27 August Daily Market Report

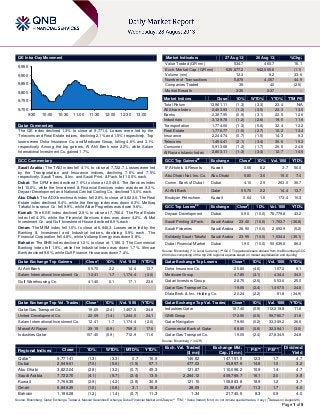

- 1. Page 1 of 5 QE Intra-Day Movement Qatar Commentary The QE index declined 1.3% to close at 9,771.4. Losses were led by the Telecoms and Real Estate indices, declining 2.1% and 1.5% respectively. Top losers were Doha Insurance Co. and Medicare Group, falling 4.6% and 3.1% respectively. Among the top gainers, Al Ahli Bank rose 2.2%, while Salam International Investment Co. gained 1.7%. GCC Commentary Saudi Arabia: The TASI index fell 4.1% to close at 7,722.7. Losses were led by the Transportation and Insurance indices, declining 7.6% and 7.5% respectively. Saudi Trans. & Inv. and Saudi Print. & Pack. fell 10.0% each. Dubai: The DFM index declined 7.0% to close at 2,549.6. The Services index fell 10.0%, while the Investment & Financial Services index was down 9.3%. Deyaar Development and National Central Cooling Co. declined 10.0% each. Abu Dhabi: The ADX benchmark index fell 2.8% to close at 3,822.0. The Real Estate index declined 9.4%, while the Energy index was down 6.3%. Methaq Takaful Insurance Co. fell 9.9%, while Aldar Properties was down 9.6%. Kuwait: The KSE index declined 2.9% to close at 7,766.4. The Real Estate index fell 4.3%, while the Financial Services index was down 4.2%. Al Mal Investment Co. and Gulf Investment House declined 8.9% each. Oman: The MSM index fell 1.0% to close at 6,846.3. Losses were led by the Banking & Investment and Industrial indices, declining 0.9% each. The Financial Corporation fell 4.8%, while Voltamp Energy was down 3.8%. Bahrain: The BHB index declined 1.2% to close at 1,186.3. The Commercial Banking index fell 1.8%, while the Industrial index was down 1.7%. Ithmaar Bank declined 9.6%, while Gulf Finance House was down 7.4%. Qatar Exchange Top Gainers Close* 1D% Vol. ‘000 YTD% Al Ahli Bank 55.70 2.2 14.4 13.7 Salam International Investment Co. 12.41 1.7 1,174.4 (2.0) Gulf Warehousing Co. 41.40 0.1 17.1 23.6 Qatar Exchange Top Vol. Trades Close* 1D% Vol. ‘000 YTD% Qatar Gas Transport Co. 19.05 (2.4) 1,457.5 24.8 United Development Co. 22.09 (1.4) 1,244.0 24.1 Salam International Investment Co. 12.41 1.7 1,174.4 (2.0) Masraf Al Rayan 29.15 (0.9) 759.3 17.6 Industries Qatar 157.40 (0.9) 712.9 11.6 Market Indicators 27 Aug 13 26 Aug 13 %Chg. Value Traded (QR mn) 534.7 460.7 16.1 Exch. Market Cap. (QR mn) 535,877.2 542,005.6 (1.1) Volume (mn) 12.3 9.2 33.6 Number of Transactions 5,878 4,057 44.9 Companies Traded 39 40 (2.5) Market Breadth 3:35 2:37 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 13,961.11 (1.3) (3.3) 23.4 N/A All Share Index 2,463.93 (1.2) (3.0) 22.3 13.0 Banks 2,387.95 (0.9) (3.1) 22.5 12.6 Industrials 3,139.78 (1.2) (2.6) 19.5 11.6 Transportation 1,774.06 (1.3) (5.6) 32.4 12.2 Real Estate 1,776.77 (1.5) (2.7) 10.2 13.4 Insurance 2,244.74 (0.7) (1.5) 14.3 9.3 Telecoms 1,454.41 (2.1) (3.4) 36.6 15.3 Consumer 5,913.68 (1.2) (1.7) 26.6 24.8 Al Rayan Islamic Index 2,803.11 (1.3) (3.4) 12.7 14.5 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% IFA Hotels & Resorts Kuwait 0.66 8.2 3.7 50.0 Abu Dhabi Nat. Ins. Co. Abu Dhabi 5.80 3.6 15.0 7.4 Comm. Bank of Dubai Dubai 4.10 2.5 263.0 36.7 Al Ahli Bank Qatar 55.70 2.2 14.4 13.7 Boubyan Petrochem. Kuwait 0.64 1.6 173.4 10.3 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Deyaar Development Dubai 0.50 (10.0) 78,779.8 43.2 Saudi Printing & Pack. Saudi Arabia 23.40 (10.0) 1,763.7 (36.8) Saudi Fisheries Saudi Arabia 28.90 (10.0) 2,692.9 (5.2) Solidarity Saudi Takaful Saudi Arabia 23.95 (10.0) 1,534.4 (35.1) Dubai Financial Market Dubai 1.90 (10.0) 50,635.0 86.3 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Qatar Exchange Top Losers Close* 1D% Vol. ‘000 YTD% Doha Insurance Co. 25.80 (4.6) 107.3 5.1 Medicare Group 47.85 (3.1) 434.4 34.0 Qatari Investors Group 28.75 (2.5) 553.6 25.0 Qatar Gas Transport Co. 19.05 (2.4) 1,457.5 24.8 Dlala Brok. & Inv. Holding Co. 20.24 (2.2) 81.8 (34.9) Qatar Exchange Top Val. Trades Close* 1D% Val. ‘000 YTD% Industries Qatar 157.40 (0.9) 112,219.8 11.6 QNB Group 172.50 (0.5) 59,780.7 31.8 Qatar Navigation 79.90 (0.2) 33,389.2 26.6 Commercial Bank of Qatar 68.80 (0.6) 32,394.1 (3.0) Qatar Gas Transport Co. 19.05 (2.4) 27,834.5 24.8 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,771.41 (1.3) (3.3) 0.7 16.9 146.82 147,151.9 12.3 1.7 4.7 Dubai 2,549.61 (7.0) (5.6) (1.5) 57.1 477.03 63,897.6 14.8 1.0 3.2 Abu Dhabi 3,822.04 (2.8) (3.2) (0.7) 45.3 121.87 110,096.2 10.9 1.4 4.7 Saudi Arabia 7,722.70 (4.1) (5.7) (2.4) 13.5 2,264.12 409,769.7 16.1 2.0 3.8 Kuwait 7,766.35 (2.9) (4.2) (3.8) 30.9 121.15 108,883.8 18.9 1.2 3.7 Oman 6,846.25 (1.0) (0.8) 3.1 18.8 28.05 23,984.9# 11.3 1.7 4.0 Bahrain 1,186.28 (1.2) (1.4) (0.7) 11.3 1.34 21,740.5 8.3 0.9 4.0 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) ( # Data as on August 26) 9,700 9,750 9,800 9,850 9,900 9,950 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QE index declined 1.3% to close at 9,771.4. The Telecoms and Real Estate indices led the losses. The index declined on the back of selling pressure from non-Qatari shareholders despite buying support from Qatari shareholders. Doha Insurance Co. and Medicare Group were the top losers, falling 4.6% and 3.1% respectively. Among the top gainers, Al Ahli Bank rose 2.2%, while Salam International Investment Co. gained 1.7%. Volume of shares traded on Tuesday rose by 33.6% to 12.3mn from 9.2mn on Monday. Further, as compared to the 30-day moving average of 6.8mn, volume for the day was 80.4% higher. Qatar Gas Transport Co. and United Development Co. were the most active stocks, contributing 11.9% and 10.1% to the total volume respectively. Source: Qatar Exchange (* as a % of traded value) Earnings and Global Economic Data Earnings Releases Company Market Currency Revenue (mn) 1H2013 % Change YoY Operating Profit (mn) 1H2013 % Change YoY Net Profit (mn) 1H2013 % Change YoY Depa Limited (Depa) Dubai AED 1,010 22.4% – – 33.0 N/A Source: Company data, DFM, ADX, MSM Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 08/27 US S&P/Case-Shiller S&P/CS 20 City MoM SA June 0.89% 1.00% 1.04% 08/27 US S&P/Case-Shiller S&P/CS Composite-20 YoY June 12.07% 12.10% 12.20% 08/27 US S&P/Case-Shiller S&P/CaseShiller Home Price Index NSA June 159.54 159.3 156.18 08/27 US S&P/Case-Shiller S&P/Case-Shiller US HPI YoY 2Q2013 10.08% – 10.10% 08/27 US S&P/Case-Shiller S&P/Case-Shiller US HPI NSA 2Q2013 146.32 – 136.59 08/27 US Conference Board Consumer Confidence Index August 81.5 79 81 08/27 Germany IFO IFO Expectations August 103.3 103.1 102.4 08/27 Germany IFO IFO Business Climate August 107.5 107 106.2 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar QCB to issue QR4bn T-bills on September 3 – The Qatar Central Bank (QCB) is set to issue treasury bills with a maturity period of 91 days, 182 days and 273 days on September 3, 2013. The total amount of issuance is QR4bn. (QCB) Qafac’s QR291mn carbon recovery plant to be ready by 2014-end – Qatar Fuel Additives’ (Qafac) General Manager Nasser Jeham al-Kuwari said the company’s carbon dioxide recovery (CDR) plant worth QR291mn is more than 50% complete and is set for commissioning by the end of 2014. The plant located at Mesaieed will meet a two-pronged objective for Qafac of both reducing emissions as well as stepping up methanol production. He also said that the plant, when operational, will recover 500 tons per day of carbon dioxide (a greenhouse gas) from its methanol reformer stack and will inject it back into its existing process to enhance the methanol production. Further, he said that the company is looking at an additional production of 100,000 tons per year of methanol. Meanwhile, Qafac has opened its new headquarters at the Bay Tower 2 in The Gate Mall. (Gulf-Times.com) (Gulf-Times.com) Consumer confidence high in Qatar – According to the findings of the MasterCard Index of Consumer Confidence, consumers in Qatar are extremely optimistic on employment, economy, regular income and stock market. The findings showed that consumers are more optimistic about employment (99.4 currently versus 98.1 previous), economy (98 vs 97) and quality of life (97.2 vs 96.2). They are also very optimistic about regular income (95.7 vs 99.3) and stock market (91.7 vs 92), despite a slight decrease in the score compared to the previous edition of the index. (Gulf-Times.com) SIIS earns QR48mn net profit from land sale – Salam International Investment Limited (SIIS) announced that two land plots among its real estate investments have been sold, in addition to the land sold previously. SIIS has achieved a net profit of QR48mn from the latest sale. Thus, the gross net profit achieved from the recent and the previous land sale deals stood at QR73mn. The results for these deals will be visible in the company’s semi-annual financial statements for 2013. (QE) Kahramaa tests its first underground substation – Kahramaa has successfully completed and tested the substation at Msheireb Downtown Doha, the flagship development of Msheireb Properties. The 66 Kilovolt substation is the first energized underground substation in Qatar. (AME Info) Qatar realty transactions rise 44.7% in July 14-18 – According to Ezdan Holding’s weekly report, the real estate transactions in Qatar reached to QR1.75bn during the week from July 14 to 18, rising 44.7% over QR1.21bn during the Overall Activity Buy %* Sell %* Net (QR) Qatari 70.28% 51.80% 98,806,392.67 Non-Qatari 29.72% 48.20% (98,806,392.67)

- 3. Page 3 of 5 previous week. The number of total transactions during the period increased to 379. (Peninsula Qatar) Qatar largest LNG exporter to South Korea – South Korean Prime Minister Chung Hong-won said that Qatar is the largest exporter of LNG to South Korea (30%) and the third exporter of crude oil (11%). He said that South Korea and Qatar are important trading partners to each other on the basis of their complementary industrial structure, adding that trading volume between the two countries has more than doubled from $123bn in 2010 to $262bn in 2012. Moreover, he said Korea’s crude oil imports from Qatar have increased from 64mn barrels in 2010 to 103mn barrels in 2012. (Gulf-Times.com) Average monthly salary in Qatar up by 20% – According to the data released by the Ministry of Development Planning & Statistics (MDPS), the average monthly salary in Qatar has gone up by more than 20% in the past 15 months. In 2Q2013, the average salary for men stood at QR10,000 and QR8,000 for women, while it stood at QR7,401 for both men and women by the end of 2011. The MDPS data showed that Qataris constituted barely 10% of the 1.7mn people in the working age group in 2Q2013. Unemployment stood at 0.3%, but among the Qataris it was at 1.5%. Further, the data also showed that most jobless were above 24 since the unemployment rate among people in the age group of 15-24 was negligible at 0.7% in 1H2013. (Peninsula Qatar) Sohail 1 to launch tomorrow, to broadcast over 100 TV channels – Qatar's first satellite Sohail 1 is set to broadcast more than 30 high definition television and 70 standard definition TV channels once it is launched into space. The satellite is set to be launched tomorrow from European Spaceport in Kourou, French Guiana, between 11.30pm and 12.20pm (Doha Time). Qatar TV, Al Jazeera channel, Al Rayyan TV and Al Kass sports channel will be among the channels that will be broadcasted on the satellite. The Qatar Satellite Company (Es'hailSat) expects to provide services from the new satellite by December 2013. (Peninsula Qatar) International Spain's recession deeper than initially stated – According to data released by the National Statistics Institute (INE), Spain's economy shrank 1.6% in 2012, versus the 1.4% contraction previously recorded. INE said the changes will affect comparisons to 2012 on a quarterly basis, and in particular, comparison with 2Q2013. The GDP figures for 2011, 2010 and 2009 were also revised, though only the 2009 revision is definitive. Spain's economy grew only 0.1% in 2011 as compared to the 0.4% previously stated. (Reuters) Japan's debt-funding costs to hit $257bn next year – According to Reuters, Japan expects to spend a record $257bn for servicing its debt during the next fiscal year, underscoring the huge burden created by the government's borrowings. Japan's Ministry of Finance will request $257bn in debt-servicing costs under the budget. That will be 13.7% higher from the amount set aside for the current fiscal year, reflecting the ministry's plan to guard against any future rise in long-term interest rates. (Reuters) India approves various projects to kick-start investment – The Indian government has approved a raft of infrastructure projects worth 1.83tn Indian rupees to revive the country’s economic growth and restore investor confidence after the rupee crashed to record lows. The government has kick-started 36 stalled projects in various sectors right from oil, gas and power to roads and railways. (Reuters) Regional GCC insurance markets face competitive and profitability pressure – According to a report by A. M. Best, the growth of the insurance markets in the GCC region will continue, albeit at a reduced pace, as economic growth remains relatively modest in 2013. The report states that all the GCC countries experienced an increase in their gross premium written, which grew to $16.3bn in 2012. The total premium rose moderately by 10.4% in 2012, a slowdown compared to 2008 when the total premium grew by 25%. Compulsory medical schemes and the expansion of motor insurance business were the most significant growth drivers in the recent years. (GulfBase.com) SCSB approves SR87mn finance for 415 projects – The Saudi Credit & Saving Bank (SCSB) has approved a financing worth SR87mn for 415 small and new enterprises in the Kingdom. By lending a capital worth a maximum amount of SR300,000, SCSB’s financing will help young aspiring Saudi entrepreneurs to start their own business. (GulfBase.com) Kingdom plans to build 22GW of nuclear power by 2030 – Saudi Arabia is planning to build 16 nuclear reactors with a combined capacity of 22 gigawatts by 2030 as part of its plan to source 20% of its electricity needs through nuclear power. King Abdullah City for Atomic & Renewable Energy’s Coordinator of Scientific Collaboration Abdul Ghani bin Melaibari said the Kingdom is planning to build the first two reactors over the next 10 years, and then add two reactors every year until it reaches 16 by 2030. He estimated that the total cost of building all the reactors will cost around $100bn. (Bloomberg) ONGC in talks with Saudi Aramco for stake in petroplant – India-based Oil & Natural Gas Corp (ONGC) is in talks with the Saudi Arabian Oil Company (Saudi Aramco) and investment boards of Kuwait and Qatar for selling 25-30% stake in its 213.96bn Indian rupee mega petrochemical plant being built in India. ONGC Petro-additions Ltd, in which ONGC holds 26% stake, is building a 1.1mn ton plant at Dahej in the Indian state of Gujarat. The plant was originally scheduled to be commissioned by December 2013, but it is way behind schedule and is now expected to be ready sometime in 2015. (Bloomberg) SHARACO signs SR308.8mn Murabaha agreement with Riyad Bank – Saudi Hotels & Resort Areas Company (SHARACO) has signed a SR308.8mn Murabaha agreement with Riyad Bank. The purpose of this loan is to finance the construction cost of its hotel, which the company intends to build in the diplomatic quarter of Riyadh. The duration of the loan facility is 10 years, which includes three years as withdrawal & grace period. (GulfBase.com) STC awards HR outsourcing contract to Aegis – The Saudi Telecom Company (STC) has awarded a human resources (HR) outsourcing contract to Aegis, the global outsourcing & technology services company owned by the Essar Group. According to sources, the contract is said to worth around $50- 60mn. (GulfBase.com) NGIC declares SR52.5mn dividend – The National Gas & Industrialization Company’s (NGIC) board has recommended the distribution of dividends worth SR52.5mn (SR0.75 per share), representing 7.5% of the face value to its shareholders. Those shareholders who are registered with the Securities Depository Center on September 9, 2013 will be eligible for this dividend, which will be distributed on October 1, 2013. (GulfBase.com) Nakheel completes construction of Al Furjan, collaborates with Mashreq – UAE-based developer Nakheel has completed

- 4. Page 4 of 5 the construction and handover of its Al Furjan community. The company is planning to build a neighborhood retail center there soon. Meanwhile, Nakheel has collaborated with Mashreq Bank to provide mortgage for investors purchasing homes at Jumeirah Park in Dubai. (GulfBase.com, AME Info) Cluttons: Dubai house prices soar as residents switch from renting to buying – According to a report released by Cluttons, residential property prices in Dubai have increased by nearly a third in 1H2013 as more residents look to buy homes rather than pay the surging rents. The average property value in the Emirate rose 30.6% in 1H2013, while average rents were up 11.3%. Apartments showed the biggest price increase, rising by an average of 25.1% during 2Q2013, which is almost double over 13.4% seen in 2Q2012. Villa prices rose by an average of 21% as compared to 24.4%. However, the report found that the average rents in Sharjah rose by just an average of 7.1% during 2Q2013 as Dubai workers were unable to afford soaring rents. (GulfBase.com) EMAL’s Phase 2 expansion project on schedule – The Emirates Aluminum Company’s (EMAL) second phase of its expansion project is 70% complete and is on schedule to meet its December 2, 2013 deadline. This multi-million-dollar project will add 520,000 tons of additional capacity to EMAL’s pot-lines. Once completed, this project will have a total production capacity of 1.3mn tons per year of aluminum. (GulfBase.com) Emirates launches non-stop passenger services to Taipei – Emirates Airlines has launched non-stop passenger services to Taipei, its 16th destination in the Far East. Commencing from February 10, 2014, this service will initially have six non-stop flights per week to Taipei's Taoyuan International Airport. (AME Info) Abu Dhabi Municipality offers tender to develop W10 F&B Plaza project – The Municipality of Abu Dhabi City has rolled out a tender inviting the private sector to develop and operate the W10 Food & Beverage Plaza (F&B) project, located on the beachfront in Block West 10. This project is set to add underground parking space for 800 vehicles and ground space for high-end retail and F&B outlets. A pedestrian underpass will provide access to the beach. (AME Info) Abu Dhabi appoints board for new financial free zone – Abu Dhabi has named a chairman and the board for a new financial free zone it hopes will attract top global banks and financial firms when it launches in 4Q2013. Ahmed Ali al-Sayegh, chairman of green energy firm Masdar, chief executive of state-owned Dolphin Energy and the deputy chairman of Abu Dhabi Media, was named chairman of the Global Marketplace Abu Dhabi. The board includes Mohammed Darwish Mohamed al Khouri, a board member of Abu Dhabi Commercial Bank and executive director of internal equities at Abu Dhabi Investment Authority. (Gulf-Times.com) ADMA-OPCO awards AED6.2bn EPC contract to NPCC led consortium – Abu Dhabi Marine Operating Company (ADMA- OPCO) has awarded a contract worth AED6.2bn to a consortium led by the National Petroleum Construction Company (NPCC), for the EPC work of Umm Lulu Full Field development project Package 2. This contract includes detailed engineering, procurement, fabrication, offshore installation, and commissioning of a large offshore super complex located in the Umm Lulu Field. This complex will comprise six bridge-linked platforms including gathering, separation, gas treatment & water disposal facilities, utilities and accommodation modules. Around 66,000 metric ton platforms will be fabricated at NPCC’s yard in Abu Dhabi. (Bloomberg) GIC signs MoU with Mizuho Bank to promote Japanese food, farm products – The Gulf Investment Corporation (GIC) has signed a MoU with Japan-based Mizuho Bank to export Japanese agricultural products to Gulf countries. This MoU aims to promote the import of food & agricultural products made in Japan and the introduction of Japanese agricultural technology in the GCC region. (Bloomberg) Moody's: High growth prospects for Islamic banking in Oman – Moody's said Omani banks now have the potential to strengthen their franchises and diversify their revenue generation after the government allowed them to offer Islamic banking services. Following the introduction of the Islamic Banking Regulatory Framework in December 2012, the Islamic banking segment is set to expand steadily, which is a credit positive for the local banks. However, Moody's cautioned that the banking industry still needs to manage various challenges to ensure delivering the anticipated growth. (Bloomberg) Oman signs MoU with Iran to import gas – Oman has signed a MoU with Iran to import gas for 25 years beginning from 2015. This deal is valued at around $60bn. (Bloomberg) Oman Flour Mills’ BoD approves to transform Atyab Investment – Oman Flour Mills’ board has approved to transform its Atyab Investment Company into a holding company. The company will be expanded after it restructuring to increase investments in flour milling & other food related activities, poultry & related activities, and logistics services for food industries. This new investment is estimated to be about OMR70mn and will create nearly 1,200 new jobs. To broaden the investor’s base, Oman Flour Mills’ board has also approved to open the opportunity in Atyab Holding to local specialized investors and foreign experienced investors from the food industry. (MSM)

- 5. Contacts Saugata Sarkar Ahmed M. Shehada Keith Whitney Sahbi Kasraoui Head of Research Head of Trading Head of Sales Manager - HNWI Tel: (+974) 4476 6534 Tel: (+974) 4476 6535 Tel: (+974) 4476 6533 Tel: (+974) 4476 6544 saugata.sarkar@qnbfs.com.qa ahmed.shehada@qnbfs.com.qa keith.whitney@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg (*July 09, 2013) Source: Bloomberg 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 Jan-10 Aug-10 Mar-11 Oct-11 May-12 Dec-12 Jul-13 QEIndex S&PPan Arab S&P GCC (4.1%) (1.3%) (2.9%) (1.2%) (1.0%) (2.8%) (7.0%) (9.0%) (6.0%) (3.0%) 0.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% Gold/Ounce 1,415.09 0.7 1.2 (15.5) DJ Industrial 14,776.13 (1.1) (1.6) 12.8 Silver/Ounce 24.47 0.6 1.7 (19.4) S&P 500 1,630.48 (1.6) (2.0) 14.3 Crude Oil (Brent)/Barrel (FM Future) 114.36 3.3 3.0 2.9 NASDAQ 100 3,578.52 (2.2) (2.2) 18.5 Natural Gas (Henry Hub)/MMBtu 3.50 (1.5) (0.0) 2.2 STOXX 600 299.01 (1.8) (1.9) 6.9 LPG Propane (Arab Gulf)/Ton* 810.00 0.0 0.0 (16.4) DAX 8,242.56 (2.3) (2.1) 8.3 LPG Butane (Arab Gulf)/Ton* 807.00 0.0 0.0 (16.7) FTSE 100 6,440.97 (0.8) (0.8) 9.2 Euro 1.34 0.2 0.1 1.5 CAC 40 3,968.73 (2.4) (2.5) 9.0 Yen 97.03 (1.5) (1.7) 11.9 Nikkei 13,542.37 (0.7) (0.9) 30.3 GBP 1.55 (0.2) (0.1) (4.4) MSCI EM 915.44 (1.9) (1.9) (13.2) CHF 1.09 0.6 0.5 (0.2) SHANGHAI SE Composite 2,103.57 0.3 2.2 (7.3) AUD 0.90 (0.5) (0.5) (13.6) HANG SENG 21,874.77 (0.6) 0.1 (3.5) USD Index 81.17 (0.3) (0.2) 1.8 BSE SENSEX 17,968.08 (3.2) (3.0) (7.5) RUB 33.15 0.3 0.4 8.6 Bovespa 50,091.55 (2.6) (4.0) (17.8) BRL 0.42 0.4 (1.0) (13.6) RTS 1,304.33 (1.5) (2.0) (14.6) 140.4 122.7 111.2