Fixed income update (Feb 2021) with ICICI Prudential Mutual Fund

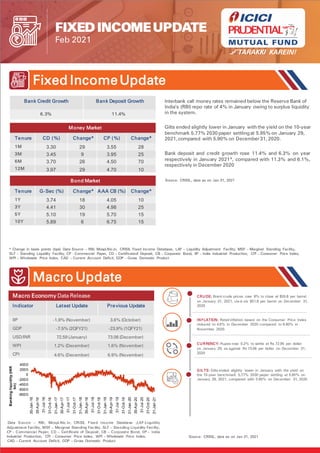

- 1. FIXED INCOMEUPDATE Feb 2021 Fixed Income Update Macro Update * Change in basis points (bps) Data Source – RBI, Mospi.Nic.in, CRISIL Fixed Income Database, LAF – Liquidity Adjustment Facility, MSF – Marginal Standing Facility, SLF – Standing Liquidity Facility, CP - Commercial Paper, CD – Certificateof Deposit, CB – Corporate Bond, IIP – India Industrial Production, CPI – Consumer Price Index, WPI – Wholesale Price Index, CAD – Current Account Deficit, GDP – Gross Domestic Product Interbank call money rates remained below the Reserve Bank of India’s (RBI) repo rate of 4% in January owing to surplus liquidity in the system. Gilts ended slightly lower in January with the yield on the 10-year benchmark 5.77% 2030 paper settling at 5.95% on January 29, 2021,compared with 5.90% on December31, 2020. Bank deposit and credit growth rose 11.4% and 6.3% on year respectively in January 2021*, compared with 11.3% and 6.1%, respectively in December 2020 Source: CRISIL, data as on Jan 31, 2021 Bank Credit Growth Bank Deposit Growth 6.3% 11.4% Money Market Tenure CD (%) Change* CP (%) Change* 1M 3.30 29 3.55 28 3M 3.45 9 3.95 25 6M 3.70 26 4.50 70 12M 3.97 29 4.70 10 Bond Market Tenure G-Sec (%) Change* AAA CB (%) Change* 1Y 3.74 18 4.05 10 3Y 4.41 30 4.98 25 5Y 5.10 19 5.70 15 10Y 5.89 6 6.75 15 Macro Economy Data Release Indicator Latest Update Previous Update IIP -1.9% (November) 3.6% (October) GDP -7.5% (2QFY21) -23.9% (1QFY21) USD/INR 72.59 (January) 73.06 (December) WPI 1.2% (December) 1.6% (November) CPI 4.6% (December) 6.9% (November) Data Source – RBI, Mospi.Nic.in, CRISIL Fixed Income Database ;LAF-Liquidity Adjustment Facility, MSF – Marginal Standing Facility, SLF – Standing Liquidity Facility, CP - Commercial Paper, CD – Certificate of Deposit, CB – Corporate Bond, IIP – India Industrial Production, CPI – Consumer Price Index, WPI – Wholesale Price Index, CAD – Current Account Deficit, GDP – Gross Domestic Product Source: CRISIL, data as on Jan 31, 2021 CRU DE: Brent crude prices rose 8% to close at $55.8 per barrel on January 31, 2021, vis-à-vis $51.8 per barrel on December 31, 2020 IN FLATION: Retail inflation based on the Consumer Price Index reduced to 4.6% in December 2020 compared to 6.90% in November 2020. CU RRENCY: Rupee rose 0.2% to settle at Rs 72.95 per dollar on January 29, as against Rs 73.06 per dollar on December 31, 2020 GILTS: Gilts ended slightly lower in January with the yield on the 10-year benchmark 5.77% 2030 paper settling at 5.95% on January 29, 2021, compared with 5.90% on December 31, 2020 -8000 -6000 -4000 -2000 0 2000 4000 30-Jan -16 30-A pr-16 31-Jul- 16 31-O ct-16 31-Jan -17 30-A pr-17 31-Jul- 17 31-O ct-17 31-Jan -18 30-A pr-18 31-Jul- 18 31-O ct-18 31-Jan -19 30-A pr-19 31-Jul- 19 31-O ct-19 31-Jan -20 30-A pr-20 31-Jul- 20 31-O ct-20 31-Jan -21 Banking liquidity (INR bn)

- 2. Our Outlook Gilts prices ended slightly lower in January with the yield on the 10-year benchmark 5.77% 2030 paper settling at 5.95% on January 29, 2021, compared with 5.90% on December 31, 2020.(Source: CRISIL Research) The Budget 2021 could rightly be called the Growth Budget. The Government deviated from the fiscal deficit roadmap and opted for a new framework to accommodate additional expenditure to support & stimulate the economy. Government expects nominal GDP growth for fiscal 2022 at 14.4% and pegs fiscal 2021 deficit at 9.5% of GDP. On a YoY basis FY21 saw sharp increase in govt. expenditure (+28% YoY) as govt. had to support the economy post pandemic hit. In FY22 govt. is maintaining the absolute expenditure at elevated FY21 levels (+1% YoY). Govt. expenditure as %age of GDP is also higher than normal at 15% (FY20 was 13%, FY21 being a Covid year was an aberration at 18%), thus giving precedence to growth over fiscal consolidation. (Source : Macquarie Research, Budget Document) Market borrowing has gone smoothly for most of FY2021 owing to RBI measures in the form of aggressive OMO purchases (including for SDLs), huge liquidity surplus, hike in HTM limit, etc. The government’s plans to increase borrowing in the current financial year by Rs 80000 Crore to end the FY 21 gross borrowing at 12.8 Lakh Crore have taken bond markets by surprise which was contrary to the expectations of a lower fiscal deficit given the recent buoyancy in revenue collections. The benchmark 10 year Government Security jumped 15 basis points to end at 6.06% on the Budget Day. The probability of a sovereign ratings downgrade has not deterred the government to expand borrowings to support growth in the backdrop of the pandemic. However, the government has also indicated a slower-than-expected pace of fiscal consolidation path i.e. 4.5% fiscal deficit target by FY 26. (Source: Kotak Research, BudgetDocument) These measures may lead to revival of the innate credit growth but also comes with the risk of inflation inching higher. Hence, the monetary easing is expected to take a backseat. The RBI is also expected to continue to gradually normalize liquidity conditions. This coupled with an extensive borrowing calendar shall lead to interest rate volatility. There is limited scope of rate cuts which was the major driver for returns in the past couple of years and thus, it’s important to rationalize return expectations going forward. In the coming years, we recommend following strategies: Accrual Strategy and Active Duration strategy. Accrual strategy due to high spread premium which is still prevalent between the spread assets and AAA & MMI instruments, as going forward capital appreciation strategy may take a back seat due to limited rate cuts. Term premiums (spread between longer and shorter end of the yield curve) remains one of the highest seen historically, because of which active duration strategy is recommended to benefit from thehigh term premium. In our portfolios, we may follow barbell strategy i.e having high exposure to extreme short-end instruments with an aim to protect the portfolio from interest rate movements and high exposureto long-end instruments with an aim to benefit from highercarry. OMO – Open Market Operations; SDL – State Development Loans; HTM – Held To Maturity Debt ValuationIndex for duration risk management Ultra Low Duration Low Duration Moderate Duration HighDuration Aggressively in HighDuration Very Cautious Aggressive Very Aggressive Cautious Very Cautious Cautious Aggressive Very Aggressive Data as on Jan 31, 2021. Debt Valuation Index considers WPI, CPI, Sensex returns, Gold returns and Real estate returns over G-Sec yield, Current Account Balance and Crude Oil Movement for calculation.

- 3. Our Recommendation Riskometers ICICI Prudential Ultra Short Term Fund is suitable for investors who are seeking*:(An open ended ultra-short term debt scheme investing in instruments such that the Macaulay duration of the portfolio isbetween3 months and 6 months) Moderate LOW HIGH Investors understand that their principal will be at Moderate risk • Short term regular income • An open ended ultra-short term debt scheme investing in a range of debt and money market instruments *Investors should consult their financialadvisors if indoubt about whether theproduct issuitable for them. ICICI Prudential Savings Fund is suitable for investors who are seeking*:(An open ended low duration debt scheme investing in instruments such that the Macaulay duration of the portfolio is between6 months and 12 months.) Moderate • Short term savings • An open ended low duration debt scheme that aims to maximize income by investing in debt and money market instruments while maintaining optimum balance of yield, safety and liquidity LOW HIGH Investors understand that their principal will be at Moderately Low risk *Investors should consult their financialadvisors if indoubt about whether theproduct issuitable for them. None of the aforesaid recommendations are based on any assumptions. These are purely for reference and the investors are requested to consult their financial advisors before investing. Note: The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the cash flow by the price. Approach Scheme Name Call to Action Rationale Short Duration ICICI Prudential Savings Fund ICICI Prudential Ultra Short TermFund ICICI Prudential Floating Interest Fund Invest for parking surplus funds Accrual + Moderate Volatility Accrual Schemes ICICI Prudential Credit Risk Fund ICICI Prudential Medium Term Bond Fund Core Portfolio with >1 Yr investment horizon Better Accrual Dynamic Duration ICICI Prudential All Seasons BondFund Long Term Approach with >3 Yrs investment horizon Active Durationand Better Accrual Please note that the Risk-o-meter(s) specified above will be evaluated and updated on a monthly basis as per SEBI circular dated October 05, 2020 on Product Labeling in Mutual Fund schemes - Risk-o-meter. Please refer to https://www.icicipruamc.com/news-and-updates/all-news for more details.

- 4. Riskometers ICICI Prudential Short Term Fund is suitable for investors who are seeking*(An open ended short term debt scheme investing in instru- ments such that the Macaulay duration of the portfolio is between 1 Year and 3 Years) Moderate LOW HIGH Investors understand that their principal will be at Moderate risk • Short term income generation and capital appreciation solution • A debt fund that aims to generate income by investing in a range of debt and money market instruments of various maturities *Investors should consult their financialadvisors if indoubt about whether theproduct issuitable for them. ICICI Prudential Medium Term Bond Fund is suitable for investors who are seeking*:(An open ended medium term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3 Years and 4 Years. The Macaulay duration of the portfolio is 1 Year to 4 years under antic ipated adverse situation) Moderate LOW HIGH Investors understand that their principal will be at Moderate risk • Medium term savings • A debt scheme that invests in debt and money market instruments with a view to maximize income while maintaining optimum balance of yield, safety and liquidity *Investors should consult their financialadvisors if indoubt about whether theproduct issuitable for them. ICICI Prudential All Seasons Bond Fund is suitable for investors who are seeking*:(An open ended dynamic debt scheme investing across duration) Moderate LOW HIGH Investors understand that their principal will be at Moderate risk • All duration savings • A debt scheme that invests in debt and money market instruments with a view to maximize income while maintaining optimum balance of yield, safety and liquidity *Investors should consult their financialadvisors if indoubt about whether theproduct issuitable for them. ICICI Prudential Corporate Bond Fund is suitable for investors who are seeking*:(An open ended debt scheme predominantly investing in AA+ and above rated corporate bonds.) Moderate LOW HIGH Investors understand that their principal will be at Moderate risk • Short term savings • An open ended debt scheme predominantly investing in highest rated corporate bonds *Investors should consult their financialadvisors if indoubt about whether theproduct issuitable for them. ICICI Prudential Credit Risk Fund is suitable for investors who are seeking*: (An open ended debt scheme predominantly investing in AA and below rated corporate bonds) Moderate LOW HIGH Investors understand that their principal will be at Moderate risk • Medium term savings • A debt scheme that aims to generate income through investing predominantly in AA and below rated corporate bonds while maintaining the optimum balance of yield, safety and liquidity *Investors should consult their financialadvisors if indoubt about whether theproduct issuitable for them. ICICI Prudential Floating Interest Fund is suitable for investors who are seeking*:(An open ended debt scheme predominantly investing in floating rate instruments (including fixed rate instruments converted to floating rate exposures using swaps/derivatives) Moderate LOW HIGH Investors understand that their principal will be at Moderate risk • Short term savings • An open ended debt scheme predominantly investing in floating rate instruments *Investors should consult their financialadvisors if indoubt about whether theproduct issuitable for them. Please note that the Risk-o-meter(s) specified above will be evaluated and updated on a monthly basis as per SEBI circular dated October 05, 2020 on Product Labeling in Mutual Fund schemes - Risk-o-meter. Please refer to https://www.icicipruamc.com/news-and-updates/all-news for more details.

- 5. ICICI Prudential Banking & PSU Debt Fund is suitable for investors who are seeking*:(An open ended debt scheme predominantly investing in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds) Moderate LOW HIGH Investors understand that their principal will be at Moderate risk • Short term savings • An open ended debt scheme predominantly investing in Debt instruments of banks, Public Sector Undertakings, PublicFinancial Institutions and Municipal Bonds *Investors should consult their financialadvisors if indoubt about whether theproduct issuitable for them. Mutual Fund investments aresubject to market risks, read all schemerelated documents carefully. In preparation of the material contained in this document, ICICI Prudential Asset Management Company Limited (the AMC) has used information that is publicly available, including information developed in-house. Some of the material used in the document may have been obtained from members/persons other than the AMC and/or its affiliates and which may have been made available to the AMC and/or to its affiliates. Information gathered and material used in this document is believed to be from reliable sources. The AMC, however, does not warrant the accuracy, reasonableness and / or completeness of any information. We have included statements / opinions / recommendations in this document, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and / or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc. The AMC (including its affiliates), the Mutual Fund, the trust and any of its officers, directors, personnel and employees, shall not be liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. The recipient alone shall be fully responsible/are liable for any decision taken on this material. All figures and other data given in this document are dated and the same may or may not be relevant in future. The information contained herein should not be construed as a forecast or promise nor should it be considered as an investment advice. Investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of ICICI Prudential Mutual Fund. The sector(s)/stock(s) mentioned in this communication do not constitute any recommenda- tion of the same and ICICI PrudentialMutualFundmayor may not have any future position in these sector(s)/stock(s). Past performance may or may not be sustained in the future. The portfolio of the scheme is subject to changes within the provisions of the Scheme Information document of the scheme. Please refer to the SID for more details. The information contained herein is only for the purpose of information and not for distribution and do not constitute an offer to buy or sell or solicitation of any offer to buy or sell any securities or financial instruments in the United States of America ("US") and/or Canada or for the benefit of US persons (being persons falling within the definition of the term "US Person" under the US Securities Act, 1933, as amended) or persons residing in Canada. Disclaimer Please note that the Risk-o-meter(s) specified above will be evaluated and updated on a monthly basis as per SEBI circular dated October 05, 2020 on Product Labeling in Mutual Fund schemes - Risk-o-meter. Please refer to https://www.icicipruamc.com/news-and-updates/all-news for more details.