis spending and generating as much moneyas she estimated when she budgeted for the project.

- 25. Financial Management for Startups At the outset,financial managementresponsibilities within a startup include making and sticking to a budgetthat aligns with the business plan,evaluating whatto do with profits and making sure your bills getpaid and that customers payyou. As the companygrows and adds finance and accounting contractors or staffers,financial managementgets more complicated.You need to make sure your employees getpaid,with accurate deductions;properlyfile taxes and financial statements;and watch for errors and fraud. This all circles back to our opening discussion ofbalancing strategic and tactical.By building a plan, you can answer the big questions: Are our goods and services profitable? Can we afford to launch a new product or make that hire? What mightthe coming 12 to 1 8 months bring for the business? Solid financial managementprovides the systems and processes to answer those questions. Passion,patience,and persistence are the ingredients to be an entrepreneur.By: Jawo, youtuber and IT Specialist