ESI Act,1948

- 2. On 19th April,1948 , the ESI Act was introduced by the Government as a scheme of social insurance for the industrial workers. The words "except the State of Jammu and Kashmir" omitted by Act No. 51 of 1970, w.e.f. 1st September, 1971. The Scheme, thereafter was first implemented at Kanpur and Delhi on 24th February 1952. The Act further absolved the employers of their obligations under the Maternity Benefit Act, 1961 and Workmen's Compensation Act 1923. The benefit provided to the employees under the Act are also in conformity with ILO conventions.

- 3. To provide for certain benefits to employees in case of sickness, maternity and injury during employment and to make provision for certain other matters in relation thereto.

- 4. “ Appropriate Government ” means, in respect of establishments under the control of the Central Government or 2 [a railway administration] or a major port or a mine or oil- field, the Central Government, and in all other cases, the 3 [State] Government . “ Confinement ” means labour resulting in the issue of a living child, or labour after 26 weeks of pregnancy resulting in the issue of a child whether alive or dead . “ Contribution ” means the sum of money payable to the Corporation by the principal employer in respect of an employee and includes any amount payable by or on behalf of the employee in accordance with the provisions of this Act . “ Corporation ” means the Employees’ State Insurance Corporation set up under this Act. “ Exempted employee ” means an employee who is not liable under this Act to pay the employee’s contribution . “ Insured person ” means a person who is or was an employee in respect of whom contributions are or were payable under this Act and who is, by reason thereof, entitled to any of the benefits provided by this Act. “ Sickness ” means a condition which requires medical treatment and attendance and necessitates abstention from work on medical grounds .

- 5. The Act is applicable to all other factories other than the seasonal factories. The appropriate government may extend the provisions of the Act or any of them to any other industrial, commercial or agricultural establishment. The existing wage limit for coverage under Act is Rs 21000 /- per month w.e.f 1st Jan,2017. Earlier it was Rs.15000/- per month.

- 6. The State Govts. have extended the provisions to : shops, hotels, restaurants, cinemas including preview theatres, road-motor transport undertakings and newspaper establishments employing 20 or more coverable employees. Educational Institutions employing 20 or more persons in Rajasthan, Bihar, Pondicherry,Jammu & Kashmir, Uttarakhand, Chattisgarh, West Bengal, Jharkhand, Kerala, UttarPradesh, Andhra Pradesh, Assam, Punjab, Tamilnadu. Private Medical Institutions in the State of West Bengal, Rajasthan, Bihar, Kerala, Himachal Pradesh, Uttarakhand, Andhra Pradesh, Punjab, Assam, UT Chandigarh, Jharkhand and Orissa.

- 7. Seasonal factories engaged exclusively in any of the activities like: cotton ginning, cotton or jute pressing, decoration of ground nuts, manufacturing coffee, indigo,lac, rubber, sugar, or tea or any manufacturing process incidental to or connected with any of the afore said activities, and including factories engaged for a period not exceeding seven months in a year in blending, packing or repackaging tea or coffee, or in such other processes as may be specified by the central govt. Mines. Railway running sheds. Govt. factories or establishments and Indian naval, military, or air force. Other Govt. notified exempted establishments.

- 8. The following persons are not to be counted a) A proprietor or a partner whether drawing salary or not; b) A contractor lending the services of his employee; c) An apprentice engaged under the Apprentice Act, 1961; d) Persons employed on contract for service, e.g. legal, technical, tax consultants etc;

- 9. To Promote and measure for health and welfare of INSURED EMPLOYEES (IE). Intervene for the rehabilitation and reemployment for disabled / injured. To appoint inspectors for purposed of the act. To determine the amount of contribution and relevant verification.

- 10. Subject to the general superintendence and control of the corporation, the standing committee shall administer the affairs of the corporation and may exercise any of the powers and perform any of the functions of the corporation. Shall submit for the consideration and decision of the corporation all such cases and matters as may be specified in the regulations made in this behalf. In its discretion, may submit any other case or matter for the decision of the corporation.

- 11. Advise [the corporation and the standing committee] on matters relating to the administration of medical benefit, the certification for purposes of the grant of benefits and other connected matters. Have such powers and duties of investigation as may be prescribed in relation to complaints against medical practitioners in connection with medical treatment and attendance. Perform such other duties in connection with medical treatment and attendance as may be specified in the regulations.

- 12. Duties - Inquiring into the correctness in any return of contribution. Ascertaining Provision of the Act has been complied. Other authorized / specified duties by the corporation. Powers - To collect require and relevant information of employer / contractor or both. To enter org / contractor premises at reasonable time and examined relevant account books and relevant documents, payment of wages etc. To examine employer, contractor, his agent / servant or IE in factory / office To make copies of extracts from any registrar, account books and other books of maintenance of org.

- 13. The employer is required to contribute at the rate of 4.75% of the wages paid/ payable in respect of every wage period. Out of which 7/8th done by Central Govt. and 1/8th done by State Govt. The employees are also required to contribute at the rate of 1.75% of their wages except when the “average daily wages in a wage period” are equal to or less than Rs.137. . For newly implemented areas, the contribution rate is 1% of wages of Employee and 3% payable by Employers for first 24 months(w.e.f. 06.10.2016). The employer should get his factory or establishments registered with the E.S.I. Corporation within 15 days after the Act becoming applicable to it, and obtain the employer’s Code Number. The regional officer will allot a code number to the employer, which must be quoted in all documents and correspondence. It is the principle employer’s responsibility to deposit his own as well as employee’s contribution in respect of all employees including the contract labor, into the E.S.I. Account. Non-availability of funds cannot be a ground for non- payment of contributions under the act. There is no provision to waive the contribution, damages and interest.

- 14. In respect of an employee employed on any other basis, (The amount of wages earned during the complete wages period in the contribution period/number of days in full or part for which he has worked for wages in that wage period) Provided that where an employee receives wages without working on any day during such wage period, he shall be deemed to have worked for 26,13, 6 or 1 days or day if the wage period, be a month, a fortnight, a week or a day respectively.

- 15. The following wage components(gross salary) are taken into account a) Basic Pay,/Wages/Salary; b) D.A/ HRA/ CCA/ Overtime/ officiating allowance/ Night shift allowance/ efficiency allowance/ Heat, Gas, Dust allowance/ Education allowance/ Food & Tea allowance/ conveyance allowance; c) Wages/ salary/ pay for weekly off and public holidays; d) Commission paid to sales staff; e) Subsistence allowance paid to an employee during the period of suspension; f) Attendance Bonus or incentive or exgratia in lieu of Attendance Bonus or production incentive; g) Regular Honorarium or salary or remuneration paid to a Director; h) Collection Bhatta paid to running staff. i) Actual payments made towards leave salary, lay off compensation, or wages for strike period. j) Any other remuneration paid or payable in cash to an employee if the terms of contract of employment, expressed or implied were fulfilled.

- 16. Consider the salary of an employee is Rs 9000 per month then the ESI calculation for the employee would be calculated as: ESI = 9000*(1.75/100) = 158 Note: Employees contribution is 1.75% The ESI calculation for the employer’s contribution would be calculated as: 9000*(4.75/100) = 428 Note: Employer’s contribution is 4.75% In case the salary goes above Rs 21,000 per month during the contribution period, the ESI would be calculated on the higher salary. For example, if the salary of an employee is raised to Rs 21,000 per month during the ESI contribution period, then the ESI would be calculated on Rs 23,000 instead of Rs 21,000. But once the contribution period is over he/she will not be eligible for benefits under ESI Act,1948.

- 17. Employers covered under the Act, are required to Pay the contribution towards the scheme on a Monthly basis. There are two contribution periods each of Six months and two corresponding benefit periods also of Six months duration as under. Contribution Period(Fiscal Year) Benefit Period(Calendar Year) 1st April to 30th Sep 1st Jan to 30th June(of the following year) 1st Oct to 31st March(of the following year) 1st July to 31st Dec

- 18. Case: If an employee has joined on 19th June in a factory and met with an accident on 15th December, will he be covered under ESI,1948? Ans- No.As the benefit Period starts from 1st Jan he wont be covered as he is a new employee to the factory. Had he been completed 9 months or more he would be benefited and insured under the Act.

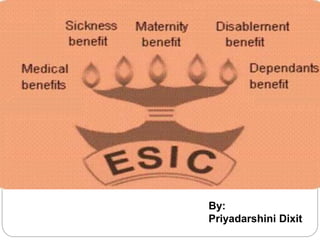

- 19. The purpose of the Employee State Insurance Act is to provide benefits as detailed in the Act particularly in section 46, to the insured persons or their dependants. Medical benefit Sickness benefit Maternity benefit Disablement benefit Dependants benefit Funeral expenses Others Benefits

- 20. The ESI Scheme provides full range of Medical Care to all Insured person and their family, through a network of ESI Dispensaries, Hospitals & Panel Clinics, Diagnostic Centers & Super Speciality. Super-Speciality treatment such as:- Open Heart Surgery, Neuron Surgery, Bone Marrow Transplant, Kidney Transplant or specialized investigations like CAT scan, MRI, Angiography etc. Eligibility for MB:- An employee who is covered under the Scheme for the first time is eligible for medical care for a period of 3 months. If employee contributes at least for 78 days in a contribution period the eligibility is there up to the end of the corresponding benefit period. Medical care is also provided to retired and permanently disabled insured persons and their spouses on payment of a token annual premium of Rs.120/-.

- 21. Sickness Benefits represents periodical cash payments made to an IP during the period of certified sickness occurring in a benefit period when IP requires medical treatment and attendance with abstention from work on medical grounds. Eligibility for SB:- Minimum 78 days contribution in one contribution period. The daily rate of Sickness Benefit is 70% of the daily wages. Max. Duration:- Maximum period of 91 days in any two consecutive benefit periods. Extended Sickness Benefit: Extended Sickness Benefit is a Cash Benefit paid for prolonged illness due to any of the 34 specified long term diseases.

- 22. Eligibility for Extended SB:- Continuous employment for a period of 2 years and should have contributed for at least 156 days in 4 preceding contribution periods. The daily rate of Extended Sickness Benefit at an enhanced rate of 80% of wages. Maximum Duration of ESB:- Including Sickness Benefit payable for 91 days the ESB is payable up to a further period of 124/309 days that can be extended up to 2 years in special circumstances on recommendation of competent authority. Enhanced Sickness Benefit equal to full wage is payable to insured persons undergoing sterilization for 7 days/14 days for male and female workers respectively.

- 23. Maternity Benefit consists of periodical cash payments in case of confinement or miscarriage or sickness arising out of pregnancy, confinement, premature birth of child or miscarriage, to an insured woman as certified by a duly appointed medical officer or mid wife. Eligibility for MB:- The contribution condition is the same as for Sickness Benefit. The daily benefit rate is double the Sickness Benefit rate and is thus roughly equivalent to the full wages subject to contribution for 70 days in the preceding 2 Contribution Periods. The Benefit is paid as follows:- (a) For Child Delivery:- For a total period of 12 weeks beginning not more than 6 weeks before the expected date of child birth. Now extended to 26 weeks w.e.f 1st April,2017, which is extendable by further one month on medical advice. (b) For Miscarriage:- For a period of 6 weeks following the date of miscarriage. (c) For Sickness arising out of pregnancy, confinement, premature birth of child or miscarriage:- For an additional period of up to 04 weeks.

- 24. In the event of the death of the Insured Woman during confinement leaving behind a child, Maternity Benefit is payable to her nominee on production of Form 24 (B). Medical Bonus:- Medical Bonus is lump sum payment made to an insured woman or the wife of an insured person in case she does not avail medical facility from an ESI hospital at the time of delivery. The amount of Bonus is Rs. 2500/-.

- 25. Disablement Benefit It is payable to an employee who is injured in the course of his employment and is permanently or temporarily disabled or contacts any occupational disease. Temporary disablement benefit (TDB): From day one of entering insurable employment & irrespective of having paid any contribution in case of employment injury. Temporary Disablement Benefit at the rate of 90% of wage is payable so long as disability continues. A person who sustains temporary disablement for not less than 3days(excluding the day of accident) shall be entitled to periodical payment as may be prescribed by the central govt. The benefit of temporary disablement is, however, not payable for any day on which the employee works, remains on lease, holiday or strike in respect of which he receives wages. Permanent disablement benefit (PDB) : The benefit is paid at the rate of 90% of wage in the form of monthly payment depending upon the extent of loss of earning capacity as certified by a Medical Board . The PDB rate is calculated as percentage of loss of earning capacity as assessed by the Medical Board/MAT/EI Court in relation to TDB.

- 26. Dependant Benefit paid at the rate of 90% of wage in the form of monthly payment to the dependants of a deceased Insured person in cases where death occurs due to employment injury or occupational hazards. Eligible Members: A widow can receive this benefit on monthly basis for life or till her Re- Marriage. A son or daughter can receive this benefit till 25 years of age. Other dependants like parents including a widowed mother etc. can also receive this benefit under certain conditions. The first installment is payable within a maximum of three months following the death of an insured person and therefore, on a regular monthly basis.

- 27. Funeral expenses are in the nature of a lump sum payment of Rs. 10000/- (revised from Rs.5000/- w.e.f:- April 2011) made to defray the expenditure on the funeral of deceased insured person. The amount is paid either to the eldest surviving member of the family or, in his absence, to the person who actually incurs the expenditure on the funeral.

- 28. Confinement Expenses : An Insured Women or an I.P.in respect of his wife in case confinement occurs at a place where necessary medical facilities under ESI Scheme are not available. Vocational Rehabilitation :To permanently disabled Insured Person for undergoing VR Training at VRS. Physical Rehabilitation : In case of physical disablement due to employment injury. Old Age Medical Care :For Insured Person retiring on attaining the age of superannuation or under VRS/ERS and person having to leave service due to permanent disability insured person & spouse on payment of Rs. 120/- per annum. Rajiv Gandhi Shramik Kalyan Yojana : This scheme of Unemployment allowance was introduced w.e.f. 01-04-2005. An Insured Person who become unemployed after being insured 3 or more years, due to closure of factory/establishment, retrenchment or permanent invalidity are entitled to :- Unemployment Allowance equal to 50% of wage for a maximum period of up to 2Years. Medical care for self and family from ESI Hospitals/Dispensaries during the period IP receives unemployment allowance. Vocational Training provided for upgrading skills - Expenditure on fee/travelling allowance borne by ESIC.

- 29. Benefit Contribution duration Benefit Amount Medical Benefit 78 days 3 month medical care Sickness Benefit 78 days 70% of Wages Maternity Benefit 70 days Double the sickness benefit+Rs. 2500 bonus per month Disablement Not required 90% of wages depending on loss in earning capacity Extended Sickness Benefit 156 days 80% of Wages

- 30. The Factory / establishment registered with in 15 days after the Act becomes applicable. Submit Form 01 to the Regional office for this purpose. Obtain Employer’s code No. for use in all ESIC Forms / documents and correspondence with the offices of the ESI Corporation. Fill the Declaration Forms in respect of all coverable employees and submit the same to the Regional Office/ Local Office of the corporation well before the ‘Appointed Day’ and obtain insurance Numbers from the concerned Local Office/ Regional Office. In respect of newly appointed employees, fill up the declaration form soon after appointment of such employees and submit the same to the Local Office Concerned. Pending receipt of identity cards/ identity certificate and may issue “certificate of employment” in Form 86 to the covered employee(s) enabling them to avail cash/medical Benefits Pay ESI contribution (Employee's Share @4.75% and the Employer’s share @ 1.75% of the wages) with in 21 days of the month following, in which the wages fall due.

- 31. Maintain an Accident Book as prescribed under the Factory Act / ESI Act. Submit an Accident Report to the Local Office / ESI Dispensary concerned immediately in respect of accidents that could result in death or disablement and within 24 hours of its occurrence otherwise. Minor accidents which do not cause absence from work need not be reported. Grant leave to insured employees on the basis of sickness certificates issued by any authorized ESI doctor.

- 32. Right to receive Payment of any benefit under the Act that shall not be “Transferable or Assignable”. Cash Benefits payable under the Act are not liable to attachment or sale in execution of any decree or order of any court. Employer shall not dismiss, discharge or reduce the wages or otherwise punish a covered employee during the period he / she is in receipt of Sickness Benefit or Maternity Benefit etc. By reason of his liability to pay his share of contribution under the ESI Act, no employer shall directly or indirectly reduce the wages of a covered employee. Right to register their grievances / complaints at any level for immediate Redressal & Judgment. Right to approach EI Court against any action/ decision of the medical Board etc.

- 33. Punishment for false statement:- In this case any false statement or false representation, shall be punishable with imprisonment up to Rs.2000 or with both Punishment for failure to pay contributions:- If any person fails to pay any contribution which under to this act he is liable to pay, he shall be punishable with imprisonment up to 3 years. Punishment for other contravention:- In contraventions like dismisses, discharges, reduces or otherwise punishes an employee, shall be punishable with imprisonment up to 1year or with fine up to Rs.4000 or with both. Power to recover damages:- If employer fails to pay the amount of contribution then corporation may recover from the employer by way of penalty. Power of court to make orders:- If court makes order for employer- if employer is not able to make this order within period then employer shall be punishable with imprisonment in respect thereof U/S.85 and shall also be liable to pay fine up to Rs.1000 for everyday.

- 34. Under Section 39(5)(a) of the ESI act, read with Regulation 31(A) of the ESI (General) Regulations 1950, the employer is liable to pay simple interest @ 15% per annum in respect of each day of default or delay in payment contributions. In addition, under the Provision of Regulation 31-C of ESI (General) Regulations, 1950, read with section 85 (B)(i) of the ESI Act, the Corporation is empowered to recover damage as under: Period of delay in Rate of Damages payment of Contribution on the amount due i)Up to less than 2 months 5% ii)2 months and above but less than 4 months 10% iii)4 months and above but less than 6 months 15% iv)6 months and above 25%

- 35. THE EMPLOYEES’ STATE INSURANCE (CENTRAL) RULES, 1950 THE EMPLOYEES’ STATE INSURANCE (GENERAL) REGULATIONS, 1950 EMPLOYEES' STATE INSURANCECORPORATION (GENERAL PROVIDENT FUND) RULES, 1995 THE MAHARSHTRA EMPLOYEES’ STATE INSURANCE(MEDICAL BENEFIT) RULES,1954 THE MAHARSHTRA EMPLOYEES’ INSURANCE COURT RULES,1959

- 36. Is the Act applicable to Kitchen of Cricket Club of India? Ans: Yes. The Kitchen is a factory under section 2(12) of the Act. The activities in the kitchen area has a direct connection with the activities carried on in the rest of the club. As such, the Act, which is made applicable to all factories is made applicable to the Club. CCI vs ESIC,1994

- 37. Is the Act applicable to employees working in the Head Office or Branch office of Factories covered by the Act? Ans: Yes if such employees are doing work connected with the administration of the factories. Associated Cement Cos Ltd vs The Regional Director, ESIC Bombay,1981

- 38. The Employees’ State Insurance Act,1948 Labour Law Agency, Mumbai http://www.esic.nic.in/