Definition of takeover

•Descargar como PPT, PDF•

15 recomendaciones•13,303 vistas

Benefits of takeover and disadvantage

Denunciar

Compartir

Denunciar

Compartir

Recomendados

Más contenido relacionado

La actualidad más candente

La actualidad más candente (20)

Rights and duties of agent, Principal and Delegation of authority

Rights and duties of agent, Principal and Delegation of authority

Destacado (6)

Hostile Takeover Strategies with Analysis of Case Studies

Hostile Takeover Strategies with Analysis of Case Studies

Similar a Definition of takeover

Similar a Definition of takeover (20)

Acquisition,Merger,Take-over and global strategy by Navid Roy

Acquisition,Merger,Take-over and global strategy by Navid Roy

Más de legalcontents

Más de legalcontents (6)

Meaning of Merger, Amalgamation, Acquisition and Merger Types

Meaning of Merger, Amalgamation, Acquisition and Merger Types

Último

Mehran University Newsletter is a Quarterly Publication from Public Relations OfficeMehran University Newsletter Vol-X, Issue-I, 2024

Mehran University Newsletter Vol-X, Issue-I, 2024Mehran University of Engineering & Technology, Jamshoro

https://app.box.com/s/7hlvjxjalkrik7fb082xx3jk7xd7liz3TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...Nguyen Thanh Tu Collection

God is a creative God Gen 1:1. All that He created was “good”, could also be translated “beautiful”. God created man in His own image Gen 1:27. Maths helps us discover the beauty that God has created in His world and, in turn, create beautiful designs to serve and enrich the lives of others.

Explore beautiful and ugly buildings. Mathematics helps us create beautiful d...

Explore beautiful and ugly buildings. Mathematics helps us create beautiful d...christianmathematics

Último (20)

On National Teacher Day, meet the 2024-25 Kenan Fellows

On National Teacher Day, meet the 2024-25 Kenan Fellows

Seal of Good Local Governance (SGLG) 2024Final.pptx

Seal of Good Local Governance (SGLG) 2024Final.pptx

Micro-Scholarship, What it is, How can it help me.pdf

Micro-Scholarship, What it is, How can it help me.pdf

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

ICT Role in 21st Century Education & its Challenges.pptx

ICT Role in 21st Century Education & its Challenges.pptx

Unit-V; Pricing (Pharma Marketing Management).pptx

Unit-V; Pricing (Pharma Marketing Management).pptx

Jual Obat Aborsi Hongkong ( Asli No.1 ) 085657271886 Obat Penggugur Kandungan...

Jual Obat Aborsi Hongkong ( Asli No.1 ) 085657271886 Obat Penggugur Kandungan...

Explore beautiful and ugly buildings. Mathematics helps us create beautiful d...

Explore beautiful and ugly buildings. Mathematics helps us create beautiful d...

Kodo Millet PPT made by Ghanshyam bairwa college of Agriculture kumher bhara...

Kodo Millet PPT made by Ghanshyam bairwa college of Agriculture kumher bhara...

Definition of takeover

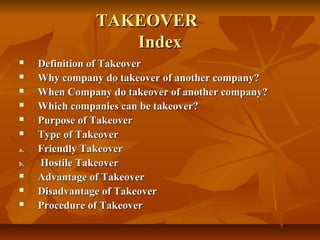

- 1. TAKEOVER Index Definition of Takeover Why company do takeover of another company? When Company do takeover of another company? Which companies can be takeover? Purpose of Takeover Type of Takeover a. Friendly Takeover b. Hostile Takeover Advantage of Takeover Disadvantage of Takeover Procedure of Takeover

- 2. Definition of Takeover A takeover bid is an offer to purchase enough share of a company to overtake the current majority shareholder. Takeover implies acquisition of control of a Company which is already registered through the purchase or exchange of shares. Takeover takes place usually by acquisition or purchase from the shareholders of a company their shares at a specified price to the extent of at least controlling interest in order to gain control of the company.

- 3. Why company do takeover of another company? if the smaller company have proven their profitability for seeking finance to grow their products which have high demand may attract the attention for an acquisition be avenue for larger acquiring companies to grow their company Small companies may become a takeover target if they fill a niche in the market that the bidder operates within.

- 4. When Company do takeover of another company? When company has a good market value and want to become bigger company, then companies try to purchase or included another company to itself company.

- 5. Which companies can be takeover? Any private company having good share and market value can be takeover of small company.

- 6. Purpose of Takeover Takeover mains purpose to make bigger or larger company from a small Company.

- 7. Types of Takeover Friendly Takeover Hostile Takeover

- 8. Friendly Takeover When a bidding company attempts to buy the majority shares without informing the board of directors first, this is considered a hostile takeover.

- 9. Hostile Takeover When the board rejects the friendly takeover offer, the bidder may choose to continue pursuing shareholders without the input of the board of directors.

- 10. Advantage of Takeover To Increased sales and revenue, increased market share and economies of scale.

- 11. Disadvantage of Takeover Job cuts as a result of a takeover is a disadvantage to the employee and reduced competition and choice for consumers.

- 12. Procedure of Takeover A company may acquire the shares of a unlisted company through what is called acquisition under Section 395 of the Companies Act, 1956. where the shares of the company are widely held by the general public, it involves the process as set out in the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 1997, as amended in 2002, 2004 and 2006. The term ‘Takeover’ has not been defined under SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 1997.

- 13. Thank You