Gold Knowledge - Thursday's dramatic drop in gold came as no surprise, And Chaturmas, the Fed & Gold's Summer Lull

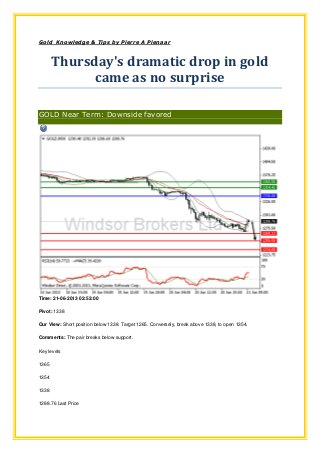

- 1. Gold Knowledge & Tips by Pierre A Pienaar Thursday's dramatic drop in gold came as no surprise GOLD Near Term: Downside favored Time: 21-06-2013 02:52:00 Pivot: 1338 Our View: Short position below 1338. Target 1265. Conversely, break above 1338, to open 1354. Comments: The pair breaks below support. Key levels 1365 1354 1338 1288.76 Last Price

- 2. 1265 1250 1234 Source: Windsor brokers Dear Valuable Friend, The huge drop was no surprise. I believe that the next major move in gold would be to the downside. The video runs just under 4 minutes and contains a lifetime of trading education. No matter what you think of gold, bull or bear, you will find this video interesting and informative and some might even say, disruptive. I will be analyzing both the macro and micro picture for gold and explain where I see it headed in the next three to six months. In my opinion gold is sure to rally. Today there is a steady, positive move, but will it hold?. As I see it, the noise around gold is based on – when a bull or bear in the market, people tend to believe it will go on like that forever. So when gold was around $1,700 there were speculations that gold would cross $2,000 an ounce. But now that gold is down to $1,380-something people anticipate it to go further down to $1,000!! Markets are driven by fundamentals which support a surge in the gold prices. Gold rose from the mid-$200s/ounce (mid-$200/oz) in 2002 to as high as $1,900/oz. That clearly suggests that things are not all right in the global economy. Politicians like to create the illusion that they can create something out of nothing and give it to people in exchange for votes. Gold gets in the way of that falsehood politicians wish to use to deceive voters for their own gain and the gain of those who fund their election campaigns. You shouldn't buy gold and silver to get rich. The reason why you purchase gold and silver is to preserve your wealth. I would like to present this article as well to get a full view of the situation of Gold on the Global Markets, and you should take note and act wisely. What is wisely? You should ensure that you have a least 10% of your Portfolio in Physical Gold, Like Gold Bullion, Coins, Spot Gold, Gold Futures, or Gold Options. However, be cautious in your buying, and short selling. Don’t use money you cannot afford to lose. ----- Chaturmas, the Fed & Gold's Summer Lull

- 3. Thursday, 6/20/2013 20:52 Gold prices typically slip in summer. So how might summer 2013 play out following the crashes this spring...? FIRST the import curbs, then the Fed. Next it will be Chaturmas, writes Adrian Ash at BullionVault. Will the 'closed season' for Indian weddings finally stall the subcontinent's gold buying this summer? It usually does. All Asian gold demand tends to ease off mid-year, but India goes dead quiet, thanks to the lack of auspicious days on the Hindu calendar. 2013's Chaturmas – literal meaning, "four months" – starts in mid-July. Although it starts later and is shorter than in 2012, the shutdown for Indian weddings will still run until early November as the Hindu gods and goddesses enjoy their Yogi Sleep. Lord Vishnu deserves a rest after the frantic gift-giving and wedding demand for gold seen so far this year. Chaturmas should also enforce a truce between Indian households – the world's No.1 gold consumers – and their government, now one of the world's most anti-gold administrations. Hiking gold import duty to 8% last month, and imposing strict new rules on how gold imports can be financed (no credit, in short), the government has still met record levels of gold demand. To their mind, that has only worsened a problem hitting emerging markets everywhere: a sudden outflow of foreign cash, spooked by chatter about the US Federal Reserve daring to slow its rate of money creation. Or maybe even raising interest rates from zero. At some point. Perhaps. The effect on what were the world's hottest investment hotspots has been dramatic. Mass protests in former darlings Turkey and Brazil come as Western fund managers hold their lowest allocations to developing economies since the Lehmans' crash of 2008. China looks to have all but stopped buying US Treasury bonds, thanks to slowing inflows of cash needing a home, plus the sudden need to keep money at hand as Chinese credit dries up. India's latest curbs on gold imports were supposed to buoy the Rupee (everyone said so), but it has sunk to new all-time lows on the currency markets regardless. Well, not quite regardless. The world's biggest gold buyers, Indian citizens boast zero mine output. So pretty much every ounce bought for weddings, festivals and the 10% of household savings which go into gold each year must come from abroad. The government warned time and again it wanted to curb those gold imports, because they dent India's current account deficit so badly that they hurt the Rupee. So mid- April's gold crash was already preceded by a sharp upturn in buying. Because people who love buying gold love buying it now if they know supply will be capped tomorrow. The Rupee's slump has only made gold more expensive. But wholesalers, if not final consumers, kept buying gold anyway. Even the end of credit-paid imports failed to dent May's surge in demand. So far, all the new 8% duty has done is spark warnings (and reports) of increased smuggling, with Dubai only a short trip away by dhow overnight. Still, the Hindu wedding season – for which tradition demands heavy gift-giving in gold – is set to end mid-July. Thanks to Chaturmas, it won't resume until after the festival calendar starts again in September. A bit like Lent for vegans, it bans the eating of certain leaves, fruit and tubers as the gods take their rest. And all else being equal, India's summer vacation from bullion also helps to cap gold prices worldwide. On a monthly basis, over the last 45 years, the Dollar gold price rose 2.2% annualized between June and September on average. The annualized rise between September and

- 4. May was 14.8%. Sure, Western fund managers following the "Sell in May" motto also helps flatten the action. But internal to gold's supply and demand balance, Chaturmas removes the No.1 consumers. From the Gregorian calendar, however, Chaturmas is a moveable marriage ban. And all told in 2013, Hindu observance allows nearly 25% more wedding days than it did in 2012 according to this chart from Kotak Mahindra Bank's Shekhar Bhandari, speaking last year at the LBMA conference in Hong Kong. The summer lull in Asian demand is delayed, in short, and wedding gift-giving will start again sooner. And failing to curb demand so far in 2013, India's government hasn't even managed to beat a rise in supply, thanks both to people's continued love (and need) for hard asset savings (Indian households have seen gold rise vs. Rupees in 30 of the last 39 years), and more recently to spring 2013's global gold discounts. All this is cold comfort, of course, to Western investors and savers watching gold prices plunge once more this week. Yes, Asian savers have hoovered up much of the gold sold from ETF trust funds, but the acceleration of gold's eastwards drift hasn't done enough to prevent a slump in prices. And it's that slump itself which really sparked the surge in Indian and Far Eastern demand. Still, thanks to these bargains, Asia is on track for record quarterly buying according to Marcus Grubb of the World Gold Council. Perhaps some 400 tonnes of gold will be sucked into India alone between April and June – "almost half of the total imports in the whole of 2012." And with Swiss refineries only now catching up with demand, that has led to record highs in the local premiums for 1- kilogram gold bars, over and above the international spot price for wholesale 400-ounce bars (12.5kg), in the Asian centers of Hong Kong, Singapore and Mumbai. Again, it's important to note that – for now – this surge has come from price-wise consumers. First Indian dealers and households stocked up ahead of New Delhi's clearly flagged action against the drain on foreign currency holdings which imports require. Second, the price slump of mid-April (and now mid-June) has unleashed pent up demand which did not exist north of $1500 per ounce. Any bargain hunting this month might well prove to be consumption brought forward as well. Only once Chaturmas ends can we gauge the strength of India's peak demand for 2013, as Diwali draws near. Two months later, Chinese wholesalers will start getting ready for the Lunar New Year gold shopping spree. Between them, Indian and Chinese consumers now buy one gold ounce in every two sold worldwide. But the first faces 8% import duty, plus 4% sales tax, and smugglers will struggle to match the record levels of legal flows. China meantime faces a banking crisis all of its own. And no one can yet say how gold-loving households will act when the credit and economic growth of the last 20 years takes a pause, nevermind a dive. Still, looking ahead, and with Western investors continuing to sell, "Gold [has been] passing from the clearly 'shaky' hands of [ETF trust fund] investors into 'strong' hands," reckons Commerzbank – "a trend that should lend support to the gold price in the medium to long term." And beyond there, don't miss where long-term economic power – and gold – is heading worldwide. If you fear a decline of the West, relative to fast-rising Asia, it makes sense to buy at least a little of their first choice for household savings. Not least at today's knock-down prices. Buy gold at the lowest prices in the safest vaults today...

- 5. Adrian Ash runs the research desk at BullionVault, the physical gold and silver market for private investors online. Formerly head of editorial at London's top publisher of private-investment advice, he was City correspondent for The Daily Reckoning from 2003 to 2008, and is now a regular contributor to many leading analysis sites including Forbes and a regular guest on BBC national and international radio and television news. Adrian's views on the gold market have been sought by the Financial Times and Economist magazine in London; CNBC, Bloomberg and TheStreet.com in New York; Germany's Der Stern and FT Deutschland; Italy's Il Sole 24 Ore, and many other respected finance publications. Nations around the world embraced gold and silver as a store of wealth and a medium of international exchange. Individuals have sought to possess precious metals as insurance against the day-to-day uncertainties of paper money. Gold, silver, platinum and palladium constitute the majority of trading in precious metals. Trading in precious metal futures market or spot market in a speculative manner provides an important alternative to traditional means of investing in precious metals such as gold bullion, coins, and mining stocks, and where substantial profits, as well as losses can be made. Trading contracts in precious metals also provide valuable trading tools for commercial producers and the users of these metals. Precious metals are traded on the futures and spot markets in contracts (a contract of gold is 100oz while a contract of silver is 5000oz). On the spot market, precious metals are usually bought or sold based on a value date of 48 hours which can be rolled over on a daily basis thereafter. Trading on the futures market is done by buying or selling precious metal for a specific settlement date in the future. For example July Gold, can be bought in March for July settlement. Trade Gold Futures here Bid Buy South African Gold Coins Options Insights Membership - Continuing Study of the Secrets of Making Money in Options Trading Index Options System Index Time Trading Machine Spot Gold

- 6. HotForex Launches its Website and Client Portal for Mobile Users $20.000 所有奖励均为现金奖励。前 10 名胜出交易者将获得奖励 - 點擊這裡註冊 Windsor brokers - 20,000$ ALLES GELDPREISE. DIE BESTEN 10 TRADER GEWINNEN $20.000 PRIX EN ARGENT. POUR LES 10 TOP TRADERS - Cliquez ici pour vous inscrire FOREX CLUB – зарабатывать на финансовом рынке с надежным форекс-брокером! You are welcome to share this market commentary or forward this to a friend. Trade smart, not with Greed Pierre A Pienaar Blog: http://www.resourcesindependenttrader.blogspot.com Pierre A Pienaar retired in 2011 from business. I would like to share my passion, my interests, knowledge & experiences in Forex, Options, Gold Investments, Futures, Stocks, Binary Options, Economics, Stamp Collection, Sports, Gardening, Reading, Photography, and Politics

- 7. Substantial risk of loss There is a substantial risk of loss of stocks, forex, commodities, futures, options, and foreign equities are substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. You should read, understand, and consider the Risk Disclosure Statement that is provided by your broker before you consider trading.