Scope and objective of the assignment

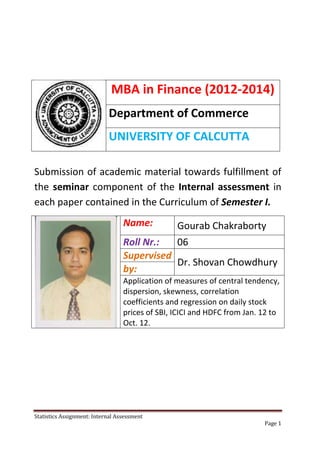

- 1. MBA in Finance (2012-2014) Department of Commerce UNIVERSITY OF CALCUTTA Submission of academic material towards fulfillment of the seminar component of the Internal assessment in each paper contained in the Curriculum of Semester I. Name: Gourab Chakraborty Roll Nr.: 06 Supervised Dr. Shovan Chowdhury by: Application of measures of central tendency, dispersion, skewness, correlation coefficients and regression on daily stock prices of SBI, ICICI and HDFC from Jan. 12 to Oct. 12. Statistics Assignment: Internal Assessment Page 1

- 2. Acknowledgement. This assignment has been a prodigious undertaking. I believe I’m a better equipped now, after completion of this assignment, to apply the concepts of statistics: Module I, in the syllabi of my MBA in Finance Program. I’m profoundly grateful to Dr. Shovan Chowdhury for his guidance and pedagogy. I sincerely appreciate a book named Microsoft Excel Functions and Formulas by Bernd Held, Wordware Publishing, Inc. I’m thankful to Mr. Tanmay Purakayet, my fellow batchmate for guiding me in the glitches faced during visiting the NSE website. Special thanks to my friend and fellow student, Mr. Sourav Sarkar for providing me with Internet connectivity and motivating me when I needed it the most. This assignment has been a satisfying and a great learning experience. Sincerely, Gourab Chakraborty, Roll No. 06 Statistics Assignment: Internal Assessment Page 2

- 3. Table of Contents Sl. Nr. Title of Content Page No. 1 Scope and Objective 4-4 2 Data Analysis 5-5 3 Summary Statistics 6-7 4 Recommendations 8-8 5 Conclusion 8-8 Statistics Assignment: Internal Assessment Page 3

- 4. 1. Scope and objective of the Assignment: 1. a Scope: To obtain the daily stock prices for the three largest banks in India, in terms of market capitalisation. Thereon, we are to calculate measures of central tendency, dispersion, skewness (appropriate), different percentiles. We also have to compute the correlation coefficients between appropriate variables and thereafter to formulate linear regression equations. 1. b. Objective: To achieve a robust understanding of the various concepts of central tendency and dispersion, skewness and lastly correlation and regression which constitutes our syllabus at large and successfully apply them . In particular, the objective is to figure out which out of the three stocks is most consistent and hence ideal for investment. 2. Data Analysis: 2. a Source of data: http://www.nseindia.com. 2 b Methodology of Analysis: In statistics, the term central tendency relates to the way in which quantitative data tend to cluster around some value. A measure of central tendency is any of a number of ways of specifying this "central value". In the simplest cases, the measure of central tendency is an average of a set of measurements, the word average being variously construed as mean, median, or other measure of location, depending on the context. Both "central tendency" and "measure of central tendency" apply to either statistical populations or to samples from a population. The mean (or average) of a set of data values is the sum of all of the data values divided by the number of data values. The median of a set of data values is the middle value of the data set when it has been arranged in ascending order. That is, from the smallest value to the highest value. The mode of a set of data values is the value(s) that occurs most often. Dispersion measures how the various elements behave with regards to some sort of central tendency, usually the mean. Measures of dispersion include range, standard deviation and absolute deviation. Absolute measures of Dispersion are expressed in same units in which original data is presented but these measures cannot be used to compare the variations between the two series. Relative measures are not expressed in units but it is a pure number. It is the ratios of absolute dispersion to an appropriate average such as co-efficient of Standard Deviation or Co-efficient of Mean Deviation. Absolute Measures include Range, Interquartile range, Quartile Deviation, Mean Deviation, Variance, Standard Deviation. Although absolute deviation is also a measure of dispersion, variance and standard deviation are better measures because of the way they're calculated. Calculating variance involves squaring the differences (deviations) between the element and the mean and this makes the differences larger and thus more manageable. Making the differences larger adds a weighting factor to them making trends easier to spot. Relative Measure include Co-efficient of Range, Coefficient of Quartile Deviation, Coefficient of mean Deviation, Coefficient of Variation. Among these the coefficient of variation is the most important and mostly used because it uses standard as the measure of absolute tendency and mean as the measure of central tendency. Statistics Assignment: Internal Assessment Page 4

- 5. A fundamental task in many statistical analyses is to characterize the location and variability of a data set. A further characterization of the data includes skewness. Skewness is a measure of symmetry, or more precisely, the lack of symmetry. A distribution, or data set, is symmetric if it looks the same to the left and right of the center point. Karl Pearson (1895) first suggested measuring skewness by mode standardizing the difference between the mean and the mode, that is, sk . Population modes are not well estimated from sample modes, but one can estimate the difference between the mean and the mode as being three times the difference between the mean and the median (Stuart 3 ( M median) &Ord, 1994), leading to the following estimate of skewness: sk est . Skewness has s also been defined with respect to the third moment about the mean also known as the moment (X ) 3 measure: 1 n 3 As regards skewness we have adopted the moment measure to compute skewness. This measure was superior to the others because: (1) It is based on all observations. (2) It employs the third moment and standard deviation to the order of 3. Hence the asymmetry becomes more prominently visible. Correlation refers to the interdependence or co-relationship of variables. Pearson's product moment correlation coefficient rho is a measure of this linear relationship. Rho is referred to as R when it is estimated from a sample of data. R lies between -1 and 1 with R = 0 is no linear correlation R = 1 is perfect positive (slope up from bottom left to top right) linear correlation R = -1 is perfect negative (slope down from top left to bottom right) linear correlation Regression is a way of describing how one variable, the outcome, is numerically related to predictor variables. The dependent variable is also referred to as Y, dependent or response and is plotted on the vertical axis (ordinate) of a graph. The predictor variable(s) is(are) also referred to as X, independent, prognostic or explanatory variables. The horizontal axis (abscissa) of a graph is used for plotting X. Equation: Y = a + bx b is the gradient, slope or regression coefficient a is the intercept of the line at Y axis or regression constant Y is a value for the outcome x is a value for the predictor Most of the statistics referred to herein above have been computed for in the various worksheets in every workbook for a bank under observation. Statistics Assignment: Internal Assessment Page 5

- 6. Summary Statistics for three banks Last State Bank Open Price (in High Low Traded Close Total Price (in Price (in Price (in Price (in Traded Turnover (in of India Rs.) Rs.) Rs.) Rs.) Rs.) Quantity Rs.) Arithmetic Mean 2067.86 2099.30 2038.65 2067.40 2067.92 2818578.3 5852174377 S.D Values 171.02 172.02 164.48 166.19 166.33 1279406.5 2688243837 Median 2112.00 2138.40 2086.75 2109.95 2113.10 2527190 5181973000 Max 2456.00 2475.00 2415.00 2448.00 2452.45 10890291 20893734000 Min 1629.00 1636.00 1611.40 1627.50 1627.65 142914 294200000 Ist Quartile 1931.95 1970.50 1899.08 1938.25 1939.63 2038301 4156519500 3rd Quartile 2192.50 2221.68 2158.80 2187.95 2187.35 3354616.5 6937868500 Avg. Dev. 140.24 140.15 137.48 137.11 137.34 887059.67 1944948364 Range 827.00 839.00 803.60 820.50 824.80 10747377 20599534000 Quartile Dev. 130.28 125.59 129.86 124.85 123.86 658157.75 1390674500 Coef. Of Var. 8.27 8.19 8.07 8.04 8.04 45.391909 45.93581229 Coef. Of Q.D. 6.17 5.87 6.22 5.92 5.86 26.043066 26.83677626 Coef. Of M.D. 6.78 6.68 6.74 6.63 6.64 31.471883 33.23462765 Moment Skewness -3.77 -3.79 -3.82 -3.84 -3.83 2.4318863 1.964975919 High Low Last Close Open Price Total Traded Price (in Price (in Traded Price (in Turnover (in Rs.) ICICI (in Rs.) Rs.) Rs.) Price (in Rs.) Quantity Arithmetic Mean 890.23 902.85 878.46 890.60 890.56 4288040.35 3817464859 S.D Values 73.02 72.97 72.40 72.34 72.34 2244451.43 2042293296 Median 899.00 909.30 879.25 892.15 896.45 3864474.00 3403447000 Max 1074.70 1086.90 1063.85 1070.50 1070.95 22410138.00 20697768000 Min 690.15 699.50 685.10 696.25 696.55 170619.00 154579000 Ist Quartile 839.55 853.73 827.03 840.83 841.95 3134719.50 2740958500 3rd Quartile 936.53 945.85 925.73 936.75 935.90 4927673.00 4444348500 Avg. Dev. 58.87 57.52 58.39 57.64 57.66 1411219.59 1281189822 Range 384.55 387.40 378.75 374.25 374.40 22239519.00 20543189000 Quartile Dev. 48.49 46.06 49.35 47.96 46.98 896476.75 851695000 Coef. Of Var. 8.20 8.08 8.24 8.12 8.12 52.34 53.49867967 Coef. Of Q.D. 5.39 5.07 5.61 5.38 5.24 23.20 25.02448253 Coef. Of M.D. 6.61 6.37 6.65 6.47 6.47 32.91 33.56127351 Moment Skewness 0.42 0.56 0.49 0.54 0.53 2.28 2.127138445 Statistics Assignment: Internal Assessment Page 6

- 7. Last Open High Low Close Total Traded Traded HDFC Price (in Price (in Price (in Price (in Price (in Quantity (in Turnover (in Rs.) Rs.) Rs.) Rs.) Rs.) Rs.) Rs.) Arithmetic Mean 539.86 545.88 533.97 540.36 540.44 2744228.98 1480412785.34 S.D Values 45.79 45.43 46.30 45.71 45.72 1126922.23 625663594.42 Median 533.00 538.90 526.30 532.95 533.05 2682627.00 1434408000.00 Max 634.85 638.90 626.15 637.00 636.90 6442805.00 3917262000.00 Min 428.90 429.80 419.50 427.15 426.85 46322.00 25179000.00 Ist Quartile 509.90 517.15 502.43 508.48 508.60 2012156.00 1069699500.00 3rd Quartile 585.28 589.10 579.18 586.50 585.55 3273339.00 1829071500.00 Avg. Dev. 37.83 37.39 38.60 38.00 38.00 861475.77 468956348.13 Range 205.95 209.10 206.65 209.85 210.05 6396483.00 3892083000.00 Quartile Dev. 37.69 35.98 38.38 39.01 38.48 630591.50 379686000.00 Coef. Of Var. 8.48 8.32 8.67 8.46 8.46 41.07 42.26 Coef. Of Q.D. 7.07 6.68 7.29 7.32 7.22 23.51 26.47 Coef. Of M.D. 7.01 6.85 7.23 7.03 7.03 31.39 31.68 Moment Skewness 0.06 0.07 0.04 0.05 0.05 0.85 1.13 For the correlation values for the various statistics kindly refer to the worksheet named correlation in each workbook and for the regression equation kindly refer to the remaining worksheets comparing two of the given statistics. (Regression equations have been obtained amongst various values for the stock price and between total traded quantity and turnover. These statistics display almost linear relationship. This is further corroborated by the scatter plots contained in the worksheets. Statistics Assignment: Internal Assessment Page 7

- 8. Recommendations: (1) As the data for the stock prices were available, we had computed and can take mean as a measure of central tendency. However, theoretically, median is the central measure of central tendency, unaffected by the presence of outliers. In case of HDFC and ICICI which display very less skewness, mean can be safely assumed as the measure of central tendency. However, in the case of SBI where skewness is –ve and discernable, we would rather accept median as the measure of central tendency. (2) So follows from logic that for ICICI and HDFC, with minimal skewness, standard deviation is the most appropriate measure of dispersion whereas for SBI, Quartile deviation is a better measure of dispersion than standard deviation. Conclusions: Based on the information collected from the NSE data for the three Banks, largest by market capitalisation, in India and the statistical measures obtained from various numerical operations performed on the data, the following calculations can be made: (1) Based on the measures of central tendency for various price statistics and turnover, SBI ranks Ist, followed by ICICI and with HDFC placed at third. (2) Based on the relative measure of dispersion, the stock price of HDFC is the most stable or the least volatile and that of SBI is the most volatile. So from an investor’s point of view HDFC is the best choice. (3) This conclusion is further strengthened from the measure of skewness which is highest for SBI and least for HDFC. Besides stock prices for SBI are skewed to the left or it is negatively skewed. So, higher values of stock prices are likely to be more. So for a trader SBI is ideal. (4) Across the spectrum, for any day there is a very strong association between the various values for the attributes of stock price (ie. open price, high price, low price, and last traded price). By putting the value of one value for a stock price in the regression equation the other value can be easily computed. Howvever, no such association is found between stock price and its total traded quantity or turnover. Nevertheless, there is a strong correlation between the total traded quantity and turnover. Statistics Assignment: Internal Assessment Page 8