Team 9, Nanjing. Presentation deck

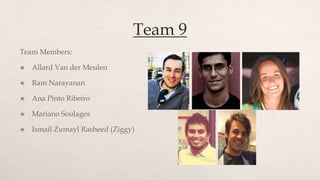

- 1. Team 9 Team Members: Allard Van der Meulen Ram Narayanan Ana Pinto Ribeiro Mariano Soulages Ismail Zumayl Rasheed (Ziggy)

- 3. Founding Mandate, Structure & Members “The purpose of the Bank shall be to foster economic growth and co-operation in the region of Asia and the Far East and to contribute to the acceleration of the process of economic development of the developing member countries in the region, collectively and individually.” Mission: With due consideration to economy and efficiency, ADB shall procure quality goods and/or services for its operations at the most competitive market prices available using the most competitive procurement method applicable and giving due regard to the reputation of the supplier or provider, promptness of delivery, terms of payment and availability of adequate warranty and servicing facilities, among others. Asian Development Founded: 1966 Bank Presently based in : Manila, Philippines (27 missions, 3 rep. offices) Asian Development Fund (+36 67 Member countries others) 48 Regional + 19 Non-Regional countries Methods to mandate: • Ensure the ADB procures high quality goods and/or services for its institutional requirements. Ordinary Capital • Ensure every purchase represents good value for money to the ADB. Resources • Ensure the ADB uses the most appropriate procurement methods with due consideration to (OCR) competitiveness, fairness, and transparency. • Ensure all qualified suppliers are offered the opportunity to compete for ADB business. • Ensure the ADB and suppliers comply with contractual obligations.

- 4. Funding & Resourcing Top 10 Shareholders • Capital Subscription by member countries (2011) • Income generated from loan repayments 15.7% Japan (NB) • Borrowings in International financial markets 15.7% USA (NB) • Bilateral and multilateral donors and investment 6.5% China (B) incomes 6.4% India (B) 5.8% 5.3% Australia (NB) Canada (NB) Core Activities 5.1% Rep. of Korea (B) 4.3% Germany (NB) 2.7% Malaysia (B) 2.4% Philippines (B)

- 5. Member Countries Non Regional Regional Non Regional Regional Austria, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Ital Afghanistan, Australia, Azerbaijan, Bangladesh, Bhutan, Brunei, Darussalam, y, Luxembourg, The Cambodia, China, Cook Islands, Fiji Islands, Georgia, Hong Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Turkey, United Kingdom, United States Kong, India, Indonesia, Japan, Kazakhstan, Kiribati, Korea, Kyrgyz, Republic of Lao, Malaysia, Maldives, Marshall Islands, Micronesia, Mongolia,Myanmar, Nauru, Nepal, New Zealand, Pakistan, Palau, Papua New Guinea, Philippines, Samoa, Singapore, Solomon Islands, Sri

- 6. European Bank for Reconstruction and Development(EBRD) • Helping countries through the challenging process of transition

- 7. Founding Mandate, Structure & Members • “The EBRD invests in change in more than 30 countries across Europe, central Asia and the southern and eastern Mediterranean” • Mission: Invest in Change • Founded: April 1991 • Presently based in : London, United Kingdom • Member countries : 64 countries & 02 Institutions • Method to mandate: only work in countries that are committed to democratic principles. Safe guarding human rights and respect for the environment is part of the strong corporate governance

- 8. Funding & Resourcing Top 10 Shareholders • Capital Subscription by member countries • Structured debt products 10% USA • Bonds issued in capital markets 8.5% United Kingdom • Local currency Bonds Issuance 8.5% France • Trade facilitation program 8.5% Italy • Donor funding's 8.5% Japan 8.5% 4.0% Germany Russia Core Activities 3.4% Spain Finantial Investments in „11: €9.1 billion 3.4% Canada Infrastructure Institutions 3.0% European Union Total projects: €210.7 billion Climate change Capital: €30 billion Finance sector and Sustainable Investments Energy Countries of operation: 29

- 9. Member Countries European Bank for Reconstruction and Development member states Members, only financing Members, recipients of investments Albania, Armenia, Australia, Austria, Azerbaijan, Belarus, Belgium, Bosnia and Herzegovina, Bulgaria, Canada, Croatia, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, Macedonia, France, Georgia, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Japan, Jordon, Kazakhstan, Korea, Kyrgyz Republic, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Mexico, Moldova, Mongolia, Montenegro, Morocco, Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Russian, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Tajikistan, Tunisia, Turkey, Turkme nistan, Ukraine, United Kingdom, USA, Uzbekistan

- 10. African Development Bank (AfDB) A regional multilateral supranational financial institution.

- 11. Founding Mandate & Structure “To spur sustainable economic development and social progress in its regional member countries thus contributing to poverty reduction” African Developme nt Bank Mission: Help reduce poverty, and improve living conditions on the continent African Developme Founded: 1964 nt Fund Presently based in : Tunis, Tunisia 77 Member countries Nigeria Trust Fund 53 African (RMC) + 24 Non-African countries (NRMC) Method to mandate: Stimulate and mobilize internal and external resources to promote investments as well as provide Regional Member Countries (RMCs) with technical assistance.

- 12. Funding & Resourcing Top 10 Shareholders • Capital Subscription by member countries • Income generated from loan repayments 9.3% Nigeria • Borrowings in International financial markets 6.6% USA 5.5% Japan • Bilateral and multilateral donors and investment 5.4% Egypt incomes 4.8% South Africa 4.2% 4.1% Algeria Germany Core Activities 4.0% Libya 3.7% Canada Education + 3.7% France Governance Vocational Training Private sector Infrastructure investments

- 13. Member Countries AfDB Beneficiary Countries ADF Beneficiary Countries AFDB and ADF Beneficiary Countries Non-African Member Countries AfDB Beneficiary Countries Non African Member Countries Algeria, Angola, Benin, Botswana, Burkina-Faso, Burundi, Cameroon, Cape-Verde, Central African Argentina, Austria, Belgium, Brazil, Canada, China, Denmark, Republic, Chad, Comoros, Congo, Democratic Republic of Congo, Côte d’Ivoire, Finland, France, Germany, India, Italy, Japan, Korea, Kuwait, Djibouti, Egypt, Eritrea, Equatorial Guinea, Ethiopia, Gabon, The Gambia, Ghana, Guinea, Guinea- Netherlands, Norway, Portugal, Saudi Arabia, Spain, Sweden, Bissau, Kenya, Lesotho, Liberia, Libya, Madagascar, Malawi, Mali, Mauritania, Mauritius, Morocco, Switzerland, United Kingdom and United States of America Mozambique, Namibia, Niger, Nigeria, Rwanda, Sao Tome and Principe, Senegal, Seychelles, Sierra Leone, Somalia, South Africa, Sudan, South Sudan, Swaziland, Tanzania, Togo, Tunisia, Uganda, Zambia and Zimbabwe.

- 14. What differentiates them ?

- 15. Potential pitfalls and Digressions from Mission • At least one of the BRIC countries is among the top three recipients of financial assistance from IBRD, IFCM AsDB, EBRD and IDB in FY2011. • Unfair usage of MDB resources by these countries. E.g. China has substantial foreign reserve holdings and can use private capital markets to fund development projects. • MDB resources, would be better suited to focusing on the needs of the world‟s poorest countries. • “the same food is better appreciated by a hungry man‟s stomach, over a satiated one‟s”

- 16. Quick Comparision MDB Name Type of Financing Type of Borrower Year Commitments Founded FY 2011 (Billion $) AfDB Non-concessional loans, Middle income governments, 1964 4.0 (African equity investments, loan creditworthy low-income governments, Development Bank) guarantees private sector firms AfDF Concessional loans and Low income governments in the region 1972 2.3 (African grants Development Fund ) ABD Non-Concessional loans, Middle income governments, 1966 9.3AsDF (Asian Development equity investments, and loan creditworthy low income governments, Bank) guarantees private sector firms AsDF Concessional loans and Low income governments in the region 1973 3.2 (Asian Development grants Fund) EBRD Non-concessional loans, Primarily private sector firms in 1991 11.8 (European Bank equity investments, and loan developing countries & developing Reconstruction and guarantees country governments in the region Development) Source

- 17. Contrast in Purpose, “If Continents were a building” EBRD: Founded: 1991 AfDB: Founded: 1964 AsDB: Founded: 1966

- 18. Shareholders Major Players Top 10 Shareholders Top 10 Shareholders Top 10 Shareholders (2011) 9.3% Nigeria 15.7% Japan (NB) 10% USA 6.6% USA 15.7% USA (NB) 8.5% United Kingdom 5.5% Japan 6.5% China (B) 8.5% France 5.4% Egypt 6.4% India (B) 8.5% Italy 4.8% South Africa 5.8% Australia (NB) 8.5% Japan 4.2% Algeria 5.3% Canada (NB) 8.5% Germany 4.1% Germany 5.1% Rep. of Korea (B) 4.0% Russia 4.0% Libya 4.3% Germany (NB) 3.4% Spain 3.7% Canada 2.7% Malaysia (B) 3.4% Canada 3.7% France 2.4% Philippines (B) 3.0% European Union

- 19. Financial Snapshot AfDB (2011) ADB (2011) EBRD (2010) total debt/total equity 264,50% 356,80% 204,35% net income/total assets 0,26% 0,56% 3,78% net income/shareholders quity 1,06% 3,80% 12,01% total equity/total assets 24,10% 14,40% 31,05% paid-in capital/subscribed capital 6,90% 5% 29,80% usable/required capital 16,30 20,3 3,10