American Express Open App

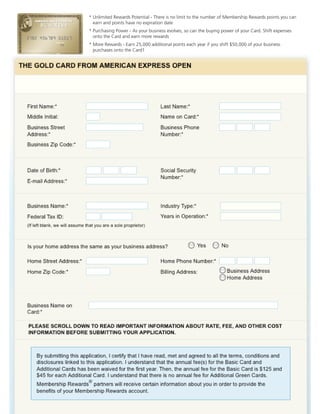

- 1. * Unlimited Rewards Potential - There is no limit to the number of Membership Rewards points you can earn and points have no expiration date * Purchasing Power - As your business evolves, so can the buying power of your Card. Shift expenses onto the Card and earn more rewards * More Rewards - Earn 25,000 additional points each year if you shift $50,000 of your business purchases onto the Card1

- 2. IMPORTANT INFORMATION REGARDING YOUR APPLICATION Annual Fees Late Payment Fees The annual fee of $125 for your Basic Card is waived for the first year of your membership. The annual fee of $45 per Additional Gold Card is waived for the first year. There is no annual fee for Additional Business Green Cards.† Varies from state to state, from zero to the greater of $35 or 2.99% of delinquent balance. All charges made on this Charge Card are due and payable when you receive your billing statement. †The first year annual fee is waived for new Card applicants only. If you transfer an existing account to the Gold Card, you are not eligible for the first year annual fee waiver. Patriot Act Notice: Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account, including your name, address, date of birth and other information that will allow us to verify your identity. Our Agreement By submitting this application, I as an individual and the Authorizing Officer of the Company (a) request that you open an account (“Account”) in the name of the Company and in my name, (b) request that Card(s) be issued on that Account as indicated on this application, (c) understand that you will renew and replace the Card(s) until I cancel, (d) agree to be individually, jointly and severally liable for all charges to the Account made by all Cards issued on the Account now or in the future, (e) agree on behalf of the Company and myself to be bound by the agreement governing the Account (“Cardmember Agreement”), and (f) REPRESENT THAT THE CARD(S) WILL BE USED FOR COMMERCIAL OR BUSINESS PURPOSES. I understand that the Cardmember Agreement includes an arbitration provision, which impacts my opportunity to have claims related to the Account heard in court or resolved by a jury, and to participate in a class action or similar proceeding. I understand that the Cardmember Agreement also provides, among other things, that (i) the Account terms, such as fees, are subject to change and (ii) I am personally responsible for payment for all charges on the Account and the Company is also jointly liable for all such charges. The information in this application is accurate through 09/30/2009. I understand that I must provide all the information requested in this application and I certify that such information is accurate. I authorize you to verify the information on this application and to receive and exchange information about me including requesting reports from consumer reporting agencies. If I ask whether or not a consumer report was requested, you will tell me, and if you received a report, you will give me the name and address of the agency that furnished it. I authorize you and your affiliates and subsidiaries to contact these sources for information at any time and to use any information obtained about me for marketing and administrative purposes. Additional Cards: I have advised Additional Card applicant(s) that you may obtain, verify, exchange, and use information about them in the same manner as described above, that they may be responsible for payment of their own charges if I fail to pay them, and that their own credit records may be affected by nonpayment of the account. I understand that Additional Card(s) will not be issued to me if I have an unsatisfactory account with American Express or if the Additional Card applicant(s) have ever had an unsatisfactory account with American Express. Please note: The Additional Gold Card from American Express OPEN has certain features and benefits, such as Roadside Assistance Anywhere and access to Gold Card Events, that are not available to Additional Business Green Cards. I acknowledge that any benefit or service offered with the Card may be modified or terminated at any time. Express Cash For U.S. Cardmembers, the fee for each cash transaction shall be the greater of $5.00 or 3% of the cash transaction with no maximum. The limit on the amount of cash that you and Additional Cardmembers on your American Express Accounts may obtain from ATMs is $1,000 (for Executive Business Card Accounts: $2,500) in any seven-day period. We may impose additional limits at our sole discretion (in addition to any limits imposed by the ATM’s operator). Express Cash transactions and fees will not be billed to your Card statement. Withdrawal amounts may vary depending on the ATM network and Cardmember credit and repayment history. If multiple withdrawals are required, a separate transaction fee will be charged. By using the service you are indicating your acceptance of the terms of the Electronic Fund Transfer agreement, which you will receive upon acknowledgement of your enrollment. No pre-set spending limit —The American Express Card has no pre-set spending limit, which gives you purchasing power that adjusts with your use of the Card and other factors. No pre-set spending limit does not mean unlimited spending. Purchasing power adjusts with your use of the Card, your payment history, credit card record and financial resources known to us, and other factors. Membership Rewards Program: Terms and Conditions for Membership Rewards Program® apply. Visit membershiprewards.com/terms or call 1-800-AXP-EARN (297-3276) for more information. Participating partners and available rewards are subject to change without notice. Gold Card Events Ticket orders may be subject to a service charge. Subject to availability as well as to prior group sales, subscription sales and special ticket holds. Casting, dates, times and prices subject to change. No refunds or exchanges. Ticket limits may apply. All events are on sale now unless otherwise stated. Some events through Gold Card Events may not be accessible to Card members with disabilities. The following American Express Cards (domestic and/or international) are eligible for Gold Card Events: Gold Card, Platinum Card®, Centurion® Card, the Delta Reserve Credit Card, International Dollar Cards, Corporate Platinum Card and the Executive Business Card, Business Gold Card, Business Platinum Card and Business Centurion Card from OPEN, if issued by American Express Travel Related Services Company Inc., American Express Centurion Bank, or American Express Bank, FSB. Gold Card Events is not offered to the following (domestic and/or international) Cards that include, but not are not limited to, select American Express® Corporate Cards, Optima® Cards, Delta SkyMiles® Credit Cards, American express Costco Credit Cards, American Express Cash Rebate Cards, Hilton HHONORS® Credit Cards or Starwood Preferred Guest® Credit Cards, Aeroplus® Credit Cards, AeroMexico® Cards, Indian Airlines® Cards, Air France® Cards, British Airway® Cards, KLM® Cards, Tiger Woods® Credit Cards. Event Ticket Protection Plan is underwritten by AMEX Assurance Company, Administrative Office, Phoenix, AZ. Coverage is determined by the terms, conditions, and exclusions of Policy AX0974 or Policy ETP-IND and is subject to change with notice. This document does not supplement or replace the Policy. This benefit is not available to residents of New York State. Car Rental Loss and Damage Insurance covers you for theft of, or damage to, most Rental Autos for the first 30 days of rental if rented from a Commercial Car Rental Company. Simply use your eligible Card to reserve, pick up, and pay for an auto rental and decline the Rental Company’s full collision damage waiver (or similar option). The coverage is in excess of your other

- 3. insurance and is only available for Rental Autos rented in the United States, its territories and possessions. See the Description of Coverage or call 1-800-338-1670 for full details. Coverage is underwritten by AMEX Assurance Company, Administrative Office, Phoenix, AZ. Coverage is subject to the terms and conditions of exclusions AX0925 and is subject to change with notice. This document does not supplement or replace the Policy Return Protection Purchases must be made in the United States and charged in full on your Card. A Refund will not be paid if, on the date we receive your Return Protection Request, any amount on your Card Account is past due for one or more billing cycle(s) or your Card is cancelled. Refunds are limited to $300 per designated item, and $1,000 annually per Cardmember Account. The item must be in “like new” condition (not visibly used or worn) and working in order to be eligible. An item is eligible if it may not be returned by the Cardmember to the store from which it was originally purchased. Any item purchased from a store that has an established return/satisfaction guarantee program which is greater than or equal to the terms of Return Protection, and provides coverage for claim, will not be eligible for a Return Protection Refund. Items not eligible for a refund are: animals and living plants; one-of-a-kind items (including antiques, artwork, and furs); limited edition items; going-out-of-business sale items; consumable or perishable items with limited life spans (such as perfume, light bulbs, non-rechargeable batteries); jewelry and precious stones; services and additional costs (such as installation charges, warranties, shipping, or memberships); rare and precious coins; used, rebuilt and refurbished items; custom-built items, cellular phones; pagers; compact discs; digital video discs; mini discs; audiotapes; videotapes; computer software; firmware (such as console games, Nintendo, etc.); maps; books of any kind; health care items (such as blood pressure machines and diabetes equipment); formal wear; tickets of any kind; motorized vehicles (such as cars, trucks, motorcycles, boats, airplanes, or riding lawn mowers) and their parts; land and buildings; firearms; negotiable instruments (such as promissory notes, stamps and travelers checks); cash and its equivalent; and items permanently affixed to home, office, vehicles, etc. (such as garage door openers, car alarms). If you have any questions regarding a Return Protection Request or the Return Protection program, please call our Customer Service Department at 800-297-8019. Purchase Protection is underwritten by AMEX Assurance Company, Administrative Office, Phoenix, AZ. Coverage is subject to the terms, conditions, and exclusions of Policy AX0951. Travel Accident Insurance Policy is underwritten by AMEX Assurance Company, Administrative Office, Phoenix, AZ. Coverage is subject to the terms, conditions, and exclusions of Policy AX0948. See Description of Coverage for complete details. Travel Services Locations Not all services are available at all locations. Services are subject to local laws and cash availability. OPEN Savings® Savings range from 3% to 25%. Payment must be made with an American Express® Business Card at the time of purchase; savings will be credited to your account. Other restrictions or limitations may apply. Subject to offer terms and conditions located at opensavings.com. Merchant participation and offers are subject to change without notice. 1-800-FLOWERS.COM® Valid on all U.S. purchases – online, in store or by telephone. 1 Bonus Points: To be eligible to earn bonus points you must be enrolled in the Membership Rewards® program at the time of purchase and charge your purchases to an eligible, enrolled American Express® Card. You can earn bonus points for your Eligible Spending** in each membership year, as follows: If your Eligible Spending in a membership year is equal to or greater than $50,000, you can earn 25,000 bonus points. Bonus points will be credited to your Membership Rewards account 6 to 8 weeks after your Eligible Spending reaches the $50,000 threshold amount. Bonus ID 2751. Terms and conditions for the Membership Rewards program apply. For more information or to enroll in the program, visit membershiprewards.com/terms or call 1-800-AXP-EARN (297-3276). Some American Express Cards are not eligible for enrollment in the program. Participating partners and available rewards are subject to change without notice. **”Eligible Spending” includes purchases of goods or services, which purchases have not been returned or otherwise credited to your Card account: it does NOT include fees, Finance Charges, Balance Transfers, Cash Advances or similar means of accessing your Card account, or the purchase of American Express Travelers Cheques, American Express Gift Cheques or other cash equivalents. I Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for full program Terms and Conditions. Some American Express Cards are not eligible for enrollment in the Program. Participating partners and available rewards are subject to change without notice. II Ticket orders may be subject to a service charge. Subject to availability as well as to prior group sales, subscriptions sales, and special ticket holds. Casting, dates and prices subject to change. No refunds or exchanges. Ticket limits may apply. Some Gold Card Events may not be accessible to Cardmembers with disabilities. III The American Express Card has no pre-set spending limit, which gives you purchasing power that adjusts with your use of the Card and other factors. No pre-set spending limit does not mean unlimited spending. Purchasing power adjusts with your use of the Card, your payment history, credit card record and financial resources known to us, and other factors. IV This feature requires enrollment and is available to accounts that meet certain eligibility criteria. V OPEN Savings®: Savings range from 3% to 25%. Payment must be made with an American Express® Business Card at the time of purchase; savings will be credited to your account. Other restrictions or limitations may apply. Subject to offer terms and conditions located at opensavings.com. Merchant participation and offers are subject to change without notice. VI Travel Accident Insurance is underwritten by AMEX Assurance Company, Administrative Office, Phoenix, AZ. Coverage is determined by the terms, conditions, and exclusions of Policy AX0948 and is subject to change with notice. This document does not supplement or replace the Policy. VII American Express Card Baggage Insurance Plan is underwritten by AMEX Assurance Company, Administrative Office, Phoenix, AZ. Coverage is determined by the terms, conditions, and exclusions of Policy AX0400 and is subject to change with notice. This document does not supplement or replace the Policy. VIII Car Rental Loss and Damage Insurance is underwritten by AMEX Assurance Company, Administrative Office, Phoenix, AZ. Coverage is determined by the terms, conditions, and exclusions of Policy AX0925 and is subject to change with notice. This document does not supplement or replace the Policy. IX Extended Warranty is underwritten by AMEX Assurance Company, Administrative Office, Phoenix, AZ. Coverage is determined by the terms, conditions, and exclusions of Policy AX0953 or Policy EW-IND and is subject to change with notice. This document does not supplement or replace the Policy. X Purchase Protection is underwritten by AMEX Assurance Company, Administrative Office, Phoenix, AZ. Coverage is determined by the terms, conditions, and exclusions of Policy AX0951 or Policy PP-IND and is subject to change with notice. This document does not supplement or replace the Policy. XI If you are dissatisfied with an eligible Card purchase and the merchant won’t take it back within 90 days of your purchase, American Express will reimburse your account for the full price, up to $300 per item, excluding shipping and handling. Coverage is limited to $1,000 annually per Card account and is subject to additional terms, conditions, and exclusions. XII Not all services available at all locations and all are subject to local laws and cash availability. XIII Comprises Travel and Foreign Exchange locations of American Express. Not all services are available at all locations and are subject to local laws and cash availability. XIV While the many Global Assist Hotline coordination and assistance services are free benefits from American Express, Cardmembers are responsible for the costs charged by third-party service providers. XV Not all disputes are resolved in the Cardmember’s favor. XVI Terms and Conditions apply. Not all providers service all markets. In some instances, it may take more than one billing cycle before initial paid amounts are posted to your Account. Please remember to cancel these payments with your service providers if you close your Card Account, and advise your service providers if your Card Account number changes. XVII Enrollment in Express Cash is required. Funds are drawn against the cash advance limit on your Account. Cash withdrawal limits apply. Transaction fees are 3% for each transaction, with a minimum of $5.00 and no maximum. The ATM owner may charge additional fees for each transaction.