Gresham "Group 150" - February 2012

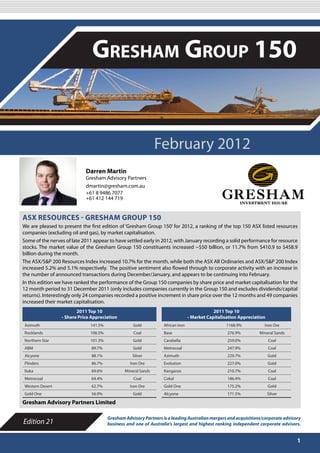

- 1. FEBRUARY 2012 Gresham Group 150 February 2012 Darren Martin Gresham Advisory Partners dmartin@gresham.com.au +61 8 9486 7077 +61 412 144 719 ASX RESOURCES - GRESHAM GROUP 150 We are pleased to present the first edition of ‘Gresham Group 150’ for 2012, a ranking of the top 150 ASX listed resources companies (excluding oil and gas), by market capitalisation. Some of the nerves of late 2011 appear to have settled early in 2012, with January recording a solid performance for resource stocks. The market value of the Gresham Group 150 constituents increased ~$50 billion, or 11.7% from $410.9 to $458.9 billion during the month. The ASX/S&P 200 Resources Index increased 10.7% for the month, while both the ASX All Ordinaries and ASX/S&P 200 Index increased 5.2% and 5.1% respectively. The positive sentiment also flowed through to corporate activity with an increase in the number of announced transactions during December/January, and appears to be continuing into February. In this edition we have ranked the performance of the Group 150 companies by share price and market capitalisation for the 12 month period to 31 December 2011 (only includes companies currently in the Group 150 and excludes dividends/capital returns). Interestingly only 24 companies recorded a positive increment in share price over the 12 months and 49 companies increased their market capitalisation. 2011 Top 10 2011 Top 10 - Share Price Appreciation - Market Capitalisation Appreciation Azimuth 141.5% Gold African Iron 1168.9% Iron Ore Rocklands 106.5% Coal Base 276.9% Mineral Sands Northern Star 101.3% Gold Carabella 259.0% Coal ABM 89.7% Gold Metrocoal 247.9% Coal Alcyone 88.1% Silver Azimuth 229.7% Gold Flinders 86.7% Iron Ore Evolution 227.0% Gold Iluka 69.6% Mineral Sands Kangaroo 210.7% Coal Metrocoal 64.4% Coal Cokal 186.4% Coal Western Desert 62.7% Iron Ore Gold One 175.2% Gold Gold One 56.9% Gold Alcyone 171.5% Silver Gresham Advisory Partners Limited Gresham Advisory Partners is a leading Australian mergers and acquisitions/corporate advisory Edition 21 business and one of Australia’s largest and highest ranking independent corporate advisors. 1

- 2. Group 150 Top 150 asX LisTed resource companies - January By Market Capitalisation Mkt Cap (A$m) % Mkt Cap (A$m) % Jan Dec Company 31-Jan-12 31-Dec-11 Change Jan Dec Company 31-Jan-12 31-Dec-11 Change 1 1 BHP Billiton Ltd. (ASX:BHP) $199,563.1 $183,270.0 8.9% 51 53 Gryphon Minerals Ltd. (ASX:GRY) $454.1 $396.7 14.5% 2 2 Rio Tinto Ltd. (ASX:RIO) $128,713.7 $112,902.2 14.0% 52 44 Mirabela Nickel Ltd. (ASX:MBN) $452.4 $550.8 (17.9%) 3 3 Newcrest Mining Ltd. (ASX:NCM) $25,794.5 $22,610.8 14.1% 53 47 Jupiter Mines Ltd. (ASX:JMS) $442.9 $488.1 (9.3%) 4 4 Fortescue Metals Group Ltd. (ASX:FMG) $15,724.7 $13,295.9 18.3% 54 57 Troy Resources Limited (ASX:TRY) $410.3 $377.5 8.7% 5 5 Iluka Resources Ltd. (ASX:ILU) $7,639.7 $6,463.7 18.2% 55 56 Cockatoo Coal Limited (ASX:COK) $391.2 $381.0 2.7% 6 6 New Hope Corp. Ltd. (ASX:NHC) $4,675.2 $4,591.2 1.8% 56 61 Cape Lambert Resources Limited (ASX:CFE) $389.1 $326.9 19.0% 7 7 OZ Minerals Limited (ASX:OZL) $3,429.8 $3,146.9 9.0% 57 55 Kingsrose Mining Limited (ASX:KRM) $384.4 $382.8 0.4% 8 8 Alumina Ltd. (ASX:AWC) $3,123.4 $2,720.8 14.8% 58 50 Indophil Resources NL (ASX:IRN) $377.0 $440.8 (14.5%) 9 9 Whitehaven Coal Limited (ASX:WHC) $2,819.1 $2,616.5 7.7% 59 59 Summit Resources Ltd. (ASX:SMM) $370.6 $357.5 3.7% 10 10 Atlas Iron Limited (ASX:AGO) $2,773.5 $2,415.6 14.8% 60 62 Guildford Coal Limited (ASX:GUF) $369.3 $322.9 14.4% 11 11 Aquila Resources Ltd. (ASX:AQA) $2,479.1 $2,409.1 2.9% 61 60 Bandanna Energy Limited (ASX:BND) $354.1 $327.7 8.1% 12 15 Lynas Corporation Limited (ASX:LYC) $2,270.8 $1,791.0 26.8% 62 58 Ramelius Resources Ltd. (ASX:RMS) $349.3 $357.7 (2.3%) 13 12 Extract Resources Ltd. (ASX:EXT) $2,147.4 $2,129.8 0.8% 63 67 Northern Star Resources Ltd. (ASX:NST) $337.9 $276.3 22.3% 14 13 PanAust Limited (ASX:PNA) $2,093.2 $1,900.8 10.1% 64 85 Metminco Limited. (ASX:MNC) $332.4 $200.9 65.4% 15 14 Aston Resources Limited (ASX:AZT) $1,962.8 $1,862.5 5.4% 65 69 Perilya Ltd. (ASX:PEM) $315.4 $253.9 24.2% 16 17 Regis Resources Limited (ASX:RRL) $1,747.2 $1,482.7 17.8% 66 65 Brockman Resources Limited (ASX:BRM) $309.9 $295.4 4.9% 17 16 Gloucester Coal Ltd. (ASX:GCL) $1,684.1 $1,745.0 (3.5%) 67 71 Noble Mineral Resources Ltd. (ASX:NMG) $292.8 $251.2 16.6% 18 21 Paladin Energy, Ltd. (ASX:PDN) $1,537.3 $1,144.6 34.3% 68 90 Azimuth Resources Limited (ASX:AZH) $292.5 $189.2 54.5% 19 19 Mount Gibson Iron Ltd. (ASX:MGX) $1,531.8 $1,212.5 26.3% 69 63 Metals X Limited (ASX:MLX) $291.1 $311.4 (6.5%) 20 31 Resolute Mining Ltd. (ASX:RSG) $1,344.0 $800.0 68.0% 70 68 Panoramic Resources Ltd. (ASX:PAN) $290.9 $255.6 13.8% 21 23 Perseus Mining Ltd. (ASX:PRU) $1,313.0 $1,094.0 20.0% 71 64 Ampella Mining Limited (ASX:AMX) $288.4 $305.9 (5.7%) 22 24 Evolution Mining Limited (ASX:EVN) $1,275.8 $1,051.5 21.3% 72 77 Galaxy Resources (ASX:GXY) $284.5 $227.9 24.8% 23 20 Sundance Resources Ltd. (ASX:SDL) $1,260.9 $1,153.9 9.3% 73 93 African Iron Limited (ASX:AKI) $283.5 $178.1 59.2% 24 22 Aquarius Platinum Ltd. (ASX:AQP) $1,242.6 $1,097.2 13.2% 74 73 Northern Iron Limited (ASX:NFE) $281.2 $236.8 18.8% 25 18 Zimplats Holdings Ltd. (ASX:ZIM) $1,146.3 $1,290.6 (11.2%) 75 79 Aditya Birla Minerals Limited (ASX:ABY) $278.9 $216.2 29.0% 26 25 Sandfire Resources (ASX:SFR) $1,106.9 $993.2 11.4% 76 84 Kagara Ltd (ASX:KZL) $275.6 $203.7 35.3% 27 27 Coalspur Mines Limited (ASX:CPL) $1,087.2 $887.0 22.6% 77 70 BC Iron Limited (ASX:BCI) $273.4 $252.6 8.3% 28 30 Kingsgate Consolidated Limited (ASX:KCN) $1,078.3 $803.0 34.3% 78 72 Tiger Resources Ltd. (ASX:TGS) $271.8 $245.0 11.0% 29 32 Ivanhoe Australia Limited (ASX:IVA) $1,041.2 $784.4 32.7% 79 88 Equatorial Resources Limited (ASX:EQX) $267.6 $191.0 40.1% 30 29 Medusa Mining Limited (ASX:MML) $1,020.1 $840.6 21.3% 80 66 Bougainville Copper Ltd. (ASX:BOC) $264.7 $280.7 (5.7%) 31 26 Western Areas NL (ASX:WSA) $992.1 $914.9 8.4% 81 73 Iron Ore Holdings Limited (ASX:IOH) $258.5 $228.4 13.2% 32 28 Independence Group NL (ASX:IGO) $918.5 $878.9 4.5% 82 73 Alkane Resources Limited (ASX:ALK) $254.2 $243.5 4.4% 33 36 Silver Lake Resources Limited (ASX:SLR) $808.4 $663.0 21.9% 83 78 Focus Minerals Limited (ASX:FML) $242.0 $220.4 9.8% 34 35 CGA Mining Limited (ASX:CGX) $800.3 $663.6 20.6% 84 81 Rex Minerals Limited. (ASX:RXM) $241.2 $214.3 12.5% 35 40 Energy Resources of Australia Ltd. (ASX:ERA) $797.3 $634.2 25.7% 85 73 Aspire Mining Limited (ASX:AKM) $235.8 $229.6 2.7% 36 37 Gindalbie Metals Ltd. (ASX:GBG) $779.7 $654.9 19.0% 86 83 Red 5 Ltd. (ASX:RED) $233.1 $208.0 12.0% 37 41 ST Barbara Ltd. (ASX:SBM) $761.9 $631.7 20.6% 87 80 Marengo Mining Limited (ASX:MGO) $230.6 $215.5 7.0% 38 33 Gold One International Limited (ASX:GDO) $686.4 $721.7 (4.9%) 88 89 Greenland Minerals and Energy Ltd (ASX:GGG) $226.9 $189.5 19.8% 39 42 Discovery Metals Ltd. (ASX:DML) $683.1 $579.2 17.9% 89 86 Base Resources Limited (ASX:BSE) $221.0 $200.3 10.3% 40 34 CuDeco Ltd. (ASX:CDU) $679.5 $677.4 0.3% 90 82 Straits Resources Limited (ASX:SRQ) $219.2 $211.1 3.8% 41 38 Grange Resources Limited (ASX:GRR) $675.3 $646.0 4.5% 91 108 Orocobre Limited (ASX:ORE) $199.7 $131.1 52.4% 42 43 Intrepid Mines Limited (ASX:IAU) $667.6 $571.0 16.9% 92 91 Gujarat NRE Coking Coal Limited (ASX:GNM) $193.6 $178.7 8.3% 43 39 Sphere Minerals Limited (ASX:SPH) $635.0 $635.0 0.0% 93 87 Murchison Metals Limited (ASX:MMX) $193.3 $192.5 0.5% 44 45 Flinders Mines Limited. (ASX:FMS) $537.3 $510.0 5.4% 94 92 Cokal Limited (ASX:CKA) $192.7 $178.6 7.9% 45 49 Saracen Mineral Holdings Limited (ASX:SAR) $510.8 $445.5 14.7% 95 99 OM Holdings Limited (ASX:OMH) $190.8 $160.7 18.8% 46 48 Integra Mining Ltd. (ASX:IGR) $503.5 $452.8 11.2% 96 95 Tanami Gold NL (ASX:TAM) $189.2 $174.9 8.2% 47 54 Beadell Resources Ltd (ASX:BDR) $490.1 $394.7 24.2% 97 100 Carabella Resources Limited (ASX:CLR) $185.9 $156.0 19.2% 48 51 Mineral Deposits Ltd. (ASX:MDL) $475.3 $424.4 12.0% 98 106 Arafura Resources Limited (ASX:ARU) $184.0 $134.3 37.0% 49 46 Kangaroo Resources Limited (ASX:KRL) $463.6 $498.0 (6.9%) 99 94 Nucoal Resources Limited (ASX:NCR) $182.2 $175.7 3.7% 50 52 Bathurst Resources Ltd (ASX:BTU) $455.2 $420.6 8.2% 100 102 Norton Gold Fields Limited (ASX:NGF) $178.4 $148.7 20.0% Includes ASX Resource companies excluding oil and gas 2

- 3. FEBRUARY 2012 Mkt Cap (A$m) % Mkt Cap (A$m) % Jan Dec Company 31-Jan-12 31-Dec-11 Change Jan Dec Company 31-Jan-12 31-Dec-11 Change 101 105 ABM Resources NL (ASX:ABU) $176.5 $146.6 20.3% 126 140 Coalworks Limited (ASX:CWK) $111.8 $89.5 25.0% 102 101 Hillgrove Resources Ltd. (ASX:HGO) $170.6 $154.8 10.3% 127 127 Doray Minerals Limited (ASX:DRM) $111.6 $103.3 8.0% 103 111 Papillon Resources Limited (ASX:PIR) $170.4 $123.7 37.8% 128 130 Hot Chili Limited (ASX:HCH) $111.4 $97.7 14.0% 104 112 Gold Road Resources Limited (ASX:GOR) $169.6 $120.9 40.3% 129 116 Azumah Resources Ltd (ASX:AZM) $111.4 $115.6 (3.7%) 105 96 Blackgold International Hold. Ltd (ASX:BGG) $169.4 $174.2 (2.7%) 130 124 YTC Resources Limited (ASX:YTC) $109.7 $104.7 4.8% 106 97 Astron Ltd. (ASX:ATR) $154.2 $166.6 (7.4%) 131 119 Pacific Niugini Ltd (ASX:PNR) $109.2 $109.2 0.0% 107 122 Cobar Consolidated Resources Ltd (ASX:CCU) $151.1 $106.6 41.7% 132 117 Rocklands Richfield Limited (ASX:RCI) $108.1 $115.3 (6.2%) 108 103 FeOre Limited (ASX:FEO) $148.2 $148.2 0.0% 133 166 Alliance Resources Ltd. (ASX:AGS) $107.5 $71.6 50.0% 109 107 Mincor Resources NL (ASX:MCR) $145.8 $132.2 10.3% 134 159 Peninsula Energy Limited (ASX:PEN) $106.8 $76.9 38.9% 110 114 White Energy Company Limited (ASX:WEC) $143.8 $120.1 19.7% 135 113 Robust Resources Limited (ASX:ROL) $105.6 $120.4 (12.3%) 111 98 Atlantic Ltd (ASX:ATI) $140.4 $164.9 (14.9%) 136 144 PanTerra Gold Limited (ASX:PGI) $105.3 $86.8 21.3% 112 126 Altona Mining Limited (ASX:AOH) $137.5 $103.7 32.5% 137 - World Titanium Resources Ltd. (ASX:WTR) $104.4 - - 113 118 Kula Gold Limited (ASX:KGD) $131.8 $112.6 17.0% 138 133 Western Desert Resources Ltd (ASX:WDR) $104.3 $92.8 12.4% 114 109 Kentor Gold Limited (ASX:KGL) $131.7 $127.5 3.3% 139 152 Reed Resources Ltd. (ASX:RDR) $103.2 $80.7 27.9% 115 104 Deep Yellow Ltd. (ASX:DYL) $129.8 $146.7 (11.5%) 140 136 Highlands Pacific Limited (ASX:HIG) $102.8 $92.5 11.1% 116 123 Dragon Mountain Gold Ltd (ASX:DMG) $129.8 $104.9 23.7% 141 137 Sylvania Platinum Limited (ASX:SLP) $99.4 $91.9 8.2% 117 147 African Energy Resources Limited (ASX:AFR) $125.7 $84.9 48.1% 142 128 Metrocoal Ltd. (ASX:MTE) $99.2 $101.3 (2.1%) 118 110 Crescent Gold Limited (ASX:CRE) $123.7 $123.7 0.0% 143 142 Crusader Resources Limited (ASX:CAS) $99.1 $88.1 12.5% 119 115 Moly Mines Ltd. (ASX:MOL) $123.2 $119.3 3.2% 144 131 Red Hill Iron Ltd (ASX:RHI) $98.8 $96.6 2.3% 120 120 Stanmore Coal Limited (ASX:SMR) $121.5 $108.3 12.2% 145 145 Toro Energy Ltd (ASX:TOE) $97.5 $85.8 13.6% 121 125 Alcyone Resources Ltd (ASX:AYN) $117.9 $104.6 12.7% 146 162 Citigold Corporation Limited (ASX:CTO) $96.1 $75.1 27.9% 122 148 South Boulder Mines Ltd. (ASX:STB) $117.5 $83.2 41.2% 147 164 Ironbark Zinc Ltd. (ASX:IBG) $95.8 $73.7 30.0% 123 121 Ausgold Limited (ASX:AUC) $113.8 $106.6 6.7% 148 132 Resource Generation Limited (ASX:RES) $95.4 $95.4 0.0% 124 129 Finders Resources Limited (ASX:FND) $113.7 $98.0 16.1% 149 138 Dragon Mining Limited (ASX:DRA) $94.0 $91.7 2.5% 125 154 ZYL Limited (ASX:ZYL) $112.4 $80.6 39.4% 150 139 Voyager Resources Limited (ASX:VOR) $93.7 $91.1 2.9% Source: Capital IQ new enTranTs - January eXiTs - January 125 ZYL Limited (ASX:ZYL) MHM Metals Limited (ASX:MHM) Major Exits in December included: 133 Alliance Resources Ltd. (ASX:AGS) Tribune Resources Limited (ASX:TBR) Coal and Allied - acquired 134 Peninsula Energy Limited (ASX:PEN) Mungana Goldmines Ltd (ASX:MUX) MacArthur Coal - acquired 137 World Titanium Resources Ltd. (ASX:WTR) Centrex Metals Limited (ASX:CXM) Adamus Resources - acquired 139 Reed Resources Ltd. (ASX:RDR) Australasian Resources Ltd (ASX:ARH) 146 Citigold Corporation Limited (ASX:CTO) Cerro Resources NL (ASX:CJO) 147 Ironbark Zinc Ltd. (ASX:IBG) IMX Resources Ltd. (ASX:IXR) Based on market capitalisation as at 31 January vs 31 December Group 150 Leaders and LaGGers - markeT capiTaLisaTion performance - January Leaders Laggers * Included material placement, acquisition and/or option conversion during month 3

- 4. Group 150 Group 150 markeT capiTaLisaTion -1.7% 458.9 +27.5% -19.1% Market Valuation (A$b) - Group 150 asX indeX performance - January Group 150 mkT cap - by commodiTy merGer & acquisiTions - announced in december & January Percent Premium - Premium - Date Value Consideration Target Acquirer Sought 1 Day Prior 1 Month Prior Announced (A$m) Offered (%) (%) (%) 24-Jan-2012 Phillips River Mining Limited (ASX:PRH) Silver Lake Resources Limited (ASX:SLR) 20.9 100 56.6 18.2 Equity 22-Jan-2012 Rift Valley Resources Limited (ASX:RFV) Bright Star Resources Limited (ASX:BUT) 15.4 100 71.1 62.5 Equity 13-Jan-2012 Stonewall Mining (Pty) Limited Meridien Resources Limited (ASX:MRJ) 35.8 100 - - Cash; Equity 10-Jan-2012 African Iron Limited (ASX:AKI) Exxaro Resources Limited (JSE:EXX) 277.9 100 27.5 37.8 Cash 9-Jan-2012 Grosvenor Gold Pty Limited Resource and Investment NL (ASX:RNI) 47.4 100 - - Combinations 30-Dec-2011 Zanthus Resources, Buddadoo Metals & KingX Coziron Resources Ltd. (ASX:CZR) 25.0 100 - - Equity 28-Dec-2011 KBL Mining Limited, Mineral Hill Mine NSE Guangdong Guangxin Mining Group Co. Ltd 80.0 25 - - Cash 23-Dec-2011 Atlas Iron Limited, Yerecoin magnetite project Cliffs Natural Resources Inc. (NYSE:CLF) 18.0 100 - - Cash 16-Dec-2011 Balla Balla Magnetite Project Forge Resources Ltd. (ASX:FRG) 40.0 100 - - Cash 12-Dec-2011 Brockman Resources Limited (ASX:BRM) Wah Nam International Australia Pty. Ltd. 198.0 45 34.4 35.6 Cash; Equity 11-Dec-2011 Aston Resources Limited (ASX:AZT) Whitehaven Coal Limited (ASX:WHC) 2,431.5 100 12.7 0.0 Equity 11-Dec-2011 Boardwalk Resources Pty Limited Whitehaven Coal Limited (ASX:WHC) 697.8 100 - - Cash; Equity Source: Capital IQ Announced Australian Resources (excluding oil and gas) Mergers and Acquisitions >A$10m 4

- 5. FEBRUARY 2012 2011 - Top performers (wiThin currenT Group 150) Top 20 - Share Price Appreciation 150% 141% 125% CY 11 Share Price Appreciation 106% 101% 100% 90% 88% 87% 75% 70% e 64% 63% 57% 50% 41% 33% 27% 27% 27% 25% 22% 17% 15% 13% 10% 0% Top 20 - Market Capitalisation Appreciation 1200% 1169% 1000% CY 11 Market Capitalisation Appreciation 800% 600% 400% e 277% 259% 248% 230% 227% 211% 186% 175% 171% 200% 150% 138% 111% 111% 107% 87% 70% 58% 56% 52% 0% Source: Capital IQ 5

- 6. Group 150 Group 150 members - 12 monTh performance To 31 december 2011 Share Price Performance Market Capitalisation Performance # Company % # Company % # Company % # Company % 1 Azimuth 141.5% 76 Metals X -28.8% 1 African Iron 1168.9% 76 Whitehaven -21.1% 2 Rocklands 106.5% 77 Perseus -29.0% 2 Base 276.9% 77 Resource Gen. -23.3% 3 Northern Star 101.3% 78 Cockatoo Coal -29.2% 3 Carabella 259.0% 78 Perseus -23.5% 4 ABM 89.7% 79 Gloucester -29.4% 4 Metrocoal 247.9% 79 Dragon -24.4% 5 Alcyone 88.1% 80 Rio Tinto -29.4% 5 Azimuth 229.7% 80 Gryphon -24.5% 6 Flinders 86.7% 81 Medusa -31.2% 6 Evolution 227.0% 81 Iron Ore Hold. -24.5% 7 Iluka 69.6% 82 Sundance -31.3% 7 Kangaroo 210.7% 82 Grange -25.7% 8 Metrocoal 64.4% 83 Crusader -32.5% 8 Cokal 186.4% 83 Sundance -26.0% 9 Western Desert 62.7% 84 Hillgrove -32.8% 9 Gold One 175.2% 84 Newcrest -26.9% 10 Gold One 56.9% 85 Tanami Gold -33.0% 10 Alcyone 171.5% 85 BHP Billiton -27.1% 11 Regis 40.8% 86 Ironbark Zinc -33.3% 11 Voyager 149.7% 86 PanAust -27.7% 12 Dragon Mountain 33.3% 87 Kentor Gold -33.3% 12 Northern Star 137.7% 87 Kingsgate -27.8% 13 Silver Lake 27.0% 88 Aquila -34.7% 13 Rocklands 111.1% 88 Hillgrove -28.1% 14 Voyager 26.8% 89 Fortescue -34.7% 14 Western Desert 110.5% 89 Cockatoo Coal -29.3% 15 Hot Chili 26.7% 90 CGA -35.6% 15 ABM 106.8% 90 Metals X -30.9% 16 Base 21.9% 91 Iron Ore Hold. -36.4% 16 Flinders 86.8% 91 Medusa -31.0% 17 New Hope 16.7% 92 Gryphon -36.7% 17 Iluka 69.5% 92 Rio Tinto -32.7% 18 Resolute 14.7% 93 OZ Minerals -36.8% 18 ZYL 57.7% 93 Tanami Gold -33.0% 19 Astron 13.0% 94 Ausgold -37.1% 19 Silver Lake 56.4% 94 Kentor Gold -33.3% 20 Pacific Niugini 10.0% 95 Perilya -40.2% 20 Hot Chili 52.1% 95 Ironbark Zinc -33.3% 21 PanTerra 7.1% 96 Azumah -42.3% 21 Atlas Iron 49.7% 96 Aquila -34.7% 22 Troy 7.0% 97 Citigold -43.3% 22 Focus 45.2% 97 Fortescue -34.7% 23 Astron Ltd. 5.9% 98 Altona -43.3% 23 Regis 43.7% 98 CGA -35.6% 24 Guildford 2.7% 99 Toro Energy -45.0% 24 Dragon Mountain 40.9% 99 Equatorial -35.8% 25 African Iron -0.2% 100 Kula -45.4% 25 Noble 36.1% 100 Stanmore Coal -37.5% 26 Ramelius -0.5% 101 Intrepid -45.8% 26 Cobar 26.1% 101 Citigold -39.8% 27 Kingsrose -0.7% 102 Marengo -46.3% 27 Mineral Deposits 26.0% 102 Azumah -40.1% 28 Papillon -0.9% 103 Stanmore Coal -47.0% 28 Resolute 23.9% 103 Reed -40.9% 29 Doray -1.1% 104 Mount Gibson -47.2% 29 PanTerra 23.0% 104 OZ Minerals -43.5% 30 Sphere Minerals -1.3% 105 Kingsgate -47.6% 30 Sphere Minerals 21.9% 105 Toro Energy -44.4% 31 Carabella -2.2% 106 Aditya Birla -48.5% 31 Gold Road 21.6% 106 Intrepid -44.9% 32 Focus -3.8% 107 Lynas -49.3% 32 Doray 17.0% 107 Greenland M&E -45.1% 33 ZYL -4.1% 108 Mirabela -50.9% 33 Papillon 15.8% 108 Kula -45.4% 34 St Barbara -4.9% 109 Galaxy -51.4% 34 Pacific Niugini 15.2% 109 Marengo -45.8% 35 Cape Lambert -5.0% 110 Equatorial -51.6% 35 Ramelius 14.9% 110 Bandanna -46.3% 36 Mineral Deposits -6.2% 111 Peninsula -52.0% 36 New Hope 14.0% 111 Mount Gibson -47.2% 37 Discovery -7.7% 112 Rex Minerals -52.4% 37 Norton Gold 13.9% 112 Peninsula -47.2% 38 Norton Gold -7.9% 113 Independence -52.5% 38 YTC 13.7% 113 Ivanhoe -47.5% 39 Atlas Iron -8.5% 114 Indophil -53.2% 39 Astron 13.1% 114 Lynas -47.7% 40 Cobar -8.5% 115 Panoramic -54.9% 40 Altona 12.8% 115 Aditya Birla -48.5% 41 BC Iron -9.2% 116 Alumina -55.0% 41 Troy 8.4% 116 Gindalbie -49.6% 42 Alkane -9.5% 117 Bandanna -55.2% 42 Crescent 8.2% 117 Mirabela -50.9% 43 Extract -9.8% 118 Ampella -55.4% 43 Saracen 7.8% 118 Nucoal -50.9% 44 Finders -10.3% 119 Summit -55.4% 44 Guildford 7.3% 119 African Energy -50.9% 45 Beadell -10.4% 120 Nucoal -55.7% 45 Kingsrose 7.3% 120 Rex Minerals -51.3% 46 YTC -10.6% 121 African Energy -55.9% 46 Cape Lambert 6.6% 121 Panoramic -51.8% 47 Saracen -10.7% 122 Aquarius -56.3% 47 CuDeco 2.4% 122 Jupiter Mines -52.6% 48 Noble -11.1% 123 Reed -57.0% 48 Astron Ltd. 1.8% 123 Ampella -54.4% 49 Western Areas -14.7% 124 Brockman -58.4% 49 Gloucester 0.6% 124 Alumina -55.0% 50 Bathurst -18.1% 125 Bougainville Cop. -58.6% 50 Alkane -2.2% 125 Summit -55.4% 51 Cokal -18.4% 126 Alliance -58.8% 51 Atlantic -3.5% 126 Aquarius -55.5% 52 Gold Road -18.4% 127 Deep Yellow -60.0% 52 St Barbara -4.9% 127 Orocobre -56.3% 53 CuDeco -18.7% 128 Ivanhoe -60.2% 53 Beadell -5.3% 128 Northern Iron -58.3% 54 Sandfire -18.9% 129 Gindalbie -61.2% 54 Coalspur -6.1% 129 Brockman -58.4% 55 Red 5 -19.0% 130 Orocobre -61.4% 55 Finders -6.6% 130 Bougainville Cop. -58.6% 56 Atlantic -19.4% 131 Greenland M&E -61.9% 56 Discovery -6.7% 131 Alliance -58.8% 57 Zimplats -19.5% 132 Northern Iron -62.1% 57 Extract -6.9% 132 Sylvania -58.9% 58 Crescent -20.0% 133 Mincor -64.2% 58 Bathurst -7.3% 133 Metminco -59.7% 59 Red Hill -20.0% 134 Jupiter Mines -64.7% 59 Coalworks -9.8% 134 Deep Yellow -59.9% 60 Whitehaven -21.3% 135 Murchison -65.9% 60 Aspire -10.1% 135 Sth Boulder -61.4% 61 Coalspur -21.5% 136 Sth Boulder -67.8% 61 BC Iron -10.4% 136 Kagara -64.5% 62 Evolution -22.2% 137 Kagara -68.5% 62 Indophil -11.8% 137 Mincor -64.9% 63 Robust -22.5% 138 Highlands Pacific -68.6% 63 Western Areas -14.9% 138 Murchison -65.4% 64 Aspire -22.9% 139 Metminco -70.4% 64 Crusader -15.7% 139 Paladin -68.0% 65 BHP Billiton -23.9% 140 Paladin -72.2% 65 Integra -16.4% 140 Highlands Pacific -68.7% 66 Sylvania -24.7% 141 Arafura -75.3% 66 Robust -17.2% 141 ERA -70.1% 67 Coalworks -24.9% 142 Moly Mines -75.4% 67 Sandfire -17.3% 142 Moly Mines -74.1% 68 Integra -25.2% 143 OM Holdings -77.2% 68 Ausgold -17.4% 143 Gujarat NRE -74.9% 69 Grange -25.8% 144 Gujarat NRE -77.5% 69 Perilya -18.0% 144 Arafura -75.2% 70 Dragon -25.8% 145 ERA -83.4% 70 Galaxy -18.1% 145 OM Holdings -77.2% 71 Newcrest -26.4% 146 White Energy -89.0% 71 Red 5 -18.6% 146 White Energy -88.6% 72 Resource Gen. -27.5% 147 Straits - 72 Tiger -18.8% 147 Straits - 73 Kangaroo -27.5% 148 Blackgold - 73 Zimplats -19.5% 148 Blackgold - 74 Tiger -27.7% 149 FeOre - 74 Red Hill -20.0% 149 FeOre - 75 PanAust -28.1% 150 World Titanium - 75 Independence -20.3% 150 World Titanium - 6

- 7. FEBRUARY 2012 base meTaLs - secTor performance Share Price Performance - January 2012 Copper Nickel Zinc Share Price Performance Share Price Performance - Since 30 June 2011 Share Price Performance Share Price Performance - Hi / Low / Current Share Price Performance 7

- 8. Group 150 coaL - secTor performance Share Price Performance - January 2012 Share Price Performance Share Price Performance - Since 30 June 2011 Share Price Performance Share Price Performance - Hi / Low / Current Share Price Performance 8

- 9. FEBRUARY 2012 diversified - secTor performance indusTriaL mineraLs - secTor performance Share Price Performance - January 2012 Share Price Performance Share Price Performance Share Price Performance - Since 30 June 2011 Share Price Performance Share Price Performance Share Price Performance - Hi / Low / Current Share Price Performance Share Price Performance 9

- 10. Group 150 GoLd - secTor performance Share Price Performance - January 2012 Share Price Performance Share Price Performance - Since 30 June 2011 168% 109% Share Price Performance Share Price Performance - Hi / Low / Current Share Price Performance 10

- 11. FEBRUARY 2012 iron ore - secTor performance Share Price Performance - January 2012 Share Price Performance Share Price Performance - Since 30 June 2011 Share Price Performance Share Price Performance - Hi / Low / Current Share Price Performance 11

- 12. Group 150 pLaTinum - secTor performance uranium - secTor performance Share Price Performance - January 2012 Share Price Performance Share Price Performance Share Price Performance - Since 30 June 2011 Share Price Performance Share Price Performance Share Price Performance - Hi / Low / Current Share Price Performance Share Price Performance 12

- 13. FEBRUARY 2012 consensus commodiTy price forecasTs - January Gold (US$/oz) Silver (US$/OZ) $3,500 $50 $3,000 $37.25 $40 $33.18 $34.03 $2,500 $1,975 $29.50 $1,737 $1,823 $1,610 $30 $23.25 $2,000 $1,400 $1,500 $20 $1,000 $10 $500 $0 $0 Spot 2012 2013 2014 2015 Spot 2012 2013 2014 2015 Copper (US$/lb) Nickel (US$/lb) $10.43 $11.04 $6.00 $12.00 $9.57 $9.53 $8.92 $5.00 $3.77 $3.90 $3.78 $3.86 $3.58 $4.00 $8.00 $3.00 $2.00 $4.00 $1.00 $0.00 $0.00 Spot 2012 2013 2014 2015 Spot 2012 2013 2014 2015 Zinc (US$/lb) Lead (US$/lb) $2.00 $2.00 $1.28 $1.34 $1.50 $1.13 $1.50 $1.13 $1.20 $1.09 $1.00 $1.00 $0.96 $0.96 $1.00 $1.00 $0.50 $0.50 $0.00 $0.00 Spot 2012 2013 2014 2015 Spot 2012 2013 2014 2015 Iron Ore Fines 62% (US$/mt) Uranium (US$/lb) $200 $100 $142.40 $151.00 $151.50 $135.00 $68.00 $70.00 $150 $120.00 $75 $59.00 $52.00 $100 $50 $50 $25 $0 $0 Spot 2012 2013 2014 2015 Spot 2012 2013 2014 2015 AUD:USD NYMEX (US$/bbl) $1.25 $1.07 $1.02 $150 $0.97 $110.50 $114.00 $115.00 $0.88 $0.85 $98.48 $100.00 $1.00 $100 $0.75 $0.50 $50 $0.25 $0.00 $0 Spot 2012 2013 2014 2015 Spot 2012 2013 2014 2015 Source: Bloomberg Consensus Estimates - Median / High / Low 13

- 14. recenT resources TransacTions Group 150 Mergers and Acquisitions 2011 2011 2010 2009 GRAM 2009 2009 2008 Advised Advised Bathurst Advised BHP Advised BG Advised Guandong Advised Allied Gold Advised Gem Wesfarmers on Resources on Billiton on its Group on its $1bn Rising on its $216m on its $54m Diamonds on its the sale of acquisition of $204m offer for takeover offer for cornerstone acquisition of $300m acquisition Premier Coal to Galilee Resources United Minerals Pure Energy investment in Pan Australian of Kimberley Yancoal Australia. from Eastern Corporation. Resources Aust. Solomons Gold. Diamonds. Limited. Limited. Takeover Defence 2011 2010 2010 2010 2009 2009 2007 Advised Aragon Advised Polaris Advised Indophil Advised Advised Energy Advised Brandrill Advised Summit Resources on $69m Metals NL on on $545m Centaurus Metals on its $86m Limited on its Resources on its takeover offer by $178m takeover recommended Resources on its proportional takeover $45m takeover A$1.2bn takeover Westgold offer by Mineral offer from Zijin $20m merger offer by China offer by Ausdrill by Paladin Energy. Resources. Resources with Glengarry Guangdong Nuclear Limited. Limited. Resources. Power Group. Strategic Advisory, Joint Ventures and Capital Markets 2010 2010 2009 2008 2009/08 2008 2008 Advised BHP Introduced Advised BHP Advised Advised Iluka on its Advised Advised Iluka Billiton on its Denham Capital to Billiton on the Bannerman $114m Murchison Metals Resources on its US$116bn iron Trans Tasman disposal of the Resources on its institutional on its joint venture $54m Narama coal ore production Resources resulting Yabulu Nickel financing with placement and with Mitsubishi. divestment to joint venture with in NZ iron sands refinery. Resource Capital $353m accelerated Xstrata. Rio Tinto. investment. Funds. right issue. Gresham Advisory Partners Limited A.B.N. 97 003 344 269 Level 17, 167 Macquarie Street, Level 10, 1 Collins Street, Level 3, 28 The Esplanade, Sydney NSW 2000 Melbourne VIC 3000 Perth WA 6000 Telephone: 61 2 9221 5133 Telephone: 61 3 9664 0300 Telephone: 61 8 9486 7077 Facsimile: 61 2 9221 6814 Facsimile: 61 3 9650 7722 Facsimile: 61 8 9486 7024 Website: www.gresham.com.au Terms and Conditions Information contained in this publication The opinions, advice, recommendations and other information contained in this publication, whether express or implied, are published or made by Gresham Advisory Partners Limited (ABN 88 093 611 413), Australian financial services license (247113), and by its officers and employees (collectively “Gresham Advisory Partners”) in good faith in relation to the facts known to it at the time of preparation. Gresham Advisory Partners has prepared this publication without consideration of the investment objectives, financial situation or particular needs of any individual investor, and you should not rely on the publication for the purpose of making a financial decision. To whom this information is provided This publication is only made available to persons who are wholesale clients within the meaning of section 761G of the Corporations Act 2001. This publication is supplied on the condition that it is not passed on to any person who is a retail client within the meaning of section 761G of the Corporations Act 2001. Disclaimer and limitation of liability To the maximum extent permitted by law, Gresham Advisory Partners will not be liable in any way for any loss or damage suffered by you through use or reliance on this information. Gresham Advisory Partners’ liability for negligence, breach of contract or contravention of any law, which cannot be lawfully excluded, is limited, at Gresham Advisory Partners’ option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you. No warranties made as to content Gresham Advisory Partners makes no warranty, express or implied, concerning this publication. The publication provided by us on an “AS IS” basis at your sole risk. Gresham Advisory Partners expressly disclaims, to the maximum extent permitted by law, any implied warranty of merchant- ability or fitness for a particular purpose, including any warranty for the use or the results of the use of the publication with respect to its correctness, quality, accuracy, completeness, or reliability. Copyright Copyright in this publication is owned by Gresham Advisory Partners. You may use the information in this publication for your own personal use, but you must not (without Gresham Advisory Partners’ consent) alter, reproduce or distribute any part of this publication, transmit it to any other person or incorporate the information into any other document. General matters These Terms and Conditions are governed by the law in force in the State of Victoria, and the parties irrevocably submit to the non-exclusive jurisdiction of the courts of Victoria and courts of appeal from them for determining any disputes concerning the Terms and Conditions. If the whole or any part of a provision of these Terms and Conditions are void, unenforceable or illegal in a jurisdiction it is severed for that jurisdiction. The remainder of the Terms and Conditions have full force and effect and the validity or enforceability of that provision in any other jurisdiction is not affected. This clause has no effect if the severance alters the basic nature of the Terms and Conditions or is contrary to public policy. If Gresham Advisory Partners do not act in relation to a breach by you of these Terms and Conditions, this does not waive Gresham Advisory Partners’ right to act with respect to subsequent or similar breaches. 14