Filing of income tax return for financial year 2017

•

1 recomendación•423 vistas

Filing of income tax return for the 2017-18 financial year is approaching, with the deadline of July 31st for individuals not requiring a tax audit, and September 30th for those that do. Anyone with over 250,000 rupees in taxable income must file a return. Tax audits are mandatory for businesses over 1 crore rupees in sales and professionals over 50 lakhs in receipts. Returns can be filed online or physically, and different forms apply based on income level and sources. Advance tax is due quarterly for those forecasting over 10,000 rupees in tax, and rates range from 5-30% depending on income level with exemptions for seniors.

Denunciar

Compartir

Denunciar

Compartir

Descargar para leer sin conexión

Recomendados

Más contenido relacionado

La actualidad más candente

La actualidad más candente (20)

Similar a Filing of income tax return for financial year 2017

Similar a Filing of income tax return for financial year 2017 (20)

Income Tax Planning for financial Year 2016-17 & Expected Slab and deduction ...

Income Tax Planning for financial Year 2016-17 & Expected Slab and deduction ...

Tax Rates for Assessment Year 2021 22 | CA Sana Baqai

Tax Rates for Assessment Year 2021 22 | CA Sana Baqai

Más de Dr. Sanjay Sawant Dessai

Profile of The Cuncolim Educational Society's College of Arts and Commerce Cuncolim Goa for the academic year 2020-21The Cuncolim Educational Society's College of Arts and Commerce Cuncolim Goa

The Cuncolim Educational Society's College of Arts and Commerce Cuncolim Goa Dr. Sanjay Sawant Dessai

Income exempted under section 10 of income tax Act 1961 for assessment year 2017-18, based on B Com Syllabus of Goa University Income exempted under section 10 of Income tax Act 1961 for assessment year 2...

Income exempted under section 10 of Income tax Act 1961 for assessment year 2...Dr. Sanjay Sawant Dessai

Permissible deductions from gross total income U/s 80C to 80U for assessment year 2026-17 for B Com( taxation ) Students of Goa University

Permissible deductions from gross total income chapter VI A - u/s 80C to 80U

Permissible deductions from gross total income chapter VI A - u/s 80C to 80UDr. Sanjay Sawant Dessai

Más de Dr. Sanjay Sawant Dessai (20)

India Budget 2024 25. Highlights of budgeted expediture

India Budget 2024 25. Highlights of budgeted expediture

The Cuncolim Educational Society's College of Arts and Commerce Cuncolim Goa

The Cuncolim Educational Society's College of Arts and Commerce Cuncolim Goa

Cuncolim Education Society's College of Arts and Commerce , Cuncolim Goa

Cuncolim Education Society's College of Arts and Commerce , Cuncolim Goa

Performance of sensex ( index) companes over period of one year

Performance of sensex ( index) companes over period of one year

Computation of profits & gains of business or profession

Computation of profits & gains of business or profession

Income exempted under section 10 of Income tax Act 1961 for assessment year 2...

Income exempted under section 10 of Income tax Act 1961 for assessment year 2...

Ratio analysis - Financial ratios for B Com students

Ratio analysis - Financial ratios for B Com students

Normal rates of tax for individual for assessment year 2016 17

Normal rates of tax for individual for assessment year 2016 17

Permissible deductions from gross total income chapter VI A - u/s 80C to 80U

Permissible deductions from gross total income chapter VI A - u/s 80C to 80U

Computation of Capital Gains for Assessment year 2016-17

Computation of Capital Gains for Assessment year 2016-17

Último

VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai Escorts

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Today call girl service available 24X7*▬█⓿▀█▀ 𝐈𝐍𝐃𝐄𝐏𝐄𝐍𝐃𝐄𝐍𝐓 CALL 𝐆𝐈𝐑𝐋 𝐕𝐈𝐏 𝐄𝐒𝐂𝐎𝐑𝐓 SERVICE ✅

⭐➡️HOT & SEXY MODELS // COLLEGE GIRLS

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

★ SAFE AND SECURE HIGH CLASS SERVICE AFFORDABLE RATE

★ 100% SATISFACTION,UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL 24x7 :: #S07 3 * 5 *7 *Star Hotel Service .In Call & Out call SeRvIcEs :

★ A-Level (5 star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob)Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

100% SAFE AND SECURE 24 HOURS SERVICE AVAILABLE HOME AND HOTEL SERVICES

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai E...

VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai E...roshnidevijkn ( Why You Choose Us? ) Escorts

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...dipikadinghjn ( Why You Choose Us? ) Escorts

Model Call Girl Services in Delhi reach out to us at 🔝 9953056974 🔝✔️✔️

Our agency presents a selection of young, charming call girls available for bookings at Oyo Hotels. Experience high-class escort services at pocket-friendly rates, with our female escorts exuding both beauty and a delightful personality, ready to meet your desires. Whether it's Housewives, College girls, Russian girls, Muslim girls, or any other preference, we offer a diverse range of options to cater to your tastes.

We provide both in-call and out-call services for your convenience. Our in-call location in Delhi ensures cleanliness, hygiene, and 100% safety, while our out-call services offer doorstep delivery for added ease.

We value your time and money, hence we kindly request pic collectors, time-passers, and bargain hunters to refrain from contacting us.

Our services feature various packages at competitive rates:

One shot: ₹2000/in-call, ₹5000/out-call

Two shots with one girl: ₹3500/in-call, ₹6000/out-call

Body to body massage with sex: ₹3000/in-call

Full night for one person: ₹7000/in-call, ₹10000/out-call

Full night for more than 1 person: Contact us at 🔝 9953056974 🔝. for details

Operating 24/7, we serve various locations in Delhi, including Green Park, Lajpat Nagar, Saket, and Hauz Khas near metro stations.

For premium call girl services in Delhi 🔝 9953056974 🔝. Thank you for considering us!Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X79953056974 Low Rate Call Girls In Saket, Delhi NCR

Call Girl Mumbai Indira Call Now: 8250077686 Mumbai Escorts Booking Contact Details WhatsApp Chat: +91-8250077686 Mumbai Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertainin. Plus they look fabulously elegant; making an impressionable. Independent Escorts Mumbai understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Call Girl Srinagar Indira Call Now: 8617697112 Srinagar Escorts Booking Contact Details WhatsApp Chat: +91-8617697112 Srinagar Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable. Independent Escorts Srinagar understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(INDIRA) Call Girl Srinagar Call Now 8617697112 Srinagar Escorts 24x7

(INDIRA) Call Girl Srinagar Call Now 8617697112 Srinagar Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Model Call Girl Services in Delhi reach out to us at 🔝 9953056974 🔝✔️✔️

Our agency presents a selection of young, charming call girls available for bookings at Oyo Hotels. Experience high-class escort services at pocket-friendly rates, with our female escorts exuding both beauty and a delightful personality, ready to meet your desires. Whether it's Housewives, College girls, Russian girls, Muslim girls, or any other preference, we offer a diverse range of options to cater to your tastes.

We provide both in-call and out-call services for your convenience. Our in-call location in Delhi ensures cleanliness, hygiene, and 100% safety, while our out-call services offer doorstep delivery for added ease.

We value your time and money, hence we kindly request pic collectors, time-passers, and bargain hunters to refrain from contacting us.

Our services feature various packages at competitive rates:

One shot: ₹2000/in-call, ₹5000/out-call

Two shots with one girl: ₹3500/in-call, ₹6000/out-call

Body to body massage with sex: ₹3000/in-call

Full night for one person: ₹7000/in-call, ₹10000/out-call

Full night for more than 1 person: Contact us at 🔝 9953056974 🔝. for details

Operating 24/7, we serve various locations in Delhi, including Green Park, Lajpat Nagar, Saket, and Hauz Khas near metro stations.

For premium call girl services in Delhi 🔝 9953056974 🔝. Thank you for considering us!call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️9953056974 Low Rate Call Girls In Saket, Delhi NCR

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangements Near You

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9352852248

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 🌐 beautieservice.com 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9352852248

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S020524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9352852248

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...From Luxury Escort : 9352852248 Make on-demand Arrangements Near yOU

Último (20)

Airport Road Best Experience Call Girls Number-📞📞9833754194 Santacruz MOst Es...

Airport Road Best Experience Call Girls Number-📞📞9833754194 Santacruz MOst Es...

VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai E...

VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai E...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

Mira Road Memorable Call Grls Number-9833754194-Bhayandar Speciallty Call Gir...

Mira Road Memorable Call Grls Number-9833754194-Bhayandar Speciallty Call Gir...

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

CBD Belapur Expensive Housewife Call Girls Number-📞📞9833754194 No 1 Vipp HIgh...

CBD Belapur Expensive Housewife Call Girls Number-📞📞9833754194 No 1 Vipp HIgh...

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(Sexy Sheela) Call Girl Mumbai Call Now 👉9920725232👈 Mumbai Escorts 24x7

(Sexy Sheela) Call Girl Mumbai Call Now 👉9920725232👈 Mumbai Escorts 24x7

Diva-Thane European Call Girls Number-9833754194-Diva Busty Professional Call...

Diva-Thane European Call Girls Number-9833754194-Diva Busty Professional Call...

Business Principles, Tools, and Techniques in Participating in Various Types...

Business Principles, Tools, and Techniques in Participating in Various Types...

(INDIRA) Call Girl Srinagar Call Now 8617697112 Srinagar Escorts 24x7

(INDIRA) Call Girl Srinagar Call Now 8617697112 Srinagar Escorts 24x7

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️

Navi Mumbai Cooperetive Housewife Call Girls-9833754194-Natural Panvel Enjoye...

Navi Mumbai Cooperetive Housewife Call Girls-9833754194-Natural Panvel Enjoye...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

Best VIP Call Girls Morni Hills Just Click Me 6367492432

Best VIP Call Girls Morni Hills Just Click Me 6367492432

Filing of income tax return for financial year 2017

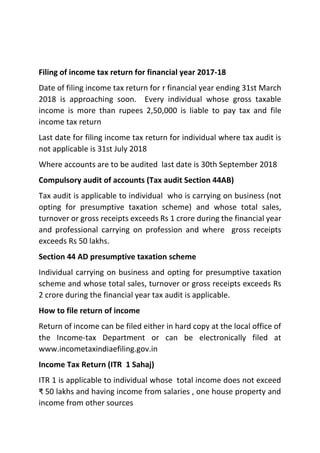

- 1. Filing of income tax return for financial year 2017-18 Date of filing income tax return for r financial year ending 31st March 2018 is approaching soon. Every individual whose gross taxable income is more than rupees 2,50,000 is liable to pay tax and file income tax return Last date for filing income tax return for individual where tax audit is not applicable is 31st July 2018 Where accounts are to be audited last date is 30th September 2018 Compulsory audit of accounts (Tax audit Section 44AB) Tax audit is applicable to individual who is carrying on business (not opting for presumptive taxation scheme) and whose total sales, turnover or gross receipts exceeds Rs 1 crore during the financial year and professional carrying on profession and where gross receipts exceeds Rs 50 lakhs. Section 44 AD presumptive taxation scheme Individual carrying on business and opting for presumptive taxation scheme and whose total sales, turnover or gross receipts exceeds Rs 2 crore during the financial year tax audit is applicable. How to file return of income Return of income can be filed either in hard copy at the local office of the Income-tax Department or can be electronically filed at www.incometaxindiaefiling.gov.in Income Tax Return (ITR 1 Sahaj) ITR 1 is applicable to individual whose total income does not exceed ₹ 50 lakhs and having income from salaries , one house property and income from other sources

- 2. ITR Form 2 is for Individuals having income exceed rupees 50,00,000 and having income from salaries, house property, capital gains and other sources ITR 3 It is applicable to an individual who is carrying on a proprietary business or profession. ITR 4 Also known as SUGAM is applicable to individuals who have opted for the presumptive taxation scheme Who is supposed to pay Advance Tax Tax payer having estimated tax liability of Rs. 10,000 or more is liable to pay advance tax. However, for senior citizen, an individual of the age of 60 years and above not having any income from business or profession is not liable to pay advance tax. An individual who is liable to pay advance tax is required to estimate his current income and pay advance tax accordingly Instalments of advance tax and due dates (Sec 211) For financial year 2017-18 1st instalment of 15 percent of advance tax is to be paid on or before the 15th June 2017 2nd Instalment of up to 45 percent of tax liability to be paid on or before the 15th September 2017. 3rd Instalment of up to 75 percent of the tax lability to be paid by 15th December 2017 4th instalment of 100 percent of tax liability to be paid on or before the 15th March 2018 For non payment of advance tax, tax payer has to pay interest on late payment Income tax rates for financial year 2017-18 (Slab rates) An individual having income up to Rupees 2,50,000 is exempted for payment of income tax.

- 3. Income between rupees 2,50,000 to Rupees 5 lakhs, tax payable is at 5 percent Income above rupees 5, lakhs and up to rupees 10 lakhs tax to be paid at the rat of 20 percent And income above Rupees 10,Lakhs tax rate applicable is of 30 percent For senior citizen For senior citizen above age of 60 years but below 80 years of age, income up to rupees 3,00,000 is exempted from tax and rest of the slab rates are same For individual above 80 years of age income up to rupees 5,00,000 is exempted from tax and rest of the slab rates are same Surcharge: The amount of income-tax shall be increased by a surcharge at the rate of 10% of such tax, where total income exceeds fifty lakh rupees but does not exceed one crore rupees Where total income exceeds one crore rupees the amount of income- tax shall be increased by a surcharge at the rate of 15% of such tax. Education and secondary and higher education cess Education cess of 2 percent and 1 percent higher education cess to be paid on income tax and surcharge calculated Every tax payer has to file income tax return by due date that is by 30th July or 30th September to avoid tax inquiry from tax authorities