Budget 2015 highlights

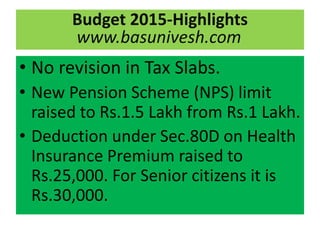

- 1. • No revision in Tax Slabs. • New Pension Scheme (NPS) limit raised to Rs.1.5 Lakh from Rs.1 Lakh. • Deduction under Sec.80D on Health Insurance Premium raised to Rs.25,000. For Senior citizens it is Rs.30,000. Budget 2015-Highlights www.basunivesh.com

- 2. • Transport Allowance limit raised to Rs.1,600 PM from Rs.800 PM. • Interest earned from Sukanya Samriddhi Account is exempted. So now it is EEE (Exempt-Exempt- Exempt). • Service Tax rate raised to 14% from earlier 12%. Budget 2015-Highlights www.basunivesh.com

- 3. • Wealth Tax replaced with 2% surcharge on taxable income over Rs.1 Cr. • 100% Tax Deduction for contributions to Swachh Bharat and Clean Ganga under Sec.80G. Budget 2015-Highlights www.basunivesh.com

- 4. • PAN Card mandatory for all buy or sell exceeding in value of Rs.1 Lakh. • You have option to choose between EPF or NPS. Budget 2015-Highlights www.basunivesh.com

- 5. • Unclaimed deposit in PPF and EPF is used for Senior Citizen Welfare Fund. • Government will incentivize Credit & Debit Card Transactions. Budget 2015-Highlights www.basunivesh.com

- 6. • 2% Swachh Bharat Cess on all or any service. So Service Tax will be 14%+2%=16%. • Merger of two mutual funds will not lead you any capital gain tax. Budget 2015-Highlights www.basunivesh.com

- 7. • Surcharge on Dividend Distribution Tax raised from 10% to 12%. • Advance Rs.20,000 or more in cash for purchase of property is prohibited. Budget 2015-Highlights www.basunivesh.com

- 8. • Introduction of Gold Deposit Scheme, Sovereign Gold Bonds and Indian-made Gold Coins. • Introduction of Tax Free Infra Bonds. Budget 2015-Highlights www.basunivesh.com

- 9. • Hiding Income will face penalty of 300% of Asset Value also 10 Yrs of jail for evaders. Budget 2015-Highlights www.basunivesh.com

- 10. • Pradhan Mantri Suraksha Bima Yojana introduced. Sum Assured is Rs.2 Lakh. Premium will be Rs.12 per year. Budget 2015-Highlights www.basunivesh.com

- 11. • Atal Pension Yojana introduced. Govt will also pay 50% of beneficiaries premium subject to limit of Rs.1,000 each year for five years. Account must be opened before 31st Dec 2015. Budget 2015-Highlights www.basunivesh.com

- 12. • Pradhan Mantri Jeevan Jyoti Bima Yojana introduced. This covers natural as well as accidental death. Sum Assured will be Rs.2 Lakh. Premium will be Rs.330 per year and for age group 18-50. Budget 2015-Highlights www.basunivesh.com