7 city report

- 1. The National Home Builders Association has just released their June numbers for new housing starts and it’s not good news. The modest revival they enjoyed the past year ended in May after Federal Tax credits expired. Unsold inventory is only 213,000 units nationwide, the lowest level in nearly 40 years, and even at that it would take more than 8 months to sell off. The National Association of Realtors® will be releasing their numbers in a day or two and again, if the winks and nods in the media are to be believed, the news will not be good. Housing sales, which had been growing in many markets, appear to have hit a wall in May after the Federal Tax credits expired. Unsold inventory remains at 24 months or longer in some areas of the country. The Mortgage Bankers Association is bemoaning the fact that in spite of interest rates lower than any time in memorable history, new mortgage applications are way down and refi’s, which should be driving the business, are in the tank. AND NOW FOR SOMETHING COMPLETELY DIFFERENT! (with apologies to Monty Python). Southwest California must have missed the memo telling us to drive off a cliff. Month over month unit sales in 4 of our 6 markets were up in June after small drops in May. Temecula sales were up briskly in June and both Murrieta and Temecula set new sales volume records in June. (Chart 1). This helped drive sales to record levels for the 1st half of the year – up substantially over 2009 sales and nearly double sales volume from 2008. Murrieta and Lake Elsinore nearly tripled their sales volume over 2007. (Chart 3). Inventories have crept up ever so slightly throughout the region but are still hovering in that 2 – 3 month range, which is less than half of what is considered healthy and less than 10% of some other regions of the country. Demand is still with us. The percentage of listings that sell has crept down slightly but we’re still selling 70+% of inventory across most of our markets. (Chart 5). The reason inventory is up and selling percentage is down reflects the product mix – nearly 50% of our market is comprised of short-sales, which are still failing 65% of the time. Standard sales – those old fashioned harbingers of good times, made up 33% of our market last month while bank-owned properties only contributed 21% - down from almost 92% 18 months ago. Prices continued to stabilize across the market with half our cities up a little, half down a little. The ones that were up this month were down last and the ones down last were up this – we’re bumping along the bottom. (Chart 2). Of long term interest, 1st half comparisons show the price performance from our 2007 peak. Down 50% - 60% across the regions, Chart 4 shows a precipitous decline from 2007 to 2008 and a more moderate drop from 2008 to 2009. The good news is after that unprecedented dive, median prices across the region have stabilized the past two years and shown slight improvement in a couple markets. What lies ahead? Well, given the fact that loan mods and short-sales are failing at prodigious rates nationwide, Notices of Trustee Sales are creeping up again as a possible prelude to banks taking more properties back. That hasn’t happened yet but there are those who still worry about a shadow inventory as a precursor of a double-dip in pricing, especially if unemployment remains a concern. After all, there are still an estimated 1/3 of homeowners upside-down in their mortgage (11 to 15 million homeowners). People who are upside down can’t take advantage of the interest rates to refi and people who are out of work can’t buy a new home regardless of interest rates or tax credits. We are also seeing some trending among middle and upper income homeowners to exercise strategic defaults to the degree that both Fannie & Freddie have issues new guidelines to dis-incent that practice. Bottom line – when you read the national headlines and witness the angst ridden media fanning the bonfires of calamity, keep your eye on the local market. Now more than ever, all real estate is local. The strength of our cities and promoting local jobs initiatives is key to keeping our region trending against the tide and keeping our local recovery alive. Of course that’s just my opinion – for what it’s worth.

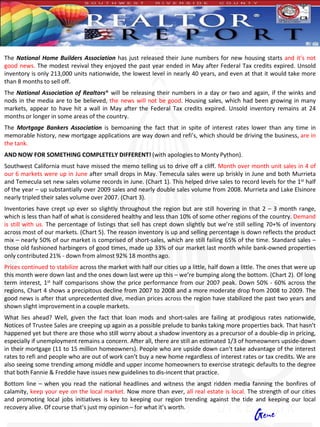

- 2. 250 Monthly Unit Sales 200 150 100 50 0 3/09 6/09 9/09 12/09 3/10 6/10 Temecula Murrieta Lake Elsinore Menifee Wildomar Canyon Lake $350,000 $300,000 $250,000 $200,000 $150,000 $100,000 Monthly Median Price $50,000 $0 3/09 6/09 9/09 12/09 3/10 6/10 Temecula Murrieta Lake Elsinore Menifee Wildomar Canyon Lake

- 3. 1200 First Half Sales Comparison 1000 800 600 400 200 0 Temecula Murrieta Wildomar Lake Elsinore Menifee Canyon Lake 1st Half '07 1st Half '08 1st Half '09 1st half '10 700,000 First Half Median Price Comparison 600,000 500,000 400,000 300,000 200,000 100,000 0 Temecula Murrieta Wildomar Lake Elsinore Menifee Canyon Lake 1st Half '07 1st Half '08 1st Half '09 1st Half '10

- 4. 5 600 9 0 June Demand Chart 4 500 2 4 3 3 3 5 5 400 9 3 1 9 2 2 300 4 2 1 1 1 5 9 9 9 9 1 9 2 8 1 200 4 1 2 0 0 3 7 9 6 6 7 7 6 6 7 7 7 7 5 5 5 6 100 6 8 6 1 1 9 9 0 4 2 3 3 2 2 2 6 2 4 9 2 2 8 0 . . . . . . 3 6 1 1 6 2 1 9 0 On Market Pending Closed (Demand) Days on Market % Selling Months Supply (Supply) Murrieta Temecula Lake Elsininore Menifee Canyon Lake Wildomar June Market Activity by Sales Type In % Active Closed Failed Escrow Activity Bank Owned 21% 39% 8% 30% 27% Short Sales 47% 35% 65% 52% 47% Standard Sales 33% 26% 27% 18% 26% Other 1% 1% 2% 1% 1% Data courtesy of Stats4Agents.com Notice of Notice of Back to Sold to Default Trustee Sale Bank (REO) 3rd Party Data courtesy of ForeclosureRadar.com