Axis common kim equity

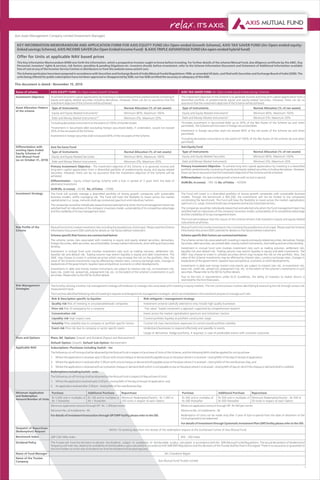

- 1. This Key Information Memorandum (KIM) sets forth the information, which a prospective investor ought to know before investing. For further details of the scheme/Mutual Fund, due diligence certificate by the AMC, Key Personnel, investors’ rights & services, risk factors, penalties & pending litigations etc. investors should, before investment, refer to the Scheme Information Document and Statement of Additional Information available free of cost at any of the Investor Service Centres or distributors or from the website www.axismf.com. The Scheme particulars have been prepared in accordance with Securities and Exchange Board of India (Mutual Funds) Regulations 1996, as amended till date, and filed with Securities and Exchange Board of India (SEBI). The units being offered for public subscription have not been approved or disapproved by SEBI, nor has SEBI certified the accuracy or adequacy of this KIM. Offer for Units at applicable NAV based prices Axis Asset Management Company Limited (Investment Manager) KEY INFORMATION MEMORANDUM AND APPLICATION FORM FOR AXIS EQUITY FUND (An Open-ended Growth Scheme), AXIS TAX SAVER FUND (An Open-ended equity- linked savings Scheme), AXIS INCOME SAVER (An Open Ended Income Fund) & AXIS TRIPLE ADVANTAGE FUND (An open-ended hybrid fund) The Fund by utilizing a holistic risk management strategy will endeavor to manage risks associated with investing in equity markets. The risk control process involves identifying & measuring the risk through various risk measurement tools. The Fund has identified following risks of investing in equities and designed risk management strategies, which are embedded in the investment process to manage such risks. Risk & Description specific to Equities Risk mitigants / management strategy Quality risk Risk of investing in unsustainable/weak companies Investment universe carefully selected to only include high quality businesses Price risk Risk of overpaying for a company “Fair value” based investment a approach supported by comprehensive research Concentration risk Invest across the market capitalization spectrum and industries / sectors Liquidity risk High impact costs Control portfolio liquidity at portfolio construction stage Volatility Price volatility due to company or portfolio specific factors Control risk class /sector/stock exposures to control overall portfolio volatility Event risk Price risk due to company or sector specific event Understand businesses to respond effectively and speedily to events Usage of derivatives: Hedge portfolios, if required, in case of predictable events with uncertain outcomes Plans: Nil; Options: Growth and Dividend (Payout and Reinvestment) Default Option: Growth; Default Sub-Option: Reinvestment Subscriptions /Purchases including Switch - ins: The following cut-off timings shall be observed by the Mutual Fund in respect of purchase of Units of the Scheme, and the following NAVs shall be applied for such purchase: 1. Where the application is received upto 3.00 pm with a local cheque or demand draft payable at par at the place where it is received - closing NAV of the day of receipt of application; 2. Where the application is received after 3.00 pm with a local cheque or demand draft payable at par at the place where it is received - closing NAV of the next Business Day; and 3. Where the application is received with an outstation cheque or demand draft which is not payable on par at the place where it is received - closing NAV of day on which the cheque or demand draft is credited. Redemptions including Switch - outs: The following cut-off timings shall be observed by the Mutual Fund in respect of Repurchase of Units: 1. Where the application received upto 3.00 pm - closing NAV of the day of receipt of application; and 2. An application received after 3.00 pm - closing NAV of the next Business Day. AXIS EQUITY FUND (An Open-ended Growth Scheme) To achieve long term capital appreciation by investing in a diversified portfolio predominantly consisting of equity and equity related securities including derivatives. However, there can be no assurance that the investment objective of the Scheme will be achieved. Type of Instruments Normal Allocation (% of net assets) # Equity and Equity Related Instruments Minimum 80%; Maximum 100% # Debt and Money Market Instruments* Minimum 0%; Maximum 20% # Including derivatives instruments to the extent of 100% of the Net Assets *Investment in Securitized debt (excluding foreign securitized debt), if undertaken, would not exceed 20% of the net assets of the Scheme. Investment in foreign securities shall not exceed 40% of the net assets of the Scheme. Axis Tax Saver Fund Type of Instruments Normal Allocation (% of net assets) Equity and Equity Related Securities Minimum 80%; Maximum 100% Debt and Money Market Instruments Minimum 0%; Maximum 20% Primary Investment Objective - The investment objective of the Scheme is to generate income and long-term capital appreciation from a diversified portfolio of predominantly equity and equity-related Securities. However, there can be no assurance that the investment objective of the Scheme will be achieved. Differentiation - Equity Linked Savings Scheme with a lock in period of 3 years from the date of allotment/ investment. AUM (Rs. in crores) - 43.89; No. of Folios - 15996 The Fund will actively manage a diversified portfolio of strong growth companies with sustainable business models, whilst managing risk. The Fund will have the flexibility to invest across the market capitalization (i.e. Large, mid and small cap companies) spectrum and industries / sectors. The companies would be individually researched and selected only when the fund management team has satisfied itself on robustness of the company’s business model, sustainability of its competitive advantage and the credibility of its top management team. Mutual Fund Units involve investment risks including the possible loss of principal. Please read the Scheme Information Document (SID) carefully for details on risk factors before investment. Scheme specific Risk Factors are summarized below: The scheme carries risks associated with investing in equity and equity related securities, derivatives, foreign Securities, debt securities, securitized debt, money market instruments, short selling and securities lending. Investment in mutual fund units involves investment risks such as trading volumes, settlement risk, liquidity risk and default risk. Trading volume may restrict liquidity in equity and debt investments. The AMC may choose to invest in unlisted securities which may increase the risk on the portfolio. Also, the value of the Scheme investments may be affected by interest rates, currency exchange rates, changes in law/policies of the government, taxation laws and political, economic or other developments. Investments in debt and money market instruments are subject to interest rate risk, re-investment risk, basis risk, credit risk, spread risk, prepayment risk, etc. to the extent of the scheme’s investments in such securities. Please refer to the SID for further details. Purchase Additional Purchase Repurchase Rs 5,000 and in multiples of Rs 100 and in multiples of Minimum Redemption/Switch - Rs 1,000 or Re 1 thereafter Re 1 thereafter 100 Units in respect of each Option Minimum application amount through SIP - Rs. 1,000 per month Minimum No. of installments - 36 For details of investment/transaction through SIP/SWP facility please refer to the SID. Within 10 working days from the receipt of the redemption request at the Authorized Centre of Axis Mutual Fund. S&P CNX Nifty Index BSE - 200 Index Name of scheme Investment Objective Asset Allocation Pattern of the scheme Differentiation with existing Open Ended Equity Schemes of Axis Mutual Fund (as on October 31, 2010) Investment Strategy Risk Profile of the Scheme Risk Management Strategies Plans and Options Applicable NAV Minimum Application and Redemption Amount/Number of Units Despatch of Repurchase (Redemption) Request Benchmark Index Dividend Policy Name of Fund Manager Name of the Trustee Company AXIS TAX SAVER FUND (An Open-ended equity-linked savings Scheme) The investment objective of the Scheme is to generate income and long term capital appreciation from a diversified portfolio of predominantly equity and equity-related Securities. However, there can be no assurance that the investment objective of the Scheme will be achieved. Type of Instruments Normal Allocation (% of net assets) # Equity and Equity Related Instruments Minimum 80%; Maximum 100% Debt and Money Market Instruments^ Minimum 0%; Maximum 20% ^Includes Investment in Securitized Debt up to 20% of the Net Assets of the Scheme (as and when permitted). The Scheme will not invest in foreign securitized debt. Investment in foreign securities shall not exceed 40% of the net assets of the Scheme (as and when permitted). # Including derivatives instruments to the extent of 100% of the Net Assets of the scheme (as and when permitted). Axis Equity Fund Type of Instruments Normal Allocation (% of net assets) Equity and Equity Related Securities Minimum 80%; Maximum 100% Debt and Money Market Instruments Minimum 0%; Maximum 20% Primary Investment Objective - To achieve long term capital appreciation by investing in a diversified portfolio predominantly consisting of equity and equity related securities including derivatives. However, there can be no assurance that the investment objective of the Scheme will be achieved. Differentiation - An open ended growth scheme with no lock in period. AUM (Rs. In crores) - 794.18; No. of Folios - 163594 The Fund will invest in a diversified portfolio of strong growth companies with sustainable business models. Though the benchmark is BSE-200, the investments will not be limited to the companies constituting the benchmark. The Fund will have the flexibility to invest across the market capitalization spectrum (i.e. Large, mid and small cap companies) and across industries/ sectors. The companies would be individually researched and selected only when the fund management team has satisfied itself on robustness of the company’s business model, sustainability of its competitive advantage and the credibility of its top management team. The Fund will endeavor that the corpus of the scheme remains fully invested in equity and equity-related instruments at all times. Mutual Fund Units involve investment risks including the possible loss of principal. Please read the Scheme Information Document (SID) carefully for details on risk factors before investment. Scheme specific Risk Factors are summarized below: The scheme carries risks associated with investing in equity and equity related securities, derivatives, foreign Securities, debt securities, securitized debt, money market instruments, short selling and securities lending. Investment in mutual fund units involves investment risks such as trading volumes, settlement risk, liquidity risk and default risk. Trading volume may restrict liquidity in equity and debt investments. The AMC may choose to invest in unlisted securities which may increase the risk on the portfolio. Also, the value of the Scheme investments may be affected by interest rates, currency exchange rates, changes in law/policies of the government, taxation laws and political, economic or other developments. Investments in debt and money market instruments are subject to interest rate risk, re-investment risk, basis risk, credit risk, spread risk, prepayment risk, etc. to the extent of the scheme’s investments in such securities. Please refer to the SID for further details. Due to the lock in requirements under ELSS Guidelines, the ability of investors to realize returns is restricted for the first three years. Purchase Additional Purchase Repurchase Rs 500 and in multiples of Rs 500 and in multiples of Minimum Redemption/Switch - Rs 500 or Rs 500 thereafter Rs 500 thereafter 50 Units in respect of each Option Minimum application amount through SIP - Rs 500 per month Minimum No. of installments - 36 Redemption of Units can be made only after 3 year of lock-in-period from the date of allotment of the Units proposed to be redeemed. For details of investment through Systematic Investment Plan (SIP) facility please refer to the SID. 1 This document is dated : November 15, 2010 Mr Chandresh Nigam Axis Mutual Fund Trustee Limited The Trustee will have the discretion to declare the dividend, subject to availability of distributable surplus calculated in accordance with the SEBI (Mutual Funds) Regulations. The actual declaration of dividend and frequency will inter-alia, depend on availability of distributable surplus calculated in accordance with SEBI (MF) Regulations and the decisions of the Trustee shall be final in this regard. There is no assurance or guarantee to the Unit holders as to the rate of dividend nor that the dividend will be paid regularly.

- 2. Performance of the scheme (as on October 29, 2010) Expenses of the Scheme (i) Load Structure (also applicable to SIP and Switches) (ii) Recurring Expenses Waiver of Load for Direct Applications Tax Treatment for Investors Unitholders Daily Net Asset Value (NAV) Publication For Investor Grievances please contact Unithholder’s Information Entry load : NA Exit load : 1% if redeemed within 1 year from date of allotment. Actual expenses for the financial year ended March 31, 2010 - 1.79% (audited) Not applicable Investors are advised to refer to the paragraph on Taxation in the “Statement of Additional Information” and to consult their own tax advisors with respect to the specific amount of tax and other implications arising out of their participation in the scheme. The NAV will be declared on all business days and will be published in 2 newspapers. NAV can also be viewed on www.axismf.com and www.amfiindia.com [You can also telephone us at 1800 3000 3300.] Registrar - Karvy Computershare Private Limited, Unit - Axis Mutual Fund, Karvy Plaza, H No 8-2-596, Street 1, Banjara Hills, Hyderabad 34. Tel 040 2331 2454 Fax 040 2331 1968 Mutual Fund - Mr Milind Vengurlekar, 11th Floor, Nariman Bhavan, Vinay K Shah Marg, Nariman Point, Mumbai 400 021. Tel 022 3940 3300 Toll Free 1800 3000 3300 Fax 022 2204 0130 E-mail customerservice@axismf.com Web www.axismf.com Account Statements: An account statement reflecting the number of Units allotted shall be dispatched to the Unit Holder by ordinary post / courier / electronic mail within the following periods: (i) Within 30 days from the date of closure of NFO / acceptance of valid application. (ii) In case of SIP/SWP - within 10 working days from the end of quarter (March, June, September and December). However, the first account statement under SIP/SWP shall be issued within 10 working days of the initial investment/transaction and in case of specific request, the account statement shall be despatched within 5 working days from the receipt of such request without any charges. Annual Account Statement: The Mutual Fund shall provide the Account Statement to the Unit holders who have not transacted during the last six months prior to the date of generation of account statements. The account statements in such cases may be generated and issued along with the Portfolio Statement or Annual Report of the Scheme. Annual Report: Scheme-wise Annual Report or an abridged summary thereof shall be mailed to all Unit Holders within four months from the date of closure of the relevant accounting year i.e. 31st March each year. Half yearly disclosures: The Mutual Fund shall publish a complete statement of the Scheme portfolio and the unaudited financial results, within one month from the close of each half year (i.e. 31st March and 30th September), by way of an advertisement at least, in one National English daily and one regional newspaper in the language of the region where the head office of the Mutual Fund is located. The Mutual Fund may opt to send the portfolio to all Unit holders in lieu of the advertisement. The Annual Report, portfolio statement and the unaudited financial results will also be displayed on the website of the Mutual Fund (www.axismf.com) and Association of Mutual Funds in India (www.amfiindia.com). Actual expenses for the financial year ended March 31, 2010 - 2.50% (audited) No Load will be charged on the Units allotted on reinvestment of Dividends. The above mentioned load structure shall be equally applicable to the special products such as SIP, switches and SWP (only for Axis Equity Fund) etc. offered under the Scheme. However, for switches between equity schemes, no load will be charged by the AMC. Further, for switches between the Growth and Dividend Option, no load will be charged by the scheme. SEBI vide its circular no. SEBI/IMD/CIR No. 4/ 168230/09 dated June 30, 2009 has decided that there shall be no entry Load for all Mutual Fund Schemes. The upfront commission on investment made by the investor, if any, shall be paid to the ARN Holder (AMFI registered Distributor) directly by the investor, based on the investor's assessment of various factors including service rendered by the ARN Holder. The Trustee / AMC reserve the right to change / modify the Load structure from a prospective date. The recurring expenses as a % of average weekly net assets of the Scheme (including the Investment Management and Advisory Fees) shall be as per the limits prescribed under the SEBI (MF) Regulations. These are as follows: On the first Rs. 100 crores - 2.50%; On the next Rs. 300 crores - 2.25%; On the next Rs. 300 crores - 2.00%; On the balance of assets - 1.75%. Entry load : NA Exit load : Nil AXIS INCOME SAVER (An Open Ended Income Fund) The Scheme seeks to generate regular income through investments in debt & money market instruments, along with capital appreciation through limited exposure to equity and equity related instruments. It also aims to manage risk through active asset allocation. Type of Instruments Normal Allocation (% of net assets) Debt* and money market instruments# Minimum 65%; Maximum 99% Equity and Equity related instruments# Minimum 1%; Maximum 35% *Includes securitized debt (excluding foreign securitized debt) up to 65% of the net assets of the Scheme. # Includes derivative instruments to the extent of 100% of the Net Assets of the scheme. The Scheme can invest up to 50% of net assets in Foreign Securities. Axis Income Saver, an open ended Income fund is a new scheme offered by Axis Mutual Fund and is not a minor modification of any other existing scheme/ product of Axis Mutual Fund. Axis Treasury Advantage Fund Asset Allocation Type of Instruments Normal Allocation (% of net assets) Money Market & Debt instruments with maturity/ average maturity/ residual maturity/ interest rate Minimum 70%; Maximum 100% resets less than or equal to 1 year Debt instruments with maturity/ average maturity/ residual maturity/ interest rate resets greater than 1 year Minimum 0%; Maximum 30% Primary Investment Objective - The investment objective is to provide optimal returns and liquidity to the investors by investing primarily in a mix of money market and short term debt instruments which results in a portfolio having marginally higher maturity as compared to a liquid fund at the same time maintaining a balance between safety and liquidity. However, there can be no assurance that the investment objective of the scheme will be achieved. Differentiation - No equity exposure AUM (Rs. In crores) - 752.75; No. of Folios - 952 Axis Short Term Fund Asset Allocation Type of Instruments Normal Allocation (% of net assets) Money market instruments and debt Instruments including government securities, corporate debt, securitized debt and other debt instruments with Minimum 30%; Maximum 100% maturity/ average maturity/ residual maturity/ interest rate resets less than or equal to 375 days or have put options within a period not exceeding 375 days. Debt instruments including government securities, corporate debt, securitized debt and other debt Minimum 0%; Maximum 70% instruments with maturity/ average maturity/ residual maturity/ interest rate resets greater than 375 days Primary Investment Objective -The scheme will endeavor to generate stable returns with a low risk strategy while maintaining liquidity through a portfolio comprising of debt and money market instruments. However, there can be no assurance that the investment objective of the scheme will be achieved. Differentiation - No equity exposure AUM (Rs. In crores) - 87.45 No. of Folios - 346 The asset allocation pattern and investment objective of above open ended income / debt schemes doesn’t provide for investment in equity and equity related instruments, whereas the asset allocation pattern of Axis Income Saver provides for investment in equity and equity related instruments upto 35% of net assets of the Scheme. Accordingly, Axis Income Saver is different from existing income/ debt schemes of Axis Mutual Fund. The scheme has dual objectives of generating income and capital gains while attempting to manage the risk from the market. In order to achieve the twin objectives, the scheme intends to follow a top-down and bottom-up investment strategy. The top-down process would lead to the asset-allocation between equities and fixed income and the bottom-up process would lead to construction of the portfolio using specific securities. The scheme would invest both in equities and fixed income instruments. Allocation between the two asset classes will be done using a quantitative asset allocation methodology. This methodology will be the primary tool to manage the overall risk of the portfolio in such a way as to achieve the objective of managing risk. The quantitative tool has been simulated with a target of limiting the downside to 5% in a calendar year. Within equities and fixed income, the portfolio would be actively managed to optimize returns within the respective asset class. Name of scheme Investment Objective Asset Allocation Pattern of the scheme Differentiation with existing Open Ended Debt Schemes of Axis Mutual Fund (as on October 31, 2010) Investment Strategy Type of Instruments Normal Allocation (% of net assets) # Equity and Equity Related Instruments Minimum 30%; Maximum 40% # Debt and Money Market Instruments* Minimum 30%; Maximum 40% Gold Exchange Traded Funds Minimum 20%; Maximum 30% *Investment in Securitized debt (excluding foreign securitized debt) - Up to 40% of the net assets of the Scheme. # Including derivatives instruments to the extent of 80% of the net assets of the Scheme. Investment in foreign securities - Up to 50% of the net assets of the Scheme. Axis Triple Advantage Fund, an open ended hybrid fund is a new scheme offered by Axis Mutual Fund and is not a minor modification of any other existing scheme/product of Axis Mutual Fund. Further, the existing products of Axis Mutual Fund are either debt, liquid or equity funds and hence the 'hybrid fund' under consideration cannot be compared with any other existing schemes. The scheme seeks to provide superior risk adjusted returns through diversification across various asset classes such as equity, fixed income & gold that have historically shown low correlation with each other. 2 AXIS TRIPLE ADVANTAGE FUND (An open-ended hybrid fund) To generate long term capital appreciation by investing in a diversified portfolio of equity and equity related instruments, fixed income instruments & gold Exchange Traded Funds. Under normal circumstances, the asset allocation pattern will be: th Date of Allotment - 5 January, 2010 Past performance may or may not be sustained in future. Returns are absolute for period less than 1 year. Since inception returns are calculated on Rs. 10 invested at inception. Calculations are based on Growth Option NAVs. Axis Equity Fund - Growth S&P CNX Nifty (Benchmark) *Inception to March 31, 2010 Absolute returns for the past 1 financial year. 2009-2010* 4.00% -0.55% Axis Equity Fund S&P CNX Nifty Returns Since Inception 18.70% 14.02% th Date of Allotment - 29 December, 2009 Past performance may or may not be sustained in the future. Returns are absolute for periods less than 1 year. Since inception returns are calculated on Rs 10 invested at inception. Calculations are based on Growth NAVs. Axis Tax Saver Fund BSE - 200 Index Returns Since Inception 29.71% 16.91% Axis Tax Saver Fund - Growth BSE 200 (Benchmark) 8.48% 1.17% 2009-2010* *Inception to March 31, 2010 Absolute returns for the past 1 financial year.

- 3. Purchase Additional Purchase Repurchase Rs 5,000 in multiples of Re 1 thereafter Rs 100 and in multiples of Re 1 thereafter Minimum Redemption - Rs 1,000 or 100 Units or account balance whichever is lower in respect of each Option For details of investment/transaction through SIP/STP/SWP facility please refer to the SID. Within 10 working days from the receipt of the redemption request at the Authorized Centre of Axis Mutual Fund. CRISIL MIP Blended Fund Index The Scheme performance would be benchmarked against a customized composite benchmark consisting of S & P CNX Nifty (35%), CRISIL Composite Bond Fund Index (35%) and INR Price of Gold (30%). Mutual Fund Units involve investment risks including the possible loss of principal. Please read the SID carefully for details on risk factors before investment. Scheme specific Risk Factors are summarized below: The scheme carries risks associated with investing in equities, fixed income instruments, derivatives, foreign securities, securitized debt, gold exchange traded funds, short selling and securities lending. Investment in mutual fund units involves investment risks such as trading volumes, settlement risk, liquidity risk and default risk. The AMC may choose to invest in unlisted securities which may increase the risk on the portfolio. Also, the value of the Scheme investments may be affected by currency exchange rates, changes in law/policies of the government, taxation laws and political, economic or other developments. Investments in debt and money market instruments are subject to interest rate risk, re-investment risk, basis risk, credit risk, spread risk, prepayment risk, etc. Equity and equity related instruments are volatile by nature. Investments in gold exchange traded funds are subject to market risk, risks associated with investment in physical gold, liquidity risk, counterparty risk, etc. Please refer to the SID for further details. The investment team of the AMC will carry out rigorous in depth credit evaluation of the money market and debt instruments (other than GSecs) proposed to be invested in. The credit evaluation will essentially be a bottom up approach and include a study of the operating environment, past track record, future prospects and the financial health of the issuer. With respect to the equity component, the Scheme would invest in a diversified portfolio of equity and equity related securities which would help alleviate the sector/market capitalization related concentration risk. The AMC has experienced investment professionals to help limit investment universe to carefully selected high quality businesses. The AMC would incorporate adequate safeguards for controlling risks in the portfolio construction process. These would be periodically evaluated. The scheme will also use derivatives and other hedging instruments, as may be permitted by SEBI and RBI, from time to time, to protect the value of the portfolio. The risk control process involves identifying & measuring risks through various risk measurement tools. For portfolio diversification, the scheme will also invest in gold ETFs as gold, historically, has shown a low correlation to other asset classes like equity & debt. Plans: Nil; Options: Growth and Dividend (Payout & Reinvestment) Default Option: Growth; Default Sub Option: Reinvestment; Risk Profile of the Scheme Risk Management Strategies Plans and Options Applicable NAV Minimum Application and Redemption Amount/Number of Units Despatch of Repurchase (Redemption) Request Benchmark Index Dividend Policy Name of Fund Manager Name of the Trustee Company Performance of the scheme (as on October 29, 2010) Expenses of the Scheme (i) Load Structure (applicable to SIP/STP/SWP and Switches) (ii) Recurring Expenses Waiver of Load for Direct Applications Tax Treatment for Investors (Unitholders) Daily Net Asset Value (NAV) Publication For Investor Grievances please contact Unithholder’s Information The Trustee will have the discretion to declare the dividend, subject to availability of distributable surplus calculated in accordance with the SEBI (Mutual Funds) Regulations. For Axis Income Saver the trustee will endavour to declare the Dividend as per the specified frqequencies, subject to availability of distributable surplus calculated in accordance with the Regulations. The actual declaration of dividend and frequency will inter-alia, depend on availability of distributable surplus calculated in accordance with SEBI (MF) Regulations and the decisions of the Trustee shall be final in this regard. There is no assurance or guarantee to the Unit holders as to the rate of dividend nor is there assurance that dividend will be paid regularly. 3 Mutual Fund Units involve investment risks including the possible loss of principal. Please read the SID carefully for details on risk factors before investment. Scheme specific Risk Factors are summarized below: The scheme carries risks associated with investing in equity and equity related securities, derivatives, debt and money market securities, Foreign Securities, securitized debt, short selling and securities lending. Investment in mutual fund units involves investment risks such as trading volumes, settlement risk, liquidity risk and default risk. The AMC may choose to invest in unlisted securities which may increase the risk on the portfolio. Also, the value of the Scheme investments may be affected by currency exchange rates, changes in law/ policies of the government, taxation laws and political, economic or other developments. Investments in debt and money market instruments are subject to interest rate risk, re-investment risk, basis risk, credit risk, spread risk, prepayment risk, etc. Equity and equity related instruments are volatile by nature. The name of the scheme should in no way be construed as a guarantee or assurance of returns or capital invested in the scheme. The scheme aims to manage the risk using a quantitative asset allocation methodology to decide the allocation between equity and fixed income securities. The investment team of the AMC will carry out rigorous in-depth credit evaluation of the money market and debt instruments (other than GSecs) proposed to be invested in. The credit evaluation will essentially be a bottom-up approach and include a study of the operating environment of the issuer, the past track record as well as the future prospects of the issuer and the short term/ long term financial health of the issuer. With respect to the equity component, the Scheme would invest in a diversified portfolio of equity and equity related securities which would help alleviate the sector/ market capitalization related concentration risk. The AMC has experienced investment professionals to help limit investment universe to carefully selected high quality businesses. The AMC would incorporate adequate safeguards for controlling risks in the portfolio construction process, which would be periodically evaluated. The scheme will also use derivatives and other hedging instruments, as may be permitted by SEBI and RBI, from time to time, in order to protect the value of the portfolio. The risk control process involves identifying & measuring the risk through various Risk Measurement Tools. Plans: Nil; Options: Growth and Dividend (Payout & Reinvestment) Sub Options: The Dividend Option would provide the following sub options: - Quarterly; - Half Yearly; - Annual; If Dividend payable under Dividend Payout option is equal to or less than Rs 500 then the Dividend would be compulsorily reinvested in the option of the Scheme. Default Option: Growth; Default Sub Option: Reinvestment; Default Dividend frequency: Quarterly Dividend Subscriptions/ Purchases including Switch - ins: The following cut-off timings shall be observed by the Mutual Fund in respect of purchase of units of the Scheme, and the following NAVs shall be applied for such purchase: 1. Where the application is received upto 3.00 pm with a local cheque or demand draft payable at par at the place where it is received – closing NAV of the day of receipt of application; 2. Where the application is received after 3.00 pm with a local cheque or demand draft payable at par at the place where it is received – closing NAV of the next Business Day ; and 3. Where the application is received with an outstation cheque or demand draft which is not payable on par at the place where it is received – closing NAV of day on which the cheque or demand draft is credited. Additional Clause for Axis Income Saver: In respect of purchase of units with amount equal to or more than Rs 1 crore, irrespective of the time of receipt of application, the closing NAV of the day on which the funds are available for utilization shall be applicable. Redemptions including Switch - outs: The following cut-off timings shall be observed by the Mutual Fund in respect of Repurchase of units: 1. Where the application received upto 3.00 pm – closing NAV of the day of receipt of application; and 2. An application received after 3.00 pm – closing NAV of the next Business Day. Entry load: Nil; Exit load: 1% if redeemed/switched out within 1 year from date of allotment. For switches between the Growth and Dividend Option, no load will be charged by the scheme. Mr. R. Sivakumar (for the debt component of the portfolio) and Mr. Pankaj Murarka (for the equity component of the portfolio) Axis Mutual Fund Trustee Limited Mr. Chandresh Nigam and Mr. R. Sivakumar Entry load: NA; Exit load: 1% if redeemed/ switched out within one year from date of allotment. Units issued on reinvestment of Dividends shall not be subject to Load. SEBI vide its circular no. SEBI/IMD/CIR No. 4/ 168230/09 dated June 30, 2009 has decided that there shall be no entry Load for all Mutual Fund Schemes. The upfront commission on investment made by the investor, if any, shall be paid to the ARN Holder (AMFI registered Distributor) directly by the investor, based on the investor's assessment of various factors including service rendered by the ARN Holder. The Trustee/ AMC reserves the right to change/ modify the Load structure from a prospective date. The recurring expenses as a % of average weekly net assets of the Scheme (including the Investment Management and Advisory Fees) shall be as per the limits prescribed under the SEBI (MF) Regulations. These are as follows: On the first Rs. 100 crores - 2.25%; On the next Rs. 300 crores - 2.00%; On the next Rs. 300 crores - 1.75%; On the balance of assets - 1.50%. The recurring expenses as a % of average weekly net assets of the Scheme (including the Investment Management and Advisory Fees) shall be as per the limits prescribed under the SEBI (MF) Regulations. These are as follows: On the first Rs. 100 crores - 2.50%; On the next Rs. 300 crores - 2.25%; On the next Rs. 300 crores - 2.00%; On the balance of assets - 1.75%. Actual expenses for the previous financial year - Not applicable Investors are advised to refer to the paragraph on Taxation in the “Statement of Additional Information” and to consult their own tax advisors with respect to the specific amount of tax and other implications arising out of their participation in the scheme. The NAV will be declared on all business days and will be published in 2 newspapers. NAV can also be viewed on www.axismf.com and www.amfiindia.com [You can also telephone us at 1800 3000 3300.] Registrar - Karvy Computershare Private Limited, Unit - Axis Mutual Fund, Karvy Plaza, H No 8-2-596, Street 1, Banjara Hills, Hyderabad 34. Tel 040 2331 2454 Fax 040 2331 1968 Mutual Fund - Mr Milind Vengurlekar, 11th Floor, Nariman Bhavan, Vinay K Shah Marg, Nariman Point, Mumbai 400 021. Tel 022 3940 3300 Toll Free 1800 3000 3300 Fax 022 2204 0130 E-mail customerservice@axismf.com Web www.axismf.com Account Statements: An account statement reflecting the number of Units allotted shall be dispatched to the Unit Holder by ordinary post / courier/ electronic mail within the following periods: (i) Within 30 days from the date of closure of NFO/ acceptance of valid application. (ii) In case of SIP/ STP/ SWP - within 10 working days from the end of quarter (March, June, September and December). However, the first account statement under SIP/ STP/ SWP shall be issued within 10 working days of the initial investment/transaction and in case of specific request, the account statement shall be despatched within 5 working days from the receipt of such request without any charges. Annual Account Statement: The Mutual Fund shall provide the Account Statement to the Unit holders who have not transacted during the last six months prior to the date of generation of account statements. The account statements in such cases may be generated and issued along with the Portfolio Statement or Annual Report of the Scheme. Annual Report: Scheme-wise Annual Report or an abridged summary thereof shall be mailed to all Unit Holders within four months from the date of closure of the relevant accounting year i.e. 31st March each year. Half yearly disclosures: The Mutual Fund shall publish a complete statement of the Scheme portfolio and the unaudited financial results, within one month from the close of each half year (i.e. 31st March and 30th September), by way of an advertisement at least, in one National English daily and one regional newspaper in the language of the region where the head office of the Mutual Fund is located. The Mutual Fund may opt to send the portfolio to all Unit holders in lieu of the advertisement. The Annual Report, portfolio statement and the unaudited financial results will also be displayed on the website of the Mutual Fund (www.axismf.com) and Association of Mutual Funds in India (www.amfiindia.com). th Date of Allotment - 16 July, 2010 Past performance may or may not be sustained in future. Returns are absolute for period less than 1 year. Since inception returns are calculated on Rs. 10 invested at inception. Calculations are based on Growth Option NAVs. Axis Income Saver CRISIL MIP Blended Fund Index Returns Since Inception 3.06% 2.50% Axis Triple Advantage Fund 35% of S&P CNX Nifty + 35% of CRISIL Composite Bond Fund Index + 30% of INR Price of Gold Returns Since Inception 2.66% 4.53% rd Date of Allotment - 23 August, 2010 Past performance may or may not be sustained in future. Returns are absolute for period less than 1 year. Since inception returns are calculated on Rs. 10 invested at inception. Calculations are based on Growth Option NAVs.

- 4. 1. GENERAL INSTRUCTIONS 1. TheApplicationFormshouldbecompletedinENGLISHandinBLOCKLETTERSonly. 2. All cheque, demand draft, pay orders should be crossed “Account Payee only” and made favouring “scheme nameA/cFirstinvestorname”or“SchemenameA/cPermanentAccountno”. 3. ThedefaultoptionshallbeasspecifiedinSID/KIMofrespectiveschemes. 4. For any correction / changes (if any) made on the application form, applicants are requested to authenticate thesamebycanceling,enteringthecorrectdetailsandcounter-signingthecorrectionsbysole/allapplicants. 5. Application forms along with Cheques/ DDs/ Debit Mandates can be submitted to ISC’s/ OPA of Karvy ComputershareandofficesofAxisAMCaslistedinform. 6. Investors must write the Application Form number / Folio number on the reverse of the cheques/ draft accompanyingtheApplicationForm,ifapplicable. 7. Investorsarerequestedto check the contentsof theaccountstatementandany discrepancyhas to be reported to the AMC / Registrar within 7 calendar days on the receipt of the statement, else the particulars would be presumedtobecorrect. 8. Any application may be accepted or rejected at the sole and absolute discretion of theAMC /Trustee, without assigninganyreasonwhatsoever. 9. Incompleteformsareliabletoberejected. 10. Pleasenotethatanon-transferableaccountstatementwillbeissuedforeachinvestment. 11. Unitsallottedaresubjecttorealisationofcheques. 12. All Unitholders who have invested/ may invest through channel distributors and intend to make their future investments through the Direct route, are advised to complete the procedural formalities prescribed by AMC fromtimetotime. 13. Please note that there would be a cooling period of not more than 10 days in case the investor changes the bankmandateforvalidationandverificationofbankaccounts. 2. DECLARATION AND SIGNATURES 1. The signature can be in English or in any Indian language. 2. Thumb impressions must be attested by a Magistrate / Notary Public under his / her official seal. 3. In case of HUF, the Karta wiII sign on behalf of the HUF. 4. Applications by minors should be signed by their guardian. 5. For Corporates, Signature of Authorised Signatory from Authorised Signatory List (ASL) is required. 3. PAYMENTS 1. AtpresentdirectdebitfacilitythroughdebitmandateisavailablewithAxisBank. 2. TheAMC intends using electronic payment services (like NEFT,RTGS,ECS (Credits) and such like) to the extent possible for dividend / redemption proceeds towards ensuring faster realization of proceeds for the investor.To facilitate verification of your bank account details for the purpose, please furnish the following details in the form: (a) ClearingCircle(CityName)inwhichyourBankbranchparticipates. (b) MICRCodeofyourbank/branch(9digitnumberappearingnexttothechequenumberonthechequeleaf) (c) IFSC Code of your bank / branch (11 character alphanumeric code, imprinted on your cheque leaf). If your chequeleafdoesnotcarrythis,pleasecheckforthesamewithyourlocalBankbranch. In case the Unit holders require these to be sent by cheque/ draft using postal/ courier service,the unit holders shallprovideappropriateinstructionsforthesametotheAMC/Registrar. 3. You are also requested to enclose a cancelled cheque leaf (or copy thereof) in case your investment instrument is notfromthesamebankaccountasmentionedinthebankmandatedetailsintheapplicationform. 4. TheAMC has put in place sufficient checks and balances but will not be liable for any wrong credits on account ofwronginformationpresentedbytheinvestorhimself. 5. The Fund may from time to time commence / discontinue Direct Credit arrangements with various banks for directcreditofredemptions/dividends.Investorswouldnothavetosubmitaseparateconsentlettertoavailof this service.The AMC would commence this operation based on the bank mandate details forwarded by the Investor. 6. Any communication / despatch of redemption / dividend proceeds,account statements etc.to the unit holders would be made by the Registrar / AMC in such a manner as they may consider appropriate in line with reasonablestandardsofservicing. 4. BANK DETAILS Investorsare requestedto mentionthe bankaccountdetails,since the same is mandatoryas per the directives issued by SEBI. Applications without this information will be deemed to be incomplete and are liable for rejection. The MutualFundreservestherighttoholdredemptionproceedsincasetherequisitedetailsarenotsubmitted. a) Investor having multiple accounts The Mutual Fund has also provided a facility to the investors to register multiple bank accounts.By registering multiple bank accounts, the investors can use any of the registered bank accounts to receive redemption / dividend proceeds. These account details will be used by the AMC / Mutual Fund / R&TA for verification of instrumentusedforsubscriptiontoensurethatthirdpartypaymentsarenotusedformutualfundsubscription, except where permitted above. Investors are requested to avail the facility of registering multiple bank accounts by filling in the Application Form for Registration of Multiple Bank Accounts available at our ISCs / OPAsoronourwebsitewww.axismf.com. Investment bank cheque submitted along with subscription should be same as the beneficiary investor, or should be as per bank mandate details provided in the Multiple Bank Accounts Registration form (except for MinorlessthanRs.50,000/-investmentsandCorporate/Nonindividuals). For Demand draft submitted by investor, would be allowed only with the required documents such as certificate issued by banker stating that Demand draft has been issued by debiting the investor bank account along with investor name and PAN.In case a pre-funded instrument issued by the Bank against Cash shall not be accepted for investments of Rs.50,000/- or more.This also should be accompanied by a certificate from the bankergivingname,addressandPANofthepersonwhohasrequestedforthedemanddraft. • In case of RTGS/NEFT/NECS payment submitted by investor, it would be allowed only with the required documents such as certificate issued by banker stating the RTGS/NEFT/NECS is issued by debiting the investor bankaccountandwithinvestornameandPAN. • In case the payment submitted by the investor is from a bank other than the bank account mentioned on the 'Multiple Bank Account Registration Form' the following documents needs to be provided any one of 'the paymentchequetohavethepreprintednameoftheholder/s,Bankstatement,PassbookorBankcertificate'or elseapplicationisliableforrejection. b) Restriction onAcceptance ofThirdParty Payments for Subscription of Units a) When payment is made through instruments issued from an account other than that of the beneficiary investor, the same is referred to as Third-Party payment. In case of payments from a joint bank account, the first holder of the mutual fund folio has to be one of the joint holders of the bank account from which paymentismade. b) TheAsset management Company shall not accept subscriptions withThird-Party payments except in the followingexceptionalsituations: 1. Payment by Parents/Grand-Parents/related persons on behalf of a minor in consideration of natural love and affectionorasgiftforavaluenotexceedingRs.50,000/-(eachregularpurchaseorperSIPinstallment) 2. PaymentbyEmployeronbehalfofemployeeunderSystematicInvestmentPlansthroughPayrolldeductions. 3. CustodianonbehalfofanFIIoraclient. 5. Documents to be obtained for exceptional cases: Investorssubmittingtheirapplicationsthroughtheabovementioned'exceptionalcases'arerequiredtocomplywith thefollowing,withoutwhichapplicationsforsubscriptionsforunitswillberejected/notprocessed/refunded. (A) MandatoryKYC for all investors (guardianin case of minor) and the personmaking the payment i.e.third party. In order for an application to be considered as valid, investors and the person making the payment should attachtheirvalidKYCAcknowledgementLettertotheapplicationform. 1. The nomination can be made only by individuals holding units on their own behalf singly or jointly. Non-Individuals including Society, Trust, Body Corporate, Partnership Firm, Karta of Hindu Undivided Family, holder of Power of Attorneycannotnominate.Iftheunitsareheldjointly,alljointholderswillsignthenominationform. 2. A minor can be nominated and in that event, the name and address of the guardian of the minor nominee shall be provided by the Unitholder. If no guardian is provided, nomination of minor will be invalid.The guardian should be a personotherthantheUnitholder.NominationcanalsobeinfavouroftheCentralGovt,StateGovt,localauthority,any persondesignatedbyvirtueofhisofficeorareligiouscharitabletrust. 3. The Nominee shall not be a trust other than a religious or charitable trust, society, body corporate, partnership firm, Karta of Hindu Undivided Family or a Power ofAttorney holder.A non-resident Indian can be a Nominee subject to the exchangecontrolsinforce,fromtimetotime. 4. Nominationinrespectoftheunitsstandsrescindeduponthetransferofunits. 5. ThenominationfacilityextendedundertheSchemeissubjecttoexistinglaws.TheAMCshall,subjecttoproductionof such evidence which in their opinion is sufficient,proceed to effect the payment / transfer to the Nominee(s).Transfer of Units / payment to the nominee(s) of the sums shall discharge the Mutual Fund / AMC of all liability towards the estateofthedeceasedUnitholderandhis/her/theirsuccessors/legalheirs. 6. The cancellation of nomination can be made only by those individuals who hold units on their own behalf singly or jointly and who made the original nomination. (Please note that if one of the joint holder dies other surviving holder cannotcancel.) 7. On cancellation of the nomination,the nomination shall stand rescinded and theAsset Management Company shall not beunderanyobligationtotransfertheunitsinfavouroftheNominee. 8. Nominationshallberegisteredonlyiftheformisfilledincompletely. 9. Nomination can be made for maximum of 3 nominees. In case of multiple nominees, the percentage of allocation / shareinfavourofeachofthenomineesshouldbeindicatedagainsttheirnameandsuchallocation/shareshouldbein whole numbers without any decimals making a total of 100 percent. In the event of Unit holders not indicating the percentage of allocation / share for each of the nominees,the Mutual Fund / theAMC,by invoking default option shall settletheclaimequallyamongstallthenominees. 10. The investor(s) by signing this nomination form is / are deemed to have read and understood the provisions of Regulation 29 A of SEBI (Mutual Funds) Regulations, 1996, read with SEBI circular dated Feb. 16, 2004 and / or any amendments thereto or any rules / regulations framed in pursuance thereof governing the nomination facility and agree/stobeboundbythesame. For multiple nomination form please contact the nearest AMC office or Registrar.The form can be obtained from the websitewww.axismf.com Please read the SID carefully before signing the application form and tendering payment. INSTRUCTIONS FOR COMPLETING THE APPLICATION FORM INSTRUCTIONS FOR COMPLETING THE NOMINATION SECTION (B) Submission of a separate, complete and valid 'Third Party Payment Declaration Form' from the investors (guardian in case of minor) and the person making the payment i.e. third party.The said Declaration Form shall, inter-alia,contain the details of the bank account from which the payment is made and the relationship with the investor(s).Please contact the nearest OPA/ISC ofAxis Mutual Fund or visit our website www.axismf.com for the saidDeclarationForm. 6. PAN AND KYC DETAILS Please furnish PAN & KYC details for each applicant/unit holder, including for Guardian and / or Power Of Attorney (POA)holdersasexplainedintheparagraphs below. 7. PAN As per SEBI Circular No. MRD/DoP/Cir- 05/2007 dated April 27, 2007, it is now mandatory that Permanent Account Number (PAN) issued by the IT Department would be the sole identification number for all participants transacting in the securities market, irrespective of the amount of transaction. Please note that furnishing of PAN with an attested copy of your PAN Card for each applicant / unit holder is mandatory for all investments. In the absence of this, your application will be rejected.The attestation of the PAN card may be done by a Notary Public or a Gazetted Officer or a Manager of a Bank or a financial advisor under it's / his seal and should carry the name and designation of the person attestingit. PAN will not be required incase of SIP where aggregate of installments in a financial year i e April to March does not exceedRs50,000.Thisexemptionwillbeapplicableonlytoinvestmentsbyindividuals, Non Resident Indian (NRI),minors,joint holders and sole proprietary firms (but not including Persons of Indian Origin (PIO), Hindu Undivided Family (HUF) and other categories). PAN requirement is also exempt for investors residing in the state of Sikkim, Central Government, State Government, and the officials appointed by the courts e.g. Official liquidator, Court receiver etc. (under the category of Government) subject to AMC confirming the above mentioned status.However,thiswouldbesubjecttosubmissionofnecessarydocumentsrequiredbytheAMCfromtimetotime. Any one of the following PHOTO IDENTIFICATION documents can be submitted along with Micro SIP applications as proofofidentificationinlieuofPAN. • Voter Identity Card • Driving License • Government/ Defense identification card • Passport • Photo Ration Card • Photo Debit Card (Credit card not included because it may not be backed up by a bank account) • Employee ID cards issued by companies registered with Registrar of Companies • Photo Identification issued by Bank Managers of ScheduledCommercialBanks/GazettedOfficer/ElectedRepresentativestotheLegislativeAssembly/Parliament•ID card issued to employees of Scheduled Commercial / State / District Co-operative Banks • Senior Citizen / Freedom Fighter ID card issued by Government • Cards issued by Universities/ deemed Universities or institutes under statutes like ICAI, ICWA, ICSI • Permanent Retirement Account No (PRAN) card isssued to New Pension System (NPS) subscribers by CRA (NSDL) • Any other photo ID card issued by Central Government/ State Governments/ Municipal authorities/GovernmentorganizationslikeESIC/EPFO 8. KYC COMPLIANCEWITHANTI MONEY LAUNDERING (AML) REGULATIONS Withreferencetothecircular35/MEM-COR/54/10-11dated16thAugust2010fromAMFIeffective1stOctober2010: • KYCiscompulsoryforallnonindividuals,NRIandchanneldistributorinvestors.* • Investors covered under this clause are - Corporate, Partnership Firms, Trusts, HUF, NRIs including PIOs & all individualandnonindividualinvestorsofchanneldistributors. • Individuals (except for NRI and through Channel Distributors) shall be required to be KYC compliant for investmentsofRs50,000andabove. Please note that it is mandatory for each applicant / unit holder to be KYC-compliant. Please enclose a copy of the KYC Acknowledgement Letter issued by CDSL Ventures Ltd with your application for investment. PLEASE ALSONOTETHEFOLLOWING: • GuardianstominorapplicantsneedtobeKYCcompliant. • POAHoldersneedtobeKYCcompliantirrespectiveoftheamountofinvestment. In case you are not yet KYC-compliant, please approach a Point of Service (POS) of CDSL Ventures Limited to obtainKYCcomplianceandsubmitacopyofyourKYCacknowledgementlettertous. *Foranyinvestmentamount. 9. APPLICATIONS UNDER POWER OFATTORNEY AnapplicantwantingtotransactthroughapowerofattorneymustlodgethephotocopyofthePowerofAttorney(PoA) attested by a Notary Public or the original PoA (which will be returned after verification) within 30 days of submitting theApplication Form /Transaction Slip at a Designated ISC’s / Official Point of acceptance or along with the application in case of application submitted duly signed by POA holder. Applications are liable to be rejected if the power of attorneyisnotsubmittedwithintheaforesaidperiod. 10. ELECTRONIC SERVICES FACILITY TheAMCintendstoprovideElectronicTransactionFacilityincludingthroughitswebsiteandoverphone. For more details, Terms & Conditions and for availability of Online Transaction refer AMC website www.axismf.comandforEasyCallfacilitypleasecontactthenearestAMCorRegistrar. 11. SIP 1. Unit Holder can enroll for the SIP by submitting duly completed SIP Application Form and one time debit mandate form for electronic debits.Alternatively unit holder can enroll for the SIP using EasyCall facility subject toservicesofferedbyAMCfromtimetotime.Thefirstinvestmentshallbethroughchequeonly. 2. AnInvestorshallhavetheoptionofchoosinganydateofthemonthashisSIPdate.TheminimumamountperSIP installment shall be as specified in SID / KIM.The minimum number of installments under the SIP is 36.If the SIP period is not specified by the unit holder then the SIP enrolment will be deemed to be for perpetuity and processedaccordingly. 3. AllSIPcheques/paymentinstructionswillbeofthesameamountandsamedate(excludingfirstcheque). 4. There will be a gap of 30 days between first SIP Installment and the second installment in case SIP started during ongoingoffer. 5. IftheFundfailstogettheproceedsfromthreeInstallmentsoutofacontinuousseriesofInstallmentssubmittedatthe timeofinitiatingaSIP(SubjecttoaminimumunderSIPi.e.36months),theSIPisdeemedasdiscontinued. 6. Investors can discontinue the SIP facility at any time by sending a written request to any of the Official Point(s) of Acceptance.Noticeofsuchdiscontinuanceshouldbereceivedatleast30dayspriortotheduedateofthenextdebit. 7. Incaseof“AtPar”cheques,investorsneedtomentionedtheMICRnumberofhisactualbankbranch. 8. AxisMutualFundreservestherighttorejectanyapplicationwithoutassigninganyreasonthereof. 9. Investor will not hold Axis Mutual Fund, its registrars and other service providers responsible if the transaction is delayed or not effected or the investor bank account is debited in advance or after the specific SIP date due to various clearingcyclesforECS. 10. Axis Mutual Fund, its registrars and other service providers shall not be responsible and liable for any damages/ compensation for any loss, damage etc. incurred by the investor. The investor assumes the entire risk of using this facilityandtakesfullresponsibility. 11. You can download the SIP application form and the SIP debit mandate form from our website www.axismf.com or contactanyoftheAMCoffices 12. NRIs,FIIs a) Repatriation Basis • NRIs :Payment may be made either by inward remittance through normal banking channels or out of funds held in a Non-Resident (External) RupeeAccount (NRE) / Foreign Currency (Non-Resident)Account (FCNR). In case Indian rupee drafts are purchased abroad or from Foreign CurrencyAccounts or Non-resident Rupee Accounts an account debit certificate from the Bank issuing the draft confirming the debit will need to be enclosed. • FIIsshallpaytheirsubscriptioneitherbyinwardremittancethroughnormalbankingchannelsoroutoffunds held in Foreign Currency Account or Non-Resident Rupee Account maintained by the FII with a designated branchofanauthoriseddealer. b) Non-repatriationBasis In the case of NRIs,payment may be made either by inward remittance through normal banking channels or out of funds held in a NRE / FCNR / Non-Resident Ordinary Rupee Account (NRO). In case Indian rupee drafts are purchased abroad or from Foreign Currency Accounts or Non-resident Rupee Accounts an account debit certificatefromtheBankissuingthedraftconfirmingthedebitwillneedtobeenclosed.

- 5. *To be processed in CMS software under client code “AXISMF” Signature of Account Holder(s) as per bank records / Authorised Signatory(ies) AXIS MUTUAL FUND - DEBIT MANDATE (For Axis Bank account holders only) TO BE DETACHED BY THE REGISTRAR (KARVY COMPUTERSHARE PVT LTD) AND PRESENTED TO AXIS BANK CMS BRANCH *To CMS DEPARTMENT - Axis Bank I/ We authorise you to debit my/ our account no. to pay for the purchase of Axis Equity Fund / Axis Tax Saver Fund / Axis Income Saver / Axis Triple Advantage Fund (Strike off those not applicable) Please debit an amount of Rs (in figures) Rs (in words) Name of the account holder(s) Application No. Stamp & Signature Application No.AXIS MUTUAL FUND - ACKNOWLEDGMENT SLIP (To be filled in by the investor) an application for purchase of units in Received from Mr/ Ms/ M/s/ Dr for Rs (in figures) on Date vide instrument no.D D M M Y Y Option Axis Tax Saver FundAxis Equity Fund Form1 Refer instruction related to PAN & KYC UNIT HOLDER INFORMATION Name of the First Applicant / Corporate Investor Mr/ Ms/ M/s/ Dr/ Minor PAN (mandatory) Enclosed- PANProof KYCLetter Name of the Second Applicant Mr/ Ms/ M/s/ Dr PAN (mandatory) Enclosed- PANProof KYCLetter Name of the Third Applicant Mr/ Ms/ M/s/ Dr PAN (mandatory) Enclosed- PANProof KYCLetter Name of the Guardian (in case of a minor) Mr/ Ms/ M/s/ Dr PAN (mandatory) Enclosed- PANProof KYCLetter Name of the Power of Attorney Holder Mr/ Ms/ M/s PAN (mandatory) Enclosed- PANProof KYCLetter Name of the Third Party (When payment is made through instruments issued from an account other than that of the beneficiary investor) Mr/ Ms/ M/s PAN (mandatory) PANProof KYCLetter Enclosed- Relation DeclarationForm (Mandatory) 2 Refer instruction related to PAN & KYC Refer instruction related to PAN & KYC Refer instruction related to PAN & KYC Refer instruction related to PAN & KYC Existing Investors - Please fill in Sections 1, 9, 10,11 and 13 only1 EXISTING FOLIO NUMBER Axis Income Saver Dividend Frequency* Axis Triple Advantage Fund R R Refer instruction related to PAN & KYC OVERSEAS ADDRESS (Mandatory in case of NRIs/ FIIs) (PO Box address is not sufficient. Investors residing overseas & with PO Box address must provide their Indian address) Address City State Pincode Mobile Landline No. Email 6B MODE OF OPERATION Single Joint Anyone or Survivor4 OCCUPATION (of First/ Sole Applicant) Service Housewife Defence Professional Retired Business Agriculture Other (specify)5 CONTACT DETAILS - FIRST APPLICANT/ GUARDIAN/ CORPORATE(PO Box address is not sufficient. Mobile number and email id is mandatory to avail of online facility.) Contact Person (In case of Non Individual Investor) Address City State Pincode Landline No. Mobile (Holder 1)* Email (Holder 1)* Mobile (Holder 2)* Email (Holder 2)* Mobile (Holder 3)* Email (Holder 3)* * Mandatory to transact using online transaction mode on our website www.axismf.com 6A STATUS OF FIRST APPLICANT Resident Individual Bank HUF Proprietor Minor Society FII Partnership Firm NRI PIO Trust Company Other (specify) 3 (Default option is Joint) Application No. R Upfront commission shall be paid directly by the investor to the AMFI registered distributor based on the investors’ assessment of various factors including the service rendered by the distributor. Distributor Code / ARN No. Sub-distributor Code / ARN No. / Sol ID Serial Number, Date and Time Stamp Date D D M M Y Y Date of Birth D D M M Y Y Age (No. of years) Y Y Date D D M M Y Y Dividend Re-investmentDividend PayoutGrowth *Applicable only for Axis Income Saver 10A COMMON APPLICATION FOR EQUITY & HYBRID FUNDS

- 6. For list of official point of acceptance please visit www.axismf.com Axis Asset Management Company Limited Investment Manager to Axis Mutual Fund 11th Floor, Nariman Bhavan, Vinay K Shah Marg, Nariman Point, Mumbai 400 021, India. Tel 91 22 3940 3300 Fax 91 22 2204 0130 Toll Free 1800 3000 3300 Email customerservice@axismf.com www.axismf.com Document attached (Any one) Cancelled Cheque with name pre-printed Bank statement Pass book Bank Certificate MODE OF CORRESPONDENCE (Where the investor has provided his e-mail id, the AMC shall send all communication to the investor via e-mail. Investors who wish to receive correspondence through physical mode instead of e-mail are requested to ). Email communication will help save paper & the planet. I/ Wewishtoreceiveallcommunicationthroughphysicalmodeinlieuofemail. ü 8 BANK ACCOUNT DETAILS OF FIRST / SOLE APPLICANT (Refer “Bank Details” under Instructions. Please enclose a copy of a cancelled cheque) For Multiple Bank Accounts Registration form available at www.axismf.com. Name of Bank Branch City State Account No. Account Type Current Savings NRO NRE FCNR Others MICR code* IFSC code** (specify) Note: In case bank details are not provided in “Multiple Bank Account Registration Form’ as default bank the above section 9 bank details shall be treated as default bank.. *Mandatory for dividend payout via ECS (The 9 digit code appears on your cheque next to the cheque number) **Mandatory for credit via RTGS/ NEFT (11 digit code also found on your cheque leaf.) 9 Cheque / DD RTGS NEFT Debit Mandate (For Axis Bank A/c holders only. Also fill section 10A) Cheque / DD UTR (for RTGS / NEFT) No. Cheque/DD Date Drawn on Bank Branch Cheque Issuer Name Branch Name In case cheque is issued by person other than the investor City State Account No. Account Type Current Savings NRO NRE FCNR Others (specify) D D M M Y Y PAYMENT OPTIONS (Please üeither Cheque / DD payment or RTGS/ NEFT)10 Total amount Rs (In figures) Rs (In words) DD Charges Rs (In figures) inclusive of DD charges if any inclusive of DD charges if any if any Having read and understood the content of the SID / SAI of the scheme,I / we hereby apply for units of the scheme.I have read and understoodtheterms,conditions,rules andregulations governingthescheme.I /Weherebydeclarethattheamountinvestedinthe scheme is through legitimate source only and does not involve designed for the purpose of the contravention of any Act, Rules, Regulations,Notifications or Directives of the provisions of the IncomeTaxAct,Anti Money Laundering Laws,Anti Corruption Laws or any other applicable laws enacted by the Government of India from time to time. I / We have understood the details of the Scheme & I / we have not received nor have been induced by any rebate or gifts, directly or indirectly in making this investment. I / We confirm that the funds invested in the Scheme, legally belongs to me / us. In event “Know Your Customer” process is not completed byme/ ustothe satisfactionofthe MutualFund,(I/ weherebyauthorizethe MutualFund,toredeemthe funds invested inthe Scheme,infavourofthe applicant,atthe applicable NAV prevailing onthe dateofsuchredemptionand undertake suchother action with such funds that may be required by the law.)TheARN holder has disclosed to me/ us all the commissions (in the form of trail commission or any other mode), payable to him for the different competing Schemes of various Mutual Funds from amongst which the Scheme is being recommended to me / us. For NRIs only - I / We confirm that I am/ we are Non Residents of Indian nationality / origin and that I /We have remitted funds from abroad through approved banking channels or from funds in my/ our NonResidentExternal/NonResidentOrdinary/FCNRaccount.I/Weconfirmthatdetailsprovidedbyme/usaretrueandcorrect. Second ApplicantFirst / Sole Applicant / Guardian Power of Attorney HolderThird Applicant 13 DECLARATION AND SIGNATURES I/We do hereby nominate the under mentioned person to receive the units to my / our credit in this folio no. in the event of my / our death. I / We also understand that all payments and settlements made to such Nominee, and signature of the Nominee acknowledgment receiptthereofshallbeavaliddischargebytheAMC/MutualFund/ Trustee. Nominee's Name Relationship Address 12 NOMINATION DETAILS D D M Y YM Y Y In case Nominee is a Minor Name of Guardian Address of Guardian DateofBirth SignatureofGuardian In case of more than one nominee,kindly submit multiple nomination (maximum 3 nominees) forms. Extra nomination forms can be obtained from the nearest ISC or Registrar or from the AMCwebsite. Axis Tax Saver FundAxis Equity Fund Axis Income Saver Axis Triple Advantage Fund Option Dividend Re-investmentGrowth Dividend Payout Dividend Frequency* Quarterly Half Yearly Annual *Applicable only for Axis Income Saver Form1 11 INVESTMENT DETAILS CONTACT & ADDRESS OF POWER OF ATTORNEY HOLDER (PO Box address is not sufficient) Address City State Pincode Mobile Landline No. Email 7 Document submitted. Sr Documents Individuals Companies Trusts Societies Partnership FIIs NRIs Investments Kindly (ü) No Firms through POA 1 Resolution / Authorisation to invest üüü üü 2 List of Authorised Signatories with Specimen Signature(s) üüü üü ü 3 Memorandum & Articles of Association ü 4 Trust Deed ü 5 Bye-Laws ü 6 Partnership Deed ü 7 Notarised Power of Attorney ü 8 Account Debit Certificate in case payment is made by DD from NRE / FCNR A/c where applicable üü 9 PAN Proof (not required for existing investors) ü üüü üüü ü # 10 KYC acknowledgment letter (required if not already submitted) ü üüü üüü ü 11 Copy of cancelled cheque ü üüü üüü ü Alldocumentsin1to6aboveshouldbeoriginalsortruecopiescertifiedbytheDirector/Trustee/CompanySecretary/AuthorisedSignatory/NotaryPublic/Partnerasapplicable.Originalswillbehandedoverafterverification. # Individuals(exceptforNRIorinvestorsthroughChannelDistributors)shallberequiredtobeKYCcompliantforinvestmentsofRs50,000andabove. CHECKLIST Documents as listed below are to be submitted along with the Application Form (as applicable to your specific case)

- 7. AXIS MUTUAL FUND - ACKNOWLEDGMENT SLIP (To be filled in by the investor) an application for purchase of units in Received from Mr/ Ms/ M/s/ Dr for Rs (in figures) on Date vide instrument no.D D M M Y Y Axis Tax Saver FundAxis Equity Fund Stamp & Signature Application No. MODE OF OPERATION Single Joint Anyone or Survivor (Default option is Joint)4 OVERSEAS ADDRESS (Mandatory in case of NRIs/ FIIs) (PO Box address is not sufficient. Investors residing overseas & with PO Box address must provide their Indian address) Address City State Pincode Mobile Landline No. Email 6B Form2 Upfront commission shall be paid directly by the investor to the AMFI registered distributor based on the investors’ assessment of various factors including the service rendered by the distributor. Existing Investors - Please fill in Sections 1, 9, 10,11 and 13 only1 EXISTING FOLIO NUMBER CONTACT & ADDRESS OF POWER OF ATTORNEY HOLDER (PO Box address is not sufficient) Address City State Pincode Mobile Landline No. Email 7 SIPRegistrationbyNewInvestor SIPRegistrationbyExistingInvestor MicroSIPRegistrationbyNewInvestor MicroSIPRegistrationbyExistingInvestor **Applicants (including POA holders) investing Rs 50,000 and above are required to comply with the KYC norms. (Please refer to the Terms and Conditions overleaf) *MicroSIP-PANisnotmandatoryincaseofMicroSIP.PleaserefertotheTermsandConditionsoverleaf. DateofBirth Typeofsupportingdocument IdentificationnumberdetailsD D M M Y Y Application No. STATUS OF FIRST APPLICANT Resident Individual Bank HUF Proprietor Guardian Society FII Partnership Firm NRI PIO Trust Company Minor Other (specify) 3 Date D D M M Y Y 5 OCCUPATION (of First/ Sole Applicant) Service Housewife Defence Professional Retired Business Agriculture Other (specify) Axis Income Saver CONTACT DETAILS - FIRST APPLICANT/ GUARDIAN/ CORPORATE (PO Box address is not sufficient. Mobile number and email id is mandatory to avail of online facility.) Contact Person (In case of Non Individual Investor) Address City State Pincode Landline No. Mobile (Holder 1) Email (Holder 1) Mobile (Holder 2) Email (Holder 2) Mobile (Holder 3) Email (Holder 3) 6A Option Dividend Frequency*Dividend Re-investmentDividend PayoutGrowth *Applicable only for Axis Income Saver Axis Triple Advantage Fund APPLICATION FORM FOR R R UNIT HOLDER INFORMATION Name of the First Applicant / Corporate Investor Mr/ Ms/ M/s/ Dr/ Minor PAN (mandatory)* Enclosed- PANProof KYCLetter** Name of the Second Applicant Mr/ Ms/ M/s/ Dr PAN (mandatory)* Enclosed- PANProof KYCLetter** Name of the Third Applicant Mr/ Ms/ M/s/ Dr PAN (mandatory)* Enclosed- PANProof KYCLetter** Name of the Guardian (in case of a minor) Mr/ Ms/ M/s/ Dr PAN (mandatory)* Enclosed- PANProof KYCLetter** Name of the Power of Attorney Holder Mr/ Ms/ M/s PAN (mandatory)* Enclosed- PANProof KYCLetter** Name of the Third Party (When payment is made through instruments issued from an account other than that of the beneficiary investor) Mr/ Ms/ M/s PAN (mandatory) PANProof KYCLetter Enclosed- Relation DeclarationForm (Mandatory) 2 Refer instruction related to PAN & KYC Refer instruction related to PAN & KYC Refer instruction related to PAN & KYC Refer instruction related to PAN & KYC Refer instruction related to PAN & KYC Date of Birth D D M M Y Y Age (No. of years) Y Y Refer instruction related to PAN & KYC Distributor Code / ARN No. Sub-distributor Code / ARN No. / Sol ID Serial Number, Date and Time Stamp

- 8. I/We do hereby nominate the under mentioned person to receive the units to my / our credit in this folio no. in the event of my / our death. I / We also understand that all payments and settlements made to such Nominee, and signature of the Nominee acknowledgment receiptthereofshallbeavaliddischargebytheAMC/MutualFund/ Trustee. Nominee's Name Relationship Address 12 NOMINATION DETAILS D D M Y YM Y Y In case Nominee is a Minor Name of Guardian Address of Guardian DateofBirth SignatureofGuardian In case of more than one nominee,kindly submit multiple nomination (maximum 3 nominees) forms. Extra nomination forms can be obtained from the nearest ISC or Registrar or from the AMCwebsite. Having read and understood the content of the SID / SAI of the scheme,I / we hereby apply for units of the scheme.I have read and understoodthe terms,conditions,rules and regulations governing the scheme.I /We herebydeclarethatthe amountinvestedinthe scheme is through legitimate source only and does not involve designed for the purpose of the contravention of any Act, Rules, Regulations,Notifications or Directives of the provisions of the IncomeTaxAct,Anti Money Laundering Laws,Anti Corruption Laws oranyotherapplicablelawsenactedbytheGovernmentofIndiafromtimetotime.I/WehaveunderstoodthedetailsoftheScheme &I/wehavenotreceivednorhavebeeninducedbyanyrebateorgifts,directlyorindirectlyinmakingthisinvestment.I/Weconfirm that the funds invested in the Scheme,legally belongs to me / us.In event “KnowYour Customer”process is not completed by me / us to the satisfaction of the Mutual Fund,(I / we hereby authorize the Mutual Fund,to redeem the funds invested in the Scheme,in favour of the applicant,at the applicable NAV prevailing on the date of such redemption and undertake such other action with such funds that may be required by the law.)TheARN holder has disclosed to me/ us all the commissions (in the form of trail commission oranyothermode),payabletohimforthedifferentcompetingSchemesofvariousMutualFundsfromamongstwhichtheSchemeis being recommended to me / us. I/We confirm the I/We do not have any existing Micro SIP investments which together with the current application will result in aggregate investments exceeding Rs. 50,000 in a year (Applicable for Micro SIP investment only. For NRIs only - I/WeconfirmthatIam/weareNonResidentsofIndiannationality/originandthatI/Wehaveremittedfundsfrom abroad through approved banking channels or from funds in my/ our Non Resident External / Non Resident Ordinary / FCNR account.I/Weconfirmthatdetailsprovidedbyme/usaretrueandcorrect. Second ApplicantFirst / Sole Applicant / Guardian Power of Attorney HolderThird Applicant 13 DECLARATION AND SIGNATURES MODE OF CORRESPONDENCE (Where the investor has provided his e-mail id, the AMC shall send all communication to the investor via e-mail. Investors who wish to receive correspondence through physical mode instead of e-mail are requested to ). Email communication will help save paper & the planet. I/Wewishtoreceiveallcommunicationthroughphysicalmodeinlieuofemail.ü 8 Axis Asset Management Company Limited Investment Manager to Axis Mutual Fund 11th Floor, Nariman Bhavan, Vinay K Shah Marg, Nariman Point, Mumbai 400 021, India. Tel 91 22 3940 3300 Fax 91 22 2204 0130 Toll Free 1800 3000 3300 Email customerservice@axismf.com www.axismf.com Terms & Conditions - Micro SIPs where aggregate of installments in a rolling 12 month period or in a financial year i.e.April to March do not exceed Rs 50,000 (hereinafter referred as“Micro SIP”) shall be exempt from the requirement of PAN,subject to submission of any one of the necessary photo identification documents as detailed below.This exemption will be applicable only to investments by individuals (including NRIs, butnotPIOs),minors,soleproprietaryfirmsandjointholders.HUFsandothercategorieswillnotbeeligiblefortheexemption. Investors (including joint holders) should submit a photocopy of any one of the following photo identification documents (current and valid and either self-attested by the investor or attested by anAMFI registered Distributor mentioning the AMFI Registration number) along with the application form as a proof of identification in lieu of PAN: • Voter Identify Card •Driving License • Government/Defence identification card • Passport • Photo Ration Card • Photo Debit Card (Credit card not included) • Employee ID cards issued by companies registered with Registrar of Companies • Photo Identification issued by Bank Managers of Scheduled Commercial Banks / Gazetted Officer / Elected Representatives to the Legislative Assembly / Parliament • ID card issued to employees of Scheduled Commercial / State / District Co-operative Banks • Senior Citizen / Freedom Fighter ID card issued by Government • Cards issued by Universities / deemed Universities or institutes under statues like ICAA, ICWA, ICSI • Permanent RetirementAccount No (PRAN) cardissuedtoNewPensionSystem(NPS)subscribersbyCRA(NSDL)•AnyotherphotoIDcardissuedbyCentralGovernment/Municipalauthorities/GovernmentorganizationlikeESIC/EPFO. Payment Mechanism Electronic Debit (Please Complete mandate form for electronic debit form 3) Cheque/DD (Please provide details below) First SIP Transaction via Cheque No. First Cheque date Drawn on (Bank/ Branch Name) In case cheque is issued by person other than the investor PAYMENT OPTIONS (The first SIP transaction has to be through a cheque. Please attach a copy of cancelled cheque.)10 Total amount Rs (In figures) Rs (In words) DD Charges inclusive of DD charges if any inclusive of DD charges if any Rs (In figures) if any SIP Start Date End Date (should be a minimum of 3 years from the start date) No. of Installments Monthly SIP amount Rs. Rs.(in figures) (in words) D D M M Y Y D D M M Y Y D D M M Y Y Total No. of Cheques Cheque No. From To BANK ACCOUNT DETAILS OF FIRST/ SOLE APPLICANT (Refer “Bank Details” under Instructions. Please enclose a copy of a cancelled cheque) Name of Bank Branch City State Account No. Account Type Current Savings NRO NRE FCNR Others MICR code* IFSC code** *Mandatory for dividend payout via ECS (The 9 digit code appears on your cheque next to the cheque number) **Mandatory for credit via RTGS/ NEFT (11 digit code also found on your cheque leaf.) (specify) 9 Documents as listed below are to be submitted along with the Application Form (as applicable to your specific case)CHECKLIST INVESTMENT DETAILS11 Axis Tax Saver FundAxis Equity Fund Form2 Axis Income Saver Option Dividend Re-investmentGrowth Dividend Payout Dividend Frequency* Quarterly Half Yearly Annual *Applicable only for Axis Income Saver Axis Triple Advantage Fund th th st (SIP unavailable on dates 29 , 30 , and 31 of every month)