Withholding tax response 2011

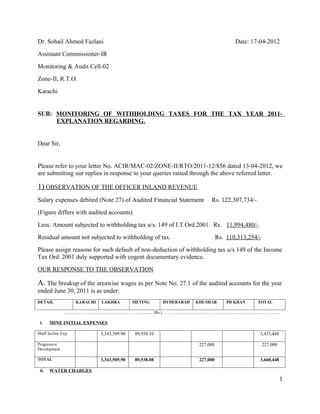

- 1. Dr. Sohail Ahmed Fazlani Date: 17-04-2012 Assistant Commissioner-IR Monitoring & Audit Cell-02 Zone-II, R.T.O. Karachi SUB: MONITORING OF WITHHOLDING TAXES FOR THE TAX YEAR 2011- EXPLANATION REGARDING. Dear Sir, Please refer to your letter No. ACIR/MAC-02/ZONE-II/RTO/2011-12/856 dated 13-04-2012, we are submitting our replies in response to your queries raised through the above referred letter. 1) OBSERVATION OF THE OFFICER INLAND REVENUE Salary expenses debited (Note 27) of Audited Financial Statement Rs. 122,307,734/- (Figure differs with audited accounts) Less: Amount subjected to withholding tax u/s. 149 of I.T.Ord.2001. Rs. 11,994,480/- Residual amount not subjected to withholding of tax. Rs. 110,313,254/- Please assign reasons for such default of non-deduction of withholding tax u/s.149 of the Income Tax Ord. 2001 duly supported with cogent documentary evidence. OUR RESPONSE TO THE OBSERVATION A. The breakup of the areawise wages as per Note No. 27.1 of the audited accounts for the year ended June 30, 2011 is as under: DETAIL KARACHI LAKHRA METING HYDERABAD KHUSHAB PD KHAN TOTAL ………………………………………………………. (Rs.) ………………………………………………………………………… i. MINE INITIAL EXPENSES Shaft Incline Exp. 3,343,509.90 89,938.10 3,433,448 Progressive 227,000 227,000 Development TOTAL 3,343,509.90 89,938.08 227,000 3,660,448 ii. WATER CHARGES 1

- 2. Water Charges 9,280 1,600,093 22,700 11,685 235,836.92 1,879,594.92 Water Charges 162,447.50 162,447.50 Katha Water Charges 486,227.58 486,227.58 Kalyal TOTAL 9,280 1,600,093 22,700 11,685 883,311.60 2,528,270 iii. MINE CONTROLLER Mine Sardar 1,539,445 129,400 688,433 115,980 2,473,258 Chowkidar Salary 2,073,268 118,000 183,677 20,250 2,395,195 Time Keeper 455,400 326,367 781,767 Weighmen Salary 1,200 1,200 TOTAL 4,068,112.98 247,400 183,677 1,016,000 136,230 5,651,420 iv. WAGES COAL CUTTING Wages Coal Cutter 26,636,814.18 148,842 18 7,348,746 119,275.50 34,253,695.68 Mate Commission 4,668,831.95 18,540 596,500 12,857.50 5,296,729.45 Summer Seam 925,656,87 4,238,682 5,164,338.87 TOTAL 32,231,302,92 167,382 18 12,183,928 132,133 44,714,764 v. WAGES DRIVAGE & CROSS CUTTING Wages Drivage 9,355,696 172,520 6,876,326 142,825 16,547,367 Debris Charges 1,639,947 1,639,947 TOTAL 9,355,695.82 172,520 8,516,273 142,825 18,187,314 vi. MINE LIGHTING Wages Safety Lamp 301,380 301,380 Over Time 75,564 457,749 51,050 64,995 387,572 1,036,930 TOTAL 75,564 457,749 51,050 64,995 688,951 1,338,310 vii. BONUS & EXGRATIA Bouns 586,973 7,454,964 11,860 110,996 746,858 50,759 8,962,410 Gtatuity 227,125 1,410,950 4,200 231,901 29,250 1,903,426 TOTAL 814,098 8,865,913.51 11,860 115,196 978,759 80,009 10,865,836 2

- 3. GRAND TOTAL 898,942 58,996,721.0 762,850.10 375,571 24,495,423 491,197 86,946,362 3 (i to vii) B. The breakup of the areawise wages as per Note No. 27.2 of the audited accounts for the year ended June 30, 2011 is as under: DETAIL KARACHI LAKHRA METING HYDERABAD KHUSHAB PD KHAN TOTAL ………………………………………………………. (Rs.) ………………………………………………………………………… i. WAGES, SALARIES & TRANSPORTATION CHARGES Coal Transportation 927,255 66,580 993,835 Loss Of Live Stock Salaries For 685,432 15,642 65,356 435,670 1,202,100 Transportation TOTAL 685,432 15,642 65,356 1,362,925 66,580 2,195,935 ii. WAGES FOR TRANSPORTATION Wages Repair & 159,446.69 1,586,686 1,746,132.69 Maint. Vehicle Wages Rope Way 231,121 231,121 Wages Power 350,670 350,670 House Wages Haulage 2,245,419.70 13,100 1,251,169 3,509,688.70 Wages Repair & 305,858 11,672 839,533.61 441,109 1,598,172.61 Maint. Wages 4,249,184 3,200 4,252,384 TOTAL 2,710,724.09 24,772 8,508,363.61 444,309 11,688,169 iii. STORE CONSUMED Store Consumed 1,432,405.8 7,272,992 198,192.23 418,924 3,475,850.32 224,405 13,022,769.43 Vehicle 8 3

- 4. Store Consumed Rope Way Store Consumed 98,802.05 98,802.05 Power House Store Consumed 24,827 55,739.18 80,566.18 Work Shop Store Consumed 2,306,910.95 80,946.92 3,291,159.06 5,679,016.93 Haulage Store Consumed 166,292 3,581.70 298,722.71 3,996 472,592.41 Misc. TOTAL 1,432,405.8 9,771,021.95 282,720.85 418,924 7,220,273.03 228,401 19,353,747 8 GRAND TOTAL 1,432,405.8 13,167,178.3 323,134.85 484,280 17,091,561.93 739,290 33,237,851 8 4 (i to iii) C. The breakup of the area wise expenses of wages as per Note No. 27.3 of the audited accounts for the year ended June 30, 2011 is as under: DETAIL KARACHI LAKHRA METING HYDERABAD KHUSHAB PD KHAN TOTAL ………………………………………………………. (Rs.) ………………………………………………………………………… i. WAGES REPAIR & MAINTENANCE Wages Repair & 244,026 2,573,139.10 40,564 6,378,355.17 9,236,084.27 Maint. R & M Wages Repair & 5,113,976.13 30,720 3,778,912 248,664 9,172,272.13 Maint. Mine Wages Repair & 111,124 288,593 41,157 440,874 Maint. Building Wages Repair & 10,410 10,410 Maint. Roads Wages Repair & 1,287,445.60 1,200 682,473 1,971,118.60 Maint. Misc. TOTAL 244,026 9,096,094.83 31,920 40,564 11,128,333.17 289,821 20,830,759 ii. STORE CONSUMED Air Compressor 29,607.76 29,607.76 4

- 5. Air Compressor Oil Air Compressor 11,550 11,550 Khb Store Consumed 401,095.62 401,095.62 Lighting & Building Store Consumed 109,355 25,683.17 54,037.45 35,467 224,542.62 Building Store Consumed 643,750 643,750 Roads TOTAL 109,355 55,290.93 1,110,433.07 35,467 1,310,546 GRAND TOTAL 353,381 9,151,385.7 31,920 40,564 12,238,766.24 325,288 22,141,305 6 (i to ii) D. The breakup of the salaries, house rent allowance, provident fund, EOBI, medical allowance, staff welfare, compensation, bonus, gratuity as per Note No. 28.1of the audited accounts for the year ended June 30, 2011 is as under: SALARIES AND OTHER BENEFITS Amount (Rs.) Salaries 14,830,092 House Rent 2,348,986 Allowance Other Allowances 3,456,625 Provident Fund 1,489,297 E.O.B.I 2,109,074 Medical Allowance 1,410,172 Staff Welfare 3,354,624 Compensation 387,364 Gratuity TOTAL 29,386,234 EXPLANATORY NOTES 5

- 6. Our Company is engaged in business of extraction of coal from LAKHRA (SINDH), METING (SINDH), KHUSHAB (PUNJAB) AND P.D.KHAN (PUNJAB). Coal mining operations are purely based on manual work. We have 550 workers in Lakhra Mines, 290 workers in Khushab Mines, 17 workers in Meting Mines and 20 workers at P.D Khan Mines. To extract the coal these workers include coal cutters, katcha workers, mine repair & maintenance workers, mine sardars, chowkidar, haulage drivers etc. Payments to these workers are made from time to time, which remains below taxable limit in each case, as far as their monthly and annual wages are concerned. Therefore, being below taxable limit, no withholding tax is deducted from their payments, because section 149 combined with clause 1A of First Schedule of Income Tax Ordinance, 2001 mentions that no withholding tax will be deducted if the taxable income on account of salaries or wages does not exceed Rs. 300,000 per annum. As the coal is extracted from mines with the help of manual labor, therefore, the main proportion of the overall expenditure comprises of wages payments in the form of coal cutting wages of coal cutters, wages katcha work, wages of repair and maintenance of mines, wages of repair and maintenance of roads and building, salaries of staff relating to mines, wages of vehicles staff and workshop etc. Normally 65% to 70% of the total expenses of any coal extraction area, comprises of wages of labor, whose annual wages do not exceed taxable limit and therefore, there is no question of any withholding tax u/s.149. All the payments on account of wages made to the workers are supported by salary registers and wages sheets signed by them. Complete detail of wages paid to coal cutters, daily wage rate workers, katcha workers of Lakhra and Khushab areas are available in our coal mining areas. CNIC No’s of workers whether monthly rated, daily rated or piece work employed are also available in our record. The no. of workers, employees working in the coal mining areas are around eight hundred seventy seven. Further it may be noted that: - Medical allowance as per clause (139) of Second Schedule of the Income Tax Ordinance, 2001 is exempt from payment of withholding tax. Therefore, no withholding tax was deducted from payment of medical allowance to the employees. - No withholding tax was deducted from payment of gratuity to the employees in accordance with sub clause iv of clause 13 of Second Schedule, which states that no withholding tax to be deducted on the payment of gratuity which is 50% of the amount receivable or Rs.75,000 whichever is less. - Staff welfare / Compensation expenses of workers and contribution to recognized Provident Fund and EOBI also do not come within the deduction of withholding tax from these payments. - Bonus and House rent allowance was included in the salary while deducting withholding tax from the employees. 6

- 7. i. Directors’ remuneration amounting to Rs.5,974,838 was subjected to withholding tax duly deducted from the payment of salaries to working directors and deposited as per income tax challans attached herewith. ii. The bonus amounting to Rs.8,962,410 paid to workers does not fall within the preview of deduction of withholding tax because the payment of wages including bonus per individual worker remained below taxable limit of Rs.300, 000. iii. The gratuity amounting to Rs.1,903,426 was paid to workers. No withholding tax was deducted from these payments because payment to each worker was within the exemption limit under clause (13) sub clause (iv) of Part-I of the Second Schedule to the Income Tax Ordinance, 2001. iv. Accordingly, a sum of Rs.1,545,475 was deducted as withholding tax from the payments of salaries of Rs.11,994,480 to the employees. The remaining amount of salaries was below taxable limit i.e. Rs. 300,000/- per annum per employee and therefore, no withholding tax u/s.149 was required to be made. v. Salaries of all the Senior and Junior employees of all six areas are verifiable from the salary register, salary sheets, accounts books etc and wherever withholding tax u/s.149 was applicable, has not only been deducted but has also been deposited as per the challans / evidences submitted and also disclosed in the annual statement filed u/s.165 / 149 of Income Tax Ordinance, 2001. vi. As for as salaries and other benefits under Note No. 27.1 are concerned, an amount of Rs.1,545,475 was deducted as withholding tax from salaries payments of Rs.11,994,480. Whereas withholding tax was not deducted from the remaining payments of salaries due to being below able taxable limit of Rs.300,000. Withholding Tax was deducted from all those senior and junior employees who came in the ambit of deduction of withholding tax on account of payment of salaries and other benefits. It may be noted that company has already filed with you all the relevant annual statements of withholding tax, inter-alia including salary; commission; rent; supplies; contracts; services, etc. alongwith evidences of tax deduction and deposit into Government account. Further, as desired, even audited financial statements for year ended 30.06.2011 corresponding to Tax Year 2011 have been filed with you. From audited financial statements, you have picked up figures of various heads of expenses under profit and loss account, on which 100% en-block withholding tax is required by you. You have not considered whether withholding tax provisions are attracted or not in certain cases and/or exemption of recipients and/or payments within the threshold of exemption limit of 7

- 8. withholding tax on payments to individual parties, salaries / wages, other expenses etc., and has thrown full burden of reconciliation of same on the company. It may be noted that such burden on the company for reconciling each and every head of profit and loss account to prove, on which amount withholding tax was deductible and accordingly, deducted and the balance amount was not attracting provisions of withholding tax, is extraordinary burden which otherwise can be verifiable from books of accounts / ledgers and vouchers produced. The learned Appellate Tribunal has in number of cases held that the collection of tax is basically function of the Revenue Officer and not that of deducting authorities who have been made responsible to deduct tax as Government agents under the law and therefore, revenue officer must proceed very judicially before penalizing the assessee. In yet another case, ITAT has observed that the provisions of S.50 read with S.52 and other related sections such as S.139, S.140 and S.142 of Income Tax Ordinance, 1979 are harsh and extraordinary burden on taxpayers, who are providing services without a charge. As such invoking S.52 by treating assessee-in-default seems more an effort of making immediate recovery than to create a legal and just charge is not justified as a routine order. 2) OBSERVATION OF THE OFFICER INLAND REVENUE Following “Administrative Expenses” enumerated in Note 28 of the financial statements, were liable to deduction of withholding tax. A tentative picture of rate applicable and deductible amount for each head of expenditure is depicted as under: Sr. Description of Expenses Amount Claimed Tentative Rate Tentative Amount No. Applicable of Tax Deductible 1 Travelling & Conveyance 2,018,391 6% 121,103 2 Repair & Maintenance 22,439,869 6% 1,346,392 (Figure differs with audited accounts) 3 Stationery/ Office Supplies 526,264 3.5% 18,419 4 Advertisement 63,900 6% 3,834 5 Professional Charges 1,110,400 6% 66,624 6 Others. 5,030,892 6% 301,853 (Figure differs with audited accounts) 7 Rent/Rates/Taxes 1,180,300 As per Sch. 80,030 8 Mark-up Interest. 898,760 6% 53,926 9 Profit On Debts. 537,486 6% 32,249 10 Other Expenses 33,249,236 6% 1,994,954 8

- 9. (Figure differs with audited accounts) Total 4,019,384 Sr. Description Initial Allowances and Addition Rate Taxable Amount No. Amortization (Purchases Assets) 1 Building (all types) 1,719,621 3.5% 60,187 2 Motor Vehicle 235,000 3.5% 8,225 3 Machinery and plant ( not otherwise 246,257 3.5% 8,619 specified) 4 Computer hardware including printer 163,300 3.5% 5,715 and allied items. Total 82,746 You are advised to justify for short deduction of tax together with complete details of payments and amount of tax deduction under each head of expenditure separately duly substantiated with copy of paid challans/ CPR in original. OUR RESPONSE TO THE OBSERVATION A. TIMBER & GENERAL STORES Areawise timber consumed in the coal mines during the year ended June 30, 2011 is as under: Amount (Rs.) Lakhra 8,995,054 Meting 210,117 Khushab 4,225,785 P D Khan 64,349 TOTAL 13,495,305 Timber is purchased from forest department and growers of the timber whose income is basically exempt from income tax because timber is a agricultural produce and its income is exempt from income tax. Therefore, no withholding tax was deducted from payments to the timber growers. We refer SRO 586 (1) 91 dated 30/06/1991 (Serial No. V). According to this circular, no withholding tax should be deduced while making payments to those who produce timber. B. GENERAL STORE CONSUMED 9

- 10. The areawise consumption of the stores consumed, parts consumed and machinery accessories and tools consumed etc. in our mines of various areas are as under. Amount (Rs.) Lakhra 4,867,493 Meting 84,186 Khushab 1,702,576 TOTAL 6,654,255 Taxpayer Company is engaged in operation of coal extraction in Lakhra, Meting, Khushab and Pind Dadan Khan. Where stores are consumed in abundance in the mines, haulage engines installed at the mouth of the mines, rail lines, roads, buildings, vehicles, wire ropes, diesel generators, mining lamps, mining machinery etc. As the coal mines are located in the far off hilly area, therefore, wear and tear, oil and lubrication, breakage, depreciation of mining machinery and coal transportation is on very high side as regards expenses. It may be noted that the above stores consumed includes 60% to 70% diesel / oil purchased for vehicles and for generators, because in coal mining business of extraction of coals, in absence of electricity connection, full time generators are used where diesel is an essential requirement. Similarly, for transportation of coal, diesel is used in vehicles and no tax deduction is to be made from payments of petroleum products, including diesel and oil, as they are exempt from withholding tax. Further, withholding tax was duly deducted and deposited from those suppliers who supplied goods of value above Rs. 25,000/- per annum. No withholding tax was deducted from those parties who supplied goods below Rs. 25,000/- per annum, as per SRO 586(1)/91 dated 30-06- 1991 and SRO 826(1) / 91 dated 24-08-1991 (clause xii). The imported goods supplied in same condition by M/s Cummins Sales and Services Pakistan and M/s Cables and Conductors did not come under withholding tax because they imported the items on which tax has already been paid by them at source u/s.148 and therefore, they are exempt from second time withholding tax u/s.153. Withholding tax of Rs.549,473/- was deducted from payment aggregating to Rs. 8,036,013/- on account of purchases of goods under this head, the remaining amount did not attract withholding tax because each party as it remained below taxable limit. The amount on which withholding tax was not deducted belongs to those suppliers/shopkeepers from whom items of store are purchased on day to day basis in cash in very small amounts. The number of these suppliers /shopkeepers is in hundreds, supported by their bills, cash memos, invoices etc. C. FREIGHT & CARRIAGE The areawise payments of the freight & carriage are as under: Amount (Rs.) Karachi 5,420 10

- 11. Lakhra 877,866 Meting 112,023 Hyderabad 492 Khushab 440,008 P D Khan 16,440 TOTAL 1,452,249 Section 153(1) (b) mentions that withholding tax @ 2% (transportation services) will be deducted from each party. However, if total services per annum of each individual party is below Rs. 10,000/- per annum, then no deduction is required. Further, it may be noted that Freight and carriage expenses of all areas comprises of very small amount say Rs.2,000/-, Rs.5,000 and Rs. 6,000 etc. However, withholding tax was duly deducted from all those payments following in the taxable limit for purpose of withholding tax. We are enclosing challans of withholding tax during the year ended June 30, 2011. D. REPAIR & MAINTENANCE The areawise expenditures of repair & maintenance of office equipments and furniture are as under: Amount (Rs.) Lahore 61,020 Lakhra 9,400 Hyderabad 2,850 Khushab 22,922 TOTAL 96,192 These expenses were incurred on the repair & maintenance of office equipments and office furniture. Those expenditures are incurred on day to day basis in small amounts. No withholding tax was deducted from the payments of bills of repair & maintenance which individually and separately do not cross the taxable limit of Rs.10,000 per annum. E. LEGAL & PROFESSIONAL AND AUDIT FEE i. A sum of Rs.65,000 was paid to auditors of the company M/S Daudally Lalani & Co. for conducting the audit of our company for the year ended June 30, 2011. Withholding tax of 6% on payment made to them was deducted and deposited into the Govt. treasury. Photocopy of the payment receipt is enclosed herewith. 11

- 12. ii. An amount of Rs.933,000 was paid to the legal consul of the company viz ABS & Company Advocates, Akram Associates and Qazi Mohammad Aslam Advocate, Khushab for contesting the legal cases of the company. We deducted withholding tax of 6% on payment made to them was deducted and deposited into the Govt. treasury. The payments receipts of withholding tax are being enclosed with this letter. An amount of Rs.33,900 was paid on account of purchasing legal documents and court expenses in small amounts. So, withholding tax was not deducted on these amounts due to being small amounts. iii. A sum of Rs.52,000 was paid to legal consultant of the Company Chaudhary Umar Hayat, Advocate for contesting he legal cases of the company. We duly deducted withholding tax at the rate of 6% on payments which was deposited into Govt. treasury. iv. We paid a sum of Rs.21,500 as professional fee in the account of the Excise & Taxation Office, Govt. of Sindh. This amount was Govt. levy. No withholding tax was deducted on this amount because payment of Govt. dues does not attract provisions of withholding tax. v. We paid an amount of Rs.45,000 to M/S Akber G Merchant & Co. Chartered Accountants as income tax consultancy fee. Withholding tax of 6% on payment made to them was deducted and deposited into the Govt. A/c. vi. Our company deducted withholding tax from all payments of legal and professional charges which were above taxable limit of Rs.10,000 per individual per annum. So withholding tax was duly deducted in the light of SRO 586 (1) 91 dated 30/06/1991 and SRO 826 (1) 91 dated 24/08/1991 (clause XII). We are producing herewith extract of books of accounts comprising of all the cash books, ledgers, salary registers, original vouchers / evidences and wages sheets / register, etc. for your verification in support of our all above contentions and then return to us. We hope that above explanation will suffice your purpose of monitoring of withholding tax and in case, you desire any further document / evidence / explanation, please let us know. NOTE: Our company has paid Rs.39,950,434 (Rs.35,352,530: 30/06/2010) to Govt. Exchequer in the form of Sales Tax and Central Excise Duty. This payment can be verified from the audited accounts for the year ended June 30, 2011 and FBR Web Portal. Thanking you. 12

- 13. Yours faithfully MOHAMMAD AZAM CHIEF ACCOUTANT MOHAMAD AMIN BROS. (PVT) LTD. ATTACHMENTS 1. Annual Statement of Deduction of Income Tax from Salary under Rule 44(1). 2. Annual Statement of Collection or Deduction of Income Tax under Section 165 (2). 3. Copies of exemption certificates issued during the year ended 30/06/2011. 4. Photocopies of withholding tax challans deducted from those deriving salaries / wages above the taxable limit for the year ended 30/06/2011. 13

- 14. 5. Photocopies of tax challans deducted from supplies, services, commission, rent paid for the year ended 30/06/2011 are enclosed. 6. Wages / salaries payment sheets of our main coal extraction areas viz Lakhra and Khushab for the months of December 2010 and June 2011 are enclosed to support our above mentioned replies. 14