Post office saving account for women and men

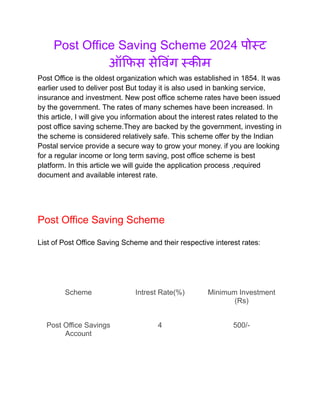

- 1. Post Office Saving Scheme 2024 पोस्ट ऑफिस सेविंग स्कीम Post Office is the oldest organization which was established in 1854. It was earlier used to deliver post But today it is also used in banking service, insurance and investment. New post office scheme rates have been issued by the government. The rates of many schemes have been increased. In this article, I will give you information about the interest rates related to the post office saving scheme.They are backed by the government, investing in the scheme is considered relatively safe. This scheme offer by the Indian Postal service provide a secure way to grow your money. if you are looking for a regular income or long term saving, post office scheme is best platform. In this article we will guide the application process ,required document and available interest rate. Post Office Saving Scheme List of Post Office Saving Scheme and their respective interest rates: Scheme Intrest Rate(%) Minimum Investment (Rs) Post Office Savings Account 4 500/-

- 2. National Savings Recurring Deposit Account 6.7 100 /- per month National Savings Time Deposit Account ( 1 year) 6.9 1000/- National Savings Time Deposit Account(2 year) 7.0 1000/- National Savings Time Deposit Account(3 year) 7.0 1000/- National Savings Time Deposit Account( 5 year) 7.5 1000/- National Savings Monthly Income Account 7.4 1000/- Senior Citizens Savings Scheme Account 8.2 1000/- Public Provident Fund Account 7.1 500/-

- 3. National Savings Certificates 7.7 1000/- Kisan Vikas Patra Account 7.5 1000/- Sukanya Samriddhi Account 8.2 250/- Post Office Saving Scheme in Brief: Post Office Savings Account It is a normal saving account. Individuals can open savings accounts with minimal documentation, making them accessible to a wide range of savers, including those in rural areas. National Savings Recurring Deposit Account The recurring deposit account is account in Indian banks and Post Office which helps people with regular incomes to deposit a fixed amount every month into their recurring deposit account and earn interest at the rate applicable to fixed deposits.

- 4. National Savings Time Deposit Account National Saving Time deposit is an interest-bearing bank account that has a pre-set date of maturity.Time deposits generally pay a slightly higher rate of interest than a regular savings account. The longer the time to maturity, the higher the interest payment will be. National Savings Monthly Income Account It is a highest earning scheme. It offers a guaranteed monthly income to investors. investor contribute a amount and earn a fixed interest every month. Senior Citizens Savings Scheme Account Senior Citizens Savings Scheme is very good scheme for senior citizens. The scheme offers a High internet rate on the deposit. The internet rate declared during the time of investment remain fixed throughout the maturity. Public Provident Fund Account PPF schemes facilitate long-term savings and retirement planning by offering tax-efficient investment options with attractive interest rates. These schemes have a lock-in period of 15 years, during which individuals can contribute regularly and accumulate substantial wealth over time. PPF accounts enjoy tax benefits under Section 80C of the Income Tax Act, making them popular among individuals seeking tax-saving opportunities.

- 5. National Savings Certificates National Saving schemes provide individuals with fixed-income investment options backed by the government. These certificates have a maturity period of five or ten years, offering competitive interest rates compounded annually. Kisan Vikas Patra Account KVP schemes target rural investors, particularly farmers, by providing them with an accessible and attractive savings option. These schemes offer fixed interest rates and have a lock-in period, encouraging long-term savings habits among rural communities. KVPs facilitate financial inclusion by extending savings opportunities to underserved populations, thereby fostering economic empowerment and resilience. Sukanya Samriddhi Account Sukanya Samriddhi Yojana (SSY) is a savings scheme launched back in 2015 as part of the Government initiative Beti Bachao, Beti Padhao campaign. This scheme enables guardians to open a savings account for their girl child. The maturity period of SSY is 21 years from the account opening or upon her marriage after attaining 18 years. Benefits of Post Office Saving Schemes: Accessibility: Post office saving schemes are widely accessible, with branches located across urban, semi-urban, and rural areas, ensuring inclusivity and convenience for savers from diverse backgrounds. Security: These schemes are government-backed, instilling confidence among investors regarding the safety and reliability of their deposits.

- 6. Competitive Interest Rates: Post office saving schemes offer competitive interest rates, providing investors with opportunities to earn stable returns on their savings. Tax Benefits: Certain schemes such as PPF and NSC offer tax benefits, enabling individuals to reduce their tax liabilities while building wealth for the future. Financial Inclusion: Post office saving schemes promote financial inclusion by catering to individuals from underserved communities, empowering them to participate in formal financial systems and secure their financial well-being. Considerations for Investors: Investment Objectives: Investors should assess their financial goals and risk tolerance to determine the most suitable post office saving scheme for their needs. Lock-in Period: Some schemes, such as PPF and NSC, have lock-in periods that restrict premature withdrawals. Investors should consider their liquidity needs before committing to long-term schemes. Interest Rate Risk: While post office saving schemes offer competitive interest rates, investors should remain vigilant about fluctuations in interest rates that may impact their returns over time. Tax Implications: Investors should familiarize themselves with the tax implications of different schemes, especially those offering tax benefits, to optimize their tax planning strategies. Inflation Considerations: Despite offering stable returns, post office saving schemes may be susceptible to inflation erosion over the long term. Investors should diversify their investment portfolio to mitigate inflation risk and preserve purchasing power.

- 7. Required Documents for Post Office Saving Scheme ● Application form ● KYC form ● Pan card, Aadhaar card, Driving licence, Voters ID card for identify verification. ● Date of birth document Process to apply for a post office Saving Scheme ● Visit the nearest post office branch ● Get the application form to open the relevant account for a post office. ● Fill the form with required detail and Summit with KYC proof and initial deposit amount. ● Once your application is process you will receive a passbook. Conclusion: Post office saving schemes play a pivotal role in fostering financial inclusion, promoting savings culture, and mobilizing funds for economic development. With their accessibility, security, and competitive returns, these schemes cater to the diverse needs of investors across various socioeconomic strata. By understanding the features, benefits, and considerations associated with post office saving schemes, individuals can make informed decisions to secure their financial future and achieve their long-term goals. Welcome to our official website of Naukri Hub. just open www.naukri-hub.co.in for all kinds of update related to jobs, schemes and events.