Final work improved 6_revised (1)

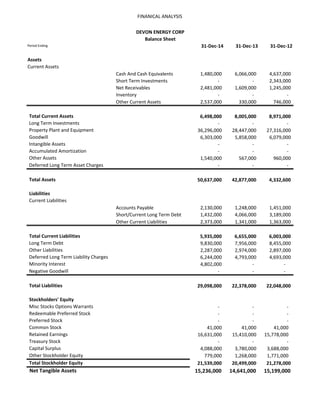

- 1. FINANICAL ANALYSIS 31-Dec-14 31-Dec-13 31-Dec-12 Cash And Cash Equivalents 1,480,000 6,066,000 4,637,000 Short Term Investments - - 2,343,000 Net Receivables 2,481,000 1,609,000 1,245,000 Inventory - - - Other Current Assets 2,537,000 330,000 746,000 6,498,000 8,005,000 8,971,000 - - - 36,296,000 28,447,000 27,316,000 6,303,000 5,858,000 6,079,000 - - - - - - 1,540,000 567,000 960,000 - - - 50,637,000 42,877,000 4,332,600 Accounts Payable 2,130,000 1,248,000 1,451,000 Short/Current Long Term Debt 1,432,000 4,066,000 3,189,000 Other Current Liabilities 2,373,000 1,341,000 1,363,000 5,935,000 6,655,000 6,003,000 9,830,000 7,956,000 8,455,000 2,287,000 2,974,000 2,897,000 6,244,000 4,793,000 4,693,000 4,802,000 - - - - - 29,098,000 22,378,000 22,048,000 - - - - - - - - - 41,000 41,000 41,000 16,631,000 15,410,000 15,778,000 - - - 4,088,000 3,780,000 3,688,000 779,000 1,268,000 1,771,000 21,539,000 20,499,000 21,278,000 15,236,000 14,641,000 15,199,000Net Tangible Assets DEVON ENERGY CORP Balance Sheet Common Stock Retained Earnings Treasury Stock Capital Surplus Other Stockholder Equity Stockholders' Equity Misc Stocks Options Warrants Redeemable Preferred Stock Preferred Stock Negative Goodwill Total Stockholder Equity Total Current Liabilities Long Term Debt Other Liabilities Deferred Long Term Liability Charges Minority Interest Liabilities Current Liabilities Total Liabilities Accumulated Amortization Other Assets Deferred Long Term Asset Charges Total Assets Total Current Assets Long Term Investments Property Plant and Equipment Goodwill Intangible Assets Period Ending Assets Current Assets

- 2. FINANICAL ANALYSIS 42,004 41,639 41,274 19,566,000 10,397,000 9,501,000 2,332,000 2,268,000 2,074,000 17,234,000 8,129,000 7,427,000 Research Development - - - Selling General and Administrative 8,290,000 2,743,000 2,457,000 Non Recurring 1,999,000 2,030,000 2,098,000 Others 3,319,000 2,780,000 2,811,000 Total Operating Expenses - - - 4,698,000 567,000 74,000 Total Other Income/Expenses Net 959,000 (10,000) (8,000) Earnings Before Interest And Taxes 4,585,000 566,000 53,000 Interest Expense 526,000 417,000 370,000 Income Before Tax 4,059,000 149,000 (317,000) Income Tax Expense 2,368,000 169,000 (132,000) Minority Interest (84,000) - - Net Income From Continuing Ops 1,691,000 (20,000) (185,000) Discontinued Operations - - (21,000) Extraordinary Items - - - Effect Of Accounting Changes - - - Other Items - - - 1,607,000 (20,000) (206,000) - - - 1,607,000 (20,000) (206,000) Net Income Preferred Stock And Other Adjustments Net Income Applicable To Common Shares Non-recurring Events Operating Income or Loss Income from Continuing Operations Gross Profit Operating Expenses Period Ending Total Revenue DEVON ENERGY CORP Income Statement Cost of Revenue

- 3. FINANICAL ANALYSIS 31-Dec-14 31-Dec-13 31-Dec-12 1,607,000 -20,000 -206,000 3,319,000 2,780,000 2,811,000 1,263,000 2,803,000 2,332,000 - - - 79,000 161,000 105,000 - - - -371,000 -288,000 -86,000 5981000 5436000 4956000 -13,450,000 -6,758,000 -8,225,000 57,000 2,343,000 -840,000 5,209,000 416,000 1,539,000 -8,184,000 -3,999,000 -7,526,000 -621,000 -348,000 -324,000 503,000 3,000 27,000 -2,234,000 361,000 1,921,000 -2,000 4,000 5,000 -2,354,000 20,000 1,629,000 -29,000 -28,000 23,000 -4,586,000 1,429,000 -918,000Change In Cash and Cash Equivalents Net Borrowings Other Cash Flows from Financing Activities Total Cash Flows From Financing Activities Effect Of Exchange Rate Changes Total Cash Flows From Investing Activities Financing Activities, Cash Flows Provided By or Used In Dividends Paid Sale Purchase of Stock Investing Activities, Cash Flows Provided By or Used In Capital Expenditures Investments Other Cash flows from Investing Activities Changes In Inventories Changes In Other Operating Activities Total Cash Flow From Operating Activities Operating Activities, Cash Flows Provided By or Used In Depreciation Adjustments To Net Income Changes In Accounts Receivables Changes In Liabilities DEVON ENERGY CORP Statement of Cash Flows Period Ending Net Income

- 4. FINANICAL ANALYSIS Historical Financial Information: YE 2014 YE 2013 YE 2012 (millions of USD) Revenue Growth (%) Revenues 19,566,000 10,397,000 9,501,000 Cost of sales 2,332,000 2,268,000 2,074,000 Selling, general and administrative expenses 4,971,000 (37,000) (354,000) Research and development expenses - - - Operating costs and expenses 5,318,000 4,810,000 4,909,000 Reported Operating Profit (EBIT) 6,945,000 3,356,000 2,872,000 Net Interest Expense 526,000 417,000 370,000 Other income/(loss) net 959,000 (10,000) (8,000) Depreciation, amortization and impairment losses 3,319,000 2,780,000 2,811,000 Debt prepayment premiums and charges and other items EBITDA 2,141,000 169,000 (301,000) Add back: Stock based compensation net of tax Add back: Revenue recognition adjustments Add back: Other Adjusted EBITDA TTM Adjusted EBITDA 2,141,000 169,000 (301,000) Net Interest Expense Net Capital Expenditures (13,450,000) (6,758,000) (8,225,000) Cash Flow from Changes in Working Capital Accounts Free Cash Flow TTM Free Cash Flow (11,309,000) (6,589,000) (8,526,000) Fiscal Year Ended,

- 5. FINANICAL ANALYSIS Period Ending 31-Dec-14 31-Dec-13 Assets Current Assets Cash And Cash Equivalents 1,480,000 3% 6,066,000.00 14% Short Term Investments - - Net Receivables 2,481,000 5% 1,609,000.00 4% Inventory - - Other Current Assets 2,537,000 5% 330,000.00 1% Total Current Assets 6,498,000 13% 8,005,000.00 19% Long Term Investments - - Property Plant and Equipment 36,296,000 72% 28,447,000.00 66% Goodwill 6,303,000 12% 5,858,000.00 14% Intangible Assets - - Accumulated Amortization - - Other Assets 1,540,000 3% 567,000.00 1% Deferred Long Term Asset Charges - - Total Assets 50,637,000 100% 42,877,000.00 100% Liabilities Current Liabilities Accounts Payable 2,130,000 4% 1,248,000.00 3% Short/Current Long Term Debt 1,432,000 3% 4,066,000.00 9% Other Current Liabilities 2,373,000 5% 1,341,000.00 3% Total Current Liabilities 5,935,000 12% 6,655,000.00 16% Long Term Debt 9,830,000 19% 7,956,000.00 19% Other Liabilities 2,287,000 5% 2,974,000.00 7% Deferred Long Term Liability Charges 6,244,000 12% 4,793,000.00 11% Minority Interest 4,802,000 9% - Negative Goodwill - - Total Liabilities 29,098,000 57% 22,378,000.00 52% Stockholders' Equity Misc Stocks Options Warrants - - Redeemable Preferred Stock - - Preferred Stock - - Common Stock 41,000 0% 41,000.00 0% Retained Earnings 16,631,000 33% 15,410,000.00 36% Treasury Stock - - Capital Surplus 4,088,000 8% 3,780,000.00 9% Other Stockholder Equity 779,000 2% 1,268,000.00 3% Total Stockholder Equity 21,539,000 43% 20,499,000.00 48% Net Tangible Assets 15,236,000 14,641,000.00 DEVON ENERGY CORP Balance Sheet

- 6. FINANICAL ANALYSIS 31-Dec-14 31-Dec-13 19,566,000 100% 10,397,000 100% 2,332,000 12% 2,268,000 22% 17,234,000 88% 8,129,000$ 78% Research Development - - Selling General and Administrative 8,290,000 42% 2,743,000 26% Non Recurring 1,999,000 10% 2,030,000 20% Others 3,319,000 17% 2,780,000 27% Total Operating Expenses - - 4,698,000 24% 567,000 5% Total Other Income/Expenses Net 959,000 5% (10,000) 0% Earnings Before Interest And Taxes 4,585,000 23% 566,000 5% Interest Expense 526,000 3% 417,000 4% Income Before Tax 4,059,000 21% 149,000 1% Income Tax Expense 2,368,000 12% 169,000 2% Minority Interest (84,000) 0% - Net Income From Continuing Ops 1,691,000 9% (20,000) 0% Discontinued Operations - - Extraordinary Items - - Effect Of Accounting Changes - - Other Items - - 1,607,000 8% (20,000) 0% - - 1,607,000 8% (20,000) 0% Net Income Preferred Stock And Other Adjustments Net Income Applicable To Common Shares Non-recurring Events Operating Income or Loss Income from Continuing Operations Gross Profit Operating Expenses DEVON ENERGY CORP Income Statement Period Ending Total Revenue Cost of Revenue

- 8. FINANCIAL ANALYSIS Ratio Analysis YE 2014 YE 2013 YE 2012 Liquidity Ratios Current Ratio 1.0949 1.2029 1.4944 Quick Ratio 1.0949 1.2029 1.4944 Asset Management Ratios Inventory Turnover (Total COGS/Inventories) N/A N/A N/A Accounts Receivable Turnover (Net Sales/AR) 7.8863 6.4618 7.6313 Days Sales Outstanding 46.2826 56.4860 47.8292 Fixed Assets Turnover 0.5391 0.3655 0.3478 Total Assets Turnover 0.3864 0.2425 2.1929 Debt Management Ratios Debt Ratio (Total debt-to-assets) 0.5746 0.5219 5.0889 Debt to Equity Ratio 1.3509 1.0917 1.0362 Liabilities-to-assets ratio Times-interest-earned ratio 8.7167 1.3573 0.1432 EBITDA coverage ratio 15.0266 8.0240 7.7405 Profitability Ratios Profit Margin (Operating) 0.2343 0.0544 0.0056 Profit Margin (NET) 0.0821 -0.0019 -0.0217 Basic Earning Power Return on Assets 0.0317 -0.0005 -0.0475 Return on Equity 0.0746 -0.0010 -0.0097 Market Value Ratios Earnings per share 3.9679 -0.0498 -0.5150 Price-to-earnings ratio 15.3608 -1220.8740 -97.7282 Cash flow per share 14.7679 13.5224 12.3900 Price-to-cash flow ratio 4.1272 4.4918 4.0621 Book Value per share (SE/#of shares) 53.1827 50.9925 53.1950 Market-to-book ratio 1.1460 1.1912 0.9461 Dec 31 2012 #of shares in thousands 50.33 400000.00 Dec 31 2013 60.74 402000.00 Dec 31 2014 60.95 405000.00 compare with peer benchmark Fiscal Year Ended,

- 9. FINANCIAL ANALYSIS Calculation 1.8316 1.8075 1.6484 2.0389 1.8316 1.8075 1.6484 2.0389 0.0000 N/A N/A N/A 7.8091 9.3699 4.4157 9.6417 53.1566 38.9547 82.6587 37.8563 0.5692 0.6443 0.4451 0.6182 0.4529 0.5141 0.3257 0.5188 0.5501 0.5533 0.6066 0.4905 1.2795 1.3338 1.5422 0.9626 0.0000 23.6472 36.9551 8.1907 25.7958 42.1070 69.7079 10.9767 45.6364 0.3680 0.1570 0.6588 0.2881 0.2254 0.0915 0.4230 0.1617 0.5953 0.5829 0.6421 0.5610 0.2094 0.1134 0.3502 0.1646 4.2596 2.8822 4.5764 5.3201 9.1796 6.7170 3.4350 17.3868 8.7828 6.9673 3.5983 15.7828 4.3361 2.7787 4.3688 5.8608 23.6008 25.4138 13.0668 32.3216 1.6089 0.7618 1.2030 2.8619 EOG 2014 Industry Avg 2014 CHK 2014 ECA 2014

- 10. 31-Dec-14 31-Dec-13 Cash And Cash Equivalents 4,146,000 912,000 Short Term Investments - - Net Receivables 2,236,000 2,445,000 Inventory - - Other Current Assets 1,086,000 299,000 7,468,000 3,656,000 271,000 481,000 32,515,000 37,134,000 - - - - - - 497,000 511,000 - - 40,751,000 41,782,000 Accounts Payable 2,406,000 1,796,000 Short/Current Long Term Debt 396,000 208,000 Other Current Liabilities 3,061,000 3,511,000 5,863,000 5,515,000 11,154,000 12,886,000 1,126,000 1,389,000 4,403,000 3,852,000 1,302,000 2,145,000 - - 22,546,000 23,642,000 - - - - 3,062,000 3,062,000 7,000 7,000 1,483,000 688,000 (37,000.00)$ (46,000.00)$ 12,531,000 12,446,000 (143,000.00)$ (162,000.00)$ 16,903,000 15,995,000 16,903,000 15,995,000 Chesapeake Energy Corporation Net Tangible Assets Treasury Stock Capital Surplus Other Stockholder Equity Total Stockholder Equity Misc Stocks Options Warrants Redeemable Preferred Stock Preferred Stock Common Stock Retained Earnings Negative Goodwill Total Liabilities Stockholders' Equity Total Current Liabilities Long Term Debt Other Liabilities Deferred Long Term Liability Charges Minority Interest Total Assets Liabilities Current Liabilities Intangible Assets Accumulated Amortization Other Assets Deferred Long Term Asset Charges Total Current Assets Long Term Investments Property Plant and Equipment Goodwill Period Ending Assets Current Assets

- 11. 31-Dec-14 31-Dec-13 Cash And Cash Equivalents 338,000 2,566,000 Short Term Investments - - Net Receivables 1,816,000 1,668,000 Inventory - - Other Current Assets 707,000 56,000 2,861,000 4,290,000 138,000 214,000 18,015,000 10,035,000 2,917,000 1,644,000 - - - - 394,000 526,000 296,000 939,000 24,621,000 17,648,000 Accounts Payable 2,386,000 1,927,000 Short/Current Long Term Debt 20,000 1,025,000 Other Current Liabilities - - 2,406,000 2,952,000 7,340,000 6,124,000 3,354,000 3,420,000 1,836,000 5,000 - - - - 14,936,000 12,501,000 - - - - - - 2,450,000 2,445,000 5,188,000 2,003,000 - - 1,358,000 15,000 689,000 684,000 9,685,000 5,147,000 6,768,000 3,503,000Net Tangible Assets Encana Corporation Treasury Stock Capital Surplus Other Stockholder Equity Total Stockholder Equity Misc Stocks Options Warrants Redeemable Preferred Stock Preferred Stock Common Stock Retained Earnings Negative Goodwill Total Liabilities Stockholders' Equity Total Current Liabilities Long Term Debt Other Liabilities Deferred Long Term Liability Charges Minority Interest Total Assets Liabilities Current Liabilities Period Ending Assets Current Assets Total Current Assets Long Term Investments Property Plant and Equipment Goodwill Intangible Assets Accumulated Amortization Other Assets Deferred Long Term Asset Charges

- 12. 31-Dec-14 31-Dec-13 31-Dec-12 Cash And Cash Equivalents 2,087,213 1,318,209 876,435 Short Term Investments - - - Net Receivables 1,870,550 1,908,256 1,685,781 Inventory 706,597 563,268 683,187 Other Current Assets 751,661 282,282 344,481 5,416,021 4,072,015 3,589,884 - - - 29,172,644 26,148,836 23,337,681 - - - - - - - - - 174,022 353,387 409,013 - - - 34,762,687 30,574,238 27,336,578 Accounts Payable 3,202,983 2,464,578 2,309,671 Short/Current Long Term Debt 6,579 134,121 414,196 Other Current Liabilities 174,746 263,017 200,191 3,384,308 2,861,716 2,924,058 5,903,354 5,906,642 5,905,602 939,497 865,067 894,758 6,822,946 5,522,354 4,327,396 - - - - - - 17,050,105 15,155,779 14,051,814 - - - - - - - - - 205,492 202,732 202,720 14,763,098 12,168,277 10,175,631 (70,102.00)$ (15,263.00)$ (33,822.00)$ 2,837,150 2,646,879 2,500,340 (23,056.00)$ 415,834 439,895 17,712,582 15,418,459 13,284,764 17,712,582 15,418,459 13,284,764 Total Stockholder Equity Net Tangible Assets EOG Resources, Inc. Common Stock Retained Earnings Treasury Stock Capital Surplus Other Stockholder Equity Stockholders' Equity Misc Stocks Options Warrants Redeemable Preferred Stock Preferred Stock Deferred Long Term Liability Charges Minority Interest Negative Goodwill Total Liabilities Current Liabilities Total Current Liabilities Long Term Debt Other Liabilities Deferred Long Term Asset Charges Total Assets Liabilities Period Ending Assets Current Assets Total Current Assets Long Term Investments Property Plant and Equipment Goodwill Intangible Assets Accumulated Amortization Other Assets

- 13. FINANCIAL ANALYSIS 31-Dec-14 31-Dec-13 20,951,000 17,506,000 13,875,000 11,356,000 7,076,000 6,150,000 Research Development - - Selling General and Administrative 554,000 686,000 Non Recurring 329,000 794,000 Others 2,915,000 2,903,000 Total Operating Expenses - - 3,477,000 2,069,000 Total Other Income/Expenses Net 11,000 (98,000.00)$ Earnings Before Interest And Taxes 3,289,000 1,669,000 Interest Expense 89,000 227,000 Income Before Tax 3,200,000 1,442,000 Income Tax Expense 1,144,000 548,000 Minority Interest (139,000.00)$ (170,000.00)$ Net Income From Continuing Ops 1,917,000 724,000 Discontinued Operations - - Extraordinary Items - - Effect Of Accounting Changes - - Other Items - - 1,917,000 724,000 (644,000.00)$ (250,000.00)$ 1,273,000 474,000 Net Income Preferred Stock And Other Adjustments Net Income Applicable To Common Shares Chesapeake Energy Corporation Income from Continuing Operations Non-recurring Events Operating Expenses Operating Income or Loss Period Ending Total Revenue Cost of Revenue Gross Profit

- 14. FINANCIAL ANALYSIS 31-Dec-14 31-Dec-13 8,019,000 5,858,000 3,431,000 2,776,000 4,588,000 3,082,000 Research Development - - Selling General and Administrative 460,000 573,000 Non Recurring - 21,000 Others 1,797,000 1,618,000 Total Operating Expenses - - 2,331,000 870,000 Total Other Income/Expenses Net 2,952,000 (319,000.00)$ Earnings Before Interest And Taxes 5,283,000 551,000 Interest Expense 654,000 563,000 Income Before Tax 4,629,000 (12,000.00)$ Income Tax Expense 1,203,000 (248,000.00)$ Minority Interest (34,000.00)$ - Net Income From Continuing Ops 3,392,000 236,000 Discontinued Operations - - Extraordinary Items - - Effect Of Accounting Changes - - Other Items - - 3,392,000 236,000 - - 3,392,000 236,000 Net Income Preferred Stock And Other Adjustments Net Income Applicable To Common Shares Encana Corporation Income from Continuing Operations Period Ending Total Revenue Cost of Revenue Gross Profit Non-recurring Events Operating Expenses Operating Income or Loss

- 15. FINANCIAL ANALYSIS 31-Dec-14 31-Dec-13 18,035,340 14,487,118 2,534,389 2,066,893 15,500,951 12,420,225 Research Development - - Selling General and Administrative 5,285,634 4,621,096 Non Recurring 976,453 522,942 Others 3,997,041 3,600,976 Total Operating Expenses - - 5,241,823 3,675,211 Total Other Income/Expenses Net (45,050.00)$ (2,865.00)$ Earnings Before Interest And Taxes 5,196,773 3,672,346 Interest Expense 201,458 235,460 Income Before Tax 4,995,315 3,436,886 Income Tax Expense 2,079,828 1,239,777 Minority Interest - - Net Income From Continuing Ops 2,915,487 2,197,109 Discontinued Operations - - Extraordinary Items - - Effect Of Accounting Changes - - Other Items - - 2,915,487 2,197,109 - - 2,915,487 2,197,109 Net Income Preferred Stock And Other Adjustments Net Income Applicable To Common Shares EOG Resources, Inc. Income from Continuing Operations Non-recurring Events Operating Expenses Operating Income or Loss Period Ending Total Revenue Cost of Revenue Gross Profit

- 16. FINANCIAL ANALYSIS Tax rate 40% ! Net operating working capital 2014 NOWC = Operating current assets - Operating current liabilities 2014 NOWC = $6,498,000 - $4,503,000 2014 NOWC = $1,995,000 2013 NOWC = Operating current assets - Operating current liabilities 2013 NOWC = $8,005,000 - $2,589,000 2013 NOWC = $5,416,000 Total net operating capital 2014 TOC = NOWC + Fixed assets 2014 TOC = $1,995,000 + $36,296,000 2014 TOC = $38,291,000 2013 TOC = NOWC + Fixed assets 2013 TOC = $5,416,000 + $28,447,000 2013 TOC = $33,863,000 Investment in total net operating capital 2014 2013 2014Inv. In TOC = TOC - TOC 2014Inv. In TOC = $38,291,000 - $33,863,000 2014Inv. In TOC = $4,428,000 Net operating profit after taxes 2014 NOPAT = EBIT x ( 1 - T ) 2014 NOPAT = $4,585,000 x 60% 2014 NOPAT = $2,751,000 Free cash flow 2014 FCF = NOPAT - Net investment in operating capital 2014 FCF = $2,751,000 - $4,428,000 2014 FCF = -$1,677,000 Return on invested capital 2014 ROIC = NOPAT / Total net operating capital 2014 ROIC = $2,751,000 / $38,291,000 2014 ROIC = 7.2% b. Identify the number of shares outstanding at the end of the year, the year-end closing stock price per share, and assume that the after-tax cost of capital is 8%. Calculate EVA and MVA for the most recent year. Key Input Data FINANCIAL ANALYSIS

- 17. FINANCIAL ANALYSIS Additional Input Data Stock price per share 60.95 # of shares (in thousands) 405000 After-tax cost of capital 8.0% Market Value Added MVA = Stock price x # of shares - Total common equity MVA = $60.95 x 405,000 - $21,539,000 MVA = $24,684,750 - $21,539,000 MVA = $3,145,750 Economic Value Added EVA = NOPAT - (Operating Capital x After-tax cost of capital) EVA = $2,751,000 - $38,291,000 x 8% EVA = $2,751,000 - $3,063,280 EVA = -$312,280 b. Identify the number of shares outstanding at the end of the year, the year-end closing stock price per share, and assume that the after-tax cost of capital is 8%. Calculate EVA and MVA for the most recent year. FINANCIAL ANALYSIS

- 18. FINANICAL ANALYSIS Brief Analysis of Devon Energy Corporation Devon Corporation is an independent leading gas exploration and production company which operates onshore of Canada and North America. The company’s head office is located in Oklahoma City, OK and it is one of well renowned fortune 500 company. Devon Energy is listed within the New York Stock Exchange, and is part of the Oil and Gas Industry, which has an Oligopolistic market Structure. Dominant Player By considering the figures for the share of Gas Sales Segment Market Share, Natural Gas Liquid Segment Market Share and Oil Sales Segment Market Share which are 14.61%, 36.8% and 17.53% respectively it can be ascertain that Devon Energy is a dominant player within its industry. Competitors of Devon Energy Corporations Followings are the some major competitors of the Devon Corporation; Abraxas Petroleum Corporations Andarako Petroleum Corporations Apache Corporations BP Plc

- 20. FINANCIAL ANALYSIS 2014 2013 2012 1.27/(1+(1-0.4)*(1.3509)) 1.27/(1+(1-0.4)*(1.0917)) 1.27/(1+(1-0.4)*(1.0362)) 0.701448187 0.767362328 0.783119157 2014 2013 2012 1.04/(1+(1-0.4)*(1.3509)) 1.04/1+(1-0.4)*(1.0917 1.04/1+(1-0.4)*(1.0362) 0.574414263 0.628391198 0.641294428 Note Part (a) Unlever Firms Beta by using the Regression model Beta Part (b) Unlever Firms Beta by using the publishing beta of Yahoo Finance Tax rate has been assumed 40%

- 21. FINANCIAL ANALYSIS 2015 2016 2017 2018 2019 Net Income 1,878,336 2,254,003 2,704,804 3,245,765 3,894,918 Depreciations 7,129,600 10,429,600 13,729,600 17,129,600 20,829,600 Changes in Working Captial 7,648 923,730 1,108,476 1,330,171 1,596,205 Operating Cash Flows 9,015,584 13,607,333 17,542,879 21,705,535 26,320,722 Capital Expenditures (35,000,000) (68,000,000) (101,000,000) (135,000,000) (172,000,000) Interest 810,615 834,933 859,981 885,781 912,354 Unleverd Free Cash Flows (25,173,801) (53,557,734) (82,597,139) (112,408,684) (144,766,923) Unleverd Free Cash Flows

- 22. FINANCIAL ANALYSIS 2014 2015 2016 2017 2018 2019 Equity $21,539,000 $22,202,230 $22,868,297 $23,554,346 $24,260,977 $24,988,806 Long Term Debt $9,830,000 $10,132,686 $10,436,667 $10,749,767 $11,072,260 $11,404,427 Interest Rate 0.075 0.080 0.080 0.080 0.080 0.080 Inerest Expense $737,250 $810,615 $834,933 $859,981 $885,781 $912,354 2014 2015 2016 2017 2018 2019 Net Receivables $2,481,000 $2,573,063 $3,087,676 $3,705,211 $4,446,253 $5,335,503 Turnover 10 In Days 38 40 40 40 40 40 Accounts Payable $2,130,000 $2,045,585 $2,454,702 $2,945,643 $3,534,771 $4,241,725 Turnover 1 In Days 264 265 265 265 265 265 Inventory N/A N/A N/A N/A N/A N/A turnover N/A N/A N/A N/A N/A N/A In days N/A N/A N/A N/A N/A N/A Net Working Capital $4,611,000 $4,618,648 $5,542,378 $6,650,853 $7,981,024 $9,577,229 Change in Working Capital $7,648 $923,730 $1,108,476 $1,330,171 $1,596,205 Capital Structures Working Capital

- 23. FINANCIAL ANALYSIS Beta of the firm 1.04 Risk Free Return 3.07% Market Risk Premium 5.78% Return on Equity by CAPM 10.41% Retun on Debt 3.46% Propotion of Debt 27.00% Propotion of Equity 73% Average Tax Rate of the firm WACC =[Cost of Debt x % Debt x (1 – Tax Rate)] + Cost of Equity x % Equity 9.83/36.17 = 0.27 Relevnat Data for the Calculation of WACC WACC= (0.27)(0.346)(0.42) + (0.73)(0.1041) = 0.0798 WACC = 7.98% 1-0.27 = 0.73 58%

- 24. FINANCIAL ANALYSIS 31-Dec-14 % 31-Dec-15 31-Dec-16 31-Dec-17 31-Dec-18 31-Dec-19 19,566,000$ 100% 20,152,980$ 20,757,569$ 21,380,296$ 22,021,705$ 22,682,357$ 2,332,000$ 12% 2,418,358$ 2,490,908$ 2,565,636$ 2,642,605$ 2,721,883$ 17,234,000$ 88% 17,734,622 18,266,661 18,814,661 19,379,101 19,960,474 Operating Expenses Research Development - Selling General and Administrative 8,290,000$ 42% 8,464,252 8,718,179 8,979,725 9,249,116 9,526,590 Non Recurring 1,999,000$ 10% 2,015,298 2,075,757 2,138,030 2,202,171 2,268,236 Others 3,319,000$ 17% 3,426,007 3,528,787 3,634,650 3,743,690 3,856,001 Total Operating Expenses - 4,698,000$ 24% 4,836,715 4,981,817 5,131,271 5,285,209 5,443,766 Income from Continuing Operations Total Other Income/Expenses Net 959,000$ 5% 1,007,649 1,037,878 1,069,015 1,101,085 1,134,118 Earnings Before Interest And Taxes 4,585,000$ 23% 4,635,185 4,774,241 4,917,468 5,064,992 5,216,942 Interest Expense 526,000$ 3% 604,589 622,727 641,409 660,651 680,471 Income Before Tax 4,059,000$ 21% 4,232,126 4,359,090 4,489,862 4,624,558 4,763,295 Income Tax Expense 2,368,000$ 12% 2,418,358 2,490,908 2,565,636 2,642,605 2,721,883 Minority Interest 84,000$ 0% Net Income From Continuing Ops 1,691,000$ 9% Non-recurring Events Discontinued Operations - Extraordinary Items - Effect Of Accounting Changes - Other Items - 1,607,000$ 8% 1,612,238 1,660,606 1,710,424 1,761,736 1,814,589 - 1,607,000$ 8% 1,612,238 1,660,606 1,710,424 1,761,736 1,814,589 Cell C5 showing the revunues of 2014 has been mulitplied by 1.03 "3%" growth rate to get the forcasted figure of sales in 2015 in Cell E5 . Simliarly Cell E5 has been multiplied by 1.03 "3% growth rate to get the forcasted figure of revenues in 2016 in Cell F 5 and So on. Rest of figures for itmes like Cost of Sales to Net Income have been calculated by multilplying the respective % to Respecive Slaes in that year. Gross Profit DEVON ENERGY CORP Forcasted Income Statement for Next Five years Period Ending Total Revenue Cost of Revenue Operating Income or Loss Net Income Preferred Stock And Other Adjustments Net Income Applicable To Common Shares Note: It has been forcasted that the growth rate for the sales revenues would be 3% for upcoming five years.

- 25. FINANCIAL ANALYSIS Period Ending 31-Dec-14 % Assets Current Assets Cash And Cash Equivalents 1,480,000 2.92% Short Term Investments - Net Receivables 2,481,000 4.90% Inventory - Other Current Assets 2,537,000 5.01% Total Current Assets 6,498,000 12.83% Long Term Investments - Property Plant and Equipment 36,296,000 71.68% Goodwill 6,303,000 12.45% Intangible Assets - Accumulated Amortization - Other Assets 1,540,000 3.04% Deferred Long Term Asset Charges - 0.00% Total Assets 50,637,000 100.00% 0.00% Liabilities 0.00% Current Liabilities 0.00% Accounts Payable 2,130,000 4.21% Short/Current Long Term Debt 1,432,000 2.83% Other Current Liabilities 2,373,000 4.69% 0.00% Total Current Liabilities 5,935,000 11.72% Long Term Debt 9,830,000 19.41% Other Liabilities 2,287,000 4.52% Deferred Long Term Liability Charges 6,244,000 12.33% Minority Interest 4,802,000 9.48% Negative Goodwill - 0.00% Total Liabilities 29,098,000 57.46% 0.00% Stockholders' Equity 0.00% Misc Stocks Options Warrants - Redeemable Preferred Stock - Preferred Stock - Common Stock 41,000 0.08% Retained Earnings 16,631,000 32.84% Treasury Stock - Capital Surplus 4,088,000 8.07% Other Stockholder Equity 779,000 1.54% 0.00% Total Stockholder Equity 21,539,000 42.54% 0.00% Net Tangible Assets 15,236,000 30.09% FORCASTED INCOME STATEMENT

- 27. FINANCIAL ANALYSIS 31-Dec-15 31-Dec-16 31-Dec-17 31-Dec-18 31-Dec-19 Sales Sales Sales Sales Sales 20,152,980 20,757,569 21,380,296 22,021,705 22,682,357 1,525,572 1,571,339 1,618,480 1,667,034 1,717,045 - - - - - 2,557,395 2,634,117 2,713,141 2,794,535 2,878,371 - - - - - 2,615,119 2,693,573 2,774,380 2,857,612 2,943,340 - - - - - - 6,899,030 7,106,000 7,319,180 7,538,756 - - - - - 37,413,629 38,536,038 39,692,119 40,882,883 42,109,369 6,497,082 6,691,995 6,892,755 7,099,537 7,312,523 - - - - - - - - - - 1,587,420 1,635,042 1,684,094 1,734,616 1,786,655 - - - - - - - - - - 52,196,218 53,762,105 55,374,968 57,036,217 58,747,303 - - - - - - - - - - - - - - - 2,195,587 2,261,455 2,329,298 2,399,177 2,471,153 1,476,094 1,520,377 1,565,988 1,612,968 1,661,357 2,446,070 2,519,452 2,595,035 2,672,886 2,753,073 - - - - - 6,117,751 6,301,284 6,490,322 6,685,032 6,885,583 10,132,686 10,436,667 10,749,767 11,072,260 11,404,427 2,357,421 2,428,144 2,500,988 2,576,018 2,653,299 6,436,266 6,629,354 6,828,234 7,033,081 7,244,074 4,949,864 5,098,359 5,251,310 5,408,850 5,571,115 - - - - - - - - - - 29,993,988 30,893,808 31,820,622 32,775,240 33,758,497 - - - - - - - - - - - - - - - - - - - - - - - - - 42,262 43,530 44,836 46,181 47,567 17,143,103 17,657,396 18,187,118 18,732,731 19,294,713 - - - - - 4,213,878 4,340,294 4,470,503 4,604,618 4,742,757 802,987 827,077 851,889 877,446 903,769 - - - - - 22,202,230 22,868,297 23,554,346 24,260,977 24,988,806 - - - - - 15,705,148 16,176,303 16,661,592 17,161,439 17,676,282 FORCASTED INCOME STATEMENT

- 28. FINANCIAL ANALYSIS Note: It has been forcasted that to generate a $1 of sales it would be required $2.59 worth of total assets for upcoming five years.(2) Total Sales in a given period like E4 has been mulitplied by 2.59 to get the total asset requird to incorporate such growth of revenues in 2015 and so on.Rest of figures for itmes like Cash and Equivalent to Stockholder's Equity have been calculated by multilplying the respective % to Respecive total assets in that year. figure of 2.59 is calcualted by dividing the Total Assets in year 2014 by the toal revenues of 2014 = 50637000/19566000."2.59 $" This shows the asset required to produce the sales of 1$.

- 29. FINANCIAL ANALYSIS Old Assets 36,296,000 36,296,000 36,296,000 36,296,000 36,296,000 New captial Expendiures 35,000,000 68,000,000 101,000,000 135,000,000 172,000,000 Total Assets 71,296,000 104,296,000 137,296,000 171,296,000 208,296,000 2,015 2,016 2,017 2,018 2,019 Capital Expendiures 35,000,000 68,000,000 101,000,000 135,000,000 172,000,000 Dereciation Total Deprecitaon 2015 3,500,000 3,500,000 2016 6,800,000 6,800,000 2017 10,100,000 10,100,000 2018 13,500,000 13,500,000 2019 17,200,000 17,200,000 Old Assets 36,296,000 36,296,000 36,296,000 36,296,000 36,296,000 Total Depreciation Depreciation 2015 3,629,600 3,629,600 2016 3,629,600 3,629,600 2017 3,629,600 3,629,600 2018 3,629,600 3,629,600 2019 3,629,600 3,629,600 Total Depreciation 2015 7,129,600 2016 10,429,600 2017 13,729,600 2018 17,129,600 2019 20,829,600 Total Assets