Gloucester, VA New School Bonds Issue - August, 2013

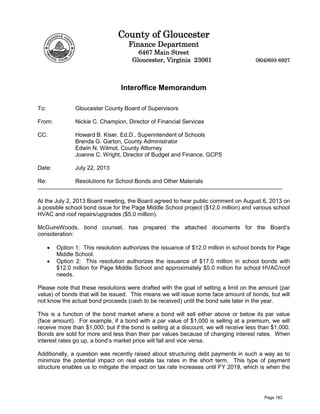

- 1. County of Gloucester Finance Department 6467 Main Street Gloucester, Virginia 23061 (804)693-6927 Interoffice Memorandum To: Gloucester County Board of Supervisors From: Nickie C. Champion, Director of Financial Services CC: Howard B. Kiser, Ed.D., Superintendent of Schools Brenda G. Garton, County Administrator Edwin N. Wilmot, County Attorney Joanne C. Wright, Director of Budget and Finance, GCPS Date: July 22, 2013 Re: Resolutions for School Bonds and Other Materials At the July 2, 2013 Board meeting, the Board agreed to hear public comment on August 6, 2013 on a possible school bond issue for the Page Middle School project ($12.0 million) and various school HVAC and roof repairs/upgrades ($5.0 million). McGuireWoods, bond counsel, has prepared the attached documents for the Board’s consideration: • Option 1: This resolution authorizes the issuance of $12.0 million in school bonds for Page Middle School. • Option 2: This resolution authorizes the issuance of $17.0 million in school bonds with $12.0 million for Page Middle School and approximately $5.0 million for school HVAC/roof needs. Please note that these resolutions were drafted with the goal of setting a limit on the amount (par value) of bonds that will be issued. This means we will issue some face amount of bonds, but will not know the actual bond proceeds (cash to be received) until the bond sale later in the year. This is a function of the bond market where a bond will sell either above or below its par value (face amount). For example, if a bond with a par value of $1,000 is selling at a premium, we will receive more than $1,000; but if the bond is selling at a discount, we will receive less than $1,000. Bonds are sold for more and less than their par values because of changing interest rates. When interest rates go up, a bond’s market price will fall and vice versa. Additionally, a question was recently raised about structuring debt payments in such a way as to minimize the potential impact on real estate tax rates in the short term. This type of payment structure enables us to mitigate the impact on tax rate increases until FY 2019, which is when the Page 182

- 2. communications system is paid in full. An example (Case 3) has been included in the discussion materials from Davenport & Company, which structures the payments in such a way that the possible tax rate increase in FY 2015 is reduced from 2.5 cents to 2.0 cents. Please note that this structure comes at a cost of approximately $303,750 (using the assumptions provided in the materials) over the life (20 years) of the debt. This debt repayment structure allows us is reduce the payments on the front end with larger payments into the term of the debt. As noted above, this option does come at a price, and extensive use of this type of repayment scheduling is not seen favorably by credit agencies. Please do not hesitate to let me know if you have any questions or need further information. Page 183

- 3. OPTION 1 AT A MEETING OF THE GLOUCESTER COUNTY BOARD OF SUPERVISORS, HELD ON TUESDAY, AUGUST 6, 2013, AT 7:00 P.M., IN THE COLONIAL COURTHOUSE, 6504 MAIN STREET GLOUCESTER, VIRGINIA: ON A MOTION MADE BY ______________________ AND SECONDED BY ____________________ THE FOLLOWING RESOLUTION WAS ADOPTED BY THE FOLLOWING VOTE: Carter M. Borden, ____; Ashley C. Chriscoe, ____; Christopher A. Hutson, ____; Andrew James, Jr., ____; John H. Northstein, ____; Robert J. Orth, ____; Louise D. Theberge, ____; RESOLUTION AUTHORIZING THE ISSUANCE AND SALE OF GENERAL OBLIGATION SCHOOL BONDS OF THE COUNTY OF GLOUCESTER, VIRGINIA TO BE SOLD TO THE VIRGINIA PUBLIC SCHOOL AUTHORITY AND PROVIDING FOR THE FORM AND DETAILS THEREOF WHEREAS, the Board of Supervisors (the "Board") of the County of Gloucester, Virginia (the "County") has determined that it is necessary and expedient to borrow an amount not to exceed the amount set forth in paragraph 1 below and to issue its general obligation school bonds to finance certain capital projects for public school purposes; WHEREAS, the Board held a public hearing on August 6, 2013, on the issuance of the Bonds (as defined below) in accordance with the requirements of Section 15.2-2606, Code of Virginia of 1950, as amended (the "Virginia Code"); WHEREAS, the School Board of the County has requested by resolution the Board to authorize the issuance of the Bonds (as hereinafter defined) and has consented to the issuance of the Bonds; WHEREAS, the County proposes to enter into a Bond Sale Agreement (the "Bond Sale Agreement") with the Virginia Public School Authority ("VPSA") which will indicate that the amount set forth below in paragraph 1 is the amount of proceeds requested (the "Proceeds Requested") from the VPSA in connection with the sale of the Bonds; WHEREAS, VPSA's objective is to pay the County a purchase price for the Bonds which, in VPSA's judgment, reflects the Bonds' market value (the Page 184

- 4. "VPSA Purchase Price Objective"), taking into consideration such factors as the amortization schedule the County has requested for the Bonds relative to the amortization schedules requested by other localities, the purchase price to be received by VPSA for its bonds, and other market conditions relating to the sale of VPSA's bonds; and WHEREAS, such factors may result in requiring the County to accept a discount, given the VPSA Purchase Price Objective and market conditions, under which circumstance the proceeds from the sale of the Bonds received by the County will be less than the Proceeds Requested. NOW, THEREFORE, BE IT RESOLVED BY THE BOARD OF SUPERVISORS OF THE COUNTY OF GLOUCESTER, VIRGINIA: 1. Authorization of Bonds and Use of Proceeds 2. . The Board hereby determines that it is advisable to contract a debt and to issue and sell general obligation school bonds of the County in the aggregate principal amount not to exceed $12,000,000 (the “Bonds”) for the purpose of financing certain capital projects for public school purposes, consisting primarily of a portion of the cost of construction and equipping of a new middle school (the “Project”). The Board hereby authorizes the issuance and sale of the Bonds in the form and upon the terms established pursuant to this Resolution. Sale of the Bonds 3. . It is determined to be in the best interest of the County to accept the offer of VPSA to purchase from the County, and to sell to VPSA, the Bonds at a price determined by VPSA and accepted by the Chairman of the Board or the County Administrator and upon the terms established pursuant to this Resolution. The County Administrator and the Chairman of the Board, or either of them, and such officer or officers of the County as either of them may designate, are hereby authorized and directed to enter the Bond Sale Agreement with the VPSA providing for the sale of the Bonds to VPSA in such form as may be approved by the Chairman of the Board and the County Administrator, or either of them. Details of the Bonds. The Bonds shall be issuable in fully registered form in denominations of $5,000 and whole multiples thereof; shall be dated the date of issuance and delivery of the Bonds; shall be designated "General Obligation School Bonds, Series 2013" (or such other designation as the County Administrator may approve) shall bear interest from the date of delivery thereof payable semi-annually on each January 15 and July 15 (each an "Interest Payment Date"), at the rates established in accordance with paragraph 4 of this Resolution; and shall mature on July 15 in the years (each a "Principal Payment Date") and in the amounts established in accordance with paragraph 4 of this Resolution. The Interest Payment Dates and the Principal Payment Dates are subject to change at the request of VPSA. Page 185

- 5. 4. Interest Rates and Principal installments 5. . The County Administrator is hereby authorized and directed to accept the interest rates on the Bonds established by VPSA, provided that the true interest cost of the Bonds does not exceed six and one-half percent (6.5%) per annum. The County Administrator is further authorized and directed to accept the aggregate principal amount of the Bonds and the amounts of principal of the Bonds coming due on each Principal Payment Date ("Principal Installments") established by VPSA, including any changes in the Interest Payment Dates, the Principal Payment Dates and the Principal Installments which may be requested by VPSA provided that such aggregate principal amount shall not exceed the maximum amount set forth in paragraph 1 above and the final maturity of the Bonds shall not be later than 26 years from their date. The execution and delivery of the Bonds as described in paragraph 8 hereof shall conclusively evidence such Interest Payment Dates, Principal Payment Dates, interest rates, principal amount and Principal Installments as having been so accepted as authorized by this Resolution. Form of the Bonds. The Bonds shall be initially in the form of a single, temporary typewritten bond substantially in the form attached hereto as Exhibit A 6. . Payment; Paying Agent and Bond Registrar (a) For as long as VPSA is the registered owner of the Bonds, all payments of principal, premium, if any, and interest on the Bonds shall be made in immediately available funds to VPSA at or before 11:00 a.m. on the applicable Interest Payment Date, Principal Payment Date or date fixed for prepayment or redemption, or if such date is not a business day for Virginia banks or for the Commonwealth of Virginia, then at or before 11:00 a.m. on the business day next succeeding such Interest Payment Date, Principal Payment Date or date fixed for prepayment or redemption. . The following provisions shall apply to the Bonds: (b) All overdue payments of principal and, to the extent permitted by law, interest shall bear interest at the applicable interest rate or rates on the Bonds. (c) The County Administrator is authorized and directed to designate a bank or trust company as Bond Registrar and Paying Agent for the Bonds. 7. Prepayment or Redemption. The Principal Installments of the Bonds held by the VPSA coming due on or before July 15, 2023, and the definitive Bonds for which the Bonds held by the VPSA may be exchanged that mature on or before July 15, 2023, are not subject to prepayment or redemption prior to their stated maturities. The Principal Installments of the Page 186

- 6. Bonds held by the VPSA coming due on or after July 15, 2024, and the definitive bonds for which the Bonds held by the VPSA may be exchanged that mature on or after July 15, 2024, are subject to prepayment or redemption at the option of the County prior to their stated maturities in whole or in part, on any date on or after July 15, 2023, upon payment of the prepayment or redemption prices (expressed as percentages of Principal Installments to be prepaid or the principal amount of the Bonds to be redeemed) set forth below plus accrued interest to the date set for prepayment or redemption: Dates Prices July 15, 2023 through July 14, 2024 ........................ 101% July 15, 2024 through July 14, 2025 ......................... 100.5 July 15, 2025 and thereafter...................................... 100; Provided, however 8. , that the Bonds shall not be subject to prepayment or redemption prior to their stated maturities as described above without first obtaining the written consent of VPSA or the registered owner of the Bonds. Notice of any such prepayment or redemption shall be given by the Bond Registrar to the registered owner by registered mail not more than ninety (90) and not less than sixty (60) days before the date fixed for prepayment or redemption. The County Administrator is authorized to approve such other redemption provisions, including changes to the redemption dates set forth above, as may be requested by VPSA. Execution of the Bonds 9. . The Chairman or Vice Chairman and the Clerk or any Deputy Clerk of the Board are authorized and directed to execute and deliver the Bonds and to affix the seal of the County thereto. The manner of such execution may be by facsimile, provided that if both signatures are by facsimile, the Bonds shall not be valid until authenticated by the manual signature of the Paying Agent. Pledge of Full Faith and Credit. For the prompt payment of the principal of, and the premium, if any, and the interest on the Bonds as the same shall become due, the full faith and credit of the County are hereby irrevocably pledged, and in each year while any of the Bonds shall be outstanding there shall be levied and collected in accordance with law an annual ad valorem tax upon all taxable property in the County subject to local taxation sufficient in amount to provide for the payment of the principal of, and the premium, if any, and the interest on the Bonds as such principal, premium, if any, and interest shall become due, which tax shall be without limitation as to rate or amount and in addition to all other taxes authorized to be levied in the County to the extent other funds of the County are not lawfully available and appropriated for such purpose. Page 187

- 7. 10. Use of Proceeds Certificate; Non-Arbitrage Certificate 11. . The Chairman of the Board and the County Administrator, or either of them and such other officer or officers of the County as either may designate are hereby authorized and directed to execute a Non-Arbitrage Certificate, if required by bond counsel, and a Use of Proceeds Certificate setting forth the expected use and investment of the proceeds of the Bonds and containing such covenants as may be necessary in order to show compliance with the provisions of the Internal Revenue Code of 1986, as amended (the "Code"), and applicable regulations relating to the exclusion from gross income of interest on the Bonds and on the bonds to be issued by the VPSA (the "VPSA Bonds"), a portion of the proceeds of which will be used to purchase the Bonds. The Board covenants on behalf of the County that (i) the proceeds from the issuance and sale of the Bonds will be invested and expended as set forth in such Use of Proceeds Certificate and the County shall comply with the covenants and representations contained therein and (ii) the County shall comply with the provisions of the Code so that interest on the Bonds and on the VPSA Bonds will remain excludable from gross income for federal income tax purposes. State Non-Arbitrage Program; Proceeds Agreement 12. . The Board hereby determines that it is in the best interests of the County to authorize and direct the County Treasurer to participate in the State Non- Arbitrage Program in connection with the Bonds. The County Administrator and the Chairman of the Board, or either of them and such officer or officers of the County as either of them may designate, are hereby authorized and directed to execute and deliver a Proceeds Agreement with respect to the deposit and investment of proceeds of the Bonds by and among the County, the other participants in the sale of the VPSA Bonds, VPSA, the investment manager, and the depository in such form as may be approved by the County Administrator, whose approval will be conclusively evidenced by the execution and delivery of the Proceeds Agreement. Continuing Disclosure Agreement 13. . The Chairman of the Board and the County Administrator, or either of them, and such other officer or officers of the County as either of them may designate are hereby authorized and directed (i) to execute a Continuing Disclosure Agreement, setting forth the reports and notices to be filed by the County and containing such covenants as may be necessary in order to show compliance with the provisions of the Securities and Exchange Commission Rule 15c2-12, under the Securities Exchange Act of 1934, as amended, and directed, and (ii) to make all filings required by the Bond Sale Agreement should the County be determined by the VPSA to be a Material Obligated Person (as defined in the Bond Sale Agreement and the Continuing Disclosure Agreement). Filing of Resolution. The appropriate officers or agents of the County are hereby authorized and directed to cause a certified copy of this Resolution to be filed with the Circuit Court of the County. Page 188

- 8. 14. Further Actions 15. . The County Administrator, the Chairman of the Board, and all such other officers, employees and agents of the County as either of them may designate are hereby authorized to take such action as the County Administrator or the Chairman of the Board may consider necessary or desirable in connection with the issuance and sale of the Bonds and any such action previously taken is hereby ratified and confirmed. Effective Date The undersigned Clerk of the Board of Supervisors of the County of Gloucester, Virginia, hereby certifies that the foregoing constitutes a true and correct extract from the minutes of a meeting of the Board of Supervisors held on ______________ 2013, and of the whole thereof so far as applicable to the matters referred to in such extract. I hereby further certify that such meeting was a regularly scheduled meeting and that, during the consideration of the foregoing resolution, a quorum was present. . This Resolution shall take effect immediately. ________________________________ Clerk, Board of Supervisors of the County of Gloucester, Virginia (SEAL) Page 189

- 9. EXHIBIT A (FORM OF TEMPORARY BOND) NO. TR-1 $____________ UNITED STATES OF AMERICA COMMONWEALTH OF VIRGINIA COUNTY OF GLOUCESTER General Obligation School Bond Series 2013 The COUNTY OF GLOUCESTER, VIRGINIA (the "County"), for value received, hereby acknowledges itself indebted and promises to pay to the VIRGINIA PUBLIC SCHOOL AUTHORITY the principal amount of ______________________ Dollars ($___________), in annual installments in the amounts set forth on Schedule I attached hereto payable on July 15, 20___ and annually on July 15 thereafter to and including July 15, 20__ (each a "Principal Payment Date"), together with interest from the date of this Bond on the unpaid installments, payable semi-annually on January 15 and July 15 of each year commencing on _______ 15, 2014 (each an "Interest Payment Date;" together with any Principal Payment Date, a "Payment Date"), at the rates per annum set forth on Schedule I For as long as the Virginia Public School Authority is the registered owner of this Bond, _______________, Richmond, Virginia, as bond registrar (the "Bond Registrar") shall make all payments of principal, premium, if any, and interest on this Bond, without presentation or surrender hereof, to the Virginia Public School Authority, in immediately available funds at or attached hereto, subject to prepayment or redemption as hereinafter provided. Both principal of and interest on this Bond are payable in lawful money of the United States of America. Page 190

- 10. before 11:00 a.m. on the applicable Payment Date or date fixed for prepayment or redemption. If a Payment Date or date fixed for prepayment or redemption is not a business day for banks in the Commonwealth of Virginia or for the Commonwealth of Virginia, then the payment of principal, premium, if any, or interest on this Bond shall be made in immediately available funds at or before 11:00 a.m. on the business day next succeeding the scheduled Payment Date or date fixed for prepayment or redemption. Upon receipt by the registered owner of this Bond of said payments of principal, premium, if any, and interest, written acknowledgment of the receipt thereof shall be given promptly to the Bond Registrar, and the County shall be fully discharged of its obligation on this Bond to the extent of the payment so made. Upon final payment, this Bond shall be surrendered to the Bond Registrar for cancellation. The full faith and credit of the County are irrevocably pledged for the payment of the principal of and the premium, if any, and interest on this Bond. The resolution adopted by the Board of Supervisors authorizing the issuance of the Bonds provides, and Section 15.2-2624 of the Code of Virginia of 1950, as amended, requires, that there shall be levied and collected an annual tax upon all taxable property in the County subject to local taxation sufficient to provide for the payment of the principal, premium, if any, and interest on this Bond as the same shall become due which tax shall be without limitation as to rate or amount and shall be in addition to all other taxes authorized to be levied in the County to the extent other funds of the County are not lawfully available and appropriated for such purpose. This Bond is duly authorized and issued in compliance with and pursuant to the Constitution and laws of the Commonwealth of Virginia, including the Public Finance Act of 1991, Chapter 26, Title 15.2, Code of Virginia of 1950, as amended, and resolutions duly Page 191

- 11. adopted by the Board of Supervisors of the County and the School Board of the County to provide funds for capital projects for school purposes. This Bond may be exchanged without cost, on twenty (20) days written notice from the Virginia Public School Authority at the office of the Bond Registrar on one or more occasions for one or more temporary bonds or definitive bonds in marketable form and, in any case, in fully registered form, in denominations of $5,000 and whole multiples thereof, having an equal aggregate principal amount, having principal installments or maturities and bearing interest at rates corresponding to the maturities of and the interest rates on the installments of principal of this Bond then unpaid. This Bond is registered in the name of the Virginia Public School Authority on the books of the County kept by the Bond Registrar, and the transfer of this Bond may be effected by the registered owner of this Bond only upon due execution of an assignment by such registered owner. Upon receipt of such assignment and the surrender of this Bond, the Bond Registrar shall exchange this Bond for definitive Bonds as hereinabove provided, such definitive Bonds to be registered on such registration books in the name of the assignee or assignees named in such assignment. The principal installments of this Bond coming due on or before July 15, 2023 and the definitive Bonds for which this Bond may be exchanged that mature on or before July 15, 2023 are not subject to prepayment or redemption prior to their stated maturities. The principal installments of this Bond coming due on or after July 15, 2024, and the definitive Bonds for which this Bond may be exchanged that mature on or after July 15, 2024 are subject to prepayment or redemption at the option of the County prior to their stated maturities in whole or in part, on any date on or after July 15, 2023, upon payment of the prepayment or redemption prices (expressed as percentages of principal installments to be prepaid or the principal amount Page 192

- 12. of the Bonds to be redeemed) set forth below plus accrued interest to the date set for prepayment or redemption: Dates Prices July 15, 2023 through July 14, 2024.................................................. 101% July 15, 2024 through July 14, 2025 ................................................... 100.5 July 15, 2025 and thereafter................................................................ 100; Provided, however All acts, conditions and things required by the Constitution and laws of the Commonwealth of Virginia to happen, exist or be performed precedent to and in the issuance of this Bond have happened, exist and have been performed in due time, form and manner as so required, and this Bond, together with all other indebtedness of the County, is within every debt and other limit prescribed by the Constitution and laws of the Commonwealth of Virginia. , that the Bonds shall not be subject to prepayment or redemption prior to their stated maturities as described above without the prior written consent of the registered owner of the Bonds. Notice of any such prepayment or redemption shall be given by the Bond Registrar to the registered owner by registered mail not more than ninety (90) and not less than sixty (60) days before the date fixed for prepayment or redemption. THE REMAINDER OF THIS PAGE IS LEFT INTENTIONALLY BLANK Page 193

- 13. IN WITNESS WHEREOF, the Board of Supervisors of the County of Gloucester, Virginia, has caused this Bond to be issued in the name of the County of Gloucester, Virginia, to be signed by its Chairman or Vice-Chairman, its seal to be affixed hereto and attested by the signature of its Clerk or any of its Deputy Clerks, and this Bond to be dated ____________, 2013. COUNTY OF GLOUCESTER, VIRGINIA [SEAL] ATTEST: By: ________________________________ Clerk, Board of Supervisors of the County of Gloucester, Virginia By: __________________________________ Chairman, Board of Supervisors of the County of Gloucester, Virginia Page 194

- 14. ASSIGNMENT FOR VALUE RECEIVED, the undersigned sells, assigns and transfers unto _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ (PLEASE PRINT OR TYPEWRITE NAME AND ADDRESS, INCLUDING ZIP CODE, OF ASSIGNEE) PLEASE INSERT SOCIAL SECURITY OR OTHER IDENTIFYING NUMBER OF ASSIGNEE: ________________________________________ the within Bond and irrevocably constitutes and appoints __________________________________________________ attorney to exchange said Bond for definitive bonds in lieu of which this Bond is issued and to register the transfer of such definitive bonds on the books kept for registration thereof, with full power of substitution in the premises. Dated: ______________________ Signature Guaranteed: ___________________________________ (NOTICE: Signature(s) must be guaranteed by an "eligible guarantor institution" meeting the requirements of the Bond Registrar which requirements will include membership or participation in STAMP or such other "signature guarantee program" as may be determined by the Bond Registrar in addition to, or in substitution for, STAMP, all in accordance with the Securities Exchange Act of 1934, as amended.) ______________________________ Registered Owner (NOTICE: The signature above must correspond with the name of the Registered Owner as it appears on the front of this Bond in every particular, without alteration or change.) Page 195

- 15. OPTION 2 AT A MEETING OF THE GLOUCESTER COUNTY BOARD OF SUPERVISORS, HELD ON TUESDAY, AUGUST 6, 2013, AT 7:00 P.M., IN THE COLONIAL COURTHOUSE, 6504 MAIN STREET GLOUCESTER, VIRGINIA: ON A MOTION MADE BY ______________________ AND SECONDED BY ____________________ THE FOLLOWING RESOLUTION WAS ADOPTED BY THE FOLLOWING VOTE: Carter M. Borden, ____; Ashley C. Chriscoe, ____; Christopher A. Hutson, ____; Andrew James, Jr., ____; John H. Northstein, ____; Robert J. Orth, ____; Louise D. Theberge, ____; RESOLUTION AUTHORIZING THE ISSUANCE AND SALE OF GENERAL OBLIGATION SCHOOL BONDS OF THE COUNTY OF GLOUCESTER, VIRGINIA TO BE SOLD TO THE VIRGINIA PUBLIC SCHOOL AUTHORITY AND PROVIDING FOR THE FORM AND DETAILS THEREOF WHEREAS, the Board of Supervisors (the "Board") of the County of Gloucester, Virginia (the "County") has determined that it is necessary and expedient to borrow an amount not to exceed the amount set forth in paragraph 1 below and to issue its general obligation school bonds to finance certain capital projects for public school purposes; WHEREAS, the Board held a public hearing on August 6, 2013, on the issuance of the Bonds (as defined below) in accordance with the requirements of Section 15.2-2606, Code of Virginia of 1950, as amended (the "Virginia Code"); WHEREAS, the School Board of the County has requested by resolution the Board to authorize the issuance of the Bonds (as hereinafter defined) and has consented to the issuance of the Bonds; WHEREAS, the County proposes to enter into a Bond Sale Agreement (the "Bond Sale Agreement") with the Virginia Public School Authority ("VPSA") which will indicate that the amount set forth below in paragraph 1 is the amount of proceeds requested (the "Proceeds Requested") from the VPSA in connection with the sale of the Bonds; WHEREAS, VPSA's objective is to pay the County a purchase price for the Bonds which, in VPSA's judgment, reflects the Bonds' market value (the Page 196

- 16. "VPSA Purchase Price Objective"), taking into consideration such factors as the amortization schedule the County has requested for the Bonds relative to the amortization schedules requested by other localities, the purchase price to be received by VPSA for its bonds, and other market conditions relating to the sale of VPSA's bonds; and WHEREAS, such factors may result in requiring the County to accept a discount, given the VPSA Purchase Price Objective and market conditions, under which circumstance the proceeds from the sale of the Bonds received by the County will be less than the Proceeds Requested. NOW, THEREFORE, BE IT RESOLVED BY THE BOARD OF SUPERVISORS OF THE COUNTY OF GLOUCESTER, VIRGINIA: 1. Authorization of Bonds and Use of Proceeds 2. . The Board hereby determines that it is advisable to contract a debt and to issue and sell general obligation school bonds of the County in the aggregate principal amount not to exceed $17,000,000 (the "Bonds") for the purpose of financing certain capital projects for public school purposes, consisting primarily of $12,000,000 to finance a portion of the costs of the construction and equipping of a new middle school and approximately $5,000,000 to finance the costs of HVAC improvements and roof repairs or replacements for various County schools (the "Project"). The Board hereby authorizes the issuance and sale of the Bonds in the form and upon the terms established pursuant to this Resolution. Sale of the Bonds 3. . It is determined to be in the best interest of the County to accept the offer of VPSA to purchase from the County, and to sell to VPSA, the Bonds at a price determined by VPSA and accepted by the Chairman of the Board or the County Administrator and upon the terms established pursuant to this Resolution. The County Administrator and the Chairman of the Board, or either of them, and such officer or officers of the County as either of them may designate, are hereby authorized and directed to enter the Bond Sale Agreement with the VPSA providing for the sale of the Bonds to VPSA in such form as may be approved by the Chairman of the Board and the County Administrator, or either of them. Details of the Bonds. The Bonds shall be issuable in fully registered form in denominations of $5,000 and whole multiples thereof; shall be dated the date of issuance and delivery of the Bonds; shall be designated "General Obligation School Bonds, Series 2013" (or such other designation as the County Administrator may approve) shall bear interest from the date of delivery thereof payable semi-annually on each January 15 and July 15 (each an "Interest Payment Date"), at the rates established in accordance with paragraph 4 of this Resolution; and shall mature on July 15 in the years (each a "Principal Payment Date") and in the amounts established in accordance with Page 197

- 17. paragraph 4 of this Resolution. The Interest Payment Dates and the Principal Payment Dates are subject to change at the request of VPSA. 4. Interest Rates and Principal installments 5. . The County Administrator is hereby authorized and directed to accept the interest rates on the Bonds established by VPSA, provided that the true interest cost of the Bonds does not exceed six and one-half percent (6.5%) per annum. The County Administrator is further authorized and directed to accept the aggregate principal amount of the Bonds and the amounts of principal of the Bonds coming due on each Principal Payment Date ("Principal Installments") established by VPSA, including any changes in the Interest Payment Dates, the Principal Payment Dates and the Principal Installments which may be requested by VPSA provided that such aggregate principal amount shall not exceed the maximum amount set forth in paragraph 1 above and the final maturity of the Bonds shall not be later than 26 years from their date. The execution and delivery of the Bonds as described in paragraph 8 hereof shall conclusively evidence such Interest Payment Dates, Principal Payment Dates, interest rates, principal amount and Principal Installments as having been so accepted as authorized by this Resolution. Form of the Bonds. The Bonds shall be initially in the form of a single, temporary typewritten bond substantially in the form attached hereto as Exhibit A 6. . Payment; Paying Agent and Bond Registrar (a) For as long as VPSA is the registered owner of the Bonds, all payments of principal, premium, if any, and interest on the Bonds shall be made in immediately available funds to VPSA at or before 11:00 a.m. on the applicable Interest Payment Date, Principal Payment Date or date fixed for prepayment or redemption, or if such date is not a business day for Virginia banks or for the Commonwealth of Virginia, then at or before 11:00 a.m. on the business day next succeeding such Interest Payment Date, Principal Payment Date or date fixed for prepayment or redemption. . The following provisions shall apply to the Bonds: (b) All overdue payments of principal and, to the extent permitted by law, interest shall bear interest at the applicable interest rate or rates on the Bonds. (c) The County Administrator is authorized and directed to designate a bank or trust company as Bond Registrar and Paying Agent for the Bonds. 7. Prepayment or Redemption. The Principal Installments of the Bonds held by the VPSA coming due on or before July 15, 2023, and the definitive Bonds for which the Bonds held by the VPSA may be exchanged that Page 198

- 18. mature on or before July 15, 2023, are not subject to prepayment or redemption prior to their stated maturities. The Principal Installments of the Bonds held by the VPSA coming due on or after July 15, 2024, and the definitive bonds for which the Bonds held by the VPSA may be exchanged that mature on or after July 15, 2024, are subject to prepayment or redemption at the option of the County prior to their stated maturities in whole or in part, on any date on or after July 15, 2023, upon payment of the prepayment or redemption prices (expressed as percentages of Principal Installments to be prepaid or the principal amount of the Bonds to be redeemed) set forth below plus accrued interest to the date set for prepayment or redemption: Dates Prices July 15, 2023 through July 14, 2024 ........................ 101% July 15, 2024 through July 14, 2025 ......................... 100.5 July 15, 2025 and thereafter...................................... 100; Provided, however 8. , that the Bonds shall not be subject to prepayment or redemption prior to their stated maturities as described above without first obtaining the written consent of VPSA or the registered owner of the Bonds. Notice of any such prepayment or redemption shall be given by the Bond Registrar to the registered owner by registered mail not more than ninety (90) and not less than sixty (60) days before the date fixed for prepayment or redemption. The County Administrator is authorized to approve such other redemption provisions, including changes to the redemption dates set forth above, as may be requested by VPSA. Execution of the Bonds 9. . The Chairman or Vice Chairman and the Clerk or any Deputy Clerk of the Board are authorized and directed to execute and deliver the Bonds and to affix the seal of the County thereto. The manner of such execution may be by facsimile, provided that if both signatures are by facsimile, the Bonds shall not be valid until authenticated by the manual signature of the Paying Agent. Pledge of Full Faith and Credit. For the prompt payment of the principal of, and the premium, if any, and the interest on the Bonds as the same shall become due, the full faith and credit of the County are hereby irrevocably pledged, and in each year while any of the Bonds shall be outstanding there shall be levied and collected in accordance with law an annual ad valorem tax upon all taxable property in the County subject to local taxation sufficient in amount to provide for the payment of the principal of, and the premium, if any, and the interest on the Bonds as such principal, premium, if any, and interest shall become due, which tax shall be without limitation as to rate or amount and in addition to all other taxes authorized to be levied in the County to the extent other funds of the County are not lawfully available and appropriated for such purpose. Page 199

- 19. 10. Use of Proceeds Certificate; Non-Arbitrage Certificate 11. . The Chairman of the Board and the County Administrator, or either of them and such other officer or officers of the County as either may designate are hereby authorized and directed to execute a Non-Arbitrage Certificate, if required by bond counsel, and a Use of Proceeds Certificate setting forth the expected use and investment of the proceeds of the Bonds and containing such covenants as may be necessary in order to show compliance with the provisions of the Internal Revenue Code of 1986, as amended (the "Code"), and applicable regulations relating to the exclusion from gross income of interest on the Bonds and on the bonds to be issued by the VPSA (the "VPSA Bonds"), a portion of the proceeds of which will be used to purchase the Bonds. The Board covenants on behalf of the County that (i) the proceeds from the issuance and sale of the Bonds will be invested and expended as set forth in such Use of Proceeds Certificate and the County shall comply with the covenants and representations contained therein and (ii) the County shall comply with the provisions of the Code so that interest on the Bonds and on the VPSA Bonds will remain excludable from gross income for federal income tax purposes. State Non-Arbitrage Program; Proceeds Agreement 12. . The Board hereby determines that it is in the best interests of the County to authorize and direct the County Treasurer to participate in the State Non- Arbitrage Program in connection with the Bonds. The County Administrator and the Chairman of the Board, or either of them and such officer or officers of the County as either of them may designate, are hereby authorized and directed to execute and deliver a Proceeds Agreement with respect to the deposit and investment of proceeds of the Bonds by and among the County, the other participants in the sale of the VPSA Bonds, VPSA, the investment manager, and the depository in such form as may be approved by the County Administrator, whose approval will be conclusively evidenced by the execution and delivery of the Proceeds Agreement. Continuing Disclosure Agreement 13. . The Chairman of the Board and the County Administrator, or either of them, and such other officer or officers of the County as either of them may designate are hereby authorized and directed (i) to execute a Continuing Disclosure Agreement, setting forth the reports and notices to be filed by the County and containing such covenants as may be necessary in order to show compliance with the provisions of the Securities and Exchange Commission Rule 15c2-12, under the Securities Exchange Act of 1934, as amended, and directed, and (ii) to make all filings required by the Bond Sale Agreement should the County be determined by the VPSA to be a Material Obligated Person (as defined in the Bond Sale Agreement and the Continuing Disclosure Agreement). Filing of Resolution. The appropriate officers or agents of the County are hereby authorized and directed to cause a certified copy of this Resolution to be filed with the Circuit Court of the County. Page 200

- 20. 14. Further Actions 15. . The County Administrator, the Chairman of the Board, and all such other officers, employees and agents of the County as either of them may designate are hereby authorized to take such action as the County Administrator or the Chairman of the Board may consider necessary or desirable in connection with the issuance and sale of the Bonds and any such action previously taken is hereby ratified and confirmed. Effective Date The undersigned Clerk of the Board of Supervisors of the County of Gloucester, Virginia, hereby certifies that the foregoing constitutes a true and correct extract from the minutes of a meeting of the Board of Supervisors held on ______________ 2013, and of the whole thereof so far as applicable to the matters referred to in such extract. I hereby further certify that such meeting was a regularly scheduled meeting and that, during the consideration of the foregoing resolution, a quorum was present. . This Resolution shall take effect immediately. ________________________________ Clerk, Board of Supervisors of the County of Gloucester, Virginia (SEAL) Page 201

- 21. EXHIBIT A (FORM OF TEMPORARY BOND) NO. TR-1 $____________ UNITED STATES OF AMERICA COMMONWEALTH OF VIRGINIA COUNTY OF GLOUCESTER General Obligation School Bond Series 2013 The COUNTY OF GLOUCESTER, VIRGINIA (the "County"), for value received, hereby acknowledges itself indebted and promises to pay to the VIRGINIA PUBLIC SCHOOL AUTHORITY the principal amount of ______________________ Dollars ($___________), in annual installments in the amounts set forth on Schedule I attached hereto payable on July 15, 20___ and annually on July 15 thereafter to and including July 15, 20__ (each a "Principal Payment Date"), together with interest from the date of this Bond on the unpaid installments, payable semi-annually on January 15 and July 15 of each year commencing on _______ 15, 2014 (each an "Interest Payment Date;" together with any Principal Payment Date, a "Payment Date"), at the rates per annum set forth on Schedule I For as long as the Virginia Public School Authority is the registered owner of this Bond, _______________, Richmond, Virginia, as bond registrar (the "Bond Registrar") shall make all payments of principal, premium, if any, and interest on this Bond, without presentation or surrender hereof, to the Virginia Public School Authority, in immediately available funds at or attached hereto, subject to prepayment or redemption as hereinafter provided. Both principal of and interest on this Bond are payable in lawful money of the United States of America. Page 202

- 22. before 11:00 a.m. on the applicable Payment Date or date fixed for prepayment or redemption. If a Payment Date or date fixed for prepayment or redemption is not a business day for banks in the Commonwealth of Virginia or for the Commonwealth of Virginia, then the payment of principal, premium, if any, or interest on this Bond shall be made in immediately available funds at or before 11:00 a.m. on the business day next succeeding the scheduled Payment Date or date fixed for prepayment or redemption. Upon receipt by the registered owner of this Bond of said payments of principal, premium, if any, and interest, written acknowledgment of the receipt thereof shall be given promptly to the Bond Registrar, and the County shall be fully discharged of its obligation on this Bond to the extent of the payment so made. Upon final payment, this Bond shall be surrendered to the Bond Registrar for cancellation. The full faith and credit of the County are irrevocably pledged for the payment of the principal of and the premium, if any, and interest on this Bond. The resolution adopted by the Board of Supervisors authorizing the issuance of the Bonds provides, and Section 15.2-2624 of the Code of Virginia of 1950, as amended, requires, that there shall be levied and collected an annual tax upon all taxable property in the County subject to local taxation sufficient to provide for the payment of the principal, premium, if any, and interest on this Bond as the same shall become due which tax shall be without limitation as to rate or amount and shall be in addition to all other taxes authorized to be levied in the County to the extent other funds of the County are not lawfully available and appropriated for such purpose. This Bond is duly authorized and issued in compliance with and pursuant to the Constitution and laws of the Commonwealth of Virginia, including the Public Finance Act of 1991, Chapter 26, Title 15.2, Code of Virginia of 1950, as amended, and resolutions duly Page 203

- 23. adopted by the Board of Supervisors of the County and the School Board of the County to provide funds for capital projects for school purposes. This Bond may be exchanged without cost, on twenty (20) days written notice from the Virginia Public School Authority at the office of the Bond Registrar on one or more occasions for one or more temporary bonds or definitive bonds in marketable form and, in any case, in fully registered form, in denominations of $5,000 and whole multiples thereof, having an equal aggregate principal amount, having principal installments or maturities and bearing interest at rates corresponding to the maturities of and the interest rates on the installments of principal of this Bond then unpaid. This Bond is registered in the name of the Virginia Public School Authority on the books of the County kept by the Bond Registrar, and the transfer of this Bond may be effected by the registered owner of this Bond only upon due execution of an assignment by such registered owner. Upon receipt of such assignment and the surrender of this Bond, the Bond Registrar shall exchange this Bond for definitive Bonds as hereinabove provided, such definitive Bonds to be registered on such registration books in the name of the assignee or assignees named in such assignment. The principal installments of this Bond coming due on or before July 15, 2023 and the definitive Bonds for which this Bond may be exchanged that mature on or before July 15, 2023 are not subject to prepayment or redemption prior to their stated maturities. The principal installments of this Bond coming due on or after July 15, 2024, and the definitive Bonds for which this Bond may be exchanged that mature on or after July 15, 2024 are subject to prepayment or redemption at the option of the County prior to their stated maturities in whole or in part, on any date on or after July 15, 2023, upon payment of the prepayment or redemption prices (expressed as percentages of principal installments to be prepaid or the principal amount Page 204

- 24. of the Bonds to be redeemed) set forth below plus accrued interest to the date set for prepayment or redemption: Dates Prices July 15, 2023 through July 14, 2024.................................................. 101% July 15, 2024 through July 14, 2025 ................................................... 100.5 July 15, 2025 and thereafter................................................................ 100; Provided, however All acts, conditions and things required by the Constitution and laws of the Commonwealth of Virginia to happen, exist or be performed precedent to and in the issuance of this Bond have happened, exist and have been performed in due time, form and manner as so required, and this Bond, together with all other indebtedness of the County, is within every debt and other limit prescribed by the Constitution and laws of the Commonwealth of Virginia. , that the Bonds shall not be subject to prepayment or redemption prior to their stated maturities as described above without the prior written consent of the registered owner of the Bonds. Notice of any such prepayment or redemption shall be given by the Bond Registrar to the registered owner by registered mail not more than ninety (90) and not less than sixty (60) days before the date fixed for prepayment or redemption. THE REMAINDER OF THIS PAGE IS LEFT INTENTIONALLY BLANK Page 205

- 25. IN WITNESS WHEREOF, the Board of Supervisors of the County of Gloucester, Virginia, has caused this Bond to be issued in the name of the County of Gloucester, Virginia, to be signed by its Chairman or Vice-Chairman, its seal to be affixed hereto and attested by the signature of its Clerk or any of its Deputy Clerks, and this Bond to be dated ____________, 2013. COUNTY OF GLOUCESTER, VIRGINIA [SEAL] ATTEST: By: ________________________________ Clerk, Board of Supervisors of the County of Gloucester, Virginia By: __________________________________ Chairman, Board of Supervisors of the County of Gloucester, Virginia Page 206

- 26. ASSIGNMENT FOR VALUE RECEIVED, the undersigned sells, assigns and transfers unto _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ (PLEASE PRINT OR TYPEWRITE NAME AND ADDRESS, INCLUDING ZIP CODE, OF ASSIGNEE) PLEASE INSERT SOCIAL SECURITY OR OTHER IDENTIFYING NUMBER OF ASSIGNEE: ________________________________________ the within Bond and irrevocably constitutes and appoints __________________________________________________ attorney to exchange said Bond for definitive bonds in lieu of which this Bond is issued and to register the transfer of such definitive bonds on the books kept for registration thereof, with full power of substitution in the premises. Dated: ______________________ Signature Guaranteed: ___________________________________ (NOTICE: Signature(s) must be guaranteed by an "eligible guarantor institution" meeting the requirements of the Bond Registrar which requirements will include membership or participation in STAMP or such other "signature guarantee program" as may be determined by the Bond Registrar in addition to, or in substitution for, STAMP, all in accordance with the Securities Exchange Act of 1934, as amended.) ______________________________ Registered Owner (NOTICE: The signature above must correspond with the name of the Registered Owner as it appears on the front of this Bond in every particular, without alteration or change.) Page 207

- 27. Discussion Materials County of Gloucester, VA Prepared By Davenport & Company LLC Member NYSE - FINRA - SIPC August 6, 2013 1 Page 208

- 28. DAVENPORT & COMPANY LLC County of Gloucester, VA 2 Background Gloucester County (the “County”) is currently in the process of planning for and financing the Construction of Page Middle School. The Construction is estimated to cost $26 million and the construction bids are expected to be received this month (i.e. July 2013). The Construction is expected to be financed as follows: Insurance Payout: $8,000,000 (To be Received) Qualified School Construction Bonds: 6,000,000 (Already Received) Remaining Required Financing: 12,000,000 (To be Received) Total: $26,000,000 The County also expects a VDOT Revenue Sharing Grant of approximately $1,000,000. Additionally, the County has a $5,000,000 need for School Capital in its Adopted Fiscal Year 2014 Budget related to HVAC and Roof Projects. Page 209

- 29. DAVENPORT & COMPANY LLC County of Gloucester, VA 3 New Money Financings Following discussions with County Staff, Davenport & Company LLC (“Davenport”) has developed three models examining Debt Affordability, which can be found on the following pages and are comprised of the following: Case 1: $12 Million New Money Financing (Page Middle School Only) Case 2: $17 Million New Money Financing (Page Middle School and HVAC/Roof Projects) Case 3: $12 Million New Money Financing (Page Middle School Only) with alternative principal repayment structure All cases assume that the borrowing occurs as part of the Fall 2013 Virginia Public School Authority Pooled Bond Issuance. A 20 Year Level Debt Service structure has been assumed for Cases 1 and 2; Case 3 assumes a structured principal amortization. All Cases assume that 1¢ is equal to $400,000, and is not expected to grow in value. While the VPSA Schedule is not yet available, VPSA has typically closed its Fall Pool Bond Issuance in the November timeframe (i.e. the County can likely expect to receive funds around this time). Page 210

- 30. DAVENPORT & COMPANY LLC County of Gloucester, VA 4 Debt Affordability Analysis – Case 1 A B C D E F G H I J K L FY Existing DS(1) FY2014 Remaining Required Financing(2) Total FY2014 Net Budget Appropriation(1,3) FY2015 Tax Increase(4) Total Revenues Available Surplus/ (Deficit) Capital Reserve Utilized Adjusted Surplus/ (Deficit) Estimated Incremental Tax Equivalent Capital Reserve Fund Balance 2014 4,397,219 - 4,397,219 4,397,219 - 4,397,219 - - - -- - 2015 4,371,318 919,375 5,290,693 4,397,219 1,000,000 5,397,219 106,527 - 106,527 2.50 106,527 2016 4,260,521 919,750 5,180,271 4,397,219 1,000,000 5,397,219 216,948 - 216,948 -- 323,475 2017 4,234,812 921,300 5,156,112 4,397,219 1,000,000 5,397,219 241,108 - 241,108 -- 564,583 2018 4,101,627 921,950 5,023,577 4,397,219 1,000,000 5,397,219 373,642 - 373,642 -- 938,225 2019 2,884,809 921,700 3,806,509 4,397,219 1,000,000 5,397,219 1,590,711 - 1,590,711 -- 2,528,936 2020 2,644,223 920,550 3,564,773 4,397,219 1,000,000 5,397,219 1,832,446 - 1,832,446 -- 4,361,382 2021 2,633,104 918,500 3,551,604 4,397,219 1,000,000 5,397,219 1,845,616 - 1,845,616 -- 6,206,998 2022 2,627,046 920,438 3,547,483 4,397,219 1,000,000 5,397,219 1,849,736 - 1,849,736 -- 8,056,734 2023 2,595,417 921,250 3,516,667 4,397,219 1,000,000 5,397,219 1,880,552 - 1,880,552 -- 9,937,286 2024 2,583,412 920,938 3,504,349 4,397,219 1,000,000 5,397,219 1,892,870 - 1,892,870 -- 11,830,156 2025 1,851,370 919,500 2,770,870 4,397,219 1,000,000 5,397,219 2,626,349 - 2,626,349 -- 14,456,506 2026 1,839,343 916,938 2,756,281 4,397,219 1,000,000 5,397,219 2,640,939 - 2,640,939 -- 17,097,445 2027 1,824,937 918,138 2,743,075 4,397,219 1,000,000 5,397,219 2,654,145 - 2,654,145 -- 19,751,590 2028 1,319,919 917,988 2,237,907 4,397,219 1,000,000 5,397,219 3,159,313 - 3,159,313 -- 22,910,902 2029 935,670 921,375 1,857,045 4,397,219 1,000,000 5,397,219 3,540,175 - 3,540,175 -- 26,451,077 2030 936,032 918,300 1,854,332 4,397,219 1,000,000 5,397,219 3,542,887 - 3,542,887 -- 29,993,964 2031 939,233 918,763 1,857,995 4,397,219 1,000,000 5,397,219 3,539,224 - 3,539,224 -- 33,533,188 2032 307,256 917,650 1,224,906 4,397,219 1,000,000 5,397,219 4,172,314 - 4,172,314 -- 37,705,502 2033 307,257 919,850 1,227,107 4,397,219 1,000,000 5,397,219 4,170,113 - 4,170,113 -- 41,875,614 2034 307,257 920,250 1,227,507 4,397,219 1,000,000 5,397,219 4,169,713 - 4,169,713 -- 46,045,327 2035 297,235 - 297,235 4,397,219 1,000,000 5,397,219 5,099,985 - 5,099,985 -- 51,145,312 Total 48,199,016 18,394,500 66,593,516 Total - Total TaxEffect 2.50¢ (1)Assumes the Federal Subsidies on the QSCBs are equal to 91.3% of the interest payments on the QSCBs, per the County's Budget; also includes the VRS Refunding Note. (2)Assumes the $12,000,000 FY 2014 Remaining Required Financing is borrowed at 4.5% over 20 years with debt service payments beginning in FY 2015. (3)Assumes the County budgets its FY 2014 Debt Service going forward. (4)Assumes the value of 1 penny is equal to $400,000 and does not grow over time. Revenues Available for Debt ServiceDebt Service Requirements Debt Service Cash Flow Surplus (Deficit) Page 211

- 31. DAVENPORT & COMPANY LLC County of Gloucester, VA 0% 2% 4% 6% 8% 10% 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Page Middle Budgeted/Projected Utility Transfer Existing Policy 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2014 2016 2018 2020 2022 2024 2026 2028 2030 2032 2034 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Page Middle Existing Policy $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Page Middle Existing Policy 5 Key Debt Ratios – Case 1 10-Year Payout Ratio Debt per Capita Debt to Assessed Value Debt Service vs. Expenditures Fiscal Payout Year Ratio 2014 60.1% 2015 63.5% 2016 65.7% 2017 68.2% 2018 71.4% 2019 73.9% 2020 76.9% 2021 80.7% 2022 85.4% 2023 88.5% 2024 92.7% 2025 98.4% 2026 100.0% 2027 100.0% 2028 100.0% 2029 100.0% 2030 100.0% 2031 100.0% 2032 100.0% 2033 100.0% 2034 100.0% 2035 100.0% Page 212

- 32. DAVENPORT & COMPANY LLC County of Gloucester, VA 6 Debt Affordability Analysis – Case 2 A B C D E F G H I J K L M FY Existing DS(1) FY2014 Remaining Required Financing(2) FY2014 HVAC/Roof Repair Financing(3) Total FY2014 Net Budget Appropriation(1,4) FY2015 Tax Increase(5) Total Revenues Available Surplus/ (Deficit) Capital Reserve Utilized Adjusted Surplus/ (Deficit) Estimated Incremental Tax Equivalent Capital Reserve Fund Balance 2014 4,397,219 - - 4,397,219 4,397,219 - 4,397,219 - - - -- - 2015 4,371,318 919,375 383,073 5,673,766 4,397,219 1,400,000 5,797,219 123,454 - 123,454 3.50 123,454 2016 4,260,521 919,750 383,229 5,563,500 4,397,219 1,400,000 5,797,219 233,719 - 233,719 -- 357,173 2017 4,234,812 921,300 383,875 5,539,987 4,397,219 1,400,000 5,797,219 257,233 - 257,233 -- 614,406 2018 4,101,627 921,950 384,146 5,407,723 4,397,219 1,400,000 5,797,219 389,496 - 389,496 -- 1,003,902 2019 2,884,809 921,700 384,042 4,190,550 4,397,219 1,400,000 5,797,219 1,606,669 - 1,606,669 -- 2,610,571 2020 2,644,223 920,550 383,563 3,948,336 4,397,219 1,400,000 5,797,219 1,848,884 - 1,848,884 -- 4,459,455 2021 2,633,104 918,500 382,708 3,934,312 4,397,219 1,400,000 5,797,219 1,862,908 - 1,862,908 -- 6,322,362 2022 2,627,046 920,438 383,516 3,930,999 4,397,219 1,400,000 5,797,219 1,866,221 - 1,866,221 -- 8,188,583 2023 2,595,417 921,250 383,854 3,900,521 4,397,219 1,400,000 5,797,219 1,896,698 - 1,896,698 -- 10,085,281 2024 2,583,412 920,938 383,724 3,888,073 4,397,219 1,400,000 5,797,219 1,909,146 - 1,909,146 -- 11,994,427 2025 1,851,370 919,500 383,125 3,153,995 4,397,219 1,400,000 5,797,219 2,643,224 - 2,643,224 -- 14,637,652 2026 1,839,343 916,938 382,057 3,138,338 4,397,219 1,400,000 5,797,219 2,658,882 - 2,658,882 -- 17,296,533 2027 1,824,937 918,138 382,557 3,125,632 4,397,219 1,400,000 5,797,219 2,671,588 - 2,671,588 -- 19,968,121 2028 1,319,919 917,988 382,495 2,620,402 4,397,219 1,400,000 5,797,219 3,176,818 - 3,176,818 -- 23,144,939 2029 935,670 921,375 383,906 2,240,951 4,397,219 1,400,000 5,797,219 3,556,268 - 3,556,268 -- 26,701,207 2030 936,032 918,300 382,625 2,236,957 4,397,219 1,400,000 5,797,219 3,560,262 - 3,560,262 -- 30,261,469 2031 939,233 918,763 382,818 2,240,813 4,397,219 1,400,000 5,797,219 3,556,406 - 3,556,406 -- 33,817,876 2032 307,256 917,650 382,354 1,607,260 4,397,219 1,400,000 5,797,219 4,189,960 - 4,189,960 -- 38,007,835 2033 307,257 919,850 383,271 1,610,378 4,397,219 1,400,000 5,797,219 4,186,842 - 4,186,842 -- 42,194,677 2034 307,257 920,250 383,438 1,610,944 4,397,219 1,400,000 5,797,219 4,186,275 - 4,186,275 -- 46,380,952 2035 297,235 - - 297,235 4,397,219 1,400,000 5,797,219 5,499,985 - 5,499,985 -- 51,880,937 Total 48,199,016 18,394,500 7,664,375 74,257,891 Total - Total TaxEffect 3.50¢ (1)Assumes the Federal Subsidies on the QSCBs are equal to 91.3% of the interest payments on the QSCBs, per the County's Budget; also includes the VRS Refunding Note. (2)Assumes the $12,000,000 FY 2014 Remaining Required Financing is borrowed at 4.5% over 20 years with debt service payments beginning in FY 2015. (3)Assumes the $5,000,000 FY 2014 HVAC/Roof Financing is borrowed at 4.5% over 20 years with debt service payments beginning in FY 2015. (4)Assumes the County budgets its FY 2014 Debt Service going forward. (5)Assumes the value of 1 penny is equal to $400,000 and does not grow over time. Revenues Available for Debt ServiceDebt Service Requirements Debt Service Cash Flow Surplus (Deficit) Page 213

- 33. DAVENPORT & COMPANY LLC County of Gloucester, VA 0% 2% 4% 6% 8% 10% 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 HVAC/Roof Page Middle Budgeted/Projected Utility Transfer Existing Policy 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2014 2016 2018 2020 2022 2024 2026 2028 2030 2032 2034 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 HVAC/Roof Page Middle Existing Policy $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 HVAC/Roof Page Middle Existing Policy 7 Key Debt Ratios – Case 2 10-Year Payout Ratio Debt per Capita Debt to Assessed Value Debt Service vs. Expenditures Fiscal Payout Year Ratio 2014 57.7% 2015 61.1% 2016 63.3% 2017 65.8% 2018 69.0% 2019 71.6% 2020 74.7% 2021 78.7% 2022 83.6% 2023 87.3% 2024 92.1% 2025 98.6% 2026 100.0% 2027 100.0% 2028 100.0% 2029 100.0% 2030 100.0% 2031 100.0% 2032 100.0% 2033 100.0% 2034 100.0% 2035 100.0% Page 214

- 34. DAVENPORT & COMPANY LLC County of Gloucester, VA 8 Debt Affordability Analysis – Case 3 A B C D E F G H I J K L FY Existing DS(1) FY2014 Remaining Required Financing(2) Total FY2014 Net Budget Appropriation(1,3) FY2015 Tax Increase(4) Total Revenues Available Surplus/ (Deficit) Capital Reserve Utilized Adjusted Surplus/ (Deficit) Estimated Incremental Tax Equivalent Capital Reserve Fund Balance 2014 4,397,219 - 4,397,219 4,397,219 - 4,397,219 - - - -- - 2015 4,371,318 825,000 5,196,318 4,397,219 800,000 5,197,219 902 - 902 2.00 902 2016 4,260,521 933,250 5,193,771 4,397,219 800,000 5,197,219 3,448 - 3,448 -- 4,350 2017 4,234,812 935,250 5,170,062 4,397,219 800,000 5,197,219 27,158 - 27,158 -- 31,508 2018 4,101,627 941,350 5,042,977 4,397,219 800,000 5,197,219 154,242 - 154,242 -- 185,750 2019 2,884,809 941,325 3,826,134 4,397,219 800,000 5,197,219 1,371,086 - 1,371,086 -- 1,556,836 2020 2,644,223 940,400 3,584,623 4,397,219 800,000 5,197,219 1,612,596 - 1,612,596 -- 3,169,432 2021 2,633,104 938,575 3,571,679 4,397,219 800,000 5,197,219 1,625,541 - 1,625,541 -- 4,794,973 2022 2,627,046 940,850 3,567,896 4,397,219 800,000 5,197,219 1,629,324 - 1,629,324 -- 6,424,297 2023 2,595,417 942,000 3,537,417 4,397,219 800,000 5,197,219 1,659,802 - 1,659,802 -- 8,084,099 2024 2,583,412 942,025 3,525,437 4,397,219 800,000 5,197,219 1,671,782 - 1,671,782 -- 9,755,881 2025 1,851,370 940,925 2,792,295 4,397,219 800,000 5,197,219 2,404,924 - 2,404,924 -- 12,160,806 2026 1,839,343 938,700 2,778,043 4,397,219 800,000 5,197,219 2,419,176 - 2,419,176 -- 14,579,982 2027 1,824,937 940,350 2,765,287 4,397,219 800,000 5,197,219 2,431,932 - 2,431,932 -- 17,011,915 2028 1,319,919 940,650 2,260,569 4,397,219 800,000 5,197,219 2,936,650 - 2,936,650 -- 19,948,565 2029 935,670 944,600 1,880,270 4,397,219 800,000 5,197,219 3,316,950 - 3,316,950 -- 23,265,514 2030 936,032 941,975 1,878,007 4,397,219 800,000 5,197,219 3,319,212 - 3,319,212 -- 26,584,727 2031 939,233 943,000 1,882,233 4,397,219 800,000 5,197,219 3,314,987 - 3,314,987 -- 29,899,713 2032 307,256 947,450 1,254,706 4,397,219 800,000 5,197,219 3,942,514 - 3,942,514 -- 33,842,227 2033 307,257 950,100 1,257,357 4,397,219 800,000 5,197,219 3,939,863 - 3,939,863 -- 37,782,089 2034 307,257 930,475 1,237,732 4,397,219 800,000 5,197,219 3,959,488 - 3,959,488 -- 41,741,577 2035 297,235 - 297,235 4,397,219 800,000 5,197,219 4,899,985 - 4,899,985 -- 46,641,562 Total 48,199,016 18,698,250 66,897,266 Total - Total TaxEffect 2.00¢ (1)Assumes the Federal Subsidies on the QSCBs are equal to 91.3% of the interest payments on the QSCBs, per the County's Budget; also includes the VRS Refunding Note. (2)Assumes the $12,000,000 FY 2014 Remaining Required Financing is borrowed at 4.5% over 20 years with structured debt service payments beginning in FY 2015. (3)Assumes the County budgets its FY 2014 Debt Service going forward. (4)Assumes the value of 1 penny is equal to $400,000 and does not grow over time. Revenues Available for Debt ServiceDebt Service Requirements Debt Service Cash Flow Surplus (Deficit) Page 215

- 35. DAVENPORT & COMPANY LLC County of Gloucester, VA 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Page Middle Existing Policy 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2014 2016 2018 2020 2022 2024 2026 2028 2030 2032 2034 0% 2% 4% 6% 8% 10% 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Page Middle Budgeted/Projected Utility Transfer Existing Policy $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Page Middle Existing Policy 9 Key Debt Ratios – Case 3 10-Year Payout Ratio Debt per Capita Debt to Assessed Value Debt Service vs. Expenditures Fiscal Payout Year Ratio 2014 60.0% 2015 63.4% 2016 65.6% 2017 68.2% 2018 71.3% 2019 73.9% 2020 76.8% 2021 80.6% 2022 85.3% 2023 88.5% 2024 92.7% 2025 98.4% 2026 100.0% 2027 100.0% 2028 100.0% 2029 100.0% 2030 100.0% 2031 100.0% 2032 100.0% 2033 100.0% 2034 100.0% 2035 100.0% Page 216

- 36. DAVENPORT & COMPANY LLC County of Gloucester, VA Observations Overall, this presentation has discussed capital, rather than focusing on operating costs. Any additional/unfunded operating costs would be additive to the proposed tax impact model; Debt Service on the $12 million Page Middle School Financing is estimated to have an impact that is roughly equivalent to 2.0¢ - 2.5¢ pennies (assuming each penny is worth $400,000); Debt Service attributable to the $5 million HVAC and Roof Projects is estimated to have an additional 1¢ equivalent impact, or 3.0 ¢ - 3.5¢ when combined with the Page Financing; and, The County has historically managed its debt in a conservative fashion. Having policies in place is seen as a positive from a credit rating and “Best Practice” perspective, and the County should strive to follow these policies in its operating and capital planning efforts. 10 Page 217

- 37. DAVENPORT & COMPANY LLC County of Gloucester, VA Next Steps 11 Date Action July 2, 2013 County Board considers approval of Preliminary Authorizing Resolution. July 9, 2013 School Board considers approval of VPSA application. August 6, 2013 County Board conducts Public Hearing. August Timeframe VPSA application submitted. September 3, 2013 County Board considers final approval of the financing. Oct./Nov. Timeframe VPSA Bonds are sold. Nov./Dec. Timeframe VPSA Bonds are closed and funds are available for the Project. Page 218

- 38. DAVENPORT & COMPANY LLC County of Gloucester, VA Disclaimer Unless the enclosed material specifically addresses Davenport & Company LLC (“Davenport”) provision of financial advisory services or investment advisory services, or Davenport has an agreement with the recipient to provide such services, the recipient should assume that Davenport is acting in the capacity of an underwriter or placement agent. The Municipal Securities Rulemaking Board (“MSRB”) Rule G-17 requires an underwriter to deal fairly at all times with both municipal issuers and investors. The rule also requires an underwriter to disclose that the underwriter’s primary role is to purchase securities with a view to distribution in an arm’s length commercial transaction with the issuer and the underwriter has financial and other interests that differ from those of the issuer; unlike a municipal advisor, the underwriter does not have a fiduciary duty to the issuer under the federal securities laws and is, therefore, not required by federal law to act in the best interest of the issuer without regard to its own financial or other interests; the underwriter has a duty to purchase securities from the issuer at a fair and reasonable price, but must balance that duty with its duty to sell municipal securities to investors at prices that are fair and reasonable; the underwriter will review the official statement of the issuer’s securities in accordance with, and as part of, its responsibilities to investors under the federal securities laws, as applied to the facts and circumstances of the transaction. Davenport’s compensation when serving as an underwriter is normally contingent on the closing of a transaction. Clients generally prefer this arrangement so they are not obligated to pay a fee unless the transaction is completed. However, MSRB Rule G-17 requires an underwriter to disclose that compensation that is contingent on the closing of a transaction or the size of a transaction presents a conflict of interest, because it may cause the underwriter to recommend a transaction that is unnecessary or to recommend that the size of the transaction be larger than is necessary. This material was prepared by investment banking, or other non-research personnel of Davenport. This material was not produced by a research analyst, although it may refer to a Davenport research analyst or research report. Unless otherwise indicated, these views (if any) are the author’s and may differ from those of the Davenport fixed income or research department or others in the firm. This material may have been prepared by or in conjunction with Davenport trading desks that may deal as principal in or own or act as market maker or liquidity provider for the securities/instruments mentioned herein. The trading desk may have accumulated a position in the subject securities/instruments based on the information contained herein. Trading desk materials are not independent of the proprietary interests of Davenport, which may conflict with your interests. Davenport may also perform or seek to perform financial advisory, underwriting or placement agent services for the issuers of the securities and instruments mentioned herein. This material has been prepared for information purposes only and is not a solicitation of any offer to buy or sell any security/instrument or to participate in any trading strategy. Any such offer would be made only after a prospective participant had completed its own independent investigation of the securities, instruments or transactions and received all information it required to make its own investment decision, including, where applicable, a review of any offering circular or memorandum describing such security or instrument. That information would contain material information not contained herein and to which prospective participants are referred. This material is based on public information as of the specified date, and may be stale thereafter. We have no obligation to tell you when information herein may change. We make no representation or warranty with respect to the completeness of this material. Davenport has no obligation to continue to publish on the securities/instruments mentioned herein. Any securities referred to in this material may not have been registered under the U.S. Securities Act of 1933, as amended, and, if not, may not be offered or sold absent an exemption therefrom. Recipients are required to comply with any legal or contractual restrictions on their purchase, holding, sale, exercise of rights or performance of obligations under any securities/instruments transaction. The securities/instruments discussed in this material may not be suitable for all investors. This material has been prepared and issued by Davenport for distribution to market professionals and institutional investor clients only. Other recipients should seek independent financial advice prior to making any investment decision based on this material. This material does not provide individually tailored investment advice or offer tax, regulatory, accounting or legal advice. Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences, of the transaction. You should consider this material as only a single factor in making an investment decision. The value of and income from investments and the cost of borrowing may vary because of changes in interest rates, foreign exchange rates, default rates, prepayment rates, securities/instruments prices, market indexes, operational or financial conditions or companies or other factors. There may be time limitations on the exercise of options or other rights in securities/instruments transactions. Past performance is not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized. Actual events may differ from those assumed and changes to any assumptions may have a material impact on any projections or estimates. Other events not taken into account may occur and may significantly affect the projections or estimates. Certain assumptions may have been made for modeling purposes only to simplify the presentation and/or calculation of any projections or estimates, and Davenport does not represent that any such assumptions will reflect actual future events. Accordingly, there can be no assurance that estimated returns or projections will be realized or that actual returns or performance results will not materially differ from those estimated herein. Some of the information contained in this document may be aggregated data of transactions in securities or other financial instruments executed by Davenport that has been compiled so as not to identify the underlying transactions of any particular customer. This material may not be sold or redistributed without the prior written consent of Davenport. Version 07/24/13 CH TC Page 219

- 39. County of Gloucester Finance Department 6467 Main Street Gloucester, Virginia 23061 (804)693-6927 Interoffice Memorandum To: Gloucester County Board of Supervisors From: Nickie C. Champion, Director of Financial Services CC: Howard B. Kiser, Ed.D., Superintendent of Schools Brenda G. Garton, County Administrator Joanne C. Wright, Director of Budget and Finance, GCPS Date: July 8, 2013 Re: School HVAC and Roof Replacement Capital Program It came to my attention at the July 2nd Board meeting that I had not provided sufficient materials for you to make an informed decision on the possible $5.0 million school borrowing request for HVAC and school roof needs. In order to rectify that issue, I would like to provide the following summary of events and supporting documents: • One very important financial planning tool for local governments is a Capital Improvements Program. Investments in capital infrastructure, facilities, and equipment are quite often large and very expensive. Special planning, financing, and management procedures are called for to ensure that the projects and acquisitions are needed, well designed, and efficiently implemented (meaning the money we invest in capital is well spent). In Gloucester County, we define a capital project for planning purposes as a tangible asset that has a useful life of at least 5 years or costs at least $50,000. • The annual capital planning process begins each fall with all County departments, County agencies, and the School Division being asked to submit any project they would like to see considered for inclusion in the final adopted Capital Improvements Plan. • The School Board approved their FY 2014-2018 Capital Improvements Plan on September 11, 2012. This plan was then forwarded to the County for inclusion in the capital planning process and funding consideration. Please see attachment A, which includes a summary of all submitted school projects as well as itemized details for roof replacement and HVAC needs. The total five-year request for roof replacements was $1,689,000 and HVAC was $21,155,308. For additional planning purposes, the School Division also included amounts out beyond FY 2018. • The County Administrator’s Capital Improvements Advisory Committee met to consider all requests (School Board as well as County departments and agencies) late in 2012. Page 220