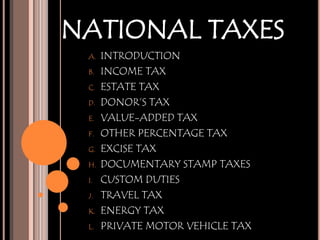

National taxes

- 1. NATIONAL TAXES A. INTRODUCTION B. INCOME TAX C. ESTATE TAX D. DONOR’S TAX E. VALUE-ADDED TAX F. OTHER PERCENTAGE TAX G. EXCISE TAX H. DOCUMENTARY STAMP TAXES I. CUSTOM DUTIES J. TRAVEL TAX K. ENERGY TAX L. PRIVATE MOTOR VEHICLE TAX

- 2. A. INTRODUCTION Kinds of Taxes under existing laws. They are: NATIONAL TAXES. Those imposed by the National Government under the National Internal Revenue Code and other laws particularly the Tariff and Customs Code. LOCAL TAXES. Those imposed by local government to meet particular needs under the Local Government Code, such as real property tax and the community tax (formerly residence tax).

- 3. KINDS OF NATIONAL INTERNAL REVENUE TAXES 1.The following are deemed to be National Internal Revenue Taxes: a. income tax b. estate and donor’s taxes c. value-added tax d. other percentages taxes e. excise taxes on certain goods f. documentary taxes g. other taxes as are or hereafter may be imposed and collected by the Bureau of Internal Revenue.

- 4. KINDS OF NATIONAL INTERNAL REVENUE TAXES 2. The following are, among others, the National Taxes imposed by special laws: a. custom duties b. travel tax c. energy tax d. private motor vehicle tax

- 5. B. INCOME TAX Income (for tax purposes) means all wealth which flows into the taxpayer other than as mere return on capital. So, not all receipts of a person are income. Income Tax is a tax on a person’s income, profits and the like, realized in one taxable year. It is imposed at progressive or gradual rates, there being one set of schedule rates for compensation or employment income, and for business, professional and other types of non- compensation income.

- 6. NATURE AND PURPOSE OF INCOME TAX It is generally regarded as a privilege tax and not a tax on property. It is a tax on privilege to earn an income . Its purpose is to raise revenue.

- 7. GROSS INCOME Gross income is all income but not including exempt income and income subject to final income tax. salaries or wages for services including fees, commissions, and similar items and those derived from business or profession, sale of and other dealings in property, interests, rents, dividends, and securities.

- 8. All kinds of income of whatever kind and derived from whatever source including those derived from gambling and illegal transactions are taxable.

- 9. TAXABLE INCOME Taxable Income is gross income as defined above, less the deductions allowed by law, including in the case of individuals, the allowable personal and additional exemptions.

- 10. INCOMES SUBJECTS TO FINAL INCOME TAX Certain incomes (referred to as passive incomes) are subject to final tax which shall be withheld by the payor and paid by him to the Bureau of Internal Revenue. They are reported by the withholding agent (payor) and paid by him to the BIR. Examples of such incomes and their corresponding final rates are:

- 11. 1. Royalties (except from books, literary works and musical compositions-10%) prizes; other winnings; interests from bank deposits; yield or other monetary benefit from deposit substitutes (interest on money market placements); and yield or other monetary benefit from trust funds and similar arrangements-20%; Prizes amounting to Php.10,000 or less are to be included in taxable income and taxable accordingly. Winnings from Philippine Charity Sweepstakes and lotto are exempt from income tax; and

- 12. 2. Cash and/or property dividends received from a corporation.- 6%, 8%, and 10%, effective 1998, 1999, ad 2000, respectively. 3. Net capital gains from sale of shares of stock not traded through the stock exchange- 5% on the amount not exceeding Php.100,000, and 10% of any amount in excess of Php.100,000; so if the net capital gains is Php.120,000, the final tax is Php.7,000 (Php.5,000+Php.2,000). 4. Capital gains from sale or real property.- 6% based on the gross selling price or current fair market value, whichever is higher.

- 13. EXCLUSIONS FROM GROSS INCOME They are incomes that are exempt from the tax, e.g., life insurance proceeds paid to beneficiaries upon the death of the insured as they are considered more as an indemnity rather than as gains or profits, and payments for injuries or sickness as they are compensatory in nature.

- 14. Other examples of exempt income are: retirement benefits (under certain conditions) received from private firms, Social security and GSIS benefits, Prizes and awards granted in recognition of religious, charitable, scientific, educational, artistic literary or civic achievement, or in sports competition. Exclusions are not considered in determining gross income. Deductions, on other hand, are subtracted from gross income to arrive at taxable (net) income.

- 15. DEFINITION OF DEDUCTIONS Deductions are items or amounts which the law allows to be deducted from gross income to arrive at taxable income.

- 16. 1. For Corporations and business (i.e., not professional) partnerships, the itemized deductions are: Ordinary and necessary trade, business or professional expenses; Interests on indebtedness; Taxes; Losses; Bad debts; Depreciation; Depletion; Charitable and other contributions; Research and development expenditures; and Pension trust contributions of employees.

- 17. 2. For compensation earners, no deductions are allowed except only personal and additional exemptions.

- 18. AMOUNTS OF PERSONAL AND ADDITIONAL EXEMPTIONS ALLOWABLE TO INDIVIDUALS There is allowed in the nature of a deduction from the amount of taxable income, whether compensation or not, the following basic personal exemptions: 1. Php.20,000.00- for single individual or married individual judicially decreed as legally separated with no qualified dependents; 2. Php.32,000.00- for each married individuals (husband or wife); or a total of Php.64,000 in case both spouses earn income; and

- 19. 3. Php.25,000- for an unmarried individual who is the “head of the family” depending upon him or her for support. The additional exemption of Php.8,000 for every child but not exceeding four (4) dependents may be claimed by one of the spouses in the case of married individuals. NOTE: the Husband and wife shall compute their individual income tax separately based on their respective total taxable income. The resulting tax due from both spouses shall be added and the tax payable shall be the sum thereof.

- 20. DEFINITION AND SCOPE OF TERM “HEAD OF THE FAMILY” A head of the family is an individual who actually supports and maintains in one household, one or more individuals, who are closely connected with him by blood relationship, relationship by marriage, or by adoption. A head of a family includes an unmarried or legally separated man or woman with:

- 21. 1. One or both parents, or 2. One or more brothers or sisters, or 3. One or more legitimate, recognized natural, or legally adopted children living with and dependent upon him or her for their chief support. A recognized natural child is one who born outside of wedlock between a man and a wife, who, at the time of the conception of the child, were legally free to marry each other, and is recognized by one or both parents.

- 22. COMPUTATION OF INDIVIDUAL INCOME TAX 1. Resident citizens- The formula for computing the tax for resident citizens may be stated as follows:

- 23. Gross income from all sources(within and/or outside the Philippines Less: Allowable (itemized) deductions or 10% Optional standard deductions (OSD) _______________________________________ = Net Income from all sources Less: Personal and additional exemptions _______________________________________ = Taxable income Multiplied by: Graduated tax rate in Sec.24(A) of the Tax Code ________________________________________ = Amount of income tax due and payable

- 24. 2. Non-resident citizens and overseas contract workers. -The same computation exempt that only income derived from sources within the Philippines is taxable. 3. Resident Aliens - the same computation as for non- resident citizens.

- 25. 4. Non-resident aliens. - The tax is imposed also only on income derived from sources within the Philippines. a. If engaged in trade or business in the Philippines, he is taxed in the same manner as non-resident citizen or resident alien. b. If not so engaged, the tax is equal to 25% of the entire or gross income (i.e., without deduction) received.

- 26. c. If employed by regional or area headquarters and regional operating headquarters of multinational companies, or by offshore banking units, or by foreign petroleum service contractors or subcontractors, the tax is 15% of such gross compensation income. The same rate applies to Filipinos employed and occupying the same position.

- 27. INDIVIDUALS REQUIRED/NOT REQUIRED TO FILE INCOME TAX RETURNS The tax return is the sworn statement wherein the taxpayer states the facts as to the nature and extent of his tax liability for the taxable year. 1. Under the law, the following individuals are required to file an income tax return: a. Every resident citizen regardless of the source of his income, within or outside the Philippines;

- 28. b. Every non-resident and resident alien, as their income from sources within the Philippines; and c. Every non-resident alien engaged in trade business or in the exercise of his profession in the Philippines, as to his income from sources within the Philippines.

- 29. 2. The following individuals are not required to file an income tax return: a. An individual whose gross income does not exceed to his total personal and additional exemptions for dependents, except if engaged in business or practice of profession, regardless of the amount of gross income.

- 30. b. An individual earning from a single employer pure compensation income not exceeding Php.60,000, the income tax on which has already been correctly withheld by the employer, are no longer required to file the annual income tax returns; hence, the following are not exempted: 1. Those who do not derive income purely from compensation; 2. Those whose pure compensation income for the taxable year exceeds Php.60,000; and

- 31. 3. Those deriving compensation income concurrently from two or more employers at any time during the taxable year even if it does not exceed Php.60,000. c. An individual whose income consists solely of interest, prizes, royalties, etc. subject to final income tax which is required to be withheld by the payor and paid by him to the Bureau of Internal Revenue; and d. An individual who is exempt from tax under the Tax Code or other laws.

- 32. FILING OF RETURN AND PAYMENT OF TAX 1. When- the individual income tax return covering income of the preceding taxable year must be filed in duplicate on or before April 15 of each year or, in meritorious cases, within the extension which may be granted by the Commissioner of Internal Revenue.

- 33. FILING OF RETURN AND PAYMENT OF TAX 2. Where- Except in the cases where the Commissioner of Internal Revenue otherwise permits, it must be filed with the; revenue district office, Revenue collection officer, An authorized agent bank, or Duly authorized treasurer of the city or municipality or where such person has his legal residence or principal place of business in the Philippines; otherwise, With the office of Commissioner of Internal Revenue.

- 34. FILING OF RETURN AND PAYMENT OF TAX 3. By Whom- By the following persons: a. A resident citizen b. A non-resident citizen c. A resident alien d. A non-resident alien The income tax is paid at the time the return is filed. This is called the “pay-as-you-file” system.

- 35. C. ESTATE TAX Estate Tax is a tax on the right of the deceased person to transmit his lawful heirs or beneficiaries. Inheritance Tax is a tax on the right of the heirs or beneficiaries to receive the estate of the deceased person. It is no longer imposed.

- 36. NATURE OF ESTATE AND INHERITANCE TAXES They are not direct taxes on property, nor are they a capitation tax; that is, the tax is laid neither on the property, nor on the transferor or the transferee. In other words, they are privilege taxes.

- 37. PURPOSE OF THE TAX The estate and inheritance taxes are two (2) types of death taxes. They are imposed at high rates to help reduce undue concentration of wealth in society to which the receipt of the inheritance is a contributing factor. Their imposition conforms to the widely accepted principle of ability to pay.

- 38. NET ESTATE Net estate means gross estate less allowable deductions and specific exemptions. “Specific Exemptions” are those which are declared by law as expressly exempt from the tax such as bequests to charitable institutions, subject to certain conditions.

- 39. TAX IMPOSED ON NET STATE The estate tax is imposed upon the basis of the net estate considered as a unit computed in accordance with the exempt. Thus, if the value of the estate is Php.500,000, only Php.300,000 is subject to estate tax.

- 40. DEDUCTIONS FROM THE GROSS ESTATE The allowable deductions consist of the amounts permitted by law to be deducted from the value of the gross estate which include, among others, funeral, judicial and medical expenses, losses, indebtedness, and taxes, an amount equivalent to the value of decedent’s family home not exceeding Php.1,000,000, standard deduction equivalent to Php.1,000,000 and the amount of all transfers to or for the use of the Government or any political subdivision thereof.

- 41. FILING OF RETURN AD PAYMENT OF TAX 1. When.- Where the gross value of the estate exceeds Php.20,000, an estate tax return must be filed within six (6) months from the decedent’s death and the tax due thereon paid at the same time. 2. Where.- Except in cases where the Commission of Internal Revenue otherwise permits, with;

- 42. FILING OF RETURN AD PAYMENT OF TAX An authorized agent bank, or The revenue district officer, Revenue collection officer, or Duly authorized treasurer of the city or municipality where the decedent or deceased person was residing at the time of his death, or If he was a non-resident, with the Office of the Commissioner.

- 43. D. DONOR’S TAX Donation is an act of liberality whereby a person disposes gratuitously of a thing or right in favor of another who accepts it.

- 44. DONATION NOT SUBJECT TO DONOR’S TAX Donation is: Inter vivos, if made between living persons, to take during the lifetime of the donor, and Mortis causa, if made in the nature of testamentary disposition, that is, it shall take effect upon the death of the donor. The latter kind of donation is subject to estate tax.

- 45. GIFT TAX Gift Tax is a tax imposed on the transfer without consideration of property or money between two or more persons who are living at the time the transfer is made. KINDS : Donor’s tax or the tax levied on the act of giving; and Donee's tax or the tax levied on the act of receiving.

- 46. NATURE OF GIFT TAX The gift tax is a privilege tax. It is a tax on the privilege of the donor to give or on the privilege of the donee to receive. Note that the tax is imposed without reference to the death of the donor.

- 47. PURPOSE OF THE TAX 1. The gift tax is intended to supplement the estate and inheritance taxes by preventing their avoidance by those who give away property and money in anticipation of death, through the taxation of gifts inter vivos without which, the property would be subject to the said taxes. Thus, whether the transfer takes place during life or death, the burden of taxation would be about the same.

- 48. PURPOSE OF THE TAX 2. The gift tax is also intended to prevent the avoidance of income tax through the device of splitting income among numerous donees with the donor thereby escaping of the progressive rates of income taxation.

- 49. NET GIFT Net gift means the total amount of gifts less the allowable deductions and specific exemptions provided by law.

- 50. TAX IMPOSED ON THE NET GIFT The donor’s tax is computed upon the basis of the total net gifts made during the calendar year, in accordance with the schedule provided by law. Net gifts of the amount of Php.100,000 or less are exempt. Thus, if the value of the net gift is Php.150,000, only Php.50,000 is subject to donor’s tax.

- 51. FILING OF RETURN AND PAYMENT TAX 1. When.- The donor’s tax return must be filed within 30 days after the gift is made and the tax due thereon paid at the same time. 2. Where.- Except in the cases where the Commissioner of Internal Revenue otherwise permits, it must be filed with;

- 52. An authorized agent bank, or The revenue district officer, Revenue collection officer, or Duly authorized treasurer of the city or municipality where the donor was residing at the time of the donation, or If he is a non-resident, with the Office of the Commissioner.

- 53. E. VALUE-ADDED TAX Value-added tax (VAT) is a percentage tax imposed on every sale, barter, exchange, or lease of goods or properties (real or personal) or sale of services in the course of trade or business, and on every importation of goods, whether or not in the course of trade or business, based on the gross selling price or value, or the gross receipts, payable by the seller, transferor, lessor, or importer,

- 54. NATURE OF THE TAX It is a tax not on goods, properties, or services as such, but on the sale, barter, exchange, or lease of goods or properties, or performance of service for a consideration, or on the importation of goods. It is, therefore, a privilege tax.

- 55. TRANSACTIONS SUBJECT TO THE TAX Except those specifically exempted by law, VAT applies 1. Every sale of goods or properties, or importation of goods; and 2. Every sale of service (which include lease of property) other than services rendered by persons subject to “other percentage taxes” under the tax code.

- 56. Barter or exchange is considered by law as a sale. The importation of goods may be for business purpose or for the personal use or consumption of the taxpayer. But the sale of goods, properties, or services must be in the course of trade or business to be subject to VAT.

- 57. RATES BASES OF THE TAX 1. Sale of goods or properties. 2. Importation of goods. 3. Sale of services.

- 58. RATES BASES OF THE TAX 1. Sale of goods or properties. - The tax is 10% of the gross selling price or gross value in money of the goods or properties sold or bartered. Gross selling price is the total amount of money or its equivalent which the purchaser pays or is obligated to pay the seller. Certain sales are exempt from the tax.

- 59. RATES BASES OF THE TAX 2. Importation of goods. - The tax is 10% of the total value used by the Bureau of Customs in determining customs duties to which value shall be added the duties, excise taxes, and other charges due on such goods. Certain importations are exempt from the tax.

- 60. RATES BASES OF THE TAX 3. Sale of services. - the tax is 10% of the gross receipts derived by any person (e.g., broker) engaged in the performance of service for others for a fee or consideration. Certain services are exempt from the tax. Gross receipts mean the total amount of money or its equivalent representing the contract price or fee for the service performed or to be performed for another person.

- 61. TAX APPLIES ONLY TO VALUE ADDED BY SELLER Under the tax credit method for computing and collecting VAT, the taxpayer pays only the difference between the tax on his sales (output tax) and the tax on his purchases (or importation) of goods (for sale or conversion into other finished goods, or for use in the business), supplies, and materials, and services (input tax).

- 62. FILING OF RETURN AND PAYMENT OF TAX 1. When.- The quarterly value-added tax return of gross sales or gross receipts for every quarter must be filed within 25 days following the end of each quarter. VAT- registered person shall pay the tax on a monthly basis.

- 63. FILING OF RETURN AND PAYMENT OF TAX 2. Where.- The quarterly return must e filed with and the tax paid to a: Duly authorized agent bank or The revenue district officer; Revenue collection officer; or Duly authorized treasurer of the city or municipality where the taxpayer is registered as a VAT-registered person or required to register.

- 64. F. OTHER PERCENTAGE TAXES Percentage taxes are taxes based on a certain percentage of the gross selling price or gross value in money of goods sold, bartered, exchanged, or imported, or gross receipts or earnings derived by a person engaged in the sale of services. NOTE: Value-added tax is a kind of percentage tax. Services rendered by a person subject to the “other percentages taxes” imposed by the Tax Code are not subject to the value-added tax.

- 65. PERSONS OR BUSINESS SUBJECT TO AND RATES OF OTHER PERCENTAGE TAXES 1. Small business enterprises, i.e., those whose annual gross sales and/or receipts do not exceed Php.550,000,- 3% of gross quarterly sales or receipts. 2. Domestic carriers by land, air or water and transport passengers for hire, and keepers of garages- 3% of gross receipts.

- 66. 3. International carriers, air or shipping, doing business in the Philippines.- 3% of their gross quarterly receipts. 4. Franchise holders or grantees in respect to franchises on radio and/or television broadcasting companies whose annual gross receipts of the preceding year do not exceed Php.10 million,- 3% of gross receipts, and on electric, gas, and water utilities- 2%. 5. Senders of overseas messages.- 10% of the amount paid for the service.

- 67. 6. Life insurance companies.- 5% of gross premium collected. 7. Proprietors, lessees or operators of amusement places.- 15%, 18%, or 30% of gross receipts. 8. Sale of shares of stock.- ½ of 1% (0.05), 4%, 2%, and 1% of gross selling price or gross value of the shares. NOTE: Banks and Finance companies are also subject to percentage taxes until December 31,1999 when they shall be subject to value-added tax, unless otherwise provided by Congress.

- 68. OVERSEAS COMMUNICATION TAX The tax is imposed upon every overseas dispatch message or conversation transmitted from the Philippines by telephone, telewriter exchange, wireless and other communication services equivalent to 10% on the amount paid for such services payable by the person paying for the services rendered.

- 69. TAX ON RECEIPTS OF LIFE INSURANCE COMPANIES The tax is imposed on persons, companies or corporations engaged in insurance business in the Philippines equivalent to 2% of the total premiums collected. Certain premiums mentioned by law are not included in the taxable receipts.

- 70. The law exempts from the tax purely cooperative companies or associations defined as those as are conducted by the members thereof with the money collected from among themselves and solely for their own protection and not for profit. Agents of non-resident foreign insurance companies shall pay a tax equal to 10% of the total premiums received.

- 71. AMUSEMENT TAXES 1. Taxes on gross receipts. Taxes equivalent to 18% of the gross receipts of cockpits, cabarets, and day or night clubs; 10% in the case of boxing exhibitions; 15% in the case of professional basketball games; and 30% in the case of race tracks and jai-alai, irrespective of whether or not any amount is charged or pay for admission, collected from every proprietor, lessee, or operator of such establishment .

- 72. AMUSEMENT TAXES 2. Taxes on winnings. Taxes imposed on every person who wins in a horse race or jai-alai equivalent to 10% of his winnings or “dividends”. The same tax is collected from the owners of winning race horses. The amusement tax on admission to places of amusement is now levied and collected by the provinces and cities to the exclusion of national government.

- 73. TAX ON SALE OF SHARES OF STOCK 1. Shares of stock listed and traded through the local stock exchange. The tax is ½ of 1% (0.05) based on the gross selling price or gross value in money of the shares other than the sale by a dealer in securities (i.e., one regularly engaged in selling securities like stocks, as a business).

- 74. TAX ON SALE OF SHARES OF STOCK 2. Shares of stock sold through initial public offering in closely held corporations. This is also based on the gross selling price or gross value in money of the shares, in accordance with the proportion of the shares sold to the total outstanding shares after the listing in the local stock exchange at rates provided below: Up to 25%.................................... 4% over 25% up to 33 1/3%............... 2% over 33 1/3%................................. 1%

- 75. FILING AND PAYMENT OF THE TAXES 1. When.- The percentage tax return of gross sales, receipts or earnings for every quarter must be filed and the tax due thereon paid within 25 days after the end of each taxable quarter.

- 76. FILING AND PAYMENT OF THE TAXES 2. Where.- The quarterly return must be filed with and the tax paid to: An authorized agent bank, or The revenue district officer, Revenue collection officer or Duly authorized treasurer of the city or municipality where the business or principal place of business of the taxpayer is located.

- 77. The taxpayer may file a separate return for each branch or place of business or a consolidated return for all branches or places of business.

- 78. G. EXCISE TAX Excise Tax, as used in the Tax Code, are taxes imposed on certain specified goods manufactured or produced in the Philippines for domestic sale or consumption or for any other disposition and on goods imported into the Philippines. NOTE: When classifying taxes according to subject matter of object, the term “excise tax” or “privilege tax” is used to refer to a tax other than personal tax and property tax.

- 79. NATURE OF EXCISE TAX Excise Taxes subject directly the produce or goods to tax. They are, therefore, taxes on property.

- 80. KINDS OF EXCISE TAXES 1. Specific Tax. one imposed and based on weight, volume capacity, length, number, or any other physical unit. 2. Ad valorem tax. one imposed and based on selling price or other specified value of the article.

- 81. GOODS SUBJECT TO EXCISE TAXES 1. In General - Excise Taxes apply: a. To goods manufactured or produced in the Philippines for domestic use or consumption or for any other disposition; and b. To goods imported from foreign countries.

- 82. 2. In Particular – The Tax Code enumerates the goods subject to excise taxes, namely: a. Alcohol products b. Tobacco products c. Petroleum products d. Miscellaneous goods e. Mineral products

- 83. FILING OF RETURN AND PAYMENT OF THE TAXES 1. When - Unless otherwise specifically allowed the return shall be filed and the excise tax due shall be paid by the manufacturer or producer before removal of domestic products from the place of production. In the case of imported articles, the tax shall be paid by the owner or importer before release from the customs house, or by the non-exempt person in possession of the tax-exempt articles.

- 84. FILING OF RETURN AND PAYMENT OF THE TAXES 2. Where – Except as the Commissioner of Internal Revenue otherwise permits the return shall be filed with and the tax to: Any authorized agent bank or Revenue Collection officer, Duly authorized treasurer of the city or municipality where the taxpayer has his/its legal residence or principal place of business.

- 85. H. DOCUMENTARY STAMP TAXES Documentary Stamp Taxes is a tax on documents, and papers evidencing the acceptance, assignment, sale or transfer of an obligation, right or property incident thereto.

- 86. NATURE AND PURPOSE OF THE TAX It is a privilege tax because it is really imposed on transaction rather than on document. The document is only taxed because of the transaction. The purpose of the law in imposing stamp taxes is to raise revenue, and not to invalidate the contract.

- 87. EFFECT OF FAILURE TO STAMP TAXABLE DOCUMENT Such failure does not render the document invalid or void. But in such case, the following shall be the effects: 1. The document shall not be recorded or registered; 2. Such document or any record or transfer of the same shall not be admitted or used in evidence in any court until the requisite stamp or stamps shall have been affixed thereon and cancelled.

- 88. EFFECT OF FAILURE TO STAMP TAXABLE DOCUMENT 3. No notary public or other officer authorized to administer oaths shall add his jurat or acknowledgement until the document is properly stamped; and 4. The person who fails to affix the proper documentary stamps shall, for every violation, be liable in addition to the amount of tax required to be paid, an amount equivalent to 25% of such unpaid amount.

- 89. FILING OF RETURN AND PAYMENT OF THE TAX 1. By whom payable – The tax is payable by the person making, signing, issuing, accepting or transferring such obligation, right or property. 2. When payable – The tax return shall be filed and the tax due shall be paid within 10 days after the close of the month when the taxable document was made, signed, issued, accepted or transferred.

- 90. FILING OF RETURN AND PAYMENT OF THE TAX 3. Where payable – The tax return shall be filed with and the tax shall be paid through: The authorized agent Bank, or the Revenue district officer; Revenue collection officer, or Duly authorized treasurer of the city or municipality where the taxpayer has his/its legal residence or principal place of business.

- 91. DOCUMENTS SUBJECT TO THE DOCUMENTS NOT SUBJECT TO THE TAX TAX 1. Debentures and certificates of 1. Insurance policies or annuities to indebtedness; members of fraternal societies; 2. Original issue of shares and 2. Certificates of oath administered to stock; and certificates of acknowledgement by any government official in his official 3. Sales contracts or agreements; capacity; 3. Statements and compulsory 4. Bonds, loan agreements, information required by government promissory notes and bills of offices for statistical purposes and not exchange; for the benefit of the person filing the 5. Insurance policies; same; 4. Affidavits of poor persons for the purpose proving property; and 6. Powers of attorney; 5. Certificates of the assessed value of 7. Leases, mortgages, and pledges. lands not exceeding Php.200.00 in assessed value, furnished to applicants for registration of title to land.

- 92. I. CUSTOM DUTIES Custom Duties are taxes levied by a government on the importation or exportation of goods in or out of the country. Tariff, on the other hand, means a book of rates; a schedule of fees imposed into a country.

- 93. GOVERNING LAW AND ADMINISTRATIVE OFFICES The law governing tariff and customs duties is Presidential Decree No. 1464, otherwise known as the Tariff and Customs Code of 1978 which consolidated and codified the tariff and customs law in the Philippines. the offices charged with the administration and enforcement of the law are the Bureau of Customs and the Tariff Commission.

- 94. CLASSIFICATION OF CUSTOM DUTIES 1. Ordinary or regular custom duties, imposed and collected mainly as a source of revenue, namely: a. specific b. ad valorem 2. Special custom duties, imposed and collected in addition to the ordinary customs duties usually to protect local industries from unfair competition.

- 95. KINDS OF SPECIAL CUSTOMS DUTIES 1. Dumping duty- imposed on certain imported articles which are being sold or are likely to be sold at a price lower than their home market price and which may injure or retard the establishment of an industry producing like goods in the Philippines. 2. Countervailing duty- imposed on articles, upon the production, manufacture, or export which any bounty or subsidy is granted in the country of origin.

- 96. KINDS OF SPECIAL CUSTOMS DUTIES 3. Marking duty- imposed on imported articles and containers which have not been properly marked in any official language of the Philippines as to indicate the name of the country of origin of the article. 4. Retaliatory or discriminatory duty- imposed upon articles of foreign country which discriminates against Philippine Commerce.

- 97. J. TRAVEL TAX PURPOSE: The law was promulgated in line with “the policy of the Government to lessen the restriction on foreign travel”, “simplify travel regulations”, and at the same time, “to provide adequate funds for Government programs.”

- 98. PERSONS LIABLE 1. All Filipino citizens; 2. Permanent resident aliens; and 3. Non-immigrant ant aliens who have stayed in the Philippines for more than one year and are leaving the country, irrespective of the plane of issuance of ticket and the form and place of payment. SCHEDULE OF THE TAX 1. Php.2,700.00 2. Php.1,620.00 3. Php.1,350.00 (for first class passage) and Php.810.00 (for economy class passage)

- 99. PERSONS EXEMPTED Among others, the following may be mentioned; Foreign diplomatic and consular officials; Crew members of ships and airplanes flying international routes; Infants who are two years old or less; Filipino overseas contract workers, officials, etc. of the United Nations Organization and its agencies Non-resident Filipino citizens; Bona fide students with government-approved scholarships, etc.

- 100. K. ENERGY TAX PURPOSE: The tax is imposed in view of: 1) The need to discourage the uneconomic consumption of fuel and 2) The need for additional revenue to support economic development. The imposition is also in line with the Government’s energy and fuel conservation programs.

- 101. BASES OF THE TAX 1. On aircraft – The tax is imposed on non- commercial helicopters and non-commercial fixed winged aircraft based on their gross weight in kilos. 2. On watercraft – The tax is imposed on motorized speedboats, yachts, launches, and other watercrafts based on the length of the vessel.

- 102. BASES OF THE TAX 3. On electric power consumption - The tax is imposed on the monthly electric power consumption of every residential customer of electric power utilities determined in accordance with the following schedule: MONTHLY KILOWATT-HOURS THA TAX SHALL BE CONSUMPTION Not over 650 Exempt Over 650 but not over 1,000 Php.0.10 per KHW in excess of 1,000 Over 1,000 but not over 1,500 Php.35.00 plus Php.0.20 per KHW in excess of 1,000 Over 1,500 Php.135.00 plus Php.0.35 per KHW in excess of 1,500

- 103. In areas outside Metro Manila where the prevailing electric power rates (excluding the energy tax) are equal to or higher than the rates (including the energy tax) prevailing in Metro Manila, the energy tax shall not apply; if less, then the energy tax to be imposed in the former shall be equal to the difference or the full amount of the energy tax, whichever s lower.

- 104. L. PRIVATE MOTOR VEHICLES TAX PURPOSE This tax is imposed by Executive Order No.43 which amended R.A. No. 4136, otherwise known as the “Land Transportation and Traffic Code,” as amended. The law was issued to rationalize the structure of the tax on private motor vehicles by basing the same on ability to pay of the owners thereof.

- 105. SCHEDULE OF THE TAX VEHICULAR TYPE Vehicle Light Medium Heavy Utility (0-601cc) (1601cc- (2801cc & (2700kg. 2800cc) Over) GW & below) Age Current 1 years old Php.1,000 Php.3,000 Php.6,000 Php.1,000 2 years old 1,000 3,000 6,000 1,000 3 years old 1,000 3,000 6,000 1,000 4 years old 1,000 2,400 6,000 1,000 5 years old 1,000 2,400 6,000 1,000 Over 5 years 700 1,200 2,800 900 old

- 106. PREPARED BY: VICENTE, REYNEBERT B. BSEII-SST