Rbi ppt

•Descargar como PPTX, PDF•

4 recomendaciones•4,291 vistas

RBI MONETARY POLICY 2011-12

Denunciar

Compartir

Denunciar

Compartir

Recomendados

Más contenido relacionado

La actualidad más candente

La actualidad más candente (20)

Report on Monetary Policies & its transmission mechanism

Report on Monetary Policies & its transmission mechanism

Destacado

Destacado (20)

Reserve Bank Of India : Role ,Functions Structure and Management

Reserve Bank Of India : Role ,Functions Structure and Management

Reserve Bank of India- Management of Financial Services project

Reserve Bank of India- Management of Financial Services project

Role of RBI in Indian Banking System - ITT Presentation

Role of RBI in Indian Banking System - ITT Presentation

Similar a Rbi ppt

Similar a Rbi ppt (20)

Banking & Nbfc Q411 Earnings & Policy Impacts (23rd May11)

Banking & Nbfc Q411 Earnings & Policy Impacts (23rd May11)

Change in monetary policy last 5 years in Bangladesh

Change in monetary policy last 5 years in Bangladesh

Comparative Study of Monetary Policy Statements of Bangladesh Bank for the Fi...

Comparative Study of Monetary Policy Statements of Bangladesh Bank for the Fi...

Más de SRI GANESH

Más de SRI GANESH (20)

Último

https://app.box.com/s/x7vf0j7xaxl2hlczxm3ny497y4yto33i80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...

80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...Nguyen Thanh Tu Collection

Making communications land - Are they received and understood as intended? webinar

Thursday 2 May 2024

A joint webinar created by the APM Enabling Change and APM People Interest Networks, this is the third of our three part series on Making Communications Land.

presented by

Ian Cribbes, Director, IMC&T Ltd

@cribbesheet

The link to the write up page and resources of this webinar:

https://www.apm.org.uk/news/making-communications-land-are-they-received-and-understood-as-intended-webinar/

Content description:

How do we ensure that what we have communicated was received and understood as we intended and how do we course correct if it has not.Making communications land - Are they received and understood as intended? we...

Making communications land - Are they received and understood as intended? we...Association for Project Management

https://app.box.com/s/7hlvjxjalkrik7fb082xx3jk7xd7liz3TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...Nguyen Thanh Tu Collection

Último (20)

Unit-V; Pricing (Pharma Marketing Management).pptx

Unit-V; Pricing (Pharma Marketing Management).pptx

Jual Obat Aborsi Hongkong ( Asli No.1 ) 085657271886 Obat Penggugur Kandungan...

Jual Obat Aborsi Hongkong ( Asli No.1 ) 085657271886 Obat Penggugur Kandungan...

ICT role in 21st century education and it's challenges.

ICT role in 21st century education and it's challenges.

Micro-Scholarship, What it is, How can it help me.pdf

Micro-Scholarship, What it is, How can it help me.pdf

UGC NET Paper 1 Mathematical Reasoning & Aptitude.pdf

UGC NET Paper 1 Mathematical Reasoning & Aptitude.pdf

80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...

80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...

ICT Role in 21st Century Education & its Challenges.pptx

ICT Role in 21st Century Education & its Challenges.pptx

Interdisciplinary_Insights_Data_Collection_Methods.pptx

Interdisciplinary_Insights_Data_Collection_Methods.pptx

Making communications land - Are they received and understood as intended? we...

Making communications land - Are they received and understood as intended? we...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

Rbi ppt

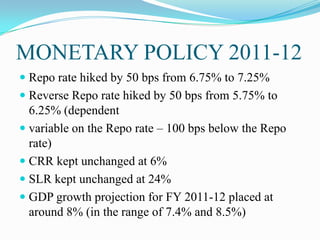

- 1. MONETARY POLICY 2011-12 Repo rate hiked by 50 bps from 6.75% to 7.25% Reverse Repo rate hiked by 50 bps from 5.75% to 6.25% (dependent variable on the Repo rate – 100 bps below the Repo rate) CRR kept unchanged at 6% SLR kept unchanged at 24% GDP growth projection for FY 2011-12 placed at around 8% (in the range of 7.4% and 8.5%)

- 2. CONT- FY 2011-12 March end WPI inflation baseline projection placed at 6% with an upward bias M3 growth projected at 16%, deposit growth at 17% and non-food credit growth at 19% Bank rate kept unchanged at 6%. MSF introduced at 1% above the Repo rate (8.25%) LAF corridor width set at 200 bps (with base at reverse repo – 6.25% & ceiling at MSF – 8.25%) MP 2011-12.docx

- 3. FIRST QUARTERLY REVIEW Increase / (Decrease) At present since March 2010 Repo Rate .5% 8%. Reverse Repo Rate .5% 7% Cash Reserve Ratio Unchanged 6%. Statutory Liquidity Unchanged 24% Ratio Bank Rate Unchanged 6%

- 4. KEY FEATURES GDP growth projection for FY 2011-12 kept unchanged at around 8% Inflation projection for March end FY 2011-12 revised upwards to 7% from 6%

- 5. SECOND QUARTERLY REVIEW Increase / (Decrease) At present Repo Rate .25% 8.5% Reverse Repo Rate .25%. 7.5% Cash Reserve Ratio Unchanged 6% Statutory Liquidity Unchanged 24% Ratio Bank Rate Unchanged 6%

- 6. KEY FEATURES RBI lowered the growth forecast for 2011-12 from 8% to 7.6% (in line with our expectations) Inflation forecast is kept at 7% by Mar-12 end. Money supply and Credit growth maintained at 15.5% and 18% respectively Depreciation of the rupee has emerged as another risk for inflation. Indian economy continued to face suppressed inflation as prices are administered in petroleum sector.

- 8. Increase / (Decrease) At present Repo Rate Unchanged 8.50% Reverse Repo Unchanged 7.50% Rate Cash Reserve .50% 5.50% Ratio Statutory Unchanged 24.00% Liquidity Ratio Bank Rate Unchanged 6.00%

- 9. KEY FEATURES The drop in November 2011 WPI inflation to 9.11%, mainly due to softening in food inflation (4.35% for the week ended December 3, 2011) GDP growth rate has fallen to 6.9% from 7.7%(expected in Q2) Due to sharp moderation in industrial growth to -5.1% The fiscal deficit at 74.4% of budgeted 2011-12 was significantly higher than 42.6% in 2010-11

- 10. CONT- FDs (Fixed Deposits) are offering interest in the range of 7.25% - 9.40% p.a. Projection of GDP growth for 2011-12 is revised downwards from 7.6% to 7%. In reducing the CRR,INR 320 bn of primary liquidity will be injected into the banking system

- 12. RBI projections in three reviews in 2011-12 Table 1: RBI Projections in Monetary Reviews (in %) May-11 Jul 11 Oct-11 Growth (2011-12) 8 8 7.6 Inflation (Mar-12) 6 7 7 M3 (Mar-12) 16 15.5 15.5 Deposit (Mar-12) 17 - - Credit (Mar-12) 19 18 18

- 14. PRESENTATION BY