Vistage Member Companies Outperform D&B

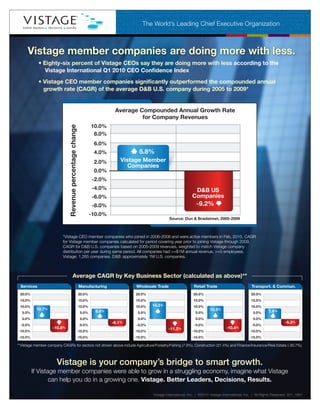

- 1. CONNECTIONS.STRENGTH.ADVISE.LEARN.COLLABORATE.ADVISORS.EXECUTIVE.COMMUNITY.CARING.INSPIRE.CONNECT.LEADE RS.FOCUS.TRUST.DECISIONS.RESULTS.COACHING.STRATEGY.GROWTH.SUPPORT.SUCCESS.NETWORK.CHALLENGE.EXPERTISE. VISIONARY.LEADERSHIP.GROWTH.JOIN.LEAD.EDUCATE.CONNECTIONS.STRENGTH.ADVISE.LEARN.COLLABORATE.ADVISORS.EXE CUTIVE.COMMUNITY.CARING.INSPIRE.CONNECT.LEADERS.FOCUS.TRUST.DECISIONS.RESULTS.COACHING.STRATEGY.GROWTH.S The World’s Leading Chief Executive Organization UPPORT.SUCCESS.NETWORK.CHALLENGE.EXPERTISE.VISIONARY.LEADERSHIP.GROWTH.JOIN.LEAD.EDUCATE.CONNECTIONS.ST RENGTH.ADVISE.LEARN.COLLABORATE.ADVISORS.EXECUTIVE.COMMUNITY.CARING.INSPIRE.CONNECT.LEADERS.FOCUS.TRUST. DECISIONS.RESULTS.KNOWLEDGE.COACHING.STRATEGY.GROWTH.SUPPORT.SUCCESS.NETWORK.CHALLENGE.EXPERTISE.VISI ONARY.LEADERSHIP.GROWTH.JOIN.LEAD.EDUCATE.CONNECTIONS.STRENGTH.ADVISE.LEARN.COLLABORATE.ADVISORS.EXECU Vistage member companies are doing more with less. • Eighty-six percent of Vistage CEOs say they are doing more with less according to the Vistage International Q1 2010 CEO Confidence Index • Vistage CEO member companies significantly outperformed the compounded annual growth rate (CAGR) of the average D&B U.S. company during 2005 to 2009* Average Compounded Annual Growth Rate for Company Revenues 10.0% Revenue percentage change 8.0% 6.0% 4.0% 5.8% 2.0% Vistage Member Companies 0.0% -2.0% -4.0% D&B US -6.0% Companies -8.0% -9.2% -10.0% Source: Dun & Bradstreet, 2005-2009 *Vistage CEO member companies who joined in 2006-2008 and were active members in Feb, 2010. CAGR for Vistage member companies calculated for period covering year prior to joining Vistage through 2009. CAGR for D&B U.S. companies based on 2005-2009 revenues, weighted to match Vistage company distribution per year during same period. All companies had >=$1M annual revenue, >=5 employees. Vistage: 1,265 companies. D&B: approximately 1M U.S. companies. Average CAGR by Key Business Sector (calculated as above)** Services Manufacturing Wholesale Trade Retail Trade Transport. & Commun. 20.0% 20.0% 20.0% 20.0% 20.0% 15.0% 15.0% 15.0% 15.0% 15.0% 10.0% 10.0% 10.0% 14.5% 10.0% 10.0% 10.7% 10.3% 5.0% 5.0% 8.8% 5.0% 5.0% 5.0% 7.8% 0.0% 0.0% 0.0% 0.0% 0.0% -6.1% -5.3% -5.0% -5.0% -5.0% -5.0% -5.0% -10.8% -11.2% -10.4% -10.0% -10.0% -10.0% -10.0% -10.0% -15.0% -15.0% -15.0% -15.0% -15.0% **Vistage member company CAGRs for sectors not shown above include Agriculture/Forestry/Fishing (7.9%), Construction (21.4%) and Finance/Insurance/Real Estate (-30.7%). Vistage is your company’s bridge to smart growth. If Vistage member companies were able to grow in a struggling economy, imagine what Vistage can help you do in a growing one. Vistage. Better Leaders, Decisions, Results. Vistage International, Inc. | ©2010 Vistage International, Inc. | All Rights Reserved. 221_1667