MCB-Newsletter-07 Final

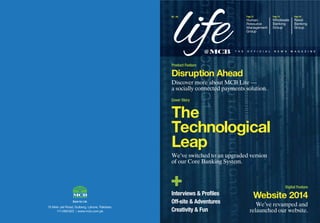

- 1. The Technological Leap We»ve switched to an upgraded version of our Core Banking System. Cover Story Disruption Ahead Discover more about MCB Lite ƒ a socially connected payments solution. Product Feature Website 2014 We»ve revamped and relaunched our website. Digital Feature+Interviews & Profiles Off-site & Adventures Creativity & Fun T H E O F F I C I A L N E W S M A G A Z I N E V2 | 01 Page 15 Page 43 @ Page 37 Human Resource Management Group Wholesale Banking Group Retail Banking Group 15 Main Jail Road, Gulberg, Lahore, Pakistan. 111-000-622 | www.mcb.com.pk

- 2. Editor’s NoteContributors Year 2014 has passed with a lot of zeal and momentous happenings. Some have received a bonus, others got promoted and rest are striving best to make it possible for the coming year. We at CCM, with the support of our team are always in the move to present most of these happenings to you in the form of our newsletter called “Life@MCB”. In this issue of Life@MCB, we dedicate the cover and rest of the pages to the success stories that took place during 2014. These stories include MCB’s Core Banking System Upgrade, launch of MCB’s Corporate Website, initiation of our Hajj Campaign and various other initiatives that make us even more proud to be a part of this organization, then we already are. Team RBG has set their tone in the cover story about “MCB Lite”.Asma tells us about “fitness at work” whereas Mazhar Iqbal and Khalil-ur-Rehman have uniquely expressed their creative perspectives of life and existence. This issue also covers an interview of Ali Shafi and Sufian Ghafoor. Both of these personalities carry their exceptional point of views but are yet similar in defining the true essence of life. It is always heartening to receive contributions from your end. Your appreciation and healthy criticism is the sole reason behind our motivation to come up with the fifth issue of this publication. Our aim is to entertain you and to keep you updated about all the latest happenings at MCB, so that we remain intact via the spirit of words created through this newsletter. We would love to hear your thoughts. Please send us your comments or other story ideas at sara.afzal@mcb.com.pk Thanks! MCB Lite By Digital Banking-RBG (North) Corporate Website Usman Akram Retail Banking Group Mehboob Elahi Treasury & FX Group Usman Khan Audit & RAR Group Mohammad Farooq Wasi Compliance & Controls Group M.Danish Iqbal Risk Management Group Musharraf Iftikhar Financial Control Group Khurram Saeed Govt. Hajj Scheme 2014 Amna Ahmed Operations Group Imran Rashid Special Assets Management Group Khalid Ishaaq Wholesale Banking Group Adrish Ali CSR & Security Group Akbar Ali Islamic Banking Group Haroon Siddiqui Mubeen Akhtar Information Technology Group Mohsin Dar Usman Shehzad Salman Ferozi Human Resource Management Group Tehmina Shafi Khan Creativity@MCB Adnan Ali Khan Muhammad Shafiq Syed Ali Zullquarnain Naqvi Asma Aqeel Mazhar Iqbal Khalil-Ur-Rehman Contents 1341 03 43 45 49 Cover Stories MCB Lite Corporate Website Project Ambit Govt. Hajj Scheme 2014 Group Highlights Treasury & FX Group Wholesale Banking Group Compliance & Controls Group Risk Management Group Special Assets Management Group Audit & RAR Group Financial Control Group Information Technology Group Islamic Banking Group CSR & Security Group Operations Group Human Resource Management Group Retail Banking Group Good Cheer MCB Loyalty Discounts In the Spotlight Independance Day 2014 Corporate Social Responsibility MCB Talent Awards & Honors © 2014, MCB Bank All Rights Reserved. No part of this publication may be reproduced without the prior written permission of the publisher. Sara Afzal Editor 11 51 55 56

- 3. Disruption Ahead Cover Story by Digital Banking RBG (North) What mobile phones have done to landlines in this country is exactly what mobile wallets are about to do to bank accounts. Over the next three to five years, the number of mobile wallets will far surpass the good old bank accounts. Why is that you ask? Simple, both landlines and bank accounts are privileges and will remain so. These are services, along with the infrastructure and the processes that power them are anchored in the physical world. Such utilities largely run on the proprietary of the real world infrastructure such as the wired network, bank branches, ATMs, Point-Of-Sale (POS) networks, exchange-houses and so on. And to top this, the on-boarding and the application processing for these services also unfold within the physical value chain, which means that the ‘time and space’rule apply. In most cases, actual forms are filled and transported from one location to another and sometimes to different cities before the data is manually inserted into various systems several hours, days and in certain cases weeks later. On the other hand, the next generation mobile wallets (as they come into main stream existence, which is about now) will run on wireless protocols and will not be privileges any more. Think of this day and age’s mobile connectivity; all you require is a valid ID card for the purchase and it is yours. Therefore, technically speaking all you would need is a functional mobile phone backed with an ID card and the mobile wallets will be yours to use. And if developed and designed properly, this will happen without any work being done in the physical value chain almost mimicking the experience of making an e-commerce transaction on your smart phone through feeding in your particulars online. Extending the same thought-process into the near future, it won’t be farfetched to imagine mobile wallets that will be easier to own as opposed to applying for a brand new mobile phone connection in the first place. Why? It’s pretty simple, owning a new mobile connection will still involve evoking parts of the physical value chain to execute. Think of the SIM card and in some cases the handset that would need to be purchased, as opposed to the wallet that resides in the cloud and is down loaded over the wireless internet in shape of a mobile app. Let’s for a moment step out of the payment space and into what has been going on in the rest of the world. Immediately it becomes apparent that people today are behaving, living and spending their time in radically different ways than what they were doing just fifteen or twenty years ago. We do not visit libraries, consult or print encyclopedias any more. Fact based knowledge and curriculums have little value; it is about how these facts are put into context and concepts which really counts now as the rest we can just Google in real time. We indeed Google many times more than we ever visited libraries or consulted books. We do not write letters anymore unless we are sending a legal notice to someone, instead we write emails more than we ever thought about writing with a pen and paper. Our emails get to the destination instantly as opposed to paper based communication and we expect and more or less demand immediate responses for almost everything that we write today. For most of us, news is now consumed in bite size pieces several times, throughout the day and newspapers have long seized to exist as chief sources of real time happenings, that we as individuals would be interested in. People today are making more connections with their friends and family in a single day as opposed to before the digital era. The point of all of this is to bring to notice of how almost everything stands redefined in frequency or consumption in the form of a graduated change that is made from the physical value chain to the digital one. This occurs due to dramatic reduction in costs along with the services or the utilities becoming simpler to operate and becoming real or near-time all at the same time as this transaction is made from physical to the digital. However, one thing hasn’t changed much over the last 50 years, it is the way people handle and manage money and the way payments are made. The ATM looks the same and performs more or less the same functions. The POS machine is exactly the same, that even the color of the casing is the same dull gray or black. 03 | LIFE @ MCB It won’t be far fetched to imagine mobile wallets that will be easier to own as opposed to applying for a brand new mobile phone connection. >> Discover more about MCB Lite – a socially connected payments solution.

- 4. The plastics have the same DNA and no radical change there either. Now compare this to the radio, TV, Phone or any other device that comes to mind and see how much those have changed in the last four to five decades to get a perspective of the lack of change in the way people handle money and make payments. The big question that arises is, “How is it that the banks, the payment gateway associations, POS/ATM manufacturers etc. have managed to stick to the old ways for so long in face of such colossal changes elsewhere?” To understand this phenomenon, we need to deconstruct the payment dynamics and reduce it to its simplest form: There are two main actors in the payment dynamics the seller or the merchant and the buyer or the customer. The banks and the payment associations are only the enablers or side actors if you will. In the past and in the present, the side actors were enabling payments by dealing in the physical value chain by doing the real work in terms of deploying the POS machine and connecting it to the network, managing the pre-authorization, settlement, repudiation functions and so on. Hence, the justification for two to three percent Merchant Discount Rate (MDR) charged to the seller or the merchant. The card is produced, personalized, packaged and shipped to the customer and this obviously requires work to be done in the physical value chain and therefore the fee levied in shape of annual and other charges to the customer. Fast forwarding to the present and the near future, things have changed, both buyers and sellers own smart phones that are connected to the wireless internet. POS machines or plastics are not the only options available anymore and the transactions no longer have to be delayed as they will happen in the real or near real time through mobile wallet-to-wallet interactivity with little or no cost to the parties involved. Savings in MDR and instant credit are not the only benefits that we are talking about. The big breakthrough is about bringing into reality a completely new connection between the merchants and the customers that was impossible to reach earlier. Think of a ‘zero-cost’app-to-app or wallet-to-wallet notifications over the internet that the merchant will now be able to send to the potential customer handsets informing them of for example, the 50% discount they bought within the hour or till stocks last. Customers will have the option of buying instantly through the mobile wallet sitting at home or while in the store. A little stretch of the imagination and picture of complete disruption of the retail space (including pre-sales, actual purchases and post sales scenarios) at the hands of smartphones powered by the wireless internet and linked with mobile wallets starts to reveal itself. Let’s examine what’s going on in some of the other industries. New age technology companies have made a habit out of disrupting the good old Mobile Network Operators (MNOs). The 20 year old SMS service has already been disrupted by Whatsapp along with many other similar messaging services. Skype and Viber are disrupting the standard and international calls and similar disruptions have become pretty much a norm across several other markets as well. The reason being, these services are being distributed digitally in real time and are device and platform agnostic but most of all they are free or have a price point close to zero. How do you compete with such an onslaught if your propositions still partly or wholly deal in the physical value chain? You can’t! You simply get disrupted! However, there is still one small silver lining remaining in the cloud; when the incumbent industry gets inflicted repeatedly with disruption, sometimes the disrupted players develop resilience and get really good at dishing out the similar treatment to the other cross industry players. Therefore, the MNOs after being disrupted repeatedly by the new age technology, companies are now getting good at disrupting the retail financial services industry. MNOs are striking back through the combination of agent network and mobile wallets to disintermediate the bank branches and the bank accounts and in certain cases the payment associations as well. While constructing and designing retail financial products and services, one must always remember that no one wakes up thinking about having loads of fun while making payments. Instead, we think about what we need to accomplish, consume and payments that need to be made since they are necessary enablers for those activities. This would mean that the more payments fade away in the background, the less visible they are, the more effortless handling money becomes; the faster these new behaviors would spread and take root. Also, we need to remember that payments tend to unfold in a social context and not in a vacuum. In case you are thinking about business payments these too have a social backdrop to them. The wallets of the future or at least the ones that would disrupt or attain any meaningful scale, will be built and designed on the fundamentals and principles of the social networking platforms. These will be networked-financial services products at their core with “going-viral” built into their DNA and not as marketing after thought. These services will come without any preconditions and will be platform independent meaning bank, telecom and devise agnostic. These wallets will reside in the cloud and will be distributed digitally and initialized or personalized sitting at home. If someone asked you 20 years ago, how many pictures you expect to capture during your next 3 day vacation? Your answer would surely not be 300. What the digital cameras have done to photographs, the well-designed mobile wallets are about to do to payments. Just as nobody could predict the hundreds of pictures almost every short vacation taken these days and that too mostly ‘selfies’to be shared on social networking sites, it is almost futile to attempt to predict just how many payments a day people will be making as mobile payment transformation and the related ecosystems get going. May be ten or twenty or maybe even thirty a day, who knows? It’s as good as anybody’s guess. However, one thing is for sure, we will be making a lot more of these payments through smart phones as our new payment contraptions compared to what we are making in the physical world today. Let there be no doubt that there will be a lot more of these mobile wallets around to make these payments from. Buckle up! There appears to be serious payment-disruption brewing just right around the corner to where we have already arrived in this country. 05 | LIFE @ MCB Services are being distributed digitally in real time and are device and platform agnostic but most of all they are free or have a price point close to zero. Let there be no doubt that there will be a lot more of these mobile wallets going around to make these payments easier. •

- 5. • MCB’s Revamped Corporate Website Launched! Cover Story One of this year’s major highlights has been the launch of a new corporate website of MCB Bank Limited. We have wanted to do this for years and now with the perfect combination of energetic people, under the visionary leadership of the Group Head SP&CCM, we have been able to create a better face, that is a better equipped and multi-dimensional, which carries the ability to handle a lot of new things that were unheard of on such a medium in the banking industry before. ‘Improvisation’ was the key agenda when the project was first undertaken in 2013 by the Project Team. The idea was not only to revamp the look of the website but also to ‘level-up’ the use, benefits and exposure of the new website. This is a milestone that the Bank as a team has achieved! The CMS (Content Management System) based website is now a business generating hub growing day by day; a portal of MCB Bank services, where customer queries are now being handled with an exclusive TAT of five days and allows real-time changes in content through approval cycle, which then adheres to the controlled change management mechanism. The CMS based system is capable of generating reports for further utilization and are flexible enough for addition of further add-ons. One of its kind, the website has proven to be a symbol of class through its robust features: 70% people rated the website between three to five and 117,000 plus visits were recorded from around the globe. This response was recorded only within two weeks after the Commercial Launch. This has not been an easy journey, the Project Team had to sell their idea to stakeholders and bring everybody on board at every phase of the Project before moving onto the next.The Working Group & STECO members remained actively involved in contributing all the possible ideas that could have been applied to a bank’s website. The management remained prudently active and the President especially showed keen interest throughout the project tenure for which we are whole-heartedly thankful. It is because of everyone’s efforts, which made this new website possible. The ideology of placing a new face for the Bank seems to be coming to life as ever. Since its launch, the feedback has been tremendous. We, the Website Project Team thank you for your efforts and input in making our dream project a reality. The CMS (Content Management System) based website, now a business generating hub, is growing day by day; a portal of MCB Bank services, where customer queries are handled within 5 days of TAT. The website launch was made possible because of everyone’s hard work and dedication. This has not been an easy journey, the Project Team had to sell their idea to its stakeholders and bring everybody on board at every phase of the Project before moving onto the next. by Usman Akram MCB is now a click closer to its customers – in a better way. • Fully Mobile Responsive • CMS (Content Management System) for real-time changes • Sales Lead Management • Customer Queries Management • IBAN Generator • Product Toolkits • Powerful Search Engine (within the website) • Powerful statistics / reporting tools • Flexibility for add-ons • Search Engine Optimized >>

- 6. Project Ambit Core Banking Upgrade Product Feature The Bank has switched over to an upgraded version of its Core Banking System (CBS) from SunGard’s Symbols v8.2 to the Ambit CBS v8.5 on March 17, 2014 within the planned timeframe. by Imran Rashid

- 7. As a result of such vibrant marketing, a lot of excitement was built amongst internal as well as external customers and numerous queries were directed to the Hajj Cell, branches and the Call Centre right before the announcement of Government Hajj Scheme. On the launch date, there was an over-whelming response from the customers and a steep rise in application numbers was observed on an hourly basis; kudos to all the teams involved in sharing the updates on a regular basis and keeping the enthusiasm alive amongst the staff. There was similar customer activity observed at the Islamic & Corporate Banking segments for Hajj applications, adding to the total collection. The joint efforts of all made the Campaign conclude before day-end with a whopping number of 36,289 Hajj applications breaking all previous records & leading the competition once again. Under the guidance of our President and the Senior Management, it proved to be an exemplary campaign where the whole Bank stood together for the same goal, and as a team we achieved huge success; Team MCB is forever determined to raise the bar not only for the competition but for itself too. MCB has done it again! Like last year, MCB is the market leader in country-wide Hajj application solicitation. This victory has happened yet again due to the tremendous and continuous efforts of our branch network and of the numerous support teams from across the Bank, namely: • Team Islamabad & the Hajj Cell • Remote Banking Team • ITG • Islamic Banking • Corporate Banking • All support businesses and operations group Retail Banking Product Team in coordination with CCM spear-headed Hajj Marketing Campaign 2014 and took several initiatives to create awareness amongst both external (corporate & commercial) and internal customers, including MCB sister-concerns, by using various modes of cost-effective marketing, which are: E – Channels: various means of e-channels were used to create hype before the launch: • Desktop & ATM wallpapers • Email communication through Business News and Corporate Communication etc) • SMSs and emails to our corporate and commercial customers. • MCB Website Print Media: prior to its launch, the campaign was advertised in Pakistan’s leading Newspapers: • The Nation • Nawai-e-Waqt • Friday Times Credit Card Campaign: In order to facilitate the customers a full or partial interest- free installment plan was offered to all MCB Credit Cards holders. There was an over-whelming response from the customers and a steep rise in application numbers was observed on an hourly basis. The joint efforts by all made the Campaign conclude before day-end with a whopping number of 36,289 Hajj applications breaking all previous records. Government Hajj Scheme 2014 by Amna Ahmed Read the Retail Banking Group’s success story. Success Story LEFT TO RIGHT: Mr.Jan Saeed -ROM Islamabad, Mr.Babar Sohail-RH Islamabad, Mr.Nasir Ayub-GM Islamabad, Mr. Farhan Baig -BH North, Mr.Jahangir Nazar-AHO North, Mr.Abrar Hussain-Incharge Hajj Cell, Mr.Zulfiqar Ali-BFC North. •

- 8. Team Building A team building activity helps to foster better and open communication between the employees as well as between the employees and the higher management. It has been introduced to create harmony and productive coordination amongst various teams and units of the treasury group. Since the treasury team needs to stay in the dealing room because of its work nature, it is a real challenge for managers to spare dealers and send them on training workshops. So to curb this situation, every Friday we prepare a lecture in the treasury room that is presented by one of our team member. These Friday sessions are topped by interesting team building activities and games that are organized by our group coordinator Ms. Amna Tahir. Purpose of these activities is to develop strong communication and profound relationships amongst all team members in a pleasant ambience. by Usman Khan We in Treasury feel very excited to have formally launched Pakistan’s first ever Purchasing Managers Index (PMI) under the banner of MCB Bank. It is called MCB Purchasing Managers Index or MCB PMI, which has already been released for January and March 2014 and will continue to be released bi-monthly a few more times before switching to the monthly release. As there was a dearth of economic releases to gauge the country’s economic direction, we envisioned the launch of a flag-bearer private-label i.e an economic indicator of our own which would carry the name of MCB to the economists, analysts, investors and other stake holders in the financial markets. We are glad to finally realize our vision that will not only enhance the MCB brand to another level but is a major step towards providing crucial information to the Market players both in Pakistan and abroad. MCB PMI is perhaps the first economic indicator that has been launched by the private sector. A lot of efforts by a number of people were put into this project. We are very thankful to WBG and RBG for their contributions in conducting the surveys through their network. Their efforts are highly appreciated and we look forward to their continuous and vital support. PMI is a leading indicator for the economic health of any manufacturing sector. It is considered to be an essential number in most of the developed and significant emerging economies. PMI is a keenly awaited economic data release in the developed Markets which bears material impact on the markets. The index measures five major indicators: new orders, production, employment, supplier deliveries and the inventory levels – all leading measures affording a glimpse into the future direction of the economy. A good index reading enhances the attractiveness of an economy. The magic number for the PMI is 50. A reading of 50 or higher generally indicates that the manufacturing is expanding. If manufacturing is expanding, the general economy should be doing likewise. As such, it is considered a good indicator of future GDP levels. Another useful figure to remember is 42. If the number falls below 42, over a period of time, it generally indicates contraction in the overall economy and recession could be just around the corner. The index value between 42 and 50 indicates that economic growth is anemic and flat. We are very excited to have formally launched Pakistan’s first ever Purchasing Managers Index (PMI) under MCB’s banner. Treasury & FX Group • Enhancement of brand and franchise value • Traction of bank-client relationship (First when conducting survey and later at dissemination of report). • The report may serve as MCB’s USP (unique selling proposition) • First Mover advantage - Recognition of MCB’s effort across industries - Industry wide improvement in quality of research • A good addition to our Research Products menu • Help in early identification of expansion/contraction of different sectors for the bank. Benefits to MCB • >> Group Highlights Cheering each other during the activity. Bridging all gaps. Working together as a team. It’s not just about building teams – it’s about building The Team. 13 | LIFE @ MCB

- 9. Group Highlights Wholesale Banking Group by Syed Adrish Ali The success of Wholesale Banking Group (WBG) and overseas offices is based on the positive contribution of all staff members. Our staff posted pan-Pakistan in the teams of corporate banking, investment banking, transaction banking, trade, financial institutions, portfolio management and finance & business planning that have all contributed well in their focus areas, while overseas operations in Sri Lanka, Bahrain and Dubai Representative Office have also delivered good performance in their respective niches. MCB Bank has initiated the Presidential Award to honor the valuable contributions made by key staff from various Groups. These individuals, in their areas of expertise had helped contribute towards the overall success of the Bank. Earlier this year, a ceremony was also held to honor such staff members. Key contributors from WBG and Overseas who were recognized through this award include the following staff members: Valeed Basit Saleemi, SVP, Division Head, Trade Products Division Valeed holds a Masters degree in Business Administration and Economics and has been associated with the bank since 1995. He was posted in his current role in 2012. He has done well with managing the Group’s trade portfolio and has remained a consistent high performer who relishes work and challenges. MCB is lucky to have him on board! Hassan Ali, AVP Relationship Manager, Corporate Islamabad Hassan holds a Masters degree in Business Administration and has been associated with the bank since 2008. He has been an asset to the WBG team and has shown a high level of dedication. Hassan has provided valuable contribution in all areas, while going over and above his job descript ion to help augment customer relationships. Sumedha Alahakoon Regional Manager, MCB Sri Lanka Sumedha has been associated with the bank since 2006. He is presently holding the position of Regional Manager with branches in Pettah, Maradana and Kandy assigned to him. He has been recognized for his effective management skills and over achieving the annual targets assigned for his region. Rifad Riyal Unit Head – Islamic Banking (Colombo Region), MCB Sri Lanka Rifad joined the bank in 2006. He has been instrumental in developing and promoting Islamic Banking Unit is Sri Lanka. At present he is managing the Islamic Banking Units established in Wellawatte and Kollupitiya. He has been recognized for his consistent performance and over achievement of his annual targets. The Wholesale Banking Group (WBG) is successful because of the positive contribution of all staff members in Pakistan and in our overseas offices. The corporate teams managed to touch an all-time high number for corporate advances of Rs. 200 Billion in June 2014. Investment Banking has successfully closed 6 syndicated transactions worth over Rs. 17 Billion covering telecom, sugar, paper & pulp, food processing and chemicals sectors in HY2014. The bank successfully participated in the 3G/4G auction that concluded in May 2014, where Mobilink was awarded a 3G 10MHz License at USD 301 Million and Ufone managed to bag a 3G 5MHz at USD 147.5 Million. The Transaction Banking Division (TBD) has launched PayDirect, a web based payment solution designed to support diverse payment requirements of corporate customers and large business entities. With PayDirect customers will be able to print Corporate Cheques and transfer payments to multiple accounts within MCB Bank network and to networks of other banks through IBFT facility. After successful commencement of the service, Transaction Banking added Pakistan Mercantile Exchange to its foray of PayDirect payment clients. Burqraftaar Toofan enables non-resident Pakistanis to send money to Pakistan quickly, easily and conveniently. A marketing campaign was conducted in February 2014 and the overall performance of the branches with the support of RBG management was commendable as their combined efforts have resulted in higher income for the bank, boost in customer confidence and an increase in the number of walk-in customers at our branches thereby resulting in an increased potential customers. >> 15 | LIFE @ MCB

- 10. Group Highlights Celebrating a presence of 20 years in Sri Lanka, MCB Bank marks its successful journey this year with the opening of the newest branch in Kollupitiya, as part of the Bank’s strategy to be close to its customers and to serve them with an array of qualitative and efficient banking services. The opening ceremony was graced by the Chief Minister of Western Province Hon. Prasanna Ranatunga, Deputy Governor of Central Bank of Sri Lanka Mr. Ananda Silva and many other distinguished guests. With the opening of Kollupitiya Branch, the Bank now has a total of eight branches in Sri Lanka and continues to strengthen its presence in the country. To encourage "Green Projects", MCB Sri Lanka has agreed to finance LKR 284Mn out of the full project cost which is estimated at LKR 440Mn. This facility is structured under a Diminishing Musharakah. It is expected to supply 5.7GWh of environmental friendly electricity to the national grid. MCB Bahrain partly sponsored 1st ever “Pakistan-Bahrain Investment Conference” organized by the Embassy and patronized by the Ministry of Industry and Commerce of Bahrain aimed at bringing foreign investment to Pakistan and promoting trade and economic ties between the two countries. Minister for Industry and Commerce of Bahrain, Dr. Hassan Fakhro, and Pakistan Prime Ministerial Special Assistant, Mr. Musadiq Malik, were among the dignitaries and speakers at the conference. On the eve of “National Day of Pakistan”, a ‘Fashion Show’ was organized, followed by a dinner reception which was organized by the Embassy of Pakistan in Bahrain to celebrate the occasion and to promote the soft image of Pakistan. The event was attended by ambassadors and dignitaries from various countries. MCB Sri Lanka MCB Bahrain Overseas operations in Sri Lanka, Bahrain and Dubai Representative Offices have delivered good performance in their respective niches as well. Chief Minister of Western Province Hon. Prasanna Ranatunga opening the newest MCB branch at Kollupitiya Business Head-MCB Bahrain with the Ambassador of Pakistan Mr. Jauhar Saleem and other dignitaries at the Investment Conference • 17 | LIFE @ MCB

- 11. Compliance & Controls Group Group Highlights In line with Management’s endeavor to make MCB the most compliant bank, Compliance & Controls Group (CCG) a well-integrated & robust framework; identifies, manages & monitors all potential risks that could lead to breach of laws & regulations. Since 2011, CCG has taken various measures to inculcate a strong compliance culture. by Danish Iqbal • The Bank has implemented Name Filtering systems, HOTSCAN & World-Check, to strengthen Customer Due Diligence (CDD) & Enhanced Due Diligence (EDD) process. • To be well-equipped with all the challenges and to support the business promptly CCG is in the process of developing an e-Digital Library which will provide access to all internal circulars issued by the bank along with all circulars issued by SBP, FMU & SECP and other multimedia with just a click to all users. • The AML function is committed to the highest standards of AML/CFT compliance and requires management and employees to adhere to these standards in order to prevent use of bank’s channels, products & services for money laundering and terrorist financing. With a view to bring automation into compliance monitoring and to inculcate proactive risk assessment culture, MANTAS, a transaction monitoring system is in place which generates alerts based on predefined thresholds & rules. It monitors out of pattern transactions to detect possible Money Laundering activities. • For strengthening KYC practices, the Bank has had an agreement with Bankers Accuitytm which is acclaimed industry-wide for its advance features and database, giving access to the most comprehensive data on PEPs & sanctioned individuals. • The Internal Control function promotes higher standards of control through implementation of internationally accepted COSO framework. The Bank's Risk & Control Self-Assessment (RCSA) framework is effectively functioning for ensuring ongoing operating effectiveness of key controls. • CCG in coordination with Human Resource Management Group initiated a specialized program under “Certified Branch Managers (CBM)” & “Certified Branch Operation Managers (CBOM)”. Further, comprehensive training programs on compliance and controls were also developed and implemented for field staff. • The Bank has the honor to introduce a state of the art web based CKAS (Compliance Knowledge Assessment System) testing system; in order to enhance Compliance and Controls awareness, Compliance knowledge testing through CKAS was managed and conducted for all permanent employees. • CCG participates in the SBP inspection process pro-actively along with other groups to address the pre inspection issues highlighted by SBP team, the outcome of which is the reduction of 50% gross penalty (2006 - 2010 penalty trend analysis). • The Risk Management Team planning ahead. The team working intensely to stay a step ahead of everything.The CCG team >> by Musharraf Iftikhar The core support of an organization. Risk Management The operational risk awareness were facilitated at Staff College Lahore, Multan, Karachi and Islamabad. Risk Management supports a business unit which includes recognition of risk, risk assessment, developing strategies to manage and mitigate risk using various skills, resources or techniques. Effective risk management is the cornerstone of Risk Management Group’s (RMG) philosophy, which is aimed at adding value through optimization of risk and return. MCB has created a risk culture based on modern techniques that allows risk management and business units to increase shareholder value through a better understanding of the Bank and its customers. Functions of RMG at MCB are Credit Review, Market Risk, Operational Risk, Compliance, Portfolio Management, Credit Policy and Credit Risk Control. RMG applies a structured and disciplined approach to manage risks. CRCD has played pivotal role in upgrading and implementing the core banking system (CBS v8.5). In Go-Live ambit CBS v8.5, CRCD, in addition to its existing centrally administered credit risk control function, has also assumed responsibility of centralized facility capturing & limit control in Customer Lending (CL) and Limit Control (LM) Modules on pan Pakistan basis for all RBG (Commercial) & WBG branches. The period under review also includes: • Efficient relocation of CRCD-North Lahore office from ‘MCB House’to new building titled as ‘MCB Centre’in March 2014 with no downtime in supportservicesfortheBusinessGroups. • Takeover of accounts of exposure Rs.10M is in process after having successfully achieved all previous centralized targets set by the management whereby 100% portfolio has been taken over by CRCD for WBG, Consumer (SPL, PG, BS, Auto Loans), Staff Finances and RBG (Commercial) 97% approximately." 19 | LIFE @ MCB

- 12. >> MRMD is a risk management function that works in close partnership with the business segments to identify and monitor the market and the counterparty risks throughout the Bank and to define market risk policies and procedures. The CRMD consists of the following departments, Basel II & Financial Control, Credit Policy (CPD), Portfolio Management (PM) and Credit Risk Reporting and Systems (CRRS). During the last quarter, CRRS developed an in-house behavior model to comply with SBP instructions/guidelines. This model calculates the behavior scorecards and assigns rating. They also started preparing a presentation to cover the credit portion for RMPRC forum through CRMIS system to save time and improve the quality of work. This was followed by starting work on preparation of CRMIS vs GL variance in the head of Markup Recoverable. This exercise will help in identification of the reasons for such variance. Moreover, CRRS successfully reported the eCIB data of New Personal Loan in the absence of ITG provided system dumps to avoid any State Bank of Pakistan (SBP) penalty. CPD has been actively involved in development of Policy Framework for Bank’s proposed international initiatives. The department is providing support for formulation of Risk and Policy Framework in close liaison with SPIG team to help them succeed in various international and strategic operations. CPD had also extended their full support in processing and implementing amendments/changes in credit processing and credit authority related matters that arose as a result of organizational changes which ensured smooth transition. Further, Credit Portfolio function shall now operate under the umbrella of CPD with a more focused approach towards an effective Portfolio Management. Successfully managed regular data gathering exercise for corporate, commercial customers, required for PD modeling as part of Basel II credit risk implementation project. After a thorough analysis; CRMD presented annual review for 2013 in January 2014 to the senior management. The key findings are: • Major internal frauds include misappropriation in a customer’s funds, fraudulent encashment of TDR and utilization of funds through the issuance of a cheque book on MF-80R, fraud in customer’s funds through flying entries. System generated receipts can effectively mitigate such risks. However, some critical issues such as non-ticking of posting sheets, password theft/sharing, lack of vigilance by peers/supervisors and non-balancing of General Ledger (GL) Heads still pose major risks. Therefore, line management needs to be more vigilant on this count as well. • Customer complaints remain a major source of detection for internal frauds along with involvement of officers and BM and cashiers remained high. Increased awareness is required for more effective utilization of preventive and detective controls. The line management needs to re-assess operative/design effectiveness of preventive/detective controls for risk mitigation and the proactive identification of such incidents. • KRIs like password sharing, non-ticking of daily posting sheets, non-balancing of GL heads, issues in activation of dormant accounts, violations of cheque book issuance procedures, issues relating to ATM balancing/card management, unauthorized disbursement of loans, lack of proper monitoring of pledge sites are the high risk areas and should have zero tolerance for line management. Historically, these KRIs have been translated into operational losses either in form of frauds or regulatory penalties • ATM down time around 10.33% is showing a slight improvement from 10.68% for 2012. The main reasons for down time are power crisis and connectivity issues i.e. command not established. • Customer Complaints referred by SBP remained the highest among critical logins. Further, on average 77% complaints were resolved out of which 43% were resolved within TAT (3 working days) vs 50% for year 2012. Complaint resolution within TAT needs further improvement to avoid regulatory and reputational risk. • Through effective monitoring of negative balances reports. Ops Risk successfully recovered/settled Rs.253m in 320 accounts owing to unauthorized overdrafts due to various reasons. • Five sessions of operational risk awareness were facilitated at Staff College Lahore, Multan, Karachi & Islamabad for front line officers /managers and new batches of General Banking Officer. • All compliance related matters including SBP Inspection, IRAF, Internal and External Audits were effectively handled and no instance was outstanding at year end. Credit Risk Review is segregated at three different geographical places at South, Central and North. Credit Review function ensures that lending practice remains compliant to approved policies and procedures. The divisions conduct an independent loan review and perform credit analysis. Major aim is to supplement business’efforts towards fresh name booking and deepening existing relationships through speedy and appropriate credit reviews. Year 2014 has brought in various new challenges with the handing over of EPZ,SAMG and corporate south to CRD-South, CRD-N and CRD-Central respectively. Management of TAT, despite being low on HR (due to attrition) is one of our biggest achievement. Successful BCP and RCSA runs have confirmed our focus on quality output. Credit Review function ensures that the lending practice remains compliant to approved policies and procedures. •

- 13. First of all we would like to share that during 2013, SAMG surpassed all previous records of recovery by achieving highest ever figure of Rs.1.502 billion and maintained its average recovery yield at 19%. The Group has not only exhibited a consistent run-rate in recovery across the period, but has also extended its recovery base, in terms of number of settlements/cases, by 23% over 2012. On Consumer NPLs side, substantial improvement in recovery has been witnessed and a growth of 56% over 2012 has been registered (i.e. Rs.335M vs.Rs.215M). Nonetheless, massive recovery in loss classified portfolio uplifted bank's profitability by way of reversal of provisions and resultantly bank has sustained its industry position with improved asset quality & earning per share (EPS) in 2013. This performance of Recovery Units of SAMG has also been accredited by financial analysts in the National Press on various occasions, this is of course, a matter of pride for all of us. On the compliance side, with bank's policies/procedures, SAMG has extensively improved its Internal Audit Rating and four SAMG Units out of seven have been awarded highest Audit Rating for the year 2013 i.e. "A Category". As regards to 2014, SAMG has once again achieved a milestone of Rs.1.000 billion consecutively for the seventh time. Notwithstanding the fact that 2014 carried more challenges on account of higher political certainty, strained economy together with destructive floods. Despite all these challenges, our efforts were focused on surpassing last year’s performance. The strength of SAMG is not only about the numbers being achieved in a year – it is also about the foundation SAMG has built for the future. Building on current human resource and infrastructure base, the underlying philosophy of "Innovative Pro-Activism" will further be entrenched into the mindset of SAMG's workforce, which will positively contribute towards the achievement of organizational goals in times to come. SAMG’s strength is not only about the numbers being achieved in a year – but also about the foundation they built for the future. by Khalid Ishaq Discover the milestones set by SAMG! Special Assets Management Group • Audit & RAR Group 2014 & Beyond Unleashing Creativity: We begin with the initiative that served the purpose as the foundation for the entire creativity process. It is nothing but the universal truth that ideas can be generated at any level – irrespective of the cadre or functional title. Bearing this truth in mind we, at Audit & RAR Group, introduced a platform to our team members where everyone could share their ideas and thoughts. A dedicated email account was created with the help of ITG, which is accessible to all. The email account is personally supervised by the senior management within Audit & RAR Group, who meet periodically to discuss various ideas that are received from all across the Group. These ideas have one thing in common i.e. their implementation will lead to the amelioration of the efficiency and effectiveness of the operations carried out within the Audit Group. Focusing On What Is Important: One of the prime challenges for an audit function is to keep its focus on the areas that are important either from regulatory or an operational perspective. In view of this challenge we, at Audit Group, have been shifting our focus on different areas in the past. Most recent example in this regard is the enhanced focus of Audit Group on the Anti-Money Laundering / Combating the Financing of Terrorism (AML/CFT). AML/CFT has also been the focus of the SBP over the past few years. In 2014, we have increased the weightage of findings that will be highlighted at the branches in this specific area. Not only has the weightage been augmented, but we shall also be displaying the audit rating of AML/CFT of a branch separately in its audit report. This initiative will help the Bank in maintaining constant focus on this significant area that has a great deal of room for improvement. A Colorful Initiative: Limited Scope Reviews commonly known as LSRs are conducted for around 300+ branches each year. These reviews serve as a litmus test for us and each review gives us an instant snapshot of some of the controls operating within the branch. Historically, no indicative rating was assigned to the LSRs. At times the absence of an indicative rating would result in overlooking of the LSR results. With a decision to overcome this issue, the think tank of the Audit Group came up with an idea to assign an indicative rating to the LSR results. Consequently, an interesting score based mechanism was developed. The reason I am referring to this mechanism as an interesting one is based on the fact that the indicative rating is assigned through use of colors comprising of Blue, Green, Yellow and Red. Next time when you pick up an LSR report I am sure that a mere glance at it would reveal the status of branch’s performance in the LSR it recently had. And the Journey Continues…. What you have just read is a glimpse of the initiatives that we have taken at Audit Group during 2014. Hopefully, there is a lot more to come. A journey of a thousand miles begins with a single step. We, at Audit Group, humbly believe that with each passing day we continue to take these little steps that bring us closer to our destination i.e. to become an exemplary assurance and advisory function. 05 | LIFE @ MCB by Mohammad Farooq Wassi The Road Doesn’t End Where it Bends- if You Don’t Fail to Take the Right Turn. Heraclitus, the famous Greek Philosopher, once said, “Noting Endures but Change”. Change depicts movement, it depicts life. Change is an important element in the creativity process. This Edition’s write up will highlight some of the initiatives that Audit & RAR Group took during 2014. Needless to mention that these initiatives were only possible because we had challenged the status quo. Group Highlights •

- 14. Financial Control Group endeavors a key role in bank’s financial discipline. “Nothing builds self-esteem and self-confidence like accomplishment.” - Thomas Carlyle. >> Financial Control Group (FCG) endeavors a key role in bank’s financial discipline. While ensuring that all transactions reflect international accounting patterns, FCG is responsible to present the success and growth of MCB Bank Limited in numeric order. This proficiency is achieved through all applicable accounting principles and procedures from the regulators, thus harmonizing the bank with globally acceptable standards and practices. FCG has developed a comprehensive approach to cater all financial/regulatory/budgetary challenges of the bank, therefore, separate desks/units have been formed to address the needs with greater focus. At present, five separate units have been formed as under: Financial Reporting & Investor Relations Unit: Financial Reporting Unit, being a pivotal player, prepares the periodical accounts/financial statements/and apprise the Management with various reporting on the Bank’s performance and peer group trends. The unit monitors and evaluates all accounting practices in the bank and is responsible all internal/external audits of financial statements. The keen interest of the stakeholders in MCB’s performance is indicative of the fact that, the investor relation wing has been functional in promoting the bank as a potential investment opportunity. For this purpose, the unit frequently conducts one to one session with the potential investors and attends international road shows to brief the financial performance and future outlook of the Bank. Central MIS Unit: Under the pretext of increasing regulatory and business operational needs, with regards to information that is coupled with technological advancements, it became imperative for a dynamic and growing organization such as MCB Bank Limited to manage its information effectively and efficiently. With effect from October 2009, MCB Bank Limited decided to manage its MIS engines through a centralized mechanism, Central MIS Unit that aims to reduce unnecessary dependencies on operational staff for provision of information, in effect reducing respective TAT and create uniform information definitions for availability of accurate data. The Central MIS Unit is structured to take care of business, operational and regulatory information requirements of internal and external customers of MCB Bank Limited in a timely and efficient manner. MIS reports/data are being shared with the users across the Bank on variable and fixed periods as per user needs. For this purpose CMIS have two reporting engines, Oracle GL (OGL) and or Knowledge Manager (KM). Taxation & Branch Support Unit: The Taxation & Branch Support Unit takes care of all tax related matters, arising in the branches/offices, along with significant and periodical reporting to Federal Board of Revenue and Provincial Revenue bodies. The Unit is responsible for implementing all related tax laws within the organization, which is in close liaison with tax officials/advisors. Tax planning & strategy are other notable features of this unit. The Branch Support part of this unit covers the issues related to Schedule of Bank Charges on bi-annual basis and issuance of profit rates (both declared & provisional) for local & foreign currencies. Budgeting & Planning Unit: Budgeting in present age is an important tool to forecast the financial patterns in different layers of the bank. This Unit works with specific expertise to update & apprise the management of the budgetary trends in all financial/non- financial spheres. The Unit also assists in formulating the Bank’s performance on a near to accurate basis. This involves an in depth statistical analysis on Bank’s numbers on all accounts, on historical basis, along with various comparisons and analysis in wake of overall economic position of the country. The monthly reviews of Business & Support Functions also enable the management to strategize and evaluate the performance of various sectors in line with budgetary estimates. Regulatory Reporting & Branch Licensing Unit: State Bank of Pakistan, being the central bank of the country, desires reporting requirement to be fulfilled on different intervals on a regular basis. The huge quantum of reports with regular frequencies and the stringent deadlines marks the responsibilities handled by this Unit, to be more challenging. The Unit also takes care of branch licensing issues of the Bank, which necessitate strong liaison with the State Bank and addressing reporting requirements. Branch Licensing is also responsible for opening, closing, temporary shut downs and all related issues of branches. It also maintains integral information of the entire network. Internal Control Unit: Diversified nature of above assignments necessitates more efficient and dynamic controls to be established to monitor the performance of each & every desk. However, the processes hand should be aligned and synchronized with prevailing practices and policies. Consequently, the need for an Internal Control Unit arises to effectively execute the above jobs. Internal Control Unit under direct supervision of CFO, is responsible to ensure that all Units are performing their duties as per defined practices. In addition to the aforementioned, FCG also assists the management in many other roles like, purchase committee, property evaluation and many other day to day matters. FCG also contributes key roles in management decisions, operational support and audit/SBP related issues. The work performed at FCG has become more challenging with strict statutory deadlines, interaction with the audit and inspection teams. Being the owners of the financial numbers, quality of information generated and presented to the stakeholders is definitely a key element. Team members at FCG have always ensured compliance with the challenging deadlines which sometimes comes at the cost of working very long hours. As per practice, the challenges in terms of finalization of annual accounts, timely printing of annual financial statements and addressing shareholders at the AGM, have been successfully met. Voluntary disclosures have been made in the financial statements, therefore managing to retain Best Corporate Report Award for consecutive two years. On a concluding note, year 2014 has brought significant operational challenges which were duly countered through dedication, teamwork and motivation with the commitment to deliver on similar lines and moving forward. organization, which is in close liaison with tax officials/advisors. Tax planning & strategy are other notable features of this unit. The Branch Support part of this unit covers the issues related to Schedule of Bank Charges on bi-annual basis and issuance of profit rates (both declared & provisional) for local & foreign currencies. Budgeting & Planning Unit: Budgeting in present age is an important tool to forecast the financial patterns in different layers of the bank. This Unit works with specific expertise to update & apprise the management of the budgetary trends in all financial/non- financial spheres. The Unit also assists in formulating the Bank’s performance on a near to accurate basis. This involves an in depth statistical analysis on Bank’s numbers on all accounts, on historical basis, along with various comparisons and analysis in wake of overall economic position of the country. The monthly reviews of Business & Support Functions also enable the management to strategize and evaluate the performance of various sectors in line with budgetary estimates. Regulatory Reporting & Branch Licensing Unit: State Bank of Pakistan, being the central bank of the country, desires reporting requirement to be fulfilled on different intervals on a regular basis. The huge quantum of reports with regular frequencies and the stringent deadlines marks the responsibilities handled by this Unit, to be more challenging. The Unit also takes care of branch licensing issues of the Bank, which necessitate strong liaison with the State Bank and addressing reporting requirements. Branch Licensing is also responsible for opening, closing, temporary shut downs and all related issues of branches. It also maintains integral information of the entire network. Internal Control Unit: Diversified nature of above assignments necessitates more efficient and dynamic controls to be established to monitor the performance of each & every desk. However, the processes hand should be aligned and synchronized with prevailing practices and policies. Consequently, the need for an Internal Control Unit arises to effectively execute the above jobs. Internal Control Unit under direct supervision of CFO, is responsible to ensure that all Units are performing their duties as per defined practices. In addition to the aforementioned, FCG also assists the management in many other roles like, purchase committee, property evaluation and many other day to day matters. FCG also contributes key roles in management decisions, operational support and audit/SBP related issues. The work performed at FCG has become more challenging with strict statutory deadlines, interaction with the audit and inspection teams. Being the owners of the financial numbers, quality of information generated and presented to the stakeholders is definitely a key element. Team members at FCG have always ensured compliance with the challenging deadlines which sometimes comes at the cost of working very long hours. As per practice, the challenges in terms of finalization of annual accounts, timely printing of annual financial statements and addressing shareholders at the AGM, have been successfully met. Voluntary disclosures have been made in the financial statements, therefore managing to retain Best Corporate Report Award for consecutive two years. On a concluding note, year 2014 has brought significant operational challenges which were duly countered through dedication, teamwork and motivation with the commitment to deliver on similar lines and moving forward. Financial Control Group by Khurram Saeed “It’s all about discipline.” – The FCG’s Motto. 25 | LIFE @ MCB •

- 15. by Salman Ferozi, Mohsin Dar, Usman Shehzad Catch up on the IT Group’s fast developments Information Technology Group In this era of highly competitive economy, the success in every industry is reliant on innovative products and technology infrastructure to maintain the quality of service to its customers which has been demonstrated by MCB, which can be seen in the Bank’s slogan; Bank for Life From being a mere technology hub, the IT Group of the Bank has transformed itself into a facilitator in the Banks‘ economy and is being increasingly acknowledged as the most significant differentiating factor in the business‘s success. MCB Bank has gained its reputation not only from its substantial financial status but also from offering IT enabled quality services to its customers. ITG has been continuously supporting the business to always stay ahead in the industry through customer centric approach. Information Technology Group (ITG) of MCB Bank Limited. The same is expertly driven by a team of committed professionals, providing innovative and efficient solutions to achieve and nurture strategic objectives and goals of business as well as other support groups under the guidance of robust governance model of IT Steering Committee. The IT Board Committee and collective wisdom were used to serve the internal as well external customers of the Bank. In pursuant to ITG’s Vision & Mission, the following are of paramount focus in 2014 duly complimented by vigorous IT Strategy flexible enough to adapt the changing organizational priorities and business goals. • Strengthening Management & Governance Structure; • IT Infrastructure & Operations, Solutions & Services; • Centralization of Technology investment & Software Development; • Information Security; • Business Continuity & Information Systems Disaster Recovery; • Underlying Policies & Procedures to ensure adequacy and effectiveness of IT Delivery. Amplification of Successful Telepresence Experience: In year 2010, MCB Bank acquired revolutionary immersive technology for video conferencing launched by CISCO, CISCO Telepresence Solution. To fulfil continuous need of point-to-point meetings on video conferencing infrastructure between cross functional teams from different groups stationed in distant cities, the Bank needed a technology that could gather its dispersed audience into one conferencing facility, which led to the decision of acquiring the latest and upgraded point-to-multipoint video conferencing solution, inclusive of expansion in Telepresence infrastructure at domestic and international offices of the Bank. Today, all Video Conferencing equipment can be connected with each other as well as with the Telepresence and Vice Versa. MCB has revitalized its Enterprise Data Network, in order to: • Establish Two site redundant model Lahore (Primary) and Karachi (DR). • Standardize the network infrastructure to minimize the operational expenditure. • Achieve State-of-the-art 10 Gigabit network infrastructure backbone in Data Centre; which provides robust and high availability to all business critical applications and servers. • Provide secure and reliable network infrastructure in Data Centres and at internet gateway level by implementing state-of-the-art security appliances with highest data encryption and throughput. • Provide fully redundant secure network infrastructure. • Enhance Network Capacity in core routers and switches to cater current as well as new requirements. Amplification of Successful Telepresence Experience: In year 2010, MCB Bank acquired revolutionary immersive technology for video conferencing launched by CISCO, CISCO Telepresence Solution. To fulfil continuous need of point-to-point meetings on video conferencing infrastructure between cross functional teams from different groups stationed in distant cities, the Bank needed a technology that could gather its dispersed audience into one conferencing facility, which led to the decision of acquiring the latest and upgraded point-to-multipoint video conferencing solution, inclusive of expansion in Telepresence infrastructure at domestic and international offices of the Bank. Today, all Video Conferencing equipment can be connected with each other as well as with the Telepresence and Vice Versa. MCB has revitalized its Enterprise Data Network, in order to: • Establish Two site redundant model Lahore (Primary) and Karachi (DR). • Standardize the network infrastructure to minimize the operational expenditure. • Achieve State-of-the-art 10 Gigabit network infrastructure backbone in Data Centre; which provides robust and high availability to all business critical applications and servers. • Provide secure and reliable network infrastructure in Data Centres and at internet gateway level by implementing state-of-the-art security appliances with highest data encryption and throughput. • Provide fully redundant secure network infrastructure. • Enhance Network Capacity in core routers and switches to cater current as well as new requirements. • Finalization of Short Term IT Strategy (STS) FY2014 by aligning ITG’s roadmap with Business’s deliverables. • IPPhone Locking Phase-II (Implementation of security controls over IPPhones). • Conversion of legacy application platform (Conversion of Switch Claim DB fromAccess to MS SQLServer). • Integration of RTGS system with CBS & Treasury System. (NOT COMPLETED as per my knowledge). • Revamp of existing internet banking: Oracle FlexCube Direct Banking. • ESB (Standard Middleware) – Expansion in Integration of business applications with ESB Layer with an objective to achieve optimum utilization of standard middleware. • Fee Charging Mechanism on MCB SMSAlerts facility on CBS Transactions. • Automation: ElectronicAccount Opening Form (Roll out to branches). • IPPhone Installation at 400A-Grade Branches. • Revamp of Internet/Email Gateway Solution. • BancassuranceApplication System. • IBAN Phase 2 (IBAN implementation in SSO). • TATApplication: Developed to cover the business needs of tracking/monitoring of different financing facilities. • Reward Point Management System. • Development of Warehouse Management System for identification, tracking and maintenance of ITAssets. • Review,Approval and Implementation of ‘Information Technology Policy’. • Review,Approval and Implementation of ‘Information Systems Disaster Recovery Plan 2014’ • Finalization of Short Term IT Strategy (STS) FY2014 by aligning ITG’s roadmap with Business’s deliverables. • IPPhone Locking Phase-II (Implementation of security controls over IPPhones). • Conversion of legacy application platform (Conversion of Switch Claim DB fromAccess to MS SQLServer). • Integration of RTGS system with CBS & Treasury System. (NOT COMPLETED as per my knowledge). • Revamp of existing internet banking: Oracle FlexCube Direct Banking. • ESB (Standard Middleware) – Expansion in Integration of business applications with ESB Layer with an objective to achieve optimum utilization of standard middleware. • Fee Charging Mechanism on MCB SMSAlerts facility on CBS Transactions. • Automation: ElectronicAccount Opening Form (Roll out to branches). • IPPhone Installation at 400A-Grade Branches. • Revamp of Internet/Email Gateway Solution. • BancassuranceApplication System. • IBAN Phase 2 (IBAN implementation in SSO). • TATApplication: Developed to cover the business needs of tracking/monitoring of different financing facilities. • Reward Point Management System. • Development of Warehouse Management System for identification, tracking and maintenance of ITAssets. • Review,Approval and Implementation of ‘Information Technology Policy’. • Review,Approval and Implementation of ‘Information Systems Disaster Recovery Plan 2014’ Group Highlights ITG empowered the delivery of the Upgraded Core Banking System, which includes: MCB has revamped its Corporate Website • IBM Power 780 Racks Upgrade. • Induction of best of the breed IBM PureFlex Servers (Compute Nodes). • Necessary Development in TPM & Integration of mission critical application in surround with CBS Ambit v8.5. • Migration of Oracle IAS to Oracle WebLogic. • Ensuring to run upgraded version of CBS to smoothly by addressing post go-live issues on war footing by carrying out successful performance tuning of Database layer, OS layer and Application Container Layer. • Acquisition of Enterprise License of Oracle-FCUB, Oracle- FCDB & Oracle-FCCM for World Wide use taking into account MCB Bank’s overseas expansion projects. MCB has revamped its Corporate Website • IBM Power 780 Racks Upgrade. • Induction of best of the breed IBM PureFlex Servers (Compute Nodes). • Necessary Development in TPM & Integration of mission critical application in surround with CBS Ambit v8.5. • Migration of Oracle IAS to Oracle WebLogic. • Ensuring to run upgraded version of CBS to smoothly by addressing post go-live issues on war footing by carrying out successful performance tuning of Database layer, OS layer and Application Container Layer. • Acquisition of Enterprise License of Oracle-FCUB, Oracle- FCDB & Oracle-FCCM for World Wide use taking into account MCB Bank’s overseas expansion projects. Other Accomplishments during Q1 and Q2 2014 include: Priorities and Business Goals. >>

- 16. In order to be able to meet customer demands, the IT Group is determined to follow a prudent asset procurement plan to invest in technology. • State of the art Data Center Severs Technology (IBM Power 780) and SRDF based EMC VMAX Storage with Zero Data Loss & replication in Synchronous mode; • Microsoft Compliant Bank: By adopting Microsoft collaboration and business productivity MCB Bank has enhanced the efficiency of its staff to provide services to its customers by 30 percent and maintain its technological edge in banking sector; • The deployment of latest technology infrastructure to strengthen Bank’s enterprise data network that includes the first ever implementation of Juniper’s Micro Q-Fabric equipment in Pakistan; • First ever deployment of IBM PureFlex engineered solution in the financial industry in Pakistan; • Pioneer in implementation of SBDC cloud environment for 1,000 nodes the financial sector in Pakitan; • Implementation of ORACLE FlexCube Direct Banking as Internet Banking Solution for the Bank is a trend setting initiative with delivery in a record time; • Multisite connectivity for CISCO TelePresence and Video Conferencing Solution as a unique initiative by the Bank; • Upgrade of Technology Stack for Core Banking System and other critical Business Applications; • Enhanced, secured and organized nationwide Dual Communication Media in 100% branches network and Campuses; • ECM (Electronic Content Management) based Email and File Archiving solution to ensure compliance with Regulator’s instructions; • The first Oracle Compliant Bank in Pakistan; • One of the Largest footprint of ATMs in Pakistan; • State of the art Data Center Severs Technology (IBM Power 780) and SRDF based EMC VMAX Storage with Zero Data Loss & replication in Synchronous mode; • Microsoft Compliant Bank: By adopting Microsoft collaboration and business productivity MCB Bank has enhanced the efficiency of its staff to provide services to its customers by 30 percent and maintain its technological edge in banking sector; • The deployment of latest technology infrastructure to strengthen Bank’s enterprise data network that includes the first ever implementation of Juniper’s Micro Q-Fabric equipment in Pakistan; • First ever deployment of IBM PureFlex engineered solution in the financial industry in Pakistan; • Pioneer in implementation of SBDC cloud environment for 1,000 nodes the financial sector in Pakitan; • Implementation of ORACLE FlexCube Direct Banking as Internet Banking Solution for the Bank is a trend setting initiative with delivery in a record time; • Multisite connectivity for CISCO TelePresence and Video Conferencing Solution as a unique initiative by the Bank; • Upgrade of Technology Stack for Core Banking System and other critical Business Applications; • Enhanced, secured and organized nationwide Dual Communication Media in 100% branches network and Campuses; • ECM (Electronic Content Management) based Email and File Archiving solution to ensure compliance with Regulator’s instructions; • The first Oracle Compliant Bank in Pakistan; • One of the Largest footprint of ATMs in Pakistan; The Bank has recognized & demonstrated the competitive advantages inherent in IT and has rapidly increased business levels and profitability by being the First Mover in the following segments: The Bank has recognized & demonstrated the competitive advantages inherent in IT and has rapidly increased business levels and profitability by being the First Mover in the following segments: • Data Center secondary site revamp into In-House BCRS facility. • Internet Segment Upgrade. • Upgrade of Branch end network equipment. • Expansion of Telepresence solution. • Implementation of Security Operation Center (SOC). • Acquisition and Deployment of “Derivative” solution. • Feasibility study for “Workflow management solution” and “Project Management solution”. • DR drill of critical applications. • Deployment of Oracle FCCM for AML case management & “Know your customer” (KYC). • Acquisition/Development and implementation of Core banking system (CBS) at Bahrain, Dubai, Ireland & other international operations. • Integration of CRM with Core banking system (CBS): • Improvement in customer experience. • Integration of Euronet CMS with Avanza Unison-II (RDV) to manage additional IDs for call center agents • Technology Infrastructure readiness for Banking Subsidiary in Dubai. • Technology Infrastructure readiness for New Islamic Bank • Migration of Static Data Management role to SDM division • CRM roll out to Branches. • Operation Risk solution (In-House development) • Automation of STR (Suspicious Transaction Reporting) • Upgradation of Core Technology Infrastructure (Power 780 & EMC Storage). • Data Center secondary site revamp into In-House BCRS facility. • Internet Segment Upgrade. • Upgrade of Branch end network equipment. • Expansion of Telepresence solution. • Implementation of Security Operation Center (SOC). • Acquisition and Deployment of “Derivative” solution. • Feasibility study for “Workflow management solution” and “Project Management solution”. • DR drill of critical applications. • Deployment of Oracle FCCM for AML case management & “Know your customer” (KYC). • Acquisition/Development and implementation of Core banking system (CBS) at Bahrain, Dubai, Ireland & other international operations. • Integration of CRM with Core banking system (CBS): • Improvement in customer experience. • Integration of Euronet CMS with Avanza Unison-II (RDV) to manage additional IDs for call center agents • Technology Infrastructure readiness for Banking Subsidiary in Dubai. • Technology Infrastructure readiness for New Islamic Bank • Migration of Static Data Management role to SDM division • CRM roll out to Branches. • Operation Risk solution (In-House development) • Automation of STR (Suspicious Transaction Reporting) • Upgradation of Core Technology Infrastructure (Power 780 & EMC Storage). All along, it must be remembered that IT is not an end in itself, but acquired and deployed to serve business requirements efficiently. IT strategies (LTS & STS) have been sewn into the fabric of the bank’s vision and business strategy. In order to be able to meet customer demands, IT Group is determined to follow a prudent asset procurement plan to invest in technology, upgrade technology infrastructure and deploy new technology solutions: All along, it must be remembered that IT is not an end in itself, but acquired and deployed to serve business requirements efficiently. IT strategies (LTS & STS) have been sewn into the fabric of the bank’s vision and business strategy. In order to be able to meet customer demands, IT Group is determined to follow a prudent asset procurement plan to invest in technology, upgrade technology infrastructure and deploy new technology solutions: Market Leader and Trend Setter: Looking Forward 2015: Both Revolution & Evolution: • Group Highlights Review of Islamic Banking Product Manuals: In order to comply with regulatory requirements and keeping abreast of latest changes in Islamic Banking (IB) market, the following IB products were reviewed and approved from competent approving authority. • Diminishing Musharka (Equipment). • Sharia Complaint Bank Guarantee. • Murabaha. • Salamat Car Ijarah. Activities of Credit Department: Owing to timely and justified contests along with evidences against SBPAudit objections, IBG has succeeded to bring the “IBG’s Specific” annexures at Zero in the year 2012. Hence, there will be no penal action due to absence of IBG’s annexures. Operational Excellence at IBG: • Branch Audit During the 2nd Quarter 2014, Internal Audit of nine Islamic Branches took place followed by successful issuance of reports. All these nine branches have been rated as Satisfactory. Thus, 100% results have been achieved by team IBG. • Service Quality Effective from January 2014, Islamic Branches have been taken up by Service Quality to evaluate service quality standards. Over all Service Quality Rating for Islamic Branches for the M/O April, May & June 2014 remained above 90% (A Category) showing implementation of high service quality standard and provision of required services to Islamic Customers. Participation in Conferences: • IBG participated in a “Global Forum on Islamic Finance (GFIF-2014)” organized by COMSATS Institute in March 2014. The theme of this conference was “Developments and the Way Forward”. • MCB - Islamic Banking Group, with the support of CCM, also participated in “CFO-Meeting Future Challenges” organized by ICAP on March 13th 2014. • MCB - Islamic Banking Group (IBG), also participated in “IFEC” The Third Islamic Finance Expo & Conference-2014, organized by Publicity Channel under the technical support of SBP and Riphah University along with ICMAP, Shaikh Zayed Islamic center, FPCCI & KCCI on 24th & 25th April 2014. Islamic Banking Group by Mubeen Akhtar and Haroon Siddiqui Shariah Compliant Banking Exellence. . 29 | LIFE @ MCB