4 June Daily market report

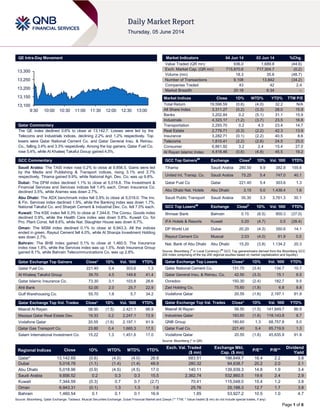

- 1. Page 1 of 6 QE Intra-Day Movement Qatar Commentary The QE index declined 0.6% to close at 13,142.7. Losses were led by the Telecoms and Industrials indices, declining 2.2% and 1.2% respectively. Top losers were Qatar National Cement Co. and Qatar General Insu. & Reinsu. Co., falling 3.4% and 3.3% respectively. Among the top gainers, Qatar Fuel Co. rose 5.4%, while Al Khaleej Takaful Group gained 4.5%. GCC Commentary Saudi Arabia: The TASI index rose 0.2% to close at 9,856.5. Gains were led by the Media and Publishing & Transport indices, rising 3.1% and 2.7% respectively. Tihama gained 9.9%, while National Agri. Dev. Co. was up 9.8%. Dubai: The DFM index declined 1.1% to close at 5,018.8. The Investment & Financial Services and Services indices fell 1.4% each. Oman Insurance Co. declined 3.5%, while Aramex was down 2.7%. Abu Dhabi: The ADX benchmark index fell 0.9% to close at 5,019.0. The Inv. & Fin. Services index declined 1.9%, while the Banking index was down 1.7%. National Takaful Co. and Sharjah Cement & Industrial Dev. Co. fell 7.0% each. Kuwait: The KSE index fell 0.3% to close at 7,344.6. The Consu. Goods index declined 0.9%, while the Health Care index was down 0.8%. Kuwait Co. for Pro. Plant Const. fell 8.6%, while Nat. Slaughter House was down 6.7%. Oman: The MSM index declined 0.1% to close at 6,943.3. All the indices ended in green. Raysut Cement fell 4.0%, while Al Sharqia Investment Holding was down 2.7%. Bahrain: The BHB index gained 0.1% to close at 1,460.5. The Insurance index rose 1.8%, while the Services index was up 1.5%. Arab Insurance Group gained 8.1%, while Bahrain Telecommunications Co. was up 2.8%. Qatar Exchange Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Fuel Co. 221.40 5.4 303.6 1.3 Al Khaleej Takaful Group 39.70 4.5 149.8 41.4 Qatar Islamic Insurance Co. 73.30 3.1 103.8 26.6 Ahli Bank 52.00 2.0 25.7 22.9 Gulf Warehousing Co. 55.70 1.6 5.7 34.2 Qatar Exchange Top Vol. Trades Close* 1D% Vol. ‘000 YTD% Masraf Al Rayan 58.50 (1.5) 2,421.1 86.9 Mazaya Qatar Real Estate Dev. 19.33 0.2 2,247.1 72.9 Vodafone Qatar 20.55 (1.6) 2,197.1 91.9 Qatar Gas Transport Co. 23.80 0.4 1,665.3 17.5 Salam International Investment Co. 15.22 1.3 1,451.6 17.0 Market Indicators 04 Jun 14 03 Jun 14 %Chg. Value Traded (QR mn) 936.0 1,689.8 (44.6) Exch. Market Cap. (QR mn) 715,870.6 717,304.7 (0.2) Volume (mn) 18.3 35.6 (48.7) Number of Transactions 9,108 13,842 (34.2) Companies Traded 43 42 2.4 Market Breadth 20:18 6:34 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 19,598.59 (0.6) (4.0) 32.2 N/A All Share Index 3,311.27 (0.2) (3.3) 28.0 15.9 Banks 3,202.84 0.2 (5.1) 31.1 15.9 Industrials 4,323.17 (1.2) (3.7) 23.5 16.8 Transportation 2,293.70 0.2 4.3 23.4 14.7 Real Estate 2,779.71 (0.3) (2.2) 42.3 13.9 Insurance 3,282.71 (0.1) (2.2) 40.5 8.6 Telecoms 1,810.41 (2.2) (2.6) 24.5 25.0 Consumer 6,861.92 3.2 2.4 15.4 27.0 Al Rayan Islamic Index 4,418.46 (0.6) (4.8) 45.5 19.2 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Tihama Saudi Arabia 280.50 9.9 382.8 155.6 United Int. Transp. Co. Saudi Arabia 75.25 5.4 747.0 40.1 Qatar Fuel Co Qatar 221.40 5.4 303.6 1.3 Abu Dhabi Nat. Hotels Abu Dhabi 3.15 5.0 1,439.4 1.6 Saudi Public Transport Saudi Arabia 35.30 3.3 3,761.3 30.1 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Ithmaar Bank Bahrain 0.15 (6.5) 900.3 (37.0) IFA Hotels & Resorts Kuwait 0.20 (4.7) 0.5 (28.4) DP World Ltd Dubai 20.20 (4.3) 350.6 14.1 Raysut Cement Co Muscat 2.03 (4.0) 81.9 0.5 Nat. Bank of Abu Dhabi Abu Dhabi 15.20 (3.8) 1,134.2 20.3 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Qatar Exchange Top Losers Close* 1D% Vol. ‘000 YTD% Qatar National Cement Co. 131.70 (3.4) 134.7 10.7 Qatar General Insu. & Reinsu. Co. 42.50 (3.3) 15.1 6.5 Ooredoo 150.30 (2.4) 182.7 9.5 Zad Holding Co. 75.60 (1.8) 6.8 8.8 Vodafone Qatar 20.55 (1.6) 2,197.1 91.9 Qatar Exchange Top Val. Trades Close* 1D% Val. ‘000 YTD% Masraf Al Rayan 58.50 (1.5) 141,849.7 86.9 Industries Qatar 183.60 (1.6) 118,143.8 8.7 QNB Group 180.60 1.3 68,757.8 5.0 Qatar Fuel Co. 221.40 5.4 65,719.9 1.3 Vodafone Qatar 20.55 (1.6) 45,635.9 91.9 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 13,142.69 (0.6) (4.0) (4.0) 26.6 683.51 196,649.7 16.4 2.2 3.8 Dubai 5,018.78 (1.1) (1.4) (1.4) 48.9 280.32 94,638.7 20.2 2.0 2.1 Abu Dhabi 5,018.96 (0.9) (4.5) (4.5) 17.0 140.11 139,939.3 14.8 1.9 3.4 Saudi Arabia 9,856.52 0.2 0.3 0.3 15.5 2,362.74 532,860.5 19.6 2.4 2.9 Kuwait 7,344.59 (0.3) 0.7 0.7 (2.7) 70.41 115,048.0 15.4 1.2 3.8 Oman 6,943.31 (0.1) 1.3 1.3 1.6 25.76 25,188.3 12.7 1.7 3.8 Bahrain 1,460.54 0.1 0.1 0.1 16.9 1.85 53,927.2 10.5 1.0 4.7 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 13,100 13,150 13,200 13,250 13,300 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QE index declined 0.6% to close at 13,142.7. The Telecoms and Industrials indices led the losses. The index fell on the back of selling pressure from non-Qatari shareholders despite buying support from Qatari shareholders. Qatar National Cement Co. and Qatar General Insu. & Reinsu. Co. were the top losers, falling 3.4% and 3.3% respectively. Among the top gainers, Qatar Fuel Co. rose 5.4%, while Al Khaleej Takaful Group gained 4.5%. Volume of shares traded on Wednesday fell by 48.7% to 18.3mn from 35.6mn on Tuesday. Further, as compared to the 30-day moving average of 28.4mn, volume for the day was 35.7% lower. Masraf Al Rayan and Mazaya Qatar Real Estate Dev. were the most active stocks, contributing 13.2% and 12.3% to the total volume respectively. Source: Qatar Exchange (* as a % of traded value) Ratings, Earnings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Majid Al Futtaim Holding Fitch UAE LT IDR/SUR/ST IDR BBB/BBB/F3 BBB/BBB/F3 – Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Credit Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, SUR – Senior Unsecured Rating) Earnings Releases Company Market Currency Revenue (mn)1Q2014 % Change YoY Operating Profit (mn) 1Q2014 % Change YoY Net Profit (mn) 1Q2014 % Change YoY Bahrain Mumtalakat Holding Co.* Bahrain BHD 1100.0 NA 70.7 204.7% 82.7 NA Source: Company data, DFM, ADX, MSM, *FY2013 results Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 06/04 US MBA MBA Mortgage Applications 30 May -3.10% – -1.20% 06/04 US ADP ADP Employment Change May 179K 210K 215K 06/04 US US Census Bureau Trade Balance April -$47.2B -$40.8B -$44.2B 06/04 US BLS Nonfarm Productivity 1Q2014 -3.20% -3.00% -1.70% 06/04 US Markit Markit US Services PMI May 58.1 58.2 58.4 06/04 US Markit Markit US Composite PMI May 58.4 – 58.6 06/04 US ISM ISM Non-Manf. Composite May 56.3 55.5 55.2 06/04 EU Markit Markit Eurozone Services PMI May 53.2 53.5 53.5 06/04 EU Markit Markit Eurozone Composite PMI May 53.5 53.9 53.9 06/04 EU Eurostat PPI MoM April -0.10% -0.10% -0.20% 06/04 EU Eurostat PPI YoY April -1.20% -1.20% -1.60% 06/04 EU Eurostat GDP SA QoQ 1Q2014 0.20% 0.20% 0.20% 06/04 EU Eurostat GDP SA YoY 1Q2014 0.90% 0.90% 0.90% 06/04 France Markit Markit France Composite PMI May 49.3 49.4 49.3 06/04 France Markit Markit France Services PMI May 49.1 49.2 49.2 06/04 Germany Markit Markit Germany Services PMI May 56 56.4 56.4 06/04 Germany Markit Markit/BME Germany Composite PMI May 55.6 56.1 56.1 06/04 UK HM Treasury Official Reserves Changes May -$613M – $139M 06/04 UK Markit Markit/CIPS UK Composite PMI May 59 58.7 59.2 06/04 UK Markit Markit/CIPS UK Services PMI May 58.6 58.2 58.7 06/04 Spain Markit Markit Spain Services PMI May 55.7 56.1 56.5 06/04 Spain Markit Markit Spain Composite PMI May 55.6 – 56.3 06/04 Italy Markit Markit/ADACI Italy Composite PMI May 52.7 – 52.6 06/04 Italy Markit Markit/ADACI Italy Services PMI May 51.6 51.4 51.1 06/04 China NBS Leading Index April 100.1 – 99.75 06/04 Japan Markit Markit Japan Services PMI May 49.3 – 46.4 06/04 Japan Markit Markit/JMMA Japan Composite PMI May 49.2 – 46.3 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 52.90% 52.69% 1,973,452.38 Non-Qatari 47.09% 47.31% (1,973,452.38)

- 3. Page 3 of 6 News Qatar Cabinet approves draft law on financial system – The Qatari Cabinet approved a draft law on the financial system of the state, which aims at optimizing the use of public funds and to keep abreast with global best practices in public business. The cabinet also approved a draft decision to establish tenders & bidding committee at the Foreign Ministry, which will undertake the functions of the central & local tenders committee as stipulated in the tenders & biddings related law. The cabinet also approved the application of the provisions of Law No 24 of 2002 concerning retirements and pensions of Qatari employees working with Qatar Jet Fuel Company and Woqod Vehicles Inspection. (Gulf-Times.com) QE to introduce measures to enhance operational efficiency – The Qatar Exchange (QE) is all geared up to introduce securities lending and borrowing, margin trading, omnibus accounts and a central counterparty (CCP) as part of its measures to further enhance the operational efficiency and attractiveness to foreign investors. The introduction of omnibus account indicates the QE’s readiness in introducing derivatives, which are expected to come once CCP is in place. QE’s CEO Rashid bin Ali al-Mansoori said that the Morgan Stanley Composite Index (MSCI) reclassification process highlighted a number of issues that had been addressed by the exchange and other authorities in order to raise the market efficiency. (Gulf- Times.com) Qatar Rail gets four more TBMs for Doha Metro – The Qatar Railways Company (Qatar Rail) has received four more tunnel boring machines (TBMs) for Phase 1 of Doha Metro. The four TBMs ‘Al Mayeda’, ‘Al Khor’, ‘Lehwaila’ and ‘Al Wakra’ were made by Germany’s Herrenknecht and will be used for the Red Line North and South Underground projects. Al Mayeda and Al Khor will be used for the Red Line North Underground. The design & build for this project will be undertaken by a joint venture led by Italy-based Salini Impregilo and comprising South Korea-based S K Engineering & Construction Company and Qatar’s Galfar Al Misnad Engineering & Contracting. (Gulf- Tiimes.com) Ezdan Mall in Al Wakrah to open in 1Q2015 – The construction of Ezdan Mall in Al Wakrah is complete and is expected to be officially opened in 1Q2015. The 72,000-square meter property will feature over 120 shops along with a hypermarket, and will be able to provide space for at least 1,500 cars. Ezdan Holding Group’s (ERES) CEO Ali al Obaidli said that the FIFA World Cup 2022 would have an impact on real estate investments, similar to the tourism sector which is expected to witness a boom during the coming years. He added that the Al Shamal Hotel is likely to be launched by the end of 2014, which would be a vital addition to the group’s hotel chain. (Gulf-Base.com) Huge rise in property sales – Real estate sales peaked at a historic high recently, with transactions totaling QR2.3bn in the last week of May (May 25 to 29), up a huge 63.8% over the previous week. Real estate giant, Ezdan, said in a report that a total of 388 transactions took place in the week, with the maximum being in Umm Salal Ali, at 197. Ezdan did not provide reasons for the huge rise in transactions but said five massive deals worth QR900m concluded in the week took the total to QR2.3bn. The largest deal worth a staggering QR290mn was concluded in Umm Salal Ali. It was a plot land admeasuring a huge 145,000 square meters. The second largest deal was concluded in Doha with the value of QR250mn. (Peninsula Qatar) QA in league of green airlines due to GTL fuel usage; bags IATA’s Fast Travel Green Award – The use of gas-to-liquid (GTL) technology in the local aviation industry places Qatar Airways (QA) among the league of airlines that put a premium on reducing air pollution and environment protection. QA has been using GTL fuel for all of its flights flying out of Doha. Apart from being an eco-friendly jet fuel, the GTL gives a huge burn fuel benefit to QA and an additional range for the same quantity of fuel. Meanwhile, QA has been awarded the “Fast Travel Green Award” by the International Air Transport Association (IATA) in recognition of its innovation in passenger comfort. At the 70th IATA Annual General Meeting and World Transport Summit 2014 in Doha, the IATA welcomed two key industry programs undertaken by QA and the newly opened Hamad International Airport, which will help in enhancing security and passenger convenience. (Gulf-Times.com) International US economy on solid ground despite cooler hiring – Companies in the US hired far fewer workers than expected in May 2014, but an acceleration in the services sector supported views the economy was regaining strength after sagging early this year. According to payrolls processor ADP, private employers added 179,000 jobs to their payrolls last month after hiring 215,000 workers in April. Meanwhile, the Institute for Supply Management said the services sector index rose to 56.3 last month from 55.2 in April, the highest reading in nine months, on the back of new orders, order backlogs and increased hiring. The firming economic tone was highlighted by the Federal Reserve's anecdotal Beige Book, which noted moderate growth in all 12 Fed regions. With only a few notable exceptions, including mixed reports on the strength of the housing industry, the document pointed to broad gains in the economy. (Reuters) Eurozone economy stutters as ECB gears up for action – Price cuts by Eurozone firms failed to prevent business growth from losing momentum in May, all but sealing the case for looser monetary policy a day before the European Central Bank meets. Markit's Composite Purchasing Managers' Index (PMI) widely seen as a good gauge of growth, dipped to 53.5 in May, below April's final 54.0. The slowdown in growth came despite firms again cutting prices. The output price index nudged up to 48.8 from 48.7, but has held below the break-even mark since April 2012. GDP growth was confirmed at just 0.2% for 1Q2014. The bloc's growth was once again supported by Germany and pointed to Eurozone GDP expanding 0.4-0.5% in 2Q2014. (Reuters) ONS: UK labor market tightest in four years – An analysis by the UK's statistics agency, the Office for National Statistics (ONS) showed that slack in Britain's labor market has fallen to a four-year low and wages may be about to pick up, suggesting a possibility of an interest rate hike. Last year, the Bank of England (BoE) said it would only consider raising rates when unemployment reaches 7%. However, after joblessness hit that level far sooner than forecast, the central bank said it would look at a broader range of data before tightening policy. In 1Q2014, the ONS found Britons worked 974.5mn hours – 84.8% of the total 1.150bn hours they wanted to work. This was the highest percentage for any calendar quarter since 1Q2009, as compares to a trough of 83.2% in early 2012. This pattern mirrors that of unemployment which peaked at 8.4% in 4Q2011 and now stands at 6.8%, its lowest since the three months to January 2009. It may raise questions about whether the BoE's focus on labor measures other than the headline unemployment rate yields significantly greater insight. (Reuters)

- 4. Page 4 of 6 DB capital hike delay due to court bottleneck – Deutsche Bank's (DB) plans for an €8bn capital rise came to an abrupt halt when a procedural bottleneck in a German court forced Germany's leading lender to delay the issue by several days. The bank's biggest investor, Sheikh Hamad Bin Jassim Bin Jabor Al-Thani of Qatar, has made his first contribution to the capital hike, paying €1.75bn for 60mn shares, but a Frankfurt court has taken longer than expected to register it into the shareholder registry. The delay comes as an embarrassing glitch in DB’s second capital hike in as many years, designed to strengthen its capital base and to see the bank through a costly restructuring. Sheikh Hamad Bin Jassim is expected to invest over €2bn and hold around 6% of DB’s shares when the two- part capital hike is completed. (Reuters) G-7 spares Russia new sanctions urging Ukraine diplomacy – The Group of Seven nations have spared Russia from further sanctions in favor of diplomatic efforts to resolve the Ukraine crisis, giving the Kremlin another chance to cut off support to pro-Moscow separatists. Russia’s seizure of Crimea and the menace in eastern Ukraine led the US and the EU to impose asset freezes and travel bans on 98 people and 20 companies, while stopping short of broader curbs on investment that might damage western economies as well. Debate over further penalties is raging in the 28-nation EU, which relies on Russia for 30% of its natural gas supply. The German government has faced down business leaders who objected to sanctions, while gas customers such as Slovakia have opposed a tougher line. (Bloomberg) Regional IATA: GCC poised for robust cargo growth – The International Air Transport Association has forecast a promising future for the cargo industry in the Gulf region, with the Middle East seeing the highest growth rate among global regions. According to IATA statistics, the Middle East recorded 8.7% YoY growth in freight-ton-kilometers (FTK) in April 2014. The available FTK also increased by 8.3% in April 2014 as compared to April 2013. Growth in FTK in the Middle East during the first four months of 2014 was 11% YoY, while the available FTK rose by 9.1% YoY. The air cargo business generates around $60bn in combined annual freight revenues. (GulfBase.com) IEA: Mideast should boost oil investments – The International Energy Agency (IEA) has warned that a potential shortfall in the investment in crude oil production in the Middle East could create a $15 spike in oil prices by 2025. The world will need a total of $40tn invested in energy supply and $8tn on energy efficiency by 2035 in order to meet the growing demand and falling output from mature energy sources. (GulfBase.com) Al Tamimi: Lighter regulation to revive Gulf IPOs – Initial public offers of equity (IPOs) in Gulf Arab countries are set to boom, helped by lighter regulation and legal reforms, as governments seek to diversify their oil-dependent economies. Al Tamimi & Company’s Managing Partner Husam Hourani said an exemption from Dubai IPO rules granted by regulators to Emaar Properties, which will permit an offer worth up to $2.45bn, is a sign of good times. He said Emaar will not be the last company to get an exemption. The total value of IPOs among the six GCC countries peaked at $12bn in 2007 and then plunged as markets froze up. Last year, GCC IPOs totaled roughly $2bn. IPO activity has recovered more slowly in the GCC region than it has in much of the world. Some Gulf firms have preferred to go to foreign markets such as London to seek greater liquidity and less restrictive rules. (Reuters) BCRED: Key role for private firms in booming housing sector – The rapid urbanization and population growth in the GCC region have resulted in an increased demand for affordable housing units from low- and middle-income households. Estimates from the United Nations show that the number of people living in cities is growing by at an average of 2.1% every year, while the region’s population is booming and expected to reach 52.9mn by 2020. Faced with the enormous challenge of providing decent living to the target income groups, GCC states have implemented massive social housing projects, various housing subsidy programs, and accessible loan mechanisms to meet the high demand. Best Choice Real Estate Development (BCRED), a Saudi Arabian real estate investment and development firm based in the Gulf, has forecast that the region is set to experience an influx of affordable housing solutions to address this gap. (Gulf-Times.com) SABB-HSBC: Saudi non-oil business activity slows in May – According to a survey by Saudi British Bank (SABB), HSBC Bank and Markit Economics, growth of non-oil business activity in Saudi Arabia slowed in May 2014, as new orders rose at their most sluggish pace since September 2011. The seasonally adjusted Purchasing Managers' Index (PMI) slipped to 57 points in May from 58.5 points in April, though it remained well above the 50-point mark separating expansion from contraction. While output growth continued to accelerate to 62.3 points in May from 61 points in April, growth in new orders dropped sharply to 63.6 points from 67.6 points. The rise in export orders also slowed considerably to 54.6 points. Saudi companies surveyed said they hired more staff in May, albeit at a marginal rate of 50.9 points. (GulfBase.com) IDB launches $180mn Renewable Energy for Poverty Reduction plan – The Islamic Development Bank (IDB) has launched a program to release $180mn in financing to six African countries for renewable energy projects as part of a broad strategy to deepen its involvement in the region. The new $180mn initiative, called ‘Renewable Energy for Poverty Reduction’, will target projects over the next three years to improve access to electricity in Africa's rural areas where about 70% of households lack power. Around $125mn has been committed by the bank and initial talks with potential partners such as the OPEC Fund for International Development have started to secure the rest. (GulfBase.com) Maaden to extract 500,000 ounces of gold – The Saudi Arabian Mining Company’s (Maaden) President & CEO, Khalid bin Saleh Al Mudaifer said that the company is planning to explore and extract 500,000 ounces of gold in the Kingdom, particularly in the Madinah region. (GulfBase.com) Saudi CMA approves GIB Capital’s capital rise – Saudi CMA’s board has approved GIB Capital’s request to increase its capital from SR60mn to SR200mn. (Tadawul) RAK Bank to raise foreign ownership to 40% – The National Bank of Ras Al Khaimah (RAK Bank) is set to increase the maximum limit of its foreign ownership to 40%. The bank said that the stocks are to be listed through the stock e-registration system used by the Abu Dhabi stock exchange. The bank is allowed to list its stocks on the condition that 60% is owned by Emiratis. (Bloomberg) DIB buys 25% of Indonesia's Bank Panin – Dubai Islamic Bank (DIB) has completed the purchase of a 24.9% stake in Indonesian Bank Panin Syariah from its parent firm. Last month, DIB said that it was in talks to buy 25% of Indonesia's only listed Shar’iah-compliant lender, which it would jointly manage and operate with Bank Panin Indonesia. Earlier, Bank Panin

- 5. Page 5 of 6 Indonesia had said an unidentified buyer had acquired 10% of the Islamic unit on May 21 and 13.5% on May 22. (Reuters) Meydan inks AED700mn bank financing deal – The Meydan Group is tapping Commercial Bank International (CBI) for a revolving project financing facility worth AED700mn that will go toward building 1,500 villas for Emirates Group in Meydan City. The loan tenor is for eight years and structured in a way to keep the interest rate lower than the prevailing market rates. (Bloomberg) Nakheel Partners E&V to launch new company – Dubai- based Nakheel has signed a letter of intent with German real estate brokerage Engel & Völkers (E&V) to create a new company for selling and leasing properties in the Emirate. Trading under the E&V brand, the new JV expects to open its Dubai office on October 1, 2014. (Bloomberg) Al Basel Group to open travel agency in DWC – UAE-based Al Basel Group plans to open a new travel agency, ‘Tuwaiq’ in Dubai World Central (DWC). The new travel agency will cater to both local and international tourists in the Middle East region’s upper and middle-class segments. The agency will offer services that include consultancy, booking and mentoring. (Bloomberg) Tasweek aims for AED1bn IPO in December – Abu Dhabi- based property investor Tasweek expects to launch an IPO of its shares by December 2014. The AED1bn private company founded by Masood Al Awar, confirmed that it was seeking to list 55% of its shares on either the Abu Dhabi Securities Exchange or the Dubai Financial Market within 2014. The company added that it expected to appoint a financial adviser for the float by the end of June 2014. (Bloomberg) Aldar repays $1.25bn bond on maturity; reduces debt cost – Aldar Properties stated that it has repaid a $1.25bn bond, which has matured at the end of May 2014. The bond carried an annual interest cost of 10.75% and was repaid using cash. The company has refinanced or agreed on new terms for all its financing facilities since its merger with another property firm Sorouh, and has achieved significant interest savings. Its weighted average cost of debt has reduced from 5.8% to 2.8%. (ADX) Ghantoot, Sheikh Suroor to develop AED860mn resort at Saadiyat Island – The Ghantoot Group and Sheikh Suroor Projects Department have signed an agreement to develop an AED860mn resort at Saadiyat Island in Abu Dhabi. Jumeirah will be operating the property, which is expected to be ready by end of 2017 and will be locally managed. The Saadiyat Island Beach Resort complex will have a low-rise 295-room hotel and 11 luxury villas, along with meeting rooms and a spa. (Bloomberg) ODB pumps OMR5.4mn into Al Rafad fund for funding small businesses – Oman Development Bank (ODB) has provided a total of OMR5.4mn to Al Rafad Fund in five months to finance projects. The amount was provided in the first five months between January and May 2014, which constitutes 73% of the loan applications. As many as 290 applications for a total loan of OMR7.4mn were received. (GulfBase.com) L&T bids lowest for Duqm airport tender – Larsen & Toubro (L&T) has become the lowest bidder in a major tender for developing a passenger terminal and other support facilities at Duqm airport. The terminal building is designed to handle 500,000 passengers per annum, and the scope of work will include a cargo building, firefighting building, air traffic complex, ground support equipment workshop and other support facility buildings. Among the three companies that submitted bids, L&T is the lowest one with OMR36.27mn, followed by Galfar Engineering & Contracting at OMR40.61mn and Mohammed Abdel Mohsen Al Kharafi & Sons of Abu Dhabi at OMR43.75mn. (GulfBase.com) RCC appoints Group CEO – Raysut Cement Company (RCC) has appointed Salem Alawi Mohammed Baabood as the Group Chief Executive Officer with effect from June 3, 2014. (MSM)

- 6. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 190.0 200.0 210.0 Jun-10 Jan-11 Aug-11 Mar-12 Oct-12 May-13 Dec-13 QE Index S&P Pan Arab S&P GCC 0.2% (0.6%) (0.3%) 0.1% (0.1%) (0.9%) (1.1%) (1.5%) (1.0%) (0.5%) 0.0% 0.5% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% Gold/Ounce 1,243.92 (0.1) (0.5) 3.2 DJ Industrial 16,737.53 0.1 0.1 1.0 Silver/Ounce 18.82 0.0 0.0 (3.3) S&P 500 1,927.88 0.2 0.2 4.3 Crude Oil (Brent)/Barrel (FM Future) 108.40 (0.4) (0.9) (2.2) NASDAQ 100 4,251.64 0.4 0.2 1.8 Natural Gas (Henry Hub)/MMBtu 4.57 (0.6) 1.8 5.1 STOXX 600 343.56 0.0 (0.2) 4.7 LPG Propane (Arab Gulf)/Ton 100.88 (2.8) (3.5) (20.3) DAX 9,926.67 0.1 (0.2) 3.9 LPG Butane (Arab Gulf)/Ton 121.75 (1.1) (1.2) (10.3) FTSE 100 6,818.63 (0.3) (0.4) 1.0 Euro 1.36 (0.2) (0.3) (1.0) CAC 40 4,501.00 (0.1) (0.4) 4.8 Yen 102.75 0.2 1.0 (2.4) Nikkei 15,067.96 0.2 3.0 (7.5) GBP 1.67 (0.1) (0.1) 1.1 MSCI EM 1,031.19 (0.5) 0.3 2.8 CHF 1.11 (0.1) (0.2) (0.5) SHANGHAI SE Composite 2,024.83 (0.7) (0.7) (4.3) AUD 0.93 0.1 (0.4) 4.0 HANG SENG 23,151.71 (0.6) 0.3 (0.7) USD Index 80.66 0.1 0.4 0.8 BSE SENSEX 24,805.83 (0.2) 2.4 17.2 RUB 35.03 (0.1) 0.4 6.6 Bovespa 51,832.98 (0.4) 1.2 0.6 BRL 0.44 (0.1) (1.8) 3.6 RTS 1,324.87 0.1 2.2 (8.2) 188.9 155.2 141.1