1216webskbaexp

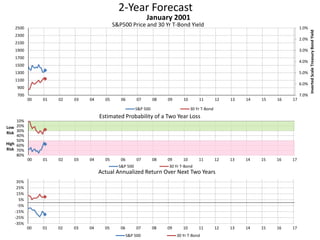

- 1. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield January 2001 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 2. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield February 2001 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 3. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield March 2001 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 4. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield April 2001 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 5. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield May 2001 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 6. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield June 2001 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 7. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield July 2001 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 8. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield August 2001 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 9. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield September 2001 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 10. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield October 2001 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 11. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield November 2001 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 12. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield December 2001 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 13. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield January 2002 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 14. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield February 2002 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 15. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield March 2002 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 16. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield April 2002 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 17. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield May 2002 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 18. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield June 2002 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 19. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield July 2002 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 20. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield August 2002 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 21. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield September 2002 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 22. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield October 2002 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 23. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield November 2002 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 24. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield December 2002 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 25. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield January 2003 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 26. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield February 2003 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 27. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield March 2003 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 28. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield April 2003 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 29. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield May 2003 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 30. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield June 2003 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 31. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield July 2003 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 32. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield August 2003 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 33. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield September 2003 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 34. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield October 2003 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 35. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield November 2003 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 36. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield December 2003 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 37. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield January 2004 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 38. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield February 2004 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 39. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield March 2004 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 40. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield April 2004 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 41. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield May 2004 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 42. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield June 2004 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 43. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield July 2004 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 44. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield August 2004 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 45. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield September 2004 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 46. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield October 2004 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 47. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield November 2004 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 48. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield December 2004 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 49. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield January 2005 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 50. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield February 2005 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 51. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield March 2005 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 52. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield April 2005 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 53. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield May 2005 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 54. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield June 2005 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 55. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield July 2005 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 56. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield August 2005 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 57. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield September 2005 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 58. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield October 2005 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 59. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield November 2005 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 60. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield December 2005 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 61. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield January 2006 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 62. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield February 2006 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 63. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield March 2006 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 64. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield April 2006 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 65. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield May 2006 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 66. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield June 2006 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 67. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield July 2006 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 68. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield August 2006 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 69. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield September 2006 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 70. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield October 2006 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 71. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield November 2006 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 72. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield December 2006 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 73. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield January 2007 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 74. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield February 2007 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 75. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield March 2007 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 76. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield April 2007 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 77. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield May 2007 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 78. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield June 2007 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 79. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield July 2007 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 80. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield August 2007 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 81. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield September 2007 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 82. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield October 2007 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 83. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield November 2007 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 84. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield December 2007 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 85. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield January 2008 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 86. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield February 2008 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 87. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield March 2008 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 88. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield April 2008 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 89. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield May 2008 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 90. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield June 2008 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 91. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield July 2008 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 92. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield August 2008 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 93. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield September 2008 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 94. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield October 2008 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 95. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield November 2008 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 96. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield December 2008 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 97. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield January 2009 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 98. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield February 2009 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 99. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield March 2009 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 100. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield April 2009 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 101. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield May 2009 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 102. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield June 2009 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 103. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield July 2009 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 104. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield August 2009 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 105. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield September 2009 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 106. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield October 2009 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 107. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield November 2009 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 108. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield December 2009 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 109. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield January 2010 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 110. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield February 2010 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 111. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield March 2010 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 112. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield April 2010 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 113. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield May 2010 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 114. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield June 2010 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 115. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield July 2010 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 116. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield August 2010 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 117. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield September 2010 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 118. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield October 2010 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 119. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield November 2010 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 120. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield December 2010 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 121. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield January 2011 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 122. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield February 2011 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 123. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield March 2011 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 124. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield April 2011 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 125. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield May 2011 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 126. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield June 2011 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 127. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield July 2011 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 128. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield August 2011 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 129. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield September 2011 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 130. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield October 2011 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 131. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield November 2011 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 132. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield December 2011 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 133. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield January 2012 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 134. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield February 2012 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 135. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield March 2012 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond

- 136. 2-Year Forecast S&P500 Price and 30 Yr T-Bond Yield 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0%700 900 1100 1300 1500 1700 1900 2100 2300 2500 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 InvertedScaleTreasuryBondYield April 2012 S&P 500 30 Yr T-Bond 10% 20% 30% 40% 50% 60% 70% 80% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Low Risk High Risk Estimated Probability of a Two Year Loss S&P 500 30 Yr T-Bond -35% -25% -15% -5% 5% 15% 25% 35% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Actual Annualized Return Over Next Two Years S&P 500 30 Yr T-Bond