ICD Initiation Report

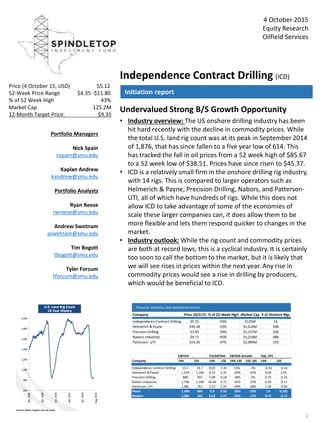

- 1. 4 October 2015 Equity Research Oilfield Services Independence Contract Drilling (ICD) Initiation report Undervalued Strong B/S Growth Opportunity • Industry overview: The US onshore drilling industry has been hit hard recently with the decline in commodity prices. While the total U.S. land rig count was at its peak in September 2014 of 1,876, that has since fallen to a five year low of 614. This has tracked the fall in oil prices from a 52 week high of $85.67 to a 52 week low of $38.51. Prices have since risen to $45.37. • ICD is a relatively small firm in the onshore drilling rig industry, with 14 rigs. This is compared to larger operators such as Helmerich & Payne, Precision Drilling, Nabors, and Patterson- UTI, all of which have hundreds of rigs. While this does not allow ICD to take advantage of some of the economies of scale these larger companies can, it does allow them to be more flexible and lets them respond quicker to changes in the market. • Industry outlook: While the rig count and commodity prices are both at record lows, this is a cyclical industry. It is certainly too soon to call the bottom to the market, but it is likely that we will see rises in prices within the next year. Any rise in commodity prices would see a rise in drilling by producers, which would be beneficial to ICD. 1 Portfolio Managers Nick Spain nspain@smu.edu Kaplan Andrew kandrew@smu.edu Portfolio Analysts Ryan Reese rwreese@smu.edu Andrew Swetnam aswetnam@smu.edu Tim Bogott tbogott@smu.edu Tyler Forcum tforcum@smu.edu Financial, valuation, and operational metrics Price (4 October 15, USD) $5.12 52-Week Price Range $4.35 -$11.80 % of 52 Week High 43% Market Cap 125.2M 12-Month Target Price: $9.35 Company Price 10/2/15 % of 52-Week High Market Cap # of Onshore Rigs Independence Contract Drilling $5.12 43% $125M 14 Helmerich & Payne $49.28 53% $5,310M 348 Precision Drilling $3.95 39% $1,157M 236 Nabors Industries $9.71 45% $3,210M 488 Patterson- UTI $14.26 47% $2,099M 159 EBITDA EV/EBITDA EBITDA Growth Adj. EPS Company 14A 15E 14A 15E 14A-15E 15E-16E 14A 15E Independence Contract Drilling 15.5 23.7 9.05 7.34 53% -7% -0.33 -0.16 Helmerich & Payne 1,559 1,106 6.53 3.32 -29% -42% 6.09 3.05 Precision Drilling 800 497 5.09 6.18 -38% -2% 0.75 -0.23 Nabors Industries 1,746 1,140 10.46 5.71 -35% -17% 0.03 -0.17 Patterson- UTI 1,081 552 3.37 5.25 -49% -28% 1.46 -0.83 Mean 1,040 664 6.9 5.56 -20% -19% 1.6 0.332 Median 1,081 552 6.53 5.71 -35% -17% 0.75 -0.17

- 2. 4 October 2015Spindletop Energy Fund • Company Background: Independence Contract Drilling is an integrated onshore drilling services provider that completed its IPO in August 2014. ICD manufactures and operates state of the art ShaleDriller rigs. These rigs are walking rigs that facilitate pad drilling, with minimal time to move a rig from one location to another. ICD owns and operates 14 drilling rigs. ICD primarily operates its rigs in the Permian Basis, with ICD having an industry leading 87% utilization for 3Q15. • Reputation for Quality: ICD is recognized throughout the industry for the quality product and service they offer. ICD has a fleet wide uptime of 98%, and its rigs have proven successful, with the longest lateral drilled of 14,000 ft. in the Permian. This reputation for quality has led to some of the most respected E&P producers choosing ICD for their drilling needs, including Devon, Apache, Pioneer, Concho, & Parsley. • Strong Balance Sheet: ICD has a very strong balance sheet, that should allow it to get through this current down price cycle, and grow as rig counts rise with a future price increase. ICD has Current Assets of $36.3M and Total Assets of $289.5M. This is compared to Current Liabilities of $29.4M, Total Long Term Debt of $22.5M and Total Liabilities of $52.9M. One issue common with struggling OFS companies is a high level of debt, so ICD having so little debt puts them in a great position to grow in the future. • Solid Leadership & Company Initiatives: ICD has a great leadership team, headed by CEO Byron Dunn, a veteran of the energy industry. Together, the leadership team has undertaken initiatives such as suspending new rig building and keeping debt at a manageable level. • Analyst Recommendations: ICD has a consensus buy rating from the equity research analysts that cover the stock. Out of 10 recommendations, 9 have a Buy rating and 1 has a Hold rating. This gives us confidence in our own buy rating. 2 Why Independence Contract Drilling • Commodity Prices: As ICD is a drilling company, they have direct exposure to the risks of a prolonged down commodity price cycle, or future declines in prices. If prices continue to stay where they are for a long time, or go down further, it is likely that E&P companies would further cut new drilling operations, which could affect ICD. Investment risks