QNBFS Daily Market Report September 16, 2018

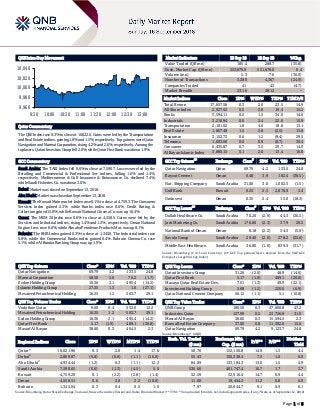

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.3% to close at 10,022.0. Gains were led by the Transportation and Real Estate indices, gaining 1.8% and 1.5%, respectively. Top gainers were Qatar Navigation and Mannai Corporation, rising 4.2% and 2.6%, respectively. Among the top losers, Qatari Investors Group fell 2.0%, while Qatar First Bank was down 1.9%. GCC Commentary Saudi Arabia: The TASI Index fell 0.6% to close at 7,590.7. Losses were led by the Retailing and Commercial & Professional Svc indices, falling 1.6% and 1.4%, respectively. Mediterranean & Gulf Insurance & Reinsurance Co. declined 7.4%, while Saudi Fisheries Co. was down 3.6%. Dubai: Market was closed on September 13, 2018. Abu Dhabi: Market was closed on September 13, 2018. Kuwait: The Kuwait Main market Index rose 0.1% to close at 4,759.3. The Consumer Services index gained 2.3%, while Banks index rose 0.6%. Credit Rating & Collection gained 12.8%, while Kuwait National Cinema Co. was up 10.4%. Oman: The MSM 30 Index rose 0.6% to close at 4,558.5. Gains were led by the Services and Industrial indices, rising 1.4% and 1.2%, respectively. Oman National Engine. Invt. rose 8.6%, while Almaha Petroleum Products Mar. was up 8.1%. Bahrain: The BHB Index gained 0.3% to close at 1,345.0. The Industrial index rose 0.8%, while the Commercial Banks index gained 0.4%. Bahrain Cinema Co. rose 5.1%, while Al Baraka Banking Group was up 1.9%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Navigation 69.79 4.2 133.5 24.8 Mannai Corporation 58.50 2.6 70.2 (1.7) Ezdan Holding Group 10.36 2.1 495.4 (14.2) Islamic Holding Group 27.35 1.3 1.0 (27.1) Mesaieed Petrochemical Holding 16.25 1.2 503.7 29.1 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 9.00 0.4 532.0 12.2 Mesaieed Petrochemical Holding 16.25 1.2 503.7 29.1 Ezdan Holding Group 10.36 2.1 495.4 (14.2) Qatar First Bank 5.17 (1.9) 489.1 (20.8) Masraf Al Rayan 38.60 0.3 404.5 2.3 Market Indicators 13 Sep 18 12 Sep 18 %Chg. Value Traded (QR mn) 185.4 288.7 (35.8) Exch. Market Cap. (QR mn) 553,879.9 551,678.0 0.4 Volume (mn) 5.3 7.6 (30.0) Number of Transactions 3,280 4,367 (24.9) Companies Traded 41 43 (4.7) Market Breadth 23:16 28:12 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,657.58 0.3 2.0 23.5 14.9 All Share Index 2,927.52 0.5 2.0 19.4 15.2 Banks 3,594.11 0.2 1.5 34.0 14.6 Industrials 3,210.94 0.0 2.4 22.6 15.9 Transportation 2,101.02 1.8 4.6 18.8 13.1 Real Estate 1,867.48 1.5 2.0 (2.5) 15.8 Insurance 3,152.73 0.6 1.2 (9.4) 29.5 Telecoms 1,003.06 0.0 0.9 (8.7) 39.4 Consumer 6,435.87 0.7 3.5 29.7 14.0 Al Rayan Islamic Index 3,880.15 0.1 2.0 13.4 16.8 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Qatar Navigation Qatar 69.79 4.2 133.5 24.8 Raysut Cement Oman 0.48 3.9 182.4 (38.5) Nat. Shipping Company Saudi Arabia 31.00 3.0 1,002.5 (1.5) Gulf Bank Kuwait 0.25 2.5 2,076.0 3.4 Ominvest Oman 0.35 2.4 13.0 (18.3) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Dallah Healthcare Co. Saudi Arabia 70.20 (2.9) 44.3 (30.5) Jarir Marketing Co. Saudi Arabia 176.80 (2.3) 37.9 20.5 National Bank of Oman Oman 0.18 (2.2) 34.5 (5.0) Savola Group Saudi Arabia 29.40 (2.0) 278.2 (25.6) Middle East Healthcare. Saudi Arabia 36.80 (1.9) 839.5 (31.7) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatari Investors Group 31.26 (2.0) 48.9 (14.6) Qatar First Bank 5.17 (1.9) 489.1 (20.8) Mazaya Qatar Real Estate Dev. 7.01 (1.3) 49.9 (22.1) Investment Holding Group 5.68 (1.2) 220.0 (6.9) Qatar National Cement Company 56.12 (1.1) 5.1 (10.8) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 180.50 0.3 47,660.8 43.2 Industries Qatar 127.99 0.2 23,726.8 31.9 Masraf Al Rayan 38.60 0.3 15,594.5 2.3 Barwa Real Estate Company 37.00 0.8 11,382.6 15.6 Qatar Navigation 69.79 4.2 9,123.7 24.8 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,021.96 0.3 2.0 1.4 17.6 50.76 152,150.8 14.9 1.5 4.4 Dubai# 2,809.87 (0.8) (0.6) (1.1) (16.6) 55.43 100,338.4 7.5 1.0 6.0 Abu Dhabi# 4,934.44 (1.2) 0.3 (1.1) 12.2 84.09 133,184.3 13.0 1.5 4.9 Saudi Arabia 7,590.65 (0.6) (1.3) (4.5) 5.0 536.66 481,747.4 16.7 1.7 3.7 Kuwait 4,759.29 0.1 (2.2) (2.8) (1.4) 52.59 32,916.4 14.7 0.9 4.4 Oman 4,558.51 0.6 2.8 3.2 (10.6) 11.08 19,444.2 11.2 0.8 6.0 Bahrain 1,345.04 0.3 0.4 0.5 1.0 7.97 20,644.7 9.1 0.9 6.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any; # Data as of September 12, 2018) 9,960 9,980 10,000 10,020 10,040 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose 0.3% to close at 10,022.0. The Transportation and Real Estate indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. Qatar Navigation and Mannai Corporation were the top gainers, rising 4.2% and 2.6%, respectively. Among the top losers, Qatari Investors Group fell 2.0%, while Qatar First Bank was down 1.9%. Volume of shares traded on Thursday fell by 30.0% to 5.3mn from 7.6mn on Wednesday. Further, as compared to the 30-day moving average of 6.3mn, volume for the day was 15.7% lower. Vodafone Qatar and Mesaieed Petrochemical Holding Company were the most active stocks, contributing 10.0% and 9.5% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 09/13 US Bureau of Labor Statistics CPI MoM August 0.2% 0.3% 0.2% 09/13 US Bureau of Labor Statistics CPI YoY August 2.7% 2.8% 2.9% 09/13 US Department of Labor Initial Jobless Claims 8-September 204k 210k 205k 09/13 US Department of Labor Continuing Claims 1-September 1,696k 1,710k 1,711k 09/14 US Federal Reserve Industrial Production MoM August 0.4% 0.3% 0.4% 09/13 Germany German Federal Statistical Office CPI MoM August F 0.1% 0.1% 0.1% 09/13 Germany German Federal Statistical Office CPI YoY August F 2.0% 2.0% 2.0% 09/13 France INSEE CPI MoM August F 0.5% 0.5% 0.5% 09/13 France INSEE CPI YoY August F 2.3% 2.3% 2.3% 09/13 Japan Bank of Japan PPI YoY August 3.0% 3.1% 3.0% 09/13 Japan Bank of Japan PPI MoM August 0.0% 0.1% 0.4% 09/14 India Directorate General of Commerce Trade Balance August -$17,394.5mn -$17,307.5mn -$18,020.0mn 09/14 India Directorate General of Commerce Exports YoY August 19.2% – 14.3% 09/14 India Directorate General of Commerce Imports YoY August 25.4% – 28.8% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar Germany could help boost Qatar SME sector – As a country whose economy is mostly driven by its small- and medium- sized enterprises (SMEs), Germany could play a significant role in helping Qatar further develop its SME ecosystem, a top bank executive said. “Germany has always been a leader or one of the leading economies in the world. Interestingly, Germany has a strong SME sector in areas like manufacturing and robotics with world leadership position,” The Commercial Bank’s CEO, Joseph Abraham told Gulf Times on the sidelines of a recently- held forum in Berlin. “And that’s where Qatar can tap into the expertise of Germany to collaborate and help build its own businesses. Qatar is building its own capabilities in the fields of self-sufficiency and technology, and I think there’s a lot of scope; and it’s at the SME level where there is a lot of scope beyond just the big companies,” he continued. According to Abraham, banks in Qatar, including The Commercial Bank, are working in partnership with Qatar Development Bank (QDB) to help support SMEs through QDB’s indirect loan facility program called ‘Al Dhameen’. (Gulf-Times.com) Qatar, Spain to step up cooperation in investment field – Qatar and Spain have agreed to establish an institutional framework for cooperation to achieve common objectives. This came in a joint statement issued in Madrid on cooperation in the field of investment between Qatar and Spain after talks by HE the Deputy Prime Minister and Minister of Foreign Affairs Sheikh Mohamed bin Abdulrahman Al-Thani and Spanish Prime Minister Pedro Sanchez. The Qatar Investment Authority (QIA) and Compania Espanola de Financiacion del Desarrollo (the Spanish development finance company) will also submit a memorandum of understanding that will set guidelines and operational procedures to promote business and joint investment, the statement added. (Gulf-Times.com) Qatar-based company plans to make electric cars – A Qatar- based company is planning to manufacture and market electric cars of different sizes and capacities, using technologies from a Japanese partner. "We will make a formal announcement of our project on September 19 in Doha," Qatar Quality Trading Company’s Managing Director, Musa Ramadan told Gulf Times. The Japanese company's (ARM) Chairman, Takayuki Hirayama is to make a presentation of the project on the occasion. Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 17.28% 34.68% (32,263,326.57) Qatari Institutions 27.90% 40.64% (23,615,799.57) Qatari 45.18% 75.32% (55,879,126.14) GCC Individuals 0.50% 1.41% (1,691,094.62) GCC Institutions 1.53% 2.17% (1,175,817.29) GCC 2.03% 3.58% (2,866,911.91) Non-Qatari Individuals 7.29% 8.39% (2,042,410.71) Non-Qatari Institutions 45.50% 12.72% 60,788,448.76 Non-Qatari 52.79% 21.11% 58,746,038.05

- 3. Page 3 of 6 Ramadan said once their plan is announced, they would proceed to secure necessary clearance from concerned departments to produce environment-friendly cars. "If everything goes well, we may be able to start its commercial production in about a year from now, from a plant to be set up somewhere on the outskirts of New Industrial Area," explained Ramadan. (Gulf-Times.com) Qatar expands economic zones to encourage SMEs – Qatar announced a major expansion of the economic zone for small and medium enterprises (SMEs) by developing an additional area of 825,000 square meters and providing the necessary infrastructure and basic services for industrial projects. Addressing a meeting organized by the Ministry of Energy and Industry at the Sheraton, HE the Minister of Energy and Industry, Mohamed bin Saleh Al-Sada said the expansion would be completed in the first quarter of 2019. With this, the total area of economic zones will exceed 11mn square meters, Al- Sada said at the event, which was attended among other dignitaries by HE the Prime Minister and Minister of Interior, Sheikh Abdullah bin Nasser bin Khalifa Al-Thani. (Gulf- Times.com) First Finance opens latest branch at Mawater City – First Finance Company (FFC), a subsidiary of Barwa Bank Group, has opened its newest branch at Mawater City. The objective of the branch (located at Area 1, opposite Aqua Park, Building number 5) is to facilitate car purchases and easy access of finance for individuals, First Finance stated. Aimed to be a one-stop-shop, this branch would assist ease to customers in buying and financing for cars. (Gulf-Times.com) MoI: Workers can complete RP process in home countries – The Visa Support Services Department at the Ministry of Interior (MoI), in collaboration with the Ministry of Administration Development, Labor and Social Affairs, has held a seminar to explain the details of an initiative that allows expatriate workers to complete Qatar residency permit (RP) procedures in their home countries. The project covers procedures such as fingerprinting and biometric data processing, medical examination and the signing of work contracts for expatriates abroad, the MoI said. The initiative was first announced in November last year, with the MoI signing an agreement with a Singapore-based company to carry out the procedures. Major Abdullah Khalifa Al-Mohannadi, Director of the Visa Support Services Department, explained the procedures for bringing expatriate workers from eight nations by completing all procedures in their home countries while the employer in Qatar can initiate the procedures electronically via the MoI website. (Gulf-Times.com) International QNB Group: World trade volume rebound weakens – After more than four years in the doldrums, world trade volumes have rebounded strongly over the last two years. However, recently, important cyclical indicators and gauges for trade momentum are starting to weaken, QNB Group noted in its ‘weekly economic commentary’. In fact, according to data from the Dutch Bureau for Economic Policy Analysis (CPB), a leading agency in the monitoring of world trade, the three-month average YoY growth in world trade volumes jumped from 2.1% over April 2012-April 2016 to 5.2% in January 2018; followed by a slow down to 3.7% in June. According to QNB Group analysts there are two main reasons for the recovery. Firstly, IMF data showed that global growth had strengthened from an average of 3.5% YoY in 2012-2016 to 3.8% in 2017, with a degree of synchronization not seen since 2010. In 2017, the Euro Area and Japan had accelerated to 2.3% and 1.7% from sluggish growth rates of 0.8% and 1.2%, between 2012 and 2016. The US economy regained momentum to grow 2.3% after its industrial sector endured a shallow recession in 2015-2016, while emerging markets (EM) were able to grow faster at 4.8%. China managed to control capital outflows and avoid a deeper deceleration or new bouts of disorderly devaluation. Secondly, commodity prices have also rebounded after the 2014-2016 weakness. According to the World Bank, both energy and non- energy commodities slumped by 69% and 25%, respectively, from June 2014 to their through in January 2016. Subsequently, they grew by 123% and 12% in the 32 months to August 2018; this is key to world trade volumes as commodities are one of the largest and most volatile portions of tradable goods. (Peninsula Qatar) US retail sales slow, but exhibit underlying strength – US retail sales recorded their smallest gain in six months in August, as consumers cut back on purchases of motor vehicles and clothing, but upward revisions to July data kept intact expectations of strong economic growth in the third quarter. Other data showed the biggest drop in import prices in more than 1-1/2 years in August, amid a decline in the cost of fuels and a range of other goods. The weak import price data came on the heels of soft inflation readings in August. Signs of cooling consumer spending and inflation did not change views that the Federal Reserve will raise interest rates later this month. The US central bank has increased borrowing costs twice this year. The Commerce Department stated retail sales edged up 0.1% last month, the smallest rise since February. Data for July was revised higher to show sales rising 0.7% instead of the previously reported 0.5% gain. Economists polled by Reuters had forecasted retail sales increasing 0.4% in August. Retail sales in August advanced 6.6% from a year ago. Excluding automobiles, gasoline, building materials and food services, retail sales nudged up 0.1% last month after an upwardly revised 0.8% jump in July. These so-called core retail sales correspond most closely with the consumer spending component of gross domestic product. Core retail sales were previously reported to have increased 0.5% in July. Despite the slowdown in core retail sales in August, consumer spending remains supported by a tightening labor market, which is steadily pushing up wages. (Reuters) Eurozone’s labor costs rise at fastest pace in nearly six years – Eurozone’s labor costs rose at their steepest rate in almost six years in the second quarter of 2018, data released showed supporting the European Central Bank (ECB), as it curbs economic stimulus. Labor costs in the 19 countries sharing the Eurozone rose by 2.2% YoY, EU statistics agency Eurostat stated, up from 2.1% in the first quarter. The increase was the highest rate since the third quarter of 2012. The ECB is on track to end bond purchases this year and raise interest rates next autumn, with inflation rebounding and growth leveling off at a relatively healthy pace. Eurozone’s wage costs rose by 1.9%, the steepest increase in a year, while non-wage labor costs were up 2.9%. Among the larger countries, labor costs rose by 3.6%

- 4. Page 4 of 6 in Italy, 2.4% in France, 2.0% in Germany and just 0.7% in Spain. (Reuters) Reuters Poll: Japan's August exports seen rising modestly, core CPI ticking up – Japan likely posted another month of only modest export gains in August amid rising worries over global trade friction, a Reuters poll showed. Exports were seen rising 5.6% in August from a year earlier, the poll of 16 economists found, after a gain of 3.9% in July. Imports likely grew 14.9% last month due to higher oil prices, which would result in a trade deficit of 468.7bn Yen ($4.19bn) for the month, the poll showed. In July, imports grew 14.6%, and the trade deficit was 231.2bn Yen. In July, Japan’s export growth slowed with shipments of cars to the US sinking. Total export orders shrank slightly in August due to weaker demand from China, a business survey showed. Japan and the US will likely hold a second round of trade talks on September 21, between Economy Minister Toshimitsu Motegi and US Trade Representative Robert Lighthizer. Japan’s core consumer inflation rate likely ticked up in August on energy costs and prices of accommodation as well as cellphone communication, analysts said. The nationwide core consumer price index (CPI), which excludes fresh food prices but includes fuel costs, likely rose 0.9% in August from a year earlier, the poll showed, slightly up from 0.8% growth in July. (Reuters) G20 trade ministers say WTO reform 'urgent' as new Trump tariffs loom – Trade and investment ministers from G20 countries meeting in Argentina said there was an “urgent need” to improve the World Trade Organization (WTO), a joint statement said. With US President Donald Trump readying tariffs on another $200bn in Chinese goods, the ministers said they were “stepping up the dialogue” on international trade disputes, according to the statement issued at the summit. It did not provide any details of possible WTO reforms or how dialogue on trade was being increased. “Obviously the new tariff measures are not positive,” Argentina’s Production and Labor Minister, Dante Sica, said in a news conference at the end of the one-day meeting. “But we need to see how things evolve.” German Deputy Economy Minister Oliver Wittke said the joint declaration sent a powerful signal about the importance of strengthening WTO “especially in times of ‘America first’ and increasing global protectionism,” with next steps to follow, when G20 leaders meet in Argentina at the end of November. (Reuters) WSJ: Trump to announce new China tariffs as early as Monday – US President Donald Trump plans to announce new tariffs of about $200bn on Chinese imports as early as Monday, the Wall Street Journal (WSJ) reported. The tariff level will likely be about 10%, below the 25% announced, when the administration first said it was considering this round of tariffs, the newspaper noted. (Reuters) Growth in Chinese home prices accelerates to two-year high – China’s home prices accelerated in August at the fastest pace in nearly two years, a sign that Beijing’s efforts to boost a slowing economy may once again be heating up frothy real estate markets. While solid growth in the sector could cushion the impact of a vigorous multi-year government crackdown on debt and escalating trade tensions with the US, it could also stoke fears of a bubble. Average new home prices in China’s 70 major cities rose 1.4% in August from a month earlier, higher than July’s reading of 1.1%, Reuters calculated from an official survey published. That marks the fastest gain since September 2016, and the 40th straight month of price increases, Reuters calculations show, despite tougher curbs designed to rein in a near-three-year real estate boom that has spilled over from megacities to the hinterland. In a sign of broadening market strength, 67 out of the 70 cities surveyed by the National Bureau of Statistics (NBS) reported a monthly price increase for new homes, up from 65 in July. Only one city - Xiamen in the south - had an actual price decline. Compared with a year ago, new home prices climbed 7%, speeding up from July’s 5.8% rise, the NBS data showed. (Reuters) Regional IEA: OPEC’s output at 9-month high as Libya, Nigeria and Saudi Arabia offset Iran – OPEC’s crude production rose to a 9-month high of 32.63mn barrels per day (bpd) in August as a significant decline in Iranian output ahead of US sanctions was offset by gains in Libya, Nigeria and Saudi Arabia, the International Energy Agency (IEA) stated in its monthly report. Iran’s production fell by 150k bpd to 3.63mn bpd, the lowest since July 2016. (Bloomberg) Saudi Aramco says reports on SABIC deal are entirely speculative – Recent media reports on the potential Saudi Aramco-SABIC transaction are entirely speculative, Saudi Aramco stated in a tweet. Saudi Aramco added that the company will provide updates when appropriate. (Bloomberg) US, Saudi Arabia forum to study role of SMEs in boosting bilateral trade – The US-Saudi Arabian Business Council, in collaboration with Saudi Aramco, the Small and Medium Enterprises General Authority, and the US Commercial Service, announced the launch of the US-Saudi Arabia SME Forum: Accelerating Growth and International Partnerships. Taking place on October 1-2, 2018, the SME Forum will offer a high level perspective on the roles of SMEs in boosting bilateral trade, sharing of know-how, and co-innovating solutions to benefit the US and Saudi Arabian markets. Edward Burton, CEO of the US-Saudi Arabian Business Council, said estimates showed that SMEs comprise 90% of businesses in Saudi Arabia and account for 60% of total employment. (GulfBase.com) Emaar Properties 'among world's 10 most valuable real estate companies' – Leading global developer Emaar Properties has been ranked as the world's largest property company outside China with a brand value of over $2.7bn, thus making it the first choice for international investors seeking high-value returns. According to Brand Finance, a leading brand valuation and strategy consultancy, Emaar Properties is also among the top 10 brands in the Middle East. The ranking underpins Emaar Properties' appeal among high net worth global investors seeking real estate investment opportunities in Dubai, with Emaar Properties already serving more than 200 nationalities as its valued customers. (GulfBase.com) Abu Dhabi Islamic Bank raises $750mn in Tier-1 perpetual Sukuk – Abu Dhabi Islamic Bank stated it has raised $750mn of additional Tier 1 through a perpetual Sukuk that complies with the Basel III regulatory framework issued by the Central Bank of the United Arab Emirates. Abu Dhabi Islamic Bank started marketing the notes on September 12, 2018. (Reuters)

- 5. Page 5 of 6 Abu Dhabi Financial Group offers revised bid for Abraaj's Middle East funds – Abu Dhabi Financial Group submitted a revised bid to acquire the management rights for the Middle East funds of stricken Dubai-based Abraaj, according to a document seen by Reuters. The Abu Dhabi-based alternative investment firm is among more than a dozen bidders seeking to buy the bulk of Abraaj’s private equity funds. However, in a letter to investors in Abraaj Funds, Abu Dhabi Financial Group stated that the bid is unlikely to materialize given the convolution of the situation. To address this, Abu Dhabi Financial Group is seeking a dedicated budget to conduct a full forensic audit and a litigation budget. Its new offer includes up to $6mn for the audit and litigation financing as well as $10mn credit facility to fund the operations of the Middle East funds. (Reuters) Abu Dhabi Ferrari park developer to move debt to invest firm – Aldar Properties plans to transfer about $1.63bn of debt to an investment firm that the Abu Dhabi Ferrari theme-park developer set up. “As a group we’re maintaining the debt policies and the dividend policies that we’ve had in the past. This action doesn’t change any of that it doesn’t change our promises to the capital market and our dividend policy,” Aldar Properties’ Chief Financial Officer, Greg Fewer said. (Gulf- Times.com) Moody's assigns ‘Ba3(hyb)’ rating to additional Tier 1 capital securities of Al Ahli Bank of Kuwait – Moody's Investors Service (Moody's) assigned a ‘Ba3(hyb)’ rating to the proposed USD-denominated, perpetual, non-cumulative additional Tier 1 (AT1) capital securities to be issued by Al Ahli Bank of Kuwait. The securities constitute direct, unconditional, subordinated and unsecured obligations of Al Ahli Bank of Kuwait. The terms and conditions of the capital securities incorporate Basel III- compliant non-viability language in accordance with Central Bank of Kuwait instructions, and will qualify as additional Tier 1 regulatory capital. The ‘Ba3(hyb)’ rating assigned to the AT1 securities is based on Al Ahli Bank of Kuwait's standalone creditworthiness and is positioned three notches below the bank's baseline credit assessment (BCA) and Adjusted BCA of ‘baa3’, in accordance with Moody's standard notching guidance for contractual non-viability preferred securities with optional non-cumulative coupon suspension. (Moody's) CBO issues treasury bills worth OMR10mn – The Central Bank of Oman (CBO) raised OMR10mn by way of allotting treasury bills last week. The treasury bills are for a maturity period of 182 days, from September 12, 2018 until March 13, 2019. The average accepted price reached 98.795 for every OMR100, and the minimum accepted price arrived at 98.790 per OMR100. Whereas the average discount rate and the average yield reached 2.41662% and 2.44610%, respectively. The interest rate on the Repo operations with CBO is 2.639% for the period from September 11, 2018 to September 17, 2018 while the discount rate on the Treasury Bills Discounting Facility with CBO is 3.389%, for the same period. (GulfBase.com) Oman says August oil output fell to 974,500 bpd – Oman’s production of crude oil and condensates dropped to an average of 974,500 bdp in August, the oil ministry stated. Oman’s crude oil and condensate production averaged 975,500 bpd in July. (Reuters) Investcorp lists sports firm Leejam on Tadawul – Bahrain-based Investcorp, a global provider and manager of alternative investment products, announced the listing of portfolio company Leejam Sports Company (Leejam) on Tadawul on September 10, 2018. Leejam marks Investcorp’s second Saudi Arabian portfolio company to successfully list on the Tadawul, the first fitness chain to list in the region, and the first company to list on the Saudi Arabian exchange so far this year. Leejam is considered the largest fitness center operator in Saudi Arabia and the MENA region, and was ranked the 17th largest company globally by the International Health, Racquet & Sports Club Association in its 2017 ‘Global 25’ list in terms of number of fully owned fitness centers. (GulfBase.com) Bahrain's waterfront project on track for 2019 launch – Work is in full swing at Sa’ada, a premium waterfront project being developed by Bahrain Real Estate Investment Company (Edamah) in the Muharraq area of the Kingdom, at an investment of BHD45mn. With the phase one work fully completed in July, the project is on schedule for completion by the fourth quarter of 2019, according to the Ministry of Works, Municipalities Affairs and Urban Planning. (GulfBase.com)

- 6. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg ( # Data as of December 12, 2018) Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 50.0 75.0 100.0 125.0 Aug-14 Aug-15 Aug-16 Aug-17 Aug-18 QSE Index S&P Pan Arab S&P GCC (0.6%) 0.3% 0.1% 0.3% 0.6% (1.2%) (0.8%) (1.5%) (1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi# Dubai# Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,193.50 (0.7) (0.2) (8.4) MSCI World Index 2,166.59 0.2 1.4 3.0 Silver/Ounce 14.06 (0.8) (0.8) (17.0) DJ Industrial 26,154.67 0.0 0.9 5.8 Crude Oil (Brent)/Barrel (FM Future) 78.09 (0.1) 1.6 16.8 S&P 500 2,904.98 0.0 1.2 8.7 Crude Oil (WTI)/Barrel (FM Future) 68.99 0.6 1.8 14.2 NASDAQ 100 8,010.04 (0.0) 1.4 16.0 Natural Gas (Henry Hub)/MMBtu 2.91 (1.7) 1.0 (17.8) STOXX 600 377.85 0.0 1.8 (6.0) LPG Propane (Arab Gulf)/Ton 105.62 0.1 0.6 8.1 DAX 12,124.33 0.2 2.1 (9.1) LPG Butane (Arab Gulf)/Ton 117.25 1.4 4.2 11.0 FTSE 100 7,304.04 0.0 1.5 (8.2) Euro 1.16 (0.6) 0.6 (3.2) CAC 40 5,352.57 0.1 2.6 (2.5) Yen 112.06 0.1 1.0 (0.6) Nikkei 23,094.67 1.1 2.6 2.0 GBP 1.31 (0.3) 1.1 (3.3) MSCI EM 1,028.53 1.1 0.5 (11.2) CHF 1.03 (0.2) 0.2 0.7 SHANGHAI SE Composite 2,681.64 (0.4) (1.0) (23.2) AUD 0.72 (0.6) 0.6 (8.4) HANG SENG 27,286.41 1.0 1.2 (9.2) USD Index 94.93 0.4 (0.5) 3.0 BSE SENSEX 38,090.64 1.0 (0.7) (0.7) RUB 68.09 (0.2) (2.6) 18.2 Bovespa 75,429.09 1.0 (2.0) (21.9) BRL 0.24 0.8 (2.8) (20.6) RTS 1,094.73 0.9 4.2 (5.2) 79.1 77.8 77.0