Summer internship report 2012

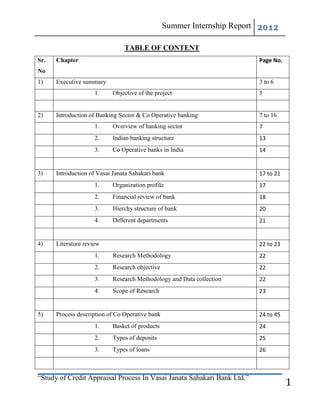

- 1. Summer Internship Report 2012 TABLE OF CONTENT Sr. Chapter Page No. No 1) Executive summary 3 to 6 1. Objective of the project 5 2) Introduction of Banking Sector & Co Operative banking 7 to 16 1. Overview of banking sector 7 2. Indian banking structure 13 3. Co Operative banks in India 14 3) Introduction of Vasai Janata Sahakari bank 17 to 21 1. Organization profile 17 2. Financial review of bank 18 3. Hierchy structure of bank 20 4. Different departments 21 4) Literature review 22 to 23 1. Research Methodology 22 2. Research objective 22 3. Research Methodology and Data collection 22 4. Scope of Research 23 5) Process description of Co Operative bank 24 to 45 1. Basket of products 24 2. Types of deposits 25 3. Types of loans 26 “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 1

- 2. Summer Internship Report 2012 6) Project profile 46 to 69 Credit Appraisal Mechanism 1. Credit appraisal 46 2. Departments related to Loan Process 46 3. Delegation of Lending Power 51 4. Flow chart of Loan Procedure of Retail Loan 53 5. Retail Loan Process 54 6. Flow Chart of Loan Procedure of Corporate Loan 61 7. Corporate Loan Process 62 7) NPA Management & its classification 70 to 73 1. Guiding principles 70 2. Asset classification 70 3. Provisions 73 4. Action under SARFAESI ACT 73 8) Case study 74 1. Personal Loan 74 2. Housing Loan 74 9) Findings and conclusion 75 to 79 10) Learning Experience 80 11) Appendix 81 12) Bibliography 83 “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 2

- 3. Summer Internship Report 2012 EXECUTIVE SUMMARY Once a project opportunity is conceived and it is considered after the preliminary screening, a detailed feasibility study has to be undertaken covering marketing, technical, and financial aspects of the project. The study in the form of Loan process mechanism and along with going through the borrower‟s information, general information of the proposal, past record of borrower and details of security mortgaged. Financial records of the borrower audited, provisional and projected such as Profit and loss account statements, Balance Sheet and Cash and Fund Flow Statements needed to be considered. The ratios such as current Ratio, Debt Service Coverage Ratio etc. are also checked. The ultimate decision whether to grant the credit to borrower for the application or not and how to go about it , is undertaken after this study which discloses whether the borrower has good past record and information provided are true and fair. My project concerns Credit Appraisal process, in which I need to asses if the borrower should be granted credit, and what should be the recommended loan amount. This all is done after carefully evaluating the financials and securities provided by the borrower. Various financial ratios are calculated for the past and future data provided by the borrower after checking the veracity of the same. The various ratios, which are frequently calculated include: Current ratio: [(Receivables + material and finished good inventory)/ (creditors for goods and expenses)] Long term debt-equity ratio [Long Term Debt/ Net worth] Interest coverage ratio [(Profit Before Interest – Provision for Tax)]/(Interest payments due for the year] Fixed assets coverage ratio “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 3

- 4. Summer Internship Report 2012 [Fixed Assets/ (Term loan and other long term debt obligations)] Debt-service coverage ratio [{(Profit after tax + Interest on term loan + Depreciation} + Other non-cash charges]/ [Interest on term loan + Principle Repayment] Profit after tax/sales Debtors Velocity [Average Receivables/Credit Sales* No. of days in a year.] Creditors Velocity [Average Payables/Credit Purchase* No. of days in a year.] Stock Velocity [Average Stocks/Cost of goods Sold* No. of days in a year.] Two other important criterions are IRR and DSCR Financial institutions calculate the Internal Rate of Return (IRR). The Internal Rate of Return refers to the rate of return that the project is expected to generate based on its projected cash flows accruing over its expected lifespan. Institutions have a threshold IRR that the project needs to surpass to assess its viability. DSCR refers to the ability of the project to generate sufficient cash flows to repay the debt taken to finance the project. This includes the principal along with the interest component. The above ratios are taken and matched with the standard, though a certain amount of flexibility is exercised depending on the perception and personal judgment of the appraising officer. A rating is assigned to the project based on the scores of the different ratios. A cut-off rating determines financing decision (whether the project would finance or not). Above the rating, the projects may be categorized into excellent, good and average. Based on this and the project characteristics, the final terms and conditions of financial assistance are decided upon “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 4

- 5. Summer Internship Report 2012 like: Moratorium Repayment period Availability period Security (like first charge, personal guarantee etc.) Interest rate All the expenses like service fee, processing fee, document fee and other expenses like inspection of site, factory, etc. are charged to the applicant and are a source of income for the lending institution. Credit Appraisal:- Credit appraisal is done to evaluate the credit worthiness of a borrower. The credit proposal is prepared to indicate the need based requirement and the rationale for its recommendation. Bank has in place a well-defined framework for approving credit limits of different segments. Requests for credit facilities from the prospective borrowers shall be on the prescribed format and the full-fledged proposal should be prepared for submission to the appropriate sanctioning authority for approval. These proposals analyze various risks associated with bank lending i.e. business risks, financial risks, management risks, etc. and clarify the process by which such risks will be managed on an on going basis. Objective of the study:- The objective of research is to study the Co-operative Banking in Vasai Janata Sahakari Bank Ltd. The area of study in Vasai Janata Sahakari Bank Ltd include:- 1. To make an item wise study of the component of Credit Appraisal and Process. 2. The study also involves the study of procedural formalities included in sanctioning the finance to its clients. 3. This study would involve analyzing the balance sheets of their clients in determining “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 5

- 6. Summer Internship Report 2012 their financial needs. 4. To suggest the step to be taken to increase the efficiency in Credit Appraisal. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 6

- 7. Summer Internship Report 2012 INTRODUCTION 1. Overview of Indian Banking Sector Banking in India originated in the last decades of the 18th century. The first banks were The General Bank of India, which started in 1786, and Bank of Hindustan, which started in 1790; both are now defunct. The oldest bank in existence in India is the State Bank of India, which originated in the Bank of Calcutta in June 1806, which almost immediately became the Bank of Bengal. This was one of the three presidency banks, the other two being the Bank of Bombay and the Bank of Madras, all three of which were established under charters from the British East India Company. For many years the Presidency banks acted as quasi-central banks, as did their successors. The three banks merged in 1921 to form the Imperial Bank of India, which, upon India's independence, became the State Bank of India in 1955. History Merchants in [Calcutta] established the Union Bank in 1839, but it failed in 1848 as a consequence of the economic crisis of 1848-49. The Allahabad Bank, established in 1865 and still functioning today, is the oldest Joint Stock bank in India.(Joint Stock Bank: A company that issues stock and requires shareholders to be held liable for the company's debt) It was not the first though. That honor belongs to the Bank of Upper India, which was established in 1863, and which survived until 1913, when it failed, with some of its assets and liabilities being transferred to the Alliance Bank of Simla. Foreign banks too started to app, particularly in Calcutta, in the 1860s. The Comptoire d'Escompte de Paris opened a branch in Calcutta in 1860, and another in Bombay in 1862; branches in Madras and Pondicherry, then a French colony, followed. HSBC established itself in Bengal in 1869. Calcutta was the most active trading port in India, mainly due to the trade of the British Empire, and so became a banking center. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 7

- 8. Summer Internship Report 2012 The first entirely Indian joint stock bank was the Oudh Commercial Bank, established in 1881 in Faizabad. It failed in 1958. The next was the Punjab National Bank, established in Lahore in 1895, which has survived to the present and is now one of the largest banks in India. Around the turn of the 20th Century, the Indian economy was passing through a relative period of stability. Around five decades had elapsed since the Indian Mutiny, and the social, industrial and other infrastructure had improved. Indians had established small banks, most of which served particular ethnic and religious communities. The presidency banks dominated banking in India but there were also some exchange banks and a number of Indian joint stock banks. All these banks operated in different segments of the economy. The exchange banks, mostly owned by Europeans, concentrated on financing foreign trade. Indian joint stock banks were generally undercapitalized and lacked the experience and maturity to compete with the presidency and exchange banks. This segmentation let Lord Curzon to observe, "In respect of banking it seems we are behind the times. We are like some old fashioned sailing ship, divided by solid wooden bulkheads into separate and cumbersome compartments." The period between 1906 and 1911, saw the establishment of banks inspired by the Swadeshi movement. The Swadeshi movement inspired local businessmen and political figures to found banks of and for the Indian community. A number of banks established then have survived to the present such as Bank of India, Corporation Bank, Indian Bank, Bank of Baroda, Canara Bank and Central Bank of India. The fervour of Swadeshi movement lead to establishing of many private banks in Dakshina Kannada and Udupi district which were unified earlier and known by the name South Canara ( South Kanara ) district. Four nationalized banks started in this district and also a leading private sector bank. Hence undivided Dakshina Kannada district is known as "Cradle of Indian Banking". During the First World War (1914–1918) through the end of the Second World War (1939– “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 8

- 9. Summer Internship Report 2012 1945), and two years thereafter until the independence of India were challenging for Indian banking. The years of the First World War were turbulent, and it took its toll with banks simply collapsing despite the Indian economy gaining indirect boost due to war-related economic activities. At least 94 banks in India failed between 1913 and 1918 as indicated in the following table: Years Number of banks Authorised capital Paid-up Capital that failed (Rs. Lakhs) (Rs. Lakhs) 1913 12 274 35 1914 42 710 109 1915 11 56 5 1916 13 231 4 1917 9 76 25 1918 7 209 1 Post-Independence The partition of India in 1947 adversely impacted the economies of Punjab and West Bengal, paralyzing banking activities for months. India's independence marked the end of a regime of the Laissez-faire for the Indian banking. The Government of India initiated measures to play an active role in the economic life of the nation, and the Industrial Policy Resolution adopted by the government in 1948 envisaged a mixed economy. This resulted into greater involvement of the state in different segments of the economy including banking and finance. The major steps to regulate banking included: The Reserve Bank of India, India's central banking authority, was established in April 1934, but was nationalized on January 1, 1949 under the terms of the Reserve Bank of India (Transfer to Public Ownership) Act, 1948 (RBI, 2005b).[1] In 1949, the Banking Regulation Act was enacted which empowered the Reserve Bank of India (RBI) "to regulate, control, and inspect the banks in India". “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 9

- 10. Summer Internship Report 2012 The Banking Regulation Act also provided that no new bank or branch of an existing bank could be opened without a license from the SBI, and no two banks could have common directors. Nationalization Banks Nationalization in India: Newspaper Clipping, Times of India, July 20, 1969 Despite the provisions, control and regulations of Reserve Bank of India, banks in India except the State Bank of India or SBI, continued to be owned and operated by private persons. By the 1960s, the Indian banking industry had become an important tool to facilitate the development of the Indian economy. At the same time, it had emerged as a large employer, and a debate had ensued about the nationalization of the banking industry. Indira Gandhi, then Prime Minister of India, expressed the intention of the Government of India in the annual conference of the All India Congress Meeting in a paper entitled "Stray thoughts on Bank Nationalization." The meeting received the paper with enthusiasm. Thereafter, her move was swift and sudden. The Government of India issued an ordinance ('Banking Companies (Acquisition and Transfer of Undertakings) Ordinance, 1969')) and nationalised the 14 largest commercial banks with effect from the midnight of July 19, 1969. These banks contained 85 percent of bank deposits in the country. Jayaprakash Narayan, a national leader of India, described the step as a "masterstroke of political sagacity." Within two “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 10

- 11. Summer Internship Report 2012 weeks of the issue of the ordinance, the Parliament passed the Banking Companies (Acquisition and Transfer of Undertaking) Bill, and it received the presidential approval on 9 August 1969. A second dose of nationalization of 6 more commercial banks followed in 1980. The stated reason for the nationalization was to give the government more control of credit delivery. With the second dose of nationalization, the Government of India controlled around 91% of the banking business of India. Later on, in the year 1993, the government merged New Bank of India with Punjab National Bank. It was the only merger between nationalized banks and resulted in the reduction of the number of nationalized banks from 20 to 19. After this, until the 1990s, the nationalized banks grew at a pace of around 4%, closer to the average growth rate of the Indian economy. Liberalization In the early 1990s, the then Narasimha Rao government embarked on a policy of liberalization, licensing a small number of private banks. These came to be known as New Generation tech- savvy banks, and included Global Trust Bank (the first of such new generation banks to be set up), which later amalgamated with Oriental Bank of Commerce, Axis Bank(earlier as UTI Bank), ICICI Bank and HDFC Bank. This move, along with the rapid growth in the economy of India, revitalized the banking sector in India, which has seen rapid growth with strong contribution from all the three sectors of banks, namely, government banks, private banks and foreign banks. The next stage for the Indian banking has been set up with the proposed relaxation in the norms for Foreign Direct Investment, where all Foreign Investors in banks may be given voting rights which could exceed the present cap of 10%,at present it has gone up to 74% with some restrictions. The new policy shook the Banking sector in India completely. Bankers, till this time, were used to the 4-6-4 method (Borrow at 4%; Lend at 6%;Go home at 4) of functioning. The new wave ushered in a modern outlook and tech-savvy methods of working for traditional banks. All this “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 11

- 12. Summer Internship Report 2012 led to the retail boom in India. People not just demanded more from their banks but also received more. Currently (2010), banking in India is generally fairly mature in terms of supply, product range and reach-even though reach in rural India still remains a challenge for the private sector and foreign banks. In terms of quality of assets and capital adequacy, Indian banks are considered to have clean, strong and transparent balance sheets relative to other banks in comparable economies in its region. The Reserve Bank of India is an autonomous body, with minimal pressure from the government. The stated policy of the Bank on the Indian Rupee is to manage volatility but without any fixed exchange rate-and this has mostly been true. With the growth in the Indian economy expected to be strong for quite some time-especially in its services sector-the demand for banking services, especially retail banking, mortgages and investment services are expected to be strong. One may also expect M&As, takeovers, and asset sales. In March 2006, the Reserve Bank of India allowed Warburg Pincus to increase its stake in Kotak Mahindra Bank (a private sector bank) to 10%. This is the first time an investor has been allowed to hold more than 5% in a private sector bank since the RBI announced norms in 2005 that any stake exceeding 5% in the private sector banks would need to be vetted by them. In recent years critics have charged that the non-government owned banks are too aggressive in their loan recovery efforts in connection with housing, vehicle and personal loans. There are press reports that the banks' loan recovery efforts have driven defaulting borrowers to suicide. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 12

- 13. Summer Internship Report 2012 2. Indian Banking Structure “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 13

- 14. Summer Internship Report 2012 3. Co Operatives Banks in India The Co-operative banks has a history of almost 100 years. The Co-operative banks are an important constituent of the Indian Financial System, judging by the role assigned to them, the expectations they are supposed to fulfill, their number, and the number of offices they operate. The co-operative movement originated in the West, but the importance that such banks have assumed in India is rarely paralleled anywhere else in the world. Their role in rural financing continues to be important even today, and their business in the urban areas also has increased phenomenally in recent years mainly due to the sharp increase in the number of primary co- operative banks. While the co-operative banks in rural areas mainly finance agricultural based activities including farming, cattle, milk, hatchery, personal finance etc. along with some small scale industries and self-employment driven activities, the co-operative banks in urban areas mainly finance various categories of people for self-employment, industries, small scale units, home finance, consumer finance, personal finance, etc. Some of the co-operative banks are quite forward looking and have developed sufficient core competencies to challenge state and private sector banks. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 14

- 15. Summer Internship Report 2012 Co operative Banks in India are registered under the Co-operative Societies Act. The cooperative bank is also regulated by the RBI. They are governed by the Banking Regulations Act 1949 and Banking Laws (Co-operative Societies) Act, 1965. These banks provide most services such as savings and current accounts, safe deposit lockers, loan or mortgages to private and business customers. For middle class users, for whom a bank is where they can save their money, facilities like Internet banking or phone banking is not very important. The co-operative banking structure in India is divided into following main 5 categories: Primary Urban Co-op Banks Primary Agricultural Credit Societies District Central Co-op Banks State Co-operative Banks Land Development Banks Co-operative banks function on the basis of 'no-profit no-loss'. Co-operative banks, as a principle, do not pursue the goal of profit maximization. Therefore, these banks do not focus on offering more than the basic banking services. So, co-operative banks finance small borrowers in industrial and trade sectors, besides professional and salary classes. Cooperative banks in India finance rural areas under: Farming Cattle Milk Hatchery Personal finance Cooperative banks in India finance urban areas under: Self-employment “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 15

- 16. Summer Internship Report 2012 Industries Small scale units Home finance Consumer finance Personal finance Some facts about Cooperative banks in India Some cooperative banks in India are more forward than many of the state and private sector banks. According to NAFCUB the total deposits & lendings of Cooperative Banks in India is much more than Old Private Sector Banks & also the New Private Sector Banks. This exponential growth of Co operative Banks in India is attributed mainly to their much better local reach, personal interaction with customers, their ability to catch the nerve of the local clientele. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 16

- 17. Summer Internship Report 2012 INTRODUCTION OF VASAI JANATA SAHAKARI BANK LTD. Vasai Janata Sahakari Bank Ltd, Vasai was established on 6th October 1973 by people committed to social cause in Vasai. Few enthusiastic RSS Leaders gathered together with a common goal to make available the banking facility to the common man. They had an aim that any person in need of genuine financial difficulty should have a source for raising loan and such person should not be a prey of traditional moneylenders. Names of few Pioneers are as follows 1. Shri . Shantaram Dhuri. 2. Shri. D. R. Raje 3. Shri. Y. G. Gaikwad 4. Shri. V. B. Pai 5. Shri. W. T. Samant The Bank has always kept the goal of helping economically weaker section society and has carved a place as bank of masses and not only for classes. 1. Organization Profile Vasai Janata Sahakari Bank Ltd. commenced its business operations in 21st September, 1973 and has completed 39 years of responsible and responsive banking operations. Since incorporation without any interruption, Bank has been awarded "A" Grade Audit Classification. The faith and trust of the customer has made a bank to leave a benchmark for itself with high quality of services and serving the community at large. Since 39 years of bank incorporation the only motto of bank is serve the customers from economically weaker, lower, middle and upper income classes, Small Businessman, Professionals, Small & Medium Enterprises and Corporate who can secure their financial dreams under one roof. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 17

- 18. Summer Internship Report 2012 Bank has been showing Average Growth of 20%, in Business during last 3 years and the net N.P.A. of the Bank is 0% over the three consecutive years. Bank's total Business from the level of Rs.1536 Crores in 2006-2007, has grown to Rs.2723 Crores as on March 31, 2011. Bank is having 10 Branches in Thane District and 1 in Mumbai i.e. at Vasai Gaon, Navghar (Vasai East), Virar (East & West), Nalasopara (East & West), Boisar, Dahanu and Dahisar having its operations in semi urban & rural areas. Bank has completed 38 years of its purposeful existence and has always been in forefront for development of economically backward class population. Bank has more than One lakh depositors in number, and Bank already started Core Banking solution. Bank has been awarded 'A' Class by the Statutory Auditors over the years and Grade - 'I' by Reserve Bank of India. Presently the Bank is having eight branches and deposit of Bank at present is Rs.26133 Cr as of, March 31st 2011. Over the years, the bank has consistently shown robust growth not only in size of Deposits and Advances but has also maintained profitability. 2. Financial review of Bank The position as on March 31, 2011 is as follows: Particular Amount Reserves 1679 cr. Deposit 26153 cr. Loans 12982 cr. Total Income 2723 cr. Profit 482 cr. Dividend 15% “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 18

- 19. Summer Internship Report 2012 Facilities to the customers like: Core Banking Solutions Demand Draft facility. Teller facility at Virar, Vasai & Nallasopara Branch, 12 x 7 days banking at our Virar, Navghar Branch (Except Bank Holiday) Seven days banking at Virar, Vasai, Navghar & Dhaisar. I. Core Banking Solution With an initiative to give the modern banking facility to its customer, the bank has successfully implemented the Core Banking Solution; the customer is no more the customer of a Branch, but the Bank's Customer. CBS is a step towards enhancing customer convenience through anywhere and Anytime Banking – 1. Any Branch Banking - Banking from any Branch of the Bank irrespective of the Branch where the customer is having account. 2. Balance Enquiry - customer can make enquiries about the balance; debit or credit entries in his/her account. 3. Cash Withdrawal – the customer can withdraw cash upto the stipulated limit from any branch irrespective of his/her account in the branch. 4. Cheque / Cash Deposits - To deposit cash / cheques into account of some other person who has account with any of the branch of the bank. 5. Statement & Passbook printing 6. Cheque Status enquiry 7. Fund Transfer – the customer can make the fund transfer instantly from one account to another account in the Bank (his / her own or third party) 8. EMI of Loan & RD installments can be paid 9. Personalized Cheque Book facilities “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 19

- 20. Summer Internship Report 2012 3. Hierchy structure of bank Chairman Vice-Chairman Board of Director's General Manager D. General Manager Senior Manager/ Executives Branch Branch Branch Branch Manager Manager Manager Manager Administrative Administrative Administrative Administrative Staff Staff Staff Staff “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 20

- 21. Summer Internship Report 2012 4. Different Departments in Vasai Janata Sahakari Bank LOAN & ADVANCE DEPT INDUSTRY ACCOUNT FINANCE DEPT DEPT VASAI JANATA SAHAKARI BANK DEPARTMENT RECOVERY TREASURY & LEGAL DEPT DEPT CLEARING DEPT “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 21

- 22. Summer Internship Report 2012 LITRATURE REVIEW 1. RESEARCH METHODOLOGY Research Statement “Study of Loan Process Mechanism in Vasai Janata Sahakari Bank Ltd.” 2. Research Objective I. To understand Loan process Mechanism in Vasai Janata Sahakari Bank Ltd. II. To analysis and conclude the data collected by primary data and secondary data. 3. Research Methodology & Primary Data Collection Data collected specifically for the study of Loan Appraisal & Renewal from Vasai Janata Sahakari Bank Ltd. Since the research carried out for this project is descriptive in nature, the various documents and official files would require for understanding the methodology used by the banks. The data collection is done by personal interview or direct observations. At the same time, related articles, newspapers, magazines, in-house journals, Credit Policy of banks, etc were referred. The information on the project under consideration is obtained by the bank employees and officials. Also I went through various files and the official correspondence of the bank for better understanding the topic under the study. The methodology also include finding out the financial ratio, understanding the credit rating and assessment of Credit Appraisal and renewal of the companies. Secondary Data:- This data is collected from bank‟s internal documents which make on monthly basis. Secondary data is scrutinized on the basis of suitability, reliability, adequacy and accuracy. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 22

- 23. Summer Internship Report 2012 Suitability: It has been ensured that the data available is suitable for the purpose of inquiry on hand. Reliability: The data is reliable because it is collected from the bank‟s internal sources. 4. Scope of Research The research concluded on Nallasopara branch. And the Scope of research within bank and Nallasopara branch. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 23

- 24. Summer Internship Report 2012 PROCESS DESCPRITION OF CO OPERATIVE BANK 1. Basket of Products VJSB various products Deposit Product Loan Product Janata Industrial Saving a/c Loan Scheme Loans to Current a/c professional Recurring Janata Samruddhi Deposit Scheme Group Loan Fix Deposit Scheme Vidya Vardhini(Educational Loan Scheme) Personal Loan Mortgage Loan “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 24

- 25. Summer Internship Report 2012 2. Types of Deposit Bank has various Deposits schemes with attractive rate of interest. Period/Type of Rate of Interest w.e.f 15.06.2012 Deposits % p.a % p.a General Sr.Citizen A. Savings Bank Deposits 4.00 4.00 B. Term Deposits 15 Days to 45 Days 4.50 6.00 91 Days to 180 Days 5.50 6.00 181 Days to 364 Days 6.00 6.50 For 1 Year 9.50* 10.00 1 year upto3 years 8.50^ 9.00 Above 3 years 10.25 10.75 500 Days 9.00 9.50 Notes - 1. *Effective Interest Rate 9.84% 2. ^Effective Interest Rate 11.98% 3. “Sahakar Utkarsha Thev” Rate of Interest 10% for 555 days For Senior Citizen & Reg. Society 10.25% “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 25

- 26. Summer Internship Report 2012 3. Types of Loans Various Loans available In Vasai Janata Sahakari Bank Janata Industrial Loan Scheme Loans to professional Janata Samruddhi Scheme Group Loan Scheme Vidya Vardhini(Educational Loan Scheme) Personal Loan Mortgage Loan Niwara Loan House Repair/ Improvement Loan Gruhalakshmi Loan Computer Loan Vehicle Loan Gold Loan Term Loan “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 26

- 27. Summer Internship Report 2012 I. Janata Industrial Loan Scheme:- This loan scheme formulated special scheme for small and medium scale industries enterprises (SME Sector) As a helping hand to the dynamic entrepreneurs in this sector. Features: Purchasing industrial gala/unit. Acquisition of plant & machinery. Expansion / Modification & technological up gradation. Complete package of project finance including working capital finance. Interest rate 12% p.a. This most competitive rate in the banking sector. The Limit of this Loan is Rs. 2,00,000 & Margin is 25%. The rate of interest is 12%. There are at least two Granter required for this Loan. The repayment period is 60 Months & membership is “A”. The E.M.I is Rs. 2,225 on Rs.1,00,000. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 27

- 28. Summer Internship Report 2012 II. Loans to professional:- For any type of the business requirements of the professional like Doctors (MBBS, BAMS, BHMS, BDS),Pathologists, Physiotherapists , Charted Accountants, Architects, Engineers, and interior Designers. Special rate of interest rate @ 11% offered. The loan will get on the basis of Term Loan under any scheme. The rate of interest rate is 11% & Repayment period is 84% Months. The membership is “A”. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 28

- 29. Summer Internship Report 2012 III. Janata Samrudhi Scheme:- Special loan scheme of personal loan up to Rs. 200000 for the confirmed employees of the Sthanik Sanstha, Hospitals, Educational Institution . The employer to give undertaking deduct the monthly installment from salary. Rate of interest: 13% (o.5% rebate for absolute punctuality in repayment of EMI) Period : 60 months “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 29

- 30. Summer Internship Report 2012 IV. Group Loan Scheme:- Special scheme of personal loan upto Rs. 2.00 Lacs, for the permanent employees of the company. The Employer to give undertaking to deduct the monthly installment from salary. Rate of interest : 12.5% Period : 60 months. This Loan basically given to group of people. It is Consists of 15- 20 members. The limit for this Loan is Rs. 100000. The Margin is Nil & Rate of interest is 12.5%. The repayment period is 60 months. The Monthly E.M.I is Rs. 2,200 on Rs.100000. There should at least one Granter & Membership should be “B”. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 30

- 31. Summer Internship Report 2012 V. Vidya Vardhini : Educational Loan Scheme :- Vidyavardhini Educational Loan Scheme for the students. This specially designed scheme aims at providing financial assistance to meritorious students to enable them to pursue higher studies in India or abroad. Amount of loan: Education In India Rs. 5 lacs Foreign Education Rs. 10 lacs Period: 7 years (including moratorium) The repayment will start form six month after completion of the course / education or after getting job whichever is earlier. Only the interest payment should be made in the moratorium period. Security equivalent to the amount of bank finance, by way of mortgage of the property, or any security acceptable to the bank. Insurance policy of s tudent, equivalent to the amount of bank finance, to be assigned in favour of the bank. The membership required is “A”. The EMI will be Rs.100000 for Education loan in India. For education loan in Aboard EMI will be depend on moratorium. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 31

- 32. Summer Internship Report 2012 VI. Personal Loan :- The Loan purpose is to get loan for personal use. The maximum Limit is up to Rs.200000. The interest rate on this loan is 15%. The repayment period is 36 Months. The EMI is Rs.3,470. If person is paying loan regularly than person gets the rebate of 2% & His EMI reduce to Rs.2380. There should at least two granter are required for this Loan & membership should be “A”. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 32

- 33. Summer Internship Report 2012 VII. Mortgage loan :- The limit for this Loan is 100 lacs & Margin is 40%. The rate of interest is 13% & repayment is 60 months. The E.M.I is Rs. 2,275 on Rs.100000. There should ne at least two granter are required for this Loan & Membership Is “A”. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 33

- 34. Summer Internship Report 2012 VIII. Niwara Loan (Home Loan):- This loan is also called as Housing Loan. Its divided into two parts. First part is amount up to Rs. 500000 & Second Part is divided in to Rs 500000 – 2500000. The margin for this loan is 10%. The Margin for this Loan 10%. The Interest Rate for this type of loan is 11% & 12% respectively. The repayment time in 180 Months. The E.M.I is Rs.1140- Rs. 100000 on loan up to Rs. 500000 & Rs. 1200 – Rs. 100000 for Loan up to Rs. 500000- Rs 2500000. There should be at least 2 Granters are required for this loan & Membership is “A”. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 34

- 35. Summer Internship Report 2012 IX. Gold Loan:- The Gold loan limit is Rs.200000. The margin is 25% & the rate of interest rate is 11.50%. The repayment time 12 months. The monthly will be Rs. 8865 on Rs. 100000 & if person is giving 10 gram of gold to bank than bank is giving them Rs. 12000 & the repayment will be bullet repayment. No guarantor is required for this type of loan. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 35

- 36. Summer Internship Report 2012 X. Cash Credit Loan:- It is divided in to two parts. First part is stock & second is Debtor. For Stock margin is 30%. At least two grunter required for that & Membership is “A”. For debtors it should be below 90 days. & margin is 40%. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 36

- 37. Summer Internship Report 2012 XI. Deposit Loan:- This Loan may give for purpose of document like F.D & The Interest Rate is F.D Rate + 2% There are No Granter Required for this Loan. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 37

- 38. Summer Internship Report 2012 XII. Computer Loan:- This Loan facility provides these who want to buy Computer. The limit for this type of Loan is Rs.30000. The Margin is 25% & The interest Rate is 11.50%. The Repayment period is 36 month. The E.M.I is Rs. 990 for 30000. There should be at least one granter is required for this type of loan. The Membership is “B”. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 38

- 39. Summer Internship Report 2012 XIII. Vehicle Loan:- The limit for this of Loan is Rs. 1500000. It is divided in to three parts. First part is for Personal use & Margin for this loan is 15%. The Interest rate for this type of loan is 11.50%. The repayment time is 60 Months & Membership should be “A”. The Monthly EMI is Rs.2200 on Rs. 100000. The Second part is loan for Business purpose but amount is up to Rs. 100000 & margin for this type of loan is 15%. The interest rate is 11.50% & repayment time is 36 month E.M.I is Rs.3,300 on Rs. 100000. There should be at least one granter is required for this both cases. The third part is for above Rs.100000 & Margin is 15%. The rate of interest is 13% & repayment period is 60 months. There should at least two granter are required for this type of loan & EMI is Rs. 2,275 on Rs.100000. Membership is “A”. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 39

- 40. Summer Internship Report 2012 XIV. House Repair/Improvement Loan:- This loan mainly given for the Improvement/Repair purpose. The person can get loan up to Rs. 200000. The margin for this type loan is 30%. The interest rate is 12.50%. The repayment time is 60 Months & The monthly E.M.I should be “A”. There should be at least two granter required. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 40

- 41. Summer Internship Report 2012 XV. Gruhalakshmi Loan:- The limit for this type of loan is Rs. 300000. The margin for this type loan is 30%. The interest rate on this type Loan is 11.50%. The Repayment time is 48 Months. There should be at least two granter are required for this Loan & Membership should be “A”. The Monthly EMI is Rs. 2610 on Rs. 100000. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 41

- 42. Summer Internship Report 2012 XVI. Term Loan:- The limit for this Loan is above Rs.5000000. The first part is Rs. 2 lac – Rs. 10 lac & Margin is 25%. The rate of interest is 12.50% & repayment period is 60 months. The membership is “A” & The EMI will be Rs. 2250 on Rs.1 lac. Second part is divided in to Rs. 10 lac – Rs. 50 lac. Margin is 25% & rate of interest is 13%. The Repayment time is 60 Months & Membership is required “A”. The EMI is Rs. 2275 on Rs. 1 lac. Third part is divided in to Rs. 50 lac & Above & Margin is 25%. The rate of interest is 13.50% & Repayment time is 60 months & membership is “A”. At least two granter required for all. Special Features of Loan: Attractive rate of interest Convenient repayment schedule Minimum processing charges Early sanction Rebate on rate of interest on regular repayment of loan “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 42

- 43. Summer Internship Report 2012 Concession in rate of interest for registered small scale industries No project report required up to limit of Rs. 10 lacs Timely enhancement on working capital limits and hassle free renewals Fast decision Flexibility on collateral security Ever supportive for all your financial requirements Customer friendly approach No hidden cost Flexibility on margins Minimum paper work Background- Various Schemes on Various Loans Sr. Loan Name Amount(In Margin Interest Months granter Membe E.M.I No. lacs) (%) (%) rship 1 Niwara Rs. 5.00 Lacs 10 11 180 2 A Rs. 1140 – Rs. 10000 Rs. 5.00 Lacs 10 12 180 2 A Rs. 1,200 – Rs. to 25 Lacs 100000 2 House Repair Rs. 2 Lacs 30 12.5 60 2 A Rs. 2,250 – Rs. 100000 3 Personal Rs. 1 Lacs Nil 15 36 2 A Rs. 3,470 – Rs. 100000 Janata Samrudhi N.A 13 60 Scheme 4 Gruhalaxsmi Rs. 3 Lacs 20 11.5 48 2 A Rs. 2,610 – Rs. 100000 5 Computer Rs. 30000 25 11.5 36 1 B Rs. 990 – Rs.30000 6 Vehicle Rs. 15 Lacs “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 43

- 44. Summer Internship Report 2012 Personal 15 11.5 60 1 A Rs. 2,200 – Rs. 1,00,000 Loan up to 1 15 11.5 36 Rs. 3,300 – Rs. lacs 1,00,000 Business use 15 13 60 2 A Rs. 2,275 – Rs. 1,00,000 7. Group Rs. 1 Lacs Nil 12.5 60 1 B Rs. 2,200 – Rs.1,00,000 8. Mortgage Rs.100 Lacs 50 13 60 2 A Rs. 2,275 – Rs. 1,00,000 9. Vidya Vardhini (Educational Loan) Within India Rs. 5 lacs 25 25 84 2 A Rs. 1,660 – Rs. 1,00,000 Abroad Rs. 10 Lacs 25 25 84 2 A Depend On Moratorium 10. Gold Rs. 2 Lacs 25 11.5 12 N.A B Rs. 8,865 – Rs. 1,00,000 11. Document Above 3 year 25 Up to N.A B NSC, KVP, maturity LIC Surrender Value Below 3 Year 50 11.5 Date of N.A B NSC, KVP, documen LIC Surrender t Value 12. ECS- Personal Rs. 1 Lacs 25 12 36 2 A Rs. 3,325 – Rs. 100000 13. Travel In India Rs. 1 Lacs 20 12.5 24 Abroad Rs. 2 Lacs 20 24 2 A Rs. 4,735 – Rs. 1,00,000 “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 44

- 45. Summer Internship Report 2012 14. Janata Rs. 2 Lacs 25 12 60 2 A Rs. 2,225 – Rs. Industrial Loan 1,00,000 Scheme 15. Term Loan Rs. 2 to Rs. 10 25 60 2 A Rs. 2,225 – Rs. Lacs 1,00,000 Rs. 10 to Rs. 25 60 2 A Rs. 2,275 – Rs. 50 Lacs 1,00,000 Rs.50 Lacs & 25 13.5 60 2 A Above 16. Cash Credit Stock 30 2 A Debtor (below 40 2 A 90 days) 17. Builder & 25 15 2 A Developers 18. Deposit Principal 10 FD Rate Up to N.A N.A +2 maturity of FDR 19. Loans to Term Loan 11 84 A professional under any scheme 20. Janata Industrial Loan Scheme “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 45

- 46. Summer Internship Report 2012 CREDIT APPRIASAL MECHANISM 1. Credit Appraisal:- Credit appraisal is done to evaluate the credit worthiness of a borrower. The credit proposal is prepared to indicate the need based requirement and the rationale for its recommendation. Bank has in place a well-defined framework for approving credit limits of different segments. Requests for credit facilities from the prospective borrowers shall be on the prescribed format and the full-fledged proposal should be prepared for submission to the appropriate sanctioning authority for approval. These proposals analyze various risks associated with bank lending i.e. business risks, financial risks, management risks, etc. and clarify the process by which such risks will be managed on an ongoing basis. 2. Departments related to Loan Process: A) Branch : An applicant comes with loan application at banks respective branches. All credit proposals will be accepted by Vasai Janata Sahakari Bank respective branches. Applicants required documents are taken into branches according to loan amount it goes to respective authorities. After taking all required documents scrutiny is prepared by branch. Then it depends on the proposal bank decide to give it loan or not. And in this if any loan more than Rs.5 lacs this loan proposal send to head office. B) Head Office: Branch office scrutiny is sent to head office as per requirements. The main role of head office is to check whether credit policies are properly followed or not. Head Office includes CIBIL Dept, Legal Dept, Recovery Dept and Mortgage Dept. CIBIL (CREDIT INFORMATION BUREAU LTD) Dept: India's first credit information bureau- is a repository of information, which contains the credit history of commercial and consumer borrowers. CIBIL's equity was held by State Bank of India, Housing Development Finance “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 46

- 47. Summer Internship Report 2012 Corporation Limited, Dun & Bradstreet Information Services India Private Limited and Trans Union International Inc. The shareholding pattern was in the proportion of 40:40:10:10 respectively. CIBIL is a composite Credit Bureau, which caters to both commercial and consumer segments. The Consumer Credit Bureau covers credit availed by individuals while the Commercial Credit Bureau covers credit availed by non- individuals such as partnership firms, proprietary concerns, private and public limited companies, etc. Banks, Financial Institutions, State Financial Corporations, Non-Banking Financial Companies, Housing Finance Companies and Credit Card Companies are Members of CIBIL. A Credit Information Report (CIR) is a factual record of a borrower's credit payment history compiled from information received from different credit grantors. Its purpose is to help credit grantors make informed lending decisions - quickly and objectively. Encryption is technique used to mask proprietary information in order to prevent it from being accessed by unauthorized individuals. Only authorized individuals who have been provided with the appropriate decoding software can unscramble the information. Thus, encrypted information that our Members provide us with is extremely secure. For every credit proposal applicants, his companies /organizations CIBIL report is taken. Also CIBIL report of all sureties is taken in Vasai Janata Sahakari Bank LTD. We can also get ranking of applicant through this report. 600/900 is considering as good score. To get ranking of applicant extra fees is charged. Limitations: CIBIL report can show records of only those banks which are member of CIBIL. If applicant took loan from other banks which are not CIBIL member then bank is unable to know that information. I. Legal Dept : This department checks mortgagability of securities. Its legal “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 47

- 48. Summer Internship Report 2012 aspects, also they check legal deeds .If any loan goes into default then all legal terms are taken care by this dept. Central Law Dept makes agreements between the applicant and the bank. II. Recovery Dept : Loans which are default i.e. which are not paid in stipulated time, those loans come under recovery dept. They send notice to applicant and accordingly follow all legal procedures against the defaulter. This dept. file a case against the defaulter in the court and recover a recovery certificate which is known as award. Award is kind of legal certificate in which applicants complete details are mentioned including his loan amount, interest rate, EMI and securities provided by the applicant. Also the pending amount that may be principle amount + interest is mentioned. III. Mortgage Dept. : Mortgage dept takes care about all details of mortgaged properties .This dept also verifies that whether given property is already mortgage to other bank or not. For immovable properties mortgage is done. For movable properties hypothecation is done. Property is mortgage especially when loan is taken against that same property. e.g. In housing loan ,the house is mortgage on which the loan is taken . Mortgage is of various types i.e. Simple Mortgage, English Mortgage, Mortgage by deposit of title deed, Mortgage by conditional sale, Anamolus Mortgage and Usufructory Mortgage. Vasai Janata Sahakari Bank accepts only simple registered and equitable mortgage. Mortgage Dept verifies property or place and values the property according to the market rate through which the stamp duty and registration fee is calculated. In major and metropolitan cities if the property have to be mortgage then equitable mortgage is done and rest other properties besides the major cities Simple register mortgage is done. In equitable mortgage “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 48

- 49. Summer Internship Report 2012 registration is not required. Only the agreement paper is required between the applicant and the bank. If the movable property is kept as a security then the hypothecation of the same property is done. E.g. In vehicle loan, the vehicle is hypothecated in the name of bank from which the loan is taken for the same vehicle. In Term loan and cash credit loan hypothecation of stock and book debts is made as security. The value of stock and book debts is calculated on the basis of the financial statement submitted in the documentation of the loan procedure. IV. IFD (Industrial Finance dept): IFD at head office is looking after by Senior Manager and managers. Their duty in brief respect of technical scrutiny and monitoring manufacturing proposes. For loans purchase of machineries above Rs.15Lakh IFD will verify the genuineness of quotations, competitive rates and available better alternate machineries at cheaper rate as well as of better qualities. In respect of determination of working capital they will study the production /processing cycle of the industrial unit and decide the working capital limit based on credit purchases, credit allowed on sales, minimum inventory levels, raw materials, work in progress and finish goods. IFD shall always update themselves in respect of various types of suppliers of machineries / equipment‟s, price list through market contacts and internet. Corporate loans like working capital loan, loan taken for purchase of new machinery, etc technical scrutiny is created on the basis of product manufactured in the industry, organized or unorganized sector, sufficient infrastructure, potentiality of product, demand in market, competition for the same product, profit margin. Industries comes under IFD are Printing and Dyeing, Engineering “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 49

- 50. Summer Internship Report 2012 Units, Chemical Manufacturing Units, Textile Mills, Pharmaceutical Companies, Construction Equipments, etc. Core activity of IFD: IFD has their own data to analyze and scrutinizes the manufacturing units .They are well known with production cycle of the industry .For service and trading activity there is no interference of technical dept. the branch and DGM scrutiny is used for such activity. Firstly in IFD Dept project is introduce by applicant which includes acquiring land, construction of a site , purchase of machinery or an industrial unit ,etc. then the verification of the quotation and the project progress is checked . Cost of machinery is verified with the supplier and with other substitute companies machineries .In case of acquiring land and construction corporate finance dept is introduce to verify the details. In case of purchase of machinery and industrial unit scrutiny is done on the basis of technical viability which is served by IFD. In case of production unit working capital calculation is done by IFD for which they need to have complete knowledge of production side of the company. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 50

- 51. Summer Internship Report 2012 3. Delegation of Lending Power Sr. Type Of Loan BM Senior DGM GM Board of No Manager Directors 1 Loan against Gold ornaments 2.00 2.00 2.00 2.00 Full Power 2 Loan/Overdraft against Bank‟s own 10.00 15.00 20.00 25.00 Full Power Fixed Deposit 3 Loan/OD against other approved paper 2.00 15.00 15.00 15.00 Full Power security viz. LIC, NSC, KVP 4 Personal Loan Unsecured and ECS loans 2.00 2.00 2.00 2.00 Full Power 5 Personal loans secured by salary 2.00 2.00 2.00 2.00 Full Power Deduction under sec 49 and janata Samrudhi Loan Scheme. 6 Niwara Loan secured by mortgage of 5.00 10.00 10.00 15.00 Full Power flat/house being purchases out of Bank finance. 7 Mortgage Loan and Overdraft (Vasai 5.00 10.00 10.00 15.00 Full Power Vyapar scheme) against real estate. 8 Vehicle Loan: 2 Wheelers & 4 Wheelers 5.00 10.00 10.00 15.00 Full Power secured by Hypothecation of vehicle purchased out of Bank finance. 9 Term loan to acquired asset i.e fixed Nil 10.00 10.00 15.00 Full Power asset for construction of factory premises and P & M Furniture & Fixture. 10 Cash credit against Hypothecation of 5.00 10.00 10.00 15.00 Full Power stock & Book debts with 100% collateral security and Cash Credit Renewal. 11 Temporary over limit in CC a/c upto 2.00 10.00 10.00 15.00 Full Power 10% of sanction cc limit or maximum as given in this table whichever is lower. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 51

- 52. Summer Internship Report 2012 12 Temporary over-limit in OD against 2.00 10.00 10.00 15.00 Full Power property upto 10% of sanction OD limit or Maximum as given in the table. Whichever is lower 13 Temporary over-limit in OD against F. D 2.00 10.00 10.00 15.00 Full Power a/c upto 5% of sanction OD limit or maximum as given in this table. Whichever is lower 14 Non- funded facilities viz. Bank Nil 10.00 10.00 15.00 Full Power Guarantee, L.C etc. fully secured 15 Education Loan 10.00 10.00 10.00 Full Power 16 Staff loan Sanction power with General Manger only Full Power staff Housing loan up to Rs. 8 lacs or less and all other types Staff loans. Reference: - Letter issued to the Branches of Vasai Janata Sahakari Bank LTD. By Head Office “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 52

- 53. Summer Internship Report 2012 4. Flow Chart of Loan Procedure of Retail Loan Loan Applied Visit to applicants home, workplace CIBIL Report of applicant No Make Reject Member Yes Documents Taken Check Eligibility Sanction Loan Amount Preparation of security documents Mortgage Done Release Credit Facility No Loan Recovery Repay Dept Yes Loan completely repaid “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 53

- 54. Summer Internship Report 2012 5. Retail Loan Process 1) Loan Applied: Applicant comes to bank‟s branch with credit proposal .According to the type of loan, bank asked for documents. 2) Receipt of documents (Balance sheet, KYC paper, Different Govt registration no, MOA, AOA, and properties of document 3) Visit to applicant’s home, workplace: Bank‟s employee‟s gives visit to applicant‟s home and workplace so that his /her relatives come to know about loan application. Also bank can get his past record from his colleagues, relatives. 4) CIBIL Report: Bank takes out CIBIL report of applicant, his sureties so that bank can know about the applicants past loans and whether he is able to pay those loans regularly or not. If CIBIL report shows that the applicant is unable to repay his past loans or he has many other loans then bank can reject his application. Through CIBIL report bank can know applicants loan amounts but bank is unable to view other bank‟s names from which those loans are taken .To get that information bank have to give application to CIBIL . 5) Decision on giving Membership: According to credit policies loan can be given to only members of bank. To give loan first applicant has to become member of the bank. Applicant can be permanent member or temporary member. Bank checks his past records and then decide whether to make him member or not. 6) Documents Taken: After making member bank asks for required documents to member i.e. His residential proofs, his income proof, legal documents if required. Also bank makes agreement with applicant if required. 7) Eligibility Status: According to the bank‟s credit policies every applicant should have minimum amount as a take home salary for his basic livelihood. According to Vasai Janata Sahakari bank‟s credit policy salaried applicant should have minimum Rs.4500 /-and maximum Rs.20, 000/- as take home salary. i. e.g.- If applicant has applied for a loan of Rs.2,00,000 as a personal “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 54

- 55. Summer Internship Report 2012 loan ,ROI- 15% ,EMI-60, Salary of the applicant – Gross Salary – Rs.10463 per month. Net Salary – Rs.8, 800 per month 1. Now we need to find the eligibility amount of the applicant i.e. according to its salary how much loan bank can sanction. ii. Net Salary – Rs.8, 800 iii. Min. Take home (-) Rs.4500 i. Rs.4300 iv. According to the policy 60 EMI and 15% ROI v. Loan amount EMI vi. 1, 00,000 2,353 vii. 1,82,745 4,300 b. In the above calculation Rs.4,300 is the balance amount after the minimum take home salary is removed i.e. Rs.4,500. So Rs.4,300 can be fully utilized as the EMI for the loan .The eligibility amount of the applicant whose net salary is Rs. 8,800 is Rs.1,82,745. So according to the loan application the applicant is not eligible for the loan amount of the Rs.2, 00,000. i. From the eligibility amount loan is given according to margins which are mentioned in credit policies. 8) Sanctioning Loan: In this acceptance, scrutiny, recommendation is come under sanctioning process. A. Acceptance:- I. All credit proposals will be accepted by respective Branches/Credit Cell. However, the proposals for In-Principle Acceptance as determined from time to time will be accepted at Regional Offices but after acceptance In-Principle of such proposals by the Board, they will be once again scrutinized by the Branch and sent to Head Office through respective Regional Offices. II. The all credit proposal Regional Offices for scrutiny and recommendations. In case of enhancement/additional facilities above Rs.100.00 Lakh will be accepted “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 55

- 56. Summer Internship Report 2012 and scrutinized by head office. However, the DGM/AGM should involve the respective Branch Managers/In-charges for account information, visit and other preliminary data collection and make them accountable for the same. The proposals should be scrutinized by the Regional Offices and with the recommendation of the DGM the proposals shall be sent to Head Office for sanction. III. Credit Proposals except Housing Loans, beyond the powers of Regional Offices shall be sent to Head Office duly scrutinized and recommended by the Branch office. Housing Loans, beyond the powers of Offices shall be sent directly to Head Office, duly scrutinized and recommended by the Branch/Credit Cell. IV. All other proposals shall be accepted, scrutinized and recommended by the Branches/Credit Cells and the proposals beyond the delegation of the Branches/Credit Cells shall be forwarded to the Head office. V. In exceptional cases the proposals may be accepted at Head Office directly. VI. Acceptance and Scrutiny should be done as per the laid down norms and instructions issued by Head Office from time to time. VII. The Specialized Credit Cells will follow the procedure as laid down in Office Orders No. 206 dated 10.11.2005 and No. 218 dated 18.9.2006 respectively. They will send proposals beyond the delegated power of DGM and upto the delegated authority of the Managing Director, directly to Head Office. VIII. The Regional Offices will send the proposals beyond the delegated power of DGM & upto the delegated power of the GM/MD, directly to Head Office for sanction and proposals beyond the delegated power of the GM/MD. IX. The Branches shall not sanction Security loans against income proof by Affidavit and there is no established business. However, if earlier loan sanctioned on the basis of Affidavit is repaid/ repaying regularly, new loan/top up loan can be sanctioned. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 56

- 57. Summer Internship Report 2012 X. In case of applications for loans from Class-IV Employees of Municipal Corporation of Mumbai, Navi Mumbai, Thane, Bhiwandi, Dombivali, Kalyan, Pune & other Municipal Corporations etc. can be considered if their full salaries are received/ credited regularly through ECS in their accounts for more than six months. They should give 2 good salary earners as sureties. XI. Branches shall invariably obtain Credit Report from Credit Information Bureau of India Ltd, (CIBIL) or from other Credit Information Agencies, of all applicants i.e. Individual as well as Commercial Borrowers and its Partners, Directors, Trustees as per Circular OC No. 433 dated 8.4.2008 and 456 dated 8.10.2008. Branches shall also check the www.cibil.com for the List of Defaulters whenever new and takeover credit proposals are received. XII. In-Principle Loan Approval Letters: For Surety Loans:- 'In-principle' Loan Approval letters can be issued to our customers whose salary is being remitted to our Bank through ECS. The approved amount will be based on the salary amount received in the Branch. The Branch In-charge may issue In- principle approval letter. For Housing Loans & Education Loans to students:- Branch In-charge or in his absence the next official will interview the applicant, apprise him of all requirements and get Housing/Education Loan Preliminary Application filled. He will obtain the latest income proof of the applicant and co- applicant, wherever applicable. On the basis of latest income proof of Applicant and Co-applicant, the Branch In-charge will on the same day issue Preliminary Approval of Housing/Education Loan amount upto Rs. 25.00 Lakh/Rs.10.00 Lakh respectively, in the appropriate formats. In case the Branch In-charge or in his absence, the next official is not satisfied about the proposal, he will forward it to the next higher authority for perusal/rejection along with their specific remarks as to why the proposal could not be sanctioned at his end. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 57

- 58. Summer Internship Report 2012 B. Scrutiny: Scrutiny is very important part in sanctioning loan. Branch Office make scrutinizes on credit proposal along with managers remarks. For some proposal only branches makes scrutiny. Branch Office scrutiny is sent to head offices and head office remarks also get added into it. In the scrutiny whole proposal of the applicant, its securities, Financial analysis of applicant is written . Also managers & GMs remarks get added. Applicant‟s strength and weaknesses also written down and at the end the whole proposal is goes in front of board meeting if required. Their remarks also get added. In Branch office financial analysis of applicant is done. His current ratio, quick ratio is calculated and compared with the policies requirements. Ratios are different according to sensitive area, general areas. Ranking also done in Branch offices if required. C. Recommendations:- (i) Recommendations by Branch In-charge and other Sr. Officials upto Managing Director has to be specific. Recommendations for sanction or rejection shall be supported by justification. (ii) For the Loans to be sanctioned by Branch In-charges, specific recommendation by the In-charge of Loan Dept., such as Asst. Accountant/Accountant/ Second Manager & whoever is actively involved in the Scrutiny, of the Branch is a must. (iii) Unless the Borrower/applicant agrees to mortgage the property and is in possession of documents, Title Deeds, Branch Office shall not recommend credit limits subject to mortgage of such properties. Recommendations shall strictly on the basis of offered prime and collateral securities only. They should not impose conditions which are not explicitly offered by the Applicants, like additional securities of property/FDRs etc. (iv) The Branch Office should ensure that in respect of each property, the “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 58

- 59. Summer Internship Report 2012 original Share Certificate and /or Sale Deeds duly registered & are held by the Mortgagor. (v) Similarly, the stipulation of new RD account or FDR as collateral security should not be mentioned in the recommendation without consulting the applicant and he agreeing for the same. Branches Office should obtain consent letter from the applicant. (vi) Generally the recommendations of Branch In-charge, AGM of ROs and DGM of Regional Office should not vary substantially as both are following the same credit appraisal norms as set out in the Credit Policy and various guidelines/instructions of the Bank. In case of mistake on the part of the Branch, RO/ZO should point out these mistakes in writing and advise these concerned Branch/In-charges suitably for the first instance. In case of repetition of mistakes in determining PBF and in preparation of the scrutiny notes, the Branch In-charge should be issued a Warning Memo. Similarly, Personnel Dept. should also be advised to initiate action against the concerned Branch in- charge/Scrutinizing Official, for concealment, wrong reporting of information, etc. as may be observed by the R.O./Z.O./H.O. However, the Branch In-charges and Regional Office may differ in their recommendations by noting the reasons. After recommendations appraisal get sanction accordingly. Sanctioning of loans and advanceds proposals after 23 days at branch level will be viewed sd violation of delegation authority attracting disciplinary action against the in- charge of the Branch. 8. Preparation of Security Documentation: The Appropriate Sanction Letter should be prepared and sent by the disbursement authorities containing all the Terms and Conditions of sanction. The Borrower and the sureties should give a letter accepting unconditionally all the terms and conditions of sanction and it should be kept along with other documents. The copy of sanction letter should be sent to all sureties. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 59

- 60. Summer Internship Report 2012 All documents should be executed as per the manual of Documentation/ guidelines issued by higher authorities. It should be ensured that proper documentations are executed with right amount of stamp duty as per H.O. guidelines issued from time to time .It should also be ensured that Borrower fulfills all terms and conditions stipulated by the Board/Sanctioning Authorities. 9. Preparation of Mortgage Deed: Mortgage agreement is prepared according to application. For immovable properties mortgage is done and for movable properties hypothecation is done. Mortgage Dept takes care of all terms and conditions and legal formalities. 10. Release credit Facility: If all documents, term and conditions are fulfill then credit facilities are released. 11. Repayment Of Loan: If the loan is not repaid regularly or if the applicant fails to repay the interest & the principal amount then the case of the credit proposal becomes default. Then this default case goes to the recovery dept. Where all necessary legal actions are taken against the defaulter. “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 60

- 61. Summer Internship Report 2012 6. Flow Chart of Loan Procedure of Corporate Loan Loan Applied Visit to applicants home, workplace CIBIL Report of applicant No Make Reject Member Yes Documents Taken Check Eligibility Sanction Loan Amount Prepare security documents Mortgage Done, IFD report taken Release Credit Facility No Loan Recovery Repay Dept Yes Loan completely repaid “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 61

- 62. Summer Internship Report 2012 7. Corporate Loan Process 1) Loan Applied: Applicant comes to bank‟s branch with credit proposal. According to loan type bank asked for documents. In the corporate loan applicant‟s interview is taken by bank‟s respective authorities. 2) Visit to applicant’s home, workplace: Bank‟s employee‟s gives visit to applicant‟s home and workplace so that his /her relatives come to know about loan application. Also bank can get his past record from his colleagues, relatives. 3) CIBIL Report: Bank takes out CIBIL report of applicant, his sureties so that bank can know about applicants past loans and whether he is able to pay those loans regularly or not. If CIBIL report shows that applicant is unable to repay his past loans or he has many other loans then bank can reject his application. Through CIBIL report bank can know applicants loan amounts but bank unable to see bank‟s names through which those loans are taken .To get that information bank have to give application to CIBIL . 4) Decision on giving Membership: According to credit policies loan can be given to only members of bank. To give loan first applicant have to become member of the bank. Applicant can be permanent member or temporary member. Bank checks his past records and then decide whether to make him member or not. 5) Documents Taken: After making member bank ask for required documents to member .His residential proofs, his income proof, legal documents if required. Also bank makes agreement with applicant if required. Balance sheet of 3 years is required. i. For CC and Term loans business‟s financial data is required. For business loans past 3 years, current years, next 3 years (projected) financial data is required. 6) Eligibility Status: For eligibility of term loan and CC facilities eligibility is calculated according to margins given in the credit policies. Also their average DSCR “Study of Credit Appraisal Process In Vasai Janata Sahakari Bank Ltd.” 62