Webinar Slides: Critical Steps to Keep your BSA Program Current

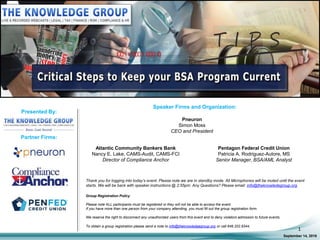

- 1. Speaker Firms and Organization: Atlantic Community Bankers Bank Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Thank you for logging into today’s event. Please note we are in standby mode. All Microphones will be muted until the event starts. We will be back with speaker instructions @ 2:55pm. Any Questions? Please email: info@theknowledegroup.org Group Registration Policy Please note ALL participants must be registered or they will not be able to access the event. If you have more than one person from your company attending, you must fill out the group registration form. We reserve the right to disconnect any unauthorized users from this event and to deny violators admission to future events. To obtain a group registration please send a note to info@theknowledgegroup.org or call 646.202.9344. Presented By: September 14, 2016 1 Partner Firms: Pentagon Federal Credit Union Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pneuron Simon Moss CEO and President

- 2. September 14, 2016 2 Please note the FAQ.HELP TAB located to the right of the main presentation. On this page you will find answers to the top questions asked by attendees during webcast such as how to fix audio issues, where to download the slides and what to do if you miss a secret word. To access this tab, click the FAQ.HELP Tab to the right of the main presentation when you’re done click the tab of the main presentation to get back. For those viewing the webcast on a mobile device, please note: o These instructions are for Apple and Android devices only. If you are using a Windows tablet, please follow the instructions for viewing the webcast on a PC. o The FAQ.HELP TAB will not be visible on mobile devices. o You will receive the frequently asked questions & other pertinent info through the apps chat window function on your device. o On Apple devices you must tap the screen anywhere to see the task bar which will show up as a blue bar across the top of the screen. Click the chat icon then click the chat with all to access the FAQ’s. o Feel free to submit questions by using the “questions” function built-in to the app on your device. o You may use your device’s “pinch to zoom function” to enlarge the slide images on your screen. o Headphones are highly recommended. In the event of audio difficulties, a dial-in number is available and will be provided via the app’s chat function on your device.

- 3. September 14, 2016 3 Follow us on Twitter, that’s @Know_Group to receive updates for this event as well as other news and pertinent info. If you experience any technical difficulties during today’s WebEx session, please contact our Technical Support @ 866-779-3239. We will post the dial information in the chat window to the right shortly and it’s available in the FAQ.Help Tab on the right. Please redial into the webcast in case of connectivity issue where we have to restart the Webex event. You may ask a question at anytime throughout the presentation today via the chat window on the lower right hand side of your screen. Questions will be aggregated and addressed during the Q&A segment. Please note, this call is being recorded for playback purposes. If anyone was unable to log in to the online webcast and needs to download a copy of the PowerPoint presentation for today’s event, please send an email to: info@theknowledgegroup.org. If you’re already logged in to the online Webcast, we will post a link to download the files shortly and it’s available in the FAQ.Help Tab

- 4. September 14, 2016 4 If you are listening on a laptop, you may need to use headphones as some laptops speakers are not sufficiently amplified enough to hear the presentations. If you do not have headphones and cannot hear the webcast send an email to info@theknowledgegroup.org and we will send you the dial in phone number. About an hour or so after the event, you'll be sent a survey via email asking you for your feedback on your experience with this event today - it's designed to take less than two minutes to complete, and it helps us to understand how to wisely invest your time in future events. Your feedback is greatly appreciated. If you are applying for continuing education credit, completions of the surveys are mandatory as per your state boards and bars. 6 secret words (3 for each credit hour) will be given throughout the presentation. We will ask you to fill these words into the survey as proof of your attendance. Please stay tuned for the secret word. If you miss a secret word please refer to the FAQ.Help tab to the right. Speakers, I will be giving out the secret words at randomly selected times. I may have to break into your presentation briefly to read the secret word. Pardon the interruption.

- 5. September 14, 2016 55 Basic Annual Subscription – LIVE CLE Webcasts $199 (After Instant Discount) Pro Annual Subscription – LIVE CLE & Recorded Webcasts $299 (After Instant Discount) You get all these features: Unlimited Access to LIVE CLE Webcasts & Materials PLUS Free CLE Credit Processing Unlimited Access to Course Materials for LIVE Webcasts One-Click Registration Free Webcast Calendar Organizer with Outlook Integration $16.58 per month (Billed Annually – $199) You get all these PRO features: Unlimited Access to LIVE CLE Webcasts & Materials PLUS Free CLE Credit Processing Unlimited Access to Course Materials for LIVE Webcasts One-Click Registration Free Webcast Calendar Organizer with Outlook Integration Unlimited Access to Recorded Webcasts & Materials $299 per year MobileCLE.org is simple to use: On any device, log into your mobileCLE.org account and choose a LIVE continuing legal education webcast or recorded/on-demand course using one of our many powerful search engines (by legal practice area or keywords such as Patent, FACTA, Data Privacy, eDiscovery etc.). Register for your CLE webcast by clicking the reserve button. On the day and time of your LIVE webcast, simply click Launch! and with 2 taps on your screen you’re earning CLE! Practice Areas: Administrative Law, Alternative Dispute Resolution, Antitrust, Appellate Litigation, Bankruptcy, Communications Law, Corporate Law, Employment/Labor Law, Environmental Law, Government Contracts Law, Health Law, Immigration Law, Intellectual Property Law, International Development Law, International Trade Law, Mergers and Acquisitions, National Security Law, Privacy Law, Real Estate Law, Securities Law, Sports/Entertainment Law, Tax Law, Trusts and Estates Law, and White Collar Crime To sign up: www.mobilecle.org

- 6. Sponsor: September 14, 2016 6 Pneuron’s leading business orchestration software enables organizations to flexibly leverage their existing applications, infrastructure, services and data to create and deliver actionable intelligence – in half the time and cost. Through Pneuron’s innovative, distributed approach, companies are no longer faced with the complex centralization and integration requirements of traditional approaches. Pneuron and its patented groundbreaking technology have garnered numerous awards and recognitions including: Forrester Breakout Vendor, Inc. 5000 fastest growing private company, MIT Sloan School CIO Enterprise Innovator Award, 2015 Gartner Cool Vendor, CRN’s 2015 & 2016 Emerging Vendors designation and SD Times Company to Watch.

- 7. Partner Firms: September 14, 2016 7 Compliance Anchor®, a unit of Atlantic Community Bankers Bank, provides an online, cost effective training solution which includes topic-specific webinars and Veterans’ Venues, with a focus on BSA and consumer compliance. Veterans’ Venues are online webinar/networking events through which participants are provided the latest regulatory updates including final and proposed regulations, regulatory issuances, enforcement actions, specific topic information, other items of interest and industry news. The phone lines are then opened for discussion and questions. Compliance Anchor also provides bank training and support to community banks, remotely or in person based upon the needs of the financial institution.

- 8. Brief Speaker Bios: Simon Moss Simon Moss is the Chief Executive Officer and Board Member for Pneuron Corporation. In this role, Moss is responsible for overseeing the management, strategy and operations of the business on a global basis. Under Moss’ leadership, the company was founded, capitalized and the strategic platform developed, transforming Pneuron into a global technology provider. Simon brings over 20 years of successful strategic leadership as CEO, Partner and Board member in the financial services industry, and has a proven track record as a successful entrepreneur. September 14, 2016 8 Nancy E. Lake, CAMS-Audit, CAMS-FCI Nancy Lake has over a decade of experience in the BSA/AML world. Nancy was CAMS certified in 2008, received her CAMS-Audit certification in 2013, and her CAMS-FCI certification in 2015. She has served as BSA Officer in multiple banks where she successfully set up the entire BSA program. She has conducted bank wide BSA/AML training including Board of Director training. Nancy has experience working with or implementing several automated BSA/AML monitoring systems. ► For more information about the speakers, you can visit: https://theknowledgegroup.org/event-homepage/?event_id=2100 Patricia A. Rodriguez-Autore, MS Patricia Rodriguez-Autore is currently the Bank Secrecy Act Senior Manager at Pentagon Federal Credit Union where she is responsible for designing, implementing, and managing all aspects of the AML/BSA/OFAC Program. Prior to PenFed, Patricia was the Compliance BSA/AML Consultant at O’Conner Law Firm where she executed all Banking related cases pertaining to regulatory and compliance issues, including BSA/AML/OFAC/USA Patriot Act, Privacy, Information protection and several other consumer regulations.

- 9. Over the past several years the Bank Secrecy Act (BSA) has caused dramatic operational change. There are myriad factors impacting BSA programs including new and changing products, competitive services, evolving markets and increased regulatory scrutiny around KYC and money-laundering operations. Added to this market and regulatory pressure, there is substantial financial scrutiny on the ongoing cost of compliance and the draconian impacts of non-compliance. The BSA officer is under incredible pressure to protect the organization, stay current and reduce costs. In this Knowledge Group Section LIVE webcast, a panel of distinguished professionals will help you understand the most critical issues facing the BSA team which will include: • Overview of Pressures facing BSA teams • Snapshot of the current regulatory environment • Key tips to keep pace with growing volume of alerts, emerging threats and increasing regulation • Mini-case studies of how several global banks are making change and seeing results • Advice for regulators to help them help Banks improve their BSA programs • Live interactive Q&A session This live webcast will provide BSA Officers, BSA teams and Regulators with a comprehensive overview of the modern-day BSA program. Attending this course will give you the tools you need to understand how to optimize the BSA program at your firm. Advanced registration is recommended as space is limited. September 14, 2016 9

- 10. Featured Speakers: September 14, 2016 10 SEGMENT 1: Simon Moss CEO and President Pneuron SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 11. Introduction Simon Moss is the Chief Executive Officer and Board Member for Pneuron Corporation. In this role, Moss is responsible for overseeing the management, strategy and operations of the business on a global basis. Under Moss’ leadership, the company was founded, capitalized and the strategic platform developed, transforming Pneuron into a global technology provider. Simon brings over 20 years of successful strategic leadership as CEO, Partner and Board member in the financial services industry, and has a proven track record as a successful entrepreneur. Moss was most recently the CEO of Avistar and served four years with Mantas, moving the company into positive revenue streams and ultimate acquisition by Oracle Corporation. Previously, he served as Partner at Price Waterhouse Coopers, and was co-Founder of Risk Management Services Practice at IBM, all rounding out his extensive experience in financial services, trading and consulting practices. Simon excels in corporate revitalization and developing new go to market strategies for small emerging businesses as well as Fortune 1000 organizations. Moss is also on the Board of Directors for C6 Intelligence. September 14, 2016 11 SEGMENT 1: Simon Moss CEO and President Pneuron

- 12. Steps to Keep your BSA Program Current September 14, 2016 12

- 13. The Pillars of the BSA Program September 14, 2016 13 KYC Transaction Monitoring FIU Organizational Governance, Tone from the Top, Ethical Culture Data Governance Reporting and Documentation Global Customer 360 View

- 14. KYC Health Check Metrics (Completeness of Analysis) Number of data sources used as part of onboarding risk check Number of clients moved to EDD Speed and consistency of client onboarding Speed of ad hoc customer risk analysis and reporting September 14, 2016 14 Automating access and analysis of multiple data and information at point of onboarding offers huge value cost, risk and time value. This “tipping point” of data is critical for multiple risk, cost and competitive advantages.

- 15. TMS Health Check Metrics (Speed and Agility of Deployment) Time of development and deployment for new scenarios Time to add new variables, new entities and foci on existing scenarios Speed of adding new data sources, asset classes, customers or business to existing scenarios Ability of internal team to develop and manage new scenarios. September 14, 2016 15 Accelerating scenario development/adjustment both in analytical and data source categories offers significant regulatory, cost and risk advantages. Current: 6 Target: 24 Average annual scenario development and deployment duration (with installed TMS)

- 16. FIU Health Check Metrics (Operational ROI, Consistency and Time of Investigation) % of false positives within TMS alert volumes Average analysis/investigation time - alerts, cases, SARs Average operational cost per alert/case Ratio of SARS to alert volume Consistency metrics around closed alerts, investigated cases and SARs September 14, 2016 16 Current Manual Analysis Activities Volume of Alerts Analyzed day 1Pre-processing Start of Workday Validation of results and intelligence Pre-processing, analysis and investigation results creation (25%) (90%) Best Practice Automating investigation processes, data access, analysis and investigation into pre- processing transforms the FIU in effectiveness, focus and cost.

- 17. Reporting and Documentation Health Check Metrics (Global transparency and agile across all activities, processes and resources) Global dashboards supporting all functions and KPIs Consistent reporting baseline for BSA office, regional offices, audit, compliance and risk committees Drill down with appropriate data lineage into identified risks or concerns. Integrated metrics across all functions, processes and technologies (KYC, TMS, FIU) Agile ability to enquire and analyze based on requests or material events. September 14, 2016 17 Global BSA Systems

- 18. 18

- 19. 19 Resources United Nations Office on Drugs and Crime, Money-Laundering and Globalization. . https://www.unodc.org/unodc/en/money-laundering/globalization.html National Money Laundering Risk Assessment (2015). https://www.treasury.gov/resource-center/terrorist-illicit- finance/Documents/National%20Money%20Laundering%20Risk%20Assessment%20%E2%80%93%2006-12- 2015.pdf Dow Jones & ACAMS, Global Anti-Money Laundering Survey Results (2016). http://files.acams.org/pdfs/2016/Dow_Jones_and_ACAMS_Global_Anti-Money_Laundering_Survey_Results_2016.pdf From Source to Surveillance: The Hidden Risk in AML Monitoring System Optimization (Sept. 2010). https://www.pwc.com/us/en/anti-money-laundering/publications/assets/aml-monitoring-system-risks.pdf Anti-Money Laundering Risk Assessment and Customer Due Diligence—A Global Perspective (June 2013). https://www.lexisnexis.com/risk/downloads/whitepaper/anti-money-laundering-risk-assessment-and- customer-due-diligence-study.pdf

- 20. Introduction Nancy Lake has over a decade of experience in the BSA/AML world. Nancy was CAMS certified in 2008, received her CAMS-Audit certification in 2013, and her CAMS-FCI certification in 2015. She has served as BSA Officer in multiple banks where she successfully set up the entire BSA program. She has conducted bank wide BSA/AML training including Board of Director training. Nancy has experience working with or implementing several automated BSA/AML monitoring systems. Nancy joined Atlantic Community Bankers Bank in 2012 to develop a new consulting division, Compliance Anchor. Nancy is utilizing her BSA experience and 19 years as an educator to provide assistance to community banks in managing risk and developing sound internal programs and best practices. September 14, 2016 20 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 21. FDIC Consent Order • 7/19/16 – Community Bank in Illinois with about $326M in assets received a consent order for BSA – https://www5.fdic.gov/EDOBlob/Mediator.aspx?UniqueID=bd2c985a-fe0c-429b-9e1f-0513b0ffa987 • The standard requirements were mentioned: – Written BSA Compliance Program (“Specifically, the policy should provide for written, detailed guidelines regarding the administration of high risk customer relationships, including the solicitation, opening, and ongoing monitoring of all such accounts for suspicious activity and the filing of all required reports resulting there from.”) – BSA Oversight (Specialized training for the BSA Officer) – Account Monitoring (Specialized training specific to the Bank’s automated account transaction monitoring system for the Bank’s BSA Officer) – Look Back Review September 14, 2016 21 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 22. FDIC Consent Order cont. • Specifics on Account Monitoring – All core applications interfaced with the transaction monitoring system – Procedures to ensure timely review of alerts for possible SARs – Procedures, controls, and delegations of authority for determining when alerts/cases are closed or evaluated further – Procedures regarding the minimal level of documentation supporting the decision to close alerts – Procedures and controls for establishing or making changes to system parameters used by the system to generate transaction alerts/cases September 14, 2016 22 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 23. OCC Consent Order • 7/20/16 – Community Bank in Texas with about $212M in assets received a consent order from the OCC for BSA – http://www.occ.gov/static/enforcement-actions/ea2016-069.pdf • Staffing was one of the first issues addressed and required: – The workload of current BSA staff – The skill sets of current BSA staff – The levels of experience required to appropriately implement the Bank’s BSA/AML monitoring tools • The need for succession planning for the BSA Officer role to ensure continuity of BSA/AML oversight in the event of employee departures. • Additional Note on Staffing: “Any BSA staff (employees or consultants) hired pursuant to this Article shall have an adequate level of experience and expertise to facilitate the Bank in ensuring appropriate oversight of its BSA/AML program, taking into account the specific BSA/AML risk profile of the Bank, the technical aspects of its monitoring systems, and the deficiencies noted in the audit and ROE.” September 14, 2016 23 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 24. OCC Consent Order cont. • The BSA monitoring system was also addressed and required procedures that include: – An analysis of the filtering thresholds established by the Bank – Periodic testing and monitoring of thresholds for their appropriateness to the Bank’s customer base, products, services, and geographic areas – A requirement that any changes to thresholds are approved at the senior management level and periodically reported to the Board – A requirement that documentation of any changes to the thresholds is maintained and available to auditors and examiners • The monitoring section also included: “a requirement for independent third party validation of the models used for the BSA/AML monitoring systems in order to ensure that all accounts and transactions are captured and that the systems are adequate to detect potentially suspicious activity” September 14, 2016 24 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 25. OCC Consent Order cont. • The order discussed CDD/EDD and included “policies…should give consideration to FinCEN’s recently issued regulation on Customer Due Diligence…” and stated that “At a minimum, these policies and procedures…shall include: – Baseline documentation requirements and processes to be used for CDD at account opening, including ACH specific customer and originator due diligence policies, processes, and procedures per OCC Bulletin 2008-12, Payment Processors Guidance. – Specification of the EDD information that bank personnel must obtain for higher-risk accounts, which among other information should include: September 14, 2016 25 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank Purpose of Account Source of Funds and Wealth Individuals with Ownership or Control Occupation or Type of Business Financial Statements Bank References Domicile (Where Business is Organized) Proximity of Customer’s Residence, Employment, or Business to the Bank Description of the Customer’s Primary Trade Area (Note International) Description of Business Operations (Vol. of Sales, Customers, Suppliers) Explanations for Changes in Account Activity

- 26. NY Fines Mega Bank $180M • 8/19/16 – NY Department of Financial Services (DFS) Press Release: “DFS Fines Mega Bank $180M for Violating AML Laws” – http://www.dfs.ny.gov/about/press/pr1608191.htm • Mega International Commercial Bank of Taiwan is a major international financial institution with approximately $103B in assets, including $9B at its New York branch. • “The compliance failures that DFS found at the New York Branch of Mega Bank are serious, persistent and affected the entire Mega banking enterprise and they indicate a fundamental lack of understanding of the need for a vigorous compliance infrastructure. DFS's recent examination uncovered that Mega Bank's compliance program was a hollow shell, and this consent order is necessary to ensure future compliance.” September 14, 2016 26 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 27. NY Fines Mega Bank $180M cont. • The findings of the DFS included: – The BSA/AML officer for the New York branch, who was based at the bank’s Taiwan headquarters, and the branch’s chief compliance officer both lacked familiarity with U.S. regulatory requirements. In addition, the chief compliance offer had conflicted interests because she had key business and operational responsibilities, along with her compliance role. – Compliance staff at both the head office and branch failed to periodically review surveillance monitoring filter criteria designed to detect suspicious transactions. Also, numerous documents relied upon in transaction monitoring were not translated to English from Chinese, precluding effective examination by regulators. – The New York branch procedures provided virtually no guidance concerning the reporting of continuing suspicious activities; had inconsistent compliance policies; and failed to determine whether foreign affiliates had in place adequate AML controls. • In the consent order it is specifically noted that Mega Bank had a “Troubling and Dismissive Response to the DFS Examination” September 14, 2016 27 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 28. Definition and Types Includes: • Trafficking of organs • Trafficking of people for forced labor • Child soldiering (think ISIS) • Trafficking of people for sexual exploitation • Commercial sex exploitation of children in tourism September 14, 2016 28 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 29. Monies Involved • Most recent figure (May 20, 2014) based on data from an International Labour Organization study in 2012 = $150 billion http://www.ilo.org/global/about-the-ilo/newsroom/news/WCMS_243201/lang--it/index.htm Consider the global sports market (including all ticket sales, merchandise, etc.) which generated $146 billion in 2014 According to the 2012 study, $150 billion is split as follows: – $99 billion = commercial sexual exploitation – $34B in construction, manufacturing, mining and utilities; – $9B in agriculture, including forestry and fishing; – $8B saved by private households by not paying or underpaying domestic workers held in forced labor September 14, 2016 29 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 30. Overseas • Taliban pays $7,000 - $14,000 for children as young as seven years old to use them as suicide bombers • Top 10 countries for human trafficking account for 71% of the estimated 21 million people trafficked globally each year • Included in the top 10 countries are: – India – Pakistan – Democratic Republic of the Congo – Central African Republic September 14, 2016 30 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 31. United States • Lincoln signed the Emancipation Proclamation in 1863 and the 13th Amendment formally abolished slavery almost 150 years ago, yet slavery continues today in the form of human trafficking • Human Trafficking exists in all 50 states • U.S. = a source and transit country for human trafficking • U.S. – considered one of the top destination points for victims of child trafficking and exploitation September 14, 2016 31 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 32. Sex Workers vs. Sex Trafficking • Key = Voluntary or Not Voluntary • Sex Workers – Individuals who choose to be in the lifestyle • Sex Trafficking – Individuals who do not choose to be in the sex industry and/or cannot leave because of force, fraud or coercion. Follow the money – if an individual suspected of prostitution has a bank account with a balance and unrestricted access to the funds, they are more likely to be a sex worker and not a victim of human trafficking. September 14, 2016 32 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 33. Brianna – The Girl Next Door • Good girl, good home, great student (two years of college in H.S.) • From a small town in the state 0f Washington • Older guy came into the coffee shop where she worked • Brought in younger guys – “coincidentally” she had lots in common with the younger guys • Developed a friendship over long period of time • Convinced her to visit them at their house – Big, beautiful Victorian home with nice cars and lots of money – Invited her to spend the night - nothing bad happened – Convinced her to move out of her home and in with them – Invited her to go to Arizona for Christmas • Asked friend to help her move out – he told his dad who had just had human trafficking training – led to her rescue (had already been sold to a pimp in Arizona) September 14, 2016 33 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 34. Sobering Statistics • American girls and boys are being stalked by traffickers • Typical places include Facebook, movie theatres, parks, bowling alleys, after school activities, orphanages, malls • Traffickers want younger and younger children - average age of entry into sexual exploitation – Boys = 11-13 – Girls = 12-14 • 300,000 – 400,000 American children each year • Average life expectancy of a child once forced into slavery is only seven years September 14, 2016 34 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 35. Demand and Supply • As long as there are people demanding services, there will be traffickers supplying the demand! • Contributing Factors – Porn industry – generated $13 billion in 2006 alone – Entertainment industry with sexually explicit movies • 50 Shades of Grey (displays sexual dominance over women) • Generated $81.6 million in its opening three days – Explosion of the Internet – buyers and sellers connect in minutes – Money – 2003 study found that a sex slave can earn at least $250,000 for her pimp each year • It will take more than governments, private organizations, citizens and law enforcement to fight this problem, financial institutions must get involved! September 14, 2016 35 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 36. Case Study Red Flags • Both businesses were in the cleaning industry • Both had an Any Town, MAR address, but Articles of Incorporation were in FL • Both addresses on the Articles of Incorporation were to a United Parcel Service location • Always Clean Inc. stated they opened their account in Any Town, MAR as a second operating location. Simply Clean Inc. indicated they opened their account in Any Town, MAR based on a referral from a friend who said it was a good area to do business • After Always Clean Inc. accounts were closed by Bank #1, they opened accounts at Bank #2. Simply Clean Inc. brought their accounts to Bank #1 from Bank #2 • Both businesses had addresses in the same apartment complex next to each other September 14, 2016 36 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 37. Case Study Red Flags cont. • Alternate addresses in the same apartment complex for both businesses were one street away from the primary addresses • Both businesses had numerous rentals in the same apartment complex • Man #1 was paid by Lady#1 via a check from Bank #2 • Both businesses had rent payments to numerous cities in MAR • Simply Clean Inc.’s account was funded in 2013 by check deposits from Always Clean Inc. and two hotels • Always Clean Inc. regularly funded their accounts with check deposits from Simply Clean Inc.’s account and the same two hotels • Both businesses wrote checks to four of the exact same individuals for similar amounts • At no point did the customer make debit payments that appear to be going toward business expenses for janitorial/cleaning company September 14, 2016 37 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 38. Increase Your Awareness • Be aware of the scope of human trafficking within your own footprint • Search the internet – Organizations fighting human trafficking – Human Trafficking 101 for School Administrators and Staff - http://www.dhs.gov/sites/default/files/publications/blue-campaign/Blue%20Campaign%20- %20Human%20Trafficking%20101%20for%20School%20Administrators%20and%20Staff.pdf – National Human Trafficking Resource Center (NHTRC) – Information by state: http://www.traffickingresourcecenter.org/states – Report Card for your state - http://sharedhope.org/what-we-do/bring-justice/reportcards/ • Read some books – Hidden Girl – story of Shyima Hall –New York: Simon & Schuster, 2014 – Renting Lucy by Linda Smith - Vancouver: Shared Hope International, 2013 September 14, 2016 38 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 39. Train Your Team Red Flags for Tellers and Branch Personnel • Round dollar payroll checks being cashed by ladies scantily dressed and accompanied by a man • The same ladies presenting foreign ID cards including international drivers’ licenses and valid passports with no visa or an expired visa, or even a student ID • Evidence of being controlled • Bruises or other signs of physical abuse • Fear or depression • Not speaking on his/her own behalf and/or non-English speaking • Third party escorting the customer may always have possession of the customer’s ID Red Flags for Account Opening Personnel • Be aware of business types that are prone to human trafficking such as hotels, restaurants, truck stops, cleaning/janitorial services, massage parlors, nail salons, etc. September 14, 2016 39 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 40. Train Your Team cont. Red Flags for Account Opening Personnel cont. • Articles of Incorporation from other states, such as Florida, California, New York, Nevada or others known as major trafficking states • Addresses for businesses being a P.O. Box or the physical address of a postal store often found in a strip mall • Inconsistent dates between ID and business documentation (their ID indicates they lived in your state for several years, but the business physical address was another state for the same period of time) • Address of the business is in an apartment complex • Multiple unrelated people living at the same address • Common signer(s)/custodian(s) in apparently unrelated business and/or personal accounts. • Common information (address, phone number, employment information, etc.) used to open multiple accounts in different names September 14, 2016 40 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 41. Train Your Team cont. Red Flags for BSA/AML Personnel • Rent payments for multiple locations within apartment complexes • Rent payments made by unrelated business types (example: a cleaning business paying rent for several apartments) • New businesses making tons of money overnight • Round dollar payroll checks being cashed • ACH credits received from an international trading site for imports/exports • Wires and/or frequent travel to countries known as human trafficking hot spots • Multiple phone carriers (numbers on ads need to be changed regularly) September 14, 2016 41 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 42. Train Your Team cont. Red Flags for Check Card Debits • From an airline and/or moving company • For rent payments for related things involving trafficking such as gas, beer/liquor, restaurants, casinos, a gentleman’s club, etc. • Occurring in various cities over a short period of time such as a month Red Flags for Prepaid and Credit Cards • Multiple expenditures on websites like the ones listed on the next slide and followed by hotel spending • Travel out of state and multiple hotel expenses • Multiple payments for internet ad sites – Escort ads posted online do not obviously state that sex with children is being sold, so code words are used September 14, 2016 42 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 43. Code Words/Websites • Code Words • Websites – benaughty.com – backpage.com – girlsdateforfree.com September 14, 2016 43 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 44. Individually • Communicate the signs of human trafficking to your family and friends – Scripted answers – Inconsistent in story – Branding or tattoos, especially those reflecting ownership or money – Signs of physical abuse – Appears helpless, shamed, nervous – Malnourished – Inability or fear to make eye contact – Chronic runaway; homeless youth – Dating much older, abusive or controlling man – Not attending school or numerous school absences – Sudden change in attire, possessions, behavior – Travels to other cities frequently – Uses terms common to the commercial sex industry September 14, 2016 44 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 45. Importance of CDD/EDD Documentation • Why Document? – Saves you time – SARs, account reviews, audits, exams, etc. – Expected by auditors and examiners – Protects you as a BSA Officer – Legal recourse • What to Document – Everything! – Transactions – 314b contacts – Google searches – with screen shots – Documents – deeds, trusts, loan documents, etc. – Communications with bank staff and/or the customer • How to Document – Name/DOB or CIF # in case of duplicate names – Type of Record – CDD/EDD/SAR/Subpoena/etc. – Date September 14, 2016 45 SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank

- 46. Introduction Patricia Rodriguez-Autore is currently the Bank Secrecy Act Senior Manager at Pentagon Federal Credit Union where she is responsible for designing, implementing, and managing all aspects of the AML/BSA/OFAC Program. Prior to PenFed, Patricia was the Compliance BSA/AML Consultant at O’Conner Law Firm where she executed all Banking related cases pertaining to regulatory and compliance issues, including BSA/AML/OFAC/USA Patriot Act, Privacy, Information protection and several other consumer regulations. Patricia is an expert within the financial crimes industry, supported by extensive knowledge of domestic and international compliance policies, procedures and risk assessments related to AML/BSA/OFAC/KYC, fraud and suspicious activity detection and monitoring. September 14, 2016 46 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 47. BSA/AML Bank Secrecy Act Training September 14, 2016 47 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 48. Why Are You Here ? • Expand your knowledge of AML/BSA, Which will • Increase understanding of links in your Business Lines/Areas to the AML requirements, Which will • Raise AML awareness in the Bank, Which will • Build a partnership with the AML Department,Which will • Ensure an effective AML/BSA Program, Which will • Protect the Bank from unwittingly being used to launder money or fund terrorist activity. September 14, 2016 48 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 49. What Will You Leave With.. • Understanding of: – AML/BSA/OFAC Requirements – Importance of Knowing Your Customer • Recognition that every Bank employee has a key role in Solving the AML Puzzle • Familiarization with Money Laundering Schemes • Insight into Terrorist Financing • Comprehension of the Legislative Histories September 14, 2016 49 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 50. Mandate “Banking organizations must develop, implement and maintain effective AML programs that address the ever-changing strategies of money launderers and terrorists who attempt to gain access to the U.S. financial system.” Source: Federal Financial Institutions Examination Council’s Manual for Examination of AML/BSA (FFIEC) September 14, 2016 50 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 51. AML/BSA PROGRAM Requirements Internal policies, procedures, and controls designed to ensure compliance with the reporting and record- keeping requirements of the BSA Board Approval of the Program Designation of an AML Officer Transaction monitoring Maintenance of an ongoing employee training program and An independent audit function to test the adequacy of the program September 14, 2016 51 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 52. AML/BSA PROGRAM Requirements Identification of Customers (CIP) Currency transaction reporting (CTRs) Recording of monetary instrument sales Maintaining exemption records (CTR exemption) Identification, escalation and reporting of suspicious activity or behavior (SARs) AML Risk Assessment and Internal controls September 14, 2016 52 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 53. OFAC REQUIREMENTS Office of Foreign Assets Control 1. Block or prohibit transactions with designated foreign countries, groups or individuals 2. List of entities administered through Treasury Department 3. Applies to all individuals, businesses and entities September 14, 2016 53 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 54. Money Laundering Definition Money laundering is the process of conducting financial transactions and/or taking the proceeds from an illegal activity and Making them appear to be from a legal source, or Hiding them or placing them beyond the reach of the government, or Utilizing a series of transactions, transferring the proceeds to a Bank Secrecy Act country and later returning those funds to their original source September 14, 2016 54 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 55. In other words, the Bad Guy is trying to: • Disguise the source • Change the form • Move the funds to a place where they are less likely to attract attention September 14, 2016 55 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 56. Samples of Illegal Activities(Not limited to these) Narcotics Trafficking Gambling/Loan Sharking/Racketeering Bank Fraud, Bankruptcy Fraud Contraband Smuggling Embezzlement Terrorist Organization Funding Bribery/Public Corruption Corporate Kickback Schemes Espionage Access Device Fraud/Identity Theft Health Care Fraud Income Tax Evasion September 14, 2016 56 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 57. Money Laundering Steps 1. Placement 2. Layering 3. Integration At which steps will a launderer attempt to use the Bank? ALL 3 September 14, 2016 57 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 58. Placement Step Examples Initial placement into the financial system might be done by: Exchanging small bills for larger ones Breaking up large sums of money into less conspicuous smaller sums to be deposited Purchasing a series of money instruments (MO, travelers cheques), then depositing into an account in another location Physically carrying the money out of the United States September 14, 2016 58 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 59. Layering Step Examples In this phase, a series of conversions or movements take place to distance the funds from the original source: This can be done by wiring funds through a series of domestic accounts This can be done through the purchase and sale of investments in nominee businesses and/or individual names This can be done by wiring funds to various accounts throughout the globe, OR by disguising the transfers as payments for goods and services September 14, 2016 59 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 60. Integration Step Examples The money has been laundered and is now integrated into the legitimate economy The bad guy/gal then may choose to invest in real estate, luxury assets or even business ventures with little fear of detection September 14, 2016 60 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 61. How It Works September 14, 2016 61 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 62. Terrorist Financing Defined Terrorist financing is the funding of terrorist activities, ideologies and operations. The financing of terrorist activities can be accomplished through both unlawful and legitimate sources. The motivation between money laundering and terrorist financing may differ; however, the actual methods used to fund terrorist operations can be similar to a launderer. September 14, 2016 62 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 63. CUSTOMER IDENTIFICATION PROGRAM (CIP) Written CIP Risk Based procedures for verifying the identity of each customer Account Opening Procedures: •Name •DOB •Address •TIN Verification Procedures for both Individuals and Businesses Record Retention Procedures for the identification obtained Notice to the customer September 14, 2016 63 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 64. Know Your Customer / Customer Due Diligence In addition to required CIP, customer due diligence is required to ensure that a financial institution “knows its customers” and performs “due diligence” Risk-based approach that considers the account type, transactions and customer: • Account Opening questions and documentation • Verification of Source of wealth/funds • Verification of information -Web page, public records, credit bureaus, telephone directories, reverse directories, credit reports, Lexis Nexis, etc. • Customer Risk Rating • Enhanced Due Diligence for High Risk Customers September 14, 2016 64 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 65. High Risk Customer Categories • Non Resident Aliens (NRAs) • Foreign Mailing Address Customers • Money Service Businesses (MSBs) • Check Cashers • ATM Business Operators • Importers/Exporters • Politically Exposed Persons (PEPs) • Foreign Embassies/Consulates • Uncommon Charitable Organizations • Cash Intensive Businesses (gas stations, restaurants, convenience stores, vending machine operators, etc.) • Remote Deposit Capture Customers • Foreign Banks • Customers on whom SARs were previously filed • Customers whose records were subpoenaed in a criminal matter September 14, 2016 65 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 66. Enhanced Due Diligence Function AML/BSA Department • High Risk Account Identification, Investigation and Monitoring • Interact with the Bank’s Business Lines and Departments • Utilize Various Sources of Information • Contact with Customers • Contact with Law Enforcement • Contact with Other Financial Institutions September 14, 2016 66 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 67. SAR Filing Criteria/Conditions Banks must file on transactions suspected to be linked to criminal or BSA violations which involve but not limited to… Illegal proceeds Evading BSA Requirements Unusual activity with no known legitimate explanation Funds used to facilitate criminal activity September 14, 2016 67 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 68. Currency Transaction Reporting (CTR) Requirements The Bank must report all currency transactions in excess of $10,000 either conducted by the same person in one day or on behalf of the same person in one day • Deposits • Withdrawals • Exchanges • Multiple transactions September 14, 2016 68 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 69. Travel Rule Wire Transfers • Funds transfer - $3,000 or more originated, received, or intermediary form • Record-keeping requirement depends upon role in the transfer – Originators – Original or copy of the payment order, name and address of originator, amount, execution date, payment instructions, ID of beneficiary – Intermediary – Original or copy of the payment order – Beneficiary – Original or copy of the payment order, name, and address of beneficiary, ID of person receiving proceeds if not beneficiary, copy of the check or instrument used to effect payment September 14, 2016 69 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 70. Financial Transactions Used to Launder Money launderers take full advantage of the existing financial products and services available within financial institutions. Therefore, any type of transaction is susceptible and has been used for money laundering: Deposits Withdrawals Insurance Payments Loan Payments Wire Transfers ATM Transactions Remote Deposits Online Transactions ACH Transactions Bank Checks Stored Value Cards Securities Transactions, etc. September 14, 2016 70 SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 71. September 14, 2016 71 Contact Info: Simon Moss CEO and President Pneuron E: Simon.Moss@pneuron.com T: (203) 918-4234 Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union E: Patricia.Rodriguez-Autore@penfed.org T: (571) 329-5003 Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank E: nlake@acbb.com T: (717) 303-7854

- 72. ► You may ask a question at anytime throughout the presentation today. Simply click on the question mark icon located on the floating tool bar on the bottom right side of your screen. Type your question in the box that appears and click send. ► Questions will be answered in the order they are received. Q&A: September 14, 2016 72 SEGMENT 1: Simon Moss CEO and President Pneuron SEGMENT 2: Nancy E. Lake, CAMS-Audit, CAMS-FCI Director of Compliance Anchor Atlantic Community Bankers Bank SEGMENT 3: Patricia A. Rodriguez-Autore, MS Senior Manager, BSA/AML Analyst Pentagon Federal Credit Union

- 73. 73 Basic Annual Subscription – LIVE CLE Webcasts $199 (After Instant Discount) Pro Annual Subscription – LIVE CLE & Recorded Webcasts $299 (After Instant Discount) You get all these features: Unlimited Access to LIVE CLE Webcasts & Materials PLUS Free CLE Credit Processing Unlimited Access to Course Materials for LIVE Webcasts One-Click Registration Free Webcast Calendar Organizer with Outlook Integration $16.58 per month (Billed Annually – $199) You get all these PRO features: Unlimited Access to LIVE CLE Webcasts & Materials PLUS Free CLE Credit Processing Unlimited Access to Course Materials for LIVE Webcasts One-Click Registration Free Webcast Calendar Organizer with Outlook Integration Unlimited Access to Recorded Webcasts & Materials $299 per year MobileCLE.org is simple to use: On any device, log into your mobileCLE.org account and choose a LIVE continuing legal education webcast or recorded/on-demand course using one of our many powerful search engines (by legal practice area or keywords such as Patent, FACTA, Data Privacy, eDiscovery etc.). Register for your CLE webcast by clicking the reserve button. On the day and time of your LIVE webcast, simply click Launch! and with 2 taps on your screen you’re earning CLE! Practice Areas: Administrative Law, Alternative Dispute Resolution, Antitrust, Appellate Litigation, Bankruptcy, Communications Law, Corporate Law, Employment/Labor Law, Environmental Law, Government Contracts Law, Health Law, Immigration Law, Intellectual Property Law, International Development Law, International Trade Law, Mergers and Acquisitions, National Security Law, Privacy Law, Real Estate Law, Securities Law, Sports/Entertainment Law, Tax Law, Trusts and Estates Law, and White Collar Crime To sign up: www.mobilecle.org September 14, 2016

- 74. September 14, 2016 74 ABOUT THE KNOWLEDGE GROUP The Knowledge Group is an organization that produces live webcasts which examine regulatory changes and their impacts across a variety of industries. “We bring together the world's leading authorities and industry participants through informative two-hour webcasts to study the impact of changing regulations.” If you would like to be informed of other upcoming events, please click here. Disclaimer: The Knowledge Group is producing this event for information purposes only. We do not intend to provide or offer business advice. The contents of this event are based upon the opinions of our speakers. The Knowledge Group does not warrant their accuracy and completeness. The statements made by them are based on their independent opinions and does not necessarily reflect that of The Knowledge Group‘s views. In no event shall The Knowledge Group be liable to any person or business entity for any special, direct, indirect, punitive, incidental or consequential damages as a result of any information gathered from this webcast. Certain images and/or photos on this page are the copyrighted property of 123RF Limited, their Contributors or Licensed Partners and are being used with permission under license. These images and/or photos may not be copied or downloaded without permission from 123RF Limited

Notas del editor

- Why Points: Why form this Counsel, Why this Training, Why can’t the AML Department get is done on their own, Why all this hullabaloo over this? Our goal today is to get you answers to these questions….. Look let’s be honest you may not fully understand all of the ramifications of understanding all of the AML rules but the expectation is to start down this road……Theme you will here today is that there are certain requirements on which there are no gray, electronic monitoring is an absolute necessity…..but the human element is the best tool….the teller who questions, the wire room person who doesn't

- Points: Regulators do not view AML as a Department in the Bank but a requirement throughout the Bank Expectation is that all departments are an integral part of the program’s execution.

- Procedures that cover every facet of the Bank operations from establishing a customer relationship, understanding the expected behaviors of a customer, monitoring all customer transactions for suspicious activity, cash activity, MI activity, wire activity, high risk loan activity recognizing and accounting for changes to customers activities and services finally identifying high risk customers and establish expanded monitoring for these customers

- The Bank can be used at any step of this process: PLACEMENT: Rules at account opening – to detect the placement phase the reason we ask for CIP, ask the customer due diligence questions. LAYERING : Why the Bank looks at transactions, especially wires and cash…..because movements of funds denote the layer phase INTEGRATION : once again account opening questions related to source for funds and how the account will be used

- Because it is Risk Based, to ensure that higher risked customers are screened at a different level CDD happens in a number of ways let us give you some examples……

- Discuss questions asked at the teller line and the need for the information