NHR case-studies Infographics 31.10.2019

•

0 recomendaciones•2,293 vistas

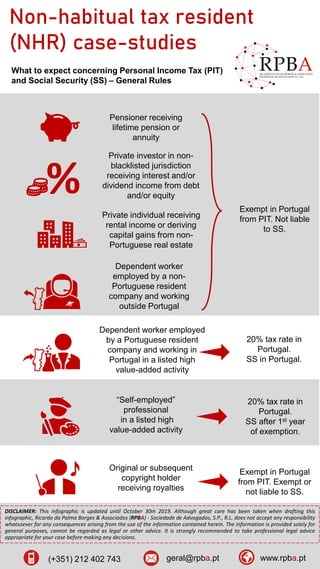

The Portuguese non-habitual tax resident regime is granted to individuals who become resident for tax purposes in Portugal. This regime may grant an exemption on certain foreign source income as well as a 20% tax rate on employment and self-employment income deriving from high value added activities during 10 years. It targets non-resident individuals who are likely to establish residence in Portugal. View a few standard case studies on this RPBA’s infographic.

Denunciar

Compartir

Denunciar

Compartir

Descargar para leer sin conexión

Recomendados

RPBA Newsletter: Cross Border Succession - Updated: 21.09.2018

RPBA Newsletter: Cross Border Succession - Updated: 21.09.2018Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

RPBA Presentation - Madeira Free Zone - Updated: 18.10.2022

RPBA Presentation - Madeira Free Zone - Updated: 18.10.2022Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) di...

Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) di...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

RPBA - Frequently Asked Questions & Reasons to Move to Portugal - Updated: 11...

RPBA - Frequently Asked Questions & Reasons to Move to Portugal - Updated: 11...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

RPBA Infographic: NHR case-studies - Updated: 09.11.2022

RPBA Infographic: NHR case-studies - Updated: 09.11.2022Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

RPBA - The Portuguese Non-Habitual Tax Resident Regime - A detailed guide on ...

RPBA - The Portuguese Non-Habitual Tax Resident Regime - A detailed guide on ...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

RPBA - Real Estate Tax Planning in Portugal - The Basics - Updated: 25.03.2022

RPBA - Real Estate Tax Planning in Portugal - The Basics - Updated: 25.03.2022Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

RPBA Presentation - The Portuguese Golden Visa Regime - Updated: 24.03.2021

RPBA Presentation - The Portuguese Golden Visa Regime - Updated: 24.03.2021Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

Recomendados

RPBA Newsletter: Cross Border Succession - Updated: 21.09.2018

RPBA Newsletter: Cross Border Succession - Updated: 21.09.2018Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

RPBA Presentation - Madeira Free Zone - Updated: 18.10.2022

RPBA Presentation - Madeira Free Zone - Updated: 18.10.2022Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) di...

Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) di...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

RPBA - Frequently Asked Questions & Reasons to Move to Portugal - Updated: 11...

RPBA - Frequently Asked Questions & Reasons to Move to Portugal - Updated: 11...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

RPBA Infographic: NHR case-studies - Updated: 09.11.2022

RPBA Infographic: NHR case-studies - Updated: 09.11.2022Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

RPBA - The Portuguese Non-Habitual Tax Resident Regime - A detailed guide on ...

RPBA - The Portuguese Non-Habitual Tax Resident Regime - A detailed guide on ...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

RPBA - Real Estate Tax Planning in Portugal - The Basics - Updated: 25.03.2022

RPBA - Real Estate Tax Planning in Portugal - The Basics - Updated: 25.03.2022Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

RPBA Presentation - The Portuguese Golden Visa Regime - Updated: 24.03.2021

RPBA Presentation - The Portuguese Golden Visa Regime - Updated: 24.03.2021Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

RPBA Newsletter - The Portuguese Non-Habitual Tax Resident Regime - Updated: ...

RPBA Newsletter - The Portuguese Non-Habitual Tax Resident Regime - Updated: ...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

Mecanismos de comunicação e troca de informações financeiras e fiscais - Actu...

Mecanismos de comunicação e troca de informações financeiras e fiscais - Actu...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

Permanent Establishment & Business Connection and it's Impact on Taxability o...

Permanent Establishment & Business Connection and it's Impact on Taxability o...DVSResearchFoundatio

Más contenido relacionado

La actualidad más candente

RPBA Newsletter - The Portuguese Non-Habitual Tax Resident Regime - Updated: ...

RPBA Newsletter - The Portuguese Non-Habitual Tax Resident Regime - Updated: ...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

Mecanismos de comunicação e troca de informações financeiras e fiscais - Actu...

Mecanismos de comunicação e troca de informações financeiras e fiscais - Actu...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

Permanent Establishment & Business Connection and it's Impact on Taxability o...

Permanent Establishment & Business Connection and it's Impact on Taxability o...DVSResearchFoundatio

La actualidad más candente (20)

RPBA Newsletter - The Portuguese Non-Habitual Tax Resident Regime - Updated: ...

RPBA Newsletter - The Portuguese Non-Habitual Tax Resident Regime - Updated: ...

Mecanismos de comunicação e troca de informações financeiras e fiscais - Actu...

Mecanismos de comunicação e troca de informações financeiras e fiscais - Actu...

Anexo II, conceptos incluidos y excluidos de la base de cotización

Anexo II, conceptos incluidos y excluidos de la base de cotización

Special provisions of presumptive taxation under income tax act 1961

Special provisions of presumptive taxation under income tax act 1961

07. payment of tax before assessment ICAB, KL, Study Manual

07. payment of tax before assessment ICAB, KL, Study Manual

VAT and Tax Govt. Treasury Deposit Code - Bangladesh

VAT and Tax Govt. Treasury Deposit Code - Bangladesh

Permanent Establishment & Business Connection and it's Impact on Taxability o...

Permanent Establishment & Business Connection and it's Impact on Taxability o...

RF Front End modules and components for cellphones 2017 - Report by Yole Deve...

RF Front End modules and components for cellphones 2017 - Report by Yole Deve...

Similar a NHR case-studies Infographics 31.10.2019

RPBA - Real Estate Tax Planning in Portugal - Update 11-04-2019

RPBA - Real Estate Tax Planning in Portugal - Update 11-04-2019Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

A. From residence to Portuguese nationality 12.04.2024

A. From residence to Portuguese nationality 12.04.2024Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

Similar a NHR case-studies Infographics 31.10.2019 (20)

NON-REGULAR TAX REGIME FOR NON-REGULAR RESIDENTS Program - E&V Presentation

NON-REGULAR TAX REGIME FOR NON-REGULAR RESIDENTS Program - E&V Presentation

Special Tax Regime for non-habitual residents in Portugal

Special Tax Regime for non-habitual residents in Portugal

Portability of a policy from France to Portugal - Baloise - Life Insurance 360

Portability of a policy from France to Portugal - Baloise - Life Insurance 360

RPBA - Real Estate Tax Planning in Portugal - Update 11-04-2019

RPBA - Real Estate Tax Planning in Portugal - Update 11-04-2019

A. From residence to Portuguese nationality 12.04.2024

A. From residence to Portuguese nationality 12.04.2024

efg thnrgbtnthbdfv e rgnethnrfrjdshrsfsmjrthgbbdsbdbdfg aefghsethdfhrshjrsf

efg thnrgbtnthbdfv e rgnethnrfrjdshrsfsmjrthgbbdsbdbdfg aefghsethdfhrshjrsf

The Legal 500 and The In-House Lawyer Comparative Legal Guide Ireland: Privat...

The Legal 500 and The In-House Lawyer Comparative Legal Guide Ireland: Privat...

Doing Business / Investing in Portugal (A quick guide)

Doing Business / Investing in Portugal (A quick guide)

The Legal 500 and The In-House Lawyer Comparative Legal Guide Ireland: Privat...

The Legal 500 and The In-House Lawyer Comparative Legal Guide Ireland: Privat...

Taxation of dividends – Get informed about whether you have to pay taxes or n...

Taxation of dividends – Get informed about whether you have to pay taxes or n...

Taxation Comparison Between The United Kingdom and Lithuania

Taxation Comparison Between The United Kingdom and Lithuania

Aija conference tlc - taxation in brazil - tax incentives for projects in i...

Aija conference tlc - taxation in brazil - tax incentives for projects in i...

Último

Último (20)

The doctrine of harmonious construction under Interpretation of statute

The doctrine of harmonious construction under Interpretation of statute

CAFC Chronicles: Costly Tales of Claim Construction Fails

CAFC Chronicles: Costly Tales of Claim Construction Fails

KEY NOTE- IBC(INSOLVENCY & BANKRUPTCY CODE) DESIGN- PPT.pptx

KEY NOTE- IBC(INSOLVENCY & BANKRUPTCY CODE) DESIGN- PPT.pptx

A SHORT HISTORY OF LIBERTY'S PROGREE THROUGH HE EIGHTEENTH CENTURY

A SHORT HISTORY OF LIBERTY'S PROGREE THROUGH HE EIGHTEENTH CENTURY

IBC (Insolvency and Bankruptcy Code 2016)-IOD - PPT.pptx

IBC (Insolvency and Bankruptcy Code 2016)-IOD - PPT.pptx

Relationship Between International Law and Municipal Law MIR.pdf

Relationship Between International Law and Municipal Law MIR.pdf

PPT- Voluntary Liquidation (Under section 59).pptx

PPT- Voluntary Liquidation (Under section 59).pptx

PowerPoint - Legal Citation Form 1 - Case Law.pptx

PowerPoint - Legal Citation Form 1 - Case Law.pptx

Police Misconduct Lawyers - Law Office of Jerry L. Steering

Police Misconduct Lawyers - Law Office of Jerry L. Steering

Presentation on Corporate SOCIAL RESPONSIBILITY- PPT.pptx

Presentation on Corporate SOCIAL RESPONSIBILITY- PPT.pptx

NHR case-studies Infographics 31.10.2019

- 1. Pensioner receiving lifetime pension or annuity Non-habitual tax resident (NHR) case-studies What to expect concerning Personal Income Tax (PIT) and Social Security (SS) – General Rules Private investor in non- blacklisted jurisdiction receiving interest and/or dividend income from debt and/or equity Exempt in Portugal from PIT. Not liable to SS. Private individual receiving rental income or deriving capital gains from non- Portuguese real estate Original or subsequent copyright holder receiving royalties Exempt in Portugal from PIT. Exempt or not liable to SS. Dependent worker employed by a non- Portuguese resident company and working outside Portugal “Self-employed” professional in a listed high value-added activity 20% tax rate in Portugal. SS after 1st year of exemption. Dependent worker employed by a Portuguese resident company and working in Portugal in a listed high value-added activity 20% tax rate in Portugal. SS in Portugal. (+351) 212 402 743 geral@rpba.pt www.rpba.pt % DISCLAIMER: This infographic is updated until October 30th 2019. Although great care has been taken when drafting this infographic, Ricardo da Palma Borges & Associados (RPBA) - Sociedade de Advogados, S.P., R.L. does not accept any responsibility whatsoever for any consequences arising from the use of the information contained herein. The information is provided solely for general purposes, cannot be regarded as legal or other advice. It is strongly recommended to take professional legal advice appropriate for your case before making any decisions.