Health FSA "Use-or-Lose" Rule Disappears

•

0 recomendaciones•202 vistas

On October 31, 2013 the Department of Treasury modified the longstanding Health FSA Use-or-Lose Rule to allow carryover of FSA funds from one plan year to the next plan year at the employer's discretion. Find out more about this change with this iGuide.

Denunciar

Compartir

Denunciar

Compartir

Descargar para leer sin conexión

Recomendados

Recomendados

News Flash November 1 2013 Two Developments Plans May Permit Participants t...

News Flash November 1 2013 Two Developments Plans May Permit Participants t...Annette Wright, GBA, GBDS

Más contenido relacionado

La actualidad más candente

La actualidad más candente (20)

Covert Taxes: Spying Issues in Health & Welfare Benefits

Covert Taxes: Spying Issues in Health & Welfare Benefits

Health Reform Bulletin 131 | The ACA Remains The Law of The Land

Health Reform Bulletin 131 | The ACA Remains The Law of The Land

The ICHRA vs. the QSEHRA: Which is right for your business?

The ICHRA vs. the QSEHRA: Which is right for your business?

Health Reform Bulletin: Implementation Guidance & ACA Updates

Health Reform Bulletin: Implementation Guidance & ACA Updates

Healthcare Reform And Risk Management By Mark Bloom

Healthcare Reform And Risk Management By Mark Bloom

Consolidated Omnibus Budget Reconciliation Act - Provision under the American...

Consolidated Omnibus Budget Reconciliation Act - Provision under the American...

What’s in Your Rule Book? A Common Sense Approach to Plan Documentation.

What’s in Your Rule Book? A Common Sense Approach to Plan Documentation.

Independent Contractor or Employee: Avoiding the Game of Guess Who

Independent Contractor or Employee: Avoiding the Game of Guess Who

Similar a Health FSA "Use-or-Lose" Rule Disappears

News Flash November 1 2013 Two Developments Plans May Permit Participants t...

News Flash November 1 2013 Two Developments Plans May Permit Participants t...Annette Wright, GBA, GBDS

Healthcare Reform Proving To Be A Calendar Challenge

Healthcare reform is a significant administrative, clinical, financial and technical undertaking. As the nation moves forward to implement the mandates, the critical resource of time is proving harder to find and pay for. As 2013 comes to an end, the changes expected for 2014 will become more apparent and as we move through the year into 2015, more changes and challenges can be expected.

www.healthcaremedicalpharmaceuticaldirectory.com

John G. Baresky

https://www.linkedin.com/in/johngbaresky

#baresky

Healthcare Reform Proving To Be A Calendar Challenge - John Baresky, #baresky

Healthcare Reform Proving To Be A Calendar Challenge - John Baresky, #bareskyBare Sky Marketing Healthcare Content Writing Services

Similar a Health FSA "Use-or-Lose" Rule Disappears (20)

News Flash November 1 2013 Two Developments Plans May Permit Participants t...

News Flash November 1 2013 Two Developments Plans May Permit Participants t...

IRS Adds an Attractive Option to Flexible Spending Accounts

IRS Adds an Attractive Option to Flexible Spending Accounts

Affordable Care Act - Planning For The 2014 and 2015 Mandates

Affordable Care Act - Planning For The 2014 and 2015 Mandates

The Impact of Health Care Reform on Large Businesses

The Impact of Health Care Reform on Large Businesses

Healthcare Reform Proving To Be A Calendar Challenge - John Baresky, #baresky

Healthcare Reform Proving To Be A Calendar Challenge - John Baresky, #baresky

News Flash July 10 2013 IRS Clarifies Pay-or-Play Delay

News Flash July 10 2013 IRS Clarifies Pay-or-Play Delay

Why Are Retirement Plans Such a Great Opportunity?

Why Are Retirement Plans Such a Great Opportunity?

Why Are Retirement Plans Such a Great Opportunity?

Why Are Retirement Plans Such a Great Opportunity?

Affordable Care Act- Healthcare Act for Large Businesses

Affordable Care Act- Healthcare Act for Large Businesses

CBIZ Manufacturing & Distribution Quarterly Newsletter - Feb 2020

CBIZ Manufacturing & Distribution Quarterly Newsletter - Feb 2020

Leveraging Federal Financial Assistance Programs During COVID-19

Leveraging Federal Financial Assistance Programs During COVID-19

Más de Infinisource

Más de Infinisource (20)

4 Things to Consider When Choosing a Payroll Provider

4 Things to Consider When Choosing a Payroll Provider

Último

Saudi Arabia [ Abortion pills) Jeddah/riaydh/dammam/++918133066128☎️] cytotec tablets uses abortion pills 💊💊 How effective is the abortion pill? 💊💊 +918133066128) "Abortion pills in Jeddah" how to get cytotec tablets in Riyadh " Abortion pills in dammam*💊💊 The abortion pill is very effective. If you’re taking mifepristone and misoprostol, it depends on how far along the pregnancy is, and how many doses of medicine you take:💊💊 +918133066128) how to buy cytotec pills

At 8 weeks pregnant or less, it works about 94-98% of the time. +918133066128[ 💊💊💊 At 8-9 weeks pregnant, it works about 94-96% of the time. +918133066128) At 9-10 weeks pregnant, it works about 91-93% of the time. +918133066128)💊💊 If you take an extra dose of misoprostol, it works about 99% of the time. At 10-11 weeks pregnant, it works about 87% of the time. +918133066128) If you take an extra dose of misoprostol, it works about 98% of the time. In general, taking both mifepristone and+918133066128 misoprostol works a bit better than taking misoprostol only. +918133066128 Taking misoprostol alone works to end the+918133066128 pregnancy about 85-95% of the time — depending on how far along the+918133066128 pregnancy is and how you take the medicine. +918133066128 The abortion pill usually works, but if it doesn’t, you can take more medicine or have an in-clinic abortion. +918133066128 When can I take the abortion pill?+918133066128 In general, you can have a medication abortion up to 77 days (11 weeks)+918133066128 after the first day of your last period. If it’s been 78 days or more since the first day of your last+918133066128 period, you can have an in-clinic abortion to end your pregnancy.+918133066128

Why do people choose the abortion pill? Which kind of abortion you choose all depends on your personal+918133066128 preference and situation. With+918133066128 medication+918133066128 abortion, some people like that you don’t need to have a procedure in a doctor’s office. You can have your medication abortion on your own+918133066128 schedule, at home or in another comfortable place that you choose.+918133066128 You get to decide who you want to be with during your abortion, or you can go it alone. Because+918133066128 medication abortion is similar to a miscarriage, many people feel like it’s more “natural” and less invasive. And some+918133066128 people may not have an in-clinic abortion provider close by, so abortion pills are more available to+918133066128 them. +918133066128 Your doctor, nurse, or health center staff can help you decide which kind of abortion is best for you. +918133066128 More questions from patients: Saudi Arabia+918133066128 CYTOTEC Misoprostol Tablets. Misoprostol is a medication that can prevent stomach ulcers if you also take NSAID medications. It reduces the amount of acid in your stomach, which protects your stomach lining. The brand name of this medication is Cytotec®.+918133066128) Unwanted Kit is a combination of two medicines, ounwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE AbudhabiAbortion pills in Kuwait Cytotec pills in Kuwait

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...Falcon Invoice Discounting

Último (20)

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi

How to Get Started in Social Media for Art League City

How to Get Started in Social Media for Art League City

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Call Girls Service In Old Town Dubai ((0551707352)) Old Town Dubai Call Girl ...

Call Girls Service In Old Town Dubai ((0551707352)) Old Town Dubai Call Girl ...

Call Girls From Raj Nagar Extension Ghaziabad❤️8448577510 ⊹Best Escorts Servi...

Call Girls From Raj Nagar Extension Ghaziabad❤️8448577510 ⊹Best Escorts Servi...

Value Proposition canvas- Customer needs and pains

Value Proposition canvas- Customer needs and pains

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377877756

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377877756

The Path to Product Excellence: Avoiding Common Pitfalls and Enhancing Commun...

The Path to Product Excellence: Avoiding Common Pitfalls and Enhancing Commun...

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

👉Chandigarh Call Girls 👉9878799926👉Just Call👉Chandigarh Call Girl In Chandiga...

👉Chandigarh Call Girls 👉9878799926👉Just Call👉Chandigarh Call Girl In Chandiga...

Call Girls Kengeri Satellite Town Just Call 👗 7737669865 👗 Top Class Call Gir...

Call Girls Kengeri Satellite Town Just Call 👗 7737669865 👗 Top Class Call Gir...

Uneak White's Personal Brand Exploration Presentation

Uneak White's Personal Brand Exploration Presentation

Health FSA "Use-or-Lose" Rule Disappears

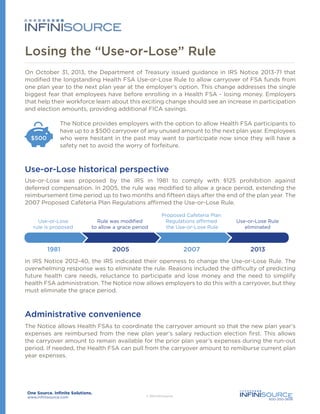

- 1. Losing the “Use-or-Lose” Rule On October 31, 2013, the Department of Treasury issued guidance in IRS Notice 2013-71 that modified the longstanding Health FSA Use-or-Lose Rule to allow carryover of FSA funds from one plan year to the next plan year at the employer’s option. This change addresses the single biggest fear that employees have before enrolling in a Health FSA - losing money. Employers that help their workforce learn about this exciting change should see an increase in participation and election amounts, providing additional FICA savings. $500 The Notice provides employers with the option to allow Health FSA participants to have up to a $500 carryover of any unused amount to the next plan year. Employees who were hesitant in the past may want to participate now since they will have a safety net to avoid the worry of forfeiture. Use-or-Lose historical perspective Use-or-Lose was proposed by the IRS in 1981 to comply with §125 prohibition against deferred compensation. In 2005, the rule was modified to allow a grace period, extending the reimbursement time period up to two months and fifteen days after the end of the plan year. The 2007 Proposed Cafeteria Plan Regulations affirmed the Use-or-Lose Rule. Use-or-Lose rule is proposed Rule was modified to allow a grace period Proposed Cafeteria Plan Regulations affirmed the Use-or-Lose Rule Use-or-Lose Rule eliminated In IRS Notice 2012-40, the IRS indicated their openness to change the Use-or-Lose Rule. The overwhelming response was to eliminate the rule. Reasons included the difficulty of predicting future health care needs, reluctance to participate and lose money and the need to simplify health FSA administration. The Notice now allows employers to do this with a carryover, but they must eliminate the grace period. Administrative convenience The Notice allows Health FSAs to coordinate the carryover amount so that the new plan year’s expenses are reimbursed from the new plan year’s salary reduction election first. This allows the carryover amount to remain available for the prior plan year’s expenses during the run-out period. If needed, the Health FSA can pull from the carryover amount to remiburse current plan year expenses. www.infinisource.com 800-300-3838

- 2. Example: Fred is able to carry over $500 in his Health FSA into the 2014 calendar plan year. His 2014 election is $2,500. On January 4, 2014, he incurs a $2,750 expense. He has a $100 expense that was incurred in 2013, but he does not $500 submit it until January 11, 2014, during the runout period. 2013 2014 The FSA pays $2,500 from the 2014 election, then the remaining $250 from $500 carryover. The $250 balance is available to reimburse the $100 expense incurred in 2013 submitted during the run-out period. Fred now has $150 remaining for 2014. Plan amendment Employers choosing to provide the carryover must amend the plan before the end of plan year from which the carryover will occur. Plan amendments must also include the elimination of any grace period. Participants must be notified of the carryover provision via a revised summary of plan description (SPD) or summary of material modifications (SMM). Plan years starting in 2013 have until the end of the plan year that starts in 2014 to amend plan documents to allow a carryover. Other rules and implications Employer plans may establish a lower maximum limit than $500, but it must be uniformly applied to all eligible participants. The carryover is applicable only to Health FSAs (not to Dependent Care FSAs). A participant’s carryover amount does not count toward $2,500 §125(i) salary reduction contribution limit. The carryover amount can include both employer and employee contributions. The carryover amount is available, even if a participant does not make an election for the next plan year. For example, if $500 remains unused at the end of the plan year, it can be carried over for the next plan year even though the participant does not elect Health FSA coverage in the following year. The participant will start the new plan year with a $500 account balance. In theory, this balance could be carried over for several years even though the participant does not elect Health FSA coverage. Unused amounts above the carryover limits are subject to forfeiture and cannot be cashed out or transferred to other taxable or nontaxable benefits (e.g., HSAs). The carryover is not available if employment terminates except via COBRA (if available). Further guidance is expected on some of the COBRA issues related to the carryover. HSA compatibility also was not addressed in the Notice. We do know that a general purpose Health FSA (including carryover) disqualifies an individual from contributing to an HSA, most likely for the entire plan year. www.infinisource.com 800-300-3838

- 3. In such an event, it appears that the Health FSA might have some design options: • Limited purpose • Post-deductible • Both limited purpose and post-deductible Based on existing regulations, it does not appear that carryover amounts would be included in nondiscrimination testing or justify a midyear election change. It is unclear whether carryover amounts need to be reported on W-2s in box 12 as Code DD. In theory, individuals wanting to contribute to an HSA could simply waive the carryover. Comparison Feature Carryover Grace period Amount available after plan year ends Up to $500 Unlimited Duration of availability after plan year ends Unlimited 2 months, 15 days Use-or-Lose Rule is no longer a major concern Yes No Likely decrease in forfeitures Yes No Likely increase in participation Yes No Likely increase in election amounts Yes No Corresponding increase in savings related to income tax and FICA for participants Yes No Corresponding increase in savings related to FICA for employers Yes No Most employers should be doing the math right now. With carryovers, will the likely moderate decrease in forfeitures be offset by the increase in FICA savings (7.65 percent)? When you do the math, many will agree that the carryover presents an exciting win-win proposition for both employers and employees! www.infinisource.com 800-300-3838