Legal aspects

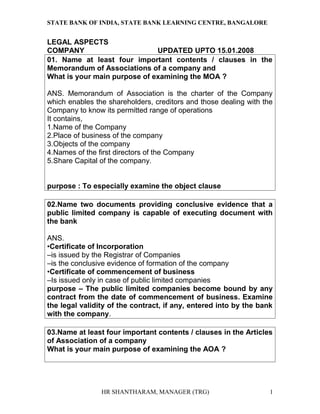

- 1. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE LEGAL ASPECTS COMPANY UPDATED UPTO 15.01.2008 01. Name at least four important contents / clauses in the Memorandum of Associations of a company and What is your main purpose of examining the MOA ? ANS. Memorandum of Association is the charter of the Company which enables the shareholders, creditors and those dealing with the Company to know its permitted range of operations It contains, 1.Name of the Company 2.Place of business of the company 3.Objects of the company 4.Names of the first directors of the Company 5.Share Capital of the company. purpose : To especially examine the object clause 02.Name two documents providing conclusive evidence that a public limited company is capable of executing document with the bank ANS. •Certificate of Incorporation –is issued by the Registrar of Companies –is the conclusive evidence of formation of the company •Certificate of commencement of business –Is issued only in case of public limited companies purpose – The public limited companies become bound by any contract from the date of commencement of business. Examine the legal validity of the contract, if any, entered into by the bank with the company. 03.Name at least four important contents / clauses in the Articles of Association of a company What is your main purpose of examining the AOA ? HR SHANTHARAM, MANAGER (TRG) 1

- 2. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE ANS. Articles of association are the rules and regulations governing the internal management of the company. It contains –No. of directors of the company –Procedure for conducting meetings of the shareholders –Procedure for transfer and transmission of shares –Borrowing powers of the company –Officers of the company and other details purpose : Examine the borrowing powers of the company and also to know the power for executing the documents and creating security 04.Before executing security documents, a company passes a board resolution. What are the three minimum clauses it should contain ? ANS. The board resolution passed at the board meeting and NOT by circulation is a document empowering the company in the following aspects : –Powers to borrow –Authority to sign –Affix the common seal of the company on the security documents 05. A company executed a document with a round rubber stamp (common seal) where one of the directors signed as ‘for and on behalf of the company’ •Whether it is in order, if so, why •If not in order, why? ANS. It is not in order, because –The common seal has to be made of a metallic substance. A round rubber seal is not a common seal, even if the words are mentioned thereon. –The affixation of the common seal requires to be witnessed by at least two persons, usually directors –Such directors cannot sign in representative capacities. They sign in the capacity of a witness HR SHANTHARAM, MANAGER (TRG) 2

- 3. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE 06.ABC & Co, Private Ltd. has the following liability structure as per the latest information: Capital Rs. 10 lakh Free Reserves Rs. 30 lakh Term Loan Rs. 25 lakh Cash Credit Rs. 20 lakh The Statutory auditor comes to your branch and cites a provision of Companies Act (section 293 (i) (d)) which says that a company cannot contract liabilities in excess of its capital and free reserves. Thus, the above contract is void ab-initio. The loan should therefore be classified as a loss asset. How would you respond to the situation? ANS. Section 293 (i)(d) of the Companies Act is applicable for public limited companies and those private companies, which are subsidiaries of public limited companies. The section is therefore not applicable in this case. Secondly, the provision says that the company contract debt beyond the level of capital + free reserves. The term debt refers to long term debt only. For the company to borrow beyond the above ceiling level, it would be necessary to obtain a resolution passed in the general body meeting of the members. The resolution must NOT be passed in circulation 07.Your bank is considering a credit facility in favour of M/s. Son & Co. Ltd. to the extent of Rs.10 Cr. This company is a wholly owned subsidiary of M/s. Father & Co. Ltd. One of the stipulations of the advance is that the parent company would provide a corporate guarantee to the bank covering the full advance. The parent company has a paid up capital of Rs.5 Cr. and a total free reserve up to Rs.7 Cr. While obtaining the documents for corporate guarantee, what are the precautions you would like to exercise? HR SHANTHARAM, MANAGER (TRG) 3

- 4. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE ANS. A guarantee provided by a public limited company is clubbed with the amount of inter-corporate deposits and loans given by it for the purpose of section 372A. As per the provisions of section 372A, the maximum amount permissible under this head is 100% of the free reserves or 60% of the aggregate of the capital and free reserves, whichever is higher. As per the statutory provisions, therefore, the company can provide a corporate guarantee to the maximum extent of Rs.7.00 Cr. to the bank. However, if the guarantee exceeds the above limit, a special resolution would be required to be passed by the guarantor company in a general meeting. •In case, the guarantee has been provided but the special resolution was not obtained beforehand, the board may be got ratified in a general meeting within 12 months of the board resolution. 08. Who should file charge? It is the primary duty of the company to have the charges filed with ROC in a proper manner However, section 134 empowers every person interested in the charge to get it registered with the ROC 09. Section 125 of the Companies Act requires a Company to file a charge within 30 days of creation thereof SAY YES OR NO. 10. A Partner has the implied authority as an agent of a Firm. Say Yes or No. Yes, act of a partner shall be binding on the firm, if it is done : •in the usual business of the partnership, •in the usual way of the business : and •as a partner, i.e.on behalf of the firm and not solely on his behalf a Firm. That is the reason why any document executed by a Partner on behalf of his Firm should also be executed by the Partner in his HR SHANTHARAM, MANAGER (TRG) 4

- 5. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE individual capacity, so that the individual estate of the Partner can also be called upon for repayment towards the firm’s dues first, before settling his other dues. •In cases where different loans provided to a Firm and its partner(s) (in individual capacities) are due, the estate of the Firm shall first be utilized towards payment of the Firm’s dues, and thereafter towards payment of individual dues of the partners, if the remaining balance of the estate permits. • •Similarly, the estate of a partner shall first be utilized towards repayment of his individual loan and balance if any, in repayment of the loan provided to the Firm. PARTNERSHIP 1.Partnership is not a legal entity. But it is a group of persons associated for a specific objective. 02.Two partnership firms can not form a Partnership firm. 03.Two companies can form partnership firm. 04.Max for Banking activity – 10 Max for Non-banking activity – 20 As per section 11 of Company act. 05. If number of members exceeds 10/20 it is an illegal association. 06.Partnership firms are to be registered with Registrar of Firms. 07.An unregistered firm can not sue it’s debtors but it can be sued. 08.A minor can be admitted for the membership of the firm, but he/she entitles only for the benefits of the farmer. Within 6 months after attaining the majority, the minor should declare his/her HR SHANTHARAM, MANAGER (TRG) 5

- 6. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE willingness to be a partner. If he does not declare, he/she automatically becomes a partner of the said firm. 09.On the death of partner, operation in CC a/c to be stopped rationale : a] As per sec. 42 of Partnership act, once the partner dies, the firm is automatically dissolved. b] to avoid application of clayton’s rule in case of debit balance vide sec. 59 to 61 if Indian Contract act. c] to protect the interest of the Bank. 10. Partnership letter is necessary while opening an account. rationale : a] partners declare in the latter that they are jointly and severally liable b] the undertake to inform the Bank if there is any change in the constitution of the firm. 11. If the same documents are signed by different parties on different dates, which date will be date of the document? If several parties to a document sign it on different dates, the practice is to reckon the last of such dates as the date of the document. However, the limitation period, as far as a partnership firm is concerned, starts from the earliest date, i.e., the date on which one of the partners first signed the document on behalf of the firm (IBA Bulletin, Feb 1990). 12.Can a partner delegate others for firm’s operations ? Ans : Every partner is an accredited agent of the firm as per sec 18 of Partnership act. He being a delegate (of the firm and that of other partners) can not further delegate as per sec 190 of Indian Contract act. HR SHANTHARAM, MANAGER (TRG) 6

- 7. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE GARNISHEE ORDER 1. Garnishee order is issued under which of the following------------ a) Civil Procedure code b) Criminal Procedure code c) Indian Contract Act. d) Banking regulation Act. a 2. A Garnishee order is issued by ------------- a) The RBI to scheduled bank for stopping payment in an account. b) The competent court for attaching funds due to a judgement debtor by a third party for payment to the judgement creditor. c) The Income Tax Recovery Officer attaching funds in the account maintained by the bank. d) The district Magistrate requiring the bank to remit to his office a certain sum of money to the debit of particular account. b 3. In the process of issuing a Garnishee order court first issues------------ a) Order Nisi b) Order primary c) Order attachment d) Order absolute a 4. Who is a garnishee in case of a bank account, where a garnishee order is served? a) Judgement debtor b) Judgement creditor c) Judgement debtor’s debtor d) Cash credit customer c 5. Your branch has received a garnishee order for the account of Mr. ‘X’. What is the first action you are required to take? c HR SHANTHARAM, MANAGER (TRG) 7

- 8. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE a) After paying the amount to the court, the customer be informed. b) After paying the amount to Judgement creditor, the customer be informed. c) Stop operations and inform customer d) None of the above 6. If the garnishee order is received on a firm’s account, what would be the position of individual account of partners being maintained with same bank branch? a) The order will be applicable b) The order will not be applicable c) It will be applicable through special order of court d) None of the above a 7. Which of the following conditions are to be fulfilled for a garnishee order to be applicable? (a) the debt should be due or accruing due (b) Money should belong to the customer in his own right (c) the amount in the account should be a credit balance (d) all of these d 8. The garnishee mentioned in a garnishee order served by court under CPC, 1908 is: (a) The customer having an account with the Bank (b) The bank on which the order was served (c) The court which issued the order b 9. Mr. Sinha enjoys an overdraft limit of Rs.20,000/-. The bank has received Garnishee order for Rs.5,000/- when the debit balance in the account is Rs.10,000/-. (a) Bank is bound to comply with the garnishee order as there is an arrangement to overdraw c HR SHANTHARAM, MANAGER (TRG) 8

- 9. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE (b) Bank is bound to comply with the order as even after paying the garnishee order the balance will be within limit. (c) Bank is not bound to comply with the order as the bank owes no money to the customer (d) None of the above 10. Garnishee order applies to (a) Cheque sent for collection but proceeds not received till time of receipt of order (b) Sale proceeds of shares lodged with the bank proceeds of which have not been received till the time of receipt of order (c) Money deposited by the customer after the time of receipt of order (d) None of the above d 11. Garnishee Order is issued under Provisions of (a) Civil Procedure Code 1908, Order 21, Rule 46 (b) Criminal Procedure Code (c) Income Tax a 12. The garnishee mentioned in a garnishee order served by a court under C.P.C.1908 is ___ a) The customer having an account with the Bank b) The bank on which the order was served c) The court which issued the order d) None of the above ] b HR SHANTHARAM, MANAGER (TRG) 9

- 10. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE 13. Mr. Ram enjoys an overdraft limit of Rs. 20000/-. The bank has received Garnishee order for Rs. 5000/- when the debit balance in the account is Rs. 10000/- a) Bank is bound to comply with the garnishee order as there is an arrangement to overdraw b) Bank is bound to comply with the order as even after paying the garnishee order the balance will be within limit c) Bank is not bound to comply with the order as the bank owes no money to the customer d) None of the above c 14.When a ‘Garnishee Nisi’ is served, the Banker should: a) Pay the balances to the judgment Debtor. b) Pay the amount as the Branch Manager feels it right. c) Stop operations in the judgment debtor’s a/c upto amount mentioned in the garnishee order & allow the operations for balance amount. d) None of these. c 15. When Court issues Garnishee Order, the Bank is known as: a) Garnishee b) Judgment Debtor c) Judgment Creditor d) None of these a 16.Which of the following account is not attachable by service of garnishee order? a) Balance in Current account b) Balance in SB account c) Balance in SB account held RD d) Balance in FOR maturing one year later. e) Balance representing cheque sent in clearing, not yet cleared.. e 17. A Garnishee order does not extend to the following: a) Term Deposits maturing after 2 years b) Credit balance in CC accounts c) Current Account d) None of the above. d HR SHANTHARAM, MANAGER (TRG) 10

- 11. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE 18. Which of the following is Garnishee under a Garnishee Order? . a) Judgement Creditor b) Judgement Debtor c) Bank d) None of these c 19.A garnishee order has been received in the name of Mr. X who is associated with the following accounts maintained with your branch. In which of these accounts the order would be applicable: A: account in the name of his minor wife under his guardianship B: overdraft account having un-availed limit of Rs.35000 C: account of a trust where he is the sole trustee D: none of the above d 20. Garnishee order can be issued by a a. creditor b. debtor c. Bank d. none d 21. In garnishee order, the bank is a- a. Paying Banker b. Garnishee c. Judgement Debtor d. Judgement Creditor b 22. The Garnishee Order is applicable when the relationship between the two is- a. Bailor- Bailee b. Trustee-Beneficiary c. Principal-Agent d. Debtor-Creditor d HR SHANTHARAM, MANAGER (TRG) 11

- 12. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE INDIAN STAMP ACT 1899 1. Points to remember for adjudication and higher/lower/same stamp areas. If there is any doubt regarding the stamp duty exeligible on a security document, the matter should be referred to the Bank’s advocate/Law Officer. As per Sec. 31 of Indian Stamp Act, the document may be sent to the collector of stamps or Stamp Authority for seeking his opinion as to the exact stamp duty payable on the document/ instrument (adjudication). If a security document travels from higher stamp the same stamp area or lower stamp area, no action is necessary in the second state. But if the stamp duty in the second state is higher, the document attracts the additional stamp duty. Such additional stamp duty should be paid before the remaining executants in the second state put their signatures on the documents, within 3 months of the date of receipt in the second state. (Overstamping, if any, in the first State does not serve the purpose in such instances). If a document travels from the state of Jammu and Kashmir to some other state and vice versa, the stamp) duty of both the states is payable. HR SHANTHARAM, MANAGER (TRG) 12

- 13. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE 2. When the bank sells gold ornaments or other valuable articles pledged to it as security for any loan, for recovering the dues, should it collect and remit sales tax to the Govt. ? As per the recent amendments to the provisions of the Kerala General Sales Tax Act, 1963 a Bank or a Financial Institution effecting the said sale has been brought under the purview of ‘dealer’. (Amendment Act 14 of 1998 to KGST Act, 1963). As per the amendment the bank is liable to collect and remit tax on the value of the gold/ other valuables sold in auction to recover the dues to it. 3. Any instrument drawn and executed outside India must be stamped within three months of entry in India 4.An unstamped or under stamped d.p.notes and bills of exchange cannot be ‘corrected’ even if the penalty is paid. 5. Stamp paper must be purchased in the name of one of the parties to the contract PLEDGE 1.Pledge is defined u/s 172 of Indian Contract Act.1.Pledge is defined u/s 172 of Indian Contract Act. 2.Pledgee has the right to possession.2.Pledgee has the right to possession. 3.3.reasonable notice u/s 176 required to be given to the borrowerreasonable notice u/s 176 required to be given to the borrower before selling the pledged goods.before selling the pledged goods. 4.The Bank is liable u/s 151 to take good care of the seized goods.4.The Bank is liable u/s 151 to take good care of the seized goods. 5.For goods and securities pledged to the Bank, there is no limitation5.For goods and securities pledged to the Bank, there is no limitation period.period. HR SHANTHARAM, MANAGER (TRG) 13

- 14. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE HYPOTHECATIONHYPOTHECATION 1.Hypothecation is defined IN SEC 2 of SARFAESI ACT (1.Hypothecation is defined IN SEC 2 of SARFAESI ACT (The Securitisation & Reconstruction of Financial Assets and Enforcement of Security Interest Act) 2.2.it is a notional, special and equitable chargeit is a notional, special and equitable charge provisions ofprovisions of 3.The possession and ownership remains with the borrower.3.The possession and ownership remains with the borrower. 4.Transfer of Property Act and Indian Contract Act are not applicable4.Transfer of Property Act and Indian Contract Act are not applicable 5.rights can be exercised through a court of law5.rights can be exercised through a court of law NEGOTIABLE INSTRUMENT ACT 1. The Negotiable Instruments Act, 1881 came into effect on (a) 1st January, 1881. (b) 1st July, 1881. (c) 1st March, 1881. (d) 1st March, 1882. d 2. The Negotiable Instruments Act, 1881 extends to : (a) all States comprising of erstwhile British India. (b) the whole of India excluding Jammu & Kashmir. (c) the whole of India including Jammu & Kashmir. (d) the whole of India except the State of Sikkim and East Bengal. c 3. How many sections are there in the Negotiable Instruments Act, 1881 ? (a) 250. D HR SHANTHARAM, MANAGER (TRG) 14

- 15. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE (b) 500. (c) 131. (d) 147. 4. Effective from 15th March, 2003, the Information Technology Act, 2000 has been amended so as to bring within its purview the: (a) bills of Exchange. (b) cheques. (c) promissory Notes. (d) electronic cheques and truncated cheques. D 5. Negotiable instruments are defined under: (a) Section 52 of the Banking Regulation Act, 1949. (b) Section 13 of the Negotiable Instruments Act, 1881. (c) Section 25 of the Reserve Bank of India Act, 1934. (d) None of these. b 6. A negotiable instrument means: (a) Bill of exchange; or (b) Cheque payable to bearer; or (c) Demand Draft; or (d) Cheque, bill of exchange or promissory note. d 7. Withdrawal forms used in savings accounts are: (a) negotiable instruments. (b) quasi negotiable instruments. (c) not negotiable instruments. (d) special bearer instruments. c 8.A hundred rupee currency note issued by Reserve Bank of India contains the following notation: "I promise to pay the bearer the sum of one hundred rupees." Therefore, the currency note is a : (a) Promissory Note. (b) Bill of Exchange. (c) Cheque. d HR SHANTHARAM, MANAGER (TRG) 15

- 16. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE (d) None of these. 9. Demand drafts issued by banks fall in the category of: (a) Promissory notes. (b) Bills of Exchange (c) Allonge (d) Special order b 10.Having regard to section 118 of the Negotiable Instruments Act, 1881, consideration, in the case of a negotiable instrument, is : (a) waived; or . (b) to be proved by the plaintiff; .or I (c) immaterial; or (d) presumed. d 11. A minor is incompetent to be a : (a) payee. (b) drawer. (c) drawee. (d) endorser without being bound by the endorsement himself. c 12. A negotiable instrument cannot be enforced against a minor when he signs it as : (a) acceptor of a bill. (b) maker of a promissory note. (c) drawer of a cheque. (d) all of these. d 13.. In view of section 8 of the Negotiable Instruments Act, 1881, the term "holder" would not include: a thief in possession of an instrument payable to bearer; or the finder of a lost instrument payable to bearer; or (c) even the payee himself if he cannot recover the amount due on the instrument, as when he is prohibited from doing so by an order of the court; or ' (d) all of these. d 14.A bank allows a temporary overdraft only for a part amount of a cheque sent in clearing. In the event b HR SHANTHARAM, MANAGER (TRG) 16

- 17. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE of dishonour of the cheque; b (a) Bank will not be a holder in due course since full consideration was not parted with while allowing overdraft against the dishonoured cheque. (b) Bank will be a holder in due course if it took the same under the circumstances mentioned in Section 9 of the Negotiable instruments Act, 1881. (c) Bank may proceed only against its customer who was allowed the overdraft but not against drawer/endorser. (d) None of these. 15. A negotiable instrument payable to bearer is negotiable by ; delivery endorsement endorsement and delivery (d) transfer deed. a 16. Hundies are governed by : (a) The Negotiable Instruments Act, 188!. (b) The Banking Regulation Act, 1949. (c) Usages and customs prevailing in various parts of the country. (d) None of these. c 17. How many parties are there in a bill of exchange? (a) Two. (b) Four (c) Three. (d) None of these. c 18. In a bill of exchange': (a) the drawer and the drawee are the same. (b) the drawee and payee are the same. (c) the payee and the acceptor are the same. (d) the drawee and the acceptor are the same.' d 19.All types of bills of exchange are required to B HR SHANTHARAM, MANAGER (TRG) 17

- 18. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE be presented, either for payment or for acceptance, to the: (a) drawer. (b) drawee (c)payee. (d) banker 20. Which of the following would constitute a cheque within the meaning of section 6 of the Negotiable Instruments Act, 1881? (a) A gives C a cheque written on a blank sheet of paper, and not on the bank's usual printed form. (b) A cheque in the electronic form. (c) The electronic image of a truncated cheque. (d) All of these. d 21. A cheque may be drawn for a maximum period of: (a) three months. (b) six months. (c) nine months. (d) none of these. d 22.The drawee of a cheque is always a : (a) company. (b) firm. (c) customer. (d) banker. d 23. How many parties are there to a promissory note? (a) One. (b) Two c) Three. , (d) No limit. b 24. An undated cheque is : (a) not considered invalid. (b) considered invalid. (c) considered not negotiable. (d) none of these a 25.A cheque may be: (a) ante-dated; or (b) post-dated c HR SHANTHARAM, MANAGER (TRG) 18

- 19. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE (c) both of these; or (d) none of these. 26. Which of the following statements about post- dated cheques are correct? (a) A post-dated cheque is only a bill of exchange when it is drawn and it becomes a cheque when it is payable on demand. . (b) A post-dated cheque becomes a cheque on the date which is written on the cheque. (c) Both of these. (d) None of these. c 27. A cheque book was issued on 16th August, 1991 to a current account holder out of which a cheque bearing 20th June, 1991 as its date, is presented for payment: . (a) The cheque should be returned with the remarks "Impossible Date"; or (b) The cheque should be returned with the remarks "Ante-dated cheque"; or (c) The cheque should be returned with the remarks "Out of date cheque"; or (d) The cheque should be paid. d 28. A cheque dated 31st September is presented for payment on 30th September: (a) The cheque will be paid. (b) The cheque will be returned with the remarks "Bears impossible date". (c) The cheque will be returned with the remarks "Irregularly drawn". (d) The cheque will be paid on or after 1st October. a 29. An undated cheque is presented at the counter by the payee: (a) The payee should be asked to fill in the date. (b) The banker as a holder has a right to fill in the date. (c) The cheque should be returned with the remarks "Cheque is un dated." c HR SHANTHARAM, MANAGER (TRG) 19

- 20. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE (d) The drawer must be contacted and his confirmation obtained. 30.A cheque filled in with the National Calendar (Saka Samvat) date is presented to you for payment: (a) You will pay the cheque because an instrument written in Hindi having Hindi date is a valid instrument. _ (b) You will refuse payment since under the Negotiable Instruments Act, 1881 cheques must be drawn in the British Calendar date. (c) It is your discretion to pay or to dishonour the cheque. (d) You will delay the payment of the cheque by asking the drawer to write the date as per British Calendar a 31. A cheque drawn in foreign currency is : (a) invalid. (b) Illegal. (c)valid (d) subject to discretion of the paying banker. c 32.. The amount in a cheque is written only in figures, the column meant for amount in words having been left blank. You will : (a) pay the cheque because amount in words is not required to be written under the law. (b) return the cheque with the reason "Ambiguous instrument." (c) return the cheque marked "Amount in words required" as a prudent banker. (d) none of these. c 33.A cheque is presented through clearing in which the amount ex pressed in words and figures differs. Acting strictly in accordance with the provisions contained in the Negotiable Instruments Act, 1881, you will: . (a) return the cheque with the remarks "Amount in words and figures differs." . (b) pay the cheque for the amount expressed in words. b HR SHANTHARAM, MANAGER (TRG) 20

- 21. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE (c) pay the cheque for the amount expressed in figures. (d) pay the cheque for the amount expressed in words or figures whichever is less. 34. The amount expressed in words on a cheque is "Rupees sixty thou sand only", whereas it is written as Rs. 600 in figures. You will: (a) pay the cheque for Rs 600. (b) pay the cheque for, rupees sixty thousand only. (c) return the cheque with the remarks "amount in words and figures differs." (d) none of these. c 35. A cheque payable to Lord Shiva or bearer is presented for payment: (a) Since the cheque is drawn in a fictitious name, it should not be paid; or , (b) The cheque may be paid to the presenter thereof; or (c) The cheque should be paid only to the drawer; or (d) The cheque will be paid to the presenter only after obtaining his identification. b 36. A cheque payable to bearer can be converted into an order one with: (a) Drawer's signature. (b) Drawee's signature. (c) No signature required. (d) Payee's signature. c 37. A bearer cheque contains two endorsements. The second endorsement is irregular. The cheque in question will be: (a) returned with the remarks "Refer to drawer." (b) paid on the collecting banker's guarantee. (c) returned with the remarks "Endorsement irregular." (d) paid in spite of irregular endorsement. d . 38.A cheque has been drawn favouring "Lord Brahma a HR SHANTHARAM, MANAGER (TRG) 21

- 22. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE or order." It is presented for payment across the counter by the priest of a local temple: a)Such a cheque should not be paid except to the drawer. Hence, it should be returned with the remarks "Irregularly, drawn"; or b)The cheque should be paid to the presentor after obtaining his identification; or (c) Since the cheque is drawn in fictitious name it becomes payable to bearer. Therefore, it should be paid to the presenter without insisting for his identification. (d) None of these. 39.A cheque is expressed to be payable to "Mr. B.K. KULKARNI or order or bearer." The words 'or order' have been inserted by the drawer himself while 'or bearer' is printed on the cheque.The cheque is pre- sented for payment by one Mr. Ram. There is no endorsement on the cheque. In the above case: (a) The cheque should be, returned with the remark 'irregularly drawn'. (b) The cheque should be returned with the remark 'payee's endorsement required'.. . (c). The cheque being a bearer one, may be paid to the presenter (d) The cheque should be presented through a bank; it cannot be paid across the counter., , b 40.Which of the following type of crossing is not recognised by the Negotiable Instruments Act, 1881 ? (a) General crossing. (b) Special crossing. (c) 'Not negotiable' crossing. (d) 'Account Payee' crossing. d 41. 'Account Payee' crossing is addressed to : a HR SHANTHARAM, MANAGER (TRG) 22

- 23. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE (a) collecting banker. (b) payee. (c) drawee banker. (d) none of these. 42. "Account Payee" crossing is : special crossing. general crossing (c) restricted crossing. (d) none of these. b 43.. In the 'case' of a bill of exchange : (a) general crossing means that the amount may be paid only to a bank. b) special crossing means that the amount may be paid only to the bank named therein. (c) crossing has a restricted application. (d) crossing has no meaning d 44. A negotiable instrument, can be endorsed by signing the same on : (a) a slip of paper annexed to the instrument; or (b) the back thereof; or (c) face thereof; or (d) the back or face thereof or on a slip of paper annexed thereto. d 45. An endorsement made by affixing a facsimile or rubber stamp is : ( a) valid only where clearing house exists; or (b) not legally valid; (c) legally valid; or (d) valid if the instrument is payable to a Government department c 46. When an order cheque is endorsed in blank: (a) its further negotiation is restricted. (b) it becomes payable to bearer and transferable by mere delivery. (c) it loses the characteristic of negotiability. " b HR SHANTHARAM, MANAGER (TRG) 23

- 24. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE (d) None of these. 47. An endorsement in pencil is : (a) illegal. (b) undesirable. (c) Specifically permissible under section 15 of the Negotiable Instruments Act.' (d)none of these. b 48. Who is incompetent to endorse an instrument? (a) Minor. (b) Married woman. (c) Illiterate. (d) None of these. d 49. In case an endorsement is not dated: (a) it is considered invalid. , (b) the date of the instrument is taken to be the date of endorsement. (c) the date of maturity is taken to be the date of endorsement. (d) it is not invalid d 50.Inchoate instrument means: (a) a negotiable instrument which 'is incomplete as' to its date, amount or name of the payee. (b) an instrument which has been lost. (c) a cheque, the payment where it has been stopped by the drawer. (d) a post-dated cheque a HR SHANTHARAM, MANAGER (TRG) 24

- 25. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE INDIAN REGISTRATION ACT 1.The registration of Mortgages of an immovable property should be done as per Sec 28 of Indian Registration act 1908. According the recent court decision on fraud, the burden lay on the plaintiff to prove that it was a fraud on registration in as much as a non-existent tree had been included therein only to attract the jurisdiction of the Sub-Registrar, when in fact there was none. Ex: 01.Case of Mrs. Ramadevi v. Ram Chandra Bali Debi of Patna High Court. In a proceeding for registration of document, the title to property can not be gone into and that the sec 28 of the IR act does not require anything more than the existence of a property within the jurisdiction of a particular Sub-Registrar in order to entitle him to register the same. (The Key word here is the Transferor should act in perfectly bonafide manner). 2.The registration has to be done within 4 months from the date execution of documents as per Sec 23 of Indian Registration act. The section reads on time for presenting document : “Subject to the provisions contained in Sec 24,25 and 26, no document other than a will shall be accepted for registration unless presented for that purpose to the proper officer within 4 months from the date of execution: Provided that a copy of a decree or order may be presented within four months from the day on which the decree or order was made , or, where it is appealable, within 4 months from the day on which it becomes final”. 3.If there is a delay in registration, the Registrar, in case where the delay in presentation does not exceed 4 months, may direct that, on payment of a fine not exceeding 10 times the amount of the proper registration – fee, such document shall be accepted for registration as per Sec 25 of IR act. Any application for such direction may be lodged with a Sub- Registrar, who shall forward it to the Registrar to whom his is HR SHANTHARAM, MANAGER (TRG) 25

- 26. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE subordinate. 4. Section 48 : Provided that the mortgage by deposit of title – deeds as defined in Sec 58 of TOP act, 1882, shall take effect against any mortgage deed subsequently executed and registered which relates to the same property 5. Sec 18 : The Documents in language not understood by the registering officer – the registering officer shall refuse to register the document unless it be accompanied by a true translation into a language commonly used in the district and also by a true copy. THE LIMITATION ACT ACKNOWLEDGEMENT OF DEBTS AND SECURITY : RENEWAL OF DOCUMENTS : REVIVAL LETTERS The Limitation Act 1963 prescribes a period before expiry of which a debt may be recovered or a right can be enforced by the Bank in a Court under a document. The essence of the Limitation Act is that it only bars the remedy and it does not extinguish the right under a document. If the debt is time barred, the Bank can still exercise its right of lien and set off and in the case of hypothecation or pledge or mortgage in English form, a power is vested in the Bank to sell HR SHANTHARAM, MANAGER (TRG) 26

- 27. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE without intervention of the Court and the limitation does not apply to such cases. However, the personal obligation of the borrower/ guarantor to pay (the dues to the Bank) could become time barred and no suit can lie for recovering the balance from them personally. As per The Limitation Act (Sections 18 to 20) the essential requirements of a revival letter (acknowledgement of debt and security) are : (a)Consent to or admission of existing liability in respect of a right or property. (b)It must show jural relationship as debtor and creditor. (c) Revival in writing should be made before the expiry of the prescribed period. (d)It should be made by borrower /guarantor against whom such right or property is claimed. (e)It should be signed by such person, i.e. the borrower /guarantor or his duly authorised agent (e.g., Registered General Power of Attorney Holder). (f) There must be an identity of the debt and admission as to such liability. A Balance Confirmation Letter (COS48 vide Specimen No.38) is, therefore, a valid acknowledgement of debt. The effect of a valid acknowledgement (revival letter) is that it commences a fresh period of limitation from the date it is executed provided it is executed before expiry of the prescribed limitation period. A revival letter is sufficient and valid even if - • It omits to specify the exact nature of the right or the property or the exact balance. • It states that the time for payment, delivery or performance has not come, that is to say, that there is still time to pay. • It is accompanied by a refusal to pay. • It requests for set off (by the borrower/guarantor) or prays for a compromise. HR SHANTHARAM, MANAGER (TRG) 27

- 28. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE REVIVAL OF THE TIME BARRED DEBT : A remedy in respect of a debt which is time barred can be revived only by a fresh promise to pay that debt in terms of the provisions contained in Section 25(3) of the Indian Contract Act. The 'imperfect right' (i.e. the right which was not exercised by the Bank within the limitation period) can be remedied only if there is a fresh promise to pay the debt by the borrower. Often it is observed that this procedure may entail obtention of documents in the loan accounts, in view of certain other legal complications. The difference between the revival letter (i.e. the acknowledgement under Section 18 of the Limitation Act) and Section 25(3) of the Indian Contract Act (fresh promise to pay the time barred debt) is that a revival letter (under Section 18) in writing (please see Specimen No.39) made before the expiry of the prescribed period only extends the limitation from the date it is so signed, whereas a new promise to pay a time barred document (under Section 25(3) of Contract Act) altogether gives a fresh cause of action and a fresh limitation period from the date of such agreement to revive the time barred debt, is executed. In other words, a revival letter (acknowledgement) cannot revive a time barred debt nor it can extend its limitation and this can be done only under Section 25(3) of the Contract Act. The Branches should, further ensure that after the execution of the Bank's standard form of agreement to revive the time barred debt, the subsequent revival letters should mention not only the said agreement to revive the time barred debt but also it should include all the loan documents which have become time barred in respect of which the said agreement was taken. REVIVAL LETTER WHEN THERE ARE PRINCIPAL AND SUPPLEMENTAL AGREEMENTS Whenever a limit in the existing credit facility is enhanced or additional facility is granted, the practice followed is to obtain a supplemental set of documents for the amount by which the existing limit is enhanced or additional facilities granted and if these advances are supported by third party guarantees, the guarantors also join in HR SHANTHARAM, MANAGER (TRG) 28

- 29. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE the execution of supplemental set of documents. If there is a change in the guarantor then an additional guarantee or a new guarantee is also taken. A linking letter along with supplemental set of documents is to be executed by the borrower and the guarantor declaring thereby that the supplemental set of documents is in addition to and not in substitution of the documents executed earlier. The linking letter is introduced for serving additionally as a revival letter covering the whole limit including the enhancements so that obtaining of revival letter separately for the documents executed earlier could be avoided. The period of limitation in respect of the earlier indebtedness will begin to run after obtaining the revival-cum-linking letter only from the date of execution of the linking letter subject, of course, to its being within time on such date. The rationale for prescribing the above procedure is to avoid the possibility of the earlier principal documents getting barred by time. Whenever supplemental agreement is taken it is only by way of an addition or modification of earlier principal/general agreement for ensuring continuity of contractual obligations and preventing any intervening charges. The supplemental agreement is not by way of renewal or in substitution of the earlier principal/general agreement. The supplemental agreement cannot for any purpose be regarded as a letter of acknowledgement of the debt. The contract between the Bank and the borrower in respect of the loan and the security created thereto and which is covered independently by the principal agreement and supplemental agreement is separate and distinct. In other words, the liability represented by/under the principal/general agreement is one contract distinct from the liability covered by/under supplemental agreement, which is altogether a separate contract. Both the contracts will have to be kept alive by obtaining revival letters duly signed by the borrower(s) and guarantor(s) within the prescribed period. In addition to the details of the principal/general agreement, the particulars of the supplemental agreement should also be mentioned in the revival-cum-linking letter for extending the period of limitation in respect of both the documents. HR SHANTHARAM, MANAGER (TRG) 29

- 30. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE PART PAYMENT : A part payment in the loan account some times extends the period of limitation for a further period. . However, such part payment should be made before the expiry of the original limitation period and the payment should be by the debtor or its duly authorised agent and the documents/voucher should be in the handwriting of the debtor or his authorised agent and duly signed by them. The part payment can be effected either by a cheque or cash or in any other valid mode. A post-dated cheque which is dishonoured may amount to an acknowledgement in writing for saving the limitation. The date for computing the limitation in that case would be the date on which the cheque was delivered to the Bank and not the date of the cheque. However, it should be noted that a valid cheque, which is dishonoured, cannot be considered to be valid part payment for purposes of Section 19 of the Limitation Act. WHO CAN EXECUTE/MAKE ACKNOWLEDGEMENT (RENEWAL LETTER/PART PAYMENT: To be a valid acknowledgement and a part payment, it should be executed/made by a person or his agent against whom the right or property is claimed. In the case of Hindu Undivided Family (HUF), the Karta of HUF is competent to execute a revival letter or make part payment of the debt, if the same is made on behalf of the HUF. It is the duty of the creditor (Bank) to ascertain whether the person executing the revival letter holds his representative capacity as such Karta. On behalf of a limited company, only such person who has been specifically authorised under a Board resolution can execute a HR SHANTHARAM, MANAGER (TRG) 30

- 31. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE valid revival letter and no one else can. An acknowledgement signed by the Secretary is not valid unless authorised to that effect by a resolution by the Board of Directors in that behalf. Statements in correspondence by Secretary do not amount to acknowledgement of liability. In the case of a partnership firm, the revival letter should be signed by all the partners of the firm. Acknowledgement by one of the partners cannot bind the other co-partners unless he is so expressly constituted as such Agent to do so on behalf of other partners. But the Bank does not prefer such type of acknowledgement. In the case of death of a borrower/guarantor, the legal heirs can execute a valid revival letter. But each one of them would be liable to the Bank only to the extent of the property inherited by them. In the case of joint account, one of the borrowers cannot bind the other co- borrowers unless he has the specific authority to bind them. In a joint account, therefore, all the joint debtors should execute the revival letters. An acknowledgement by a borrower will not bind the guarantor and vice-versa. However, if the borrower has been constituted as an attorney (by means of a Registered Power of Attorney) /agent of the guarantor, a revival letter by such borrower will be binding on the guarantor but care should be exercised that the borrower makes the acknowledgement not only for himself but also as an agent/ Constituted Attorney of the guarantor. The borrower should do so both in his personal capacity and also as an agent/ Constituted Attorney of the guarantor. ACKNOWLEDGEMENT IN A BALANCE SHEET/STOCK STATEMENT :- Under the law, there is no prescribed form of acknowledgement. It need not always be in the form of a letter. An acknowledgement in a balance sheet is valid for extending the limitation period. If a debt is admitted in a balance sheet, duly signed by the debtor company/ firm through its authorised directors/ partners, the balance sheet will serve as an acknowledgement. However, it should be ensured that the name of the Bank and the amount is specifically mentioned in the balance sheet. HR SHANTHARAM, MANAGER (TRG) 31

- 32. STATE BANK OF INDIA, STATE BANK LEARNING CENTRE, BANGALORE A suitably worded Stock statement which contains the limit, D.P. outstanding, etc. can also serve as an acknowledgement of debt, provided it is signed by the authorised representative(s) of the firm /company, HR SHANTHARAM, MANAGER (TRG) 32