Avoiding the Fiscal Cliff - American Taxpayer Relief Act

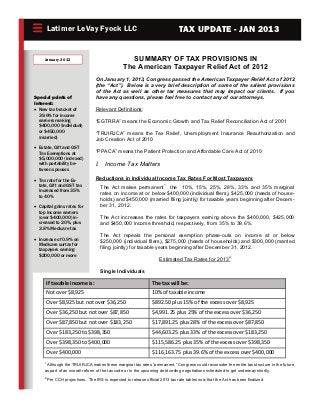

- 1. Latimer LeVay Fyock LLC TAX UPDATE - JAN 2013 January 2013 SUMMARY OF TAX PROVISIONS IN The American Taxpayer Relief Act of 2012 On January 1, 2013, Congress passed the American Taxpayer Relief Act of 2012 (the “Act”). Below is a very brief description of some of the salient provisions of the Act as well as other tax measures that may impact our clients. If you Special points of have any questions, please feel free to contact any of our attorneys. Interest: New tax bracket of Relevant Definitions: 39.6% for income earners making “EGTRRA” means the Economic Growth and Tax Relief Reconciliation Act of 2001 $400,000 (individual) or $450,000 “TRUIRJCA” means the Tax Relief, Unemployment Insurance Reauthorization and (married) Job Creation Act of 2010 Estate, Gift and GST Tax Exemptions at “PPACA” means the Patient Protection and Affordable Care Act of 2010 $5,000,000 (indexed) with portability be- I. Income Tax Matters tween spouses Tax rate for the Es- Reductions in Individual Income Tax Rates For Most Taxpayers tate, Gift and GST tax The Act makes permanent1 the 10%, 15%, 25%, 28%, 33% and 35% marginal increased from 35% rates on income at or below $400,000 (individual filers), $425,000 (heads of house- to 40% holds) and $450,000 (married filing jointly) for taxable years beginning after Decem- Capital gains rates for ber 31, 2012. top income earners (over $400,000) in- The Act increases the rates for taxpayers earning above the $400,000, $425,000 creased to 20%, plus and $450,000 income threshold, respectively, from 35% to 39.6%. 3.8% Medicare tax The Act repeals the personal exemption phase-outs on income at or below Increase of 0.9% on $250,000 (individual filers), $275,000 (heads of households) and $300,000 (married Medicare surtax for taxpayers earning filing jointly) for taxable years beginning after December 31, 2012. $200,000 or more Estimated Tax Rates for 20132 Single Individuals If taxable income is: The tax will be: Not over $8,925 10% of taxable income Over $8,925 but not over $36,250 $892.50 plus 15% of the excess over $8,925 Over $36,250 but not over $87,850 $4,991.25 plus 25% of the excess over $36,250 Over $87,850 but not over $183,250 $17,891.25 plus 28% of the excess over $87,850 Over $183,250 to $398,350 $44,603.25 plus 33% of the excess over $183,250 Over $398,350 to $400,000 $115,586.25 plus 35% of the excess over $398,350 Over $400,000 $116,163.75 plus 39.6% of the excess over $400,000 1 Although the TRUIRJCA makes these marginal tax rates “permanent,” Congress could reconsider the entire tax structure in the future as part of an overall reform of the tax code or in the upcoming debt ceiling negotiations scheduled to get underway shortly. 2 Per CCH projections. The IRS is expected to release official 2013 tax rate tables now that the Act has been finalized.

- 2. TAX UPDATE - JAN 2013 Page 2 Married Couples, Filling Jointly If taxable income is: The tax will be: Not over $17,850 10% of taxable income Over $17,850 but not over $72,500 $1,785 plus 15% of the excess over $17,850 Over $72,500 but not over $146,400 $9,982.50 plus 25% of the excess over $72,500 Over $146,400 but not over $223,050 $28,457.50 plus 28% of the excess over $146,400 Over $223,050 to $398,350 $49,919.50 plus 33% of the excess over $223,050 Over $398,350 to $450,000 $107,768.50 plus 35% of the excess over $398,350 Over $450,000 $125,846 plus 39.6% of the excess over $450,000 Medicare Surtax The Act does not affect the PPACA which adds an additional 0.9% Medicare surtax on wages received in connection with employment (including those self-employed) for taxpayers earning above $200,000 (single filers) or $250,000 (married, filing jointly). Therefore, these higher income earning will see their Medicare contributions increase from 1.45% to 2.35%. in 2013. Capital Gains and Dividends Under the Act, the long-term capital gains and dividend rates for taxpayers in the 10% and 15% brackets is equal to 0%. For those taxpayers in the 25%, 28% and 35% brackets, the long-term capital gains and dividend rates is equal to 15%. For those taxpayers in the highest bracket, 39.6%, the long-term capital gains and dividend rates is equal to 20%. Short-term capital gains will continue to be taxed at the indi- vidual income tax rate. Please keep in mind that the Act does not affect the provisions of the PPACA scheduled to become ef- fective on January 1, 2013, which requires taxpayers earning $200,000 (individual filers) and $250,000 (married, filing jointly) to also pay an additional 3.8% on Net Investment Income (such as capital gains and other income from passive investments). Therefore, the effective top rate for many higher-income taxpayers becomes 23.8% for long-term capital gains and 43.4% for short-term capital gains starting in 2013. Alternative Minimum Tax (AMT) The Act permanently patches the AMT, increasing the 2012 exemption amounts to $51,900 (individual filers) and $80,800 (married, filing jointly), indexed for inflation. Personal Exemption Phase-Out (PEP) and Pease Limitations The Act increases the threshold whereby a taxpayer would be subject to the PEP. Taxpayers with AGI over $300,000 (married, filing jointly) $275,000 (head of households) and $250,000 (single filers) will have their personal and dependency exemptions reduced or eliminated. Further, the Pease limitations on itemized deductions (which was eliminated by EGTRRA) are reinstated at the same threshold levels as the PEP.

- 3. TAX UPDATE - JAN 2013 Page 3 Credits The new Act extends the expanded child tax credit and earned income tax credits for five additional years. Payroll Tax The new Act raises taxes for all wage earners (including those self-employed) by failing to renew the 2012 payroll tax holiday. Therefore all wage earners will be contributing 6.2% (instead of 4.2%) of their earned income towards Social Security. II. Permanent Federal Estate, Gift and Generation-Skipping Transfer (GST) Tax Relief Federal Exemptions from Estate, Gift and GST The Act permanently provides for a $5 million estate, gift and generation-skipping transfer (GST) tax ex- emptions (indexed for inflation). On January 11, 2013, the IRS adjusted these exemptions for inflation to $5.25 million. The Act also increases the top tax rate for taxpayers who exceed the exemption amount from 35% to 40% for estate, gift and GST tax, effective January 1, 2013. As with the TRUIRJCA, the Act unifies the estate and gift tax exemption, thereby creating a single gradu- ated rate schedule for both taxes. That single lifetime exemption could be used for gifts and/or bequests. In addition, the Act extends a number of other GST related provisions which were set to expire, including the deemed allocation and retroactive allocation rules. Finally, the IRS has adjusted the annual gift tax exclusion for inflation from $13,000 per recipient to $14,000 per recipient for 2013. Portability The TRUIRJCA allowed the executor of a deceased spouse’s estate to transfer any unused exemption to the surviving spouse for estates of decedents dying after December 31, 2010, and before December 31 2012. The Act makes permanent this provision and is effective for estates for decedents dying after De- cember 31, 2012. Charitable Rollovers for IRAs The Act reinstates for 2012 and extends until the end of 2013 the ability of qualifying taxpayers (over 70 1/2 years of age) to direct up to $100,000 from their IRA accounts to certain charities (other than private foundations and donor-advised funds). By taking advantage of this technique, a taxpayer can exclude from income tax up to $100,000 each year to a qualified charity. In order to take advantage of this opportunity retroactively for the 2012 tax year, taxpayers can direct a distribution to charity by February 1, 2013. Also, if a taxpayer received a distribution from an IRA in De- cember of 2012, he or she can make a cash distribution to a charitable organization during January of 2013 and treat that amount as if it had been transferred to the charity directly from the IRA. III. Individual and Business Extenders The Act extends a huge amount of individual and business provisions through at least the end of 2013, including unemployment benefits, the Doc Fix (i.e. physician payment update), 50% “bonus” deprecia- tion, research and work tax credits, the $1,000 child tax credit, the $2,500 tax credit for college tuitions, and treatment of mortgage insurance premiums.

- 4. Latimer LeVay Fyock LLC Dear clients, colleagues and friends, 55 West Monroe Street We hope that this update helps with your income, estate, gift Suite 1100 and GST tax and corporate planning. As always, our Wealth Management and Corporate Services Groups are available to Phone: 312-422-8000 assist you. Fax: 312-422-8001 E-mail: pcham@llflegal.com If you have any questions regarding this update or any other Website: www.llflegal.com matter, please do not hesitate to contact me. Sincerely, Puneet Cham Puneet Cham About Latimer LeVay Fyock LLC Latimer LeVay Fyock LLC is committed to providing sophisticated and at- tentive legal services to its clients over a diverse spectrum of legal disci- plines. Our aim is to deliver sound legal advice to our clients within the specific context of their respective business and personal objectives. We focus on our clients’ practical business goals as the basis for our advice and representation. Attention to detail and sensitivity to our clients’ needs have enabled our firm and its attorneys to build long-term relationships. Our business model continues to drive our firm. Our attorneys combine many years of legal ex- perience with cutting-edge legal knowledge to provide value-added legal services to a client base consisting of a variety of manufacturing and ser- vice businesses, sophisticated financial institutions and accomplished indi- viduals and entrepreneurs. Among the services that Latimer LeVay Fyock LLC provides are: corporate mergers and acquisitions; negotiation and drafting of complex contracts and agreements; choice of and creation of entity; sophisticated capital rais- es and other financial transactions; complex and creative real estate trans- To download a copy of this tax alert: actions; wealth, tax and estate planning; and a wide variety of business and commercial litigation. WWW.LLFLEGAL.COM IRS CIRCULAR 230 NOTICE. ANY TAX ADVICE IN THIS COMMUNICATION IS NOT INTENDED OR WRITTEN BY LATI- MER LEVAY FYOCK LLC TO BE USED, AND CANNOT BE USED, BY A CLIENT OR ANY OTHER PERSON OR ENTITY FOR THE PURPOSE OF (i) AVOIDING PENALTIES THAT MAY BE IMPOSED ON ANY TAXPAYER OR (ii) PROMOTING, MAR- KETING OR RECOMMENDING TO ANOTHER PARTY ANY MATTERS ADDRESSED HEREIN. © 2013. Latimer LeVay Fyock LLC. All rights reserved. This newsletter provides general commentary on legal and tax issues to our clients, friends and colleagues. The foregoing is not intended to be legal advice or a thorough analysis of all aspects of the intended sub- ject matter. Recipients should seek an attorney or other qualified professional before initiating any actions based on the matters discussed in this newsletter.