Why Investors Need to Enter the Decentralized Finance Space-Greg Carson, XBTO Humla Ventures

•

0 recomendaciones•14 vistas

Greg Carson of XBTO Humla Ventures, Venture Capital/Digital Asset fund manager at the marcus evans Private Wealth Management Summit 2022, and the Elite Summit 2022, discusses the financial markets transformation, and what investment opportunities investors must consider.

Denunciar

Compartir

Denunciar

Compartir

Descargar para leer sin conexión

Recomendados

Recomendados

Detailed overview of First Data's IPO including its funding history, business operations, financial performance, public company comparables and relevant industry transactionsFT Partners Research: First Data IPO - Post Quiet Period Review

FT Partners Research: First Data IPO - Post Quiet Period ReviewFT Partners / Financial Technology Partners

Más contenido relacionado

La actualidad más candente

Detailed overview of First Data's IPO including its funding history, business operations, financial performance, public company comparables and relevant industry transactionsFT Partners Research: First Data IPO - Post Quiet Period Review

FT Partners Research: First Data IPO - Post Quiet Period ReviewFT Partners / Financial Technology Partners

La actualidad más candente (20)

Digital finance, crowdfunding and creative content business

Digital finance, crowdfunding and creative content business

The rise and fall and rise again of robo investing

The rise and fall and rise again of robo investing

Rise of the Robo Advisors: The Growing Trend of Automating Asset Allocation S...

Rise of the Robo Advisors: The Growing Trend of Automating Asset Allocation S...

The Changing Relationship Between Investors and Investments

The Changing Relationship Between Investors and Investments

State of Blockchains 2019: Green shoots of adoption emerge from 2018 crypto c...

State of Blockchains 2019: Green shoots of adoption emerge from 2018 crypto c...

Wealth Management Trends 2016: Findings from Tiburon Advisors

Wealth Management Trends 2016: Findings from Tiburon Advisors

Investments in Blockchains 2019 - Outlier Ventures

Investments in Blockchains 2019 - Outlier Ventures

Crowdfunding - A disruptive financial innovation - May 16, 2014

Crowdfunding - A disruptive financial innovation - May 16, 2014

FinTech Workshop 05: Michael Puhle - An introduction to Robo-Advisors

FinTech Workshop 05: Michael Puhle - An introduction to Robo-Advisors

FT Partners Research: First Data IPO - Post Quiet Period Review

FT Partners Research: First Data IPO - Post Quiet Period Review

Deal marketing on the internet: Using Software to Find Investors and Sell You...

Deal marketing on the internet: Using Software to Find Investors and Sell You...

Diffusion 2019 Launch by CEO & Founder Jamie Burke and AvA Berlin

Diffusion 2019 Launch by CEO & Founder Jamie Burke and AvA Berlin

Similar a Why Investors Need to Enter the Decentralized Finance Space-Greg Carson, XBTO Humla Ventures

Ahead of the marcus evans Private Wealth Management Summit 2020, Bill LaPrise discusses how to invest in crypto projects successfullyEnhancing the Long-Term Return of Cryptocurrency Assets-Bill La Prise, WhiteT...

Enhancing the Long-Term Return of Cryptocurrency Assets-Bill La Prise, WhiteT...Investments Network marcus evans

Similar a Why Investors Need to Enter the Decentralized Finance Space-Greg Carson, XBTO Humla Ventures (20)

How Robo Advisers, Fintech Are Revolutionising Wealth Management

How Robo Advisers, Fintech Are Revolutionising Wealth Management

The development of it in economic growth in usa & bangladesh

The development of it in economic growth in usa & bangladesh

Enhancing the Long-Term Return of Cryptocurrency Assets-Bill La Prise, WhiteT...

Enhancing the Long-Term Return of Cryptocurrency Assets-Bill La Prise, WhiteT...

Bracing for seven critical changes as fintech matures

Bracing for seven critical changes as fintech matures

Digital Transformation: A $1 Trillion Opportunity (Note: 2015 deck - somewhat...

Digital Transformation: A $1 Trillion Opportunity (Note: 2015 deck - somewhat...

DIGITAL LEADERSHIP: An interview with Saul Klein Partner with Index Ventures

DIGITAL LEADERSHIP: An interview with Saul Klein Partner with Index Ventures

Future of Wealth Management_Cisco_Fall 2015_LowRes

Future of Wealth Management_Cisco_Fall 2015_LowRes

From competition to partnerships banks, fin techs, and neobanks _ medici

From competition to partnerships banks, fin techs, and neobanks _ medici

Más de Investments Network marcus evans

Ahead of the marcus evans Private Wealth Management Summit June 2023 and the Private Wealth Management Summit September 2023, read here an interview with Andrew Zeitman discussing today’s lending environment and how investors can finance real estate investments.Financing Real Estate Deals in Today’s Lending Environment - Andrew Zeitman, ...

Financing Real Estate Deals in Today’s Lending Environment - Andrew Zeitman, ...Investments Network marcus evans

Ahead of the marcus evans Private Wealth Management Summit March 2023, and the Private Wealth Management Summit June 2023, read here an interview with Aliyah Mohamed discussing what investors need to know about investing in Canadian real estate.What Makes Canadian Real Estate Attractive to Investors - Aliyah Mohamed, Ki...

What Makes Canadian Real Estate Attractive to Investors - Aliyah Mohamed, Ki...Investments Network marcus evans

Ahead of the marcus evans Private Wealth Management Summit 2022, read here an interview with John Van Clief on the investment opportunities in the alternatives space, and what makes companies innovative and recession-resistant.What Makes an Investment Portfolio Recession-Resistant - John Van Clief, Gree...

What Makes an Investment Portfolio Recession-Resistant - John Van Clief, Gree...Investments Network marcus evans

Ahead of the marcus evans Private Wealth Management Summit 2022, Rafia Hasan discusses her views on inflation and what investors need to do. Protecting Your Portfolio Against Inflationary Pressures-Rafia Hasan, Wipfli ...

Protecting Your Portfolio Against Inflationary Pressures-Rafia Hasan, Wipfli ...Investments Network marcus evans

Ahead of the marcus evans Private Wealth Management Summit 2022, Hannah Kirby discusses real estate tokenization and what makes DAOs attractive to investors.How it is Possible to Achieve Liquidity When Investing in Real Estate-Hannah ...

How it is Possible to Achieve Liquidity When Investing in Real Estate-Hannah ...Investments Network marcus evans

Ahead of the marcus evans Private Wealth Management Summit 2021, read here an interview with Gershie Vann discussing how to deliver the yield that investors are looking for.

How Private Wealth Managers Can Capitalize on any Market Environment-Gershi...

How Private Wealth Managers Can Capitalize on any Market Environment-Gershi...Investments Network marcus evans

Ahead of the marcus evans Private Wealth Management Summit 2021, Steve Fifield discusses which sectors of the real estate market investors can gain the most from

The Real Estate Investment Opportunities Today-Steve Fifield, FRC Realty Inc.

The Real Estate Investment Opportunities Today-Steve Fifield, FRC Realty Inc.Investments Network marcus evans

Ahead of the marcus evans Private Wealth Management Summit 2020, John Molina discusses sectors that can provide investors socially valuable assets without compromising their ROI

Investing in Real Estate that Provides Social Value and a Good ROI- John Moli...

Investing in Real Estate that Provides Social Value and a Good ROI- John Moli...Investments Network marcus evans

Presentation delivered by Robert Koepp, Director, The Economist Corporate Network, The Economist at the marcus evans Private Wealth Management Summit APAC Fall 2019 in MacaoAsia's New "Super Cluster"?: Prospects and Challenges for the Greater Bay Are...

Asia's New "Super Cluster"?: Prospects and Challenges for the Greater Bay Are...Investments Network marcus evans

Presentation delivered by Chris Leung, Chief China Economist, Executive Director, DBS Bank at the marcus evans Private Wealth Management Summit APAC fall 2019 in Macao.Self-Sufficiency: A Macroeconomic Insight into China’s Financial, Political a...

Self-Sufficiency: A Macroeconomic Insight into China’s Financial, Political a...Investments Network marcus evans

Presentation delivered by Simon Littlewood, President, SDG Global Group & CEO, Li Family Office at the marcus evans Private Wealth Managements APAC Summit 2019 in MacaoBehind the Face Value: Driving Sustainability Finance to Achieve Purpose beyo...

Behind the Face Value: Driving Sustainability Finance to Achieve Purpose beyo...Investments Network marcus evans

Ahead of the marcus evans Elite Summit 2019, read here an interview with Christoph Kausch discussing the trends in the healthcare technology space and how investors can benefit from themWhat Makes Healthcare Technology Attractive to Investors-Christoph Kausch, MT...

What Makes Healthcare Technology Attractive to Investors-Christoph Kausch, MT...Investments Network marcus evans

Presentation for Private Wealth Management APAC Summit 2019

Dr Rania Azmi, Founder & CEO, Alexandrite DecisionsSurviving the Test of Time: Instilling Enduring Passion and Preserving Wealth...

Surviving the Test of Time: Instilling Enduring Passion and Preserving Wealth...Investments Network marcus evans

Presentation for Private Wealth Management APAC Summit 2019

Jeff Shammah, Principal, Blue Oceans Partners Family Office Contemporary State of Mind: Bolstering Investment Potential by Positioning fo...

Contemporary State of Mind: Bolstering Investment Potential by Positioning fo...Investments Network marcus evans

Ahead of the marcus evans Latin Private Wealth Management Summit Fall 2018, read here an interview with Edgar Nava, Orlando Sthory and Leonardo Bracho discussing how investors can take advantage of volatility How Investors Can Make Money from Volatility-Edgar Nava, Orlando Sthory and L...

How Investors Can Make Money from Volatility-Edgar Nava, Orlando Sthory and L...Investments Network marcus evans

Robert Jones, Director, FCL Advisory

Onsite presentation for Private Wealth Management APAC Summit 2018Performing FO Health Checks to Build an Entrepreneurial, Flexible yet Robust ...

Performing FO Health Checks to Build an Entrepreneurial, Flexible yet Robust ...Investments Network marcus evans

Interview with: Dr Amir Guttman, Founder & Managing Partner, High-Tech Tracking Fund (HTF)A New Approach to Investing in Private Technology Companies - Amir Guttman ne...

A New Approach to Investing in Private Technology Companies - Amir Guttman ne...Investments Network marcus evans

Interview with: Yanis Varoufakis, Former Minister of Finance in GreeceEPI Summit 2018 - Yanis Varoufakis Shares His Views on the Global Economy, Br...

EPI Summit 2018 - Yanis Varoufakis Shares His Views on the Global Economy, Br...Investments Network marcus evans

Más de Investments Network marcus evans (20)

Financing Real Estate Deals in Today’s Lending Environment - Andrew Zeitman, ...

Financing Real Estate Deals in Today’s Lending Environment - Andrew Zeitman, ...

What Makes Canadian Real Estate Attractive to Investors - Aliyah Mohamed, Ki...

What Makes Canadian Real Estate Attractive to Investors - Aliyah Mohamed, Ki...

What Makes an Investment Portfolio Recession-Resistant - John Van Clief, Gree...

What Makes an Investment Portfolio Recession-Resistant - John Van Clief, Gree...

What Pension Funds Need to Focus On - Peter Borgdorff, PFZW

What Pension Funds Need to Focus On - Peter Borgdorff, PFZW

Protecting Your Portfolio Against Inflationary Pressures-Rafia Hasan, Wipfli ...

Protecting Your Portfolio Against Inflationary Pressures-Rafia Hasan, Wipfli ...

How it is Possible to Achieve Liquidity When Investing in Real Estate-Hannah ...

How it is Possible to Achieve Liquidity When Investing in Real Estate-Hannah ...

How Private Wealth Managers Can Capitalize on any Market Environment-Gershi...

How Private Wealth Managers Can Capitalize on any Market Environment-Gershi...

The Real Estate Investment Opportunities Today-Steve Fifield, FRC Realty Inc.

The Real Estate Investment Opportunities Today-Steve Fifield, FRC Realty Inc.

Investing in Real Estate that Provides Social Value and a Good ROI- John Moli...

Investing in Real Estate that Provides Social Value and a Good ROI- John Moli...

Asia's New "Super Cluster"?: Prospects and Challenges for the Greater Bay Are...

Asia's New "Super Cluster"?: Prospects and Challenges for the Greater Bay Are...

Self-Sufficiency: A Macroeconomic Insight into China’s Financial, Political a...

Self-Sufficiency: A Macroeconomic Insight into China’s Financial, Political a...

Behind the Face Value: Driving Sustainability Finance to Achieve Purpose beyo...

Behind the Face Value: Driving Sustainability Finance to Achieve Purpose beyo...

What Makes Healthcare Technology Attractive to Investors-Christoph Kausch, MT...

What Makes Healthcare Technology Attractive to Investors-Christoph Kausch, MT...

Surviving the Test of Time: Instilling Enduring Passion and Preserving Wealth...

Surviving the Test of Time: Instilling Enduring Passion and Preserving Wealth...

Contemporary State of Mind: Bolstering Investment Potential by Positioning fo...

Contemporary State of Mind: Bolstering Investment Potential by Positioning fo...

How Investors Can Make Money from Volatility-Edgar Nava, Orlando Sthory and L...

How Investors Can Make Money from Volatility-Edgar Nava, Orlando Sthory and L...

Fragments: A Path to Ideal Money - Evan Kuo presentation

Fragments: A Path to Ideal Money - Evan Kuo presentation

Performing FO Health Checks to Build an Entrepreneurial, Flexible yet Robust ...

Performing FO Health Checks to Build an Entrepreneurial, Flexible yet Robust ...

A New Approach to Investing in Private Technology Companies - Amir Guttman ne...

A New Approach to Investing in Private Technology Companies - Amir Guttman ne...

EPI Summit 2018 - Yanis Varoufakis Shares His Views on the Global Economy, Br...

EPI Summit 2018 - Yanis Varoufakis Shares His Views on the Global Economy, Br...

Último

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investorsFalcon Invoice Discounting

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...Falcon Invoice Discounting

Último (20)

Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investors

Al Mizhar Dubai Escorts +971561403006 Escorts Service In Al Mizhar

Al Mizhar Dubai Escorts +971561403006 Escorts Service In Al Mizhar

Berhampur 70918*19311 CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Berhampur 70918*19311 CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Pre Engineered Building Manufacturers Hyderabad.pptx

Pre Engineered Building Manufacturers Hyderabad.pptx

Horngren’s Cost Accounting A Managerial Emphasis, Canadian 9th edition soluti...

Horngren’s Cost Accounting A Managerial Emphasis, Canadian 9th edition soluti...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Marel Q1 2024 Investor Presentation from May 8, 2024

Marel Q1 2024 Investor Presentation from May 8, 2024

Uneak White's Personal Brand Exploration Presentation

Uneak White's Personal Brand Exploration Presentation

Ooty Call Gril 80022//12248 Only For Sex And High Profile Best Gril Sex Avail...

Ooty Call Gril 80022//12248 Only For Sex And High Profile Best Gril Sex Avail...

Lundin Gold - Q1 2024 Conference Call Presentation (Revised)

Lundin Gold - Q1 2024 Conference Call Presentation (Revised)

HomeRoots Pitch Deck | Investor Insights | April 2024

HomeRoots Pitch Deck | Investor Insights | April 2024

Getting Real with AI - Columbus DAW - May 2024 - Nick Woo from AlignAI

Getting Real with AI - Columbus DAW - May 2024 - Nick Woo from AlignAI

QSM Chap 10 Service Culture in Tourism and Hospitality Industry.pptx

QSM Chap 10 Service Culture in Tourism and Hospitality Industry.pptx

Falcon Invoice Discounting: Unlock Your Business Potential

Falcon Invoice Discounting: Unlock Your Business Potential

Call 7737669865 Vadodara Call Girls Service at your Door Step Available All Time

Call 7737669865 Vadodara Call Girls Service at your Door Step Available All Time

How to Get Started in Social Media for Art League City

How to Get Started in Social Media for Art League City

PARK STREET 💋 Call Girl 9827461493 Call Girls in Escort service book now

PARK STREET 💋 Call Girl 9827461493 Call Girls in Escort service book now

Why Investors Need to Enter the Decentralized Finance Space-Greg Carson, XBTO Humla Ventures

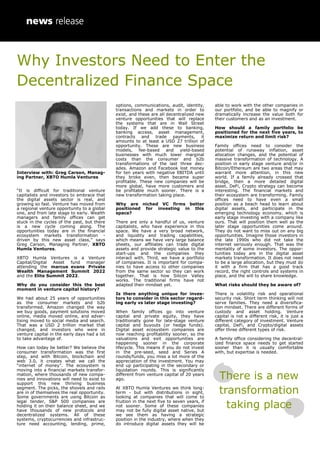

- 1. Why Investors Need to Enter the Decentralized Finance Space Interview with: Greg Carson, Manag- ing Partner, XBTO Humla Ventures “It is difficult for traditional venture capitalists and investors to embrace that the digital assets sector is real, and growing so fast. Venture has moved from a regional venture opportunity to a global one, and from late stage to early. Wealth managers and family offices can get stuck in the cycles of the past, but there is a new cycle coming along. The opportunities today are in the financial ecosystem markets transformation - driven by this new asset class,” says Greg Carson, Managing Partner, XBTO Humla Ventures. XBTO Humla Ventures is a Venture Capital/Digital Asset fund manager attending the marcus evans Private Wealth Management Summit 2022 and the Elite Summit 2022. Why do you consider this the best moment in venture capital history? We had about 25 years of opportunities as the consumer markets and b2b transformed. Amazon changed the way we buy goods, payment solutions moved online, media moved online, and adver- tising moved to social media and search. That was a USD 2 trillion market that changed, and investors who were in venture capital in the early days had a lot to take advantage of. How can today be better? We believe the consumer transformation was the first step, and with Bitcoin, blockchain and web 3.0, it creates what we call the “internet of money”. The ecosystem is moving into a financial markets transfor- mation, where thousands of new compa- nies and innovations will need to exist to support this new thriving business segment. The picks, the shovels and rails are in of themselves the real opportunity. Some governments are using Bitcoin as legal tender, S&P 500 companies are holding it on their balance sheet, and we have thousands of new protocols and decentralized systems. All of these systems, cryptocurrencies and infrastruc- ture need accounting, lending, prime, options, communications, audit, identity, transactions and markets in order to exist, and these are all decentralized new venture opportunities that will replace the systems that are in Wall Street today. If we add these to banking, banking access, asset management, contracts and trade payments, it amounts to at least a USD 27 trillion of opportunity. These are new business models, fee-based and yield-based businesses with much lower marginal costs than the consumer and b2b transformations of the last three dec- ades. Amazon and Facebook lost money for ten years with negative EBITDA until they broke even, then became super profitable. These new companies will be more global, have more customers and be profitable much sooner. There is a new transformation taking place. Why are niched VC firms better positioned for investing in this space? There are only a handful of us, venture capitalists, who have experience in this space. We have a very broad network, and liquidity and trading capabilities, which means we have very large balance sheets, our affiliates can trade digital assets and provide strategic value to the start-ups and the companies they interact with. Third, we have a portfolio of companies. It is important for compa- nies to have access to other companies from the same sector so they can work together. That is how Silicon Valley works. The traditional firms have not adapted their mindset yet. Is there anything unique for inves- tors to consider in this sector regard- ing early vs later stage investing? When family offices go into venture capital and private equity, they have traditionally gone for late-stage venture capital and buyouts (or hedge funds). Digital asset ecosystem companies are now reaching profitability sooner, so the valuations and exit opportunities are happening sooner in the corporate lifecycle. This means if you do not invest in the pre-seed, seed and Series A rounds/funds, you miss a lot more of the appreciation of the investment. You may end up participating in the secondary or liquidation rounds. This is significantly different from venture capital of 20 years ago. At XBTO Humla Ventures we think long- term - but with distributions in sight, looking at companies that will come to fruition in the next five to seven years, if not sooner. Some of these companies may not be fully digital asset native, but we see them as having a strategic position in the industry, where when they do introduce digital assets they will be able to work with the other companies in our portfolio, and be able to magnify or dramatically increase the value both for their customers and as an investment. How should a family portfolio be positioned for the next five years, to maximize return and limit risk? Family offices need to consider the potential of runaway inflation, asset allocation changes, and the potential of massive transformation of technology. A position in early stage venture and/or in Bitcoin/Ethereum are two areas that may warrant more attention, in this new world. If a family already crossed that bridge, then a more detailed digital asset, DeFi, Crypto strategy can become interesting. The financial markets and their ecosystem are transforming. Family offices need to have even a small position as a beach head to learn about digital assets, and participate in the emerging technology economy, which is early stage investing with a company like ours. That will position them well as the later stage opportunities come around. They do not want to miss out on any big opportunities. Imagine those investors in the late 1990s who did not take the internet seriously enough. That was the mentality of some investors. The oppor- tunities today are in the digital asset markets transformation. It does not need to be a large allocation, but they must do it with a firm that has a good track record, the right controls and systems in place, and the will to share knowledge. What risks should they be aware of? There is volatility risk and operational security risk. Short term thinking will not serve families. They need a diversifica- tion mindset. There are different forms of custody and asset holding. Venture capital is not a different risk, it is just a different category of investment. Venture capital, DeFi, and Crypto/digital assets offer three different types of risk. A family office considering the decentral- ized finance space needs to get started sooner than it is usually comfortable with, but expertise is needed. There is a new transformation taking place

- 2. The Investment Network – marcus evans Summits group delivers peer-to-peer information on strategic matters, professional trends and breakthrough innovations. Please note that the Summit is a closed business event and the number of participants strictly limited. For more information please send an email to press@marcusevanscy.com or visit the event websites below: Private Wealth Management Summit 2022: www.s1.privatewealthsummit.com Elite Summit 2022: www.may22.elitesummit.com About XBTO Humla Ventures Humla Ventures:XBTO is an investment firm focused on financial markets transformation. We invest in early stage (pre-seed to series A) companies building the rails of the financial markets transformation, with an emphasis on fintech and digital asset projects. Headquartered in Miami, the firm is raising the ‘financial markets transformation fund II’; investing globally for this theme that is both impact oriented and trend based. Our cornerstone investor and platform, XBTO, was the first liquidity provider for Bitcoin and the largest digital assets financial markets and exchanges since 2014. The platform and our veteran status grants us access to value added network, deal access, and outsized strategic contribution to our entrepreneurs and increase the chance and size of our companies success. In addition to offering unparalleled access to the digital asset ecosystem via our vehicle that invests purely in equity, we also offer co-investments for our LPs. www.xbtohumla.vc About marcus evans Summits marcus evans Summits are high level business forums for the world’s leading decision-makers to meet, learn and discuss strategies and solutions. Held at exclusive locations around the world, these events provide attendees with a unique opportunity to individually tailor their schedules of keynote presentations, case studies, roundtables and one-on-one business meetings. For more information, please visit: www.marcusevans.com Upcoming Events Elite Summit (Europe) - www.may22.elitesummit.com European Pensions & Investments Summit - www.may22.epi-summit.com Private Wealth Management APAC Summit - www.june22.pwmsummit.com To view the web version of this interview, please click here: http://events.marcusevans-events.com/pwm-elite2022-greg-carson Contact Sarin Kouyoumdjian-Gurunlian, Press Manager, marcus evans, Summits Division Tel: + 357 22 849 313 Email: press@marcusevanscy.com For more information please send an email to press@marcusevanscy.com All rights reserved. The above content may be republished or reproduced. Kindly inform us by sending an email to press@marcusevanscy.com