NFO Update - JPMorgan Emerging Europe, Middle East And Africa Equity Off-Shore Fund

•

1 recomendación•383 vistas

The NFO closes on 29 October 2010. It is a Equity Fund of Fund scheme. The underlying fund will invest in companies that have their registered office located in, or derive the predominant part of their economic activity from, an emerging market in central, eastern and southern Europe, Middle East or Africa

Denunciar

Compartir

Denunciar

Compartir

Descargar para leer sin conexión

Recomendados

Recomendados

Más contenido relacionado

Más de Fundsupermart.co.in

Más de Fundsupermart.co.in (12)

Sundaram Mutual Fund views on Economy and Markets!

Sundaram Mutual Fund views on Economy and Markets!

Record high earnings to propel stock markets to record high levels

Record high earnings to propel stock markets to record high levels

Último

Último (20)

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Call Girls In Noida 959961⊹3876 Independent Escort Service Noida

Call Girls In Noida 959961⊹3876 Independent Escort Service Noida

Uneak White's Personal Brand Exploration Presentation

Uneak White's Personal Brand Exploration Presentation

Call Girls Pune Just Call 9907093804 Top Class Call Girl Service Available

Call Girls Pune Just Call 9907093804 Top Class Call Girl Service Available

0183760ssssssssssssssssssssssssssss00101011 (27).pdf

0183760ssssssssssssssssssssssssssss00101011 (27).pdf

Ensure the security of your HCL environment by applying the Zero Trust princi...

Ensure the security of your HCL environment by applying the Zero Trust princi...

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

Call Girls Ludhiana Just Call 98765-12871 Top Class Call Girl Service Available

Call Girls Ludhiana Just Call 98765-12871 Top Class Call Girl Service Available

Mysore Call Girls 8617370543 WhatsApp Number 24x7 Best Services

Mysore Call Girls 8617370543 WhatsApp Number 24x7 Best Services

Business Model Canvas (BMC)- A new venture concept

Business Model Canvas (BMC)- A new venture concept

Call Girls in Delhi, Escort Service Available 24x7 in Delhi 959961-/-3876

Call Girls in Delhi, Escort Service Available 24x7 in Delhi 959961-/-3876

B.COM Unit – 4 ( CORPORATE SOCIAL RESPONSIBILITY ( CSR ).pptx

B.COM Unit – 4 ( CORPORATE SOCIAL RESPONSIBILITY ( CSR ).pptx

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377877756

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377877756

The Path to Product Excellence: Avoiding Common Pitfalls and Enhancing Commun...

The Path to Product Excellence: Avoiding Common Pitfalls and Enhancing Commun...

NFO Update - JPMorgan Emerging Europe, Middle East And Africa Equity Off-Shore Fund

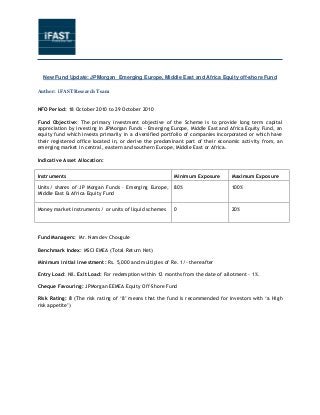

- 1. New Fund Update: JPMorgan Emerging Europe, Middle East and Africa Equity off-shore Fund Author: iFAST Research Team NFO Period: 18 October 2010 to 29 October 2010 Fund Objective: The primary investment objective of the Scheme is to provide long term capital appreciation by investing in JPMorgan Funds - Emerging Europe, Middle East and Africa Equity Fund, an equity fund which invests primarily in a diversified portfolio of companies incorporated or which have their registered office located in, or derive the predominant part of their economic activity from, an emerging market in central, eastern and southern Europe, Middle East or Africa. Indicative Asset Allocation: Instruments Minimum Exposure Maximum Exposure Units/ shares of JP Morgan Funds – Emerging Europe, Middle East & Africa Equity Fund 80% 100% Money market instruments / or units of liquid schemes 0 20% Fund Managers: Mr. Namdev Chougule Benchmark Index: MSCI EMEA (Total Return Net) Minimum initial investment: Rs. 5,000 and multiples of Re. 1/- thereafter Entry Load: Nil. Exit Load: For redemption within 12 months from the date of allotment - 1%. Cheque Favouring: JPMorgan EEMEA Equity Off-Shore Fund Risk Rating: 8 (The risk rating of ‘8’ means that the fund is recommended for investors with ‘a High risk appetite’)

- 2. Type of Fund Fund Class Style of Investing Equity Fund Debt Fund Balanced Fund Liquid Fund Domestic Fund of Funds International Fund of Funds Diversified Mid & Small Cap Contra Speciality Sectoral Growth Style Value Style Both What is EEMEA? EEMEA refers to the Emerging Europe, Middle East & Africa region and forms part of the broader Emerging Markets segment. The benchmark MSCI EMEA gives more than 80% weight-age to three geographies i.e. South Africa, Russia and Turkey. Benefit of Investing in EEMEA Fund 1) From a Valuation perspective, Russia and Turkey are among the cheapest emerging markets. Moreover the region is expected to have better earnings growth in coming years and this will be primary driver for returns. 2) The region is rich in Natural Resources; constituting 83% of world’s oil reserves, 85% of the world’s gas reserves and also a major portion of the world’s precious metal resources. 3) Demographically the region has a large young population as a percentage of the total population. This will lead to a creation of a huge working population and consumer base in the years to come. The region also has low cost of labour which will help industries to have better margins and competitive advantage. 4) Globalization will bring regions like Africa and smaller companies across EMEA to the attention of investors which will bring more coverage and flows for the region. 5) Investment in South Africa provides a gateway to invest in sub-saharan Africa which is still relatively unexplored by investors. In addition to that, China is a leading sponsor of

- 3. infrastructure projects in Africa, also China and Africa are now major trading partners, with bilateral trade expected to reach USD 100bn in 2010. 6) Turkey is expected to have strong consumption spending and offer structural growth on the back of positive economics, strong demographic profiles and deepening of Financial Markets. 7) Investment in EEMEA also provides diversification benefits. In the 8 out of the last 10 years, one or more of the EEMEA countries has outperformed the Indian Markets. Description of Parent/Underlying fund JPMorgan Funds – Emerging Europe, Middle East & Africa Equity Fund The fund was launched on 14 April 1997 and is managed by Oleg Biryulyov and Sonal Pandit. The AUM of the fund as on 31 August 2010 stands at $6.1 billion. Past Performance of the Fund: Fund Performance against benchmark since inception

- 4. Geographical Exposure of the Fund Conclusion The fund is suitable for investors with a high risk appetite. Aggressive Investors who have above average risk tolerance and have exposure to Diversified Global funds or Emerging Markets fund and looking to invest in other unique geographies and take advantage of expected structural growth in Russia, South Africa, Turkey and the Middle East can look at investing in this fund. The fund would provide investors exposure to unique geographies which are otherwise not available to Indian Investors and region/ countries like Turkey and South Africa which are hardly explored by investors. The fund will mainly focus on three regions which are rich on natural resources, strong demographic as well as have strong consumption and infrastructure demand. The fund also provides diversification benefits to India dominated assets as well as potential to generate better return over years. Investors should look at investing in this fund for a 3 to 5 year time horizon and can allocate 5% of their equity portfolio in this type of fund. Disclaimer This presentation is not to be construed as an offer or solicitation for the subscription, purchase or sale of any mutual fund. No investment decision should be taken without first viewing a fund's Scheme Information Document / Statement of Additional Information. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Past performance and any forecast is not necessarily indicative of the future or likely performance of the fund. The value of units and the income from them may fall as well as rise. Opinions expressed herein are subject to change without notice. Mutual Fund investments are subject to market risk. You are advised to carefully read the Scheme Information Document / Statement of Additional Information and go through all the risk factors mentioned in the Scheme Information Document / Statement of Additional Information issued by the mutual fund before investing.