Ukraine Monthly Economic Review, July 2017

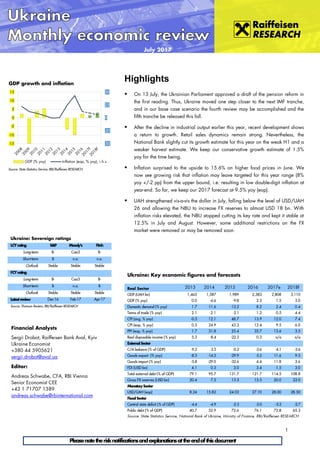

- 1. 1 Pleasenotetherisknotificationsandexplanationsattheendofthisdocument July 2017 Ukraine: Sovereign ratings LCYrating S&P Moody's Fitch Long-term B- Caa3 B- Short-term B n.a. n.a. Outlook Stable Stable Stable FCYrating Long-term B- Caa3 B- Short-term B n.a. B Outlook Stable Stable Stable Latestreview Dec-16 Feb-17 Apr-17 Source: Thomson Reuters, RBI/Raiffeisen RESEARCH Ukraine: Key economic figures and forecasts Real Sector 2013 2014 2015 2016 2017e 2018f GDP (UAH bn) 1,465 1,587 1,989 2,383 2,808 3,110 GDP (% yoy) 0.0 -6.6 -9.8 2.3 1.5 3.0 Domestic demand (% yoy) 1.7 -11.6 -12.2 8.2 2.4 0.4 Terms of trade (% yoy) 2.1 2.1 -2.1 1.2 0.5 4.4 CPI (avg, % yoy) -0.3 12.1 48.7 13.9 12.0 7.4 CPI (eop, % yoy) 0.5 24.9 43.3 12.4 9.5 6.0 PPI (eop, % yoy) 1.7 31.8 25.4 35.7 13.6 3.5 Real disposable income (% yoy) 5.3 -8.4 -22.3 0.3 n/a n/a ExternalSector C/A balance (% of GDP) -9.2 -3.5 -0.2 -3.6 -4.1 -3.6 Goods export (% yoy) -8.3 -14.5 -29.9 -5.2 11.6 9.5 Goods import (% yoy) -5.8 -29.0 -32.6 4.4 11.8 3.6 FDI (USD bn) 4.1 0.3 3.0 3.4 1.5 3.0 Total external debt (% of GDP) 79.1 95.7 131.7 121.7 114.5 108.8 Gross FX reserves (USD bn) 20.4 7.5 13.3 15.5 20.0 22.0 MonetarySector USD/UAH (eop) 8.24 15.82 24.03 27.10 28.00 28.50 FiscalSector Central state deficit (% of GDP) -4.4 -4.9 -2.3 -3.0 -3.2 -2.7 Public debt (% of GDP) 40.7 52.9 72.6 76.1 72.8 65.3 Source: State Statistics Service, National Bank of Ukraine, Ministry of Finance, RBI/Raiffeisen RESEARCH Financial Analysts Sergii Drobot, Raiffeisen Bank Aval, Kyiv Ukraine Economist +380 44 5905621 sergii.drobot@aval.ua Editor: Andreas Schwabe, CFA, RBI Vienna Senior Economist CEE +43 1 71707 1389 andreas.schwabe@rbinternational.com Source: State Statistics Service, RBI/Raiffeisen RESEARCH GDP growth and inflation -50 -25 0 25 50 -15 -10 -5 0 5 10 15 GDP (% yoy) Inflation (eop, % yoy), r.h.s. Highlights On 13 July, the Ukrainian Parliament approved a draft of the pension reform in the first reading. Thus, Ukraine moved one step closer to the next IMF tranche, and in our base case scenario the fourth review may be accomplished and the fifth tranche be released this fall. After the decline in industrial output earlier this year, recent development shows a return to growth. Retail sales dynamics remain strong. Nevertheless, the National Bank slightly cut its growth estimate for this year on the weak H1 and a weaker harvest estimate. We keep our conservative growth estimate of 1.5% yoy for the time being. Inflation surprised to the upside to 15.6% on higher food prices in June. We now see growing risk that inflation may leave targeted for this year range (8% yoy +/-2 pp) from the upper bound, i.e. resulting in low double-digit inflation at year-end. So far, we keep our 2017 forecast at 9.5% yoy (eop). UAH strengthened vis-a-vis the dollar in July, falling below the level of USD/UAH 26 and allowing the NBU to increase FX reserves to almost USD 18 bn. With inflation risks elevated, the NBU stopped cutting its key rate and kept it stable at 12.5% in July and August. However, some additional restrictions on the FX market were removed or may be removed soon.

- 2. 2 Pleasenotetherisknotificationsandexplanationsattheendofthisdocument Ukraine Economic Policy On 13 July, the Ukrainian Parliament approved a draft of the pension reform in the first reading. The project was supported by 282 deputies (out of 321). Given the high social sensitivity of the reform, we do not discard the possibility of some changes and dilatory practices before the final approval. Nevertheless, Ukraine moved one step closer to the next IMF tranche, and in our base case scenario the fourth review may be accomplished and the fifth tranche be released this fall. Regarding the land reform, it seems that the Fund shifted this requirement to the next review. The Communications Department of the IMF stated the following: “The focus of this review is on pension reform and on measures to speed up privatization and ensure concrete results in anti- corruption efforts. It’s equally important that the program remains on track and fiscal and energy sector policies remain consistent with program commitments. Land reform remains an important condition under the program, however, given the need to design the reform well and reach consensus on key steps ahead, there was a need to reset its timing to later in the year”. Recently, the President signed the law “On the Constitutional Court of Ukraine” which may be count as an anti-corruption step, while given the experience of previous reviews, privatization is not a strict requirement. Thereby, we believe that the tranche will arrive right after finalization of the pension reform. Real Sector Industrial production is recovering after the decline early this year caused by the economic blockade in Donbas. Growth of the industrial production index accelerated from 1.2% yoy in May to 3.8% yoy in June. In seasonally adjusted terms, growth amounted to 0.5% mom. Manufacturing was the leader in June – hiked by 8% yoy or by 1.3% mom. Pharmaceuticals, machinery and light industry went up by 19.1% yoy, 15.9% yoy and 10.9% yoy correspondingly. However, due to deficit of raw materials, coke production plunged by 4.2% yoy. Mining industry demonstrated a modest growth by 0.7% yoy (+0.1% mom) after four months of recession. Coal mining and oil/gas extraction industries were recovering (+7.2% yoy and +3.6% yoy respectively), but there was still a downturn in iron ores mining (-4% yoy). The Energy sector was the major outlier with 9.6% yoy decline in June (mainly due to reduction in electricity production by thermal power plants), albeit in seasonally adjusted terms it went up by 1.1% mom. To sum up, industrial production decreased by 0.4% yoy in H1 2017 owing to an unfavourable start into this year. Retail sales slightly decelerated in June – from 10.7% yoy in May to 9% yoy. Compared to the previous month, there was a decline by 2% mom. Nevertheless, cumulatively, retail sales rose by 7.1% yoy due to the growth of wages (nominal wage hiked by 37.9% yoy in June, while real – by 18.9% yoy). The National Bank of Ukraine (NBU) downgraded its GDP forecast for 2017 by 0.3pp to 1.6% yoy on the back of “worse economic performance in the first half of the year and a downward revision of grain harvest estimates”. On the other hand, given outstanding results in construction and retail sales, some market analysts expect much higher growth this year at about 3% yoy. The average for the 2017 growth forecasts recorded by Bloomberg is at around Source: State Statistics Service, RBI/Raiffeisen RESEARCH Industrial output growth by sector (% yoy) 2.6 0.5 4.5 -0.5 1.3 3.7 0.8 17.5 -0.1 6.7 9.7 9.9 2.1 -0.4 -6.0 3.6 -5.6 5.1 8.0 3.9 -… -3.3 0.0 7.6 -2.7 7.4 -30 -20 -10 0 10 20 Industrial production Mining Manufacuring (all) Utilities of manufacturing: Food Light industry Woodwork and paper Coke, refined products Chemical Pharmaceutical products Rubber, plastic and mineral… Metallurgy Machine building Jan-Jun 2016 to Jan-Jun 2015 Jan-Jun 2017 to Jan-Jun 2016 Source: IMF, RBI/Raiffeisen RESEARCH IMF EFF program financing USD4.9bn 1st tranche 29% USD1.7bn 2nd tranche 10% USD1.0bn 3d tranche 6% USD1.0bn 4th tranche 6% USD8.3bn Remaining funding 49% Source: State Statistics Service, RBI/Raiffeisen RESEARCH Industrial Production Index (s.a., 2010 = 100) 60 70 80 90 100 110 120 130 Jan-08 Aug-08 Mar-09 Oct-09 May-10 Dec-10 Jul-11 Feb-12 Sep-12 Apr-13 Nov-13 Jun-14 Jan-15 Aug-15 Mar-16 Oct-16 May-17

- 3. 3 Pleasenotetherisknotificationsandexplanationsattheendofthisdocument Ukraine 2% yoy. We project 1.5% yoy economic growth this year as economic blockade of Donbas caused significant industrial output reduction in the beginning of the year and growth in energy imports. Thus, the risks may be tilted to the upside. Virtually all forecasts for 2018 lie in a range between 3% and 3.5% yoy. Inflation Inflation figures somewhat confounded expectations in June. Growth of food prices (+3.3% mom) led to an increase in consumer prices by 1.6% mom. As a result, inflation sharply accelerated from 13.5% yoy in May to 15.6% yoy in June. Prices for vegetables and fruits surged by 16.4% mom and 13.5% mom respectively on the back of adverse weather conditions this spring that resulted in a decline of supply. Eggs prices also increased significantly – by 18.3% mom. Tobacco prices went up by 5.2% mom, while prices for alcohol grew by 0.9% mom. By contrast, clothes became cheaper in June (-2.5% mom) which was associated with seasonal effects. There was a modest growth of communal payments (+0.5% mom) driven by increases in costs of housing maintenance (+8.9% mom). Growth of transport services costs by 1.2% mom was offset by the decline of gasoline and oil prices by 1% mom, as a result, transport prices declined by 0.2% mom in June. Given the unexpectedly high growth of food prices, we see growing risk that inflation may leave targeted for this year range (8% yoy +/- 2 pp) from the upper bound, i.e. resulting in low double-digit inflation at year-end. Nevertheless, we keep our forecast at 9.5% yoy by now. Meanwhile producer prices continued to fall. In June, the producer price index (PPI) decreased by 0.6% mom, and producer price inflation decelerated to 26.3% yoy from 27.1% yoy in May. Prices in mining industry dropped by 3.4% mom owing to reduction in iron ores prices by 7.4% mom on the back of stable FX market and decline in global prices. Prices in oil and gas extraction industry decreased by 1.7% mom. Price dynamics in manufacturing also descended (-0.5% mom). Prices in coke production and metallurgy declined by 3% mom and 1.5% respectively. By contrast, prices in the energy sector slightly increased – by 0.3% mom. Balance of Payments The Current Account (C/A) deficit increased from USD 63 mn in April to USD 194 mn in May. Goods’ export growth rate accelerated from 8.2% yoy to 21.4% yoy. Food exports hiked by 30.2% yoy owing to a low statistical base. Exports of metallurgical products improved by 18.7% yoy thanks to higher global prices. Growth of imports also accelerated – from 11.4% yoy to 40.9% yoy. Imports of mineral products went up by 108.2% yoy against the backdrop of growing coal and gas purchases. The agricultural sector pushed imports of chemical products and machinery up by 32.4% yoy and 48.1% yoy respectively. As a result, merchandise trade balance deficit deepened to USD 702 mn from USD 394 mn in April. In contrast, the trade balance of services posted a surplus of USD 198 mn, which is USD 74 mn higher than in the previous month. In May, the Financial Account recorded a surplus of USD 556 mn on the back of reduction of foreign currency (FCY) outside the banking sector by USD 378 mn. FDI inflow remained very low – only USD 14 mn. The Balance of Payments (BoP) posted a surplus of USD 357 mn in May. In Jan-May, the C/A deficit was at a level of USD 1.1 bn – similar Source: State Statistics Service, RBI/Raiffeisen RESEARCH Inflation (% yoy) -10 0 10 20 30 40 50 60 70 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16 Oct-16 Jan-17 Apr-17 CPI Food prices PPI Source: State Statistics Service, RBI/Raiffeisen RESEARCH Contributions to CPI inflation* (per cent points) -10 0 10 20 30 40 50 60 70 Jan-15 Mar-15 May-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 May-16 Jul-16 Sep-16 Nov-16 Jan-17 Mar-17 May-17 Jul-17 Sep-17 Nov-17 Food and non-alcoholic beverages (42%) Alc./cig. (8%) Energy/utilities (8%) Transport (12%) Clothing (5%) Other components (25%) CPI inflation (% yoy) Source: National Bank of Ukraine, RBI/Raiffeisen RESEARCH Balance of Payments (USD bn) -2 -1 0 1 2 Current Account Financial Account Capital Account Balance of Payments

- 4. 4 Pleasenotetherisknotificationsandexplanationsattheendofthisdocument Ukraine to the previous year figure. Both exports and imports recovered – by 27% yoy and 23.1% yoy respectively (versus -12.7% yoy and -6.8% yoy in Jan-May 2016). Thanks to the IMF and the EU tranches, and significant reduction of FCY outside the banking sector, financial account recorded a surplus of USD 1.8 bn. As a result, there was a BoP surplus of USD 743 mn (USD 700 mn higher than the previous year). Monetary Policy and Exchange Rate UAH strengthened vis-a-vis the dollar in July. In mid-July, USD/UAH rate fell below the level of 26.00, and on 24 July, official rate reached the lowest mark this year of USD/UAH 25.82. Nevertheless, in late-July, we observed an upward trend, and USD/UAH rate gradually climbed to 25.92. There was only one FX auction held by the National Bank of Ukraine in July – the regulator sold USD 34.9 mn. Favourable FX market dynamics helped to restore gross international reserves by USD 353 mn in June to almost USD 18 bn. The National Bank attracted USD 300 mn at interventions. Meanwhile, debt payments amounted to only USD 5.8 mn. Generally, gross international reserves increased by USD 2.4 bn since December 2016, which was greatly aided by the IMF and the EU tranches. As of 1 July, the amount of reserves is sufficient to cover 3.7 months of future imports. The regulator continues to relax administrative measures on the FX market. First, early repayments of non-resident loans are now possible (1) for banks, (2) for businesses if an international financial organization is the shareholder of the borrower or non-resident lender and (3) for resident-borrower if the lending bank is a non-resident. Secondly, the regulator simplified the rules related to the purchase and transferring of FCY under transactions with LCY government bonds carried out by foreign investors and eased FX purchases for the purpose of fulfilling FCY liabilities by resident guarantor under the loan agreements signed with authorized banks. Finally, there were some changes concerning Certificates of Deposit (CDs) placement operations – current rules, according to which successful bids from banks are approved at interest rates indicated in the bids, will be supplemented with a new method when all bids are satisfied at a marginal interest rate set by the regulator. Moreover, the maturity of CDs will increase from 90 to 100 days. The latest changes will be effective from 1 September. Banking sector liquidity dropped on average by UAH 10-12 bn in July. At the same time, the balances on correspondent accounts were virtually unchanged (fluctuated in a range of UAH 40-55 bn), while CDs plunged by UAH 10 bn to UAH 50 bn. Considering the upsurge in inflation, risking not to achieve the inflation target this year, the NBU decided to leave the key rate at a level of 12.5%. As a result, there were no significant changes in the price of money market resources. The index of interbank rates (overnight) oscillated around 11%. Banking Sector Deposits’ dynamics improved in June. Private individuals’ (PI) deposits in UAH increased by 3.3% mom and in foreign currency (FCY) – by 0.3% mom. Corporate (CO) savings also grew in June – by 0.8% mom in LCY and Source: National Bank of Ukraine, RBI/Raiffeisen RESEARCH Gross international reserves 0 2 4 6 8 10 12 14 16 18 -3,500 -3,000 -2,500 -2,000 -1,500 -1,000 -500 0 500 1,000 May-14 Aug-14 Nov-14 Feb-15 May-15 Aug-15 Nov-15 Feb-16 May-16 Aug-16 Nov-16 Feb-17 May-17 USD mn USD bn NBU interventions/auctions Gross FX reserves, r.h.s. Source: National Bank of Ukraine, RBI/Raiffeisen RESEARCH Official USD/UAH rate 21 22 23 24 25 26 27 28 29 Source: National Bank of Ukraine, RBI/Raiffeisen RESEARCH PI deposits dynamics 3.3% 0.3% -3% -2% -1% 0% 1% 2% 3% 4% 5% LCY PI deposits, mom growth FCY PI deposits, mom growth

- 5. 5 Pleasenotetherisknotificationsandexplanationsattheendofthisdocument Ukraine by 0.7% mom in FCY. UAH lending was growing in June. CO LCY loans went up by 1.9% mom and PI LCY loans increased by 1.3% mom. In the meantime, FX loans portfolio continued to shrink – by 1% mom CO, and by 1.2% mom PI. The growth of incomes supported the improvement in deposits dynamics in Q2. PI LCY deposits hiked by 7.2% qoq and FCY deposits improved by 0.7% qoq. Corporate deposits in FCY grew much faster than LCY deposits (+2.7% qoq versus +1.2% qoq). Lending activity is gradually recovering. CO LCY loans recorded a growth by 1.7% qoq in Q2 after a reduction by 0.3% qoq in Q1. Growth of PI LCY loan portfolio has slightly decelerated – from 4.9% qoq in Q1 to 4.7% qoq. Meanwhile, households and businesses continued to reduce their FCY obligations – by 3.6% qoq and by 1% qoq respectively. Source: National Bank of Ukraine, RBI/Raiffeisen RESEARCH PI loans dynamics 1.3% -1.2% -4% -3% -2% -1% 0% 1% 2% 3% LCY PI loans, mom growth FCY PI loans, mom growth

- 6. 6 Pleasenotetherisknotificationsandexplanationsattheendofthisdocument Ukraine Risk notifications and explanations Warnings Figures on performance refer to the past. Past performance is not a reliable indicator for future results and the development of a financial instrument, a financial index or a securities service. This is particularly true in cases when the financial instrument, financial index or securities service has been offered for less than 12 months. In particular, this very short comparison period is not a reliable indicator for future results. Performance of a financial instrument, a financial index or a securities service is reduced by commissions, fees and other charges, which depend on the individual circumstances of the investor. The return on an investment in a financial instrument, a financial or securities service can rise or fall due to exchange rate fluctuations. Forecasts of future performance are based purely on estimates and assumptions. Actual future performance may deviate from the forecast. Consequently, forecasts are not a reliable indicator for future results and the development of a financial instrument, a financial index or a securities service. Any information and recommendations designated as such in this publication which are contributed by analysts from RBI’s subsidiary banks or from Raiffeisen Centrobank (“RCB”) are disseminated unaltered under RBI’s responsibility. A description of the concepts and methods used in the preparation of financial analyses is available under: www.raiffeisenresearch.com/concept_and_methods Detailed information on sensitivity analyses (procedure for checking the stability of potential assumptions made in the context of financial analyses) is available under: www.raiffeisenresearch.com/sensitivity_analysis Disclaimer Financial Analysis Responsible for this publication: Raiffeisen Bank International AG („RBI“) RBI is a credit institution according to §1 Banking Act (Bankwesengesetz) with the registered office Am Stadtpark 9, 1030 Vienna, Austria. Raiffeisen RESEARCH is an organisational unit of RBI. Supervisory authority: As a credit institution (acc. to § 1 Austrian Banking Act; Bankwesengesetz) Raiffeisen Bank International AG is subject to the supervision by the Austrian Financial Market Authority (FMA, Finanzmarktaufsicht) and the National Bank of Austria (OeNB, Oesterreichische Nationalbank). Additionally, RBI is subject to the supervision by the European Central Bank (ECB), which undertakes such supervision within the Single Supervisory Mechanism (SSM), which consists of the ECB and the national responsible authorities (Council Regulation (EU) No 1024/2013 - SSM Regulation). Unless set out herein explicitly otherwise, references to legal norms refer to norms enacted by the Republic of Austria. This document is for information purposes and may not be reproduced or distributed to other persons without RBI’s permission. This document constitutes neither a solicitation of an offer nor a prospectus in the sense of the Austrian Capital Market Act (Kapitalmarktgesetz) or the Austrian Stock Exchange Act (Börsegesetz) or any other comparable foreign law. An investment decision in respect of a financial instrument, a financial product or an investment (all hereinafter “product”) must be made on the basis of an approved, published prospectus or the complete documentation for such a product in question, and not on the basis of this document. This document does not constitute a personal recommendation to buy or sell financial instruments in the sense of the Austrian Securities Supervision Act (Wertpapieraufsichtsgesetz). Neither this document nor any of its components shall form the basis for any kind of contract or commitment whatsoever. This document is not a substitute for the necessary advice on the purchase or sale of a financial instrument, a financial product or advice on an investment. In respect of the sale or purchase of one of the above mentioned products, your banking advisor can provide individualised advice suitable for investments and financial products. This analysis is fundamentally based on generally available information and not on confidential information which the party preparing the analysis has obtained exclusively on the basis of his/her client relationship to a person. Unless otherwise expressly stated in this publication, RBI deems all of the information to be reliable, but does not make any assurances regarding its accuracy and completeness. In emerging markets, there may be higher settlement and custody risk as compared to markets with established infrastructure. The liquidity of stocks/financial instruments may be influenced, amongst others, by the number of market makers. Both of these circumstances can result in elevated risk in relation to the safety of investments made in consideration of the information contained in this document. The information in this publication is current as per the latter's creation date. It may be outdated by future developments, without the publication being changed. Unless otherwise expressly stated (www.raiffeisenresearch.com/special_compensation) the analysts employed by RBI are not compensated for specific investment banking transactions. Compensation of the author or authors of this report is based (amongst other things) on the overall profitability of RBI, which includes, inter alia, earnings from investment banking and other transactions of RBI. In general, RBI forbids its analysts and persons reporting to the analysts from acquiring securities or other financial instruments of any enterprise which is covered by the analysts, unless such acquisition is authorised in advance by RBI’s Compliance Department. RBI has put in place the following organisational and administrative agreements, including information barriers, to impede or prevent conflicts of interest in relation to recommendations: RBI has designated fundamentally binding confidentiality zones. These are typically units within credit institutions, which are isolated from other units by organisational measures governing the exchange of information, because compliance-relevant information is continuously or temporarily handled in these zones. Compliance-relevant information may fundamentally not leave a confidentiality zone and is to be treated as strictly confidential in internal business operations, including interaction with other units. This does not apply to the transfer of information necessary for usual business operations. Such transfer of information is limited, however, to what is absolutely necessary

- 7. 7 Pleasenotetherisknotificationsandexplanationsattheendofthisdocument Ukraine (need-to-know principle). The exchange of compliance-relevant information between two confidentiality zones may only occur with the involvement of the Compliance Officer. SPECIAL REGULATIONS FOR THE UNITED KINGDOM OF GREAT BRITAIN AND NORTHERN IRELAND (UK): This document does not constitute either a public offer in the meaning of the Austrian Capital Market Act (Kapitalmarktgesetz; hereinafter „KMG“) nor a prospectus in the meaning of the KMG or of the Austrian Stock Exchange Act (Börsegesetz). Furthermore, this document does not intend to recommend the purchase or the sale of securities or investments in the meaning of the Austrian Supervision of Securities Act (Wertpapieraufsichtsgesetz). This document shall not replace the necessary advice concerning the purchase or the sale of securities or investments. For any advice concerning the purchase or the sale of securities of investments kindly contact your RAIFFEISENBANK. This publication has been either approved or issued by RBI in order to promote its investment business. Raiffeisen Bank International AG (“RBI”), London Branch is authorised by the Austrian Financial Market Authority and subject to limited regulation by the Financial Conduct Authority (“FCA”). Details about the extent of its regulation by the FCA are available on request. This publication is not intended for investors who are Retail Customers within the meaning of the FCA rules and shall therefore not be distributed to them. Neither the information nor the opinions expressed herein constitute or are to be construed as an offer or solicitation of an offer to buy (or sell) investments. RBI may have affected an Own Account Transaction within the meaning of FCA rules in any investment mentioned herein or related investments and/or may have a position or holding in such investments as a result. RBI may have been, or might be, acting as a manager or co-manager of a public offering of any securities mentioned in this report or in any related security. SPECIFIC RESTRICTIONS FOR THE UNITED STATES OF AMERICA AND CANADA: This document may not be transmitted to, or distributed within, the United States of America or Canada or their respective territories or possessions, nor may it be distributed to any U.S. person or any person resident in Canada, unless it is provided directly through RB International Markets (USA) LLC (“RBIM”), a U.S. registered broker-dealer, and subject to the terms set forth below. SPECIFIC INFORMATION FOR THE UNITED STATES OF AMERICA AND CANADA: This research document is intended only for institutional investors and is not subject to all of the independence and disclosure standards that may be applicable to research documents prepared for retail investors. This report was provided to you by RB International Markets (USA) LLC (RBIM), a U.S. registered broker-dealer, but was prepared by our non-U.S. affiliate Raiffeisen Bank International AG (RBI). Any order for the purchase or sale of securities covered by this report must be placed with RBIM. You can reach RBIM at 1177, Avenue of the Americas, 5th floor, New York, NY 10036, phone +1 212-600-2588. This document was prepared outside the United States by one or more analysts who may not have been subject to rules regarding the preparation of reports and the independence of research analysts comparable to those in effect in the United States. The analyst or analysts who prepared this research (i) are not registered or qualified as research analysts with the Financial Industry Regulatory Authority (“FINRA”) in the United States, and (ii) are not allowed to be associated persons of RBIM and are therefore not subject to FINRA regulations, including regulations related to the conduct or independence of research analysts. The opinions, estimates and projections contained in this report are those of RBI only as of the date of this report and are subject to change without notice. The information contained in this report has been compiled from sources believed to be reliable by RBI, but no representation or warranty, express or implied, is made by RBI or its affiliated companies or any other person as to the report’s accuracy, completeness or correctness. Securities which are not registered in the United States may not be offered or sold, directly or indirectly, within the United States or to U.S. persons (within the meaning of Regulation S under the Securities Act of 1933 [“the Securities Act”]), except pursuant to an exemption under the Securities Act. This report does not constitute an offer with respect to the purchase or sale of any security within the meaning of Section 5 of the Securities Act and neither shall this report nor anything contained herein form the basis of, or be relied upon in connection with, any contract or commitment whatsoever. This report provides general information only. In Canada it may only be distributed to persons who are resident in Canada and who, by virtue of their exemption from the prospectus requirements of the applicable provincial or territorial securities laws, are entitled to conduct trades in the securities described herein. EU REGULATION NO 833/2014 CONCERNING RESTRICTIVE MEASURES IN VIEW OF RUSSIA’S ACTIONS DESTABILISING THE SITUATION IN UKRAINE Please note that research is done and recommendations are given only in respect of financial instruments which are not affected by the sanctions under EU regulation no 833/2014 concerning restrictive measures in view of Russia's actions destabilising the situation in Ukraine, as amended from time to time, i.e. financial instruments which have been issued before 1 August 2014. We wish to call to your attention that the acquisition of financial instruments with a term exceeding 30 days issued after 31 July 2014 is prohibited under EU regulation no 833/2014 concerning restrictive measures in view of Russia's actions destabilising the situation in Ukraine, as amended from time to time. No opinion is given with respect to such prohibited financial instruments. INFORMATION REGARDING THE PRINCIPALITY OF LIECHTENSTEIN: COMMISSION DIRECTIVE 2003/125/EC of 22 December 2003 implementing Directive 2003/6/EC of the European Parliament and of the Council as regards the fair presentation of investment recommendations and the disclosure of conflicts of interest has been incorporated into national law in the Principality of Liechtenstein by the Finanzanalyse- Marktmissbrauchs-Verordnung. If any term of this Disclaimer is found to be illegal, invalid or unenforceable under any applicable law, such term shall, insofar as it is severable from the remaining terms, be deemed omitted from this Disclaimer. It shall in no way affect the legality, validity or enforceability of the remaining terms.

- 8. 8 Pleasenotetherisknotificationsandexplanationsattheendofthisdocument Ukraine Acknowledgements This report was prepared by Raiffeisen Bank Aval on 3 August 2017 Raiffeisen Bank Aval 9, Leskova Str., 01011 Kyiv, Ukraine Tel. +380 44 490 8888 Fax +380 44 285 32 31 Call center: 0 800 500 500 (free within Ukraine) www.aval.ua Market Analysis Sergii Drobot (+380 44 590 5621) Treasury Head: Vladimir Kravchenko (+380 44 4908808) FX, MM: Yuriy Grinenko (+380 44 4908988), Olexandr Varenytsia (+380 44 4954227), Nikolay Vysotsky (+380 44 4954226) Treasury Sales: Marina Lukashenko (+380 44 4954202), Alexander Korenev (+380 44 4954200), Tatiana Kornienko (+380 44 4954201) Securities: Oleg Klimas (+380 44 4908939), Alexey Evdokimov (+380 44 4954206), Daria Shatskykh (+380 44 4954204) Multinational Corporate Customers Head: Andreas Kettlgruber (+380 44 4954110) Relationship Managers: Anna Prydybailo (+380 44 2309981), Lesia Byba (+380 44 4954271) Raiffeisen Bank International CEE Research Team GLOBAL HEAD OF RESEARCH, RBI Peter Brezinschek (1517, FA*) HEAD OF ECONOMICS / FIXED INCOME /FX RESEARCH, RBI VIENNA Gunter Deuber (5707, FA*) CEE MACRO, FX AND FIXED INCOME, RBI VIENNA Wolfgang Ernst (FX Strategist, 1500, FA*) Stephan Imre (FI Strategist, 6757, FA*) Patrick Krizan (FI Strategist, 5644, FA*) Matthias Reith (Economist, 6741, FA*) Elena Romanova (Banking sector, 1378, FA*) Andreas Schwabe (Economist, 1389, FA*) Gintaras Shlizyhus (FI Strategist, 1343, FA*) CEE CREDIT COMPANY RESEARCH, RBI VIENNA Jörg Bayer (Head, 1909, FA*) Martin Kutny (Corporates, 2013, FA*) Ruslan Gadeev (RU Financials, 2216, FA*) RBI contacts: +43 1 71707 (+ extension); [name].[surname]@rbinternational.com *FA: Financial Analyst RBI NETWORK BANK CEE RESEARCH CENTRAL EUROPE (CE) CZ: Helena Horska (+420 234 40 1413, FA*), Raiffeisenbank a.s., Prague HU: Zoltán Török (+36 1 484 4843, FA*), Raiffeisen Bank Zrt., Budapest PL: Dorota Strauch (+48 22 585 2461, FA*), Raiffeisen Polbank, Warsaw SK: Robert Prega (+421 2 5919 1303, FA*), Tatra banka, a.s., Bratislava SOUTH EAST EUROPE (SEE) AL: Joan Canaj (+355 4 238 1000 1122, FA*), Raiffeisen Bank Sh.a., Tirana BA: Ivona Zametica; (+387 33 287 784, FA*), Raiffeisen BANK d.d., Sarajevo BG: Emil Kalchev (+359 2 91985 101, FA*), Raiffeisenbank (Bulgaria, FA*) Sole-owned JSC, Sofia HR: Zrinka Zivkovic-Matijevic (+385 1 6174 338, FA*), Raiffeisenbank Austria d.d., Zagreb RO: Ionut Dumitro (+40-730-222-953, FA*), Raiffeisen Bank S.A., Bucharest RS: Ljiljana Grubic (+381 11 2207178, FA*), Raiffeisenbank a.d., Belgrade EASTERN EUROPE (EE) BY: Natalya Chernogorova +375 17 289 9231, FA*), Priorbank JSC, Minsk RU: Anastasia Baykova (+7 495 225 9114, FA*), AO Raiffeisenbank Austria, Moscow UA: Sergii Drobot (+380 44 5905621, FA*), Raiffeisen Bank Aval , Kyiv COMPANY EQUITY RESEARCH: RAIFFEISEN CENTROBANK AG, VIENNA Bernd Maurer (Head, +43 1 51520-706, FA*)