Here are the journal entries to record the percentage-of-completion for the year ended December 31, 2010:1) Costs incurred for year 2010: $800,000DR: Construction in Process CR: Cash/Accounts Payable$800,000$800,0002) Compute % complete: Costs incurred to date/Estimated total cost$4,000,000/$8,000,000 = 50% complete3) Revenue to recognize = Contract price x % complete $8,400,000 x 50% = $4,200,0004) Revenue recognized to date - Revenue recognized in prior years = Revenue for 2010

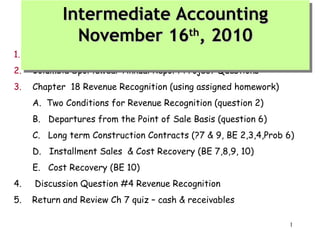

- 1. Intermediate Accounting Intermediate Accounting November 16th, 2010 November 16th, 2010 1. General Course Questions 2. Columbia Sportswear Annual Report Project Questions 3. Chapter 18 Revenue Recognition (using assigned homework) A. Two Conditions for Revenue Recognition (question 2) B. Departures from the Point of Sale Basis (question 6) C. Long term Construction Contracts (?7 & 9, BE 2,3,4,Prob 6) D. Installment Sales & Cost Recovery (BE 7,8,9, 10) E. Cost Recovery (BE 10) 4. Discussion Question #4 Revenue Recognition 5. Return and Review Ch 7 quiz – cash & receivables 1

- 2. Revenue Recognition Revenue should be recognized at the soon as what TWO conditions are met: 1. 2. Revenue should be recognized when you have ______ the W______ & P_______ is assured. Question 2 2

- 3. Revenue Recognition Classified by Type of Transaction Chapter 18 Type of Transaction Description of Revenue Timing of Revenue Recognition Sale of product from inventory Revenue from sales Date of sale (date of delivery) Chapter 18 Chapter 14 & others Chapter 10 Rendering a service Permitting use of an asset Sale of asset other than inventory Revenue from fees or services Revenue from interest, rents, and royalties Gain or loss on disposition Services performed and billable As time passes or assets are used Date of sale or trade-in 3

- 4. Timing of Revenue Recognition I. Revenue is normally recognized at the point of sale, provided: A. Revenue can be reasonably ___________, collectibility of the sales price is reasonably assured or the amount uncollectible can be ___________ reasonably. B. The earnings process is _______; the seller is not obligated to perform significant activities after the sale. II. Earlier recognition is appropriate if there is a high degree of certainty about the amount of revenue earned. III. Delayed recognition is appropriate if the degree of uncertainty concerning the amount of revenue or costs is sufficiently high or sale does not represent substantial completion of the earnings process. 4

- 5. Timing of Revenue Recognition I. Revenue is normally recognized at the point of sale, provided: A. Revenue can be reasonably measured, collectibility of the sales price is reasonably assured or the amount uncollectible can be estimated reasonably. B. The earnings process is complete; the seller is not obligated to perform significant activities after the sale. II. Earlier recognition is appropriate if there is a high degree of certainty about the amount of revenue earned. III. Delayed recognition is appropriate if the degree of uncertainty concerning the amount of revenue or costs is sufficiently high or sale does not represent substantial completion of the earnings process. 5

- 7. Departures from the Sale BasisSale Basis Departures from the Point of A. Sales with Buyback Agreements - even though title has transferred, if the seller still has the risk of ownership it is not a sale. B. Sales When Right of Return Exists - do not record the sale unless all of the following six provisions are met: (question 6) 1. Sellers _____ is known (fixed or determinable at the date of sale) 2. Buyer's payment is not contingent upon the ______ of product 3. The buyer's obligation is not altered if product is _____/______ 4. Buyer is a separate ______ from seller 5. Seller is not obligated to help buyer _______the product 6. Future returns can be _________ C. Trade Loading and Channel Stuffing - practices to book tomorrows revenues today, need to be discouraged. 7

- 8. Departures from the Sale BasisSale Basis Departures from the Point of A. Sales with Buyback Agreements - even though title has transferred, if the seller still has the risk of ownership it is not a sale. B. Sales When Right of Return Exists - do not record the sale unless all of the following six provisions are met: 1. Sellers price is known (fixed or determinable at the date of sale) 2. Buyer's payment is not contingent upon the resale of product 3. The buyer's obligation is not altered if product is stolen/damaged 4. Buyer is a separate entity from seller 5. Seller is not obligated to help buyer resell the product 6. Future returns can be estimated C. Trade Loading and Channel Stuffing - practices to book tomorrows revenues today, need to be discouraged. 8

- 9. Revenue Recognition Before Delivery Long-Term Construction Accounting Methods Percentage-of-Completion Method 1) Terms of contract must be certain, enforceable. 2) Certainty of performance by both parties 3) Estimates of completion can be made reliably Question 7 & 9 Completed Contract Method 1) For short-term contracts 2) Used for long-term contracts only when conditions for percentage completion are not met 3) Abnormal contract risks 9

- 10. Basic Idea of Percentage of Completion • • • Reflect the economic substance of the activities of the company • I/S: Revenues earned and expenses incurred to reflect the efforts and accomplishments each period. They are not all deferred until the final year of project completion. • B/S: Value of asset being constructed is adjusted at the end of each period to reflect the amount of revenue recognized on the contract Requires the use of estimates What information do we need? • Contract revenue • Expenses incurred (or other input or output measures) • Estimated remaining expenses (or other input or output measures) 10 • Billing and cash from customer

- 11. Percentage-of-Completion: Balance Sheet Accounts “Construction in Process” (CIP) •An Inventory account used to accumulate the amount recognized as Revenue throughout the contract (Similar to a Work-In-Process inventory account, but includes not only cost, but also the gross profit to date) •First the construction costs are recorded in this account as they are incurred •Then the gross profit is added to this account at the end of each period when Revenue is recognized. Thus, the balance in this account then equals the total revenue recognized on the contract to date. •This inventory account is not removed until the construction is complete and title is transferred to the new owner. Then it is offset against Billings on Construction in Process. “Billings on Construction in Process” •A Contra-Inventory account to CIP, used to accumulate the amount that a customer has been billed and thus recorded in Cash or Accts Rec. •Interim billings are not usually based upon percentage of costs or completion. Thus, the amount billed and recorded in Billings on CIP is not likely to be equal to the revenue recognized, which is the balance in the CIP account. 11

- 12. Percentage-of-Completion: Balance Sheet Accounts • “Construction in Process” (CIP) An Inventory account which equals the total revenue recognized on the contract to date. • “Billings on Construction in Process” A Contra-Inventory account to CIP, used to accumulate the amount that a customer has been billed and thus recorded in Cash or Accts Rec. • Interim billings are not usually based upon percentage of costs or completion. Thus, the amount billed and recorded in Billings on CIP is not likely to be equal to the revenue recognized, which is the balance in the CIP account. • At the end of any accounting period, the difference between the balance in “CIP” and “Billings on CIP” will appear on the balance sheet. 1) If “CIP” > “Billings on CIP”, the difference will be reported as an asset 2) If “Billing on CIP” > “CIP”, the difference will appear as a liability. • The two accounts (CIP and Billings on CIP) will equal at the end of the contract. They are closed out against each other when construction is complete and title is transferred to the new owner. 12

- 13. Percentage-of-Completion: Financial Statements Balance Sheet Cash Accounts Receivable Inventory: Construction in Process (Cost + Gross Profit = Revenue recognized to-date on the contract) Less Billings on Construction in Process (amount billed; amount of cash received and/or still in A/R) Total amount in Current assets related to the contract will equal the amount of Revenue Recognized to date on the contract (the amount in cash and/or A/R will be offset against Billings on CIP) Income Statement Construction Revenue Construction Costs Gross profit on Construction efforts s 13

- 14. Percentage-of-Completion: Journal Entries During the period to record costs of construction: DR: Construction in process (CIP) CR Cash, Raw Materials, A/P, Acc. Depr, Wages Payable When contract says you can make progress billings to customer: DR: Accounts receivable CR Billings on CIP To record cash collections: DR: Cash CR Accounts receivable End of the Accounting Period to recognize Revenue, cost & Gross Profit DR: CIP (gross profit adjustment for current year) DR. Construction Costs (Expense account) CR Construction Revenue 14

- 15. Percentage-of-Completion: Journal Entries End of Construction when construction is complete and title is transferred to the new owner: DR: Billings on Construction in process CR Construction in Process The total amount invoiced in Billings on CIP will equal the total revenue recognized to-date on the contract at the end which has been captured in the CIP account. Thus the two accounts are closed out against each other as the construction company no longer has title to the asset and the amount invoiced has been recorded in cash and/or Accounts Receivable. 15

- 16. Computing the Revenue & Gross Profit to recognize at the end of each period using Percentage-of-Completion 1 Costs incurred to date = Percent complete Most recent estimated total costs 2 Estimated total revenue x Percent complete = Revenue to be recognized to date 3 Total revenue to be recognized to date less Revenue recognized in PRIOR periods = Current period revenue 4 Current Period Revenue less current costs = Gross profit 16

- 17. Percentage-of-Completion: Homework Problem 6 Data: Contract price: $8,400,000 Start date: July, 2003 Balance sheet date: Given: 2010 Estimated cost: $4,000,000 Finish: October, 2005 Dec. 31 2011 2012 Costs incurred during the year $2,880,000 $2,230,000 Estimated costs to complete $3,530,000 $2,190,000 total estimated costs $2,190,000 $ -0- Progress Billings during year Cash collected during year $1,700,000 $3,200,000 $3,500,000 What is the percent complete, revenue, and gross 17 profit recognized each year? 17

- 18. Percentage-of-Completion: Homework Problem 6 Data: Contract price: $8,400,000 Start date: July, 2003 Balance sheet date: Given: 2010 Estimated cost: $4,000,000 Finish: October, 2005 Dec. 31 2011 2012 Costs incurred during the year $2,880,000 $2,230,000 Estimated costs to complete $3,530,000 $2,190,000 total estimated costs $6,400,000 $7,300,000 $2,190,000 $ -0$7,300,000 Progress Billings during year Cash collected during year $1,700,000 $3,200,000 $3,500,000 What is the percent complete, revenue, and gross 18 profit recognized each year? 18

- 19. Percentage-of-Completion: Homework Problem 6 2010 2011 2012 % complete to-date 2,880,000 ___% 2,880k + 2230K = $6,400,000 $5,110,000=___% $7,300,000 Revenue recognized 8,400,000 * ___% 8,400,000 *__% 8,400,000 = 3,780,000 less 3,780,000 less 5,880,000 = 2,100,000 = 2,520,000 Gross Profit (loss) $3,780,000 less $2,880,000 recognized $________ $7,300,000 $7,300,000 100 % 2,100,000 less 2,520,000 2,230,000 less 2,190,000 = $_________ = $_______ Contract to date Revenue Costs Gross Profit $3,780,000 $2,880,000 $900,000 $5,880,000 5,110,000 $ 770,000 8,400,000 7,300,000 $1,100,000 19

- 20. Percentage-of-Completion: Homework Problem 6 2010 2011 % complete to-date 2,880,000 45% 2,880k + 2230K = $6,400,000 $5,110,000=70% $7,300,000 Revenue recognized 8,400,000 * 45% = 3,780,000 Gross Profit (loss) $3,780,000 less $2,880,000 recognized $900,000 2012 $7,300,000 $7,300,000 100 % 8,400,000 * 70% 8,400,000 less 3,780,000 less 5,880,000 = 2,100,000 = 2,520,000 2,100,000 less 2,230,000 = (130,000) 2,520,000 less 2,190,000 = 330,000 Contract to date Revenue Costs Gross Profit $3,780,000 $2,880,000 $900,000 $5,880,000 5,110,000 $ 770,000 8,400,000 7,300,000 $1,100,000 20

- 21. Percentage-of-Completion: the Construction in Progress Account Note that Gross Profit is stored in the CIP Account – this is very different from “ordinary” sales transactions, where gross profit is not in any specific account • A T-account analysis of the CIP account is very useful in answering questions • For example, you could be told that Daniels Construction incurred $1 million in construction costs on a new contract this year. They expect to incur another $7 million to complete the project. The balance in the CIP account at year end is $1.2 million. What is the total revenue they expect to earn on the contract? • Answer: 1.2 – 1 = 200,000 in GP recognized • Project is 1/(1+7) or 12.5% complete, so 200,000 / 0.125 = $1,600,000 in total profit • Since profit is revenues minus expenses, total revenues must be 1.6 + 8 = $9.6 million 21

- 22. Completed Contract Method Use For Short Term Construction Contracts Or when does not meet criteria for % Completion: 1. Terms of contract not certain, or enforceable 2. Certainty of Performance by either party is in question 3. Realiable estimates to measure % complete are not available (cost, input or output measures) No revenue, no expense, no gross profit recognized until the project is actually completed. Journal entries prepared during the life of contract are the same as those prepared under the percentage-of-completion method with the exception of the last journal entry that recognizes periodic revenue, expense and gross profit. Instead, the entire revenue, expense and gross profit are recorded at the end of the project. 22

- 23. Completed Contract • Assuming the same numbers as example before, what are the journal entries under the completed contract method? • All journal entries for 2010, 2011, and 2012 would appear exactly as before, except that there would be no revenue recognition journal entry in each year • Therefore, the balance in CIP at the end of each year would represent only the inventoried construction costs 23

- 24. Losses on Contracts Need to determine if the loss is for the current period or if for the contract overall. • If on overall profitable contract, recognize the loss in the period incurred via “negative gross profit” (see example Problem 6 year 2011) • Overall unprofitable contract • Percentage of completion: Recognize entire contract loss now by “backing out” previous gross profit • Completed contract: Recognize the entire loss now. What is the theoretical justification for this? 24

- 25. Disclosures in Construction Company Financial Statements Construction contractors should disclosure: the method of recognizing revenue, the basis used to classify assets and liabilities as current (nature and length of the operating cycle), the basis for recording inventory, the effects of any revision of estimates, the amount of backlog on uncompleted contracts, and the details about receivables. 25

- 26. Revenue Recognition Before Revenue Recognition Before Delivery Delivery Completion-of-Production Basis In certain cases companies recognize revenue at the completion of production even though no sale has been made. Examples are: precious metals or agricultural products. What is the theoretical justification for this? 26

- 27. Revenue Recognition After Delivery Revenue recognition is deferred when collection of sales price is not reasonably assured and no reliable estimates can be made. Methods of deferring revenue: Installment-sales method Cost-recovery method Generally Employed Deposit method – cash received prior to delivery or transfer of property. Thus sale is not complete, and cash is recorded as a customer deposit (current liability). 27

- 28. The Installment Sales Method • Recognize income in periods of cash collection rather than at the point of sale. • Title typically does not pass to the buyer until all cash payments have been made to the seller. • Recognize both Revenue and Cost of Sales in period of sale, but Gross profit is deferred to the periods of collection. • Selling and administrative expenses are not deferred. 28

- 29. The Installment Sales Method • Installment sales must be kept separate from regular sales • Gross profit on installment sales must be determinable • The amount of cash collected from installment accounts by year sold must be known • Provision must be made to carry forward each year’s deferred gross profit separately 29

- 30. Steps to Record Installment Sales 1. 2. 3. 4. 5. Record initial Installment sale, keeping track of A/R by year sold and noting revenue as “Installment Sales”. Cost of sales and inventory reduction recorded normally, using information to compute Gross Profit rate each year. When closing “Installment Sales and COGS, defer the Gross Profit by year of sale. Record cash collections reducing A/R by year of original sale. Realize Gross profit on cash collected, taking Cash times gross profit rate in year of original sale, and reducing deferred gross profit for the corresponding 30 year.

- 31. The Installment Sales Method: Example Given: 2003 Installment sales $200,000 Cost of sales $150,000 Gross Profit $ 50,000 Cash received in: from 2003 sales $ 60,000 from 2004 sales $ -0from 2005 sales $ -0-$ 2004 2005 $250,000 $190,000 $ 60,000 $240,000 $168,000 $ 72,000 $ 100,000 $ 40,000 $ 100,000 $125,000 -0$ 80,000 Determine the realized and deferred gross profit. 31

- 32. The Installment Sales Method: Example 2003 2004 2005 Gross profit rate 25% 24% 30% Realized Gross Profit: From 2003 sales (e.g., 60,000 x 25%) ($100,000 x 25%) ($40,000 x 25%) Realized in $ 15,000 $ 25,000 $ 10,000 From 2004 sales: ($100,000 x 24%) ($125,000 x 24%) Realized in: $ -0- $ 24,000 $ 30,000 From 2005 sales: ($80,000 x 30%) Realized in: $ -0- $ -0- $ 24,000 32 32

- 33. The Installment Sales Method: 2003 Journal Entries for Gross Profit 1. When the 2003 installment sale is made: Installment A/R (2003) Installment Sales 200,000 200,000 2. Cost of Sales Inventory 150,000 3. Installment Sales Cost of Sales Deferred Gross Profit, 2003 200,000 150,000 150,000 50,000 When cash is received, some deferred GP is recognized as revenue: 4. Cash 60,000 Installment A/R (2003) 60,000 5. Deferred Gross Profit, 2003 Realized Gross Profit (I/S) (Realized: $60,000 x 25%) 15,000 15,000 33 33

- 34. The Installment Sales Method: 2004 Journal Entries for Gross Profit 1. Installment A/R Installment Sales 2. Cost of Sales Inventory (2004) 3. Installment Sales Cost of Sales Deferred Gross Profit, 2004 250,000 250,000 190,000 190,000 250,000 190,000 60,000 4. When cash is received, some deferred GP is recog’d as revenue: Cash 200,000 Installment A/R (2003) 100,000 Installment A/R (2004) 100,000 5. Deferred Gross Profit, 2003 Deferred Gross Profit, 2004 Realized Gross Profit (I/S) (Realized: ’03: $100K x 25% + ’04 $100K X 24%) 25,000 24,000 49,000 34

- 35. Installment Sales Method: 2005 Journal Entries 1. 2. 3. 4. When cash is received, some deferred GP is recognized as revenue: Cash 245,000 5. 35 35

- 36. Installment Sales Method: 2005 Journal Entries 1. Installment A/R Installment Sales 2. Cost of Sales Inventory (2005) 3. Installment Sales Cost of Sales Deferred Gross Profit, 2005 240,000 240,000 168,000 168,000 240,000 168,000 72,000 4. When cash is received, some deferred GP is recognized as revenue: Cash Installment A/R (2003) Installment A/R (2004) Installment A/R (2005) 5. Deferred Gross Profit, 2003 Deferred Gross Profit, 2004 Deferred Gross Profit, 2005 Realized Gross Profit (I/S) 245,000 40,000 125,000 80,000 10,000 30,000 24,000 64,000 (Realized: ’03: $40K x 25% + ’04 $125K X 24% + ’05 80K X 30%) 36

- 37. The Cost Recovery Method • Used when no reasonable basis for estimating collectibility as in franchises and real estate. • Seller recognizes no profit until cash payments by buyer exceed seller’s cost of merchandise. • After recovering all costs, seller includes additional cash collections in income. • The income statement reports the amount of gross profit recognized and the amount deferred. 37

- 38. The Original Example – Cost Recovery Method Given: 2003 2004 2005 Installment sales $200,000 Cost of sales $150,000 Gross Profit $ 50,000 $250,000 $190,000 $ 60,000 $240,000 $168,000 $ 72,000 Cash received in: from 2003 sales $ 60,000 from 2004 sales $ -0from 2005 sales $ -0-$ $ 100,000 $ 40,000 $ 100,000 $125,000 -0- $ 80,000 Determine the realized and deferred gross profit. 38

- 39. The Cost Recovery Method: 2003 Journal Entries 2003: (J/E’s for sales and deferral of GP are same as in installment method) 1. When the 2003 installment sale is made: Installment A/R (2003) Installment Sales 200,000 200,000 2. Cost of Sales Inventory 150,000 3. Installment Sales Cost of Sales Deferred Gross Profit, 2003 200,000 Cash collection J/E’s: 4. Cash Installment A/R (2003) 150,000 150,000 50,000 60,000 60,000 5. No Gross Profit realized until cost of Sales recovered by cash collections Note: costs remaining to recover = 150,000 – 60,000 = 90,000 before any recognition of profit 39 5. 39

- 40. The Cost Recovery Method 2004: J/E’s for sales and deferral of GP are same as in installment method Cash Installment A/R (2003) Installment A/R (2004) 200,000 100,000 100,000 • 2003 GP can be recognized: 150,000 – 60,000 – 100,000 = 10,000 to be recognized • No 2004 GP to be recognized: 190,000 – 100,000 = 90,000 Deferred GP, 2003 sales Recognized GP 10,000 10,000 40

- 41. The Cost Recovery Method 2005: J/E’s for sales and deferral of GP are same as in installment method Entry to record Cash Collections: Cash 245,000 Entry to record Realized Gross Profit: 41

- 42. The Cost Recovery Method 2005: J/E’s for sales and deferral of GP are same as in installment method Cash Installment A/R (2003) Installment A/R (2004) Installment A/R (2005) 245,000 40,000 125,000 80,000 • All cash collected in 2003 can be recognized as GP because costs covered in 2004 • 2004 GP to be recognized: 190,000 – 100,000 – 125,000 = 35,000 • No GP for 2005: 168,000 – 80,000 = 88,000 Deferred GP, 2003 sales Deferred GP, 2004 sales Recognized GP 40,000 35,000 75,000 42

- 43. Installment Sales Issues - Interest and Repossessions • Interest: recognize at time of receipt (do not defer) • Repossessions: • Be sure to account for all payments and recognition of gross profit until the repossession date • Set up repossessed goods at their fair value at repossession (not what they were worth when originally sold) • Write off any remaining A/R and deferred Gross Profit; recognizing the gain/loss to make the journal entry balance 43

- 44. Franchise Revenue (Appendix 18A) Basic Idea: • Various types of franchise arrangements, we will focus on service sponsor-retailer • Franchisor sells (1) right to operate business and (2) provides on-going support activities. • Revenue streams (1) initial sale of franchise and related assets/services (2) fees based on the operation of the franchise So how does franchisor record this revenue? 44

- 45. Franchise Revenue • Initial Franchise fee • Revenue recorded when there is: • Substantial performance • No remaining obligation to refund any cash or excuse any non-payment of note. Generally assumed to be when franchisee commences operations • Collection of fee is reasonably assured • If terms not met, then Unearned Franchise Fees • Often payment is in cash and a LT note receivable • Continuing Fees • When earned and receivable. • Often amount must be verified 45

- 46. Franchise Revenue Example On 3/31/09 the Red Hot Chicken Wing Corp. entered into a franchise agreement with Thomas Keller. In exchange for an initial franchise fee of $50,000, Red Hot will provide initial services to include the selection of location, construction of building, employee training and consulting services over several years. $10,000 is payable on 3/31/09, with the remaining $40,000 payable in annual installments. 10% interest on the note (at market rate) is payable annually. In addition, the franchisee will pay continuing franchise fees of $1000 per month for advertising and promotion provided by Red Hot, beginning immediately after the franchise begins operations. Thomas Keller opened his Red Hot franchise for business on 9/30/09 46

- 47. Franchise Revenue Example Initial Franchise fee 3/31/09 Cash 10,000 Note Receivable 40,000 Unearned franchise fee revenue 50,000 9/30/09 Unearned franchise fee revenue Franchise fee revenue 50,000 50,000 Continuing Fees 10/31/09 (& monthly) Cash 1000 Service Revenue 1000 Debt Service 3/31/10 Cash 4000 47

- 48. Consignments (Appendix 18A) Basic idea: • Consignor “gives” merchandise to a a reseller to sell on your behalf to an end user. • Can’t recognize revenue until sold to end user Entries: Ships to consignee Inventory on consignment Finished good inventory Notified of sale to end user Cash Commission expense Revenue from consigned sales COGS Inventory on consignment xxx xxx xxx xxx xxx xxx xxx 48

- 49. Revenue Recognition: US GAAP vs. IFRS 1. Long-term construction contracts when outcomes cannot be reasonably estimated: • US GAAP: must use Completed Contract Method (No revenue or expense is recognized until the end of the contract) • IFRS: must use the zero-profit method (revenues are recognized only to the extent of costs) 1. Service Revenue • US GAAP: follow specific industry guidance for revenue recognition • IFRS: typically use the % Completion method (or straightline if services are specified over a period of time) 49

- 50. 50

- 51. Percentage-of-Completion: Example Data: Contract price: $4,500,000 Start date: July, 2003 Balance sheet date: Given: Estimated cost: $4,000,000 Finish: October, 2005 Dec. 31 2003 Costs to date $1,000,000 Estimated costs to complete $3,000,000 Progress Billings during year $900,000 Cash collected during year $750,000 2004 $2,916,000 $1,134,000 $2,400,000 $1,750,000 2005 $4,050,000 $ -0$1,200,000 $2,000,000 What is the percent complete, revenue, and gross 51 profit recognized each year?

- 52. Percentage-of-Completion: Example 2003 2004 2005 % complete to-date 1,000,000 = 25% 2,916,000= 72% 4,000,000 4,050,000 100 % Revenue recognized 4,500,000 * 25% = 1,125,000 4,500,000 * 72% 4,500,000 less 1,125,000 less 3,240,000 = 2,115,000 = 1,260,000 Gross Profit recognized 1,125,000 less 1,000,000 = 125,000 2,115,000 less 1,916,000 = 199,000 1,260,000 less 1,134,000 = 126,000 52

- 53. Percentage-of-Completion: Journal Entries 2003 To record cost of construction: DR Construction in process (CIP) CR Accounts Payable 1,000,000 1,000,000 To record progress billings to customer: DR Accounts receivable CR Billings on CIP 900,000 900,000 To record cash collections: DR Cash CR Accounts receivable 750,000 750,000 53

- 54. Percentage-of-Completion: Entries Involving Third Parties 2003 To record revenue and expense DR DR CIP (plug gross profit here) 125,000 Construction Expenses 1,000,000 CR Revenue (1m/(1m+3m)x4.5m) 1,125,000 Note: Construction expenses = actual expenditures for the period 54

- 55. Balance Sheet 2003 Construction In Progress 1,000,000 Billings 900,000 125,000 900,000 1,125,000 Balance Sheet … in current assets: CIP Billings 1,125,000 (900,000) Costs and Recognized Gross Profit in excess of Billings 225,000 55

- 56. Percentage-of-Completion: Journal Entries 2004: Construction in Progress (2.916m – 1.0m) Cash, A/P, etc. 1,916,000 1,916,000 A/R Billings 2,400,000 2,400,000 Cash A/R 1,750,000 1,750,000 CIP Construction Expenses Revenue (2.916m/4.050m x 4.5m) – 1,125,000 199,000 1,916,000 2,115,000 56

- 57. % Completion Balance Sheet 2004 Construction In Progress 1,000,000 Billings 900,000 125,000 1,916,000 2,400,000 199,000 3,300,000 3,240,000 Balance Sheet … in current liabilities: Billings Less: CIP 3,300,000 (3,240,000) Billings in excess of cost and recognized gross profit 60,000 57

- 58. Percentage-of-Completion: Journal Entries 2005: CIP (4,050 – 2,916) Cash, A/P, etc. 1,134,000 A/R Billings 1,200,000 Cash A/R 2,000,000 CIP Construction Expenses Revenue (4,050/4,050 x 4,500) – 1,125 - 2,115 126,000 1,134,000 1,134,000 1,200,000 2,000,000 1,260,000 58

- 59. % Completion Balance Sheet 2005 CIP Billings 1,000,000 900,000 125,000 2,400,000 1,916,000 4,500,000 1,200,000 199,000 4,500,000 4,500,000 1,134,000 - 126,000 4,500,000 4,500,000 4,500,000 - 59

- 60. Percentage-of-Completion: Entries At the end of the contract: To record completion of project: DR Billings on CIP 4,500,000 CR Construction in process 4,500,000 Over the life of the contract, the total credits to “Billings on CIP” will equal the total amount billed to the customer, which is the total revenue received over the life of the contract. 60

- 61. Completed Contract • Assuming the same numbers as example before, what are the journal entries under the completed contract method? • All journal entries for 2003, 2004, and 2005 would appear exactly as before, except that there would be no revenue recognition journal entry in each year • Therefore, the balance in CIP at the end of each year would represent only the inventoried construction costs 61

- 62. Completed Contract: Journal Entries 2003: Construction in Progress (CIP) Cash, A/P, etc. 1,000,000 1,000,000 A/R Billings 900,000 Cash A/R 750,000 900,000 750,000 Entries above same as for % Completion. No entry to record revenues and expenses. 62

- 63. Balance Sheet 2003 – Completed Contract Construction In Progress 1,000,000 Billings 900,000 900,000 1,000,000 Balance Sheet … in current assets: CIP Billings 1,000,000 (900,000) Costs and Recognized Gross Profit in excess of Billings 100,000 63

- 64. Completed Contract: Journal Entries 2004: Construction in Progress (2,916 – 1,000) Cash, A/P, etc. 1,916,000 1,916,000 A/R Billings 2,400,000 2,400,000 Cash A/R 1,750,000 1,750,000 J/E above are same as for % Completion (no entry made for revenue and expense) 64

- 65. Completed Contract Balance Sheet 2004 Construction In Progress 1,000,000 Billings 900,000 1,916,000 2,400,000 3,300,000 2,916,000 Balance Sheet … in current liabilities: Billings Less: CIP 3,300,000 (2,916,000) Billings in excess of cost and recognized gross profit 384,000 65

- 66. Completed Contract: Journal Entries 2005: CIP (4,050 – 2,916) Cash, A/P, etc. 1,134,000 A/R Billings 1,200,000 Cash A/R 2,000,000 1,134,000 1,200,000 2,000,000 Now that the project is done, we can close out the Billings and CIP accounts and record Construction Revenue and Construction Expense: Billings Revenue 4,500,000 Construction Expenses CIP 4.050,000 4,500,000 4,050,000 66

- 67. Completed Contract Balance Sheet 2005 CIP Billings 1,000,000 900,000 2,400,000 1,916,000 4,500,000 4,500,000 1,134,000 1,200,000 4,500,000 4,050,000 4,050,000 - 4,050,000 67

Notas del editor

- When it is EARNED and either REALIZED or REALIZABL 1. Earned: when the seller has substantially accomplished what it must do to be entitled to the benefits represented by the revenue; when the earnings process is virtually complete (seller is not obligated to perform significant activities after the sale) Realized: The amount of revenue that will be collected is reasonably assured and measurable with a reasonable degree of reliability. (buyer) Collectibility of sales price is reasonably assured or the amount uncollectible can be estimated reasonably Realized - when goods and services are exchanged for cash or claims to cash (receivables) Realizable - when assets received in exchange are readily convertible to known amounts of cash or claims to cash. Assets are readily convertible when they are salable or interchangeable in an active market at readily determinable prices without significant additional cost. Revenue - the inflows of assets and/or settlements of liabilities from delivering or producing goods, rendering services, or other earnings activities that constitute the enterprise's ongoing major or central operations during a period. Recognition - the process of formally recording an item in the accounts of an entity.

- When a repurchase agreement exists at a set price and this price covers all cost of the inventory plus related holding costs, the inventory and related liability remain on the seller’s books. In other words, no sale. 1. Sellers price is known (fixed or determinable at the date of sale) 2. Buyer's payment is not contingent upon the resale of product 3. The buyer's obligation is not altered if product is stolen or damaged 4. Buyer is a separate entity from seller 5. Seller is not obligated to help buyer resell the product 6. Future returns can be estimated

- When a repurchase agreement exists at a set price and this price covers all cost of the inventory plus related holding costs, the inventory and related liability remain on the seller’s books. In other words, no sale. 1. Sellers price is known (fixed or determinable at the date of sale) 2. Buyer's payment is not contingent upon the resale of product 3. The buyer's obligation is not altered if product is stolen or damaged 4. Buyer is a separate entity from seller 5. Seller is not obligated to help buyer resell the product 6. Future returns can be estimated

- Sales price is reasonably assured, the units are interchangeable and no significant costs are involve in distributing the product. May also be difficult to determine the cost of the units produced.