15 June Daily market report

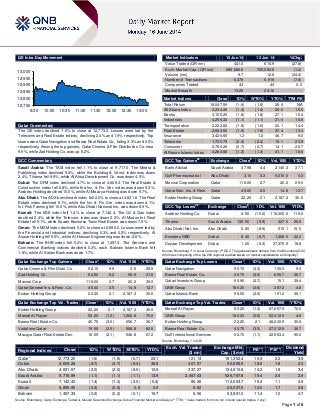

- 1. Page 1 of 5 QE Intra-Day Movement Qatar Commentary The QE index declined 1.6% to close at 12,773.2. Losses were led by the Telecoms and Real Estate indices, declining 2.4% and 1.9% respectively. Top losers were Qatar Navigation and Barwa Real Estate Co., falling 3.3% and 3.0% respectively. Among the top gainers, Qatar Cinema & Film Distribution Co. rose 9.9%, while Zad Holding Co. was up 5.2%. GCC Commentary Saudi Arabia: The TASI index fell 1.1% to close at 9,717.0. The Media & Publishing index declined 5.3%, while the Building & Const. index was down 2.4%. Tihama fell 9.9%, while Al Ahsa Development Co. was down 4.5%. Dubai: The DFM index declined 4.7% to close at 4,609.3. The Real Estate & Construction index fell 5.8%, while the Inv. & Fin. Ser. index was down 5.3%. Arabtec Holding declined 10.0%, while Al-Mazaya Holding was down 9.7%. Abu Dhabi: The ADX benchmark index fell 2.0% to close at 4,831.6. The Real Estate index declined 6.1%, while the Inv. & Fin. Ser. index was down 4.1%. Int. Fish Farming fell 10.0%, while Abu Dhabi National Ins. was down 8.9%. Kuwait: The KSE index fell 1.4% to close at 7,142.4. The Oil & Gas index declined 2.4%, while the Telecom. index was down 2.3%. Al Mudon Int. Real Estate fell 9.1%, while Kuwait Business Town Real Estate was down 7.9%. Oman: The MSM index declined 0.2% to close at 6,896.0. Losses were led by the Financial and Industrial indices, declining 0.3% and 0.2% respectively. Al Anwar Holding fell 5.0%, while Al Hassan Engineering was down 2.8 %. Bahrain: The BHB index fell 0.2% to close at 1,457.3. The Services and Commercial Banking indices declined 0.3% each. Bahrain Islamic Bank fell 1.8%, while Al Salam Bank was down 1.7%. Qatar Exchange Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distri. Co. 52.10 9.9 3.5 29.9 Zad Holding Co. 84.50 5.2 98.6 21.6 Mannai Corp. 116.00 2.7 20.2 29.0 Qatar General Ins. & Rein. Co. 45.00 2.5 14.8 12.7 Ezdan Holding Group 22.20 2.1 2,187.3 30.6 Qatar Exchange Top Vol. Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 22.20 2.1 2,187.3 30.6 Masraf Al Rayan 53.20 (1.3) 1,262.8 70.0 Barwa Real Estate Co. 40.75 (3.0) 656.7 36.7 Vodafone Qatar 19.55 (2.5) 568.8 82.5 Mazaya Qatar Real Estate Dev. 18.69 (2.1) 546.8 67.2 Market Indicators 15 Jun 14 12 Jun 14 %Chg. Value Traded (QR mn) 441.0 610.9 (27.8) Exch. Market Cap. (QR mn) 696,586.8 705,094.8 (1.2) Volume (mn) 9.7 12.8 (24.4) Number of Transactions 6,378 6,916 (7.8) Companies Traded 43 43 0.0 Market Breadth 13:29 23:16 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 19,047.59 (1.6) (1.6) 28.4 N/A All Share Index 3,234.26 (1.4) (1.4) 25.0 15.5 Banks 3,105.25 (1.8) (1.8) 27.1 15.4 Industrials 4,256.32 (1.1) (1.1) 21.6 16.6 Transportation 2,232.82 (1.6) (1.6) 20.1 14.4 Real Estate 2,683.62 (1.9) (1.9) 37.4 13.4 Insurance 3,426.65 1.2 1.2 46.7 9.0 Telecoms 1,730.79 (2.4) (2.4) 19.1 23.9 Consumer 6,786.26 (0.7) (0.7) 14.1 26.7 Al Rayan Islamic Index 4,283.58 (1.3) (1.3) 41.1 18.6 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Bank Albilad Saudi Arabia 47.98 4.4 2,145.3 37.1 Gulf Pharmaceutical Abu Dhabi 3.10 3.3 5,010.0 4.3 Mannai Corporation Qatar 116.00 2.7 20.2 29.0 Qatar Gen. Ins. & Rein. Qatar 45.00 2.5 14.8 12.7 Ezdan Holding Group Qatar 22.20 2.1 2,187.3 30.6 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Arabtec Holding Co. Dubai 4.50 (10.0) 116,300.0 119.5 Tihama Saudi Arabia 139.50 (9.9) 327.0 26.9 Abu Dhabi Nat. Ins. Abu Dhabi 5.60 (8.9) 510.1 (5.1) Emirates NBD Dubai 8.40 (6.7) 1,368.5 32.3 Deyaar Development Dubai 1.20 (6.3) 37,376.9 18.8 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Qatar Exchange Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Navigation 90.70 (3.3) 135.3 9.3 Barwa Real Estate Co. 40.75 (3.0) 656.7 36.7 Qatari Investors Group 60.90 (2.7) 15.1 39.4 QNB Group 180.20 (2.6) 287.2 4.8 Qatar Islamic Bank 96.00 (2.5) 101.2 39.1 Qatar Exchange Top Val. Trades Close* 1D% Val. ‘000 YTD% Masraf Al Rayan 53.20 (1.3) 67,657.5 70.0 QNB Group 180.20 (2.6) 52,412.9 4.8 Ezdan Holding Group 22.20 2.1 48,240.9 30.6 Barwa Real Estate Co. 40.75 (3.0) 27,012.9 36.7 Gulf International Services 92.70 (1.1) 22,563.4 90.0 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,773.20 (1.6) (1.6) (6.7) 23.1 121.14 191,352.4 15.9 2.2 3.9 Dubai 4,609.28 (4.7) (4.7) (9.4) 36.8 407.07 90,896.9 18.5 1.8 2.3 Abu Dhabi 4,831.57 (2.0) (2.0) (8.0) 12.6 337.27 134,610.8 14.2 1.8 3.4 Saudi Arabia 9,716.99 (1.1) (1.1) (1.1) 13.8 2,067.43 526,797.8 19.4 2.4 2.9 Kuwait 7,142.42 (1.4) (1.4) (2.0) (5.4) 86.26 112,063.7 16.3 1.1 3.9 Oman 6,895.95 (0.2) (0.2) 0.6 0.9 6.82 25,027.5 12.5 1.7 3.8 Bahrain 1,457.33 (0.2) (0.2) (0.1) 16.7 6.96 53,881.0 11.4 1.0 4.7 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,750 12,800 12,850 12,900 12,950 13,000 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QE index declined 1.6% to close at 12,773.2. The Telecoms and Real Estate indices led the losses. The index fell on the back of selling pressure from non-Qatari shareholders despite buying support from Qatari shareholders. Qatar Navigation and Barwa Real Estate Co. were the top losers, falling 3.3 and 3.0% respectively. Among the top gainers, Qatar Cinema & Film Distribution Co. rose 9.9%, while Zad Holding Co. was up 5.2%. Volume of shares traded on Sunday fell by 24.4% to 9.7mn from 12.8mn on Thursday. Further, as compared to the 30-day moving average of 26.8mn, volume for the day was 64.0% lower. Ezdan Holding Group and Masraf Al Rayan were the most active stocks, contributing 22.7% and 13.1% to the total volume respectively. Source: Qatar Exchange (* as a % of traded value) Earnings Earnings Releases Company Market Currency Revenue (mn)1Q2014 % Change YoY Operating Profit (mn) 1Q2014 % Change YoY Net Profit (mn) 1Q2014 % Change YoY Al Islami Foods* Dubai AED 300.0 NA – – 15.2 65.2% Source: Company data, DFM, ADX, MSM (*FY2013 results) News Qatar QCB issues bonds worth QR4bn – The Qatar Central Bank (QCB) has issued government bonds worth QR4bn on June 15, 2014, for which it received bids totaling QR12.25bn. Government bonds worth QR2.1bn with a three-year maturity were issued at a yield of 2.25%. Bonds with five-year maturity worth QR950mn were issued at 2.75% yield, while bonds with seven-year maturity worth QR950mn were issued at 3.50% yield. (QCB) GDI places QR193mn rig order with SDS for QP service – Gulf Drilling International (GDI) has placed an order worth QR193mn with US-based Superior Derrick Services (SDS) for the construction of two new land rigs that will work for Qatar Petroleum (QP). The 1,500HP rig that is being ordered has been named as GDI-7 and the 3,000HP rig as GDI-8. These rigs will take 10 and 12 months, respectively to be delivered at SDS’ factory and are scheduled to be placed into service by GDI in 3Q2015 and 4Q2015, respectively. At 3,000HP, GDI-8 will be the largest land rig in GDI’s fleet, capable of drilling extended reach wells and to greater depths. With the addition of two new rigs, GDI’s land rig fleet will comprise a total of eight, including five drilling rigs and three work-over rigs. All eight rigs are under long-term contracts with QP for drilling operations being conducted in the onshore Dukhan field. (Gulf-Times.com) QNB Group signs deal to fund Enterprise Qatar’s portal – QNB Group (QNBK). signed a two year partnership agreement with the Small and Medium Enterprises (SMEs) Development Company ‘Enterprise Qatar’ (EQ) as a conventional Funding Partner for its new online portal businesspulse.qa. This initiative is in partnership with Thomson-Reuters and operated by Zawya Internet Content Provider LLC. businesspulse.qa, a national portal and semi-government entity established in support of entrepreneurs and SMEs in Qatar, provides a comprehensive set of databases containing valuable information and knowledge. Its purpose is to facilitate a well-integrated business environment to serve and support entrepreneurs and business owners seeking to develop their operations, while assisting various governmental administrations, businessmen and entrepreneurs to make informed decisions. QNB’s objective is to enable Qatari entrepreneurs and SME owners, the driving force of tomorrow’s economy, to make important decisions by providing credible, reliable, timely, accessible and relevant data through a coherent eco-system that supports budding SMEs within the Qatari market. This agreement further emphasizes the significance of the new online portal as QNB will now offer a comprehensive range of financial products and services including a ‘Financial Health Check’ tool to help SMEs and entrepreneurs manage their money better. Other services include the ‘Apply Online for QNB Funding’ assistant, an ‘Ask the Expert’ and ‘Live Chat’ tools. Additionally, all QNB events will also be communicated online through businessPulse.qa, while SME customers can now find financial and enterprise market ‘Thought Leadership’ articles provided by QNB (QNB Group Press Release) NLCS buys property worth QR120mn – Alijarah Holding (NLCS) has completed the acquisition of a property worth QR120mn in Al-Aziziyah area. This land will be developed into retail stores and commercial offices. (QE) Pearl GTL signs QR1.2bn long-term service deals with 5 contractors – Pearl GTL, a JV of Qatar Petroleum (QP) and Shell, has signed long-term service agreements worth nearly QR1.2bn with five major contractors to provide maintenance services for its gas-to-liquids plant at Ras Laffan. Under this agreement, mechanical maintenance services will be provided by Madina and AMEC-Blackcat; electrical & instrument maintenance services will be provided by Kentech; and scaffolding, painting & insulation services will be provided by Hertel and Cape East. As part of these contracts, Pearl GTL expects more than 1,000 full-time personnel from the contractor companies to be dedicated to supporting the plant onsite. (Gulf- Times.com) Egypt in talks with Qatari Diar for 1 mn housing unit project – According to sources, negotiations are ongoing between Egyptian authorities and Qatari Diar Real Estate Investment Company for a 1mn housing unit project similar to Arabtec's 1mn housing project for low and middle-income. (Bloomberg) Overall Activity Buy %* Sell %* Net (QR) Qatari 65.35% 63.03% 10,246,858.20 Non-Qatari 34.64% 36.97% (10,246,858.20)

- 3. Page 3 of 5 QFC set to receive more local firms on Qatar growth boost – The Qatar Financial Centre (QFC) is all set to receive more number of domestic firms as Qatar’s macroeconomic growth remains intact and is poised to strengthen further. The QFC Authority’s Deputy CEO Yousef Mohamed al-Jaida said that over the last few years, the number of non-regulated firms licensed by the QFC has grown considerably as they see the benefits of using the QFC’s world-class environment to do business outside as well as inside Qatar. (Gulf-Times.com) HMC launches two building projects – The Hamad Medical Corporation (HMC) has launched two new building projects – the CyberKnife Robotic Radiosurgery System unit and the expansion of the Neonatal Intensive Care Unit (NICU), backed by the Social & Sports Activities Support Fund. The two projects are expected to be completed by 1Q2015. The CyberKnife unit will deliver improved radio surgery practice through the use of the CyberKnife Robotic Radio surgery system, which is the world’s only robotic radio surgery technique designed to treat tumors non-invasively anywhere in the body. (Peninsula Qatar) International Unicredit: US Fed in focus as investors seek reassurance – Investors will look to the Federal Reserve for reassurance in the coming week, with little economic data to assuage their concerns over the strength of the global recovery, amid signs of Iraq sliding into a civil war. The Fed is expected to keep steadily reducing its massive bond-buying stimulus by $10bn per month. Financial markets will be listening out for any hints on when the US central bank might begin raising interest rates. Unicredit said in an investor note that the Fed is preparing to move to the second step of its monetary policy exit. With the tapering of asset purchases virtually on auto pilot, the focus is gradually shifting toward actual rate hikes. Unicredit said the notion that the US monetary policy has reached a turning point could be strengthened if the Fed policymakers' median rate forecast for the end of 2016 stays at 2.25%, where it stood in March 2014, up from 1.75% in December. (Reuters) BoE says first rate rise will signal UK economy is healing – The Bank of England (BoE) Deputy Governor Charlie Bean said the bank’s first interest-rate increase from the current record low will indicate that the UK economy is returning to normal. Bean stated that he was optimistic as the economy was showing better balance toward investment. Bean’s comments came in when the BoE contends with pressure to act on housing from groups such as the Organization for Economic Cooperation & Development. The UK Chancellor of the Exchequer George Osborne last week gave the BoE’s Financial Policy Committee new powers to curb mortgage lending. Bean said a higher interest rate would not have made much difference in addressing the build-up of problems from sources such as the US housing market. Bean, who oversees monetary policy at the central bank and will retire on June 30. (Reuters) French FM expects more equitable US fine on BNP Paribas – France's finance minister, Michel Sapin, said that talks between BNP Paribas and US authorities over a potential fine for the bank for breaching US sanctions had progressed toward a more equitable level. The US authorities, including the New York financial regulator are investigating whether BNP evaded US sanctions against Iran and other countries between 2002 and 2009. BNP may have to pay a fine of about $10bn and face other penalties such as being suspended from clearing clients' dollar transactions. The French government had said such a fine would be disproportionate. (Reuters) China to meet this year's 7.5% growth target – Chinese Premier Li Keqiang said China is confident of reaching its growth target of 7.5% this year, adding that the government was ready to adjust its policy to make sure it does. The Premier said slowing growth in the world's second-largest economy was normal and not a problem. Despite considerable downward pressure, the Chinese economy is moving on a steady course. Li Keqiang stated that the government will continue to make anticipatory and moderate adjustments when necessary and is well prepared to defuse various risks. A Reuters poll in April forecast China's economic growth could slow to 7.3% in the second quarter from a 18-month low of 7.4% in 1Q2014, with a projected full-year growth of 7.3% in 2014, the weakest in 24 years. Li Keqiang had previously signaled some flexibility in achieving this year's growth target, although analysts say the government wants to prevent growth from falling towards 7%, as that could fuel job losses and threaten social stability. (Reuters) Regional Barclays appoints Chairman for MENA – Barclays has appointed Makram Azar as its Chairman for the MENA region. Azar will continue as the Vice Chairman of the bank’s global investment-banking division. Barclays further appointed Andrew Mortimer as the Country Manager for the Middle East. (Bloomberg) Visa: Saudi e-commerce grows 43% in 1Q2014 – According to Visa, Saudi Arabia has witnessed an estimated 43% overall growth in its e-commerce, comparing 1Q2013 and 1Q2014, which is MENA’s highest growth rate in 1Q2014. This growth was driven by increases in both domestic and cross-border e- commerce, which saw a 67% and 36% growth over the same period last year, respectively. General department store and airline transactions have emerged as the leading categories for spending, followed by travel agencies, financial services and fashion retail. (GulfBase.com) SCIC BoD recommends SR150mn rights issue – Salama Cooperative Insurance Company’s (SCIC) board of directors has recommended an increase in the company's capital through offering a rights issue with a total value of SR150mn. The company intends to use the proceeds to maintain the solvency margin of the business and support its future growth. (Tadawul) Tadawul becomes affiliate member of IOSCO – The Saudi Stock Exchange (Tadawul) has been granted affiliate membership with the International Organization of Securities Commissions (IOSCO), an association of national securities regulatory commissions. This agreement enables Tadawul to create an effective communication framework with market regulators and other leading exchanges around the world, as well as support the development of its capital market in the context of the ever evolving global regulatory environments. Tadawul joins 62 other affiliate members of IOSCO. (Tadawul) EIAST signs cooperation deal with Sharjah DTPS – The Emirates Institution for Advanced Science & Technology (EIAST) has signed a cooperation agreement with the Directorate of Town Planning & Survey (DTPS), in the Government of Sharjah. Under the terms of the deal, EIAST will be providing DTPS with multispectral satellite images and high resolution panchromatic images, based on DTPS’ coordinate system. (Bloomberg) Aramex acquires Mail Call Couriers – Logistics solutions provider, Aramex has acquired Mail Call Couriers, a leading courier service in metro express deliveries in Australia. The transaction enables Aramex to strengthen its Asia-Pacific proposition and provides it with important, technology-driven delivery capabilities in Australia. (DFM)

- 4. Page 4 of 5 Dubai to rehabilitate 3.5km of Umm Suqeim beach – Dubai Municipality announced that a rehabilitation project protecting Umm Suqeim Beach against erosion will be carried out over the next nine months. The scope of work will cover all areas of Umm Suqeim 1, 2 and 3 beaches starting from the second fishing harbor to Burj Al Arab Hotel at a total length of approximately 3.5km. In order to prevent erosion on the popular beachfront, beach nourishment in addition to the construction of groynes will be carried out. For this approximately 760,000 cubic meters of beach sand will be required. The project works will start next week and continue until March 2015. (Bloomberg) GCAS signs MoU for training programs – The Gulf Centre for Aviation Studies (GCAS), the training facility of Abu Dhabi Airports Company, has signed a MoU with Emirates Group Security - Centre of Aviation and Security Studies (CASS) to provide a number of joint aviation security training programs. The agreement outlines both parties’ commitment to provide niche training & development in the field of Aviation Security in direct response to the industry’s demands. (GulfBase.com) Saif Al Khaili to set up AED280mn factories in KIZAD – Abu Dhabi-based Saif Al Khaili Group has signed AED280mn deal to set up two factories in Khalifa Industrial Zone Abu Dhabi (KIZAD). The first plant, named as the ‘Emirates Chemical Factory’, will have a production capacity of 400,000 tons per year. It will be the UAE’s first plant to produce caustic soda and other chlorine derivatives to be used in various manufacturing industries. The second plant, to be based in KIZAD’s food cluster on a 284,435 square feet plot of land, will produce 70,000 ready-made meals per day for industrial catering. (Bloomberg) Emirates ID signs deal with Tejari – The Emirates Identity Authority, Emirates ID, has signed an agreement with Tejari to manage its tenders and purchases online aimed at promoting transparency in its procedures. Under the agreement, Emirates ID’s tenders will be published on Tejari’s website. Tejari will also provide online analysis and awarding of bids, as well as necessary technical support. (Bloomberg) Kuwaiti inflation slows to 2.7% in April – Kuwait has recorded an increase in its consumer price index (CPI) at a rate of 2.7% YoY in April 2014, slowing down slightly from 3.0% YoY in March. Core inflation fell from 2.8% YoY in March to 2.6% YoY in April, and inflation excluding both food & housing also continued to decelerate into April. Food price inflation slowed down from 3.6% YoY in March, to 2.9% in April. Food price inflation has remained on a downward trend since the middle of 2013. Inflation in the rented housing remain almost unchanged at 4.6% YoY. Clothing inflation slowed down from 3.3% YoY in March to 2.9% YoY in April, and the furnishing inflation figure stood almost unchanged at 4.9% YoY. (GulfBase.com) Jazeera Airways reports April operational performance – Jazeera Airways (JA) has recorded an increase in the number of passengers on its various routes and an on-time performance of 92.59% for April 2014. JA recorded a 76% increase in flown passengers on the Kuwait-Istanbul route from April 2013, and grabbed a 7% market share on the route. Flown passengers on the Kuwait-Jeddah route increased in April 2014 by 36% from April 2013, and by 19% on the Kuwait-Bahrain route. The airline grabbed a 17% market share on the Kuwait-Jeddah route and a 10% market share on the Kuwait-Bahrain route. JA grabbed a 29% market share on the Kuwait-Beirut route, a 12% market share on the Kuwait-Dubai route, a 5% market share on the Kuwait-Riyadh route and a 39% market share on the Kuwait-Al Najaf route. (GulfBase.com) NBK Capital completes sale of Nayifat Instalment – NBK Capital’s Alternative Investments Group has completed the sale of its 38% stake in Saudi-based Nayifat Instalment Company to Falcom Financial Services. The investment was made through NBK Capital Equity Partners Fund I, the firm’s private equity fund focused on acquiring stakes in growing middle market companies across the MENA region. (Bloomberg) OGC awards gas pipeline supply tender for Duqm – Oman Gas Company (OGC) has awarded the gas pipeline supply tender for Duqm Economic Zone project with an estimated cost of OMR36mn. OGC’s acting general manager (Engineering), Mansoor Al Abdali, said that the 36-inch pipeline that will run for 230 kilometers will serve the requirements of Duqm Economic Zone, and is considered to be one of the main infrastructure projects currently on in the area. Al Abdali pointed out that the tender for the construction works will be announced soon. He said the entire project is expected to be ready in 2018 and will be ready to feed the Duqm refinery, which will possibly be the first gas consumer at the zone. (GulfBase.com) AAH declares 10% cash dividend – Al Anwar Holdings’ (AAH) AGM has approved the distribution of 10% cash dividend (0.010 baiza per share) for the financial year ended March 31, 2014. (MSM) Oman has no plan to defer two-year ban on expat return – The Royal Oman Police (ROP) and the Ministry of Manpower (MoM) stated that there is no change in the date of application of the two-year ban on return of expat workers to Oman. It will come into effect from July 1, 2014. After the two-year ban comes into effect, expats will only be allowed to switch employers in Oman if they get an NOC from their current employers, even after they have completed the period of their contract. (GulfBase.com) Bahrain MoH signs deal for BHD10mn housing unit project – Bahraini Ministry of Housing (MoH) has signed an agreement with the Kuwait-based Coalition of Aresco Company and Bahrain-based Tamkon Company to build 316 housing units in the Northern City's Island No. 14. The BHD10mn project represents the second phase of the Northern City, whose first phase, comprising 530 units, is about to be completed. The project will be funded by the State of Kuwait through the GCC Development Fund. (Bloomberg) KHCB offers investment opportunities through Mudharabah – Khaleeji Commercial Bank (KHCB) announced the launch of an investment account based on the Shari’ah principle of Mudharabah. The Call Mudharabah Account combines the flexibility and convenience of a current account with the concept of profit sharing of the Mudharabah Investment Account. (Bloomberg) Investcorp named Best Private Equity House in Mideast – Investcorp has been awarded the title of "Best Private Equity House in the Middle East" by EMEA Finance at its annual achievement awards recently. The award recognizes Investcorp's substantial contribution to the industry after having completed around 150 corporate transactions since its launch in 1982 with a combined value of more than $50bn. (Gulf- Base.com)

- 5. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 190.0 200.0 210.0 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 QE Index S&P Pan Arab S&P GCC (1.1%) (1.6%) (1.4%) (0.2%) (0.2%) (2.0%) (4.7%) (6.0%) (4.8%) (3.6%) (2.4%) (1.2%) 0.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% Gold/Ounce 1,276.89 0.0 0.0 5.9 DJ Industrial 16,775.74 0.0 0.0 1.2 Silver/Ounce 19.69 0.0 0.0 1.2 S&P 500 1,936.16 0.0 0.0 4.8 Crude Oil (Brent)/Barrel (FM Future) 113.41 0.0 0.0 2.4 NASDAQ 100 4,310.65 0.0 0.0 3.2 Natural Gas (Henry Hub)/MMBtu 4.67 0.0 0.0 7.4 STOXX 600 347.07 0.0 0.0 5.7 LPG Propane (Arab Gulf)/Ton 103.63 0.0 0.0 (17.9) DAX 9,912.87 0.0 0.0 3.8 LPG Butane (Arab Gulf)/Ton 119.38 0.0 0.0 (12.5) FTSE 100 6,777.85 0.0 0.0 0.4 Euro 1.35 0.0 0.0 (1.5) CAC 40 4,543.28 0.0 0.0 5.8 Yen 102.04 0.0 0.0 (3.1) Nikkei 15,097.84 0.0 0.0 (7.3) GBP 1.70 0.0 0.0 2.5 MSCI EM 1,049.14 0.0 0.0 4.6 CHF 1.11 0.0 0.0 (0.8) SHANGHAI SE Composite 2,070.72 0.0 0.0 (2.1) AUD 0.94 0.0 0.0 5.4 HANG SENG 23,319.17 0.0 0.0 0.1 USD Index 80.58 0.0 0.0 0.7 BSE SENSEX 25,228.17 0.0 0.0 19.2 RUB 34.41 0.0 0.0 4.7 Bovespa 54,806.64 0.0 0.0 6.4 BRL 0.45 0.0 0.0 6.3 RTS 1,374.94 0.0 0.0 (4.7) 183.5 151.5 138.2