Holding Equities For The Long Term Time Versus Timing

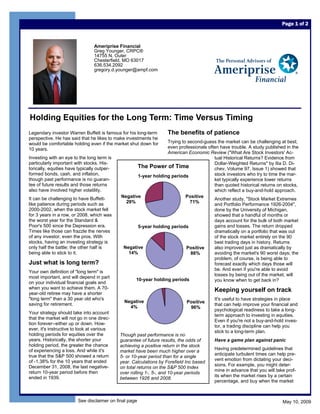

- 1. Page 1 of 2 Ameriprise Financial Greg Younger, CRPC® 14755 N. Outer Chesterfield, MO 63017 636.534.2092 gregory.d.younger@ampf.com Holding Equities for the Long Term: Time Versus Timing The benefits of patience Legendary investor Warren Buffett is famous for his long-term perspective. He has said that he likes to make investments he Trying to second-guess the market can be challenging at best; would be comfortable holding even if the market shut down for even professionals often have trouble. A study published in the 10 years. American Economic Review (quot;What Are Stock Investors' Ac- Investing with an eye to the long term is tual Historical Returns? Evidence from particularly important with stocks. His- Dollar-Weighted Returnsquot; by Ilia D. Di- The Power of Time torically, equities have typically outper- chev, Volume 97, Issue 1) showed that formed bonds, cash, and inflation, stock investors who try to time the mar- 1-year holding periods though past performance is no guaran- ket typically experience lower returns tee of future results and those returns than quoted historical returns on stocks, also have involved higher volatility. which reflect a buy-and-hold approach. Negative Positive It can be challenging to have Buffett- Another study, quot;Stock Market Extremes 29% 71% like patience during periods such as and Portfolio Performance 1926-2004quot;, 2000-2002, when the stock market fell done by the University of Michigan, for 3 years in a row, or 2008, which was showed that a handful of months or the worst year for the Standard & days account for the bulk of both market Poor's 500 since the Depression era. gains and losses. The return dropped 5-year holding periods Times like those can frazzle the nerves dramatically on a portfolio that was out of any investor, even the pros. With of the stock market entirely on the 90 stocks, having an investing strategy is best trading days in history. Returns Negative only half the battle; the other half is also improved just as dramatically by Positive 14% being able to stick to it. avoiding the market's 90 worst days; the 86% problem, of course, is being able to Just what is long term? forecast exactly which days those will be. And even if you're able to avoid Your own definition of quot;long termquot; is losses by being out of the market, will most important, and will depend in part 10-year holding periods you know when to get back in? on your individual financial goals and when you want to achieve them. A 70- Keeping yourself on track year-old retiree may have a shorter quot;long termquot; than a 30 year old who's It's useful to have strategies in place Negative Positive saving for retirement. that can help improve your financial and 4% 96% psychological readiness to take a long- Your strategy should take into account term approach to investing in equities. that the market will not go in one direc- Even if you're not a buy-and-hold inves- tion forever--either up or down. How- tor, a trading discipline can help you ever, it's instructive to look at various stick to a long-term plan. holding periods for equities over the Though past performance is no years. Historically, the shorter your Have a game plan against panic guarantee of future results, the odds of holding period, the greater the chance achieving a positive return in the stock Having predetermined guidelines that of experiencing a loss. And while it's market have been much higher over a anticipate turbulent times can help pre- true that the S&P 500 showed a return 5- or 10-year period than for a single vent emotion from dictating your deci- of -1.38% for the 10 years that ended year. Calculations by Forefield Inc based sions. For example, you might deter- December 31, 2008, the last negative- on total returns on the S&P 500 Index mine in advance that you will take prof- return 10-year period before then over rolling 1-, 5-, and 10-year periods its when the market rises by a certain ended in 1939. between 1926 and 2008. percentage, and buy when the market See disclaimer on final page May 10, 2009

- 2. Page 2 of 2 Ameriprise Financial has fallen by a set percentage. Or you might take a core-and- price. Moreover, that sale might also reduce your ability to satellite approach, combining the use of buy-and-hold princi- generate income in later years. What might it cost you in future ples for the bulk of your portfolio with tactical investing based returns by selling stocks at a low point if you don't need to? on a shorter-term outlook. Perhaps you could adjust your lifestyle temporarily instead. Market downturns are a test of how well you've diversified your Use cash to help manage your mindset assets. Though diversification can't guarantee a profit or en- Having some cash holdings can sure against a loss, it can help you manage risk by spreading be the financial equivalent of it among various types of investments, some of which may be taking deep breaths to relax. It performing better than others. can enhance your ability to make thoughtful decisions instead of Remember that everything's relative impulsive ones. If you've estab- Most of the variance in the returns of different portfolios is lished an appropriate asset allocation, you should have based on their respective asset allocations. If you've got a well enough resources on hand to prevent having to sell stocks at -diversified portfolio, it might be useful to compare its overall an inopportune time just to meet ordinary expenses or, if performance to the S&P 500. If you discover that you've done you've used leverage, a margin call. better than, say, the stock market as a whole, that realization might help you feel better about your long-term A cash cushion coupled with a disciplined investing strategy prospects. can change your perspective on market downturns. Knowing that you're positioned to take advantage of a market swoon by Current performance may not reflect past results picking up bargains may increase your ability to be patient. Don't forget to look at how far you've come since you started Know what you own and why you own it investing. When you're focused on day-to-day market move- ments, it's easy to forget the progress you've already made. When the market goes off the tracks, knowing why you origi- Keeping track of where you stand relative to not only last year nally made a specific investment can help you evaluate but to 3, 5, and 10 years ago may help you remember that the whether those reasons still hold, regardless of what the overall market is doing. If you don't understand why a security is in current situation is unlikely to last forever. your portfolio, find out. A stock may still be a good long-term Consider playing defense opportunity even when its price has dropped. Some investors try to prepare for volatile periods by reexamin- Tell yourself that tomorrow is another day ing their allocation to such defensive sectors as consumer staples or utilities (though like all The market is nothing if not cyclical. Even if you wish you had stocks, those sectors involve their sold at what turned out to be a market peak, or regret having own risks). Dividends also can sat out a buying opportunity, you may get another chance help cushion the impact of price later. Even if you're considering changes, a volatile market is probably the worst time to turn your portfolio inside out. Solid swings. asset allocation is still the basis of good investment planning. If you're retired and worried about a market downturn's impact on Be willing to learn from your mistakes your income, think before react- Anyone can look good during bull markets; smart investors are ing. If you sell stock during a pe- produced by the inevitable rough patches. Even the best aren't riod of falling prices simply be- right all the time. If an earlier choice now seems rash, some- cause that was your original game times the best strategy is to take a tax loss, learn from the plan, you might not get the best experience, and apply the lesson to future decisions. Disclosure Information -- Important -- Please Review The information contained in this material is being provided for general education purposes and with the understanding that it is not intended to be used or interpreted as specific legal, tax or investment advice. It does not address or account for your individual investor circumstances. Investment decisions should always be made based on your specific financial needs and objectives, goals, time horizon and risk tolerance. The information contained in this communication, including attachments, may be provided to support the marketing of a particular product or service. You cannot rely on this to avoid tax penalties that may be imposed under the Internal Revenue Code. Consult your tax advisor or attorney regarding tax issues specific to your circumstances. Neither Ameriprise Financial Services, Inc. nor any of its employees or representatives are authorized to give legal or tax advice. You are encouraged to seek the guidance of your own personal legal or tax counsel. Ameriprise Financial Services, Inc. Member FINRA and SIPC. The information in this document is provided by a third party and has been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by Ameriprise Financial Services, Inc. While the publisher has been diligent in attempting to provide accurate information, the accuracy of the information cannot be guaranteed. Laws and regulations change frequently, and are subject to differing legal interpretations. Accordingly, neither the publisher nor any of its licensees or their distributees shall be liable for any loss or damage caused, or alleged to have been caused, by the use or reliance upon this service. Prepared by Forefield Inc, Copyright 2009 May 10, 2009