Calculation of beta

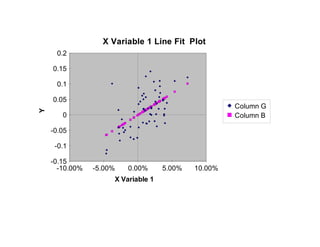

- 1. X Variable 1 Line Fit Plot 0.2 0.15 0.1 0.05 Column G Y 0 Column B -0.05 -0.1 -0.15 -10.00% -5.00% 0.00% 5.00% 10.00% X Variable 1

- 2. X Variable 1 Residual Plot 0.2 0.15 0.1 Residuals 0.05 0 -0.05 -0.1 -6.00% -4.00% -2.00% 0.00% 2.00% 4.00% 6.00% 8.00% X Variable 1

- 3. Normal Probability Plot 0.2 0.15 0.1 0.05 Y 0 -0.05 -0.1 -0.15 0 20 40 60 80 100 120 Sample Percentile

- 4. SUMMARY OUTPUT Regression Statistics Multiple R 0.57 R Square 0.32 Adjusted R Square 0.31 Standard Error 0.05 Observations 59 ANOVA df SS MS F Significance F Regression 1 0.07 0.07 27.33 0 Residual 57 0.15 0 Total 58 0.22 Coefficients Standard Errort Stat P-value Lower 95%Upper 95% Lower 95.0% Upper 95.0% Intercept 0 0.01 -0.01 0.99 -0.01 0.01 -0.01 0.01 X Variable 1 1.4 0.27 5.23 0 0.86 1.93 0.86 1.93 RESIDUAL OUTPUT PROBABILITY OUTPUT Observation Predicted YResiduals Standard Residuals Percentile Y 1 0.02 0.11 2.15 0.85 -0.13 2 -0.03 0.02 0.37 2.54 -0.11 3 0.04 -0.08 -1.5 4.24 -0.08 4 0 0.04 0.76 5.93 -0.08 5 -0.03 -0.02 -0.46 7.63 -0.07 6 0.05 -0.06 -1.1 9.32 -0.07 7 -0.03 -0.01 -0.22 11.02 -0.06 8 0.01 0.04 0.78 12.71 -0.06 9 0 0.09 1.72 14.41 -0.05 10 0.05 0.03 0.51 16.1 -0.04 11 0.01 0.01 0.15 17.8 -0.04 12 0.01 0.05 1.06 19.49 -0.04 13 0.02 -0.04 -0.88 21.19 -0.04 14 0.02 -0.02 -0.44 22.88 -0.04 15 -0.04 -0.05 -0.91 24.58 -0.03 16 0.04 0.04 0.88 26.27 -0.03 17 0 -0.07 -1.44 27.97 -0.03 18 -0.01 -0.07 -1.38 29.66 -0.02 19 0.05 0 -0.09 31.36 -0.02 20 -0.02 -0.02 -0.45 33.05 -0.02 21 0.03 0.12 2.28 34.75 -0.01 22 -0.02 -0.06 -1.14 36.44 0 23 0.01 0.06 1.13 38.14 0 24 0.04 0.07 1.3 39.83 0 25 -0.04 0.06 1.11 41.53 0 26 -0.07 -0.06 -1.19 43.22 0 27 0.01 0 -0.02 44.92 0.01 28 0.02 0 0 46.61 0.01 29 -0.04 0 -0.02 48.31 0.02

- 5. 30 0.04 -0.02 -0.45 50 0.02 31 0.06 -0.08 -1.62 51.69 0.02 32 -0.04 -0.02 -0.44 53.39 0.02 33 0.03 -0.01 -0.12 55.08 0.02 34 -0.05 0.15 3.06 56.78 0.02 35 0.02 0.04 0.82 58.47 0.02 36 0.03 0.07 1.49 60.17 0.02 37 0.05 0 -0.06 61.86 0.03 38 0.04 -0.03 -0.69 63.56 0.04 39 0.04 0 -0.03 65.25 0.04 40 0.05 -0.05 -1.02 66.95 0.04 41 0.03 -0.03 -0.54 68.64 0.04 42 0.04 0.01 0.29 70.34 0.05 43 0 -0.04 -0.83 72.03 0.05 44 0.05 -0.03 -0.69 73.73 0.05 45 -0.01 0.02 0.36 75.42 0.06 46 0.06 -0.02 -0.4 77.12 0.06 47 0.02 -0.04 -0.87 78.81 0.06 48 0.04 0.05 0.95 80.51 0.07 49 0.01 0.01 0.17 82.2 0.07 50 0.01 -0.03 -0.69 83.9 0.08 51 0.02 -0.05 -0.91 85.59 0.09 52 0.03 -0.05 -1.08 87.29 0.09 53 0 0.03 0.67 88.98 0.1 54 -0.06 -0.05 -0.98 90.68 0.11 55 0.03 0 -0.05 92.37 0.11 56 0.08 0.03 0.68 94.07 0.11 57 0.04 0.01 0.15 95.76 0.12 58 0.1 0.02 0.4 97.46 0.12 59 -0.03 -0.03 -0.54 99.15 0.14

- 6. RISK RETURN 10 Current riskfree rate = 7.50% Risk premium for stocks= 15.50% Number of periods of data= 60 Riskfree rate during period = 8.50%

- 7. RISK RETURN 11 Time period Index Price(Stock) DPS(Stock) Split Factor Index Level Return(Stock) Return(Mkt) 1 1 INR 34.16 INR 0.04 1 409.32 Infotech CNX S&P 500 2 1 INR 38.42 1 414.08 12.47% 1.16% 3 1 INR 37.87 1 404.35 -1.43% -2.35% 4 1 INR 36.42 INR 0.05 1 415.53 -3.69% 2.76% 5 1 INR 38.00 1 416.98 4.34% 0.35% 6 1 INR 36.13 INR 0.00 1 409.17 -4.93% -1.87% 7 1 INR 36.00 INR 0.05 1 424.81 -0.20% 3.82% 8 1 INR 34.50 1 415.54 -4.17% -2.18% 9 1 INR 36.25 INR 0.00 1 418.90 5.07% 0.81% 10 1 INR 39.38 INR 0.05 1 419.23 8.77% 0.08% 11 1 INR 42.18 1 432.90 7.12% 3.26% 12 1 INR 43.00 INR 0.00 1 436.64 1.94% 0.87% 13 1 INR 45.63 INR 0.05 1 439.35 6.23% 0.62% 14 1 INR 44.38 1 444.76 -2.74% 1.23% 15 1 INR 44.50 INR 0.00 1 452.73 0.28% 1.79% 16 1 INR 40.75 INR 0.06 1 440.75 -8.29% -2.65% 17 1 INR 44.00 1 451.93 7.98% 2.54% 18 1 INR 40.75 INR 0.00 1 451.51 -7.39% -0.09% 19 1 INR 37.50 INR 0.06 1 448.72 -7.82% -0.62% 20 1 INR 39.25 1 465.10 4.67% 3.65% 21 1 INR 37.75 INR 0.00 1 460.01 -3.82% -1.09% 22 1 INR 43.00 INR 0.06 1 468.42 14.07% 1.83% 23 1 INR 39.88 1 463.37 -7.27% -1.08% 24 1 INR 42.63 INR 0.00 1 467.37 6.90% 0.86% 25 1 INR 47.25 INR 0.06 1 482.29 11.00% 3.19% 26 1 INR 48.00 1 468.55 1.59% -2.85% 27 1 INR 42.00 INR 0.00 1 446.80 -12.50% -4.64% 28 1 INR 42.50 INR 0.08 1 451.48 1.37% 1.05% 29 1 INR 43.38 1 458.23 2.06% 1.50% 30 1 INR 41.63 INR 0.00 1 445.33 -4.03% -2.82% 31 1 INR 42.38 INR 0.08 1 458.85 1.98% 3.04%

- 8. RISK RETURN 12 32 1 INR 41.25 1 477.02 -2.65% 3.96% 33 1 INR 38.75 INR 0.00 1 463.89 -6.06% -2.75% 34 1 INR 39.50 INR 0.08 1 473.07 2.13% 1.98% 35 1 INR 43.50 1 455.17 10.13% -3.78% 36 1 INR 46.00 INR 0.00 1 460.41 5.75% 1.15% 37 1 INR 50.88 INR 0.08 1 471.17 10.76% 2.34% 38 1 INR 53.38 1 488.74 4.91% 3.73% 39 1 INR 53.50 INR 0.00 1 501.75 0.23% 2.66% 40 1 INR 55.38 INR 0.09 1 515.45 3.67% 2.73% 41 1 INR 55.50 1 535.24 0.23% 3.84% 42 1 INR 55.50 INR 0.00 1 545.78 0.00% 1.97% 43 1 INR 58.63 INR 0.09 1 562.81 5.79% 3.12% 44 1 INR 56.25 1 563.47 -4.05% 0.12% 45 1 INR 57.38 INR 0.00 1 585.58 2.00% 3.92% 46 1 INR 57.88 INR 0.09 1 582.32 1.03% -0.56% 47 1 INR 60.13 1 607.00 3.89% 4.24% 48 1 INR 58.88 INR 0.00 1 617.03 -2.08% 1.65% 49 1 INR 64.25 INR 0.09 1 636.87 9.28% 3.22% 50 1 INR 65.50 1 641.93 1.95% 0.80% 51 1 INR 63.88 INR 0.00 1 646.60 -2.48% 0.73% 52 1 INR 62.00 INR 0.09 1 655.01 -2.79% 1.30% 53 1 INR 60.75 1 671.01 -2.02% 2.44% 54 1 INR 62.88 INR 0.00 1 671.67 3.50% 0.10% 55 1 INR 55.63 INR 0.11 1 641.02 -11.36% -4.56% 56 1 INR 57.00 1 653.47 2.47% 1.94% 57 1 INR 63.25 INR 0.00 1 688.65 10.96% 5.38% 58 1 INR 65.88 INR 0.11 1 706.26 4.32% 2.56% 59 1 INR 73.88 1 757.53 12.14% 7.26% 60 1 INR 69.75 INR 0.00 1 742.02 -5.58% -2.05%

- 9. RISK RETURN 13 REGRESSION STATISTICS AND RISK PARAMETERS RISK AND PERFORMANCE MEASURES Intercept (Alpha) = -0.01% Slope (Beta)= 1.40 Rf(1- Beta) = -0.27% Intercept-Rf(1-Beta)= 0.26% VARIANCE STATISTICS Variance of the stock= 0 Variance of the market = 0 Systematic variance= 0 Unsystematic variance= 0 R squared = 32.41% USING BETA In estimating expected returns: Riskfree Rate = 7.50% Historical return premium= 15.50% Expected return= 29.18% In forecasting prices: Current price= INR 75.38 Annualized DPS= INR 0.44 Predicted prices: - One year from now INR 96.94

- 10. RISK RETURN 14 - Two years from now INR 124.66 - Three years from now INR 160.30 - Four years from now INR 206.14 - Five years from now INR 265.09

- 11. RISK RETURN 15 Current stock price= INR 75.38 Current Annual DPS = INR 0.44

- 12. RISK RETURN 16 (R(jt)-Rj)^2 (R(mt)-R(m))^2 (R(jt)-R(j)) X S&P 500 (R(mt)-R(m)) 0.01 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0.01 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0.01 0 0 0 0 0 0.01 0 0 0.01 0 0 0 0 0 0 0 0 0.02 0 0 0.01 0 0 0 0 0 0.01 0 0 0 0 0 0.02 0 0.01 0 0 0 0 0 0 0 0 0 0 0 0

- 13. RISK RETURN 17 0 0 0 0.01 0 0 0 0 0 0.01 0 0 0 0 0 0.01 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0.01 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0.02 0 0.01 0 0 0 0.01 0 0 0 0 0 0.01 0 0.01 0 0 0

- 14. RISK RETURN 18

- 15. RISK RETURN 19

- 16. Price(Stock): Price at the end of each month DPS(Stock): Includes dividends, if the stock went ex-dividend during the month Return on Stock = (Price (end) - Price (Beg) + Dividend)/Price(Beg) Time period Price(Stock) DPS(Stock) Return(Stock) Jan-92 34.16 0.04 Feb-92 38.42 12.47% Mar-92 37.87 -1.43% Apr-92 36.42 0.05 -3.69% May-92 38.00 4.34% Jun-92 36.13 -4.93% Jul-92 36.00 0.05 -0.20% Aug-92 34.50 -4.17% Sep-92 36.25 5.07% Oct-92 39.38 0.05 8.77% Nov-92 42.18 7.12% Dec-92 43.00 1.94% Jan-93 45.63 0.05 6.23% Feb-93 44.38 -2.74% Mar-93 44.50 0.28% Apr-93 40.75 0.06 -8.29% May-93 44.00 7.98% Jun-93 40.75 -7.39% Jul-93 37.50 0.06 -7.82% Aug-93 39.25 4.67% Sep-93 37.75 -3.82% Oct-93 43.00 0.06 14.07% Nov-93 39.88 -7.27% Dec-93 42.63 6.90% Jan-94 47.25 0.06 11.00% Feb-94 48.00 1.59% Mar-94 42.00 -12.50% Apr-94 42.50 0.08 1.37% May-94 43.38 2.06% Jun-94 41.63 -4.03% Jul-94 42.38 0.08 1.98% Aug-94 41.25 -2.65% Sep-94 38.75 -6.06% Oct-94 39.50 0.08 2.13% Nov-94 43.50 10.13% Dec-94 46.00 5.75% Jan-95 50.88 0.08 10.76% Feb-95 53.38 4.91% Mar-95 53.50 0.23% Apr-95 55.38 0.09 3.67%

- 17. May-95 55.50 0.23% Jun-95 55.50 0.00% Jul-95 58.63 0.09 5.79% Aug-95 56.25 -4.05% Sep-95 57.38 2.00% Oct-95 57.88 0.09 1.03% Nov-95 60.13 3.89% Dec-95 58.88 -2.08% Jan-96 64.25 0.09 9.28% Feb-96 65.50 1.95% Mar-96 63.88 -2.48% Apr-96 62.00 0.09 -2.79% May-96 60.75 -2.02% Jun-96 62.88 3.50% Jul-96 55.63 0.11 -11.36% Aug-96 57.00 2.47% Sep-96 63.25 10.96% Oct-96 65.88 0.11 4.32% Nov-96 73.88 12.14% Dec-96 69.75 -5.58% Variance in Returns = 0 Standard Deviation in Returns = 6.14%