Ratio Analysis

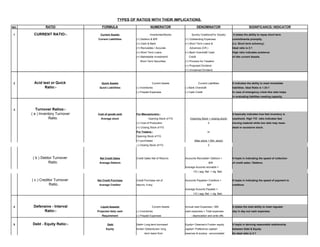

- 1. TYPES OF RATIOS WITH THEIR IMPLICATIONS. NO. RATIO FORMULA NUMERATOR DENOMINATOR SIGNIFICANCE/ INDICATOR 1 CURRENT RATIO:- Current Assets Inventories/Stocks Sundry Creditors(For Goods) It states the ability to repay short term Current Liablilities (+) Debtors & B/R (+) Outstanding Expenses commitments promptly. (+) Cash & Bank (+) Short Term Loans & (i.e. Short term solvency). (+) Recivables / Accurals Advances (CR.) Ideal ratio is 2:1 (+) Short Term Loans (+) Bank Overdraft/ Cash High ratio indicates existence (+) Marketable Investment/ Credit of idle current Assets. Short Term Securities. (+) Provison for Taxation (+) Proposed Dividend (+) Unclaimed Dividend 2 Acid test or Quick Quick Assets Current Assets Current Liablilities It indicates the ability to meet immediate Ratio:- Quick Liablilities (-) Inventories (-) Bank Overdraft liabilities. Ideal Ratio is 1.33:1 (-) Prepaid Expenses (-) Cash Credit In case of emergency crisis this ratio helps in evaluating liablities meeting capacity. 3 Turnover Ratios:- ( a ) Inventory Turnover Cost of goods sold For Manuacturers:- It basically indicates how fast inventory is Ratio. Average stock Opening Stock of FG (Opening Stock + closing stock) used/sold. High T/O ratio indicates fast (+) Cost of Production 2 moving material while low ratio may mean (+) Closing Stock of FG dead or excessive stock. For Traders:- or Opening Stock of FG (+) purchases (Max stock + Min. stock) (-) Closing Stock of FG 2 ( b ) Debtor Turnover Net Credit Sales Credit Sales Net of Returns Accounts Recivable= Debtors + It hepls in indicating the speed of collection Ratio. Average Debtors B/R of credit sales / Debtors. Average Acounts recivable = 1/2 ( opg. Bal. + clg. Bal) ( c ) Creditor Turnover Net Credit Purchase Credit Purchase net of Accounts Payable= Creditors + It hepls in indicating the speed of payment to Ratio. Average Creditor returns, if any. B/P creditors. Average Acounts Payable = 1/2 ( opg. Bal. + clg. Bal) 4 Defensive - Interval Liquid Assests Current Assets Annual cash Expenses / 365 It states the total ability to meet regualar Ratio:- Projected daily cash (-) Inventories cash expenses = Total expenses day in day out cash expenses. Requirement (-) Prepaid Expenses - depreciation and write offs. 5 Debt - Equity Ratio:- Debt Debt= Long term borrowed Equity= Owerner's Funds= equity It hepls in deriving reasonable relationship Equity funds= Debentures+ long capital+ Preference capital+ between Debt & Equity. term loans from reserves & surplus - accumulated Its ideal ratio is 2:1

- 2. fianancial Institutions. losses. 6 Debt to capital ratio:- Debt Debt= Long term borrowed Fixed Assests + net working Its basically a indicator of use of external Total funds funds= Debentures+ long capital funds and total capital employed in total. term loans from ideal ratio = 67% fianancial Institutions. 7 Coverage Ratios: ( a ) Interest Coverage EBIT Earnings before interest Interest on Debt It hepls in indicating interest obligations. It Ratio. Interest and tax states the ability to meet interest obligations of the current year.should ideally be greater than 1. ( b ) Dividend Coverage EAT Earnings after Tax Dividend on preference Capital This ratio helps in indicating ability to pay Ratio. Preference Divivend dividend on preference capital. ( c ) Total Coverage EBIT + Lease payment Earnings before interest Interest+ lease payments It helps in indicating the ability to meet total Ratio Interest+ lease payments and tax+ lease payment +(preference dividend obligations of the current year, should ideally +(preference dividend + installment of be greater than 1. + installment of principal)/(1-t) principal)/(1-t) ( d ) Total cash flow EBIT+ Lease payments EBIT+ Lease payments lease payment+interest+ Total cash flow i.e. in or out are being indicated coverage Ratio + Depreciation+ non cash + Depreciation+ non cash (principal repayment)+(1-t) with the hepl of this ratio. It hepls in indicating expenses expenses + (preference dividend)/(1-t) cash reserve of firm and its capibility to meet lease payment+interest+ daily cash requirements. (principal repayment)+(1-t) + (preference dividend)/(1-t) 8 Profit Margin:- (I) Gross profit margin Gross profits * 100 Gross profits * 100 sales This ratio is a idicator of basic/ gross profitability. sales or sales - cost of goods sold or sales-cost of goods sold*100 sales (II) Net profit margin ( a ) Operating Profit EBIT Earnings before interest sales This ratio is a indicator of operating performance of Ratio Sales and tax business. ( b ) Net profit Ratio EAT Earnings after Tax sales This ratio is a idicator of overall profitability. Sales 9 Cost of goods sold Cost of goods sold * 100 [For Manuacturers:- Net sales Indicates how fast inventory is used/ sold. High ratio

- 3. Ratio:- Net sales Opening Stock of FG indicates fast moving material while low ratio may (+) Cost of Production mean dead or excessive stock. (+) Closing Stock of FG For Traders:- Opening Stock of FG (+) purchases (-) Closing Stock of FG]*100 10 Operating Expense Administrative Expenses + Administrative Expenses + Net sales It hepls in indicating business ability to meet its Ratio:- Selling Expenses Selling Expenses total expenses effectively of current year. Net sales Ideal ratio is greater than 1. 11 Administrative Expense Administrative Expenses *100 Administrative Expenses *100 Net sales It hepls in indicating business ability to meet its Ratio:- Net sales Administrative activities expenses effectively.. Ideal ratio is greater than 1. 12 Selling Expenses Ratio:- Selling Expenses*100 Selling Expenses*100 Net sales It hepls in indicating business ability to meet its Net sales Selling activities expenses effectively.. Ideal ratio is greater than 1. 13 Opearting Ratio:- Cost of goods sold + [For Manuacturers:- Net sales It hepls in indicating business ability to meet its operating expenses * 100 Opening Stock of FG Operating activities expenses effectively.. Net sales (+) Cost of Production Ideal ratio is greater than 1. (+) Closing Stock of FG For Traders:- Opening Stock of FG (+) purchases (-) Closing Stock of FG] + operating expenses * 100 14 Financial Expenses Ratio:- Financial Expenses *100 Financial Expenses *100 Net sales It hepls in indicating business ability to meet its Net sales Financial activities expenses effectively.. Ideal ratio is greater than 1. 15 Return on Assets:- Net Profit after Tax Earnings after Taxation Average Total Assests or Tangible It indicates Net income per ruppee of average fixed/ Average Total Assets (+) Int. on debt funds Assets or Fixed Assets, i.e. tangible/ total assests. (+) Non Operating Adjts. (1/2 of opg + clg bal.) Net profit after taxes + interest (e.g. Other income/ loss on Average total Assests sale of fixed Assets etc.) Net profit after taxes + interest Average Tangible Assets Net profit after taxes + interest

- 4. Average Fixed Assests EAT+Interest-Tax advantage on Interest Average Total Assets/Tangible Assets/Fixed Assets. 16 Return on Capital Employed:- Net Profit After Taxes Earnings after Taxation Capital Employed can be computed Overall profitability of the business on the total funds . Average total capital employed (+) Int. on debt funds using- (a) Assets Route or employed can be derived easily with the help of this (+) Non Operating Adjts. (b) Liability Route. Ratio,If ROCE > Interest Rate, use of debt fund is Net Profit After Taxes+Interest (e.g. Other income/ loss on justified. - Tax advantage on interest sale of fixed Assets etc.) Average total capital employed Net Profit After Taxes+Interest Average Total Capital Employed- Average intangible Assets 17 Return on Total Shareholders Net Profit After Taxes Earnings after Taxation Average total Shareholders equity Overall return of the business on the total Equity:- Average total Shareholders equity (+) Int. on debt funds shareholders funds employed can be derived easily (+) Non Operating Adjts. with the help of this Ratio. (e.g. Other income/ loss on sale of fixed Assets etc.) 18 Return on Equity Funds.:- Net Profit After Taxes - preference Earnings after Taxation Net Fixed Assets It indicates profitability of equity funds/ owners funds dividend (+) Int. on debt funds (+) Net Working Capital invested in business. Average Ordinary Shareholders (+) Non Operating Adjts. (-) External Liablities ( LongTerm) Equity or net Worth (e.g. Other income/ loss on sale of fixed Assets etc.) 19 Earnings Per Share ( EPS):- Net profit available to equity Residual earnings, i.e. No. of equity shares outstanding = It indicates return or income per share, whether or not shareholders EAT -preference dividend equity capital distributed as dividends. Number of ordinary share outstanidng face value per share 20 Dividend per share ( DPS):- Net Profit after interest and preference Profits Distributed to equity No. of equity shares outstanding = This ratio basically states the amount of profits dividend paid to ordinary shareholders Shareholders equity capital distributed per share. Number of ordinary shares outstanding face value per share 21 Dividend Pay-out Ratio:- Total dividend to equity holders Net Profit after interest and preference Net profit available to equity It signifies the relationship between dividend total net profit belonging to equity dividend paid to ordinary shareholders shareholders distributed and earnings earned from such dividends. holders Number of ordinary shares outstanding Number of ordinary share outstanidng or Dividend per share ( DPS)

- 5. Earnings Per Share ( EPS) 22 Earning Yield:- EPS Net profit available to equity Market value of share It indicates true return on equity based on market Market value of share shareholders value of shares. Number of ordinary share outstanidng 23 Dividend Yield:- DPS Net Profit after interest and preference Market value of share It indicates true return on investment based on Market value of share dividend paid to ordinary shareholders market value of shares. Number of ordinary shares outstanding 24 Price Earning Ratio:- Market price of shares Market price of shares Net profit available to equity It indicates the relationship between market price and EPS shareholders EPS, and the shareholders perception of the company. Number of ordinary share outstanidng 25 Earning Power:- Net profit after taxes * sales Earnings after Taxation* sales sales * total assets It indicates the total earning power of business in terms sales total assets (+) Int. on debt funds of sales and fixed assets. (+) Non Operating Adjts. (e.g. Other income/ loss on sale of fixed Assets etc.) 26 Inventory Turnover Ratio:- Cost of goods sold [For Manuacturers:- Average Inventory = Indicates how fast inventory is used/ sold. High T/O ratio Average Inventory Opening Stock of FG 1/2 ( opg. Bal. + clg. Bal) indicates fast moving material while low ratio may mean (+) Cost of Production daed or excessive stock. (+) Closing Stock of FG For Traders:- Opening Stock of FG (+) purchases (-) Closing Stock of FG] 27 Raw Material Turnover:- cost of raw materials used Openeing Stock of Raw Material 1/2 ( opg. Bal. + clg. Bal) Indicates how fast/ regularly Raw materials are used in Average Raw Material inventory (+) Purchases production (-) Closing Stock of Raw material. 28 Work - in - progress:- cost of goods manufactured Materials consumed 1/2 ( opg. Bal. + clg. Bal) It indicates the work - in - progress movements / Average work in progress inventory (+) Wages production cycle. (+) production overhead 29 Debtors Turnover:- Credit sales credit sales net of returns 1/2 ( opg. Bal. + clg. Bal) Indicates the speed of collection of credit sales / debtors. Average Debtors + Average B/R OR Total Sales Debtors + B/R

- 6. 30 Average Collection Period Months (days) in a year Months (days) in a year Credit sales It states the avearge collection period of dedtors. Debtors Turnover Average Debtors + Average B/R OR Total Sales Debtors + B/R 31 Total assests Turn over:- Cost of goods sold [For Manuacturers:- 1/2 ( opg. Bal. + clg. Bal) Ability to generate sales per ruppee of total assets Average total assests Opening Stock of FG (+) Cost of Production (+) Closing Stock of FG For Traders:- Opening Stock of FG (+) purchases (-) Closing Stock of FG] 32 Fixed Assets Turnover:- Cost of goods sold [For Manuacturers:- 1/2 ( opg. Bal. + clg. Bal) Ability to generate sales per ruppee of fixed assets Average fixed assests Opening Stock of FG (+) Cost of Production (+) Closing Stock of FG For Traders:- Opening Stock of FG (+) purchases (-) Closing Stock of FG] 33 Capital Turnover:- Cost of goods sold [For Manuacturers:- 1/2 ( opg. Bal. + clg. Bal) Ability to generate sales per quantity of capital Average capital employed Opening Stock of FG employed. (+) Cost of Production (+) Closing Stock of FG For Traders:- Opening Stock of FG (+) purchases (-) Closing Stock of FG] 34 Current Assets Turnover:- Cost of goods sold [For Manuacturers:- 1/2 ( opg. Bal. + clg. Bal) Ability to generate sales per ruppee of current assets Average current assests Opening Stock of FG (+) Cost of Production (+) Closing Stock of FG For Traders:- Opening Stock of FG (+) purchases (-) Closing Stock of FG] 35 Working Capital Turnover Ratio:- Cost of goods sold [For Manuacturers:- 1/2 ( opg. Bal. + clg. Bal) Ability to generate sales based on working capital

- 7. Net Working Capital Opening Stock of FG employment. (+) Cost of Production (+) Closing Stock of FG For Traders:- Opening Stock of FG (+) purchases (-) Closing Stock of FG] DRAFTED BY: VIJAY KUMAR POPAT ROLL NO: 54. SECTION: SA - 1