ARCC

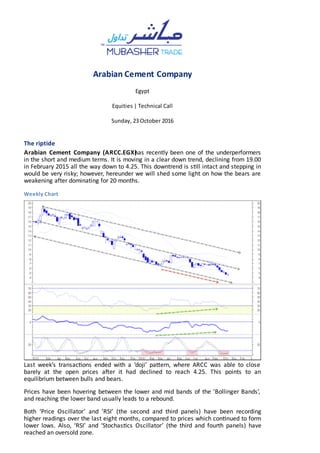

- 1. Arabian Cement Company Egypt Equities | Technical Call Sunday, 23 October 2016 The riptide Arabian Cement Company (ARCC.EGX)has recently been one of the underperformers in the short and medium terms. It is moving in a clear down trend, declining from 19.00 in February 2015 all the way down to 4.25. This downtrend is s ll intact and stepping in would be very risky; however, hereunder we will shed some light on how the bears are weakening after dominating for 20 months. Weekly Chart Last week’s transac ons ended with a ‘doji’ pa ern, where ARCC was able to close barely at the open prices a er it had declined to reach 4.25. This points to an equilibrium between bulls and bears. Prices have been hovering between the lower and mid bands of the ’Bollinger Bands’, and reaching the lower band usually leads to a rebound. Both ‘Price Oscillator’ and ’RSI’ (the second and third panels) have been recording higher readings over the last eight months, compared to prices which con nued to form lower lows. Also, ‘RSI’ and ‘Stochas cs Oscillator’ (the third and fourth panels) have reached an oversold zone.

- 2. Daily Chart Prices have reached the parallel line to the downtrend; not only that, they even skid underneath. Then they managed to proofread their path and re-enter the falling channel. On a smaller scale, ARCC broke above the downtrend line that was formed earlier this month, coinciding with the RSI rebounding from an oversold area (the second panel), positively diverging with the prices. ‘MACD’ (third panel) just generated a ‘buy’ signal. However, this does not change the fact that the downtrend is s ll intact, unless it breaks above the zero line, which it could not do last September. On the other hand, ‘MACD’ successfully spo ed the upward correction from 6.20 to 7.20 last July. Conclusion ARCC is totally controlled by bears, and stepping in is associated with high risk. Despite that, we believe those bears’ power is becoming slender, and in a few weeks we may witness a trend reversal. Hence, we recommend gradual accumula on, knowing that slipping below 4.00 calls for a ‘stop loss’, and our target lies between 5.70 -6.00. Shahd Raa'fat, CMT Senior Technical Analyst MubasherTrade Shahd.Raafat@MubasherFS.com This report is issued by Mubasher Financial Services BSC (c) is an Investment Business Firm Category 1, licensed and regulated by the Central Bank of Bahrain. Report is subject to disclosure and disclaimer mentioned here.

- 3. INSTITUTIONAL SALES MENA Inst.Sales@MubasherFS.com +971 43211167 (UAE) Egypt Institutions-Egy@Mubasher.net +202 22623310 RETAIL SALES Bahrain Global@MubasherTrade.com Call Center: +973 173 00 849 Egypt Egypt@MubasherTrade.com Call Center: 16699 / +202 2262 3230 RESEARCH Research Team Research@MubasherTrade.com Copyright ©2016, Mubasher Financial Services BSC (MFS), ALL RIGHTS RESERVED. No part or excerpt of this document may be redistributed, reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of MFS. MubasherTrade is a trademark of Mubasher Financial Services BSC. Mubasher Financial Services BSC (c) is an Investment Business Firm Category 1, licensed and regulated by the Central Bank of Bahrain.