4 Reasons your Definition of Open Banking is Too Narrow

•

1 recomendación•890 vistas

4 Reasons your Definition of Open Banking is Too Narrow

Denunciar

Compartir

Denunciar

Compartir

Descargar para leer sin conexión

Recomendados

Recomendados

Más contenido relacionado

Más de PaymentComponents

Más de PaymentComponents (7)

5 Sucess Factors when Implementing a Treasury Management System (TMS)

5 Sucess Factors when Implementing a Treasury Management System (TMS)

How APIs & emerging global standards create opportunities for software develo...

How APIs & emerging global standards create opportunities for software develo...

Último

Último (20)

QATAR Pills for Abortion -+971*55*85*39*980-in Dubai. Abu Dhabi.

QATAR Pills for Abortion -+971*55*85*39*980-in Dubai. Abu Dhabi.

logistics industry development power point ppt.pdf

logistics industry development power point ppt.pdf

Famous Kala Jadu, Black magic expert in Faisalabad and Kala ilam specialist i...

Famous Kala Jadu, Black magic expert in Faisalabad and Kala ilam specialist i...

Bhubaneswar🌹Ravi Tailkes ❤CALL GIRLS 9777949614 💟 CALL GIRLS IN bhubaneswar ...

Bhubaneswar🌹Ravi Tailkes ❤CALL GIRLS 9777949614 💟 CALL GIRLS IN bhubaneswar ...

Significant AI Trends for the Financial Industry in 2024 and How to Utilize Them

Significant AI Trends for the Financial Industry in 2024 and How to Utilize Them

Black magic specialist in Canada (Kala ilam specialist in UK) Bangali Amil ba...

Black magic specialist in Canada (Kala ilam specialist in UK) Bangali Amil ba...

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

In Sharjah ௵(+971)558539980 *_௵abortion pills now available.

In Sharjah ௵(+971)558539980 *_௵abortion pills now available.

+97470301568>>buy weed in qatar,buy thc oil in qatar doha>>buy cannabis oil i...

+97470301568>>buy weed in qatar,buy thc oil in qatar doha>>buy cannabis oil i...

Collecting banker, Capacity of collecting Banker, conditions under section 13...

Collecting banker, Capacity of collecting Banker, conditions under section 13...

Explore Dual Citizenship in Africa | Citizenship Benefits & Requirements

Explore Dual Citizenship in Africa | Citizenship Benefits & Requirements

Dubai Call Girls Deira O525547819 Dubai Call Girls Bur Dubai Multiple

Dubai Call Girls Deira O525547819 Dubai Call Girls Bur Dubai Multiple

Famous Kala Jadu, Kala ilam specialist in USA and Bangali Amil baba in Saudi ...

Famous Kala Jadu, Kala ilam specialist in USA and Bangali Amil baba in Saudi ...

Famous No1 Amil Baba Love marriage Astrologer Specialist Expert In Pakistan a...

Famous No1 Amil Baba Love marriage Astrologer Specialist Expert In Pakistan a...

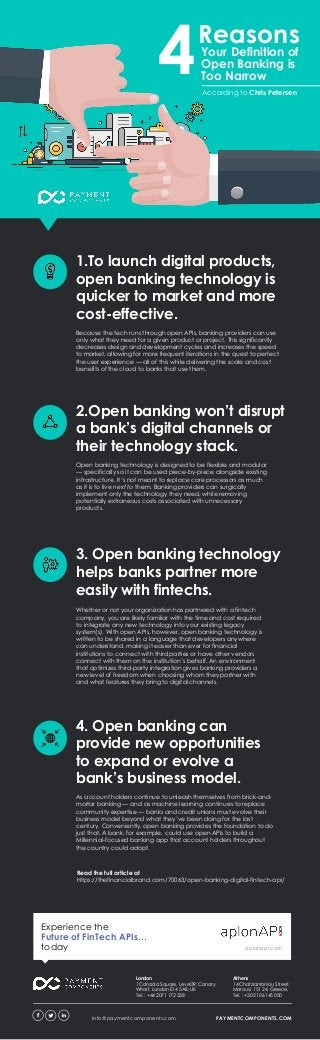

4 Reasons your Definition of Open Banking is Too Narrow

- 1. 1.To launch digital products, open banking technology is quicker to market and more cost-effective. Your Definition of Open Banking is Too Narrow Because the tech runs through open APIs, banking providers can use only what they need for a given product or project. This significantly decreases design and development cycles and increases the speed to market, allowing for more frequent iterations in the quest to perfect the user experience — all of this while delivering the scale and cost benefits of the cloud to banks that use them. 2.Open banking won’t disrupt a bank’s digital channels or their technology stack. Open banking technology is designed to be flexible and modular — specifically so it can be used piece-by-piece alongside existing infrastructure. It’s not meant to replace core processors as much as it is to live next to them. Banking providers can surgically implement only the technology they need, while removing potentially extraneous costs associated with unnecessary products. 3. Open banking technology helps banks partner more easily with fintechs. Whether or not your organization has partnered with a fintech company, you are likely familiar with the time and cost required to integrate any new technology into your existing legacy system(s). With open APIs, however, open banking technology is written to be shared in a language that developers anywhere can understand, making it easier than ever for financial institutions to connect with third parties or have other vendors connect with them on the institution’s behalf. An environment that optimizes third-party integration gives banking providers a new level of freedom when choosing whom they partner with and what features they bring to digital channels. 4. Open banking can provide new opportunities to expand or evolve a bank’s business model. As account holders continue to unleash themselves from brick-and- mortar banking — and as machine learning continues to replace community expertise — banks and credit unions must evolve their business model beyond what they’ve been doing for the last century. Conveniently, open banking provides the foundation to do just that. A bank, for example, could use open APIs to build a Millennial-focused banking app that account holders throughout the country could adopt. Experience the Future of FinTech APIs… today WWW.PAYMENTCOMPONENTS.COM London 1 Canada Square, Level39, Canary Wharf, London E14 5AB, UK Tel. : +44 2071 172 538 Athens 14 Chatziantoniou Street, Marousi, 151 24, Greece, Tel. : +30 210 6145 050 info@paymentcomponents.com 4 aplonapi.com Reasons According to Chris Petersen Read the full article at https://thefinancialbrand.com/70063/open-banking-digital-fintech-api/