Template for budgeting 2010

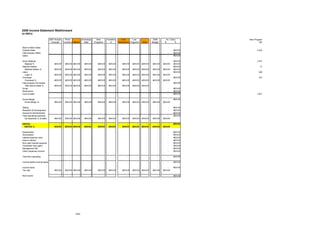

- 1. 2008 Income Statement Walkforward (in 000's) 2007 Actual/ Price/ Exchange New Transfers Cost Lost 2008 Inc / (Dec) New Program Forecast Contract Inflation Rate Programs In Reductions Programs Other Budget $ % QD Back-to-Back Sales - - Outside Sales - - #DIV/0! 4,400 Intercompany Sales - - #DIV/0! Sales - - - - - - - - - - - #DIV/0! Direct Material - - - #DIV/0! 2,992 Material % #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! Material Adders - - - - - #DIV/0! 32 Material Adders % #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! Labor - - #DIV/0! 326 Labor % #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! Overhead - - - #DIV/0! 458 Overhead % #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! Intercompany Purchases - - #DIV/0! Mat Interco Sales % #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! Scrap - - #DIV/0! Restructure - - #DIV/0! Cost of sales - - - - - - - - - - - #DIV/0! 3,807 Gross Margin - - - - - - - - - - - #DIV/0! Gross Margin % #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! Selling - - - #DIV/0! Research & Development - - #DIV/0! General & Administrative - - - #DIV/0! Total operating expenses - - - - - - - - - - - #DIV/0! Op expenses % of sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! - - EBITDA - - - - - - - - - - - #DIV/0! EBITDA % #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! Depreciation - - #DIV/0! Amortization - - #DIV/0! Interest expense cash - - #DIV/0! interco interest - - #DIV/0! Non-cash interest expense - - #DIV/0! Translation loss (gain) - - #DIV/0! Management fee - - #DIV/0! Other (expense) income - - #DIV/0! - Total Non-operating - - - - - - - - - - - #DIV/0! Income before income taxes - - - - - - - - - - - #DIV/0! Income taxes - - #DIV/0! Tax rate #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! Net Income - - - - - - - - - - - #DIV/0! 3223

- 2. 07/31/2010 REQUESTED CAPITAL: 268,766 REQUESTED EXPENSE: 5,190 273,956 Capacity Expansion: 2008 2009 2010 Total Gross Sales 6,841,627 6,841,627 6,841,627 Payment Discount 2.0% (136,833) (136,833) (136,833) Rebate 0.0% - - - Total Net Sales 6,704,794 6,704,794 6,704,794 % Tot Cost % Sales Direct Materials 66.6% 3,651,803 3,651,803 3,651,803 54.5% Material Adders 3.9% 211,805 211,805 211,805 3.2% Labor/Overhead 19.4% 1,062,503 1,062,503 1,062,503 15.8% Logistics/Whse 2.0% 107,479 107,479 107,479 1.6% Import Duties 8.2% 447,828 447,828 447,828 6.7% Total Incremental Cost 100.0% 5,481,417 5,481,417 5,481,417 81.8% MARGIN on Incremental Sales 1,223,377 1,223,377 1,223,377 1,360,210 MARGIN % Sales 18.2% 18.2% 18.2% 19.9% Cost Reduction: Total Cost Reduction - - - Requested Expense 5,190 5,190 5,190 COMBINED MARGIN 1,218,187 1,218,187 1,218,187 Ul/CSA Expense - SG&A % Sales N/A N/A N/A EBITDA 1,218,187 1,218,187 1,218,187 Depreciation: (Enter Depreciable Life) -----> 7 38,407 38,407 38,407 Taxable Income 1,179,781 1,179,781 1,179,781 Tax Rate 0.00% 12.50% 12.50% Tax Payments 0 147,473 147,473 Working Capital Items: DSO (Enter DSO) -----> 60 (1,140,271) (1,140,271) (1,140,271) Inv Turns-Normal (Enter Inv Turns) -----> 12 (304,317) (304,317) (304,317) Freight (Enter Days in Transit) -----> 35 (532,916) (532,916) (532,916) AP Days (Enter AP Days) -----> 75 760,792 760,792 760,792 Total Working Capital (1,216,712.0) (1,216,712.0) (1,216,712.0) EBITDA 1,218,187.4 1,218,187.4 1,218,187.4 Tax Payments 0.0 (147,473.0) (147,473.0) Working Capital Change (1,216,712.0) 0.0 0.0 NET CASH FLOW (268,766) 1,475 1,070,714 1,070,714 CASH FLOW ECONOMICS: RRR 13% NPV $ 1,313,125 IRR 138.1% PAYBACK (Years) 1.2 templateforbudgeting2010-100731092309-phpapp02.xls

- 3. 2007 Gross 2007 2007 net Inc/(Dec) in New (Lost) X Customers Forecast Rebate Forecast Contract Price Program Program Reason A B C D E F G H Total:

- 4. Y Z Net 2008 Reason Reason Change Budget

- 5. ECI (Huizhou) 2008 Budget Headcount & Capex Name Position Sep-07 Jan Feb Mar Apr May Jun Fin Dick Lam Controller 1 1 1 1 1 1 1 Stephen Li Manager 1 1 1 1 1 1 1 Lily Li Accountant 1 1 1 1 1 1 1 Tina Jia A. Accountant 1 1 1 1 1 1 1 Linda Lin A. Accountant 1 1 1 1 1 1 1 Samantha A. Accountant 1 1 1 1 1 1 1 Debbie A. Accountant 1 1 1 1 1 1 1 ------------ ------------ ------------ ------------ ------------ ------------ ------------ 7 7 7 7 7 7 7 Salary Jan Feb Mar Apr May Jun 65,000 65,000 65,000 68,250 68,250 68,250 35,000 35,000 35,000 38,500 38,500 38,500 6,000 6,000 6,000 6,000 6,000 6,000 9,500 9,500 9,500 10,450 10,450 10,450 7,500 7,500 7,500 8,250 8,250 8,250 8,250 8,250 8,250 8,250 8,250 8,250 7,500 7,500 7,500 8,250 8,250 8,250 ------------ ------------ ------------ ------------ ------------ ------------ Salary 138,750 138,750 138,750 147,950 147,950 147,950 MPF 6,938 6,938 6,938 7,398 7,398 7,398 Medical 2,100 2,100 2,100 2,100 2,100 2,100 Double Pay 11,563 11,563 11,563 12,329 12,329 12,329 Bonus 13,875 13,875 13,875 14,795 14,795 14,795

- 6. 5%á Jul Aug Sep Oct Nov Dec Existing 2008 1 1 1 1 1 1 65,000 68,250 1 1 1 1 1 1 35,000 38,500 1 1 1 1 1 1 14,800 6,000 1 1 1 1 1 1 9,500 10,450 1 1 1 1 1 1 7,500 8,250 1 1 1 1 1 1 7,500 8,250 1 1 1 1 1 1 7,500 8,250 ------------ ------------ ------------ ------------ ------------ ------------ 7 7 7 7 7 7 Jul Aug Sep Oct Nov Dec 68,250 68,250 68,250 68,250 68,250 68,250 38,500 38,500 38,500 38,500 38,500 38,500 6,000 6,000 6,000 6,000 6,000 6,000 10,450 10,450 10,450 10,450 10,450 10,450 8,250 8,250 8,250 8,250 8,250 8,250 8,250 8,250 8,250 8,250 8,250 8,250 8,250 8,250 8,250 8,250 8,250 8,250 ------------ ------------ ------------ ------------ ------------ ------------ 147,950 147,950 147,950 147,950 147,950 147,950 7,398 7,398 7,398 7,398 7,398 7,398 2,100 2,100 2,100 2,100 2,100 2,100 12,329 12,329 12,329 12,329 12,329 12,329 14,795 14,795 14,795 14,795 14,795 14,795

- 8. Salary for Social Security Jan Feb Mar Apr May 3,250 3,250 3,250 3,413 3,413 #N/A 224 224 224 224 #N/A 188 188 188 188 #N/A 188 188 188 188 #N/A 188 188 188 188 #N/A 188 188 188 188 #N/A 173 173 173 173

- 9. Jun Jul Aug Sep Oct Nov Dec 3,413 3,413 3,413 3,413 3,413 3,413 3,413 224 224 224 224 224 224 224 188 188 188 188 188 188 188 188 188 188 188 188 188 188 188 188 188 188 188 188 188 188 188 188 188 188 188 188 173 173 173 173 173 173 173

- 10. HK'000 Sales 30,000 Cost 25,000 Gross Margin 5,000 % 16.7% Selling Expenses 2,500 General Admin 1,030 EBITDA 1,470 4.9% HK$'000 C/M Budget F/(U) % Sales 30,000 32,000 (2,000) -6.3% Cost of Sales 24,000 26,500 2,500 9.4% Commission 1,000 1,100 100 9.1% 25,000 27,600 2,600 9.4% Gross Margin 5,000 4,400 600 13.6% 16.7% 13.8% -30.0% Selling Expenses A&P 1,300 1,500 200 13.3% Staff Salary 1,000 977 (23) -2.4% Staff Welfare 100 98 (2) -2.0% Entertainment 30 25 (5) -20.0% Traveling 60 55 (5) -9.1% Others 10 11 1 9.1% 2,500 2,666 166 6.2% General Admin. Staff salary 800 810 10 1.2% Staff welfare 80 75 (5) -6.7% Rent & Rates 100 100 - 0.0% Communication 30 25 (5) -20.0% Others 20 19 (1) -5.3% 1,030 1,029 (1) -0.1% EBITDA 1,470 705 435 61.7% 4.9% 2.2% -21.8%

- 11. Nov-07 Dec-07 Total 2007 Department RMB USD RMB USD RMB USD Customer Service 515.00 68.67 Engineering 1,520.00 202.67 Finance 4,412.10 588.28 HR 2,423.00 323.07 IT - - KPO 900.00 120.00 Manufacturing 945.00 126.00 Operations 950.00 126.67 PMC - - Production 2,020.00 269.33 Program 2,195.00 292.67 Project - - QA 1,915.00 255.33 Security 2,350.00 313.33 Supply Chain Management 300.00 40.00 ------------------- ------------ ------------ ------------ ------------ ------------ Total 20,445.10 2,726.01 0 0 0 0 =========== ======= ======= ======= ======= =======

- 12. Cashflow Jan-08 Feb-08 Mar-08 Apr-08 May-08 Jun-08 Jul-08 Aug-08 Sep-08 Net Income 157 (258) 45 22 166 72 57 454 618 Add: Depreciation 117 117 117 117 117 125 125 125 125 Change of WC A/R (545) 2,172 (1,816) (249) 694 (374) (890) (1,246) (854) Inventory 1,274 (632) 10 474 (605) (1,160) (1,339) (622) 574 A/P (803) (1,233) 784 (702) 380 1,323 1,412 706 (580) Others --------- ---------- ---------- --------- ---------- ---------- ---------- ---------- --------- (73) 307 (1,022) (478) 469 (211) (817) (1,162) (860) Capex - - - - (200) - (1,200) - - Cash (Surplus)/Loan Required (50) (165) 861 339 (552) 15 1,836 583 118 --------- ---------- ---------- --------- ---------- ---------- ---------- ---------- --------- 150 - - - - - - - - Bginning Cash Balance 150 300 300 300 300 300 300 300 300 Net Cashflow 150 - - - - - - - - Ending Cash Balance 300 300 300 300 300 300 300 300 300 ===== ====== ====== ===== ====== ====== ====== ====== =====

- 13. Cur: HKD'000 Oct-08 Nov-08 Dec-08 489 338 223 125 125 125 338 890 374 880 453 1,156 (1,063) (579) (1,062) ---------- ---------- ---------- 155 764 468 - - - (769) (1,227) (815) ---------- ---------- ---------- - - - 300 300 300 - - - 300 300 300 ====== ====== ======

- 14. ABC Company 2009 Budget Cost Reduction Jan-09 Feb-09 Mar-09 Apr-09 May-09 Jun-09 Jul-09 1. Material Saving Connector - - - - - - - Housing - - - - - - - Wire - - - - - - - Packing - - - - - - - IC - - - - - - - - - - - - - - 2. Utitlity - - - - - - - 3. Re-structure Department IT - - - - - - - Finance - - - - - - - Production - - - - - - - Material - - - - - - - - - - - - - -

- 15. Aug-09 Sep-09 Oct-09 Nov-09 Dec-09 Total How - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -