QNBFS Daily Market Report February 19, 2019

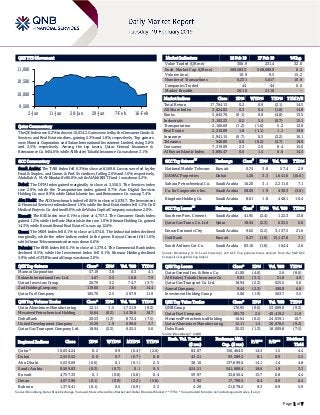

- 1. Page 1 of 7 QSE YTD Movement Qatar Commentary The QE Index rose 0.2% to close at 10,034.2. Gains were led by the Consumer Goods & Services and Real Estate indices, gaining 2.3% and 1.8%, respectively. Top gainers were Mannai Corporation and Salam International Investment Limited, rising 3.8% and 3.5%, respectively. Among the top losers, Qatar General Insurance & Reinsurance Co. fell 4.6%, while Al Khaleej Takaful Insurance Co. was down 3.1%. GCC Commentary Saudi Arabia: The TASI Index fell 0.3% to close at 8,569.8. Losses were led by the Food & Staples. and Comm. & Prof. Svc indices, falling 2.6% and 1.6%, respectively. Abdullah A. M. Al-Khodari fell 6.8%, while AlAhli REIT Fund 1 was down 4.2%. Dubai: The DFM Index gained marginally to close at 2,550.5. The Services index rose 2.0%, while the Transportation index gained 0.7%. Aan Digital Services Holding Co. rose 8.9%, while Dubai Islamic Ins. and Reinsurance Co. was up 7.4%. Abu Dhabi: The ADX benchmark index fell 0.6% to close at 5,039.7. The Investment & Financial Services index declined 1.9%, while the Real Estate index fell 1.2%. Gulf Medical Projects Co. declined 9.6%, while Waha Capital Company was down 2.0%. Kuwait: The KSE Index rose 0.1% to close at 4,757.3. The Consumer Goods index gained 1.2%, while the Basic Materials index rose 1.0%. Ithmaar Holding Co. gained 14.3%, while Kuwait Remal Real Estate Co. was up 12.4%. Oman: The MSM Index fell 0.1% to close at 4,074.0. The Industrial index declined marginally, while the other indices ended in the green. Raysut Cement fell 1.6%, while Oman Telecommunication was down 0.6%. Bahrain: The BHB Index fell 0.1% to close at 1,379.4. The Commercial Bank index declined 0.5%, while the Investment index fell 0.1%. Ithmaar Holding declined 5.9%, while GFH Financial Group was down 2.0%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Mannai Corporation 57.19 3.8 0.3 4.1 Salam International Inv. Ltd. 4.67 3.5 16.8 7.9 Qatari Investors Group 26.79 3.2 74.7 (3.7) Zad Holding Company 119.00 2.6 0.6 14.4 Qatar Fuel Company 185.70 2.5 267.9 11.9 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar Aluminium Manufacturing 12.11 1.5 1,721.9 (9.3) Mesaieed Petrochemical Holding 16.64 (0.2) 1,430.6 10.7 Doha Bank 20.53 (1.3) 872.4 (7.5) United Development Company 15.29 1.9 699.6 3.7 Qatar Gas Transport Company Ltd. 18.94 (2.3) 625.5 5.6 Market Indicators 18 Feb 19 17 Feb 19 %Chg. Value Traded (QR mn) 306.9 231.4 32.6 Exch. Market Cap. (QR mn) 569,583.3 568,680.9 0.2 Volume (mn) 10.9 9.5 15.2 Number of Transactions 6,231 5,617 10.9 Companies Traded 44 44 0.0 Market Breadth 26:16 21:18 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,764.13 0.2 0.9 (2.1) 14.3 All Share Index 3,024.02 0.3 0.4 (1.8) 14.8 Banks 3,645.76 (0.1) 0.0 (4.8) 13.5 Industrials 3,192.23 0.2 2.4 (0.7) 15.1 Transportation 2,166.69 (1.2) (1.6) 5.2 12.6 Real Estate 2,210.89 1.8 (1.1) 1.1 19.8 Insurance 2,941.15 (0.7) 0.3 (2.2) 16.1 Telecoms 940.89 0.0 (0.2) (4.7) 19.9 Consumer 7,319.09 2.3 2.9 8.4 15.0 Al Rayan Islamic Index 3,885.47 0.6 1.4 0.0 14.3 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% National Mobile Telecom. Kuwait 0.74 3.8 57.4 2.9 DAMAC Properties Dubai 1.26 3.3 1,641.6 (16.6) Sahara Petrochemical Co. Saudi Arabia 16.20 3.1 2,211.0 7.1 Co. for Cooperative Ins. Saudi Arabia 58.00 1.9 430.3 (3.8) Kingdom Holding Co. Saudi Arabia 8.61 1.8 448.1 10.4 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Southern Prov. Cement Saudi Arabia 41.95 (2.4) 122.3 13.8 Qatar Gas Trans. Co. Ltd Qatar 18.94 (2.3) 625.5 5.6 Emaar Economic City Saudi Arabia 9.62 (2.2) 3,157.5 21.6 Gulf Bank Kuwait 0.27 (1.8) 15,147.8 7.1 Saudi Airlines Cat. Co. Saudi Arabia 83.10 (1.8) 164.4 2.6 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar General Ins. & Reins. Co. 41.00 (4.6) 2.6 (8.6) Al Khaleej Takaful Insurance Co. 9.01 (3.1) 51.8 4.9 Qatar Gas Transport Co. Ltd. 18.94 (2.3) 625.5 5.6 Aamal Company 9.44 (2.3) 490.8 6.8 Investment Holding Group 5.06 (1.9) 563.7 3.5 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 176.95 (0.6) 53,689.0 (9.3) Qatar Fuel Company 185.70 2.5 49,419.2 11.9 Mesaieed Petrochemical Holding 16.64 (0.2) 24,039.1 10.7 Qatar Aluminium Manufacturing 12.11 1.5 20,678.5 (9.3) Doha Bank 20.53 (1.3) 18,009.8 (7.5) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,034.24 0.2 0.9 (6.4) (2.6) 84.07 156,464.5 14.3 1.5 4.4 Dubai 2,550.52 0.0 0.7 (0.7) 0.8 43.21 93,289.2 8.1 0.9 5.5 Abu Dhabi 5,039.69 (0.6) 0.1 (0.1) 2.5 38.16 137,899.6 14.1 1.4 4.8 Saudi Arabia 8,569.83 (0.3) (0.7) 0.1 9.5 624.51 541,689.4 18.6 1.9 3.3 Kuwait 4,757.33 0.1 (0.8) (0.8) 0.4 59.97 32,850.4 15.7 0.8 4.4 Oman 4,073.96 (0.1) (0.9) (2.2) (5.8) 3.92 17,790.5 8.4 0.8 6.4 Bahrain 1,379.41 (0.1) 0.5 (0.9) 3.2 4.20 21,078.2 9.3 0.9 5.9 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,500 10,000 10,500 11,000 2-Jan 11-Jan 20-Jan 29-Jan 7-Feb 16-Feb

- 2. Page 2 of 7 Qatar Market Commentary The QE Index rose 0.2% to close at 10,034.2. The Consumer Goods & Services and Real Estate indices led the gains. The index rose on the back of buying support from GCC and non-Qatari shareholders despite selling pressure from Qatari shareholders. Mannai Corporation and Salam International Investment Limited were the top gainers, rising 3.8% and 3.5%, respectively. Among the top losers, Qatar General Insurance & Reinsurance Company fell 4.6%, while Al Khaleej Takaful Insurance Company was down 3.1%. Volume of shares traded on Monday rose by 15.2% to 10.9mn from 9.5mn on Sunday. Further, as compared to the 30-day moving average of 9.4mn, volume for the day was 16.4% higher. Qatar Aluminium Manufacturing Company and Mesaieed Petrochemical Holding Company were the most active stocks, contributing 15.8% and 13.1% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases, Global Economic Data and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change DAMAC Properties Dubai Co. S&P Dubai LT- FIC/LT-LIC BB/BB BB-/BB- Stable – Source: News reports (* LT – Long Term, ST – Short Term, FIC –Foreign Issuer Credit, LIC – Local Issuer Credit) Earnings Releases Company Market Currency Revenue (mn) 4Q2018 % Change YoY Operating Profit (mn) 4Q2018 % Change YoY Net Profit (mn) 4Q2018 % Change YoY Etihad Etisalat Co. Saudi Arabia SR 3,162.0 11.9% 267.0 N/A 80.0 N/A DXB Entertainments* Dubai AED 541.0 -2.0% -260.0 N/A -1,001.0 N/A Al Ramz Corp. Inv. and Dev. * Dubai AED 15.0 -53.2% – – 3.3 -94.5% Ras Al Khaimah Cement Co. * Dubai AED 223.4 12.2% 11.5 N/A 21.2 N/A Zain Bahrain* Bahrain BHD 66.2 -10.2% 5.1 12.5% 5.2 20.2% Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Financials for FY2018) Earnings Calendar Tickers Company Name Date of reporting 4Q2018 results No. of days remaining Status QAMC Qatar Aluminum Manufacturing Company 20-Feb-19 1 Due QOIS Qatar Oman Investment Company 20-Feb-19 1 Due MERS Al Meera Consumer Goods Company 24-Feb-19 5 Due QFLS Qatar Fuel Company 25-Feb-19 6 Due BRES Barwa Real Estate Company 25-Feb-19 6 Due QISI The Group Islamic Insurance Company 25-Feb-19 6 Due QNNS Qatar Navigation (Milaha) 25-Feb-19 6 Due QCFS Qatar Cinema & Film Distribution Company 26-Feb-19 7 Due MCCS Mannai Corporation 26-Feb-19 7 Due AHCS Aamal Company 27-Feb-19 8 Due QGRI Qatar General Insurance & Reinsurance Company 4-Mar-19 13 Due SIIS Salam International Investment Limited 6-Mar-19 15 Due DBIS Dlala Brokerage & Investment Holding Company 13-Mar-19 22 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 25.90% 49.55% (72,578,781.32) Qatari Institutions 22.01% 21.10% 2,786,265.05 Qatari 47.91% 70.65% (69,792,516.27) GCC Individuals 0.49% 0.60% (344,433.07) GCC Institutions 14.86% 3.13% 35,982,785.51 GCC 15.35% 3.73% 35,638,352.44 Non-Qatari Individuals 7.92% 8.79% (2,682,401.12) Non-Qatari Institutions 28.83% 16.82% 36,836,564.95 Non-Qatari 36.75% 25.61% 34,154,163.83

- 3. Page 3 of 7 News Qatar QSE announces technical issue in displaying the index value on the market watch screen – QSE announced that a technical issue has impacted the index display of the market watch screen and the stock exchange is working on fixing this emergency issue. The exchange also noted that the stock prices are correct. (QSE) QIIK arranges joint lead managers, bookrunners amid $2bn Sukuk plan – Qatar International Islamic Bank (QIIK) has appointed Al Khalij Commercial Bank, Barclays, Barwa Bank, Boubyan Bank, Maybank, QNB Capital and Standard Chartered Bank as joint lead managers and bookrunners to arrange fixed income investors’ meetings in Kuala Lumpur, Hong Kong, Singapore and London, the bank announced. A benchmark Regulation S registered US Dollar Sukuk with a tenor of five years will follow under QIIK’s $2bn Sukuk program, subject to market conditions. QIIK, rated ‘A2’ and ‘A’ by Moody’s and Fitch, respectively, is the third largest listed Islamic bank in Qatar by total assets. (Qatar Tribune) Nakilat forms new joint-venture with McDermott for fabrication projects – Qatar Gas Transport Company Limited (Nakilat) has signed an agreement with McDermott to form a joint-venture (JV), company providing offshore and onshore fabrication services in Qatar. The strategic partnership aims at increasing productivity levels at Nakilat’s world-class Erhama Bin Jaber Al Jalahma Shipyard and developing local construction capabilities to support the increasing demand for the construction of offshore and onshore structures in Qatar. The establishment of the new joint venture is aligned with Qatar’s newly launched localization program, which is designed to enhance the resilience of the energy sector’s supply chain. In addition, the program aims at creating new investment opportunities within the energy sector, which will significantly contribute to Qatar’s economy. This new joint-venture comes at a strategic time, with Qatar’s ambition to localize its energy sector's supply chain and increase its liquefied natural gas production from 77mn tons per annum (mtpa) to 110mtpa in the coming years. This project will provide a range of new services that will support Nakilat and its joint ventures to undertake the construction, maintenance, repair and refurbishment of offshore and onshore structures, and all types of vessels. (QSE) GWCS offers free evaluation for consulting solutions – Gulf Warehousing Company (GWCS) has announced a campaign offering free warehouse evaluation as part of its ‘Consulting Services’, which offers warehouse development and operations optimization solutions to clients. GWC Consulting works to minimize logistics costs, increase visibility and offer better inventory control while maximizing the productivity and efficiency of warehouse operations. GWCS' Director (Business Process Improvement), Hamdan Abdulla Merchant said, “GWCS has spent the past fifteen years setting a standard for local and international logistics, a standard we are now pleased to put at the disposal of our clients, offering the same experience and innovation that has made us the preferred logistics provider in Qatar.” (Gulf-Times.com) IQCD to hold its AGM & EGM on March 5, 2019 – Industries Qatar’s (IQCD) board of directors approved the calling to convene the Annual General Meeting (AGM) and Extraordinary General Assembly Meeting (EGM) of the shareholders on March 5, 2019. In case a quorum is not met, the meetings will be held on March 12, 2019. (QSE) Doha Bank to hold its AGM and EGM on March 6 – Doha Bank’s board of directors invited its shareholders to attend the AGM and EGM, which will be held on March 6, 2019. In case of lack of quorum, a second meeting will be held on March 13, 2019. (QSE) DOHI announces the agenda for its AGM and EGM on March 25 – Doha Insurance Group’s (DOHI) board of directors invited its shareholders to attend the AGM and EGM, which will be held on March 25, 2019. (QSE) GISS to hold its AGM & EGM on March 10, 2019 – Gulf International Services’ (GISS) board of directors approved the calling to convene the AGM and EGM of the shareholders on March 10, 2019. In case a quorum is not met, the meetings will be held on March 18, 2019. (QSE) MPHC to hold its AGM and EGM on March 12, 2019 – Mesaieed Petrochemical Holding Company’s (MPHC) board of directors approved the calling to convene the AGM and EGM of the shareholders on March 12, 2019. In case a quorum is not met, the meetings will be held on March 19, 2019. (QSE) QGMD announces the opening of candidacy for board membership – Qatari German Company for Medical Devices (QGMD) announced the opening of candidacy for vacant board membership positions for the remaining membership period until 2021. The opening of candidacy began on February 18, 2019 until March 3, 2019. (QSE) NLCS’ AGM and EGM endorses items on its agenda and approves the distribution of 5% cash dividend – Alijarah Holding (NLCS) held its AGM and EGM, on February 18, 2019 and endorsed items on its agenda. The company’s AGM approved the board's proposal to distribute a dividend of 5% out of the legal reserve of the nominal value per share at the rate of QR0.50. (QSE) Reformation of QSE’s board of directors – Qatar Holding issued a resolution reforming the board of directors of Qatar Stock Exchange (QSE) under the Chairmanship of HE Ali bin Ahmed Al Kuwari, Minister of Commerce and Industry. The resolution stipulated that the membership is a four-year term renewable for one or more terms. QSE expressed its thanks and gratitude to the previous board and congratulated the new Chairman, Vice Chairman and board members and wished them success in their efforts to achieve the ambitions of investors in the Qatari market. (QSE) Tawteen initiative to enhance localization, expand SME sector – Prime Minister and Interior Minister, HE Sheikh Abdullah bin Nasser bin Khalifa Al Thani, launched Qatar Petroleum’s ‘Localisation Program for Services and Industries in the Energy Sector’ (Tawteen) - an initiative to enhance localizing the sector’s supply chain and expand the small and medium enterprises (SMEs) base. HE the Prime Minister also launched the initiative’s electronic website, which will act as an important link to the various components of the supply chain.

- 4. Page 4 of 7 The launch was part of a dedicated conference and exhibition held with a large participation of official bodies and entities, energy sector companies, and a wide spectrum of service providers and supporting industries. (Peninsula Qatar) Qatar Petroleum signs three deals worth QR9bn with major international firms – Qatar Petroleum signed three agreements worth QR9bn with leading international companies as part of Qatar Petroleum’s ‘Tawteen’ initiative. HE the Minister of State for Energy Affairs, Saad Sherida Al-Kaabi, who is also CEO of Qatar Petroleum, said, “The agreements will give an important momentum to the program’s objectives, which aims to add QR15bn worth of in-country economic investment value to the local economy, which reflects investor confidence in the Qatari economy.” Qatar Petroleum and Baker Hughes, a GE company, signed a Memorandum of Understanding (MoU) designed to help create new opportunities to expand its presence in Qatar, and to enhance its operations through continued investment in future technologies and services. The MoU would also help strengthen Qatar’s oil and gas supply chain and boost the skills of Qatari talent in the industry. Qatar Petroleum also signed a MoU with Schlumberger, which recently celebrated 70 years of presence in Qatar. The agreement will help increase Schlumberger’s footprint, which plans to expand its current operations in Zikreet, to open a new integrated base facility in Ras Laffan by the end of 2019, and to establish a Centre of Efficiency in the Free Zone to be used as a regional maintenance centre. (Gulf-Times.com) Qatar Petroleum eyes up to 60 new ships for LNG expansion plans – Qatar Petroleum may purchase around 50 to 60 new LNG vessels as part of its strategy to raise its liquefied natural gas production output from 77mn tons per year (mtpy) to 110mtpy by 2024. HE the Minister of State for Energy Affairs, Saad bin Sherida Al-Kaabi, who is also President and CEO of Qatar Petroleum, said, “The state-run oil company has a team, which is in talks with different ship builders worldwide. A team from Qatar Petroleum has visited different ship builders around the world and there will be an international tender that will be put in place to procure these ships and a mechanism that we will do related to this initiative. It depends (the number of new ships); it is still really very fluid because we need ships for different destinations and the sizes and so on, but it is more or less 50 to 60 ships. The final number will be announced once we have finalized everything.” Al-Kaabi also noted that Qatar Petroleum is looking to South Korea and other countries for its ship building needs. He added, “Qatar Petroleum is building four trains and we are moving from 77mtpy to 110mtpy in Qatar, and 16mtpy abroad, so the total number that we participate in is actually 126mtpy. We are moving ahead, and the feed will be completed next month for all the engineering onshore; the rig contract will be awarded very soon.” (Gulf-Times.com) QFZA announces 69 new investment opportunities as part of Qatar Petroleum’s ‘Tawteen’ initiative – Qatar Free Zones Authority (QFZA) has identified some 69 investment opportunities in partnership with Qatar Petroleum, under Qatar Petroleum’s landmark ‘Tawteen’ initiative launched in Doha. QFZA will provide land and property solutions to facilitate these opportunities, which are expected to contribute significantly to Qatar’s economic diversification and create thousands of new jobs. QFZA has been working closely with Qatar Petroleum in recent months to support the implementation of this program, with the shared aim of driving economic growth and expanding supply chain opportunities in Qatar. The authority participated in the launch event, where representatives from QFZA will discuss the opportunities and the land opportunity allocation process. The opportunities cover a range of areas of particular interest to QFZA, including activities in maintenance, repairs and operations (MRO), specialized services for onshore and offshore wells, digital technologies, chemicals and light engineering services. (Gulf- Times.com) German firms in talks with Qatar Petroleum for sourcing future LNG supply – Germany is looking to source some of its Liquefied Natural Gas (LNG) needs from Qatar as part of the Western European country’s energy supply diversification plans, German Ambassador, Hans-Udo Muzel said. “Germany is also actively looking at diversifying its energy supply and considering options to set up an LNG terminal. In this context, German companies are, of course, talking to Qatar Petroleum concerning the supply of LNG to Germany in the near future,” Muzel said. Germany’s plans to diversify its energy supply sources were among the major topics discussed during the sixth session of the two-day ‘Qatari-German Joint Economic Commission on Trade, Economic and Technical Cooperation’. (Gulf-Times.com) Qatar ups German investments by EUR10bn over next five years – Qatar will increase its investment by EUR10bn over the next five years in Germany. With total investments worth EUR35bn, Qatar will be the largest Arab investor in Germany, Mohammed bin Abdulrahman bin Jassim Al Thani, Chairman of sovereign-wealth fund Qatar Investment Authority (QIA), was cited as saying in an interview with Handelsblatt. German- based mid-sized companies are expected to be the focus of the planned investments. QIA is sticking to investments in Volkswagen and Deutsche Bank. (Bloomberg) Qatar witnesses tourism boom as cruise sector runs at full throttle – Cruise tourism in Qatar is steaming ahead at full speed in 2019. It is nearly one-and-half month in the New Year, but thousands of tourists in several cruise ships have stepped in to Qatari shores. Since the beginning of this year, over 41,000 tourists in cruise ships came to Qatar from Doha Port and Hamad Port. The strong inflow of tourists signals the ongoing cruise season is expected to be the busiest season so far with record number of tourists coming to Qatar. It is worth mentioning that the 2018-2019 cruise seasons began from October last year and will continue until April 2019. This season is set to be the busiest one since the development of the cruise tourism sector in Qatar as more than 140,000 visitors in 43 cruise ships are expected to dock at Doha Port during this season. Qatar had welcomed 22 cruise ships with 65,000 passengers in the 2017-2018 cruise season. (Peninsula Qatar) Qatar Chamber discusses investment cooperation with Ghana – Qatar Chamber’s First Vice Chairman, Mohamed bin Ahmed bin Twar met with a trade delegation from Ghana consisting of Director of State Protocol Ambassador Ahmed Hassan, Ambassador of Ghana to Qatar, HE Emmanuel Enos and Executive Director of M-TechX, Joseph Bonney. The meeting

- 5. Page 5 of 7 reviewed cooperation between the two countries’ business sectors and the possibility of forming partnerships between Qatari and Ghanaian companies. Twar underscored the importance of developing economic and investment ties between the two countries. Ambassador of Ghana to Qatar, HE Emmanuel Enos commended the distinct relations between Qatar and Ghana and underlined Ghana’s business sectors’ interest to bolster trade cooperation with their Qatari counterparts. (Qatar Tribune) International Auto industry lines up against possible US tariffs – The US auto industry urged President Donald Trump’s administration not to saddle imported cars and auto parts with steep tariffs, after the US Commerce Department sent a confidential report to the White House with its recommendations for how to proceed. Some trade organizations also blasted the Commerce Department for keeping the details of its ‘Section 232’ national security report shrouded in secrecy, which will make it much harder for the industry to react during the next 90 days Trump will have to review it. Representatives from the White House and the Commerce Department could not immediately be reached. The industry has warned that possible tariffs of up to 25% on millions of imported cars and parts would add thousands of dollars to vehicle costs and potentially devastate the US economy by slashing jobs. Administration officials have said tariff threats on autos are a way to win concessions from Japan and the European Union (EU). Last year, Trump agreed not to impose tariffs as long as talks with the two trading partners were proceeding in a productive manner. (Reuters) IHS Markit: UK’s household sentiment at 11-month low on job fears – British households grew more downbeat about their finances this month as job worries rose to the highest in over a year, reflecting a slowing economy and uncertain prospects for Brexit in less than six weeks’ time. Consumer spending and a strong labor market were a relative bright spot as Britain’s economy slowed last year to record its weakest growth since 2012, but since late last year there have been growing signs that Brexit uncertainty is taking a toll. IHS Markit’s Household Finance Index dropped to its lowest since March, with a component reflecting job security dropping to its lowest since January 2018, despite official figures that showed unemployment at its lowest since the mid-1970s. Official data due on Tuesday is forecasted to show the fastest wage growth since 2008, according to a Reuters poll, and a survey of businesses released earlier showed they planned to raise wages by the most in at least seven years. However, Britain remains at risk of leaving the European Union on March 29 without any transition deal to maintain existing trade arrangements, unless Prime Minister Theresa May can persuade parliament to accept Brussels’ terms or delays departure. The Bank of England predicts growth will slow this year to its weakest since 2009 even if Brexit goes smoothly, due to heightened global trade tensions and ongoing uncertainty about Britain’s long-term ties with the European Union. (Reuters) Vice Premier: China needs tax cuts to relieve pressure on economy – China’s decision to cut company taxes and fees is an important part of fiscal policy and is a hard-hitting measure needed to cope with pressure on the economy, state media reported Vice Premier Han Zheng as saying. He made the comments during a visit to the State Administration of Taxation, the official People’s Daily newspaper reported. Officials have pledged more aggressive reductions in 2019, after cutting about CNY1.3tn ($192.82bn) in taxes and fees last year. Some analysts expect the changes will be announced during the annual session of parliament in early March, along with other measures to boost economic growth and ease financial strains on struggling companies. Chinese authorities plan to set a lower economic growth target of 6% to 6.5% in 2019, sources have told Reuters, as weakening domestic demand and a damaging trade war with the US drag on business activity and consumer confidence. China’s economy grew by 6.6% in 2018, the slowest annual pace since 1990. (Reuters) Reuters Tankan: Japan’s business mood sours, tough year seen ahead – Japanese business sentiment worsened in February to levels last seen in late 2016, the Reuters Tankan poll showed, in a sign companies took a hit from weakening demand both at home and abroad in the face of slowing global growth and trade friction. The monthly poll, which tracks the Bank of Japan’s (BoJ) closely watched quarterly tankan survey, found manufacturers’ mood sliding for a fourth straight month and service-sector morale falling for the first time in four months. The worsening business sentiment underscores the risks Japan’s economy - the worlds third-largest - faces this year, including an intensifying US-China trade war and a planned nationwide sales tax hike in October. Both manufacturers’ and non-manufacturers’ sentiment is expected to slip further over the coming three months, boding ill for the central bank’s key tankan survey due next in April. Managers of 266 firms responded on condition of anonymity in the Reuters poll of 480 large and midsize companies, conducted February 1-14. The sentiment index for manufacturers fell to 13 in February from 18 seen in the previous month, dragged down by electrical machinery makers and industrial materials producers including oil refinery, steel and chemicals, the Reuters Tankan showed. The index marked the weakest reading since October 2016, and is expected to fall further to 12 in May. The service-sector index dropped sharply to 22 in February from 31 in the previous month, weighed by retailers, a worrying sign for consumption, which makes up about 60% of the economy. The index is seen falling further to 20 in May. (Reuters) Regional Finance Ministry: Saudi Arabia gets applications for February Sukuk – Saudi Arabia has received applications for the February Sukuk and the issue size for the February 2019 local Sukuk has been set at SR9.376bn, the finance ministry stated. The size of the first tranche is of SR1.805bn; it will become SR2bn at final size and will mature in 2024. The size of the second tranche is of SR0.274bn and it will become SR5.449bn at final size and will mature in 2029. The size of the third tranche is of SR7.297bn; and it will mature in 2031. (Bloomberg) Saudi Arabia’s PIF and Mubadala are unhappy with prices paid by Vision Fund – Saudi Arabia’s Public Investment Fund, or PIF, and Abu Dhabi’s Mubadala Investment, the two biggest outside investors in SoftBank’s Vision Fund, have complained about the high prices paid for tech companies by the fund, the Wall Street Journal (WSJ) reported, citing sources. The PIF is also

- 6. Page 6 of 7 concerned about SoftBank’s move of investing in companies first, then transferring the stakes to the Vision Fund, sometimes at a higher price, sources said. Some investors have complained that the fund’s decision-making process is chaotic. The Vision Fund, PIF and Mubadala have all told the WSJ that their relationships are good; the investors say that they support the fund’s strategy and governance. (Bloomberg) UAE's Emirates Development Bank hires arrangers for Dollar bond – Emirates Development Bank (EDB), wholly owned by the federal government of the UAE, has hired banks to arrange a series of fixed income investor meetings ahead of a potential sale of benchmark US Dollar-denominated five-year bonds, a document issued by one of the banks showed. Emirates NBD Capital has been appointed as the financial advisor and, together with Standard Chartered, as joint global coordinators. Emirates NBD Capital, Industrial and Commercial Bank of China Ltd, and Standard Chartered Bank have been hired as joint lead managers. Benchmark deals are generally of at least $500mn. EDB is rated ‘AA-’ (minus) by Fitch. The planned debt issue will be the bank’s first in the international debt markets and part of a $3bn bond program. Representatives of the banks will meet investors in Asia, the UAE and London starting from February 20, according to the document. (Reuters) UAE's Mubadala Petroleum signs natural gas deal for Indonesia field – Mubadala Petroleum has signed a production sharing contract for Indonesia’s South Andaman natural gas field after winning development rights in 2018 tender, the company stated. Abu Dhabi government-owned Mubadala will conduct studies for exploration within the next 3 years. The company will become the operator of field; it is already operator at adjacent Andaman I deposit and partner in Andaman II area. South Andaman fields lie in unexplored offshore area with proven hydrocarbon deposits. (Bloomberg) Mashreqbank may sell Dollar benchmark 5 year bond as soon as tomorrow – Mashreqbank may sell Dollar benchmark 5 year bond, the roadshow for which has been finished with significant positive feedback collated, according to the lead managers. Transactions can be expected as early as tomorrow. Mashreqbank previously had mandated BNP, BofAML, Commerzbank, Mashreqbank, Nomura and SocGen to arrange the roadshow, according to sources. (Bloomberg) SoftBank invests in Mubadala's new $400mn European tech fund – SoftBank Group has provided nearly half of the cash for Abu Dhabi’s state investor Mubadala Investment Co’s new $400mn fund investing in European start-ups, sources said. Mubadala, which has committed to invest $15bn in SoftBank’s Vision Fund, last week announced that Mubadala Ventures was planning to launch a $400mn technology-focused European fund this year. The Softbank Vision Fund, managed by Softbank Group, raised more than $93bn from investors including the Abu Dhabi investor, Saudi Arabia’s Public Investment Fund, Apple Inc, Foxconn, Qualcomm, Sharp Corp and SoftBank Group Corp. Abu Dhabi-based Mubadala Investment manages a $225bn portfolio. (Reuters) Abu Dhabi's Tawazun will get a stake in Russian luxury car project – Abu Dhabi’s Tawazun holding will take a 36% stake in Russian car maker Aurus, investing $124mn in the company within three years, Russia’s industry Ministry stated. Tawazun will become the main Aurus distributor in North Africa and the Middle East, the Russian ministry stated. The share of Sollers, another Russian car producer, in Aurus will fall to 0.5% as a result of the deal, it added. Aurus is a project and brand run by Russia’s Central Scientific Research Automobile and Automotive Engine Institute, known as NAMI. NAMI owns a 63.5% in the project, which, Russia has stated, will see it producing a range of luxury cars designed inside the country. (Reuters) OMV says Abu Dhabi moved 24.9% stake in OMV to MPPH From IPIC – Abu Dhabi’s 24.9% stake in Austrian oil and gas co. OMV is now held by Mubadala Petroleum and Petrochemicals Holding Co. (MPPH), according to statement. The Stake was previously owned by International Petroleum Investment Co. (IPIC). MPPH has entered into a syndicate agreement with Austrian government, which owns 31.5%. (Bloomberg) NBK may see $330mn inflows next month after FTSE review – The foreign ownership limit (FOL) removal will mostly benefit National Bank of Kuwait (NBK), with expected inflows of around $330mn. Kuwait is now expected to have a weight of about 76 basis points in FTSE’s EM All Cap index, up from 50 basis points, with the increase following the foreign ownership limit (FOL) removal for banks, analysts at Arqaam Capital’s Michael Malkoun, Jaap Meijer and Aliya El Husseini said. The inclusion of GBK and AUB, both traded in Kuwait, in emerging market index is expected to attract around $67mn and $142mn of inflows respectively. The change in weight for Kuwait Finance House (KFH) will lead to inflows of about $16mn. (Bloomberg) BBK posts 14.4% YoY rise in net profit to BHD67.1mn in FY2018 – BBK (BBK) recorded net profit of BHD67.1mn in FY2018, an increase of 14.4% YoY. Net interest income rose 20.9% YoY to BHD110.0mn in FY2018. Total operating income rose 14.2% YoY to BHD157.1mn in FY2018. Total assets stood at BHD3.6bn at the end of December 31, 2018 as compared to BHD3.8bn at the end of December 31, 2017. Loans and advances to customers stood at BHD1.8bn, while customers’ current, savings and other deposits stood at BHD2.4bn at the end of December 31, 2018. Diluted EPS came in at BHD0.052 in FY2018 as compared to BHD0.045 in FY2017. (Bahrain Bourse) Bailout of $10bn makes Bahrain debt best in Gulf as Oman lags – Bonds of Bahrain, the smallest member of the Gulf Cooperation Council (GCC), have handed investors the biggest return since the island nation’s $10bn bailout last year. For those holding Oman’s debt, the losses have piled up. Corporate and sovereign notes from Bahrain delivered an average return of almost 5% since the aid was pledged at the start of October, data compiled by Bloomberg showed. Bahrain, which is closely allied with Saudi Arabia and the US, has taken steps to cut its budget deficit as part of the deal. Inclusion in JPMorgan Chase & Co.’s emerging-market indexes, which began last month, has also helped. (Bloomberg) Bahrain sells BHD43mn of 4.15% 91-day Sukuk; bid-cover at 1.53x – Bahrain sold BHD43mn of Sukuk due on May 22, 2019. Investors have offered to buy 1.53 times the amount of securities sold. The Sukuk will settle on February 20, 2019. (Bloomberg)

- 7. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg ( # Market was closed on February 18, 2019) Source: Bloomberg (*$ adjusted returns, # Market was closed on February 18, 2019) 45.0 70.0 95.0 120.0 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 QSEIndex S&P Pan Arab S&P GCC (0.3%) 0.2% 0.1% (0.1%) (0.1%) (0.6%) 0.0% (1.0%) (0.5%) 0.0% 0.5% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,326.90 0.4 0.4 3.5 MSCI World Index 2,072.62 0.3 0.3 10.0 Silver/Ounce 15.81 0.1 0.1 2.0 DJ Industrial# 25,883.25 0.0 0.0 11.0 Crude Oil (Brent)/Barrel (FM Future) 66.50 0.4 0.4 23.6 S&P 500# 2,775.60 0.0 0.0 10.7 Crude Oil (WTI)/Barrel (FM Future)# 55.59 0.0 0.0 22.4 NASDAQ 100# 7,472.41 0.0 0.0 12.6 Natural Gas (Henry Hub)/MMBtu# 2.59 0.0 0.0 (18.7) STOXX 600 369.78 0.6 0.6 8.2 LPG Propane (Arab Gulf)/Ton# 68.50 0.0 0.0 7.9 DAX 11,299.20 0.3 0.3 5.8 LPG Butane (Arab Gulf)/Ton# 85.00 0.0 0.0 21.4 FTSE 100 7,219.47 0.2 0.2 8.8 Euro 1.13 0.1 0.1 (1.4) CAC 40 5,168.54 0.6 0.6 7.9 Yen 110.62 0.1 0.1 0.8 Nikkei 21,281.85 1.8 1.8 6.2 GBP 1.29 0.3 0.3 1.3 MSCI EM 1,036.73 0.6 0.6 7.3 CHF 1.00 0.1 0.1 (2.3) SHANGHAI SE Composite 2,754.36 2.8 2.8 12.3 AUD 0.71 (0.2) (0.2) 1.1 HANG SENG 28,347.01 1.6 1.6 9.5 USD Index# 96.90 0.0 0.0 0.8 BSE SENSEX 35,498.44 (0.9) (0.9) (3.9) RUB 66.26 (0.1) (0.1) (5.0) Bovespa 96,509.89 (1.7) (1.7) 13.8 BRL 0.27 (0.9) (0.9) 4.0 RTS 1,177.04 (0.0) (0.0) 10.1 97.4 91.6 78.1