AT&T First-Quarter Earnings Package

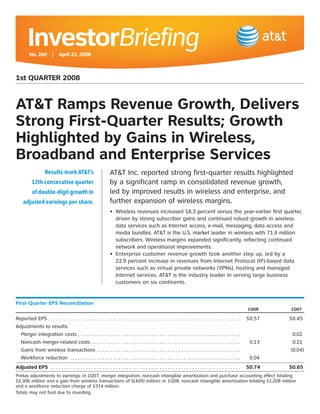

- 1. InvestorBriefing No. 260 | April 22, 2008 1st QUARTER 2008 AT&T Ramps Revenue Growth, Delivers Strong First-Quarter Results; Growth Highlighted by Gains in Wireless, Broadband and Enterprise Services Results mark AT&T’s AT&T Inc. reported strong first-quarter results highlighted by a significant ramp in consolidated revenue growth, 12th consecutive quarter led by improved results in wireless and enterprise, and of double-digit growth in further expansion of wireless margins. adjusted earnings per share. • Wireless revenues increased 18.3 percent versus the year-earlier first quarter, driven by strong subscriber gains and continued robust growth in wireless data services such as Internet access, e-mail, messaging, data access and media bundles. AT&T is the U.S. market leader in wireless with 71.4 million subscribers. Wireless margins expanded significantly, reflecting continued network and operational improvements. • Enterprise customer revenue growth took another step up, led by a 22.9 percent increase in revenues from Internet Protocol (IP)-based data services such as virtual private networks (VPNs), hosting and managed Internet services. AT&T is the industry leader in serving large business customers on six continents. First-Quarter EPS Reconciliation 1Q08 1Q07 Reported EPS . . . . . . . . . . . . . . . . . . ..................................................... $0.57 $0.45 Adjustments to results: Merger integration costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.02 Noncash merger-related costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.13 0.21 Gains from wireless transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.04) Workforce reduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.04 Adjusted EPS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0.74 $0.65 Pretax adjustments to earnings: in 1Q07, merger integration, noncash intangible amortization and purchase accounting effect totaling $2,306 million and a gain from wireless transactions of $(409) million; in 1Q08, noncash intangible amortization totaling $1,208 million and a workforce reduction charge of $374 million. Totals may not foot due to rounding.

- 2. 2 InvestorBriefing | 1Q 2008 REPORTED RESULTS AT&T CONSOLIDATED ADJUSTED REVENUE GROWTH RATES Compared with results for the year-earlier Year-Over-Year, Pro Forma AT&T continues to quarter, AT&T’s reported operating expenses 4.6% accelerate growth for the first quarter of 2008 were $24.8 billion, in consolidated up from $24.3 billion; reported operating income was $6.0 billion, up from $4.7 billion; revenues, driven by 3.2% and AT&T’s reported operating income margin gains in wireless, 2.9% was 19.5 percent, up from 16.1 percent. broadband and AT&T’s reported first-quarter 2008 net enterprise services. 2.0% 1.7% income totaled $3.5 billion, up 21.5 percent from $2.8 billion in the year-earlier quarter, and reported earnings per diluted share totaled $0.57, up 26.7 percent from $0.45 in the first quarter of 2007. 1Q07 2Q07 3Q07 4Q07 1Q08 Revenues for 2007 are adjusted to exclude merger-related directory DOUBLE-DIGIT GROWTH IN accounting impacts. 2007 comparisons are to 2006 pro forma ADJUSTED EARNINGS PER SHARE results, which combine revenues from AT&T, BellSouth and Cingular Wireless consistently for all periods. AT&T’s adjusted results for the first quarter of 2008 exclude merger-related amortization • Broadband revenues continued their record expenses and costs associated with a of solid double-digit growth, reflecting workforce reduction. Adjusted results for subscriber gains and an increased number the first quarter of 2007 excluded merger- of subscribers who select higher-speed related costs and accounting effects as service. AT&T is the U.S. leader in broad- well as gains from wireless transactions. band service with 14.6 million connections. Compared with results for the year-earlier • AT&T U-verseSM TV subscriber growth quarter, AT&T’s adjusted operating expenses continued its strong ramp, with a first- for the first quarter of 2008 totaled quarter net gain of 148,000 to reach $23.2 billion, versus $22.4 billion; adjusted 379,000 in service. The company is on operating income was $7.6 billion, up from track to reach its target of more than $7.0 billion; and AT&T’s adjusted operating 1 million AT&T U-verse TV subscribers income margin was 24.6 percent, up from by year-end 2008. 23.7 percent. AT&T’s adjusted first-quarter 2008 net REVENUE GROWTH RAMP income totaled $4.5 billion, up 10.3 percent For the quarter ended March 31, 2008, AT&T’s from $4.1 billion in the year-earlier quarter, revenues totaled $30.7 billion, up 6.1 percent and adjusted earnings per diluted share versus reported results in the year-earlier totaled $0.74, up 13.8 percent from $0.65 quarter and up 4.6 percent compared with in the first quarter of 2007. first-quarter 2007 pro forma revenues, which AT&T’s merger integration and operational exclude merger-related accounting impacts cost initiatives continue on schedule. For the on directory revenues. This marks a substan- full year 2007, operating expense savings tial step up from year-over-year pro forma from BellSouth and AT&T Corp. merger revenue growth of 2.9 percent in the fourth integration efforts and previously outlined quarter of 2007 and 1.7 percent in the first operational initiatives totaled approximately quarter of 2007. $3.9 billion. AT&T expects these expense AT&T’s first-quarter revenue growth was savings to grow in 2008 by more than driven by improved growth rates in wireless, $2 billion dollars. enterprise and wholesale, combined with stable trends in regional revenues.

- 3. 3 InvestorBriefing | 1Q 2008 ADDITIONAL BACKGROUND ON AT&T ADJUSTED OPERATING INCOME MARGIN ADJUSTED AND PRO FORMA RESULTS 24.6% AT&T’s adjusted earnings for the first Revenue growth 24.0% 23.9% quarter of 2008 exclude (1) noncash pretax and progress on 23.7% 23.7% amortization costs related to acquisitions productivity initiatives totaling $1.2 billion, or $0.13 per diluted combined to further share, and (2) a charge of $374 million, or expand margins in $0.04 per diluted share, associated with a the first quarter. workforce reduction previously disclosed in a Form 8-K filing. Adjusted results for the first quarter of 2007 excluded: (1) pretax merger-related integration costs totaling $245 million, or 1Q07 2Q07 3Q07 4Q07 1Q08 Reported 16.1% 16.8% 17.6% 18.1% 19.5% $0.02 per diluted share; (2) noncash, pretax Merger integration and amortization costs and other one-time items merger-related costs totaling $1.8 billion, or are excluded from adjusted operating income margins. $0.18 per diluted share; (3) a merger-related directory accounting impact of $301 million, CASH FROM OPERATIONS, or $0.03 per diluted share; and (4) a gain of SHARE REPURCHASES $409 million, or $0.04 per share, from Compared with results in the year-earlier wireless transactions. quarter, AT&T’s cash from operating activi- Advertising & Publishing results for 2007 ties for the first quarter of 2008 totaled were affected by accounting adjustments $5.0 billion, up from $4.6 billion; capital following AT&T’s late 2006 acquisition of expenditures totaled $4.2 billion, versus BellSouth. In accordance with purchase $3.3 billion; and free cash flow (cash from accounting rules, deferred revenues and operations minus capital expenditures) expenses for all BellSouth directories totaled $0.7 billion, compared with delivered prior to the close of the merger $1.3 billion. were eliminated from 2007 consolidated As it invests in the future of its business, results. This elimination of amortization AT&T continues to return substantial value reduced first-quarter 2007 consolidated to shareowners through dividends and revenues by $409 million and consolidated share repurchases. In the first quarter, operating expenses by $108 million. dividends paid totaled $2.4 billion and AT&T manages its print directory business shares repurchased totaled 111.6 million using amortized results. As a result, 2007 for $4.1 billion. AT&T ended the quarter amortized results are shown in the with 5.9 billion shares outstanding. Advertising & Publishing segment on AT&T’s Statement of Segment Income. STRONG BALANCE SHEET In 2008, consolidated and segment results AT&T’s balance sheet continues to be strong. reflect amortization accounting. At the end of the first quarter, AT&T’s long- term debt was $60.2 billion, and total debt was $73.5 billion. Cash and cash equivalents at the end of the quarter totaled $2.0 billion. AT&T’s first-quarter debt-to-total-capitali- zation ratio was 39.6 percent, and the company’s annualized debt-to-EBITDA was 1.6. AT&T expects its year-end 2008 debt-to-EBITDA ratio will be in the 1.3 to 1.5 range.

- 4. 4 InvestorBriefing | 1Q 2008 Wireless AT&T delivered strong wireless growth in the first quarter, reflecting the AT&T’s first-quarter wireless company’s broad high-quality network, innovative services, attractive handset results were highlighted selection, extensive sales reach and continued improvements in operations. Results included improved revenue growth, expanded margins and strong by strong double-digit growth in operating income. revenue growth driven ACCELERATED WIRELESS REVENUE GROWTH AT&T’s first-quarter wireless revenues totaled $11.8 billion, up 18.3 percent by solid subscriber gains versus the year-earlier quarter. This marked AT&T’s seventh consecutive quarter of improved wireless revenue growth. Wireless service revenues, which exclude and robust growth in handset and accessory sales, grew 17.1 percent to $10.6 billion. Revenue growth was driven by strong subscriber gains and continued wireless data services. improvement in ARPU (average monthly revenues per subscriber). AT&T has now posted seven consecutive quarters of year-over-year growth in wireless service ARPU, which was $50.18 in the first quarter, up 2.0 percent versus the year-earlier quarter. Retail postpaid subscriber ARPU growth was even stronger, up approximately 5 percent. IMPROVED SUBSCRIBER GAINS AT&T’s first-quarter net gain in wireless subscribers totaled 1.3 million, up 104,000, or 8.7 percent, versus the year-earlier quarter. AT&T ended the quarter with 71.4 million subscribers in service. Total net adds in the first quarter were reduced by approximately 330,000 due to the shutdown of AT&T’s TDMA wireless network in late February. Retail postpaid net adds totaled 705,000 in the first quarter of 2008, up 3.7 percent versus net adds in the year-earlier first quarter. AT&T continued its strong record of wireless subscriber flow share with 5.0 million first-quarter gross subscriber additions, up from 4.3 million in the year-earlier quarter. Total average monthly subscriber churn, which includes postpaid, prepaid and reseller subscribers, was 1.7 percent, flat with the year-earlier quarter and with the fourth quarter of 2007. Retail postpaid churn was 1.2 percent, down from 1.3 percent in the year-earlier quarter and flat with the fourth quarter of 2007. ROBUST GROWTH IN WIRELESS DATA SERVICES AT&T‘s wireless data revenues grew 57.3 percent versus results in the year- earlier quarter to $2.3 billion, reflecting robust increases in Internet access, e-mail, messaging, data access and media bundles. Data now represents 21.5 percent of AT&T’s total wireless service revenues, up from 16.0 percent in the first quarter of 2007 and 10.9 percent in the first quarter of 2006.

- 5. 5 InvestorBriefing | 1Q 2008 the company expects to deliver 3G services AT&T WIRELESS REVENUES to nearly 350 leading U.S. markets by the Year-Over-Year Growth AT&T posted its end of 2008, including all of the nation’s 18.3% 100 largest cities. seventh consecutive 16.3% quarter of accelerated 14.4% OPERATING INCOME GROWTH, 12.7% wireless revenue MARGIN EXPANSION 11.2% growth, reflecting Strong growth in wireless revenues, network solid subscriber gains efficiencies and operational improvements and robust adoption have driven substantial improvement in AT&T’s of data services. wireless operating income and margins. On a reported basis, AT&T’s first-quarter wireless operating expenses totaled 1Q07 2Q07 3Q07 4Q07 1Q08 $8.9 billion, and operating income was $3.0 billion, up 94.1 percent from During the first quarter, AT&T’s wireless $1.5 billion in the first quarter of 2007. customers sent more than 620 million On an adjusted basis, wireless operating multimedia messages and 44 billion text expenses totaled $8.3 billion, and operating messages, both volumes more than double income was $3.5 billion, up 38.5 percent totals in the year-earlier quarter. from $2.5 billion in the first quarter of 2007. AT&T expects continued robust growth AT&T’s reported wireless operating in wireless data services as more customers income margin was 25.0 percent, up from adopt integrated devices that deliver 15.2 percent in the year-earlier quarter, access to a broad array of applications and its adjusted wireless operating and content. At the end of the first quarter, income margin was 29.8 percent, up from 16 percent of AT&T’s postpaid wireless 25.5 percent in the year-earlier quarter. subscribers had an integrated device, up AT&T’s first-quarter wireless OIBDA service from 6 percent one year earlier. margin was 41.7 percent, the highest ever Data growth is also spurred by adoption achieved by the company’s wireless segment, of 3G-compatible devices. At the end of up from an unadjusted 37.5 percent and an the first quarter, 11 million AT&T customers adjusted 38.9 percent in the year-earlier had 3G devices. AT&T’s 3G network now quarter. (OIBDA service margin is operating includes 272 U.S. metropolitan areas, and income before depreciation and amortization, divided by total service revenues.) AT&T WIRELESS SUBSCRIBERS In millions LEADER IN WIRELESS NETWORKS, AT&T increased its 71.4 70.1 SERVICE INNOVATION wireless subscriber AT&T operates the United States’ largest base by more than 65.7 wireless digital voice and data network, and 9 million over 63.7 through roaming alliances around the world, 62.2 the past year. provides the largest global presence among U.S. wireless carriers. AT&T is moving quickly to create the next generation of wireless. In addition to its broad 3G network deployment, by the middle of this year, the company expects 1Q07 2Q07 3Q07 4Q07 1Q08 to complete its upgrade of the nation’s Subscriber increase in 4Q07 included 1.7 million subscribers added through Dobson acquisition. first High Speed Uplink Packet Access

- 6. 6 InvestorBriefing | 1Q 2008 completed successful bids for prime B Block AT&T WIRELESS DATA REVENUES spectrum in the Federal Communications Dollars in billions AT&T’s wireless data Commission’s Auction 73. $2.3 The complementary nature of the spectrum revenues grew $2.0 AT&T acquired through the FCC auction and 57.3 percent year $1.8 $1.7 from Aloha Partners gives AT&T the capacity over year and now $1.5 to meet customer needs as the company represent 21.5 percent moves to higher-speed 4G (fourth-generation) of total wireless services. Upon final award of the auctioned service revenues. B Block spectrum, AT&T’s 700 MHz spectrum will cover 100 percent of the top 200 markets and 87 percent of the U.S. population. AT&T also sets the pace for innovation in 1Q07 2Q07 3Q07 4Q07 1Q08 wireless with a host of cutting-edge devices, content and services. In recent weeks, AT&T: (HSUPA)-enabled network in current 3G • Added to its HSUPA device lineup with the markets. The network allows AT&T’s launch of two new LaptopConnect cards HSUPA-enabled laptop users to send from Option, the GT Ultra and GT Ultra large files faster and take full advantage Express. The new cards deliver enhanced of the latest interactive Internet and mobile broadband performance across two business applications. popular notebook computer formats, PC AT&T also took major steps in the first Card and ExpressCard. Both the GT Ultra quarter to add valuable wireless spectrum. and GT Ultra Express are compatible with In February, AT&T completed its acquisition Microsoft Windows Vista, Windows XP, of spectrum licenses covering 196 million Windows 2000 and Apple® Mac® OS X people in 281 license areas from a subsidiary (version 10.4.10 or later) notebooks. of Aloha Partners, L.P. In March, AT&T • Joined with MediaFLO USA Inc. to intro- duce AT&T Mobile TV with FLO, a mobile AT&T ADJUSTED WIRELESS MARGINS television service featuring high-quality Operating Income Margin OIBDA Service Margin live programming. The mobile TV service AT&T’s wireless 41.7% will launch in May 2008 on two new OIBDA service margin exclusive handsets, the LG Vu™ and the expanded 280 Samsung Access™. AT&T Mobile TV will 38.9% basis points versus 29.8% deliver full-length television content and adjusted results 25.5% sporting events from top networks, for the first quarter including programming from leading of 2007. entertainment brands CBS Mobile, Comedy Central, ESPN Mobile TV, FOX Mobile, MTV, NBC 2GO, NBC News2Go and Nickelodeon. • Unveiled plans for a redesigned MEdia Mall, the company’s one-stop shopping 1Q08 1Q07 1Q08 1Q07 Unadjusted 41.7% 15.2% 25.0% 37.5% Results destination for mobile content. Since Merger integration and intangible amortization costs excluded launching on AT&T mobile handsets in from adjusted operating income margins: $1,022 million in 1Q07 December 2004, millions of customers and $568 million in 1Q08. Merger integration costs excluded from adjusted OIBDA service margins: $124 million in 1Q07. have visited MEdia Mall to obtain

- 7. 7 InvestorBriefing | 1Q 2008 ringtones, games, videos and other access to YELLOWPAGES.COM, real-time applications, generating more than traffic updates and route information $1 billion in sales and helping to spawn and is the only mobile phone-based a wave of innovation among an ever- GPS service that provides integrated growing mobile developer community. speech recognition for address entry Like its predecessor, MEdia Mall 2.0 will and points of interest search, is currently feature more than 90,000 choices from available on BlackBerry® devices. more than 115 content providers. • Announced BusinessTalk, a new wireless • Successfully launched a new unlimited offer that brings the benefits of AT&T voice plan targeted to wireless users who FamilyTalk plans to small businesses, want the predictability of flat-rate pricing enabling them to share monthly Anytime for unlimited minutes. The plan is available Minutes for up to 40 employees. to new and existing wireless subscribers BusinessTalk plans are designed to for $99.99 a month for unlimited U.S. help small businesses better manage calling with no domestic roaming or long their monthly costs by reducing overage distance charges. charges and simplifying billing. AT&T • Introduced AT&T Navigator, a next- offers a wide range of wireless phones, generation navigation service available smart devices, LaptopConnect solutions on GPS-capable PDAs and handsets. and other services for small businesses, AT&T Navigator is designed to provide including mobile e-mail, GPS navigation clear and precise audible and visual and Push To Talk technology. turn-by-turn driving directions, including full-color moving maps, using GPS directly from a customer’s wireless phone. AT&T Navigator, which offers mobile

- 8. 8 InvestorBriefing | 1Q 2008 Wireline First-quarter revenues in AT&T’s wireline segment totaled $17.6 billion versus First-quarter results in $18.0 billion in the year-earlier quarter. This reflects a return to revenue growth AT&T’s wired operations in the company’s enterprise business, substantial improvement in wholesale revenue trends and stable revenue trends in regional business and consumer were highlighted by operations. Excluding revenues from national mass markets, the small remainder of the improved enterprise growth, former AT&T’s stand-alone long distance and local bundled business, wireline revenues increased slightly versus the year-earlier quarter and sequentially. a double-digit increase AT&T expects further stabilization in overall wireline revenue trends during the remainder of 2008 as enterprise continues to grow, wholesale trends in broadband revenues show further improvement and AT&T U-verse services gain additional scale. Compared with results for the year-earlier first quarter, on a reported basis, and a further ramp in AT&T wireline operating expenses totaled $14.8 billion, versus $15.1 billion; operating income was $2.8 billion, versus $2.9 billion; and AT&T’s wireline operating U-verse TV subscribers. income margin was 16.1 percent, which was unchanged versus the first quarter of 2007. Adjusted wireline results for the first quarter of 2007 exclude merger-related integration and amortization expenses. Adjusted wireline results for the first quarter of 2008 exclude only merger-related amortization expenses. Compared with results for the year-earlier first quarter, adjusted wireline operating expenses totaled $14.4 billion, unchanged from $14.4 billion; adjusted operating income was $3.3 billion, versus $3.6 billion; and AT&T’s adjusted wireline operating income margin was 18.5 percent, versus 20.1 percent. Moving through 2008, AT&T expects wireline expenses and margins to benefit from ongoing cost initiatives and improved IP economics. The following wireline highlights include ongoing shifts in customer categories to reflect AT&T’s management of customer relationships. FURTHER STEP UP IN ENTERPRISE GROWTH AT&T delivered further improvement in enterprise revenue growth in the first quarter, led by a 22.9 percent increase in enterprise IP data revenues, including areas such as VPNs, managed Internet services and hosting. Total enterprise revenues continued their ramp and were up 1.2 percent versus results for the first quarter of 2007. This compares with year-over-year pro forma declines of 2.0 percent in the fourth quarter of 2007 and 3.9 percent in the first quarter of 2007.

- 9. 9 InvestorBriefing | 1Q 2008 Also in the first quarter, AT&T announced AT&T TOTAL ENTERPRISE REVENUE GROWTH RATES it is joining forces with SAP America Inc. in 2 a three-year marketing agreement under AT&T’s enterprise 1.2% which AT&T will serve as a primary SAP® 1 revenue growth hosting partner, providing independent continues to be driven 0 hosting services for large business customers (0.2)% by solid demand, headquartered in North America. -1 a premier global Recent major enterprise contract wins (1.7)% network and a -2 include a five-year agreement with Royal (2.0)% broad portfolio of Dutch Shell, which calls for AT&T to provide, -3 advanced services. manage and maintain Shell’s worldwide (3.9)% -4 communications infrastructure while also managing the company’s global mobility 1Q07 2Q07 3Q07 4Q07 1Q08 Enterprise service revenue growth (3.0)% (0.7)% 0.4% 1.5% 2.1% needs. This is one of the largest commercial 2007 comparisons are to 2006 pro forma results, which combine contracts ever signed by AT&T and the results from the former BellSouth and AT&T and exclude revenues largest agreement signed with a company from acquired operations. headquartered in Europe. This agreement Enterprise service revenues, which exclude with Shell follows a series of other large CPE sales and acquisition impacts, grew wins in the past year, including deals 2.1 percent, following a 1.5 percent increase with Starbucks, General Motors, the in the preceding quarter and a decline of U.S. Department of the Treasury and IBM. 3.0 percent in the first quarter of 2007. REGIONAL BUSINESS GROWTH With solid demand and sales momentum, AT&T expects to deliver positive growth in AT&T’s regional business revenues increased total enterprise revenues throughout 2008. 2.6 percent in the first quarter to $3.2 billion, AT&T is the premier provider for enterprise with continued growth in both voice and customers, delivering networking services data services. Regional business service and solutions to multinational corporations, revenues, which exclude CPE sales, grew U.S. governmental agencies and regionally 3.4 percent. based domestic companies. AT&T continues Regional business data revenues, which to take the initiative to expand and enhance make up 30.5 percent of the category, grew its enterprise capabilities. 6.3 percent, led by strong growth in Ethernet For example, in March AT&T announced services and by 15.2 percent growth in that it plans to invest $1 billion in 2008 to IP data services, including gains in broad- extend its global network reach and capacity, band, managed Internet and VPN services. globalize its portfolio of business services Regional business revenues from small and embed the latest utility computing and and midsize firms increased approximately other technologies in the network so that 5 percent. AT&T’s broad portfolio of companies can deliver real-time applications communications services for small and to their customers, suppliers and partners. midsize businesses includes wireless, Major projects include new subsea fiber broadband Internet access, business optic cable capacity to Japan and Asia, new e-mail services, Web hosting, unified core MPLS (MultiProtocol Label Switching) messaging, remote data storage and routers in Europe, Asia and the United States, network security options. and new network-to-network connections to extend network reach into high-growth markets in Asia Pacific, Eastern Europe and South America.

- 10. 10 InvestorBriefing | 1Q 2008 In April, AT&T announced the availability AT&T U-VERSE TV CONNECTIONS IN SERVICE of new turnkey Web hosting solutions and In thousands Web site design services developed specifi- 379 AT&T ramped growth cally for small and midsize businesses. in its advanced Using these services, companies can easily IP-based TV service, and cost-effectively launch a new or improve with a net gain of an existing Web site, sell products or 231 148,000 subscribers services online, build an online community, in the first quarter. manage company e-mail, distribute digital content, host a gaming server or run many 126 other business applications. The new offerings are targeted to organizations 51 that need more than shared server space 13 and applications but do not require the 1Q07 2Q07 3Q07 4Q07 1Q08 complex multiserver environment of enterprise hosting. These offerings expanded in the first quarter with the launch of AT&T Business STABLE REGIONAL CONSUMER in a BoxSM, a service that harnesses the REVENUES, ACCELERATED power of IP communications to simplify VIDEO RAMP IT operations for smaller and midsize First-quarter regional consumer results businesses and branch offices of large continued trends of recent quarters, with businesses. The service features a single improved growth in broadband and Advanced device equipped with all necessary data TV services offsetting traditional voice access ports and connectors and delivers VoIP line pressures, resulting in stable revenues. functionality through AT&T Voice DNASM, Regional consumer revenues totaled Internet access routing with built-in firewall $5.5 billion, down 0.4 percent versus results protection, VPN capabilities, Wi-Fi data for the year-earlier quarter. access capabilities and local area network Regional consumer revenue connections connectivity with Power Over Ethernet (retail voice, high speed Internet and connections. video) totaled 49.3 million at the end of the first quarter of 2008. This compares with 49.3 million at the end of the first AT&T BROADBAND CONNECTIONS In millions quarter 2007 and 49.4 million at the end 14.6 AT&T added 491,000 of the fourth quarter of 2007. Gains in broadband connections 14.2 broadband and video connections totaled in the first quarter 2.6 million over the past year, and 13.8 and 1.8 million over consumer IP data revenues, which include the past year. revenues from broadband and AT&T 13.3 U-verse services, increased 18.5 percent 12.9 versus results for the year-earlier quarter. Reflecting growth in broadband and video, average monthly revenues per consumer primary line have increased steadily over the past several quarters, reaching $60.16 in the 1Q07 2Q07 3Q07 4Q07 1Q08 first quarter, up 5.4 percent year over year.

- 11. 11 InvestorBriefing | 1Q 2008 from any PC; an online voice mailbox so that AT&T AVERAGE MONTHLY REVENUES PER customers can listen to, manage and forward CONSUMER PRIMARY LINE voice mail from the online portal; and the AT&T’S regional $60.16 ability to check call history or click-to-call consumer ARPU has $59.14 from their U-verse TV screen. $58.62 ramped steadily over $58.15 the past several $57.08 BROADBAND GROWTH quarters, reflecting AT&T continues to deliver solid double-digit growth in broadband growth in broadband. AT&T’s broadband and TV service. revenues totaled $1.4 billion in the first quarter, up 13.2 percent versus the year- earlier quarter. In the first quarter, total high speed Internet connections, which include DSL, 1Q07 2Q07 3Q07 4Q07 1Q08 U-verse enabled AT&T High Speed Internet and satellite broadband services, increased Consumer broadband revenues continue by 491,000, and AT&T ended the first to grow at a solid double-digit pace, and quarter with 14.6 million consumer and consumer broadband net adds improved business high speed Internet connections, from recent quarters, reflecting the success up 1.8 million, or 13.9 percent, over the of new wireless/broadband bundles and the past year. rapid expansion of AT&T U-verse services. This growth reflects the quality and broad Growth in AT&T U-verse TV service, the availability of AT&T’s broadband services, the company’s next-generation IP-based video ramp in AT&T U-verse service, which has a service, continued its strong ramp during high broadband attach rate, and innovations the first quarter, achieving a net subscriber such as the launch last year of a stand-alone gain of 148,000 to reach 379,000 in service. high speed Internet service, also available AT&T expects a further ramp in the quarters as part of a new wireless and broadband ahead and is on track to reach its target of service bundle. more than 1 million subscribers by the end To boost bandwidth choices, AT&T of 2008. announced plans to offer AT&T High Speed Total video connections, which include Internet Max in February 2008. The new tier, AT&T U-verse service and bundled satellite available exclusively to AT&T U-verse television service, increased by 264,000 customers across the country, will deliver in the quarter to reach 2.6 million. more bandwidth with speeds up to 10 Mbps AT&T also broke new ground in the first downstream and up to 1.5 Mbps upstream. quarter by expanding its launch of AT&T To add convenience and portability for U-verse Voice services in Sacramento, broadband users, in January, AT&T and Kansas City, Austin, San Diego and Starbucks announced plans to deliver Connecticut. The service offers a host of AT&T Wi-FiSM service at more than 7,000 features that integrate AT&T wired and company-operated Starbucks locations wireless services including: combined AT&T across the United States. Starbucks and U-verse Voice and wireless voice mail with AT&T will offer a mix of free and paid Wi-Fi U-verse Messaging, which provides a single offerings at Starbucks stores. The initiative voice mailbox that can be accessed from any will further expand the AT&T Wi-Fi network, phone line or PC; U-verse Central, an online already the largest in the United States, to management portal that gives users the more than 17,000 U.S. hot spots and more option to manage their call preferences, than 71,000 globally. voice mail, contacts, call history and more

- 12. 12 InvestorBriefing | 1Q 2008 To capitalize on tremendous demand for WHOLESALE additional data capacity and IP-related AT&T is a leading global provider of whole- services, in February, AT&T announced that sale services, delivering a full portfolio of it is expanding capacity to deliver key network, voice, data and IP solutions to services such as long-haul private line carriers, wireless operators, cable providers, and Managed Internet Services in most of systems integrators, Internet service the 26 carrier-neutral hotels in which it providers and content providers. has a presence nationwide. Carrier-neutral In the first quarter, AT&T delivered a hotels are facilities at which multiple significant improvement in wholesale carriers interconnect and make their revenue trends, with total wholesale telecommunications services available revenues of $3.4 billion, representing a to their customers. decline of 3.9 percent versus results for the In April, AT&T announced the availability year-earlier quarter. This marks a step up of new Voice over Internet Protocol from declines in the 7 percent to 8 percent services for wholesale customers. These range over the past several quarters, as include a Gigabit Ethernet connectivity comparisons have reflected concessions interface for AT&T Voice Over IP Connect associated with AT&T’s acquisition of Service and the AT&T BusinessDirect® BellSouth Corp. and industry shifts as major portal for AT&T Global Hubbing IP consolidated carriers move traffic Access customers. to their own networks. Volume demand from wireless carriers, NATIONAL MASS MARKETS Internet service providers and content Mass market revenues totaled $730 million providers continues to accelerate, and in the first quarter, representing a decline AT&T expects that wholesale revenues will of 33.2 percent year over year. Results are continue to stabilize in 2008, as merger as expected and reflect the 2004 decision conditions pass their one-year anniversary to discontinue proactive marketing in this and carrier traffic migration nears space and AT&T’s strategy of migrating completion. customers within its regional footprint to its In addition, AT&T and IBM have announced regional platforms to deliver better service an agreement that calls for AT&T to become and a broader array of service options. the primary global network management National mass markets, which represented services provider to IBM, which will use 4.1 percent of total wireline revenues in AT&T’s global telecommunications and the first quarter, accounted for more than network management services internally 100 percent of AT&T’s year-over-year and provide these services to customers. decline in total wireline revenues. As a result, AT&T expects to receive up to $5 billion of additional revenues over the five-year term of the agreement, largely in the wholesale customer category. These revenues are expected to ramp in mid-2008.

- 13. 13 InvestorBriefing | 1Q 2008 WIRELINE VOICE SERVICES PRODUCT CATEGORIES AT&T’s first-quarter wireline voice revenues, which include retail local voice and long WIRELINE DATA SERVICES distance as well as wholesale voice, totaled AT&T’s data revenues, which include results $9.9 billion, representing a decline of from several customer categories, grew 7.1 percent versus results for the first quarter 5.9 percent versus results for the year-earlier of 2007. This comparison is consistent with first quarter to $6.2 billion. results in recent quarters, reflecting the Data growth was led by an 18.2 percent industrywide migration of voice usage increase in revenues from IP-based services, from wired to wireless platforms, customer with continued gains in high speed Internet, transitions to broadband and VoIP services managed Internet, VPN and hosting services. and increased local voice competition. Data transport service revenues increased 0.7 percent, and packet switched data revenues, which include Frame Relay and ATM services, were down 10.7 percent, consistent with industry trends. In the first quarter, 73.0 percent of AT&T’s data revenues came from retail business and consumer customers. These retail data revenues were up 7.9 percent versus results for the year-earlier quarter.

- 14. 14 InvestorBriefing | 1Q 2008 Advertising & Publishing AT&T’s Advertising & Publishing segment offers businesses a full suite of local AT&T is a leader in local search options including print and Internet Yellow Pages in addition to Web site search with more than design and search engine marketing. AT&T’s Advertising & Publishing operations deliver print directories to 1,250 print directories and more than 83 million residences and businesses in 22 states and have a premier online presence nationwide with YELLOWPAGES.COM, which offers YELLOWPAGES.COM, consumers access to local business information, the latest business listings, city guides, maps and driving directions. Combined, these print and online its fast-growing online products receive approximately 5 billion consumer searches a year for local business information and provide more than 1 million advertisers with search service. valuable sales leads to help their businesses grow. Advertising & Publishing revenue trends over the past several quarters have been generally stable, with print declines reflecting expected migration to electronic search, largely offset by rapid growth in YELLOWPAGES.COM. In the first quarter of 2008, Advertising & Publishing’s Internet revenues increased 41.1 percent versus the year-earlier quarter and 12.9 percent sequentially. In March, AT&T announced a distribution agreement with Microsoft Corp. that will put YELLOWPAGES.COM’s comprehensive advertising listings and content in front of consumers who use Microsoft’s local search sites. The agreement, launched in early April, gives YELLOWPAGES.COM advertisers exposure through Microsoft’s search pages within the Live Search and Live Search Maps properties, including MSN Yellow Pages. Compared with reported results in the year-earlier quarter, Advertising & Publishing revenues totaled $1.4 billion, unchanged from a reported $1.4 billion; operating expenses totaled $999 million, up from $976 million; and operating income totaled $418 million, compared with $467 million. Adjusted results for Advertising & Publishing exclude merger-related noncash amortization costs in both quarters. Compared with results in the year-earlier quarter, first-quarter 2008 adjusted operating expenses totaled $797 million, up from $744 million, and operating income totaled $620 million, compared with $699 million.

- 15. 15 InvestorBriefing | 1Q 2008 Other AT&T’s Other segment includes results from AT&T’s Sterling Commerce AT&T’s Other segment operations and AT&T’s customer information services operations, both of includes results from its which are included in segment revenues and operating expenses. Customer information services include operator services and directory assistance. Sterling Commerce unit, Sterling Commerce is one of the world’s largest providers of multienterprise collaboration solutions. The company serves the retail, consumer packaged customer information goods, manufacturing, financial services, health care and telecommunications industries. services and equity The Other segment includes AT&T’s proportionate share of results from Telmex and América Móvil, which are shown in the Equity in Net Income of investments in Telmex Affiliates line for this segment. AT&T’s equity interest in each company is more than 8 percent. and América Móvil. América Móvil is one of the leading providers of telecommunications services in Latin America, with more than 153 million wireless subscribers in countries throughout the region, including 50 million in Mexico, at the end of 2007. Telmex is the leading telecommunications company in Mexico. Telmex and its subsidiaries provide a wide range of telecommunications services, data and video transmission, Internet access and integrated telecommunications solutions. Telmex also offers telecommunications services through its international subsidiaries in countries including Argentina, Brazil, Chile, Colombia, Ecuador, Peru and Uruguay. On a reported basis, Other segment income totaled $15 million in the first quarter, versus $252 million in the year-earlier quarter. Other segment results for the first quarter of 2008 include the company’s $374 million workforce reduction charge. Segment revenues totaled $544 million, unchanged from the first quarter of 2007. Equity in Net Income of Affiliates totaled $241 million, up from $172 million in the year-earlier quarter. Adjusted Other segment income, which excludes merger-related and workforce reduction costs, was $406 million, compared with $287 million in the first quarter of 2007.

- 16. 16 InvestorBriefing | 1Q 2008 AT&T Inc. Consolidated Statements of Income (Unaudited) (Dollars in Millions, Except per Share Amounts) Three Months Ended 3/31/08 3/31/07 % Change Operating Revenues Voice $ 9,693 $10,455 -7.3% Data 5,972 5,655 5.6% Wireless service 10,605 9,070 16.9% Directory 1,398 1,022 36.8% Other 3,076 2,767 11.2% Total Operating Revenues 30,744 28,969 6.1% Operating Expenses Cost of services and sales (exclusive of depreciation and amortization shown separately below) 11,775 11,252 4.6% Selling, general and administrative 8,086 7,437 8.7% Depreciation and amortization 4,903 5,616 -12.7% Total Operating Expenses 24,764 24,305 1.9% Operating Income 5,980 4,664 28.2% Interest Expense 865 873 -0.9% Equity in Net Income of Affiliates 243 173 40.5% Other Income (Expense) – Net 33 504 -93.5% Income Before Income Taxes 5,391 4,468 20.7% Income Taxes 1,930 1,620 19.1% Net Income $ 3,461 $ 2,848 21.5% Basic Earnings Per Share $ 0.58 $ 0.46 26.1% Weighted Average Common Shares Outstanding (000,000) 5,997 6,224 -3.6% Diluted Earnings Per Share $ 0.57 $ 0.45 26.7% Weighted Average Common Shares Outstanding with Dilution (000,000) 6,033 6,266 -3.7%

- 17. 17 InvestorBriefing | 1Q 2008 AT&T Inc. Statements of Segment Income (Unaudited) (Dollars in Millions) Three Months Ended 3/31/08 3/31/07 % Change Wireless Segment Operating Revenues Service $10,645 $ 9,092 17.1% Equipment 1,180 905 30.4% Total Segment Operating Revenues 11,825 9,997 18.3% Segment Operating Expenses Cost of services and equipment sales 4,110 3,670 12.0% Selling, general and administrative 3,279 2,913 12.6% Depreciation and amortization 1,480 1,891 -21.7% Total Segment Operating Expenses 8,869 8,474 4.7% Segment Operating Income 2,956 1,523 94.1% Equity in Net Income of Affiliates 2 7 -71.4% Minority Interest (60) (48) -25.0% Segment Income $ 2,898 $ 1,482 95.5% Wireline Segment Operating Revenues Voice $ 9,919 $10,677 -7.1% Data 6,205 5,862 5.9% Other 1,500 1,447 3.7% Total Segment Operating Revenues 17,624 17,986 -2.0% Segment Operating Expenses Cost of sales 7,616 7,558 0.8% Selling, general and administrative 4,005 4,093 -2.2% Depreciation and amortization 3,170 3,440 -7.8% Total Segment Operating Expenses 14,791 15,091 -2.0% Segment Income $ 2,833 $ 2,895 -2.1% Advertising & Publishing Segment Operating Revenues $ 1,417 $ 1,443 -1.8% Segment Operating Expenses Cost of sales 444 455 -2.4% Selling, general and administrative 343 279 22.9% Depreciation and amortization 212 242 -12.4% Total Segment Operating Expenses 999 976 2.4% Segment Income $ 418 $ 467 -10.5% Other Segment Operating Revenues $ 544 $ 544 — Segment Operating Expenses 770 464 65.9% Segment Operating Income (Loss) (226) 80 — Equity in Net Income of Affiliates 241 172 40.1% Segment Income $ 15 $ 252 -94.0%

- 18. 18 InvestorBriefing | 1Q 2008 AT&T Inc. Consolidated Balance Sheets (Dollars in Millions, Except per Share Amounts) 3/31/08 12/31/07 Assets (Unaudited) Current Assets Cash and cash equivalents $ 1,963 $ 1,970 Accounts receivable – net of allowances for uncollectibles of $1,361 and $1,364 15,697 16,185 Prepaid expenses 1,610 1,524 Deferred income taxes 1,934 2,044 Other current assets 2,742 2,963 Total current assets 23,946 24,686 Property, Plant and Equipment – Net 96,238 95,890 Goodwill 70,815 70,713 Licenses 40,711 37,985 Customer Lists and Relationships – Net 13,692 14,505 Other Intangible Assets – Net 5,877 5,912 Investments in Equity Affiliates 2,578 2,270 Postemployment Benefit 17,645 17,291 Other Assets 6,697 6,392 Total Assets $278,199 $275,644 Liabilities and Stockholders’ Equity Current Liabilities Debt maturing within one year $ 13,301 $ 6,860 Accounts payable and accrued liabilities 18,590 21,399 Advanced billing and customer deposits 3,677 3,571 Accrued taxes 4,186 5,027 Dividends payable 2,375 2,417 Total current liabilities 42,129 39,274 Long-Term Debt 60,189 57,255 Deferred Credits and Other Noncurrent Liabilities Deferred income taxes 25,203 24,939 Postemployment benefit obligation 24,510 24,011 Unamortized investment tax credits 144 150 Other noncurrent liabilities 13,766 14,648 Total deferred credits and other noncurrent liabilities 63,623 63,748 Stockholders’ Equity Common shares issued ($1 par value) 6,495 6,495 Capital in excess of par value 91,598 91,638 Retained earnings 34,311 33,297 Treasury shares (at cost) (19,590) (15,683) Accumulated other comprehensive loss (556) (380) Total stockholders’ equity 112,258 115,367 Total Liabilities and Stockholders’ Equity $278,199 $275,644

- 19. 19 InvestorBriefing | 1Q 2008 AT&T Inc. Consolidated Statements of Cash Flows (Unaudited) (Dollars in Millions, Increase (Decrease) in Cash and Cash Equivalents) Three Months Ended 3/31/08 3/31/07 Operating Activities Net income $ 3,461 $ 2,848 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 4,903 5,616 Undistributed earnings from investments in equity affiliates (225) (156) Provision for uncollectible accounts 480 376 Amortization of investment tax credits (6) (8) Deferred income tax expense 569 65 Net gain on sales of investments (46) — Gain on license exchange — (409) Changes in operating assets and liabilities: Accounts receivable (150) 237 Other current assets 142 (748) Accounts payable and accrued liabilities (4,654) (3,232) Stock-based compensation tax benefit (7) (47) Other – net 490 71 Total adjustments 1,496 1,765 Net Cash Provided by Operating Activities 4,957 4,613 Investing Activities Construction and capital expenditures (4,247) (3,338) Acquisitions, net of cash acquired (3,662) (198) Dispositions 47 209 Proceeds from sale of securities, net of investments 131 518 Other 32 7 Net Cash Used in Investing Activities (7,699) (2,802) Financing Activities Net change in short-term borrowings with original maturities of three months or less 5,786 (2,989) Issuance of long-term debt 3,972 5,924 Repayment of long-term debt (613) (227) Purchase of treasury shares (4,071) (3,005) Issuance of treasury shares 103 687 Dividends paid (2,422) (2,218) Stock-based compensation tax benefit 7 47 Other (27) (84) Net Cash Provided by (Used in) Financing Activities 2,735 (1,865) Net decrease in cash and cash equivalents (7) (54) Cash and cash equivalents beginning of year 1,970 2,418 Cash and Cash Equivalents End of Period $ 1,963 $ 2,364