IDFC Focused Equity Fund_Quarterly note

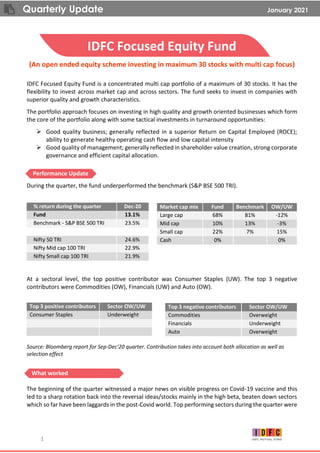

- 1. Quarterly Update January 2021 1 IDFC Focused Equity Fund (An open ended equity scheme investing in maximum 30 stocks with multi cap focus) IDFC Focused Equity Fund is a concentrated multi cap portfolio of a maximum of 30 stocks. It has the flexibility to invest across market cap and across sectors. The fund seeks to invest in companies with superior quality and growth characteristics. The portfolio approach focuses on investing in high quality and growth oriented businesses which form the core of the portfolio along with some tactical investments in turnaround opportunities: ➢ Good quality business; generally reflected in a superior Return on Capital Employed (ROCE); ability to generate healthy operating cash flow and low capital intensity ➢ Good quality of management; generally reflected in shareholder value creation, strong corporate governance and efficient capital allocation. During the quarter, the fund underperformed the benchmark (S&P BSE 500 TRI). % return during the quarter Dec-20 Fund 13.1% Benchmark - S&P BSE 500 TRI 23.5% Nifty 50 TRI 24.6% Nifty Mid cap 100 TRI 22.9% Nifty Small cap 100 TRI 21.9% At a sectoral level, the top positive contributor was Consumer Staples (UW). The top 3 negative contributors were Commodities (OW), Financials (UW) and Auto (OW). Source: Bloomberg report for Sep-Dec’20 quarter. Contribution takes into account both allocation as well as selection effect The beginning of the quarter witnessed a major news on visible progress on Covid-19 vaccine and this led to a sharp rotation back into the reversal ideas/stocks mainly in the high beta, beaten down sectors which so far have been laggards in the post-Covid world. Top performing sectors during the quarter were Market cap mix Fund Benchmark OW/UW Large cap 68% 81% -12% Mid cap 10% 13% -3% Small cap 22% 7% 15% Cash 0% 0% Top 3 positive contributors Sector OW/UW Consumer Staples Underweight Top 3 negative contributors Sector OW/UW Commodities Overweight Financials Underweight Auto Overweight Performance Update What worked

- 2. Quarterly Update January 2021 2 Realty, Metals, Banking & Finance, Capital Goods and PSUs. The fund did not have any material positions in any of these sectors. The fund’s underweight position in Consumer Staples was the only positive contributor for the quarter at a sector level. Existing positions in the underweight sector like Financials performed strongly but were not sufficient enough to match the exposure in the benchmark in this short period. Stocks which rose higher than the benchmark during the quarter were ICICI Bank, HDFC Bank, Divi’s Labs and Infosys. The fund has been having higher exposure to stable stocks so far in CY2020. While this helped the fund perform strongly during the first 3 quarters, the current quarter saw some slip, led by a very strong reversal in the cyclical stocks, post the vaccine news. A large underweight position in Financials and a large overweight position in Commodities (largely the small cap stable speciality chemical and packaging companies) impacted the relative performance for the quarter. Some of the stocks which gave negative to negligible returns during the quarter were Reliance Industries, Fine Organics, Divi’s Labs, Hero MotoCorp, IPCA Labs & Dr. Reddy’s Labs. Sep-20 Sector/Weight Fund Benchmark OW/UW Fund Commodities 13.3% 5.4% 7.9% 13.6% -0.3% Telecommunication Services 9.9% 2.0% 7.9% 9.4% 0.4% Information Technology 17.2% 13.4% 3.8% 22.7% -5.5% Auto 7.4% 6.0% 1.4% 12.2% -4.8% Industrials 4.7% 5.3% -0.6% 4.7% 0.1% Health Care 5.2% 6.1% -0.9% 12.4% -7.2% Energy 7.7% 8.9% -1.2% 10.6% -2.9% Cement / Building Mat 1.5% 2.8% -1.2% 2.8% -1.2% Financials 29.5% 32.3% -2.8% 8.6% 20.9% Utilities 0.0% 3.2% -3.2% 0.0% 0.0% Consumer Discretionary 1.5% 6.0% -4.4% 0.0% 1.5% Consumer Staples 2.3% 8.7% -6.4% 2.1% 0.2% Dec-20 Change during the Qtr During the quarter, the fund has increased its exposure in Financials compared to previous quarter end. This has been done through addition of some Mid-cap cyclical stocks. Weight in Technology sector has come off led by unwinding of a special situation positioning in Small cap company. Fund has booked profits in some of the strong performers in sectors like Pharma & Auto. Financials Financials have seen a rollercoaster ride in the entire CY2020. While the initial fall was attributed to moratorium led NPA concerns, the subsequent rally was fuelled by receding concern on ultimate loss given default and abundant liquidity. The sector still is on a recovery mode, with more than normal support given by the regulator and the government. However, the credit growth in the sector remains Key changes during the quarter Portfolio stance – Key sectors What did not work

- 3. Quarterly Update January 2021 3 feeble at mid-single digit. Even if the asset quality stress may recede at the margin, revenue growth is contingent on the revival of the broader economy. In this context, we have now added some exposure towards recovery-oriented ideas, though over-all we continue to be underweight. The progress still needs to be monitored closely, as the sector remains a large weight in the benchmark and is highly liquid as well. Information Technology Cyclically, the momentum remains strong for Tech services going into FY22E, led by increasing demand for Cloud/SaaS solutions in the key industry verticals (Banking/ Retail/ Technology). Key enabler is scaling up of digital projects with the modernization of IT stacks as software, middleware, database and IT hardware. In addition, the need to reduce costs is leading to pick-up in outsourcing and potentially offshoring to low cost locations, with Work From Anywhere (WFA) becoming accepted norm potentially even after the pandemic. With the most efficient supply chains having significant cost differential and large digital talent pool Indian IT services companies are positioned favourably. Telecom Going into 2021, sector revenues should grow again after growing 20% in 2020. This is likely to be led by tariff hikes and rising 4G data adoption. Secondly, after the adverse AGR (Adjusted Gross Revenue) case verdict in 2020, there could be a potential review of AGR dues led by incumbents’ petitions. Thirdly, 2021 would be decisive for digital services and for big players having varied models of own apps/content vs partnerships to boost subscribers and APRU (Average Revenue Per User). Sector is at reasonable valuations and likely to witness accelerated revenue and profitability growth, and hence we believe it is positioned attractively. Portfolio Metrics Fund Benchmark Commentary PB Ratio 3.1 3.0 The PB ratio of the portfolio is marginally higher than the PB ratio of the benchmark. Source: Bloomberg, Based on trailing 12 months data The fund has been delivering outperformance over the benchmark on a one-year basis for most part of CY2020. A large part of this performance has emerged from a better stock selection. Our investment approach has been driven by investing in Growth and Quality oriented companies with an active multi- cap approach. The fund has a relatively lower share of the large cap stocks as compared to its peers. The fund’s stable positioning helped in preventing the drawdowns in the early part of this calendar year. However, world over markets have seen a rotation back to the cyclical trade which is concentrated into beaten down, high beta names and sectors. While this impacted the relative performance in the short term, it has come as a surprise to many market participants, given that the actual levels of activity remain below the pre-Covid levels on most parameters. Market seems to be reacting more to the delta in the activity than the activity itself. This coupled with abundant liquidity and a generally risk on sentiment has led to exuberance, which now has engulfed the Mid & Small cap segment as well. Fund Manager Commentary Fund – Key metrics

- 4. Quarterly Update January 2021 4 Faster than expected pickup in aggregate demand going ahead could make it a consensus buy for both FPIs and DIIs thereby further fuelling the bull market rally. However, currently, the drivers of near-term aggregate demand remain weak in the form of household spending driven by weak consumer sentiment, fiscal constraints on government spending, and corporates cutting back on capex and opex. Going onto 2021, we have made some tweaks to the portfolio to start building moderate exposure to recovery-oriented names gradually. This has been done via adding exposure to some Midcap cyclical ideas in the Financial, Auto and Consumer Discretionary space and small cap ideas on Consumer Staples. In addition, we have used this strong rally to book profits to lighten some positions in the Small cap segment. Our approach would be to monitor the economic revival closely and stick to a more fundamental led portfolio rather than “flows”. As we progress towards economic revival and base effect also begins to playout in the second half of 2021, most of the growth metrics may start looking promising. We would continue to closely monitor the portfolios and will take small steps to realign to new realities. Stable Sectors: Retail Banks & NBFC’s, IT, Consumer Staple & Discretionary, Auto, HealthCare Cyclical Sectors: Corp Banks & NBFC’s, Energy & Utilities, Industrials, Cement, Commodities, Telecom Fund Stable Cyclical Total Large Cap 33% 35% 68% Mid Cap 3% 8% 10% Small Cap 2% 20% 22% Total 38% 62% Benchmark Stable Cyclical Total Large Cap 51% 29% 81% Mid Cap 6% 7% 13% Small Cap 2% 4% 7% Total 60% 40% Fund positioning – Stable & Cyclical Framework

- 5. Quarterly Update January 2021 5 Cyclical & Stable Exposure with Top 3 Stocks in each sector Fund Benchmark Fund Benchmark Banks - Corp 18.9% 8.2% Banks - Retail 7.6% 11.5% ICICI 7.9% 4.4% HDFC 7.6% 6.9% STATE BANK IND 4.8% 1.2% AXIS 3.2% 1.9% Energy 7.7% 8.9% Information Technology 17.2% 13.4% RELIANCE INDUSTRIES 7.7% 7.6% INFOSYS 7.8% 5.4% TATA CONSULTANCY 5.1% 3.6% HCL TECHNOLOGIES 2.1% 1.2% Industrials 4.7% 5.3% Consumer Staples 2.3% 8.7% SECURITY & INTELLIGENCE SERVICES 4.7% 0.0% PRATAAP SNACKS 2.3% 0.0% Commodities 13.3% 5.4% Auto 7.4% 6.0% FINE ORGANIC 7.3% 0.0% MARUTI SUZUKI 1.5% 1.2% EPL 6.0% 0.0% MRF 1.5% 0.2% HERO MOTOCORP 1.5% 0.5% Cement / Building Mat 1.5% 2.8% Health Care 5.2% 6.1% PRINCE PIPES & FITTINGS 1.5% 0.0% AUROBINDO PHARMA 1.1% 0.3% DR REDDY'S LABS 1.1% 0.7% DIVIS LABS 1.0% 0.6% Telecommunication Services 9.9% 2.0% Consumer Discretionary 1.5% 6.0% BHARTI AIRTEL 9.9% 1.4% BATA INDIA 1.5% 0.1% NBFC - Cyclical 3.1% 1.6% M&M FIN SERVICES 3.1% 0.1% The sectors / stocks mentioned herein should not be construed as an investment advice from IDFC Mutual Fund and IDFC Mutual Fund may or may not have any future position in these sectors / stocks. All data as on 31st December 2020 Fund Performance Performance based on NAV as on 31/12/2020. Past performance may or may not be sustained in future. The performances given are of regular plan growth option. Regular and Direct Plans have different expense structure. Direct Plan shall have a lower expense ratio excluding distribution expenses, commission expenses etc. #Benchmark Returns. ##Alternate Benchmark Returns. $$ The strategy of the Fund has been changed from large cap to focused fund w.e.f. April 18, 2017. The Fund Manager of the fund is Mr. Sumit Agrawal (w.e.f. 20th October 2016) Cyclical Stable

- 6. Quarterly Update January 2021 6 Other Funds managed by the Fund Manager Performance based on NAV as on 31/12/2020. Past Performance may or may not be sustained in future. The performance details provided herein are of regular plan growth option. Regular and Direct Plans have different expense structure. Direct Plan shall have a lower expense ratio excluding distribution expenses, commission expenses etc. §Current Index performance adjusted for the period from since inception to June 28, 2007 with the performance of S&P BSE 100 price return index (Benchmark). 2The fund has been repositioned from an IPO fund to a large cap fund w.e.f. April 18, 2017. @The benchmark of IDFC Focused Equity Fund has been changed from Nifty 50 TRI Benchmark change to S&P BSE 500 TRI w.e.f. Nov 11,2019. IDFC Focused Equity Fund (An open ended equity scheme investing in maximum 30 stocks with multi cap focus) Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY. The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme’s portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.