Noble Group collateral margin call Mark melin

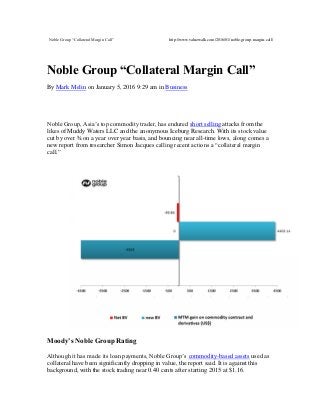

- 1. Noble Group “Collateral Margin Call” http://www.valuewalk.com/2016/01/noble-group-margin-call/ Noble Group “Collateral Margin Call” By Mark Melin on January 5, 2016 9:29 am in Business Noble Group, Asia’s top commodity trader, has endured short selling attacks from the likes of Muddy Waters LLC and the anonymous Iceburg Research. With its stock value cut by over ¾ on a year over year basis, and bouncing near all-time lows, along comes a new report from researcher Simon Jacques calling recent actions a “collateral margin call.” Moody’s Noble Group Rating Although it has made its loan payments, Noble Group’s commodity-based assets used as collateral have been significantly dropping in value, the report said. It is against this background, with the stock trading near 0.40 cents after starting 2015 at $1.16.

- 2. Moody’s has a negative outlook on the stock and Ba1 rating on senior unsecured debt. “Noble’s Ba1 corporate family and senior unsecured bond ratings reflect the low level of profitability inherent in its business, the volatility of the commodities markets in which it operates, and the consistently negative free cash flows from its core operating activities (after working capital changes) — excluding proceeds from asset sales — that it has generated while growing its business,” the Moody’s report said. Jacques sees collateral value depressed “This collateral value of Noble Group is being depressed, those loans are been called even though Noble Group never missed a payment because the market say this property and assets are worth less they claim it is worth on their books,” the report from Simon Jacques said. The report notes banks are requiring at least $1.6 billion in additional collateral that the company simply doesn’t have. This leaves limited options. “Noble is being placed into either bankruptcy or they are been place in a tremendous economics adversity that so far they’ve not seen in 2015,” Jacques said. Sale of agricultural unit was really a “margin call” The downgrade comes nearly a week after Hong Kong-based Noble Group sold its Cofco Corp. agriculture unit for nearly $750 million, a deal which helped cut debt. But Jacques calls this efforts “strictly a collateral margin call.” “Noble Group must raise money but their collateral base is new book value of $4.52 million while their Net Positive fair values gains of commodity contracts and derivatives exceeds (marked to the market) is over $4.5 million,” the report observed. “Banks aren’t provided with the access of the exact breakout of the 4,500 million and PwC has not been able to review the exact assumptions and models behind these Net Positive fair values gains of commodity contracts and derivatives.” The issue isn’t so much liquidity as much as it is solvency. The banks want more collateral. But such margin calls can be fraught with peril. “”Nothing is lost, nothing is created, and everything is transformed,” the report noted, quoting 18th century nobleman Antoine Lavoisier. Here is the entire report from Simon Jacques: Noble Group’s “Collateral Margin Call”

- 3. The downgrade of Noble Group by Moody’s depicts an aggressive financial risk and a vulnerable business risk profile* I) the first-order problem is Macro. “The downgrade of Noble Group to sub-inv. is worrisome, but the main story is about the evolution of the commodity price downtrend. 1st round effects were felt in macro indicators (lower CapEx & growth for producers and following FX/interest rate adjustments). 2nd round effects will be about commodity exporters’ governments reactions.” Those effects will dominate in 2016 said Sacha Duparc, Head trader and structurer at Banque Cantonale Vaudoise. II) Collateral margin call. The trader has billions of dollars in commodity prepays with NOCs and producer, the value of inventories and receivables collateralized by traders into trade finance arrangements have cratered in the past year. This collateral value of Noble Group is being depressed, those loans are been called even Noble Group (buoyed by liquidity in 2015) never missed a payment because the market say this property and assets are worth less they claim it is worth on their books. Banks are requiring at least 1.6 B$ more in additional collateral that Noble Group doesn’t have… Noble is being placed into either bankruptcy or they are been place in a tremendous economics adversity that so far they’ve not seen in 2015. People have been hopeful that Noble might avoid a rating downgrade after the asset sale but it couldn’t,” said a Hong Kong-based credit trader at a Japanese investment bank. Noble’s move to raise US$750 million by selling its remaining stake in Noble Agri. I repeat what have said earlier in a previous comment on FT: Noble Agri Sale was strictly a Collateral margin call. Noble Group must raise money but their collateral base is new book value of 4,528 million while their Net Positive fair values gains of commodity contracts and derivatives exceeds MTM is over 4,500 million… * Moody’s Global Credit Research – https://www.moodys.com/research/Moodys- downgrades-Noble-Group-to-Ba1-outlook-negative–PR_341857 By any model, this MTM represents between 90% and 105% of their book value. Banks aren’t provided with the access of the exact breakout of the 4,500 million and PwC has not been able to review the exact assumptions and models behind these Net Positive fair values gains of commodity contracts and derivatives. Perhaps, Antoine Lavoisier, French nobleman of the 18th century and father of modern chemistry must have a great influence on the financial reporting of Asia’s Largest Commodity trader with “Nothing is lost, nothing is created, and everything is transformed”. Solvency Problem, not liquidity I will make it clear that it is not Liquidity that banks are asking but for more Collateral from Noble starting this year because they also understand that this MTM gain on commodity contracts and derivatives of Noble will unlikely be realized at more than 10% and therefore is not valid collateral for the trader’s working capital borrowing base requirements. A close friend hedgie in NY recalled me that at the height of 08′, a IB sale desk lured them into “taking a position into undervalued trading books of the bank temporarily mispriced because of market illiquidity”. At only 66cents on the Dollar, the deal turned- out to be 0.6 cent sinky.

- 4. Enron-esque memes To put Enron in the context of 1999-2001s, it was not only the world’s largest energy trader ; it had also the same gleaming and appeal of the Trafiguras or Swiss Vitol of today. A trading or a mgnt position at Enron meant that you could do a 6 digits salary and touch a 7 digits bonus. Most of it was a management incentive program with the Enron Corp share derivatives used as a currency. Many people at other firms were lured into mngt and trading positions by commodity headhunters hired by Enron Corp providing “an offer that nobody could refuse” just months before the collapse. There are some parallels with Noble Group, one I guess is that Noble recently brought new faces people from other firms in Geneva like Kev Brassington into offers that they could not refuse in their career path… Enronesques parallels with Trafigura. Medias have recently bragged about “$775m bonuses” to 600 of Trafigura employees related to bumper profits from oil trading”. However I note in the disclaimer that’s as an all stock 5 year LOCK buyback type program, again something tied to its future performance and the commodity curve. When Enron collapsed, the story that I know is that an average trader and VP have registered 7 digits each (real losses), so it is fair to say that VPs, Management and traders were also conned. More than financial losses, can you think about the moral Mark may hold positions in one or more of the companies mentioned in this article. Tags: Moody's Noble Group Margin Call commodity derivatives Written by Mark Melin Mark Melin is an alternative investment practitioner whose specialty is recognizing a trading program’s strategy and mapping it to a market environment and performance driver. He provides analysis of managed futures investment performance and commentary regarding related managed futures market environment. A portfolio and industry consultant, he was an adjunct instructor in managed futures at Northwestern University / Chicago and has written or edited three books, including High Performance Managed Futures (Wiley 2010) and The Chicago Board of Trade’s Handbook of Futures and Options (McGraw-Hill 2008). Mark was director of the managed futures division at Alaron Trading until they were acquired by Peregrine Financial Group in 2009, where he was a registered associated person (National Futures Association NFA ID#: 0348336). Mark has also worked as a Commodity Trading Advisor himself, trading a short volatility options portfolio across the yield curve, and was an independent consultant to various broker dealers and futures exchanges, including OneChicago, the single stock futures

- 5. exchange, and the Chicago Board of Trade. He is also Editor, Opalesque Futures Intelligence and Editor, Opalesque Futures Strategies.