QNBFS Daily Market Report October 25, 2018

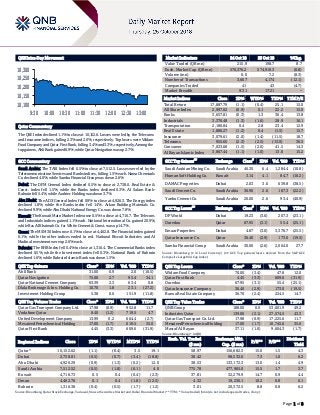

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 1.1% to close at 10,152.6. Losses were led by the Telecoms and Insurance indices, falling 2.3% and 2.0%, respectively. Top losers were Widam Food Company and Qatar First Bank, falling 3.4% and 3.3%, respectively. Among the top gainers, Ahli Bank gained 6.9%, while Qatar Navigation was up 2.7%. GCC Commentary Saudi Arabia: The TASI Index fell 0.5% to close at 7,512.5. Losses were led by the Telecommunication Services and Banks indices, falling 1.5% each. Nama Chemicals Co. declined 4.0%, while Samba Financial Group was down 2.6%. Dubai: The DFM General Index declined 0.5% to close at 2,738.0. Real Estate & Const. index fell 1.5%, while the Banks index declined 0.3%. Al Salam Bank- Bahrain fell 5.4%, while Arabtec Holding was down 3.7%. Abu Dhabi: The ADX General Index fell 0.9% to close at 4,926.3. The Energy index declined 1.8%, while the Banks index fell 1.4%. Arkan Building Materials Co. declined 9.9%, while Abu Dhabi National Energy Co. was down 7.8%. Kuwait: The Kuwait Main Market Index rose 0.5% to close at 4,716.7. The Telecom. and Industrials indices gained 1.1% each. National International Co. gained 20.9%, while Ras Al Khaimah Co. for White Cement & Const. was up 14.7%. Oman: The MSM 30 Index rose 0.1% to close at 4,462.8. The Financial index gained 0.1%, while the other indices ended in red. National Biscuit Industries and Al Madina Investment were up 2.6% each. Bahrain: The BHB Index fell 0.4% to close at 1,316.4. The Commercial Banks index declined 0.5%, while the Investment index fell 0.3%. National Bank of Bahrain declined 1.6%, while Bahrain Islamic Bank was down 1.5%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Ahli Bank 31.00 6.9 2.0 (16.5) Qatar Navigation 75.00 2.7 95.4 34.1 Qatar National Cement Company 63.39 2.3 63.4 0.8 Dlala Brokerage & Inv. Holding Co. 10.70 1.8 23.1 (27.2) Investment Holding Group 5.38 0.6 151.9 (11.8) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar Gas Transport Company Ltd. 17.98 (0.9) 952.8 11.7 Vodafone Qatar 8.40 (1.2) 719.5 4.7 United Development Company 13.99 0.2 664.4 (2.7) Mesaieed Petrochemical Holding 17.00 (1.7) 619.5 35.0 Qatar First Bank 4.45 (3.3) 609.6 (31.9) Market Indicators 24 Oct 18 23 Oct 18 %Chg. Value Traded (QR mn) 215.9 198.7 8.7 Exch. Market Cap. (QR mn) 570,376.2 574,910.3 (0.8) Volume (mn) 6.6 7.2 (8.3) Number of Transactions 3,667 4,174 (12.1) Companies Traded 41 43 (4.7) Market Breadth 9:31 17:21 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,887.79 (1.1) (0.4) 25.1 15.0 All Share Index 2,997.02 (0.9) 0.1 22.2 15.0 Banks 3,657.81 (0.3) 1.3 36.4 13.8 Industrials 3,376.48 (1.3) (1.6) 28.9 16.1 Transportation 2,180.84 0.4 2.8 23.4 12.9 Real Estate 1,886.27 (1.2) 0.4 (1.5) 15.7 Insurance 3,079.61 (2.0) (1.4) (11.5) 18.7 Telecoms 955.65 (2.3) (2.5) (13.0) 36.5 Consumer 7,023.68 (1.5) (2.0) 41.5 14.3 Al Rayan Islamic Index 3,867.44 (1.1) (1.0) 13.0 15.2 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Saudi Arabian Mining Co. Saudi Arabia 46.30 6.4 1,284.4 (10.8) Human Soft Holding Co. Kuwait 3.14 4.1 84.7 (16.2) DAMAC Properties Dubai 2.03 3.6 639.8 (38.5) Saudi Cement Co. Saudi Arabia 36.90 2.6 167.3 (22.2) Yanbu Cement Co. Saudi Arabia 20.00 2.6 93.4 (40.9) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% DP World Dubai 19.23 (3.6) 207.3 (23.1) Ooredoo Qatar 67.95 (3.1) 55.4 (25.1) Emaar Properties Dubai 4.87 (3.0) 3,376.7 (25.5) Qatar Insurance Co. Qatar 36.40 (2.9) 173.0 (19.5) Samba Financial Group Saudi Arabia 30.00 (2.6) 2,064.0 27.7 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Widam Food Company 70.00 (3.4) 47.8 12.0 Qatar First Bank 4.45 (3.3) 609.6 (31.9) Ooredoo 67.95 (3.1) 55.4 (25.1) Qatar Insurance Company 36.40 (2.9) 173.0 (19.5) Barwa Real Estate Company 36.70 (2.4) 224.5 14.7 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 188.00 0.0 53,601.9 49.2 Industries Qatar 139.00 (2.1) 27,574.5 43.3 Qatar Gas Transport Co. Ltd. 17.98 (0.9) 17,225.6 11.7 Mesaieed Petrochemical Holding 17.00 (1.7) 10,745.6 35.0 Masraf Al Rayan 37.11 (1.0) 9,604.3 (1.7) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,152.62 (1.1) (0.4) 3.5 19.1 58.97 156,682.3 15.0 1.5 4.3 Dubai 2,738.01 (0.5) (0.7) (3.4) (18.8) 38.42 98,532.6 7.3 1.0 6.2 Abu Dhabi 4,926.29 (0.9) (1.3) (0.2) 12.0 38.53 133,172.3 13.0 1.4 4.9 Saudi Arabia 7,512.52 (0.5) (1.8) (6.1) 4.0 775.78 477,965.0 15.5 1.7 3.7 Kuwait 4,716.73 0.5 0.4 (0.4) (2.3) 37.81 32,279.9 14.7 0.9 4.4 Oman 4,462.76 0.1 0.4 (1.8) (12.5) 4.32 19,236.1 10.2 0.8 6.1 Bahrain 1,316.38 (0.4) (0.5) (1.7) (1.2) 3.01 20,372.5 8.8 0.8 6.2 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,100 10,150 10,200 10,250 10,300 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QSE Index declined 1.1% to close at 10,152.6. The Telecoms and Insurance indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from GCC and non-Qatari shareholders. Widam Food Company and Qatar First Bank were the top losers, falling 3.4% and 3.3%, respectively. Among the top gainers, Ahli Bank gained 6.9%, while Qatar Navigation was up 2.7%. Volume of shares traded on Wednesday fell by 8.3% to 6.6mn from 7.2mn on Tuesday. However, as compared to the 30-day moving average of 6.1mn, volume for the day was 9.0% higher. Qatar Gas Transport Company Limited and Vodafone Qatar were the most active stocks, contributing 14.3% and 10.8% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 3Q2018 % Change YoY Operating Profit (mn) 3Q2018 % Change YoY Net Profit (mn) 3Q2018 % Change YoY Saudi Telecom Co. Saudi Arabia SR 13,333.0 5.6% 3,236.0 11.3% 2,643.0 2.9% Saudi Arabian Fertilizer Co. Saudi Arabia SR 1,008.7 63.4% 481.2 174.9% 522.2 177.2% National Shipping Company of Saudi Arabia Saudi Arabia SR 1,393.9 8.6% 139.6 -20.7% 81.3 34.3% Abdulmohsen Alhokair Group for Tourism and Development Saudi Arabia SR 315.5 -0.2% 0.6 -91.1% 1.9 -78.9% Al-Ahsa Development Co. Saudi Arabia SR 57.6 15.6% -0.4 N/A 2.5 N/A Saudi Fisheries Co. Saudi Arabia SR 3.8 -51.1% -7.5 N/A -8.7 N/A National Industrialization Co. Saudi Arabia SR 2,901.0 5.1% 682.4 22.5% 259.4 35.4% Saudi Printing and Packaging Co. Saudi Arabia SR 276.3 9.9% 0.4 -93.4% -11.8 N/A United Wire Factories Co. Saudi Arabia SR 106.7 -17.9% 2.1 -80.6% 0.5 -93.3% Saudi Company for Hardware Saudi Arabia SR 340.2 5.3% 27.8 2.0% 24.4 7.2% Source: Company data, DFM, ADX, MSM, TASI, BHB. Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 10/24 US Mortgage Bankers Association MBA Mortgage Applications 19-October 4.9% – -7.1% 10/24 US Markit Markit US Manufacturing PMI October 55.9 55.3 55.6 10/24 US Markit Markit US Services PMI October 54.7 54.0 53.5 10/24 US Markit Markit US Composite PMI October 54.8 – 53.9 10/24 EU Markit Markit Eurozone Manufacturing PMI October 52.1 53.0 53.2 10/24 EU European Central Bank M3 Money Supply YoY September 3.5% 3.5% 3.4% 10/24 EU Markit Markit Eurozone Services PMI October 53.3 54.5 54.7 10/24 EU Markit Markit Eurozone Composite PMI October 52.7 53.9 54.1 10/24 Germany Markit Markit Germany Services PMI October 53.6 55.5 55.9 10/24 Germany Markit Markit/BME Germany Composite PMI October 52.7 54.8 55.0 10/24 France INSEE National Statistics Office Business Confidence October 104 106 105 10/24 France INSEE National Statistics Office Manufacturing Confidence October 104 107 107 10/24 Japan Markit Nikkei Japan PMI Mfg October 53.1 – 52.5 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 27.46% 42.48% (32,413,238.63) Qatari Institutions 14.51% 15.32% (1,731,599.46) Qatari 41.97% 57.80% (34,144,838.09) GCC Individuals 0.58% 0.41% 366,288.77 GCC Institutions 3.15% 2.65% 1,081,140.04 GCC 3.73% 3.06% 1,447,428.81 Non-Qatari Individuals 9.85% 9.17% 1,469,859.92 Non-Qatari Institutions 44.44% 29.98% 31,227,549.36 Non-Qatari 54.29% 39.15% 32,697,409.28

- 3. Page 3 of 8 Earnings Calendar Tickers Company Name Date of reporting 3Q2018 results No. of days remaining Status QFLS Qatar Fuel Company 25-Oct-18 0 Due QIMD Qatar Industrial Manufacturing Company 25-Oct-18 0 Due QGTS Qatar Gas Transport Company Limited (Nakilat) 28-Oct-18 3 Due IGRD Investment Holding Group 28-Oct-18 3 Due BRES Barwa Real Estate Company 28-Oct-18 3 Due GISS Gulf International Services 28-Oct-18 3 Due QOIS Qatar Oman Investment Company 28-Oct-18 3 Due MERS Al Meera Consumer Goods Company 28-Oct-18 3 Due QGMD Qatari German Company for Medical Devices 28-Oct-18 3 Due AKHI Al Khaleej Takaful Insurance Company 28-Oct-18 3 Due MPHC Mesaieed Petrochemical Holding Company 29-Oct-18 4 Due AHCS Aamal Company 29-Oct-18 4 Due QFBQ Qatar First Bank 29-Oct-18 4 Due SIIS Salam International Investment Limited 29-Oct-18 4 Due QGRI Qatar General Insurance & Reinsurance Company 29-Oct-18 4 Due DOHI Doha Insurance Group 29-Oct-18 4 Due ERES Ezdan Holding Group 29-Oct-18 4 Due ZHCD Zad Holding Company 30-Oct-18 5 Due QNNS Qatar Navigation (Milaha) 30-Oct-18 5 Due MCCS Mannai Corporation 30-Oct-18 5 Due Source: QSE News Qatar IQCD reports an in-line 3Q2018; maintain Market Perform with QR126 price target – IQCD’s bottom line rises 76.0% YoY and 6.0% QoQ in 3Q2018 to QR1,316.3mn in 3Q2018, in line with our estimate of QR1,290.6mn (variation of +2.0%). The company's reported steel sales came in at QR1,533.8mn in 3Q2018, which represents an increase of 33.5% YoY. However, on a QoQ basis, steel sales fell 6.8%. Steel sales exceeded our model by 6.6% continuing a recent trend, which has seen strong steel top-line as IQCD sells (from 4Q2017 onward) billets previously earmarked for steel bar production in its Dubai operations. Income from JVs that represents IQCD’s stakes in petrochemicals and fertilizers also came in line with our forecast at QR1,073.4bn (QNBFS estimate: QR1,028.9mn or a divergence of 4.3%). JV income jumped 89.2% YoY and 8.0% QoQ. EPS amounted to QR6.32 in 9M2018 as compared to QR3.90 in 9M2017. In 9M2018, steel revenue reported under IFRS 11 was QR4.6bn, significantly up by 43.6% on last year. This revenue growth was largely attributable to a moderate improvement in sales volumes due to the change of sales mix, marketing strategy and increased selling prices. On the other hand, on a like-for-like basis, management reporting revenue, that includes steel+ petchems+ fertilizers (assuming proportionate consolidation) was QR12.3bn (QNBFS estimate: QR12.2bn), a significant increase of 24% over 2017. This increase was due to the combined effect of improved prices and volumes versus the previous year. Net Profit for 9M2018 was QR3.8bn, a healthy growth of 62.3% YoY. This improved performance was driven by a combination of factors including increased product prices, a moderate growth in sales volumes, efficiently managed operating assets base and efforts towards optimizing operations and costs. The YoY moderate improvement of sales volumes was partially due to higher PE production, as the polyethylene facilities were on an extended unplanned shutdown during the first nine months of 2017 (specifically during 1Q2017). Additionally, stable global demand aided the group’s fertilizer segment to maintain its sales volumes, while the sales of steel products improved due to aforementioned factors. IQCD’s balance sheet continues to remain solid as cash across the group stands at QR12.1bn after paying 2017’s dividend of QR3.0bn, and periodic debt payments amounting to QR0.3bn. Total debt across the group now stands at only QR0.2bn, down from QR0.5bn as at December 31, 2017. We note that reported results are in-line with our model and we are comfortable with our QR5.1bn net income estimate (QR8.44 in EPS) for 2018 and believe modest upside to our estimates is possible. We rate IQCD a Market Perform with a PT of QR126. IQCD is fully valued-to-expensive @ 16.5x and 16.0x P/E for 2018 and 2019, respectively. (QNBFS Research, Company releases) QCFS' net profit declines 21.4% YoY and 36.8% QoQ in 3Q2018 – Qatar Cinema and Film Distribution Company's (QCFS) net profit declined 21.4% YoY (-36.8% QoQ) to QR1.4mn in 3Q2018. In 9M2018, QCFS reported net profit of QR6.3mn as compared to QR7.5mn in 9M2017. EPS declined to QR1.01 in 9M2018 from QR1.20 in 9M2017. (QSE) MRDS posts 41.6% YoY increase but 73.7% QoQ decline in net profit in 3Q2018 – Mazaya Qatar Real Estate Development's (MRDS) net profit rose 41.6% YoY (but declined 73.7% on QoQ basis) to QR5.9mn in 3Q2018. In 9M2018, MRDS reported net profit of QR22.1mn as compared to QR17.6mn in 9M2017. EPS rose to QR0.191 in 9M2018 from QR0.152 in 9M2017. (QSE) Woqod opens two new petrol stations in Al Kharaitiyat and Al Thumama – Qatar Fuel Company (Woqod) has opened two new petrol stations in Al Kharaitiyat and Al Thumama, and one mobile station in Al Wakrah, as part of the company’s ongoing expansion plans. (Gulf-Times.com)

- 4. Page 4 of 8 AZF, QFC join hands to attract multinationals to sports business – With Doha's sports sector expected to reach $20bn by 2023, Aspire Zone Foundation (AZF) and Qatar Financial Centre (QFC) are together establishing Qatar Sports Business District (QSBD) to attract large sports-related multinationals and promote sustainable businesses to facilitate the commercialization of sports-related products and services. A Memorandum of Understanding (MoU) was signed by QFC’s CEO, Yousuf Mohamed Al-Jaida, and AZF’s CEO, Mohamed Khalifa Al-Suwaidi, to set up QSBD, which is aimed at creating a premier sports business cluster in the country and the wider Middle East. The MoU will see the QFC and AZF collaborate on numerous initiatives aimed at developing and promoting this industry, as well as an all-inclusive sports business district. (Gulf-Times.com) Qatar, Turkey trade likely to reach $2bn by year-end – Qatar- Turkey trade volume is expected to reach $2bn by the end of 2018, according to Turkish Ambassador to Qatar, Fikret Ozer, who spoke on the sidelines of the ‘Turkey Festival’. Ozer said the volume of trade between Qatar and Turkey stood at $1.3bn from January to August 2018, pointing to the possibility of reaching $2bn by year-end, state-run Qatar News Agency (QNA) reported. He also said there is a possibility to establish a company specialized in maritime transport between the two countries, which is under study and is scheduled to launch soon as he stressed on the need for such a company. Ozer noted that the volume of contracts awarded to the Turkish companies engaged in contracting works in Qatar is estimated at $15bn. Ozer thanked Al Meera Consumer Goods Company for featuring Turkish products in its stores. He stressed that the availability of Turkish goods in Al Meera Consumer Goods Company markets proves the importance attached by the Qatari market to Turkish products. He said since the beginning of the blockade on Qatar, Turkey “has quickly provided” all the food commodities necessary to meet the needs of the Qatari market, which in turn, contributed to the introduction of more Turkish products to the Qatari market and Qatari businessmen. He added that this contributed to the increase of Turkish exports to the Qatari market, which rose to $750mn in 2017 from $450mn in 2016. Speaking on the sidelines of the event, Al Meera Consumer Goods Company’s Chairman, Sheikh Thani bin Thamer bin Mohamed Al-Thani said Turkey is one of the first suppliers of various goods and products to the Qatari market. (Gulf-Times.com) Ooredoo ‘to continue its focus on new technologies’ – The crucial role of broadband connectivity in advancing sustainable development is highlighted in a United Nations report on broadband, Ooredoo Group’s CEO, Sheikh Saud bin Nasser Al- Thani said. “At Ooredoo, we continue to invest in next- generation technologies, people and resources that enable our communities – in particular underserved women and youth, to improve their lives and achieve their full potential. As we deploy the power of digital technology to give people access to the services and support they need, we urge governments, operators and regulators to continue working closely together to address the deepening digital inequality in global connectivity,” the Group CEO said. (Gulf-Times.com) QTA: Sealine area to be developed into tourist attraction – Qatar Tourism Authority (QTA) is keen to develop the Sealine area into a modern tourist attraction through Al Enna project as part of its 2017-2022 strategy to offer visitors memorable experiences and services. QTA’s Acting Chairman, Hassan Abdulrahman Al-Ibrahim told the Central Municipal Council that safety and security at the Sealine area is a priority for QTA. A fence was placed 15 meters before the beach to protect children, in addition to proving qualified lifeguards and providing families with a good space that keeps their privacy. He pointed out that the project also takes into consideration quad bike safety to avoid accidents. The project is expected to be completely accomplished within five years. The concept of the Sealine project is to be assessed to be implemented in other beaches across the country. Al-Ibrahim said that coordination and communication are going on with the Ministry of Municipality and Environment and Qatar Foundation to provide suitable plants for the Sealine area as part of a campaign to green an area of 300 hectares as a tourist attraction. More parking lots will be introduced to the place. (Gulf-Times.com) QInvest Portfoy, Re-Pie to invest in Turkey’s commercial property – QInvest Portfoy, a unit of Qatari QInvest, has formed a real estate investment fund with Turkey’s Re-Pie real estate investment fund in August, and is looking to invest in commercial real estate in Turkey, according to Re-Pie’s Chairman, Emre Camlibel. (Bloomberg) First planetarium in Qatar to open in December – One of the most high-tech planetariums in the region will open in Qatar in December. Occupying 2,240 square meters area, the Al Thuraya planetarium is expected to become one of the main attractions in Katara. It will offer a rare experience to visitors, blending education and entertainment, especially students, families and astronomy enthusiasts. Katara Cultural Village General Manager, Khalid bin Ibrahim Al Sulaiti tweeted that the most high-tech planetarium in the Middle East will open in Katara Cultural Village in December. The planetarium will have a seating capacity of 200 people, four seats for the disabled and another four for the elderly. It will feature a huge 22-meter screen, equipped with state-of-the-art digital projectors. (Peninsula Qatar) International US new home sales near two-year low as mortgages rates rise – Sales of new US single-family homes fell to a near two-year low in September and data for the prior three months was revised lower, in latest indications that rising mortgage rates and higher prices were sapping demand for housing. Though housing accounts for a small share of GDP, it has a bigger economic footprint. That is raising concerns that protracted housing market weakness could eventually spill over to the broader economy. Residential investment contracted in the first half of the year and is expected to have declined further in the third quarter. The Commerce Department stated that new home sales dropped 5.5% to a seasonally-adjusted annual rate of 553,000 units last month. That was the lowest level since December 2016. August’s sales pace was revised down to 585,000 units from the previously reported 629,000 units. June and July sales rates were also revised lower. New home sales have now declined for four straight months. Economists polled

- 5. Page 5 of 8 by Reuters had forecasted new home sales, which account for about 9.7% of housing market sales, falling 1.4% to a pace of 625,000 units last month. (Reuters) UK’s mortgage approvals drop to six-month low – British banks approved the fewest mortgages last month for house purchase since March and demand to refinance home loans also fell, following the Bank of England’s (BoE) interest rate rise in August, industry data showed on October 24. The number of mortgages approved for house purchase dropped to a six-month low of 38,505 in September from 39,241 in August, down 6.7% from a year earlier, the seasonally adjusted figures from UK Finance showed. Britain’s housing market has slowed since the Brexit vote in June 2016. Most of the weakness has been in London and neighboring areas, which have also been hit by a rise in purchase taxes for property worth over £1mn. Net mortgage lending dropped to £1.550bn ($2.01bn) last month from £1.617bn, the weakest since January. Unsecured consumer lending was more stable, growing by an annual 4.0% in September, but lending to non-financial companies was down by 2% on the year, extending a run of falls seen since April. The Confederation of British Industry stated that factories were scaling back investment as uncertainty about Britain’s relationship with the European Union remained unclear, little more than five months before Brexit. (Reuters) Eurozone’s businesses hit the brakes as trade war stalls growth – Eurozone’s business growth slowed much faster than expected this month, dragged down by waning orders that put a big dent in confidence, adding to evidence the bloc’s halcyon days are behind it for now, a survey showed. October’s disappointing survey is likely to concern policymakers at the European Central Bank (ECB), who are expected to end their bond-buying program in less than three months, despite a slew of political and trade concerns. The economic slowdown comes amid an escalating trade war between the US and China, a spiraling debt dispute in Italy, deadlocked Brexit negotiations and the prospect of steadily tightening financial conditions. (Reuters) French business growth expanded in October – French business activity grew in October from the previous month, a survey showed, as strength in services offset weakness in manufacturing in the Eurozone’s second-biggest economy. Data compiler IHS Markit said the preliminary reading for its composite Purchasing Managers Index rose to 54.3 points in October from a final reading of 54.0 points for September, beating a Reuters forecast for a measure of 53.8 points. IHS Markit’s Chief Business Economist, Chris Williamson, said the figures suggested France was on track for fourth-quarter economic growth of 0.4%, although the weakness in manufacturing caused partly by trade wars, was a worry. France eked out quarterly growth of only 0.2% in the first two quarters of the year, as strikes curbed activity, while warm spring weather kept energy spending low. Earlier this month, the country’s official statistics body, INSEE, stated French economic growth will rise to 0.5% in the third quarter and come in at 0.4% in the final three months, while tax cuts could give a further fillip. (Reuters) China’s central bank to support private firms seeking financing – China’s central bank will actively support private firms seeking financing through corporate bond issues and other means, as part of the government’s measures to bolster the private sector. Chinese Governor, Yi Gang said the bank is committed to create favorable financing environment for private enterprises, he said in a statement posted on the central bank’s website. China has announced plans, to help the private sector, such as easing the tax burden and implementing a list to limit foreign investments by March-end. (Reuters) Regional Islamic bonds look to tap social finance, blockchain tools – Plans to design Sukuk linked to socially-conscious finance could help mobilize large pools of assets across the Muslim world and increase the impact of Islamic finance, industry experts stated. Islamic financial firms are incorporating social elements, such as environmentally-friendly and sustainable practices, to widen their appeal beyond religiously-minded customers in the Gulf and Southeast Asia. Saudi Arabia-based Islamic Development Bank is now working on a Sukuk linked to Islamic endowments, known as waqf, Said Bouheraoua, Director of Research at the International Sharia Research Academy for Islamic Finance (ISRA), said at an industry conference in Bahrain. In a waqf-linked Sukuk, the proceeds are used for social projects and any excess yield is reinvested in the waqf assets. Waqf have been around for centuries but they are widely seen as poorly managed, given they hold large portfolios of real estate and commercial businesses worth as much as $1tn globally, according to a Dubai government estimate. Beyond waqf, other Islamic financial firms are seeking to use technology (Blockchain) to channel money into smaller social projects. (Reuters) Islamic robo-adviser to expand in Gulf, Southeast Asia by 2019 – New York-based Wahed Invest plans to offer its automated investment service in the Middle East and Southeast Asia by early next year, after the robo-adviser closed its latest round of fund raising, its CEO, Junaid Wahedna said. The Shari’ah compliant firm made its international foray in August, launching its services in Britain, aiming to tap into Muslim investors seeking religiously permissible investments. The firm is now working with the financial regulator in Malaysia and anticipates a three-month timeline for a launch in the Muslim- majority country. Wahedna said, “We are also specifically working on registering in the UAE, Bahrain, Saudi Arabia and Indonesia, and hope to have them all live by March 2019.” The firm has raised $8mn in capital this year, giving the company a valuation of $100mn, he added. The firm is backed by Gulf investors and venture firms including Boston-based Cue Ball Capital and Dubai-based BECO Capital. Robo advisers automatically create and manage portfolios made up of exchange-traded funds for customers with as little as a few hundred Dollars to invest. (Reuters) IATA predicts eastward shift; Middle East to see extra 290mn passengers – The International Air Transport Association (IATA) revealed that present trends in air transport suggest passenger numbers could double to 8.2bn in 2037. The Middle East will grow strongly with a CAGR of 4.4% and will see extra 290mn passengers on routes to, from and within the region by 2037. The total market size will be 501mn passengers. The latest update to IATA’s 20-Year Air Passenger Forecast showed

- 6. Page 6 of 8 that an increasing shift Eastwards in the center of gravity of the industry is behind the continued strong growth. Over the next two decades, the forecast anticipates a 3.5% CAGR, leading to a doubling in passenger numbers from today’s levels. (Peninsula Qatar) SABB posts 15.1% YoY increase but 12.9% QoQ decline in net profit to SR1,247mn in 3Q2018 – The Saudi British Bank (SABB) recorded net profit of SR1,247mn in 3Q2018, an increase of 15.1% YoY. However, on QoQ basis, net profit declined 12.9%. Total operating profit rose 6.6% YoY to SR1,880mn in 3Q2018. Total revenue for special commissions/investments rose 14.7% YoY to SR1,710mn in 3Q2018. Total assets stood at SR174.9bn at the end of September 30, 2018 as compared to SR179.5bn at the end of September 30, 2017. Loans and advances stood at SR112.1bn (-3.9% YoY), while customer deposits stood at SR129.3bn (-3.9% YoY) at the end of September 30, 2018. EPS came in at SR2.48 in 9M2018 as compared to SR2.17 in 9M2017. (Tadawul) RJHI posts 13.6% YoY and 0.2% QoQ rise in net profit to SR2,573mn in 3Q2018 – Al Rajhi Bank (RJHI) recorded net profit of SR2,573mn in 3Q2018, an increase of 13.6% YoY and 0.2% QoQ. Total operating profit rose 10.2% YoY to SR4,383mn in 3Q2018. Total revenue for special commissions/investments rose 10.4% YoY to SR3,508mn in 3Q2018. Total assets stood at SR356.4bn at the end of September 30, 2018 as compared to SR338.0bn at the end of September 30, 2017. Loans and advances stood at SR234.4bn (+0.5% YoY), while customer deposits stood at SR288.8bn (+6.9% YoY) at the end of September 30, 2018. EPS came in at SR4.63 in 9M2018 as compared to SR4.1 in 9M2017. (Tadawul) BSFR posts 0.4% YoY and 9.1% QoQ rise in net profit to SR1,005mn in 3Q2018 – Banque Saudi Fransi (BSFR) recorded net profit of SR1,005mn in 3Q2018, an increase of 0.4% YoY and 9.1% QoQ. Total operating profit rose 4.0% YoY to SR1,696mn in 3Q2018. Total revenue for special commissions/investments rose 4.0% YoY to SR1,783mn in 3Q2018. Total assets stood at SR189.3bn at the end of September 30, 2018 as compared to SR201.7bn at the end of September 30, 2017. Loans and advances stood at SR123.7bn (-4.1% YoY), while customer deposits stood at SR146.7bn (-5.6% YoY) at the end of September 30, 2018. EPS came in at SR2.53 in 9M2018 as compared to SR2.59 in 9M2017. (Tadawul) Saudi Arabia’s Crown Prince expects economic growth of 2.5% in 2018 – Saudi Arabia’s Crown Prince, Mohammed bin Salman said that the Kingdom will continue with reforms and spending on infrastructure, predicting the economy will grow by 2.5% this year. The Crown Prince also said that he expected economic growth next year to be higher. Higher oil prices have helped Saudi Arabia’s economy grow in 2Q2018 at its fastest pace for over a year, according to official data. Gross domestic product (GDP), adjusted for inflation, expanded 1.6% from a year earlier in 2Q2018. That was up from 1.2% in 1Q2018 and the fastest growth since 4Q2016. The pick-up was mainly due to the government sector, where growth jumped to 4.0% from 2.7%, as authorities boosted spending, the data showed. (Reuters) Saudi Arabia will not penalize banks that boycotted conference – Saudi Arabia’s central bank Governor, Ahmed al-Kholifey said the Kingdom will not penalize foreign banks that boycotted an investment conference in Riyadh because of the fallout from the killing of Saudi Arabian journalist, Jamal Khashoggi. The Governor, speaking in an interview with Al Arabiya TV, said that institutions that pulled out of the Saudi Arabian conference will still be able to apply for and obtain banking licenses to operate in the Kingdom. (Reuters) GEMS Education venture may invest $800mn in Saudi Arabia – Middle East-focused education company, GEMS Education, and a Saudi Arabian state investment firm agreed to invest up to $800mn over the next 10 years to develop a network of schools across the Kingdom, the government stated. GEMS Education, majority-owned by Dubai based Varkey Group and backed by Blackstone, signed a Memorandum of Understanding (MoU) to form the partnership with Hassana Investment Company, an asset management arm of Saudi Arabia’s General Organization for Social Insurance. The network will accommodate up to 130,000 students and create jobs for 16,000 people, of whom approximately 40% will be Saudi Arabian citizens, the government stated. (Reuters) NMC Health, Hassana Investment Company sign agreement to build Saudi healthcare network – NMC Health stated that it has signed an agreement with Hassana Investment Company, the investment arm of General Organization for Social Insurance of Saudi Arabia, to develop a pan Saudi Arabian network of world- class healthcare facilities. The memorandum of understanding targets a total investment of SR6bn and the employment of up to 10,000 staff over the next five years, NMC Health stated in a statement. (Reuters) Saipem: Saudi Arabia remains a ‘very, very important' market – Italian oil services company Saipem is committed to Saudi Arabia and plans to take part in a series of tenders in the country, its CEO, Stefano Cao said. Saudi Aramco remained Saipem’s biggest client and the country continued to be a major pillar in its strategy. Cao said, “The sheer size of investments by Saudi Aramco is the long-term basis for our engagement and commitment. Saudi Arabia is very, very important and there are many more projects we’ll be participating in.” (Reuters) Six Flags is sticking with Saudi Arabia, even as others cut ties – A parade of US companies abandoned plans to attend a Saudi Arabian investment conference after the killing of a Washington Post journalist. However, Six Flags Entertainment Corp. (Six Flags) did not cut ties for the conference. One of its executives, David McKillips, posed for a photo with Saudi Arabia’s Crown Prince, Mohammed bin Salman on the sidelines of this week’s Future Investment Initiative, according to Al Arabiya. And the theme-park operator is sticking with plans to open in the country under a licensing deal. (Bloomberg) Saudi Aramco signals chemical ambitions beyond $70bn SABIC deal – Saudi Aramco’s CEO, Amin Nasser said that he has bigger ambitions in petrochemicals beyond the planned $70bn acquisition of a strategic stake in local company SABIC, touting plastics as a key hedge against an electric-car driven slowdown in global oil demand growth. “We still have to do more,” he said. Nasser’s comments are the latest signal Saudi Aramco is transforming from a giant oil producer into a vertically integrated energy company, mirroring a shift that major publicly-listed companies such as Exxon Mobil Corp. and Royal

- 7. Page 7 of 8 Dutch Shell Plc performed years ago. The shift comes as the International Energy Agency forecasted that demand for petrochemicals, the building blocks for plastics will become the largest force in global oil demand growth, out-pacing consumption from cars, planes and trucks. (Bloomberg) Saudi Telecom Company announces interim dividend for 3Q2018 – Saudi telecom Company has declared a total interim dividend amount of SR2,000mn for 3Q2018, rewarding the shareholders with SR1 dividend per share. The total number of shares eligible for the dividend is 2,000mn. (Tadawul) Saudia in talks with Airbus, Boeing for $5bn worth of orders – Saudi Arabian Airlines (Saudia) is in talks to buy 30-50 planes for its budget unit Flyadeal, Maaal news site reported, citing sources. (Bloomberg) Emirates REIT plans to raise up to AED500mn loan – Dubai- based Emirates REIT is seeking shareholders approval to raise a secured financing facility up to AED500mn with Dubai Islamic Bank, according to a statement. The tenure of the loan will be 7 years. Emirates REIT operates as a real estate investment trust; it invests in office and retail real estate properties and related assets. (Bloomberg) Arabtec Holding wins AED610mn in contracts from Expo Dubai and Damac – Arabtec Holding announced that its wholly- owned subsidiary, Arabtec Construction, has been awarded two contracts worth a total of AED610mn for major projects in Dubai. The company stated it has won a AED311mn contract from Expo Dubai 2020 to construct the Public Realm in Concourses & Arrivals Plazas at the Expo 2020 site and AED299mn contract from Damac. (Bloomberg) US firm to start building hyperloop track in Abu Dhabi next year – A US company plans to start building an ultra-fast hyperloop track for Abu Dhabi’s transport system in 3Q2019. Hyperloop Transportation Technologies (HyperloopTT) stated that design and engineering firm Dar Al-Handasah had invested in the US based business and would be the lead designer on the Abu Dhabi project. It did not disclose the size of investment. HyperloopTT signed a contract with Abu Dhabi’s state controlled Aldar Properties in April to build a 10km track near the border with Dubai. It previously signed a contract with Abu Dhabi’s municipal affairs and transport department in 2016 for a feasibility study to connect Abu Dhabi city with Al Ain along the Oman border. (Reuters) Kuwait Finance House's third-quarter profit rises 31.4% YoY– Kuwait Finance House (KFH) posted 31.4% rise in third-quarter net profit. Net profit rose to KD73.9mn in 3Q2018, from KD56.2mn in the same period a year ago. Investment bank, EFG Hermes had forecasted that the lender will make a quarterly net profit of KD48.2mn. KFH’s operating revenue came in at KD199.7mn and operating profit at KD131.7mn in 3Q2018. In 9M2018, the bank reported profit of KD169.1mn versus KD137.9mn year ago. The bank, which owns 62.2% of Turkey’s Kuveyt Turk Participation Bank, has been in merger talks since mid-2018 with Bahrain’s Ahli United Bank. (Reuters, Bloomberg) Oman sells $1.5bn Sukuk as Khashoggi crisis raises funding costs – Oman sold $1.5bn in Sukuk but the generous investor returns it had to offer showed that the crisis over the killing of Saudi journalist Jamal Khashoggi is raising funding costs across the Gulf region, fund managers said. The bond issue is Oman’s second public debt issuance this year, as the Sultanate borrows internationally to finance a budget deficit caused by a slump in oil prices over the past few years. It follows a $6.5bn conventional bond issue in January, the country’s largest ever debt sale. The Sultanate started marketing the seven-year notes with an initial price guidance of about 300 basis points over mid-swaps. The issue, which received orders in excess of $3.5bn, was launched with a final spread of 280 basis points over mid-swaps, around 15-20 basis points above what some fund managers considered to be the new issue’s “fair value”. The bonds offer almost 50 basis points more than Oman’s existing $2bn Sukuk issued last year and due in June 2024. (Reuters) Omani investment opportunities showcased in UK – Capitalizing on its strategic location, infrastructure and talent, a top-flight Omani business delegation led by Sayyid Badr al Busaidi, Secretary-General of the Ministry of Foreign Affairs and Co-Chair of the Oman-UK Joint Working Group, met with Alistair Burt, the UK’s Minister of State for International Development & Minister of State for the Middle East and Co- Chair of the Oman–UK Joint Working Group, as well as British investors drawn from manufacturing, logistics, mining, energy, finance, investment and tourism. The purpose of the four-day Omani visit is to lure UK companies to set up offices in the Sultanate, helping them connect with the fast growing economies of the Gulf and East Africa. “Companies that are benefiting from the Sultanate’s political and economic stability, robust legal system, infrastructure and multilingual workforce,” Nasima al Balushi, the organizer of the trade delegation said. The UK is the largest investor in Oman with nearly 50% of all Foreign Direct Investment (FDI) in 2017 worth $11.8bn and is also one of the Sultanate’s top trading partners with exports of UK goods to Oman increasing YoY. The Department of International Trade (DIT) in Muscat helped support $4bn of trade in goods and services between the UK and Oman in 2017, a 92% increase from 2016. (GulfBase.com) Bahrain’s Crown Prince expects more than $600mn in FDI this year – Bahrain’s Crown Prince, Salman Al Khalifa expects more than $600mn in FDI this year. He said, “The fiscal package from Gulf allies allows us to restructure our economy to be ready and more sustainable well into the next decade. Our government revenue did not match our economic growth and this is unsustainable. We want to move from an oil economy to a smart oil economy.” (Bloomberg)

- 8. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Aug-14 Aug-15 Aug-16 Aug-17 Aug-18 QSEIndex S&P Pan Arab S&P GCC (0.5%) (1.1%) 0.5% (0.4%) 0.1% (0.9%) (0.5%) (1.4%) (0.7%) 0.0% 0.7% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,233.75 0.3 0.6 (5.3) MSCI World Index 1,988.62 (2.2) (3.6) (5.5) Silver/Ounce 14.68 (0.3) 0.7 (13.3) DJ Industrial 24,583.42 (2.4) (3.4) (0.5) Crude Oil (Brent)/Barrel (FM Future) 76.17 (0.4) (4.5) 13.9 S&P 500 2,656.10 (3.1) (4.0) (0.7) Crude Oil (WTI)/Barrel (FM Future) 66.82 0.6 (3.3) 10.6 NASDAQ 100 7,108.40 (4.4) (4.6) 3.0 Natural Gas (Henry Hub)/MMBtu 3.43 3.3 6.5 11.0 STOXX 600 353.27 (1.0) (3.3) (14.0) LPG Propane (Arab Gulf)/Ton 85.38 4.1 (8.9) (13.8) DAX 11,191.63 (1.5) (4.2) (17.9) LPG Butane (Arab Gulf)/Ton 91.50 4.3 (11.6) (15.7) FTSE 100 6,962.98 (0.8) (2.6) (13.7) Euro 1.14 (0.7) (1.1) (5.1) CAC 40 4,953.09 (1.1) (3.7) (11.6) Yen 112.26 (0.2) (0.3) (0.4) Nikkei 22,091.18 0.1 (2.1) (2.9) GBP 1.29 (0.8) (1.5) (4.7) MSCI EM 953.05 (0.8) (1.9) (17.7) CHF 1.00 (0.3) (0.2) (2.3) SHANGHAI SE Composite 2,603.30 0.2 1.9 (26.2) AUD 0.71 (0.4) (0.8) (9.6) HANG SENG 25,249.78 (0.4) (1.2) (15.9) USD Index 96.43 0.5 0.8 4.7 BSE SENSEX 34,033.96 0.7 (0.6) (12.9) RUB 65.67 0.3 0.2 14.0 Bovespa 83,063.56 (3.2) (1.6) (3.5) BRL 0.27 (1.0) (0.6) (11.3) RTS 1,125.08 1.6 (0.2) (2.5) 74.1 74.0 71.8