Banking banker customer_nomination_etc

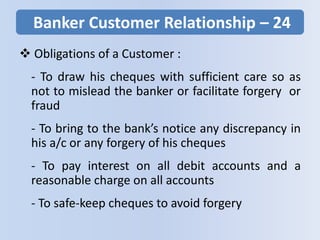

- 1. Banker Customer Relationship – 24 Obligations of a Customer : - To draw his cheques with sufficient care so as not to mislead the banker or facilitate forgery or fraud - To bring to the bank’s notice any discrepancy in his a/c or any forgery of his cheques - To pay interest on all debit accounts and a reasonable charge on all accounts - To safe-keep cheques to avoid forgery

- 2. Banker Customer Relationship Rights of a Customer : - A customer has the right on the bank to honour his cheques provided there are sufficient funds in the account and duly applicable for payment of such cheques and cheques are in order - In case the bank wrongfully dishonours a cheque, customer has right to get compensated for the damage such a dishonour would cause to his reputation

- 3. Banker Customer Relationship – 26 • Termination of Banker Customer Relationship - Voluntary Termination by either party - Termination by law (Death, Insolvency, Lunancy, Garnishee/Court Attachment Order and Income Tax/ Sales Tax Attachment Order)

- 4. Banker Customer Relationship – 27 • Operations in the Deposit Accounts: - Specimen Signature - Operation of the a/c by the a/c holder(s) - Operation of the a/c by authorised agent (Mandate or Power of Attorney) - Pay-in-Slip Book/Challan - Cheque Book - Pass Book/Statement of Account (Paper based or E- Statement)

- 5. Banker Customer Relationship – 28 • Operations in the Deposit Accounts: - New Account/Caution: Operations in a newly opened a/c should be watched/monitored closely with much care and caution for at least 6 months or such other longer period as the branch management feels in order to avoid any fraudulent or undesirable transactions as such accounts are more fraud prone.. The Cheque book should be branded as new A/c also. - Dormant Account: If there are no operation continuously for a period of 12 months in an SB a/c or 6 months in a CA, the a/c will be branded as Dormant and subsequent transactions in such accounts will be allowed with care by a senior official/ txns. to be monitored/watched carefully in order to avoid any frauds as such accounts are more fraud prone.

- 6. Banker Customer Relationship – 29 • Operations in the Deposit Accounts: - Inoperative Account: If there are no operation continuously for a period of 2 years in any SB/CA a/c (including the dormant period), the a/c will be branded as Inoperative and subsequent transactions in such accounts will be allowed with due care by a senior official/ txns. to be monitored/watched carefully in order to avoid any frauds as such accounts are more fraud prone. - Transfer to Unclaimed Balances A/C at Bank’s HO: An account remaining in Inoperative Status for more than 5 years (i.e. total no operation in the a/c for 7 years) should be transferred to Unclaimed Balances A/C at Bank’s HO.

- 7. Banker Customer Relationship – 28 • Different Types of Customers - Individuals (Single or Joint) - Minors/Illiterate Persons/Blind Persons - HUF - Club, Association, Society, Trust - Proprietorship Firm - Partnership Firm - Company - Local Authority/Body - NRI

- 8. Banker Customer Relationship – 29 • Operational Instructions in Joint Accounts/Accounts of Firms & Companies : - Either or Survivor (E or S) with 2 a/c holders - Anyone or Survivor(s) with > 2 a/c holders - Joint Operation - Former or Survivor(s) - Latter or Survivor(s) - Specific mandate/authority for accounts of Firms, Companies and other representative accounts

- 9. Banker Customer Relationship – 30 • Deposit Insurance by DICGC : - Banks Covered : Deposits of all Commercial Banks, RRBs, Co-operative Banks (Urban, State & District Central) are insured u/r this scheme by Deposit Insurance & Credit Guarantee Corporation. It is compulsory and no bank can opt out of it. - Maximum Cover : Rs. 1 lakh per depositor (in the same status and right) per bank - Deposit Insurance Premium (current rate is 10 paise per Rs.100 of assessable deposit p.a.) to be borne entirely by the insured bank

- 10. Banker Customer Relationship – 31 • Type of Deposit Accounts : - Transaction Deposit Accounts/Chequable Accounts/Demand Deposits (Current Deposit Accounts and Savings Bank Accounts) - Term/Time Deposit Accounts : 1. Fixed Deposit Accounts (FD) : (a) Cumulative/ Reinvestment Deposits where interest is reinvested with the principal and (b) Non- cumulative deposits providing periodical interest

- 11. Banker Customer Relationship – 31 2. Recurring Deposit Accounts (RD) : (a) A fixed Monthly deposit for a chosen period/no. of months (b) A Variable RD A/C - A core monthly deposit with flexibility to increase the monthly deposit - Hybrid Deposits/Flexi Deposits/Sweep in Deposits/Unitised Deposits - Certificate of Deposits (Negotiable Term Deposits)

- 12. Banker Customer Relationship – 32 • Deposit Accounts/General Norms : - Minimum Balance Requirements : Varies from Bank to Bank and also type/class of accounts offering differing level of value added services. Regular Minimum Bal. or Average Quarterly Bal. (AQB). Charges for non-maintenance of Minimum Bal. - Differing level of value added services (Free ATM/Debit Card, Free Credit Card, Free Remittance facility (DD/BC/NEFT/RTGS) up to a specified limit p.m., Free Cheque Collection facility up to a certain limit p.m., Free internet and Mobile Phone Banking etc.)

- 13. Banker Customer Relationship – 33 • Deposit Accounts/General Norms (contd.. ) : - Minimum & Maximum Period for a Term Deposits : - RD (6 months & 120 months (10 years)) - FD (Minimum : 15 days for any amount, but 7 days for an amount = or > a cut-off amount which varies from bank to bank and maximum 10 years) - For Deposits in the name of minors maximum period can be > 10 years till he becomes major and for deposits made @ court direction maximum period can be > 10 years

- 14. Banker Customer Relationship – 34 • Deposit Accounts/General Norms (contd.. ) : - Interest rates on SB/CA : Deregulated by RBI since November 2011. Banks are to fix their SB Interest. CA : No interest, SB interest is calculated on the daily balance. - Interest rates on Term Deposits : Interest rate is totally deregulated, banks are free to decide their deposit rates as approved by bank’s board or Asset Liability Committee (ALCO) which should be uniform for all depositors except for high value/bulk deposits of Rs.15 lakh and above from individuals/firms/Corporates where banks have discretion to offer/quote different rates (normally higher rates) from the normal/card rates - Fixed (Interest) Rate –vs- Floating Rate Deposits

- 15. Banker Customer Relationship – 35 • Nomination Facility for Bank Deposits, Safe Custody of Articles and Safe Deposit Lockers : - Nomination of Bank accounts are compulsory, Bank should educate their customers as to the advantages of nomination. - A valid nomination ensures that in the event of death of the sole depositor or all depositors, bank will return the amount lying in the account to the nominee without any legal hassle. Note Nomination per se does not confer any legal heirship/absolute ownership to the nominee, it only authorises the nominee to collect the amount from the bank and payment to nominee gives a valid discharge to the bank.

- 16. Banker Customer Relationship – 36 • Nomination in Bank Deposit Accounts : - Who can nominate? : The sole depositor or all joint depositors in Deposit a/cs held in individual capacity and not in any representative capacity. So No Nomination in Partnership Firm, Company, Trust, HUF or Association Accounts. - Who can be nominated? : Only Individuals can be a nominee. One nominee for each deposit a/c. Anybody including a minor, NRI, Foreigner or blind/illiterate person can be a nominee (But Not a lunatic). In case of minor nominee an adult individual to be appointed to receive the deposit in the event of the death of the depositor during the minority of the nominee. - Nomination forms in DA1/ for cancellation of nomination form DA2/Variation by DA3

- 17. Banker Customer Relationship – 37 • Nomination in Safe Custody of Articles Accounts : - Who can nominate? : Facility available only when the articles are held in the single name of an individual in his personal capacity. Thus Safe custody a/c in joint names are not eligible for nomination unlike Deposit A/C and Safe Deposit Locker A/c. - Who can be nominated? : Only one Individual can be appointed as a nominee. Anybody including a minor, NRI, Foreigner or blind/illiterate person can be a nominee (But Not a lunatic). - Nomination forms in SC1/ for cancellation of nomination form SC2/Variation by SC3

- 18. Banker Customer Relationship – 37 • Nomination in Safe Deposit Locker (SDL) Accounts : - Who can nominate? : Facility available only when the SDL A/Cs are held in the name of individuals (singly or jointly) in his/their personal capacity. - Who can be nominated? : Nominee should be Individuals. In a single a/c only one nominee, in joint a/c more than one nominee allowed, but the number of nominees should not exceed the number of joint hirers. Anybody including a minor, NRI, Foreigner or blind/illiterate person can be a nominee (But Not a lunatic). - Nomination forms in SL1 for sole hirer, SL1A for joint hirers/ for cancellation of nomination form SL2/Variation by SL3 for sole hirer and SL3A for joint hirers.

- 19. Salient Features of NI Act - 1 • Negotiable Instruments: Negotiable Instruments Act, 1881 (NI Act) does not define a Negotiable Instrument. Sec. 13 of NI Act merely states “A negotiable instrument means a promissory note, bill of exchange or cheque payable either to order or bearer”. These 3 instruments are, therefore, negotiable instruments by statute. These negotiable instruments have certain common features and any instrument that possess these features may be considered to be a negotiable instrument (e.g. bank drafts, government promissory notes etc.)

- 20. Salient Features of NI Act - 2 • Common features of Negotiable Instruments : - Transferability - Negotiability - Right of Action/Recovery 1. Freely Transferable: The right/interest/ ownership/property in an NI passes from one person to another by mere delivery, in case of a bearer instrument, or by endorsement and delivery, in case of an order instrument. However, the transferability of the instrument may be restricted by the maker or the holder as under:

- 21. Salient Features of NI Act - 3 1. Freely Transferable (Contd…): a. By the maker by drawing it payable to “X only” b. By the maker/drawer and holder by crossing it as “Account Payee” or “Account Payee only”. c. By the holder or the endorser making a restrictive endorsement like “Pay to X only”.

- 22. Salient Features of NI Act - 4 2. Title of transferee/holder better than that of transferor, i.e. free from all defects: A negotiable instrument confers an absolute and valid title on the transferee who takes it in ‘good faith (bona fide), for value and without notice of defect in the title of the transferor’. This is an exception to the general rule of law that says that ‘no one can give to another a better than what one has’. Such a holder/ transferee of NI is known as ‘holder in due course’. This is the essential feature of “Negotiability” of a negotiable instrument.

- 23. Salient Features of NI Act - 5 3. Right of Action/Recovery: The holder in due course of an NI can sue upon a negotiable instrument in his own name for the recovery of the amount of the instrument from the party liable to pay thereon. Further he need not give the notice of transfer to the party liable on the instrument to pay.

- 24. Salient Features of NI Act - 6 • Promissory Note/Sec. 4: “A Promissory Note is an instrument in writing (not being a bank note or a currency note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money only to, or to the order of a certain person, or to the bearer of the instrument.” ( 2 parties: Maker & Payee): Used in borrowing and lending transactions. Borrower is the maker (Promisor) and lender is the Payee (Promisee) of the note.

- 25. Salient Features of NI Act - 7 • Bill of Exchange/Sec. 5: “A bill of exchange is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of a certain person, or to the bearer of the instrument.” • (3 parties: Maker/Drawer, Drawee and Payee): BoE is used in business and trade involving the seller and buyer of goods/services sold on credit terms. Seller is the Drawer/Maker, Buyer is the Drawee and to whom money is to be paid is the Payee (Beneficiary).

- 26. Salient Features of NI Act - 8 Instead of paying cash, the drawee (buyer) undertakes to pay to the payee or to his order, a specified sum on demand (i.e. demand bill on presentment of the bill) or on a specified future date (i.e. usance bill after acceptance). The drawee of the bill is not liable until he accepts the bill, indicating thereby his assent to the drawer’s order to pay. Demand bill is payable immediately on presentment to the drawee. Usance bill is presented twice to the drawee-first for its acceptance and thereafter for payment on the due date.

- 27. Salient Features of NI Act - 9 The date of payment must be certain or ascertainable. Demand bill is payable on demand or immediately on presentment. Usance bill is payable after a specified period or at a future date. Usance bills attract ad valorem stamp duty and they need to be accepted by the drawee(s) to legally bind him/them for payment.

- 28. Salient Features of NI Act - 10 • Cheque/Sec. 6: “A cheque is a bill of exchange drawn on a specified banker and is not expressed to be payable otherwise than on demand.” • It also includes (i) electronic image of a Truncated Cheque and (ii) Cheque in electronic form (e-Cheque) • (3 parties: Drawer, Drawee/Bank and Payee).

- 29. Salient Features of NI Act - 11 • Common features of a Cheque : - Drawer : Account holder signing the cheque. - Drawee : Always the bank branch where the a/c holder maintains his a/c. - Payee : Beneficiary who will receive the amount mentioned in the cheque.

- 30. Salient Features of NI Act - 12 • Other features of a Cheque : - In written format (By Pen or Typed, Not in Pencil) - Form of Cheque [Cheque No., MICR Code/9 digits, A/C name & no. of the drawer, Branch Name, (RTGS/NEFT) IFSC Code/11 digits (4 a + 7 n), other security features] - Drawer’s Signature - Date of Cheque [Stale/Ante-dated (date > 3 m on date of presentation) and Post-dated cheques are Not to be paid] - Amount of Cheque (In words and Figures) - Bearer Cheque and Order Cheque (Cheques payable to X or bearer, to X, to X or order, to X only)

- 31. Salient Features of NI Act - 13 • Other features of a Cheque : - Material Alteration of the Cheque : Requires Drawer’s full signature/authentication - Holder/Holder in Due Course (Sec. 8 & 9) - Payment in due course (Sec. 10) - Payable at par Cheques/Multi-City Cheques - Crossed Cheques and Uncrossed (Open) Cheques: Open cheques can be paid across counter in cash while Crossed cheques should be collected through a bank account, i.e., no cash can be paid.

- 32. Salient Features of NI Act - 14 • Other features of a Cheque : • Crossing of Cheques - General Crossing : drawing on its face 2 parallel transverse lines - Special Crossing : addition of the name of a banker across the face of the cheque - Account Payee Crossing/Not Negotiable Crossing

- 33. Salient Features of NI Act - 15 • Endorsements [Means writing of a person’s name on the face or back of an NI or on a slip of paper (called allonge) annexed thereto for the purpose of negotiation] : Blank Endorsement, Special Endorsement/Endorsement in Full, Restrictive Endorsement, Endorsement sans recourse. • Other Negotiable Instruments : - Banker’s Drafts - Traveller’s Cheques - Dividend/Interest Warrants

- 34. Salient Features of NI Act - 16 • Circumstances when a Drawee Banker can refuse payment of a cheque : - Insufficiency of funds in the drawer’s a/c - Payment counter mended/stopped by drawer - Post dated cheque/Stale cheque - No signature of drawer/No date/Material alteration requires full signature of drawer - Drawer’s signature differs - Cheque mutilated - Crossed cheque cannot be paid across counter - Exceeds arrangement [in case of Cash Credit (CC) or Overdraft (OD)a/c]

- 35. Salient Features of NI Act - 17 • Bouncing of Cheques /Civil & Criminal Liability of the Drawer (Debtor) and the endorser(s) (Guarantors): Sec. 138 to 147 of NI Act, 1881. Following conditions are to be satisfied : - Drawing of a cheque for valid consideration, i.e. for discharge of debt or liability - Presentation to the bank within the validity period - Cheque returned unpaid/dishonoured by bank b/o insufficiency of funds or exceeds arrangement

- 36. Salient Features of NI Act - 18 - Payee or holder in due course gives notice in writing to drawer demanding payment of cheque amount within 30 days of receipt of information from the bank about the dishonour - Drawer fails to pay the amount to the payee within 15 days of the receipt of the notice - Payee must make a written complaint before the court/file criminal suit within one month from the expiry of 15 days period given to drawer to make payment (cause of action) - Maximum Punishment : Imprisonment up to 2 years or fine up to 2 times the cheque amount or both

- 37. Miscellaneous Topics • CASA Deposits, Importance of CASA and CASA ratio for a bank, Strategies for mobilising CASA Deposits

- 38. KEY WORDS/TERMINOLOGIES/GLOSSARY • Retail Banking – vs- Wholesale/Corporate Banking; Banker, Customer, KYC-AML-CFT Guidelines, Customer Due Diligence, Money Laundering, Placement, Layering & Integration, AML, Suspicious Transactions, CASA & CASA Ratio, Deposit Insurance & DICGC, Nomination • Negotiable Instruments (NI), Cheques, BoE, Promissory Notes, Negotiability, Transferability, Right of Action/Recovery, Holder & Holder in Due Course, Payment in due course, Crossing of Cheques – General/Special, Endorsements

- 39. Topics for Next Class – All of you Should get prepared before coming to the class • New Banking Technology/Electronic Banking : TBA, CBS, ATM, Credit, Debit & Smart/Charge/Stored Value Cards, Mechanics of Credit Card Transaction. Tele Banking, Internet Banking, Mobile Banking, Mobile Phone Banking. • Payment and Settlement System : Different Clearing Systems of Cheques, MICR, Cheque Truncation System (CTS), e-Cheque; Electronic Transfer of Funds – ECS, EFT, NEFT, RTGS, SWIFT etc.

- 40. Home Task & Assignment for Next Class • Group Assignment for submission in the next class through the Class representative sharp before the start of the class. • Assignment : Compare the SB, CA, Term Deposit Products along with value added services/freebies and Cash Management Solutions offered by the two banks allotted to your group. Suggest which bank gives better facility/low service charges/better value to customers product-wise.